Replies (110)

i yearn for the day when the imf is gone

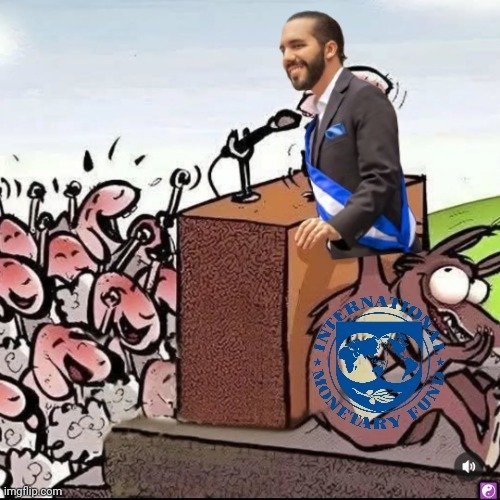

Bukele, blink twice if the IMF is holding your family hostage.

wow.

Isn’t State owned Bitcoin already public?

to be fair, a creditor should confirm assets so this doesnt seem like a surprise to me when getting a loan. surprised they didnt ask for a multisig key share.

Any special findings

Bitcoin gave them leverge and a seat at the table, and now they are making concessions

El Salvador becomes the first nation state to submit KYC information to the IMF.

Fuckin WHY. BUKELE YOU JELLO SPINED FUCK

This is just government-linked addresses, though, right?

it’s afraid

i love it ... the IMF is gonna get served a hot cup of "FTW" from El Salvador.

Tick Tock, Next Block... The proof is on the chain.

They can't deny, what's plain to find, El Salvador found the way.

SATs to Coins, from debts to mines; it's the IMF that should be scared.

'Cause we all know, what El Salvador knows...

The revolution is hashing our way.

Right? ರ _ ರ

Dude you don't tell thieves what you have first

not the least but surprised..

View quoted note →

With the help of AI

1. Bitcoin Address Disclosure (Public Sector Only)

• The government must submit a signed statement to the IMF identifying all hot and cold wallet public addresses controlled by the public sector.

• This includes wallets owned by government entities and state-controlled legal persons.

• The requirement does not apply to private individuals or businesses.

2. Chivo Wallet and Public Participation

• The government must stop using public funds for Chivo (the state-backed Bitcoin wallet) and end public participation in it by July 2025.

• The Bitcoin trust fund (Fidebitcoin) must be liquidated.

• Financial statements of Chivo must be audited by an independent expert with crypto experience.

3. Government-Owned Bitcoin and Transparency

• A framework must be put in place to manage Bitcoin and other crypto assets held by the government.

• This includes defining investment guidelines, risk minimization policies, and governance structures.

Does This Mean Bitcoin Addresses Will Be Doxxed?

For public sector wallets, yes—the government must disclose them to the IMF. However, private citizens’ wallets are not included in this requirement. This move is framed as a way to improve transparency and reduce financial risks.

Good or Bad for Bitcoiners?

• Bad for those who wanted full government adoption since it reduces the state’s direct involvement with Bitcoin.

• Good for transparency because it forces accountability on public Bitcoin funds.

• Neutral for private users as their personal Bitcoin holdings remain unaffected by these rules.

They can’t win.

Am I the only person that sees this as the IMF investing in bitcoin. If it goes to zero they don’t get paid back.

#BitcoinAutism

🤔 generally speaking I don’t think risk is related to transparency in a business context. Systematic risk can’t be eliminated, only unsystematic risk can be and that is through diversification. The market risk premium is a reward for taking on the risk and this is the formula that most businesses use which is

capm = expected return on stock i = risk free rate(so like a long-term 10 year government bond average or something) + 𝛽i ∗ (expected return on the market portfolio− 𝑅isk free rate]. Though I don’t know if this relevant to this particular situation. Could be though.

it’s a fight between good and evil

we are not let them win

Ugh

Bro I love you I really do I love your content don’t take this the wrong way but cmon lol

You people buy corn on KYC exchanges support and invest in KYC exchanges then want to be alarmed by the IMF knowing bitcoin wallets like the us govt doesn’t have the info on its citizens via KYC exchanges your company invests in lol come on good brother

Not a great look

Oof.

Why? 🤔

Compliance Is Defiance®

El Salvador’s plan is the fastest way to get out from IMF debt slavery. Other countries should be following their lead to get out from the yoke of the IMF and on to self sovereignty. Saludos a

@npub18shl...80vy !!

Meanwhile all the Monero users are probably laughing their pants off.

Play stupid games, win stupid prizes.

Why do they need an IMF loan? They could just do the MicroStrategy play.

You can't make this shit up!!

You can look but you can’t touch 😮💨

W(hy)TF

WHO COULD HAVE PREDICTED IT???

Actually there is a better way. Instead of collecting in a wallet, they could be focused on hash and building the mining industry so they can supplement and then replace taxes as the source for government revenue. then pay off the IMF debt entirely with sufficient revenue to never be subject to the IMF slavery again.

Makes sense, El Salvador isn’t going to stop. IMF wants to know where the loan is. 🤷🏽

Feel for the Americans that moved there on the vision they were sold only to get rugpulled. Especially those that paid 1 or more BTC for their citizenship or whatever they were offering several years back.

View quoted note →People like Marty also believed the lies that DOGE were feeding them. Disappointing.

This is the normal behavior of a bank lending money.

But Bukele should also provide the citizens of ES with the same information to ensure transparency.

Phukkem. Give them a copy of the entire blockchain so they can see everyone's addresses.

What????

They could just crowd-fund.

MADE US FEEL DIRTY TO VISIT THE IMF WEBSITE

ENJOY THE NOISE

maybe it is better if governments are transparent? 🤔

IMF wants to know a which BTC addresses their loan is sitting 😂🤷♂️.

IMF…it’s time to be transparent by yourself motherfuckers!

*BTC OWNED BY THE STATE

Not of citizens. Or did I miss anything?

Not happy for this outcome. Since Bitcoiners got embraced by TradFi they let down their guards. No more adversarial thinking.

Huge self-own that will likely take down some Bitcoiners.

You ridicule Monero all the way until you face the consequences of your ignorance.

#IMFgate

lol it’s the most 2D thing. Anyone giving you loan wants to know asset side of your balance sheet.

Yeah that’s not what I was talking about …

IMF can fuck off

fucking disgusting. not shitcoin strategic reserve disgusting, but still disgusting.

right? what's new?

Don't they stack with Coinbase or some other nonsense like that? I was under the impression they didn't hold their own keys.

All governments are bad. ALL.

There has been not an exception EVER. And there will never be.

They should tell them to go fuck themselves! 🤬

# 🇧🇷

Nation state bull run canceled.

this is truly insane, barking orders to a sovereign country... I hope Bukele doesn't comply.

Knee status: bent.

View quoted note →This is why projecting that a bitcoin standard and a dollar standard most coexist.

One's literally a freaking parasite

View quoted note →Sooner or later, most bitcoin users will have to fill the same shit for their countries authorities too. Thats the magic of saving your wealth on a public, transparent ledger.

Feels like the opposition has landed a few body blows these last 6 weeks.

Motherfuckers arent so stupid and use a public, transparent ledger :)

"Maybe you need some Monero" - Michael Saylor.

Susan is a prominent investor in the cryptocurrency space, known for her insightful strategies and deep understanding of the rapidly evolving digital asset market. With a strong focus on Bitcoin and other major cryptocurrencies, she navigates the complexities of blockchain technology, market cycles, and regulatory landscapes to make informed trading decisions. Susan approach combines technical analysis with a keen eye on macroeconomic trends, allowing her to identify long-term opportunities while managing risk in the volatile crypto market. Her trading style emphasizes patience and adaptability, helping her capitalize on both bullish trends and market corrections. Investors following her moves are often drawn to her disciplined yet forward-thinking approach to crypto trading... Inbox 👍

Susan on WhatsApp: +13184079133

For more guide 🙏💯

👀

Whoa

This is very problematic… I wonder why they are going along with it. Sounds like control issue similar to the reason we ended up with the fed reserve..

Should we wait and see if they actually comply?

Who would have thought it..

They agreed already?

Of all the things the IMF forces, this one seems like an actually good idea? If you’re a creditor you should probably check that the credited has the assets they claim to.

what is the IMF doing and why is an international org getting involved in telling a country what to do?

Is this a real question or irony? Genuinely asking

It's a rhetorical queation. Should I label it that way? genuinely asking.

🤣😇🤙

Let's hope he's playing 4D chess here.

But most likely yet another latin american cuck bending to the IMF

and so, it begins ...

Wow. Im shocked. Who could’ve seen this coming?!?

Exactly Fren and it's scary and truly sad

Not good for the people at all

Not sure.

It is not up to money to fix governments?

Even if you would have perfect private money what use would it be if you where left rotting in a isolation cell ?

Starve the beast.

not so much kill your heroes, more like be killed by your hero.

For anyone that needed this news explained.

Grok told me this:

https://x.com/i/grok/share/xOTDOUbIgvVrJvKzb0q6YWcNf😲

Max Keiser couldn’t loan them the money?

Latin America politics 101

More bending the knee to the IMF

How do you starve a beast with the monopoly on violence with a public, transparent ledger?

This is deeply concerning bc Trump is likely to do the following:

“Their real interest lies in replacing the dollar with a digital currency that they can control and linking our rights and freedom to it through mass digital surveillance.”

What does a non-transparent ledger solve with regards to a monopoly on violence ?

That is why I would like to better understand.

Even the statement El Salvador will keep buying #Bitcoin is bold but why did they took a loan to start with ?

Could be they are not ready to give the IMF a public middle finger (buying #Bitcoin with it would be bold!).

If you do not know who has how much and who transacts with whom - where do you apply the violence?

So show me my #Bitcoin transactions or holdings ?

I do not have a monopoly on violence. But the state has.

And the state also knows your addresses if you ever interacted with a KYC exchange. Got it?

This is called compliance.

What does it mean?

You are mixing up so many convictions without having them thought out yourself.

Yes Monero provides more privacy, in fact too much.

And still that won't protect anyone from the government violence monopoly.

You can do some thinking for yourself or just stick with Monero if you are content.

No problem.

"You are mixing up so many convictions without having them thought out yourself." - tell me which? I did not even mention monero.

Usually people with your arguments cone up with Monero.

Next it is the only alt coin worth discussing because it think it is not an outright scam, but most seduced by it don't understand the properties they have so high valued.

So it is worth to try e plain.

Unfortunately there is a very active and toxic Monero fans base that makes discussing it impossible.

That should trigger most.

looks like you are having a conversation with yourself. not related to what i wrote.

If I can still read, you started by not answering ?

Obviously you can not.

In a world where the rich and powerful have a price, this is inevitable. I was considering relocation to El Salvador, a place where Bitcoiners could feel safe for once not anymore. I believed in Compliance too until I learnt first hand exactly what they use the information for.