Replies (39)

This. Pair with boots on the ground asap.

The discount should be proportional to visa/MasterCard fees.

100%. High risk of sparkle and fade, like the other times before. Price-savvy consumers and small businesses do stuff when they have a practical reason to do stuff, not an *~ideological~* reason.

And I will put on my boots for this

Good points

Yes to this. Tap into

@Bitcoin Park Nashville and Austin,

@PresidioBitcoin, and the like.

Capital gains reform. As long as USians are literally required to calculate "capital gains" on buying a cup of coffee, adoption isn't happening.

We need a kicky sticker template for "Pay with Bitcoin, get X% off"

> a really crisp value proposition for businesses would be helpful (fees? UX? treasury?)

Absolutely needed.

It's what primary pushed me to work on this:

Let me know if you have any suggestion.

daniele

daniele

In the last period I thought about how I can introduce friends, shopkeepers and small businesses to Bitcoin. Even when someone shows some curiosity, explaining Bitcoin can be a really difficult job; it has a lot of concepts and several facets, and since everyone has priorities and thoughts on certain topics, if you touch the wrong ones, you risk annoying and losing them quickly. In addition, spending time with someone that is not already sufficiently "hot" about the topic can be a waste of time and, worse, generate a repulsive effect.

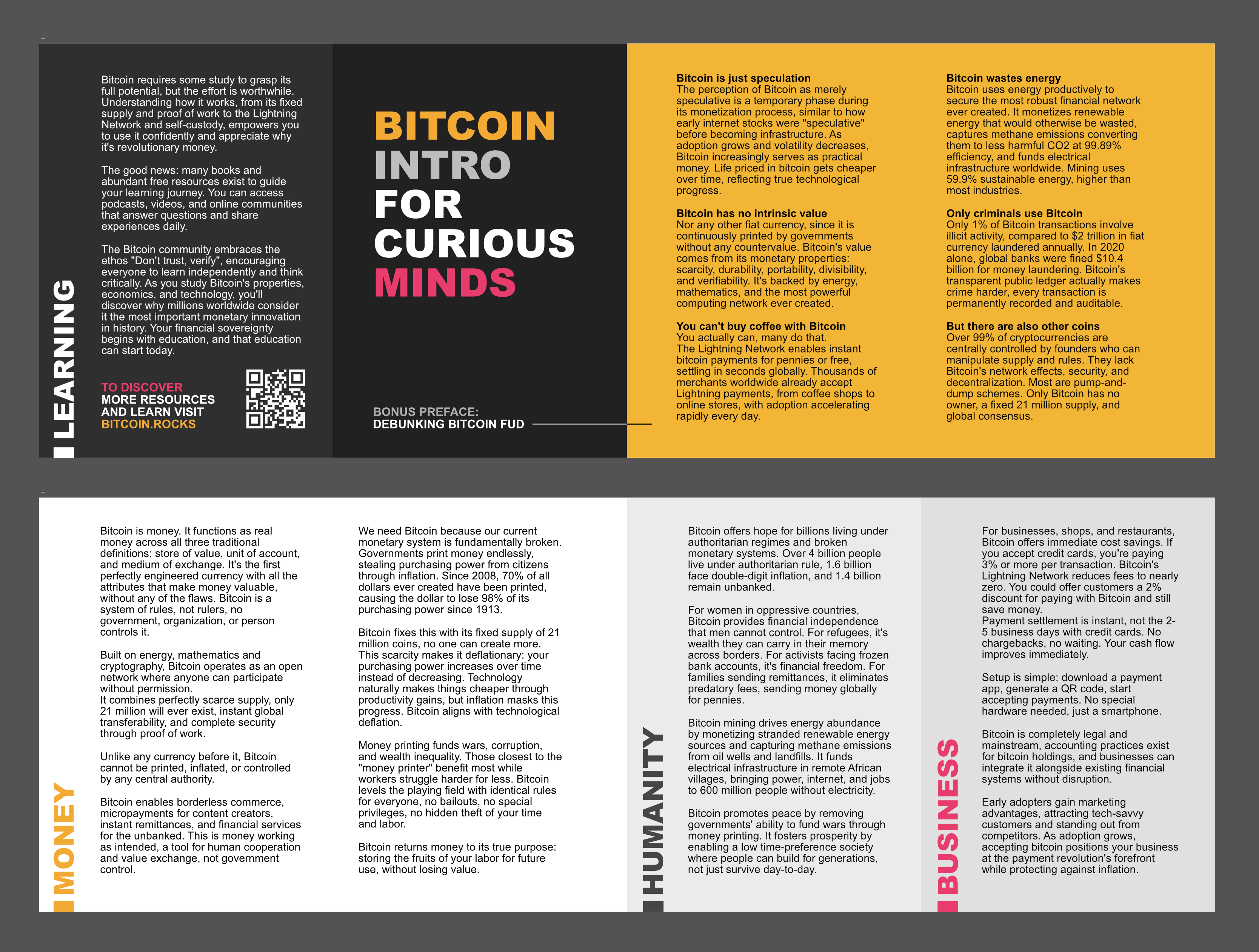

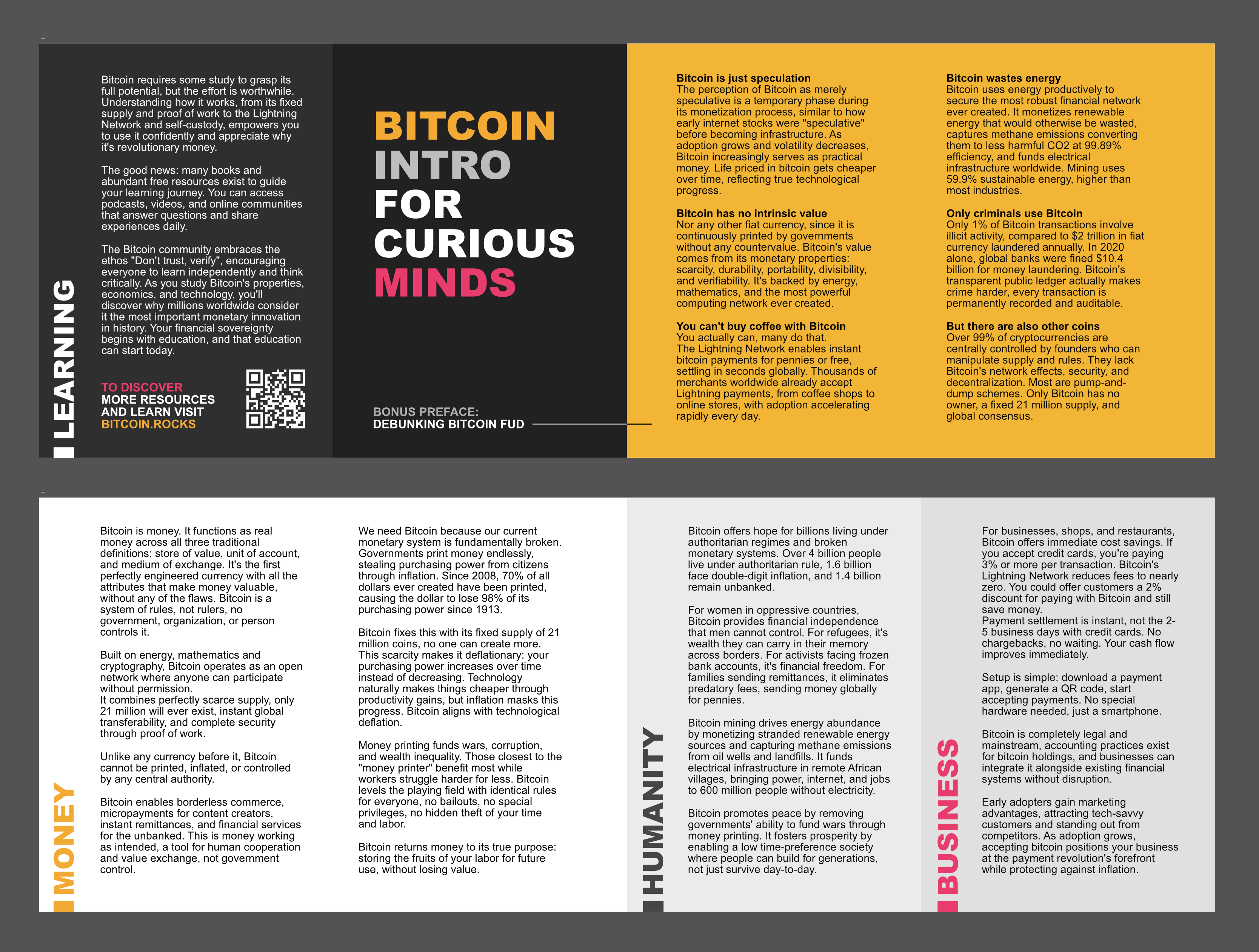

So I designed a small brochure that is a really quick introduction to Bitcoin, with the goal to activate people and trigger some reaction and/or curiosity. The plan is simple: I ask if they know about Bitcoin, leave the brochure, and wait for an immediate reaction, or I have the option of following up next time and asking for feedback; so I can get some ideas on what topics to bring up to keep the conversation going.

As you can see, I chose to give the "debunking FUD" section a primary visibility (is the first thing you see when you open the foldable), since people often learn about Bitcoin via negative and alarming news, so they are good points to activate a first doubt. Then there is a synthetic explanation of Bitcoin's money nature, why it is radically different from fiat currencies, and what impact it may have at a social and business level.

On the back there is a section that points to a website where the user can learn more. Currently I'm using bitcoin.rocks, but I will evaluate other resources or I can also build something new, maybe with some specific information for businesses, that are critical for adoption.

The idea is to release it open source, so anyone can personalize it (e.g. the learn more target), and maybe produce versions in different languages.

The dimensions are 42x15cm open, 10.5x15cm closed, foldable in 3 points; so with a standard A3 print you can get two brochures.

Does that make sense? How can I improve it?

Gamify it with leaderboard ;) top referrers get something?

I’ve been wrestling with this one. Australia (and many other countries) logs btc as subject to capital gains tax. So whenever we dispose of btc (like when we buy something with btc), it’s treated no different to a sale. We’re then liable for capital gains tax on any “profits” made from btc value growth since it was first bought. It’s a big tax too.

Lots of people only know of kyc exchanges or are not confidant or comfortable with their non kyc options.

So how can you transition a general population to btc as monetary exchange, when it’s at such a transactional disadvantage compared to fiat?

Not trying to sound pessimistic. Genuinely interested in thoughts on this for how to build the road ahead

I like some of your ideas but I don't think giving a discount is a good idea. Market prices should be determined by supply and demand and it goes against the idea of having sound money to offer discounts to those who use it.

I'm concerned about the same thing. I'm about to open a restaurant and I wouldn't want to get arrested or fined for allowing bitcoin transactions.

We don't yet know how strictly the government will enforce rules around crypto. Apparently they have software to determine crypto profits already.

We can rely on a certain level of government indifference and incompentence but that is a risky play.

I've been harping about your 3rd point at least since Steak 'n Shake started accepting Bitcoin. If merchants are suddenly able to keep 2-3% of a sale by not having to fork it over for credit card fees, they ought to at least have to option to pass some or all of that along to the customer.

I wouldn't even present it as a 'discount'. I haven't seen Square in action, yet; but, I imagine the customer must be presented with a conversion rate at some point. Imagine you're a Bitcoiner - who naturally has some idea that the current conversion rate is like 105K - and the coffee shop is offering you a rate of 107K to spend your sats instead of dollars. That's a coffee shop I would want to go back to.

Don't get too hung up on how it's exactly structured. A price that exempts the credit card fee for non credit card purchases IS the market price based on supply and demand. The credit card fee is a distortion of that market price.

I your point is that you'd prefer a 2-3% penalty for credit card customers only instead, that's fine. But ultimately, it's 6 in one; half-a-dozen in the other.

Not happening until capital gains taxes are abolished or some kind of exemption up to a certain value

View quoted note →Maybe I'm not following... but are you suggesting that having to give away a portion of a realized gain on BTC to taxes is at a transaction disadvantage compared to fiat that has no realized gain to tax?

Yes, discount and affiliates are fundamental. We've been advocating for discounts since 2023 when we traveled to some circular economies and saw low merchant adoption. And we also created a way to pay orange pilling affiliates. Unfortunately it didn't go beyond the test phase for several and personal reasons. But

@jack could easily do that.

View quoted note →never sell (for dollars) != never trade for goods & services.

i often do the later and i never do the former

merchants are also customers and can spend the bitcoin they received

They are also potential hodlers. Merchants onboarding other merchants to Bitcoin is how we win.

More than that, we need non-bitcoiners to want to use bitcoin, *because of the medium of exchange* value proposition.

Agreed, I picked 1% so that both sides get something out of it

Also hosting meetups at places that accept BTC would help as well for education and community building.

What always goes through my mind when I pay with BTC (Lightning or whatever) is that I am paying with a superior currency, and if I have fiat available (credit card), I’ll pay with that instead, because: the price is exactly the same, I don’t have to settle for 30 days, I get reward points, and when I finally settle, the fiat payment has further devalued against my BTC.

The key thing that would motivate me to pay in BTC is if they offer me a discount up front, say 5%-10% like many merchants do for ‘members’.

As for the merchants, ‘Cash is King’ - they need to be able to deposit BTC immediately as cash in their account, first, then think about stacking sats after. Merchants care about cash to run their business.

Just like most coffee shops offer free wifi, merchants will have to think about discounts for paying using a superior money, BTC, otherwise users, including myself, won’t care.

Yeah, unfortunately I think this is a reasonable position, which means the incentives really aren't there for making payments happen

For most consumers the accounting cost and effort will far outweigh any gains, given the small volume. You literally have to account for every single transaction, including hilariously tiny ones, and it's very complex to calculate the delta.

You need the date and time of disposal, the cost base (the AUD value you originally paid for that specific portion of BTC), the proceeds (the AUD value of whatever at the time of purchase), and the resultant capital gain or loss. Who on earth is going to put themselves through that hell if they don't have to?

Maybe down the line some fancy software will help, but only so much.

Also there's the question of why pay the capital gains now when you might not have to pay it later? Tax laws change, and if the current amount is high then a future amount will surely be lower.

Coffee/BTC & Coffee/USD are separate markets with seperate supplies & demands.

It'd be very unlikely & unnatural for the prices to always be the same.

Strike to Square. Tax problem solved.

Consumer disposes fiat for coffee, merchant gets whatever they want, and visa gets...nothing

And accountant gets the equivalent of several venti lattes.

I’m not suggesting its a financial disadvantage. I’m suggesting that the fact it is treated as a taxable event, puts new or potential bitcoiners off transacting in it. Because it’s not the streamline they’re used to with fiat, and depending on your timescale, holding btc is the attractive alternative.

Theres a personal use asset loophole in Australia for transactions under $10k (but with a short time limit), there’s circular economies, lightning settlements, there’s nostr zaps.. all of it works in favour of btc.

But there are tax implications and a lot of new learning hurdles for someone who doesn’t yet even know how their bank works (I’d argue the majority of bank customers).. so it makes it hard to incentivise people, when they feel overwhelmed or confused by it.

I would say the accounting cost can be overcome with automated services, personal use exemptions, non kyc, and circular economies - Kinda like just spending in cash.

I was referring more to the appeal of btc transactions not being strong enough to overcome the learning curve for newbies, or to overcome the want to hold btc.

Thanks I’m going to look into that

The bigger problem is that when you compare bitcoin to all the other options out there, including stablecoins, the only reason to choose to pay with bitcoin and not one of those other options is ideological.

Yeah you’re right, it’s a big factor. I do think there are other great strengths already though.

- I think being able to essentially do digital cashies is absolutely massive, especially as adoption increases.

- Able to avoid card fees and surcharges.

- Not needing permission for certain payments.

- A self managed level of privacy attached to payments.

- Not needing to disclose financial information in order to make a payment (credit card deets).

- Smart contracts for more complex pay setups

I think what your saying about idealogical preference is obviously a big reason for lots of people. But I think that the idealogical push will eventually lead to greater acceptance. Which will hopefully lead to even more favourable conditions like de minimis exemptions for transacting. And eventually straight up monetary adoption.

Do you think it can head that way?

The crux is that other digital methods get you all the advantages you listed with fewer drawbacks. It's not a binary choice between fiat and Bitcoin.

For the average person Bitcoin (vs other digital) is much harder to acquire out of band. You can't even top up with a debit card on Strike anymore. Now on Strike you have to go through USDT via Tron. (Yes on Strike you need USDT.) And if you're going to acquire USDT on Tron then you have all you need already, just pay in USDT, save the runaround.

And if you believe Bitcoin will go up and up then you're basically making you future self poorer by paying for your new fridge in Bitcoin as opposed to dumping your not-going-to-go-up currency. You're making yourself a chump.

At the end of the day it really does all hinge on a quasi-religious argument. But a lot of people have religion already.

Good list..looks like some of it already happening …

Yeah, great to see

So I designed a small brochure that is a really quick introduction to Bitcoin, with the goal to activate people and trigger some reaction and/or curiosity. The plan is simple: I ask if they know about Bitcoin, leave the brochure, and wait for an immediate reaction, or I have the option of following up next time and asking for feedback; so I can get some ideas on what topics to bring up to keep the conversation going.

As you can see, I chose to give the "debunking FUD" section a primary visibility (is the first thing you see when you open the foldable), since people often learn about Bitcoin via negative and alarming news, so they are good points to activate a first doubt. Then there is a synthetic explanation of Bitcoin's money nature, why it is radically different from fiat currencies, and what impact it may have at a social and business level.

On the back there is a section that points to a website where the user can learn more. Currently I'm using bitcoin.rocks, but I will evaluate other resources or I can also build something new, maybe with some specific information for businesses, that are critical for adoption.

The idea is to release it open source, so anyone can personalize it (e.g. the learn more target), and maybe produce versions in different languages.

The dimensions are 42x15cm open, 10.5x15cm closed, foldable in 3 points; so with a standard A3 print you can get two brochures.

Does that make sense? How can I improve it?

So I designed a small brochure that is a really quick introduction to Bitcoin, with the goal to activate people and trigger some reaction and/or curiosity. The plan is simple: I ask if they know about Bitcoin, leave the brochure, and wait for an immediate reaction, or I have the option of following up next time and asking for feedback; so I can get some ideas on what topics to bring up to keep the conversation going.

As you can see, I chose to give the "debunking FUD" section a primary visibility (is the first thing you see when you open the foldable), since people often learn about Bitcoin via negative and alarming news, so they are good points to activate a first doubt. Then there is a synthetic explanation of Bitcoin's money nature, why it is radically different from fiat currencies, and what impact it may have at a social and business level.

On the back there is a section that points to a website where the user can learn more. Currently I'm using bitcoin.rocks, but I will evaluate other resources or I can also build something new, maybe with some specific information for businesses, that are critical for adoption.

The idea is to release it open source, so anyone can personalize it (e.g. the learn more target), and maybe produce versions in different languages.

The dimensions are 42x15cm open, 10.5x15cm closed, foldable in 3 points; so with a standard A3 print you can get two brochures.

Does that make sense? How can I improve it?