Programmable money (ETH, etc) is hard to scale. So people build Layer 2s.

But these Layer 2s are barely decentralized. And now there’s a crop of L2s that are really just multisigs.

But wouldn’t a sufficiently large group of multisigs be somewhat decentralized? Like a digital Hawala network?

Especially for transactions (but not for smart contracts where money is locked up).

Login to reply

Replies (85)

ETH is an obvious scam and should not even be in the discussion.

THIS.

Stop the shitcoining!

If Nostr is going to succeed, you can’t police what’s going to be discussed.

Scams (like ETH) actually scale better because they are centralized (read controlled).

Actual decentralization takes time and grass roots growth.

So many Bitcoin L2s.

Spiderchain thing is a new concept that use many multisigs. It's an interesting project.

I'm not policing anything. You're a pleb here just like the rest of us; construct better arguments. Welcome to a meritocracy.

I think the Fedimint protocol on BTC can achieve this.

Happy to be in a meritocracy. Since you’re into name calling, muting you.

Fiat unicorn guy comes to nostr, Marty cringe zaps him 250k sats for calling nostr Plan B and then starts muting plebs who rightly call him a shitcoiner

#nostrelite

Programmable money (ETH, etc) is hard to scale. So people build Layer 2s.

But these Layer 2s are barely decentralized. And now there’s a crop of L2s that are really just multisigs.

But wouldn’t a sufficiently large group of multisigs be somewhat decentralized? Like a digital Hawala network?

Especially for transactions (but not for smart contracts where money is locked up).

View quoted note →

Federations are good enough until they aren't.

I struggle to think of any federations that have failed thus far, so we haven't enough data.

How would you know if the musig isn't all the same person? In btc now there is fedimint where it's custodial musltisig and the purpose is to build trust based communities of this federations, if you are going to have to always put trust better be with people you already know and trust.

Even the base layer of Eth is a joke. Nearly impossible for an average person to run a full node, hard forks continually, pre-mined up the wazoo, everyone looking to vitalik for direction

You can’t that’s the whole point. What do you think NOSTR is?

Fair point. Sybil multisigs. Ideally there’d be an on-chain reputation system with longevity and successful transaction history. But that starts getting fairly complex.

Pleb is a term of endearment.

Nostr will succeed. Anything can be discussed. Anything can be built. That's the true power of decentralization and open protocols.

What you’re trying to envision is what the spiderchain is doing. Botanix Labs is building this.

Eg decentralized multisigs where >10.000 nodes can participate in.

This Pleb must be new here, I guess we should cut him some slack.

This is the general concept of the Fedimint project. It works in production today, but very little adoption… most likely because it doesn’t have a native shitcoin for VC wealth extraction.

It's because none of them are easy enough for the masses to use just yet and everyone is trying to solve this problem. We'll get there soon enough, when the fire of adoption ignites a wave of developmental urgency.

I believe you can execute any arbitrary code/logic within a Fedimint “smart contract”

Mate, being called a pleb is not a bad thing.

We all plebs on here.

Nobody is above anyone else.

Mind you we are happy that people with a history of good open thinking like yourself with a bit of social clout are spreading the good word of nostr on the bird app.

Witness

using nostr keys (ideally with a keychain and rotation system, which is under heavy discussion recently) would make this kind of verification a lot easier

or even if just for the signatories to use their nost identities to sign events containing the keys they will use, and the relevant UTXO that will be spent

Have you really used eth?

"Hello Nostr! I'm finally here and here's how you fix it"

GFY

&>/dev/null

Pleb is a nickname here. It is not insulting at all.

Only if you’re staying humble and stacking sats

disagree. build it on a zero trust network.

But comunicate across different multisigs is less efficient than communicate on the L1 network, so is:

- few centralized L2s, not too much net-effect lost, less fees and less data on L1 ---> centralized scaling solution.

- a lot of decentralized L2s, net-effect lost, need to back to L1 to regain net-effect ----> decentralized, but not a scaling solution.

ETH is a scam. It’s not money, do more research.

Check out the fedimint protocol

This is the idea

The main app right now is Fedi

Welcome to Fedimint | Fedimint

Fedimint is an open-source protocol to custody and transact bitcoin in a community context, built on a strong foundation of privacy.

Personally, I'm a fan of Fedimint. Multisigs across a group of people & businesses is a scaling solution I can get behind.

Sure, it technically increases the chances of getting rugged, but the probabilities are minuscule, if structured properly.

Every advantage has a disadvantage. With Fedis, there are risks, but with it comes other advantages, such as privacy and scalability.

The beauty of a decentralized protocol, is that everyone is free to adopt it, in any which way they please.

The usage of L2 by the shitcooners doesn't make any sense.

ETHirium abandoned the utxo model alongside PoW later on because Bitcoin couldn't 'scale' in favor of the account/contract base model. The general assumption being that any use case that "couldn't scale on Bitcoin" would move to other chains. Bitcoin opted to scale in Layers to retain the UTXO set while shitcoiners didn't think it was possible to do so. They pretty much made new chains everyday. Different scaling methodologies from the get go.

So what the hell is a Layer 2 in ETH? It's like admitting their whole reason to exist is pointless.

Dumbass shitcoiners 😤

tbh arbitrum's model seems to be ok to some extent. obviously wouldn't touch it with tens-of-thousands of dollars-equivalent, but with something bearable, the speed and cheapness is a good trade

"Programmable money (ETH, etc) is hard to scale"

Heard of this small token called SOL?

I like that people still find this site useful 😁

Takes being called a pleb as an insult, ETH shill, and publicly announcing a mute. Sir this isn’t twitter, you look silly here. 🤣

And pay thousands of dollars for the privilege to run a node. Don't forget that part...

With enough multisigs or mints, L2s can most definitely be "sufficiently" decentralized, particularly for payments; e-cash implementations like Cashu and Fedimint are good examples of this:

Having as many mints as possible to distribute risk and having key rotation as simple as possible is what is most important, which Cashu seems to be doing the best at at the moment. Fedimint has a lot of potential but is still quite technically expensive to implement due to the added complexity of using federations, which have worse tradeoffs than, say, partial multi-path payments on Cashu in some cases:

Cashu - Open-source Ecash

Welcome to Fedimint | Fedimint

Fedimint is an open-source protocol to custody and transact bitcoin in a community context, built on a strong foundation of privacy.

GitHub

nuts/15.md at main · cashubtc/nuts

Cashu protocol specifications https://cashubtc.github.io/nuts/ - cashubtc/nuts

And pay thousands of dollars for the privilege to run a node. Don't forget that part...

View quoted note →

Thanks

That's basically Liquid. Fedi does something similar with eCash and it's also possible to spread risk between many individual (singlesig) Cashu mints, which can coordinate to make single lightning payments using MPP.

The blockchain growing 5 Petabytes/year and cost of running a validator of at least few thousand bucks a year..

I wouldn't exactly call it "small"

That was completely sarcasm over the OP not mentioning Solana, the leading fastest TPS chain.

We need a sarcasam sticker on nostr notes 😁

Well I didn't think calling the leading DEX volume chain small would require that, but I admit people don't track these metrics usually probably, haha.

DefiLlama

DEX Volume by Chain - DefiLlama

DEX Volume by Chain. DefiLlama is committed to providing accurate data without ads or sponsored content, as well as transparency.

Bitcoin on it’s base layer should be capable of being run by every person in the world.

That doesn’t make sense for Layer 2s

You really view LN in this light?

We need more of this here. Nostr can quickly turn into a Bitcoin maxi circle-jerk. It's nice to see some other perspectives come along. Great to have you and @balajis start to post more content here 😄

as much as I dislike eThErEuM and cRaPtOs, I agree with @npub1n5r9...0ngn.

the whole point of #nostr is for people to be able to discuss whatever they want.

Nostr the agonistic battleground… like twitter used to be. Ideas of all kinds.

Lively discussion between disagreeing parties is a sign of scale. If everyone on a platform agrees, you know it’s early.

Did you check Moduluszk.io ? A decentralized L2 powered by Cult DAO

“a sufficiently large group of multisigs”

So…the Lightning network?

Correct that's why we challenge poorly thought out ideas with better ones.

I'm all for challenging ideas

Those metrics mean nothing to me, when I don't know how much of it is real use cases and how much are scams, speculations or money laundering

Well if people are overwhelmingly choosing one chain over other for scams, speculations or money laundering, those are real use cases on my book, lol. Just because a use case is bad or illegal, doesn't negate the fact that it's a use case someone preferred Solana over some other chain. Also it's a myth that crypto is a common money laundering/scam apparatus:

https://www.coindesk.com/tech/2024/02/15/crypto-money-laundering-dropped-30-last-year-chainalysis-says/

https://www.coindesk.com/tech/2024/02/15/crypto-money-laundering-dropped-30-last-year-chainalysis-says/

https://www.coindesk.com/tech/2024/02/15/crypto-money-laundering-dropped-30-last-year-chainalysis-says/

https://www.coindesk.com/tech/2024/02/15/crypto-money-laundering-dropped-30-last-year-chainalysis-says/You make a good point about the importance of true decentralization for smart contracts. However, it's also worth noting that achieving perfect decentralization is extremely challenging, especially with current technological constraints. Multisigs, while not perfectly decentralized, can still provide a pragmatic solution that balances scalability and security.

For many practical purposes, a sufficiently large and distributed multisig setup can offer a level of security and decentralization that is acceptable for most users. It's about finding the right balance. While it might not be ideal for every scenario, it can serve as a step toward more scalable and secure solutions until more robust decentralized technologies are developed.

Additionally, for simple transactions where funds are not locked up long-term, multisigs can indeed function effectively and provide the necessary decentralization and security, much like a digital Hawala network.

Hhhh

It's only fair to say that, but I personally prefer real-world use cases such as helping impoverished communities, empowering women, banking the unbanked etc. And I'm sure Solana works with these use cases as well, but Bitcoin is already quite far in the game.

It's like tcp/ip and ipv4.. it's still absolute internet mainstream even though the oci model and ipv6 are far more superior 💁

Oh yea adoption wise Bitcoin is leading for sure. It'll be interesting t see the changes in market share between Lightning and something like Solana.

If we resign to scaling with multisigs, then what’s the point of ETH? Bitcoin is enough.

ETH represents yet another systemically insecure abstract power hierarchy where control authority over ledger writing privilege is centralized in the hands of the foundation and large institutional investors.

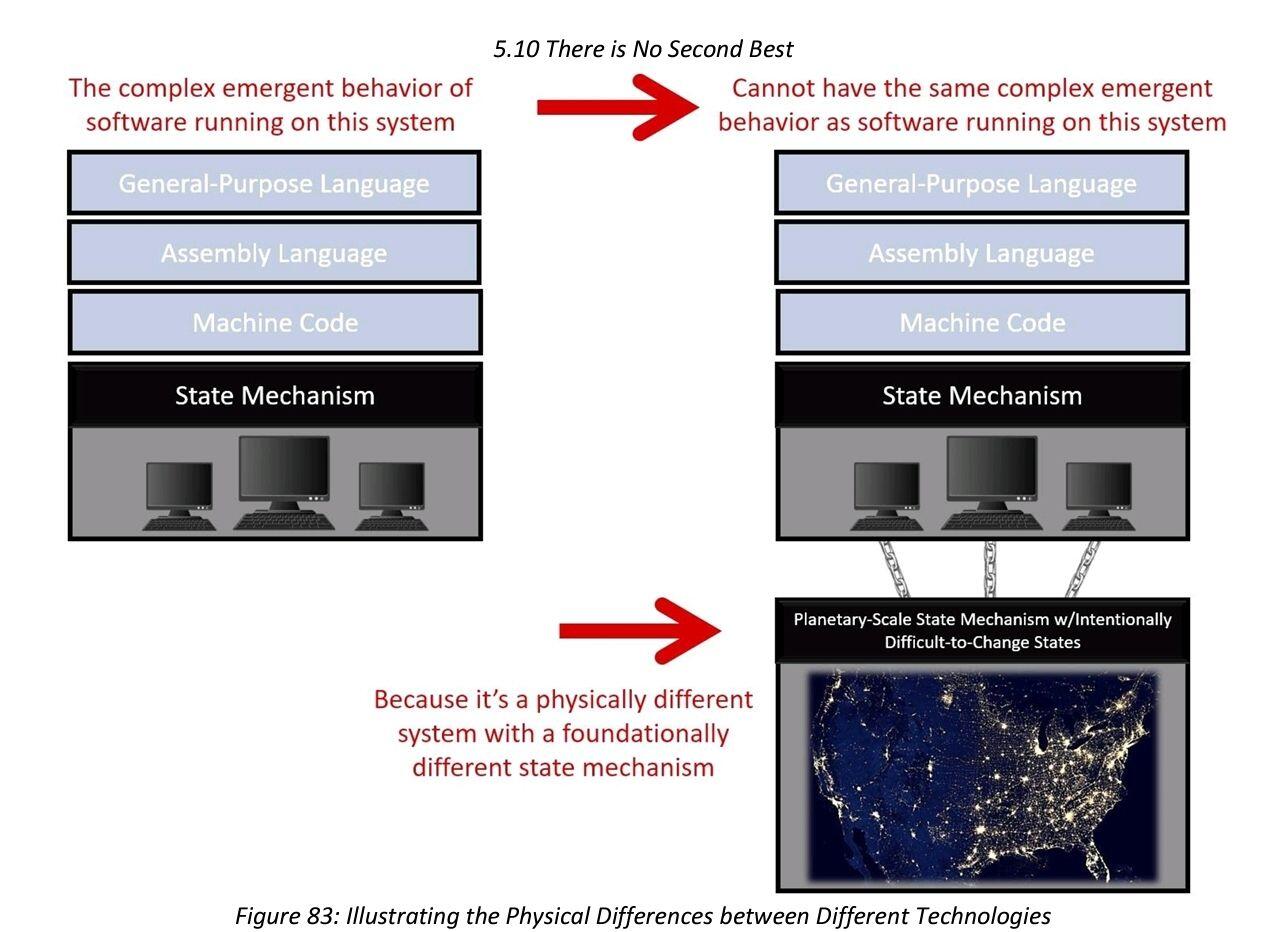

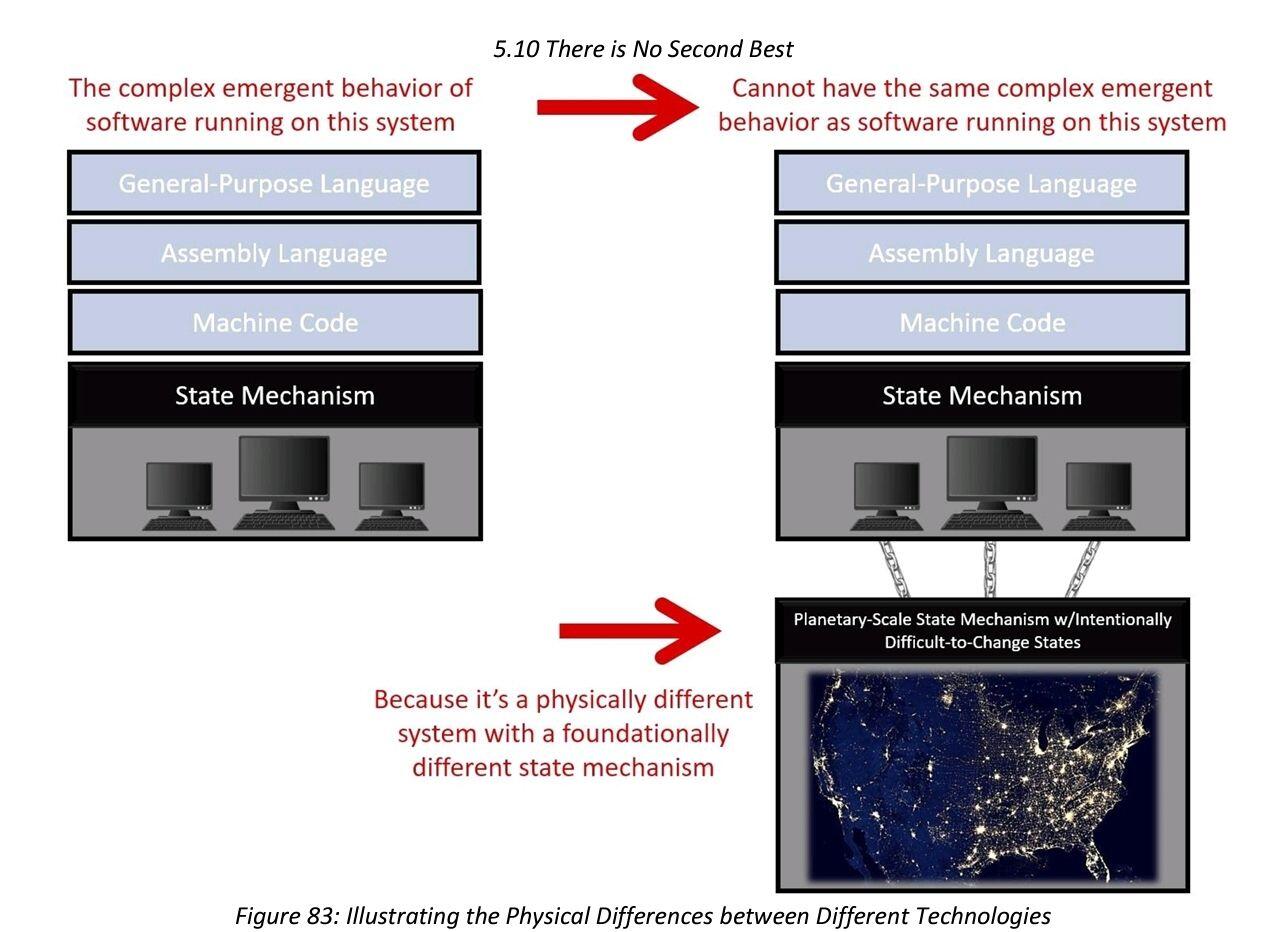

"Stake" doesn't physically exist, it is just a just a software metaphor. It is therefore impossible to physically verify that the "stake" is decentralized.

If you contrast this with Bitcoin, it is trivial to physically verify the decentralization of the network because the quantities of physical power being drawn from the environment to physically compete over ledger writing privilege is itself physically real, physically scarce, and physically decentralized.

People (especially software engineers) seem to be ignoring the physical differences between proof-of-work and proof-of-stake because they are trained in their profession to abstract away everything happening below assembly language. This causes them not to recognize changes to the underlying state-changing mechanism if they were to occur.

Ethereum abandoned proof-of-work because the temptation to regain abstract power/centralized control authority over ledger writing privilege is incredibly intoxicating to our species.

Satoshi philosophically accepted that might is right and relinquished his abstract power to the most physically powerful. An extraordinary leap of faith and an exceedingly rare trait in the world of software engineering.

The biggest risk in cybersecurity that most people don't seem to understand is how much abstract power it gives people. Developers write logic to effectively code themselves into being neo god-kings with unimpeachable control over people's data. This temptation to have unimpeachable control is what led Ethereum to abandon proof-of-work.

Satoshi created a physical-power-based resource control structure. Ethereum switched to an abstract-power-based resource control structure where it is impossible to physically verify decentralization, and is physically impossible to impeach their control over ledger writing authority.

Agreed. Premines are all temptation; any form dooms any project from the start. Satoshi presented a practical solution to the premine problem in his energy based proof of work system -- make it so the genesis block unspendable so it doesn't matter who 'starts' bitcoin 🧐 remove temptation by taking the humans out of it. That trick can only be done once.

Fundamentally digital scarcity can only happen once 🧐

I also enjoyed Soft War 🥳

you're wrong

Fair enough

ZK rollup might improve on this

Solana hodler on Nostr 🤘

Currently 3 networks are worth mentioning, BTC, if you want max privacy #Monero, if you want an easy for retail fast/cheap, hight TPS defi juggernaut, Solana. ETH TX cost is still too prohibitively expensive for a lot of things they're building on Solana.

SOL looks more like a private CBDC than a blockchain to me.

Most of DeFi is centralised, starting with stablecoins all the way to Oracles, so it make sense that Solana is getting so much attention not trying to be decentralised

Great to see different profile and conviction here though, welcome!

Oh yea Solana's not for decentralization enthusiasts for sure. What's though? ETH's better at it I believe, high fees. BTC lightning is hard to implement, requires centralized big routing nodes to operate optimally etc. Pick your poison. We don't have a perfect chain on all fronts. Scaling, decentralization, reasonable fees. Pick two I guess.

BTC offers different tradeoff

Layer1 is expensive but perfectly unstoppable

Lightning is great too, but you need to manage your channel and liquidity

Then you have cashu or custodial lightning in all sort of flavour

ZK are coming too

Solana is really just an AWS for DeFi enthusiast at this point

Except with #Algorand, scaling and decentralised from Layer 1

Welcome to Algorand

Welcome to Algorand! Discover resources to learn about the technology, to get started building dApps, to connect with the ecosystem and community, ...

No it is just you believing You’re smart, nothing more

Y recuerden Amiguitos, Naval esta en Nostr

View quoted note →

Seguimos

#Hola #Amethyst #Venezuela #Argentina #elsalvador #Mexico

still active buddy? i hope so

Doesn't seem like it