Replies (43)

"THERE WILL BE RE-HYPOTHICATION".

NO

'Just put it in, no one will read it'

Always be ready to burn your heros. Better yet, don't be a child, there are no heros.

If you read a bit lower though there’s a Trust Me Bro clause.

So just burn normal people then?

What does re-hypothicate mean?

Thanks Sean

Proof-of-Reserves would fix this. Strike does some interesting thingd, but I wouldn't take a loan unless I could find my sats using bitcoin-cli.

Jack replied to this on Twitter. Because the BTC transfers from Strike to the custody company, they have to say it's been hypothecated legally, or something to that effect.

Are you guys just now figuring out that Strike is shady af? Have you looked at the limits? Lifetime limits (if you don't want to give them your biometrics) are temporary for DEPOSITS and PERMANENT for WITHDRAWALS AND SENDS. Which means if you are not careful ans you deposit over time you are likely to run into a situation where it's impossible to withdraw or send everything you've deposited without giving out your biometrics. I.e. they can hold your money hostage.

🤣🤣

Then why would they say "without notice to you?" If the only rehypothecation being done was the transfer to the custody company, they could give notice of that to the borrower and then leave that out of the terms. Instead, they leave it open that it could be rehypothecated any number of times without you knowing.

Without corresponding proof of liability, it doesn't say that much. Celsius also did proof of reserves

this is disappointing

Sad

Slowly, then suddenly

View quoted note →Disappointed

Great pt

True, but I'm thinking something like Unchained where you hold 1 of 3 keys. At least you would know if your bitcoin was re-hypoteicated away. The fact that they don't have this before the rollout makes me nervous.

If the terms of the loan require transferring collateral to the lender in any arrangement that isn't a multisig where you are a party, then rehypothecation is likely to occur. At best the collateral will be segregated and moved individually and can be observed. At worst it will be mixed into a pool of similar collateral and you won't be made whole when a link in the chain of trust-me-bro fiduciaries goes awry. This isn't new. It's business as usual. Read and understand the terms of contracts before playing the game.

Even 1 of 3 seems very pointless if two parties can collude to take the coins. Seeing them on chain still doesn't say much, they can still be rugged at anytime, it's a false sense of security

Imo just stay humble stack sats in cold storage, don't ever worry about any of this, and just spend/sell coins when needed

I've been tinkering with BitKey. Something like this, but with seeds companies could fully verify, would be perfect for this.

What if

The customer holds key 1

Company A holds key 2

Company B holds Key 3

If customer ≠ deadbeat, customer gets sats back.

If customer = deadbeat, customer loses sats.

Now the customer is the proof of liability.

Company A says, this dude is a deadbeat.

Company B acts as an arbitrator and makes a decision based on the evidence.

If keys are lost, Bitkey can do some Bitkey stuff. ( Full Disclosure: I haven't verified how this works yet)

Risk can be mitigated further by using Anchorwatch because of insurance.

Yeah, nothing beats that advice. Loans are more risky. There is no protection against 6102 attacks.

That's the biggest risk with these trad-fi products.

I can also get an uncollatoralized loan for under 7% so it really doesn't make sense for most things.

It's only good to temporarily let the bank know you have money in the bank to qualify for a mortgage. This didn't exist when I bought my house and I'm glad because I might have gotten myself into trouble.

It was painful to buy fiat maxi bucks though.

it is the difference between legal terms and reality

loan collateral is being held securely by strike and liquidity partners, not being used to trade or “generate yield,” but needs to be moved around occasionally for business operations

strike is full reserve with strong bitcoin security practices and is well capitalized with over 1500 bitcoin in their corporate treasury

they will release proper proof of reserves in the next few months

even after that, all custodial products require trust

90% of bitcoin bought on strike is withdrawn to self custody, free dca, free withdrawals

Re-Hypothecate is specific terminology. In my business I don’t often see lawyers and attorneys just tossing extra words in for something they don’t really mean. If there’s zero risk of being re-hypothecated then have the terms rewritten.

Sad watching odell and jack cross over to the dark side.

I think we take the transparency of Jack and Strike for granted sometimes. You can tell he's working hard to get things right and address concerns.

Which is exactly what Jack said they're already doing.

I hope they do.

Dude also said to reach out on here to help with complex issues, purchases, custody arrangements. He ghosted. Maybe thought I was a spook. Meh. Moving on. Very disappointing. Come on

@jack mallers. The fine print matters.

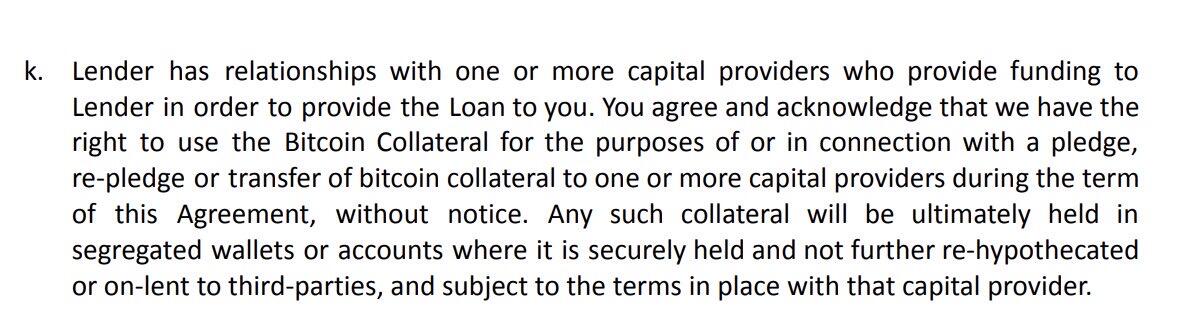

Here is the updated agreement (Section 3.K).

✅ We work with partners to facilitate the loan

✅ Your collateral is securely held in segregated wallets with us and partners

✅ Your collateral is NEVER rehypothecated, on-lent, or used in any other way

Our goal is to offer the best possible terms and experience for Bitcoiners. We will continue to iterate with you all based on feedback. Next up, we plan to provide proof-of-reserves based lending.

We work for you, #Bitcoin. Thanks for the feedback.

We want to be the most customer focused company in the world. Built by Bitcoiners, for Bitcoiners.

View quoted note →

View quoted note →He responded..

The Strike rehypothecation debate was the catalyst for all this.

View quoted note →

View quoted note →

View quoted note →