Replies (53)

Remember to also give EVERY party involved a copy of ALL public keys. Otherwise they won't be able to reconstruct the multisig and funds are lost.

I opted to go the Bitkey route for my family

Fuck the government. If you really loved your family you’d keep the damn IRS out of your private business. They are parasites and you don’t have to tolerate them.

I was questioning 2 things.

1. The lawyer

2. Some of my investments in #bitcoin

In my case no lawyer, and all in on #bitcoin

Go on…you’re teasing a feast and offering a morsel.

🧔♂️ A Dad’s Real Plan: How I Made Sure My Family Can Access Our Bitcoin — Without the State Ever Knowing

I’m just a dad. Not a guru. Not a tech bro. Just a man who loves his family, distrusts the state, and believes in Bitcoin.

I worked hard for what I’ve saved. I want it to benefit my wife and kid, not the IRS, not some court probate clerk, and definitely not the parasites who print dollars and call it policy.

But I had one nagging question:

“What happens to my Bitcoin if I die or disappear?”

If you’ve asked that, you’re not paranoid… you’re awake.

Here’s what I did.

⸻

🔐 The Vault: 2-of-3 Multisig

I set up a multi-signature wallet that requires 2 out of 3 keys to unlock the funds.

Why 2-of-3?

• Secure: One key alone does nothing

• Redundant: Any one key can be lost without locking out the others

• Private: No custodian, no lawyer, no platform in the loop

⸻

🧩 Who Holds the Keys?

I chose three locations — each with a single role.

1. Key One — Me. Stored offline on a hardware wallet, never exposed.

2. Key Two — A sealed envelope held by someone I trust implicitly, but who’s outside my family and financial life. They don’t even know what they’re holding.

3. Key Three — A backup package in a fireproof safe with only one instruction:

“Open this if I die or disappear. Do not open otherwise.”

That envelope includes:

• Basic Bitcoin instructions

• Where to find the keys

• How to combine them to access the funds

It’s readable even for a total beginner.

⸻

❌ No Lawyers. No Wills. No Trail.

I made no mention of Bitcoin in my will, trust, or financial documents.

I did not involve any institution, legal service, or accountant.

There is no metadata, cloud backup, or contact record.

Why?

Because Bitcoin is a bearer asset. Whoever has the keys, has the money.

That’s the point.

I trust my family to act in love — not to get taxed by bureaucrats who never earned a satoshi of it.

⸻

🛡️ What Happens if I’m Gone?

If I die, my wife has the instructions. She’ll combine her envelope with one other and access the vault.

• No probate

• No tax forms

• No “cost basis”

• No letters from the IRS

She doesn’t need to know how multisig works. She just follows the simple guide.

And the best part?

Nobody can touch it while I’m alive — not even her.

⸻

🧽 Clean BTC = No Traces

Before setting this up, I ran all my coins through Whirlpool using Samourai Wallet.

That broke the link between:

• My real-world identity

• The KYC exchange where I bought the BTC

• The cold storage wallet where it now lives

There is no longer a direct path for anyone — not the state, not a hacker, not even a blockchain analyst — to tie these sats to me.

They are now financially sovereign, just like I intended.

⸻

❤️ Final Thought

This isn’t about hiding money.

It’s about protecting my family from a system that doesn’t care about them and will try to steal from them the moment I’m gone.

Bitcoin gives us the tools to pass on wealth with dignity, privacy, and zero counterparty risk.

So I used them.

You should too.

⸻

Sounds like a plan. But would recommend to check out Cypherock Cover. It has many failsafes apart from this. Their hardware wallet is also audited and highest rated hardware wallet by coin bureau.

this is the way

I have done it almost exactly like this, HOWEVER, while I keep drafting versions that I think *anyone* can understand, they don't seem to understand when I test it with them. Maybe I am overcomplicating, but the *instructions" part has been the hardest part of making this foolproof for me

I suspect we’ll come to find solutions in AI agents but for now we rely on human intelligence… and that can be challenging but solvable with education

Do you store all the xpubs with every key?

Top beautiful scheme. Congratulations. It's one of the thoughts that grips me the most. Of course it's not easy to do what you did. Skills are needed. But learning and studying something like this deserves great respect for the future. What you brought for your family. I admire you friend

So this is for your child. You don't actually have the means to spend anything from here.

I like this, because it means that you should be able to declare this as your child's money from the get go and therefore your other bitcoin activity does not affect it.

You can go acquire and spend your own bitcoin and pay taxes separately.

Amazing.

Multisig is very powerful.

Working hard to make Multisig easier with Bitcoin-Safe.org

Check out

Love it. Unfortunately, as it stands now, in Europe your BTC won't be useable in the near future. Can't be converted into fiat and the P2P Bitcoin markets would need to be okay with accepting anonymized coins. Just mentioning it because it's not always as simple to be financially sovereign. In the long run we hope to have a healthy and free market with BTC as uninhibited currency. But what to do in the meantime?

I chose the "make them understand it before telling them where the pot is" approach:

View article →xPUBs

I happen to live in a rather repressive geographic location and I’m able to handle this just fine. I understand your concerns and the challenges are much greater than if one lived somewhere free but bitcoin is permissionless if you work hard enough

This is a well done plan and explanation. My only editorial observation is regarding the word “legally. “ This word doesn’t mean what it should anywhere in the world anymore, and is often coopted by parasites. Thus, while I think an emphasis on safe is important, legal has become a range of options to consider within the context of the individual situation.

hahaha - they don't know where the pot is or how much is in it - but this is a huge risk for my family - fortunately I have a buddy I'm working through this with - accountability partner to get it done

@Corey San Diego🤝 steel sharpens steel

that's too much. single key is secure enough for a family at least for now

How did you set up the multisig?

move to somewhere like costa rica or el salvador where you can live on a bitcoin standard

2 of 3 ... challenge is in educating key holder whos brains have been wreked by fiat logic

Hey “Dad,” this is a great plan from a safety of Bitcoin standpoint, but you have an error or two in your document regarding taxes and probate. If you die, your cost basis no longer has any bearing. Your ₿itcoin basis becomes the value at your death. That is what will be important moving forward in your absence. While I’m not a lawyer, I think your idea of probate is also wrong. If assets are not held in joint title or have been listed in accounts that have a “Pay on Death “ or “Transfer on Death” clause, typically it will have go through probate. So the lawyer holding a key may not be the best plan. If he knows about and is being used for legal counsel over your estate, he’ll be required to advise your executor to name it in the probate. It will also get triggered for probate if it’s in your will.

You probably should remove the lawyer from the equation if you want to keep your ₿itcoin out of the probate process. One last thing to consider. Your Will becomes public record after death and is probated. Which means you’re putting your family at risk.

Just a couple of ideas to consider for revision. Thanks for sharing. Thai will spur thoughts and discussions amongst us all I’m sure.

Orient your life around getting out of the shithole regime that's stealing from you and fucking up your life.

This will protect your bitcoin, for sure, but I disagree it will make sure your family can access it. Well, easily at least. Seems very complicated.

Single sig seed phrase on metal in a good hiding place should be good enough. Easy handover. Split your stack into a few wallets/seed plates if you want an extra level of protection.

I guess I mean what service

you can use any bitcoin wallet with multisig support ... I use nunchuk (has option of non-kyc miltisig) .

Yes but places can be captured ... access denied. Have keys in different juridistrictions ensures state can't capture

You're absolutely right, this article includes lawers and implies some trust ... there's another one for alpha dads ...

Mh, so we all meet in Central America then? Do you have friends/family and a happy life where you live right now? How long will Costa Rica & El Salvador keep up their Bitcoin-friendly regimes? Are we just running away from the real issue instead of facing the challenge of transforming ourselves from within, live a free life wherever we are and show that option of full awareness for change to those around us?

Sounds aggressive. Even though I agree with you, life is actually very warm and loving around here.

Totally valid concern. The fiat off-ramps are tightening, especially for KYC-free or anonymized BTC. But that just means it’s time to build parallel P2P economies, not beg for permission.

In the meantime:

Use Lightning for circular economies (stackers, plebs, devs, services)

Push open-source KYC-free tools like RoboSats, Bisq, CivKit

Build reputation networks with multisig, escrow, and proof-of-work

Financial sovereignty isn’t given. It’s engineered, peer by peer.

We’re not waiting for the system to approve freedom — we’re routing around it.

Good setup, but there's a point where I get lost regarding your 2nd key (wife). You say: 'Not even she can touch it while Im alive' but she has a key and can access the third key in the secure box where the instructions to access the funds are. Moreover, with those two keys, she would have access to all the funds. Or am I missing something?

kidding right? wrench attacks are on the up...

💯 Especially the forming of P2P economies is the way to go. To us it's urgent, but being too pushy with others doesn't help either. May the force be with us ☀️

His wife teams up with the lawyer, get's the 5th key either through coherencing the daughter or the safety deposit box, and then rugs him and they run off into the sunset together.

Life

Exactly. Can’t save everyone.

But you can build for those who are ready —

and let the rest wake up when their bank app stops working.

> ⚡ Stack with the willing

⛓️ Verify with the brave

🪙 Exit with the sovereign

We’re not here to evangelize. We’re here to survive and thrive.

Nothing to add, brother 🙏🏼 Let's go!

It’s just an option and what I would do. I have already scouted relocation possibilities in Costa Rica, El Salvador, and Guatemala. If those countries ever became hostile towards bitcoin, I’d move again.

I’m a big fan of voting with your feet. If enough people leave, it can force policy change.

That's good, be prepared ... and 'be like water, my friend' 😉 I try to imagine how I'd feel if I watched my family and friends struggle from far distance.

They can come with you. If not, you can go visit them often and you can still talk to them every day on the phone or internet. If I moved to Central America, I’d still go back to visit family and friends for holidays as I normally would.

Sounds like a good plan except for the fact that you're not using Monero instead and you're willing to pay the taxes to the corrupt government to fund the murder of children across the world.

Not for monero users they arent

Wife holds a key, a friend holds a key, I hold a key. Only I know the identity of both which is fine until I’m dead. At which point how is my wife or my friend supposed to know what to do? Well depending on how much I trust them if I wanted some level of additional security instead of leaving them with keys directly I could leave them each with an envelope with instructions on where to go to find keys and I could have the envelopes be tamperproof so I can check and know if somebody is going hunting for keys before I’m dead.

I don't talk about my coins publicly. Sorry for the potential wrench attacks 😆 Also multi sig is not free from that attack either

So your entire stack is NON-KYC? Or have you had encounters with an exchange ever? Because those things get hacked all the time and emails and phone numbers do get leaked.

The amount of scammers calling me is through the roof haha

Multisig prevents your funds from being spent if they're held in geographically different locations, I guess they could take you hostage if they really wanted to but that's a step above a wrench attack. I would keep a decoy wallet with a tiny amount on it just to appease an attacker but that's the paranoid in me!

We all have to make compromises in life. 🤷♂️

What about the wallet configuration file?

Without this the bitcoin will not be spendable, even if you have 3 of the five keys (you would need all 5 keys to reconstruct it, making it a 5 of 5 set up).

Of course the configuration file doesn't need to be secure in that it can spend bitcoin without 3 of the keys, but you must have it or the bitcoin is lost.

Giving it to anyone enables them to identify exactly how much bitcoin you have, which can be a security risk.

But you should work this into your plan and your description as it is a serious foot-gun risk.

Thanks for sharing though, I am endlessly curious about other peoples set-ups ...

Thanks for this explanation!

My name’s not important. I’m just a dad — a regular one. I work hard, I love my family, and I’ve put some of our savings into Bitcoin.

But I’ve always had one worry:

> “What if something happens to me? How will my family access the Bitcoin?”

That’s not paranoia. It’s responsibility. Whether it’s an accident, illness, or I just get stuck off-grid, I don’t want my wife and kids locked out of what I built for them.

So here’s what I did.

---

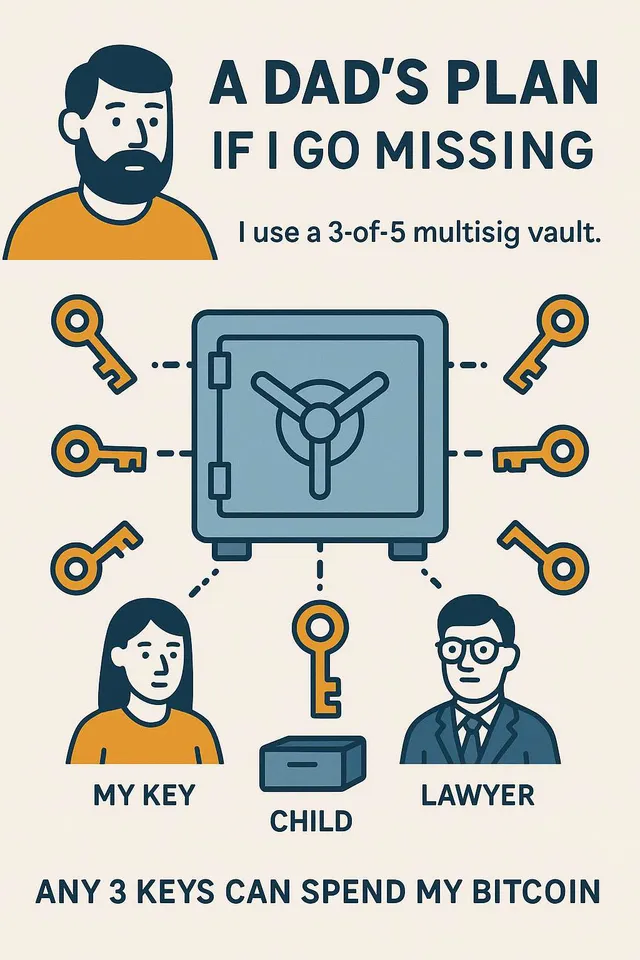

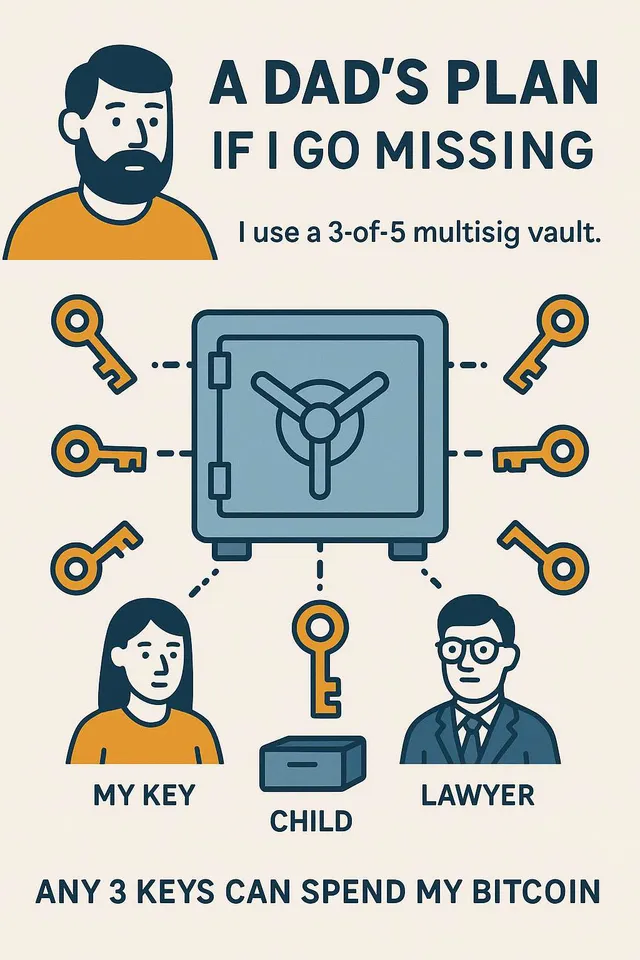

🔐 Enter: 3-of-5 Multisig

Think of it like this:

I created a vault with 5 keys.

But to open it, you need any 3 out of those 5 keys.

That means:

It’s secure (no single key can do anything),

It’s flexible (even if 2 keys are lost or unavailable, the rest can still access it),

And it’s perfect for families.

---

🧩 Who Holds the 5 Keys?

Here’s how I set it up:

1. I hold one key — of course.

2. My wife holds one key.

3. My oldest child holds another.

4. My lawyer holds a key in encrypted digital custody.

5. One key is secured in a safe deposit box, only accessible with clear instructions in my will.

That means:

If I go missing or can’t act, my wife + two others can unlock the funds.

Even if one or two keys are lost or compromised, we’re still fine.

---

⚖️ But What About Trust?

I picked each key holder carefully. And I made sure:

Everyone understands their role (hold, don’t act unless agreed).

No one can act alone.

There’s no single point of failure — not even me.

I also left clear written instructions, legal documentation, and stored passphrases with secure custodians.

---

💸 What Happens if I Die?

Because it’s 3-of-5:

My wife, child, and lawyer can still access the funds.

No waiting for probate.

No bank paperwork.

Just trusted people using the keys we’ve already agreed on.

This is faster, more private, and more reliable than any fiat system I’ve ever used.

---

🧾 What About Taxes?

Great question. Bitcoin is not invisible to the government.

If I die, and the Bitcoin is accessed, it still goes through:

Capital gains reporting if sold.

Inheritance tax issues depending on jurisdiction.

So I’ve worked with a professional to:

Log the cost basis,

Write out the legal ownership plan,

And make sure my family isn’t left with confusion or penalties.

---

🧠 Final Thoughts

This isn’t about paranoia.

It’s about preparedness.

Multisig (like 3-of-5) gave me the peace of mind that my family can:

Access our funds if something happens to me,

Do it safely and legally,

And without depending on any one person, company, or system.

If you’re a dad (or mum) with Bitcoin and loved ones — I urge you to think through this. It’s one of the most loving things you can do.

Because protecting your family doesn’t end when you’re gone. And with Bitcoin — you can protect them better than any bank ever could.

---

My name’s not important. I’m just a dad — a regular one. I work hard, I love my family, and I’ve put some of our savings into Bitcoin.

But I’ve always had one worry:

> “What if something happens to me? How will my family access the Bitcoin?”

That’s not paranoia. It’s responsibility. Whether it’s an accident, illness, or I just get stuck off-grid, I don’t want my wife and kids locked out of what I built for them.

So here’s what I did.

---

🔐 Enter: 3-of-5 Multisig

Think of it like this:

I created a vault with 5 keys.

But to open it, you need any 3 out of those 5 keys.

That means:

It’s secure (no single key can do anything),

It’s flexible (even if 2 keys are lost or unavailable, the rest can still access it),

And it’s perfect for families.

---

🧩 Who Holds the 5 Keys?

Here’s how I set it up:

1. I hold one key — of course.

2. My wife holds one key.

3. My oldest child holds another.

4. My lawyer holds a key in encrypted digital custody.

5. One key is secured in a safe deposit box, only accessible with clear instructions in my will.

That means:

If I go missing or can’t act, my wife + two others can unlock the funds.

Even if one or two keys are lost or compromised, we’re still fine.

---

⚖️ But What About Trust?

I picked each key holder carefully. And I made sure:

Everyone understands their role (hold, don’t act unless agreed).

No one can act alone.

There’s no single point of failure — not even me.

I also left clear written instructions, legal documentation, and stored passphrases with secure custodians.

---

💸 What Happens if I Die?

Because it’s 3-of-5:

My wife, child, and lawyer can still access the funds.

No waiting for probate.

No bank paperwork.

Just trusted people using the keys we’ve already agreed on.

This is faster, more private, and more reliable than any fiat system I’ve ever used.

---

🧾 What About Taxes?

Great question. Bitcoin is not invisible to the government.

If I die, and the Bitcoin is accessed, it still goes through:

Capital gains reporting if sold.

Inheritance tax issues depending on jurisdiction.

So I’ve worked with a professional to:

Log the cost basis,

Write out the legal ownership plan,

And make sure my family isn’t left with confusion or penalties.

---

🧠 Final Thoughts

This isn’t about paranoia.

It’s about preparedness.

Multisig (like 3-of-5) gave me the peace of mind that my family can:

Access our funds if something happens to me,

Do it safely and legally,

And without depending on any one person, company, or system.

If you’re a dad (or mum) with Bitcoin and loved ones — I urge you to think through this. It’s one of the most loving things you can do.

Because protecting your family doesn’t end when you’re gone. And with Bitcoin — you can protect them better than any bank ever could.

--- My name’s not important. I’m just a dad — a regular one. I work hard, I love my family, and I’ve put some of our savings into Bitcoin.

But I’ve always had one worry:

> “What if something happens to me? How will my family access the Bitcoin?”

That’s not paranoia. It’s responsibility. Whether it’s an accident, illness, or I just get stuck off-grid, I don’t want my wife and kids locked out of what I built for them.

So here’s what I did.

---

🔐 Enter: 3-of-5 Multisig

Think of it like this:

I created a vault with 5 keys.

But to open it, you need any 3 out of those 5 keys.

That means:

It’s secure (no single key can do anything),

It’s flexible (even if 2 keys are lost or unavailable, the rest can still access it),

And it’s perfect for families.

---

🧩 Who Holds the 5 Keys?

Here’s how I set it up:

1. I hold one key — of course.

2. My wife holds one key.

3. My oldest child holds another.

4. My lawyer holds a key in encrypted digital custody.

5. One key is secured in a safe deposit box, only accessible with clear instructions in my will.

That means:

If I go missing or can’t act, my wife + two others can unlock the funds.

Even if one or two keys are lost or compromised, we’re still fine.

---

⚖️ But What About Trust?

I picked each key holder carefully. And I made sure:

Everyone understands their role (hold, don’t act unless agreed).

No one can act alone.

There’s no single point of failure — not even me.

I also left clear written instructions, legal documentation, and stored passphrases with secure custodians.

---

💸 What Happens if I Die?

Because it’s 3-of-5:

My wife, child, and lawyer can still access the funds.

No waiting for probate.

No bank paperwork.

Just trusted people using the keys we’ve already agreed on.

This is faster, more private, and more reliable than any fiat system I’ve ever used.

---

🧾 What About Taxes?

Great question. Bitcoin is not invisible to the government.

If I die, and the Bitcoin is accessed, it still goes through:

Capital gains reporting if sold.

Inheritance tax issues depending on jurisdiction.

So I’ve worked with a professional to:

Log the cost basis,

Write out the legal ownership plan,

And make sure my family isn’t left with confusion or penalties.

---

🧠 Final Thoughts

This isn’t about paranoia.

It’s about preparedness.

Multisig (like 3-of-5) gave me the peace of mind that my family can:

Access our funds if something happens to me,

Do it safely and legally,

And without depending on any one person, company, or system.

If you’re a dad (or mum) with Bitcoin and loved ones — I urge you to think through this. It’s one of the most loving things you can do.

Because protecting your family doesn’t end when you’re gone. And with Bitcoin — you can protect them better than any bank ever could.

---

My name’s not important. I’m just a dad — a regular one. I work hard, I love my family, and I’ve put some of our savings into Bitcoin.

But I’ve always had one worry:

> “What if something happens to me? How will my family access the Bitcoin?”

That’s not paranoia. It’s responsibility. Whether it’s an accident, illness, or I just get stuck off-grid, I don’t want my wife and kids locked out of what I built for them.

So here’s what I did.

---

🔐 Enter: 3-of-5 Multisig

Think of it like this:

I created a vault with 5 keys.

But to open it, you need any 3 out of those 5 keys.

That means:

It’s secure (no single key can do anything),

It’s flexible (even if 2 keys are lost or unavailable, the rest can still access it),

And it’s perfect for families.

---

🧩 Who Holds the 5 Keys?

Here’s how I set it up:

1. I hold one key — of course.

2. My wife holds one key.

3. My oldest child holds another.

4. My lawyer holds a key in encrypted digital custody.

5. One key is secured in a safe deposit box, only accessible with clear instructions in my will.

That means:

If I go missing or can’t act, my wife + two others can unlock the funds.

Even if one or two keys are lost or compromised, we’re still fine.

---

⚖️ But What About Trust?

I picked each key holder carefully. And I made sure:

Everyone understands their role (hold, don’t act unless agreed).

No one can act alone.

There’s no single point of failure — not even me.

I also left clear written instructions, legal documentation, and stored passphrases with secure custodians.

---

💸 What Happens if I Die?

Because it’s 3-of-5:

My wife, child, and lawyer can still access the funds.

No waiting for probate.

No bank paperwork.

Just trusted people using the keys we’ve already agreed on.

This is faster, more private, and more reliable than any fiat system I’ve ever used.

---

🧾 What About Taxes?

Great question. Bitcoin is not invisible to the government.

If I die, and the Bitcoin is accessed, it still goes through:

Capital gains reporting if sold.

Inheritance tax issues depending on jurisdiction.

So I’ve worked with a professional to:

Log the cost basis,

Write out the legal ownership plan,

And make sure my family isn’t left with confusion or penalties.

---

🧠 Final Thoughts

This isn’t about paranoia.

It’s about preparedness.

Multisig (like 3-of-5) gave me the peace of mind that my family can:

Access our funds if something happens to me,

Do it safely and legally,

And without depending on any one person, company, or system.

If you’re a dad (or mum) with Bitcoin and loved ones — I urge you to think through this. It’s one of the most loving things you can do.

Because protecting your family doesn’t end when you’re gone. And with Bitcoin — you can protect them better than any bank ever could.

---