nobody has a crystal ball but this is my current vibe:

12-18 more months of this bull cycle

fed will cut rates, we will likely rip this fall, will likely continue through 2026, intensity and price heavily dependent on macro

most new people will buy bitcoin penny stocks rather than real bitcoin because of x influencers

at some point most participants will believe this time is different, that we have entered a supercycle

people will then get greedy and overleverage themselves, take increasing risk

blow off top and and a great unwind

mstr will probably be fine, most bitcoin penny stocks rekt, a few may get caught in fraud, there will be a narrative that mstr is going to sell, which will drive panic

bottom of the next bear will likely settle over $100k

stay humble and stack sats

Login to reply

Replies (139)

Yeah I could see this 💯🙏

"Buy into X ETF bro, it's Bitcoin without the hassle"

:D

LOVE AN ODELL PREDICTION 🚀

Bold prediction. Sticking your neck out. The amount of Bitcoin changing hands at this price will make a strong bottom.

Bitcoin treasury penny stock companies, the new alt coin pump and dumps 😆 🤣 hell naw

Buena narrativa 🫡🫡

Seems logical. Human nature doesn't change.

My vibe, everyone trending into BTC. It’s going to take longer than I expect. That’s about it

OK here you go. Bottom will be previous market top.

I agree. We're in the gradually part of gradually then suddenly. Nobody is late yet.

Can nostr survive this??

I'm determined to be the last human posting on nostr.

nobody has a crystal ball but this is my current vibe:

12-18 more months of this bull cycle

fed will cut rates, we will likely rip this fall, will likely continue through 2026, intensity and price heavily dependent on macro

most new people will buy bitcoin penny stocks rather than real bitcoin because of x influencers

at some point most participants will believe this time is different, that we have entered a supercycle

people will then get greedy and overleverage themselves, take increasing risk

blow off top and and a great unwind

mstr will probably be fine, most bitcoin penny stocks rekt, a few may get caught in fraud, there will be a narrative that mstr is going to sell, which will drive panic

bottom of the next bear will likely settle over $100k

stay humble and stack sats

View quoted note →

₿ 🔮 👀

Coinbase custody honeypot going to royally suck, literally

Sound bout right

Or, this could be the top and it drops to $20k 😂 you never know. Just stay humble and stack sats.

We'll be chilling with a bottom above 100k

The more chaos the better for bitcoin 🧡🗽

yes but also

I'll take it

Hopefully Jack mallers loses all of his jewish backers money. 🙏🙏 now that will be funny

source please

You have too much faith in Wall Street/saylor/stocks

Yeah sounds plausible I hope the paper bitcoin gets flushed out in the penny stocks rekt phase

$200k by conference day in play

It’s already different. Virtually all price action predictions or expectations from the usual suspects have been wrong. We are on track with the power law, but people hate that model for some reason.

What do you need to see before acknowledging we are in a new paradigm?

Imo a lack of a greater than 50% correction disproves that this is just another cycle and not a super cycle, by which I mean a longer than usual bull market. I don’t think we will have a blow-off top in Bitcoin. Stocks will, though.

200k by conference day!!

Let’s fucking go 🚀

TL/DR: stay humble and stack sats 🤙

🔮

Yup

I would not be surprised if this cycle played out like this

This tbh. Wild that calling a 100k bottom is so legit now. Crazy times

I can live with this

Been telling my normie friend to buy bitcoin for about 2 years. He didn’t take me seriously until the price ripped. Then he reached out and admitted I was right but that he’s going to wait for the price to go back down to around $60k. When I asked how he knew it’ll go back down to that price, he just said I know. He could’ve bought around $80k twice. He’s not going to be happy if $100k is the next cycle bottom🤣

Most won’t learn until they lose. Real bitcoin > bitcoin penny stocks. Avoid the casino, stack the asset.

I think similarly.

This is my thesis as well. The nutsack points me in this direction.

Penny stocks, what better than sats stocks on the penny? Just under 1k sats for the dollar. It's still great value imo

Sounds about right but I think we could end up back at $85k or so

stay humble and stack sats

History doesn’t repeat, but it sure as hell rhymes

🤙

Wouldn’t be happy with 100k flour …

Keen baker here.

is this like dowsing but without metal rods?

Have friends like that. The “I’ll wait for it to come back down” crowd are the forever nocoiners.

Technically they are brass

Same old same old. Just refer to the charts of @therationalroot

walk with free brass through the fields. the underground streams have a certain…pull

I can see 100k as a future bottom. ♥️

Prediction: 2026 will be a bear market, negative 50 to 70 percent

Bearish as fuck Matt. We are going to over 1M in 2026 (revised from my 2025 prediction)

Life is much more fun when you are a MAXIMUM BULLTARD

But yes SELF CUSTODY 99%

Leverage 1% for the entertainment

Why so bearish Gladstein : 800+ companies are stacking Bitcoin Going to be 10 000 next year

If BTC breaks below $107,000, it would signal a loss of momentum and invalidate the bullish scenario.

This breakdown may lead to a quickn move toward $106,000 or even $105,800, the recent swing low.

Don't you have any conflicts of interests shilling MSTR?

I bet MSTR rug pull will be infamous like Enron, Dotcom bubble etc.

He’s not gonna have fun staying poor

Covid lockdown taught me how to harness my rage.

1. Know myself.

2. Identify and study the enemy.

3. Understand their environment .

4. And exploit their vulnerabilities.

Separate perception (bullshit) from perspective (reality) eg We all have 3 faces i) The public face masked to deceive. ii) The private face - for family and friends and iii) the secret face - the REAL you - hides your shame, guilt, obsession, etc.

I'm not the clever one - Shawn Ryan's ex CIA guest - Andrew Bustamante laid this out.

Follow the money and you find the corruption - Vatican, City of London, Washington. Professor Richard Werner and Mike Malone (10 podcasts on The History of Money)

To study the enemy - Learn the nuances of the English language - political speak, bank speak, media speak, trade speak, government speak, legal speak, tech speak, finance speak - All designed to confuse, to censor, to shut you up. Grateful thanks to Nostr developers for providing a free speech platform..

Their environment - they want control. Control the food, the energy, the money - Kissinger's mantra.

The vulnerabilities -

Greed. After gorging themselves on the free money - we will witness them cannibalizing each other eg Big Pharma - Fast Foods. I stole that from Charles Hugh Smith - Hollowed Systems to create the illusion of stability. The Ratchet Effect.

Dedollarisation is happening thanks to BRICS and Bricspay blockchain. They're moving to their own currency, backed by gold reserves.

China - From their history courtesy Professor Wang Gungwu to their current status as the global factory, supply chain infrastructure, to cornering the rare earths market.

Global South - These countries have been subject to Western colonisation, slavery, scarce resource exploit, political regime change, bombed, sanctioned, genocided, poisoned, debanked - so yeah - there's some pretty pissed off people out there.

BITCOIN - doesn't care about my face. It doesn't care about politics, vaccines, borders, sanctions, wars, BIS, Federal Reserve, Rothschild, Gates etc...

Bhutan and El Salvador proved it. The crypto market cap is currently at 3.5 Trillion - compared to Forex who trade that amount every day.

So now I will focus on the risks, rewards and help the shift from Fried Fiat to Beatem up Bitcoin.

So how does this relate to Matt ODell's thread?

We come from a society of quick fixes, convenience, consumerism. Where everything activates by pressing a button.So, there will be people who like the principle of being their own bank, but don't consider the type of hardware to use, the networks, the apps, the exchanges and at the same time secure their data against theft, scams, hacks.

And then we have Wall St. They are not your friends. They have the broker, the maker, the taker - and their mode of operation is MEV - fancy name for Maximum extraction value . Translation - they slap your face when you enter and kick your ass when you exit. In other words the value you enter with, gets topped and tailed when you exit. ETF's are a classic example. Many of them are in the crypto space. See if you can pick them out.

I trust Matt ODell, Marty Bent, Jeff Booth, Peter MaCormack, Lyn Alden, Alex Goldstein. They are my sit up and listen. Trust is not easily given.

Bitcoin is hardening into a powerful tool. Its the one asset that will throw the spanner in their years of planning to turn us into dairy cows on a one way ticket to the abbotoir.

I make no apology for ranting. Its like breathing in fresh air after a recent rain shower.

To those who suffered through Covid - I'm really sorry.

lmfao half of bitcoin twitter hates me for not worshipping saylor

first time?

There is no such thing as a straight line to a million

What are they stacking it for?

Thanks for the heads up

Get Wealthier ?

Sounds about right

Whats your estimate for blow off top?

Three fiddy

He should stay humble and stack sats.

He’s too busy stacking fiat 😂

Bull cycle?

Bitcoin price has increased 48% from its 2021 top. And 2021 was a neutered bull cycle! 48% over 4 years + !

Bloody hell - the definition of a ‘bull cycle’ has definitely changed by the looks of things!

Bull ant 🐜 cycle perhaps???

View quoted note →

I share the feeling. I think (and hope so I can stack some more) that the bottom will be around 60-80k. We will see.

When $58k?

Generally agree but I think shorter timeframe and lower bottom

Lol

444

Can you eat sats?

“This Bull Cycle” @ODELL

In what world is this a bull cycle? From the 2021 top to the current price right now it’s less than a 49% gain!

Barely, just barely edging out inflation!

The copium dealing is REAL!

Stay humble and stack sats.

Shout out to me! 🐷 🪈 🇧🇬

View quoted note →

69420K bottom

Rest of us boring hodlers will just 🍿

Regardless of the sentiment’s accuracy, the two most important words here are the two most likely to be overlooked. The mind will naturally wander along the optimistic route looking for confirmation from those with clout while ignoring the risks along the way.

Leverage, for institutional and retail investors, should be understood before deployed. Particularly for the latter, as it will become incredibly easy to ignore the severity of not doing so as numbers rise and blinders become cemented.

Those will be the ones returning to this post wondering how they forgot to stay humble.

Governments are creating Bitcoin reserves…

Companies are building Bitcoin treasuries…

Sovereign wealth funds are calling Bitcoin the new 60/40 portfolio model…

…all while Bitcoin’s price is stagnant, barely 50% up from the 2021 highs.

If this was XRP, we’d be trolling the hell out of it.

Instead, we get cope like this trending. 🫠

View quoted note →

No more than you can eat FIAT.

How I eat fiat:

Hey now, that's a novel idea, EXCHANGING money/currency you can't eat for food you can!

Guess we can eat Sats if exchanges are allowed.

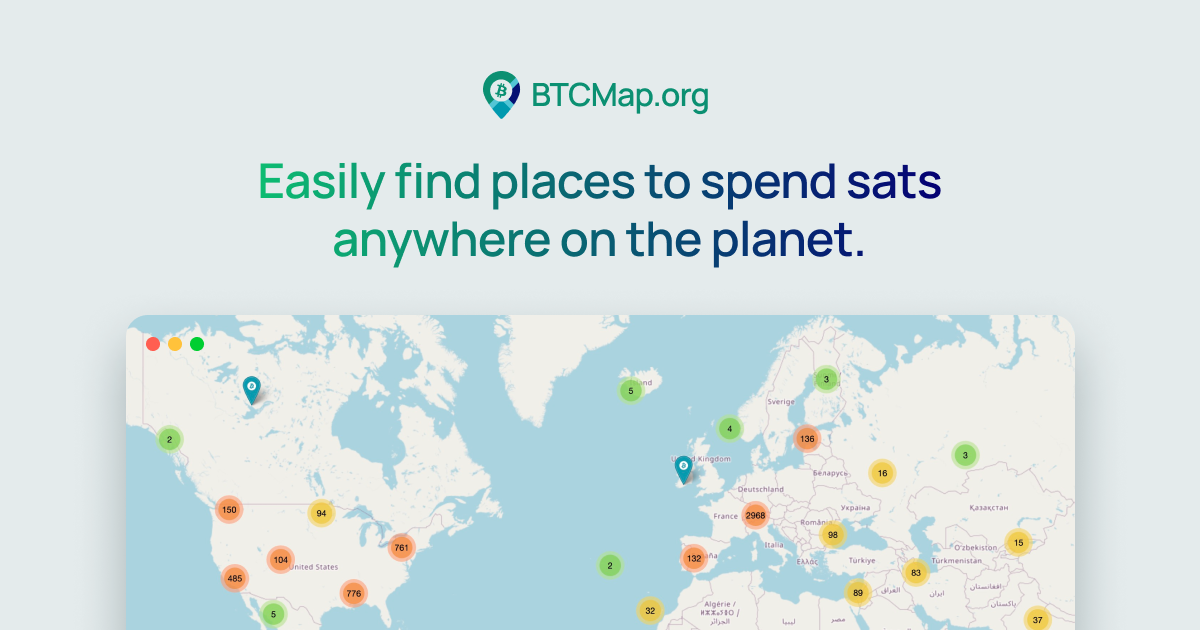

Where can you exchange sats for food. That's not a thing.

I did it multiple times the last few weeks.

You very much can.

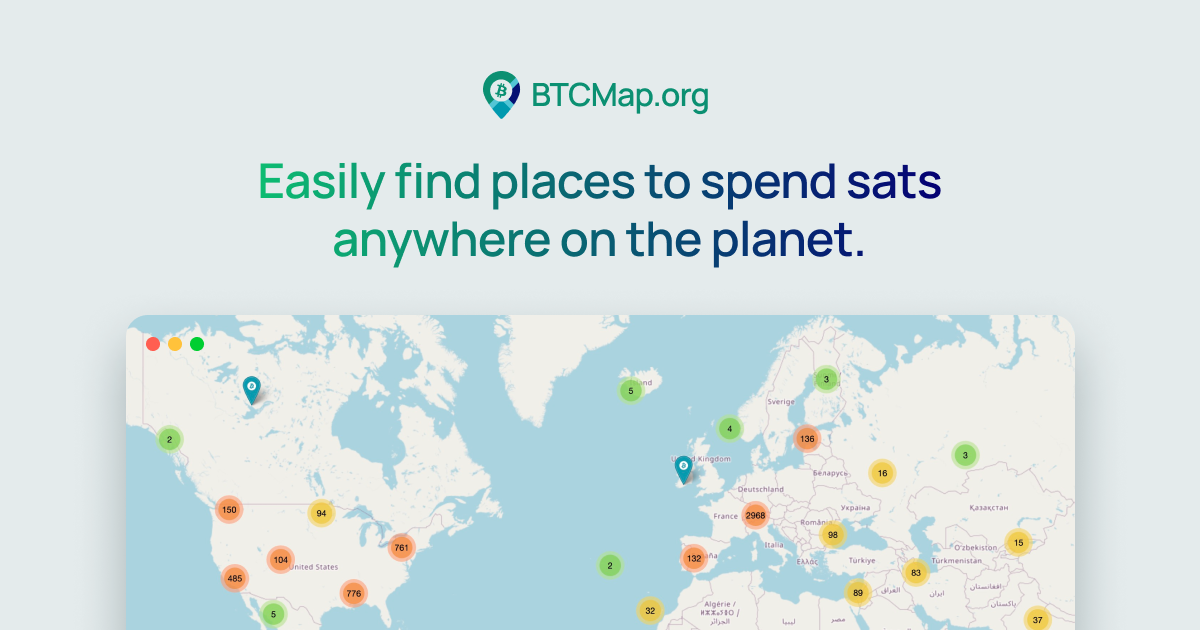

BTCmap.org

BTC Map

BTC Map

Easily find places to spend sats anywhere on the planet.

Yeah but will you be able to do that going forward? The prices fluctuate so much you never know what you're getting.

I price outside of fiat terms for my bitcoiner buyers. so does @Leathermint the value asked of the items we sell never fluctuates. Its your understanding of its price in you unit of account that is fluctuating

I don't understand what you mean. There's nothing more reliable over the long term than Bitcoin secured by energy and time through global consensus. There is variation in linear price levels that seem massive, but when looked at exponentially those variations are very small and the general trend is clear.

More will continue to adopt. More mining efforts will arise, increasing the hashrate and value. More will begin to accept it for exchange. And so on.

Bitcoin is winning, it's only a matter of time until you realize it.

People do that more and more

In addition, how do you think a new money would emerge : it has to start with store of value, but mean of exchange follow (partly in parallel)

is it is easy and practical to exchange sats for food and the fact you can’t do it everywhere is only because we are still very early

You price what where? I clicked the wedgeorganics.com link in your profile and it took me to a GoDaddy landing page.

Its a place holder for my flowers, unless you’re within 30min drive i can’t deliver to you. I appreciate your want to do commerce with me though.

@PUBKEY for one

Almost 3 years of using Bitcoin as unit of account.

Just in Queenstown, with a regional permanent population of about 50k people, there’s:

Frankton Pizzeria – Pizza Restaurant – Queenstown

Handlebar Eatery & Brewery

Handlebar Eatery & Brewery

Real Food Kitchen

Home - Real Food Kitchen | Queenstown, New Zealand

Real food and nutrient-dense ingredients help you take control of your eating habits and be the best version of yourself. Flexible delivery options...

The World Bar

The World Bar Queenstown New Zealand | Best Queenstown Nightlife

The World Bar Queenstown is the ultimate spot for drinks, good honest food, teapot cocktails, craft beer & events, live music & Queenstown's b...

Yonder Queenstown New Zealand

Yonder - Best Café Queenstown | Dinner Restaurant Queenstown

The best Queenstown cafe for coffee, breakfast or lunch from our restaurant, bar & kitchen. By night, enjoy dinner, beers & the best live music in ...

It says Bitcoin but then the price quote, €0.50, is in fiat. That shows the fiat conversion right there. The Bitcoin price will fluctuate accordingly.

I checked your website. $300+ for a wallet is a bit steep says this old fiat mind of mine. I'll keep an eye on it.

See my comment to @Leathermint below.

For the sake of Bitcoin it would help if you had some sort of website where you publish prices still, just so that we can use it to create some sort of CPI for Bitcoin.

Flowers are more useful for a CPI than wallets since that's something people buy on a regular basis whereas luxury leather wallets are a rare purchase.

Yeah I know - this was more of a funny side joke.

Of course right now people will set the Price connected to the conversion rate to Fiat. But how else should an emerging new Money System evolve? This will change with time 🙂

But there are already (very few) people living and paying only in Bitcoin. It‘s not their fault the sellers of products connect the Bitcoin price to the Fiat price. So these bitcoiners already live in a Bitcoin Standard.

Also may I ask how do you pay your suppliers? Do you just sell flowers or also grow flowers? If you grow flowers what are the inputs? Seeds, bulbs, fertilizer? I know nothing about the flower business.

I clicked the pizzeria one and they price in fiat presumably because they do a fiat conversion for you.

Bitcoin prices will fluctuate accordingly, the dream of bypassing fiat gone. #btcfail

Yes it's their fault because they don't offer a currency that allows for stable prices.

The shops price in fiat because prices are relatively stable. Not perfectly stable of course, could be bette, but much more stable than Bitcoin.

I purchase bulk bulbs from a wholesaler, my seeds from small business, my inputs are compost & free wood chips. this is my third season so many perennials are just starting to flower a bit. We specialize in flowers that dont travel well like Snap dragons and dahlias.

My side goal is to get into dried herbs as they store & ship well.

Follow #farmupdate for more

And again - how would you think a new monetary system would evolve?

You really think the way it would is Like:

„Here, I made this new Willynilly-currency: I will set the Price for 100g of bread to 10 Willynillys.“

And everything accepts this and a new currency is born? Really?

No, you need to have network effects and a mechanism to control supply so that the amount in circulation roughly matches the goods and services on offer.

This is really hard so only governments currently can do it.

Bitcoin and network effect? - Check

Controlling Money Supply in Bitcoin? - Check

Control of supply in goods and Services in circulation and offer is NOT needed (wtf?!?!). —>Otherwise gold would not function at all.

So honest question: What is the Problem again?

> Bitcoin and network effect? - Check

A network for a currency would be a circular economy of buyers and sellers. There's no such thing.

> Controlling Money Supply in Bitcoin? - Check

Controlling doesn't mean limiting. It means the supply can be increased or decreased to match the goods and services on offer.

The supply of Bitcoin can not be decreased and not be increased above 21m.

> Control of supply in goods and Services in circulation and offer is NOT needed (wtf?!?!). —

Nowhere did I say "control of supply in goods and services". We live in a free world and can offer as much or as little as we like.

However the supply of money has to roughly match the supply of goods and services for prices to be stable.

> Otherwise gold would not function at all.

It doesn't. There are as many shops doing business in gold as there are in Bitcoin. None.

> So honest question: What is the Problem again?

The above.

Sorry I think we won‘t get to a Common Sense.

All I can say is

Sry sent by mistake…

All I can say is:

How can you deny the network effect? This is just plain naive. Bitcoin Adoption is growing everywhere.

Circular Economy is not here - YET.

Bit you know what? This is exactly how a Network effect would come in place. It doesn‘t make a big „BANG“ and everything is there at once.

Instead naturally growing - that’s exactly whats happening now.

Monetary Supply has NOT to be decreased or lowered to match goods and services.

If you believe so I don‘t think we can come to a common sense 🤷♂️.

In the past humanity used Gold coins.

The Problem with that was not the fact that the Gold coin Supply couldn‘t be increased fast.

(First time I would hear this argument)

The Problem was the divisibility, the transferability and that it could be altered with (which was done a lot)

But all of these points are solved by Bitcoin.

So again - I don‘t see your arguments. In my view they are plain wrong 🤷♂️.

So I guess: agree to disagree?

But I would love to have this conversation again in 5 years!

Especially regarding the newtwork effect 😊.

OMG you’re right! That’s it everyone, bitcoin has failed because it’s imperfect from the moment of its birth. Time to abandon the life rafts and return to the HMS Titanic that is the dollar. Thanks for opening my eyes, mate, I really dodged a bullet there. Phew!

Its birth was 15 years ago?

So it's not a scam anymore then? Or drug money, government will ban, boiling the oceans etc? It's just not widely accepted enough now, is that the new FUD?? Lol

Yeah nah I don't buy the scam/drug/energy aspects. It's just not widely accepted and never will be, lacking a mechanism for stable prices.

I think you will be wrong in the „never will be“.

…. especially if your main argument is the lacking mechanism for stable prices.

But we will see I guess - love to talk to you again in 5 years about the development 😉

Will do.

Imagine thinking fiat money will be a “mechanism for stable prices”

🤡

Wow - "a 200k by conf day post"

The sats price of everything is collapsing, while the fiat price of everything never stops going up. Is this the stability you're talking about?

It's pretty good. Feel free to plot the price stability of fiat against the price stability of Bitcoin.

Both change but the changes in fiat price are much smaller.

Major 🫡

I agree with Matt, but 58k is the inevitable bottom of the next bear market.

Dread it.

Run from it.

Destiny arrives all the same.

View quoted note →

2027

the suitcoiners will be baptized.

one way or another.

I’m gonna stay humble and stack sats about it

Maybe the penny stocks are the next $100 stocks because they see the potential of the greatest asset on earth.

I’m here for BTC treasury FUD.

Companies buying Bitcoin have superior management who have thrown out trad Fi orthodoxy.

Bullish

Always time for a little bit of Dan.

odell prediction means bull market confirmed 📈🐂

to be honest, i don't believe in big price changes ... until inflation and currency devaluation really kick in

bullish

View quoted note →

Don't apologize. I really liked reading this. Thanks!

I have huge balls though

...and mempools will never clear again.

Ignore the noise and stack sats.

at some point, probably, but also admit i got that one very wrong

fine by me, i transact a lot

👀

But what about the political landscape?

Do we have an Organs Congress?

#asknostr

nobody has a crystal ball but this is my current vibe:

12-18 more months of this bull cycle

fed will cut rates, we will likely rip this fall, will likely continue through 2026, intensity and price heavily dependent on macro

most new people will buy bitcoin penny stocks rather than real bitcoin because of x influencers

at some point most participants will believe this time is different, that we have entered a supercycle

people will then get greedy and overleverage themselves, take increasing risk

blow off top and and a great unwind

mstr will probably be fine, most bitcoin penny stocks rekt, a few may get caught in fraud, there will be a narrative that mstr is going to sell, which will drive panic

bottom of the next bear will likely settle over $100k

stay humble and stack sats

View quoted note →

Whoa this is awesome. Going for a walk now, but I’ll be back to teleport into some chats tonight. 🚀

View quoted note →

View quoted note →