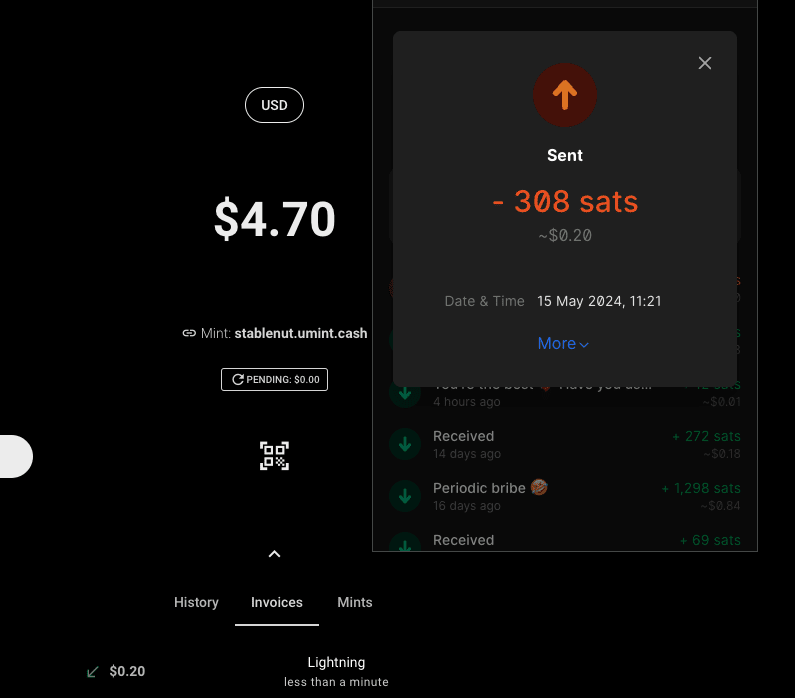

Introducing Boardwalk Cash - the first dollar-based Cashu wallet built on top of #bitcoin and connected to #nostr.

Boardwalk Cash

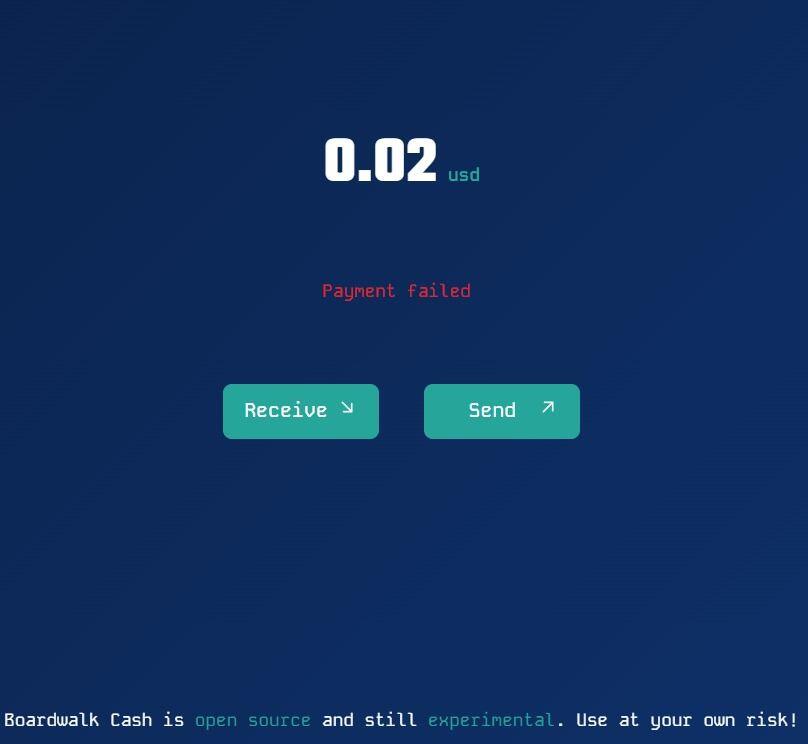

The easiest way to send and receive cash.

We now have stablecash on bitcoin - completely interoperable with the lightning network.

Share your lightning address or invoice to receive dollars. Paste a lightning address or invoice to send dollars.

Boardwalk Cash connects to any nostr client via NWC. Zap dollars on nostr apps like

@primal or on Discord with our Zap Bot.

This is a very early product and there are not many public mints, so use at your own risk. Yet, we’re excited to show some of what ecash and nostr can offer for advancing #bitcoin payments.

Replies (58)

claim $0.10 by clicking this link...

$0.10 eCash

stablenut.cashu.network

incredible work, congratulations on the launch!

True If Big!!! 🎉

nostr:npub1aeh2zw4elewy5682lxc6xnlqzjnxksq303gwu2npfaxd49vmde6qcq4nwxnostr:

@Derek Ross @PUBKEYlegend

Amazing. Good sir, no mints show with the USD filter.

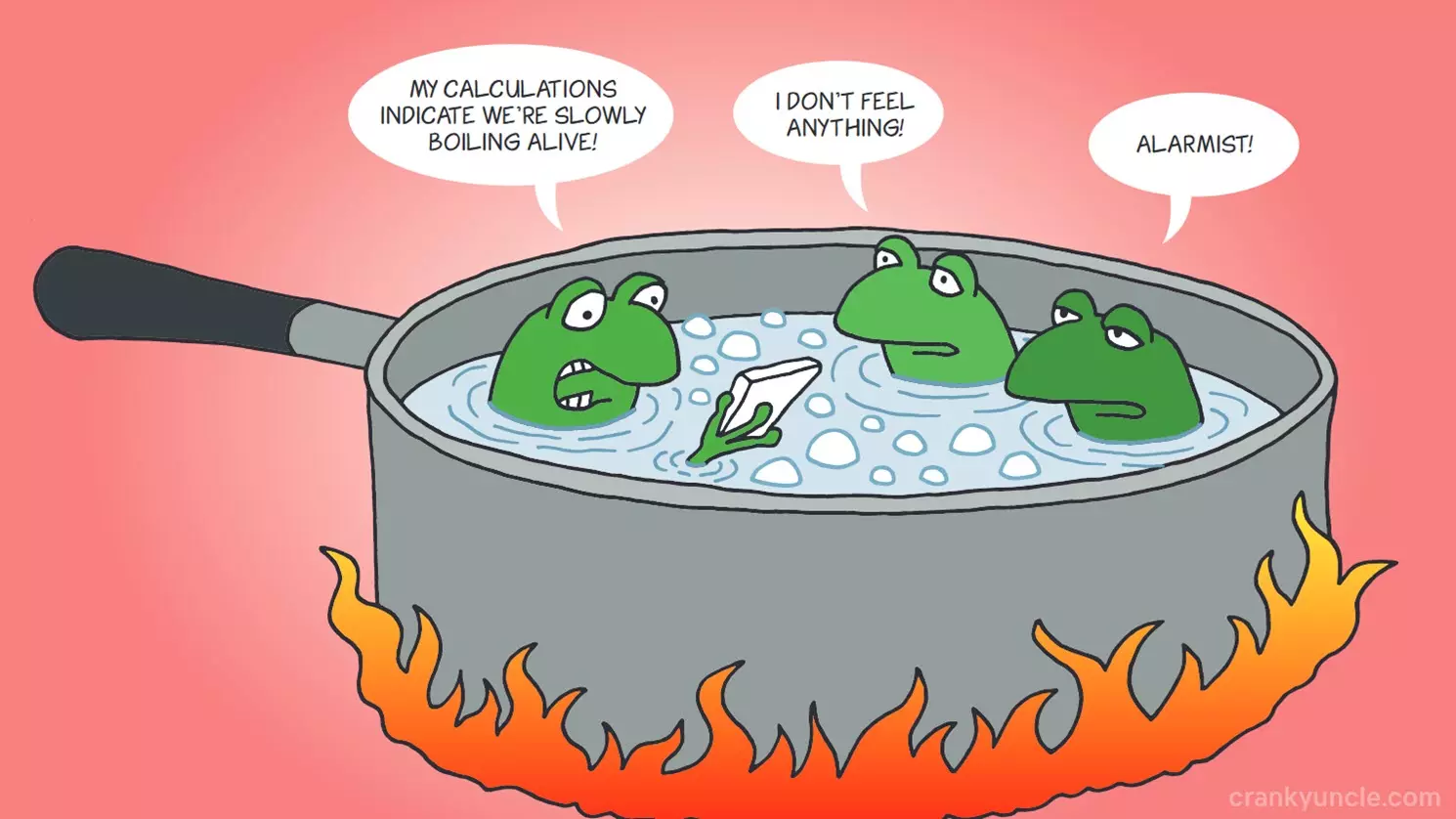

Can we please stop calling fiat stable?

Try refreshing the browser once. We're updating it now. He's the Mint URL of the current public USD mint:

https://stablenut.umint.cashnot yet. am still accumulating. dxy is gonna tumble for a decade soon so just dont rush it pl pls pls.

is this done with some sort of a short like stablesats?

Smooth as 🧈

Yikes I did a send without saving the token, money gone? Haha

How to get mint to support USD?

Which NUT supports USD?

Is the idea that mints will hold physical USD, to back the ecash?

How do I NWC back to Primal? Works great, though!

Thanks for sharing

I guess my specific question is;

What is the exact line of code(s) do I need to enter to support USD?

Trying to do this for our own mints

very cool.

Cuckbucks it is

I like slave credits

🤯 My brain can't compute what stablecash on bitcoin even means. How is it possible? Is there a technical deepdive I can watch/listen to?

I look forward to a day when this is super easy to use for my grandmother

Fiat coins

Found this:

https://github.com/toneloc/stable-channels. Looks like a reasonable explanation.

That's nuts

here

nope, you hold a USD token that has a stable USD price

🍿

@bob estoy probando lo

Pude recibir, pero no puedo enviar

bob

bob

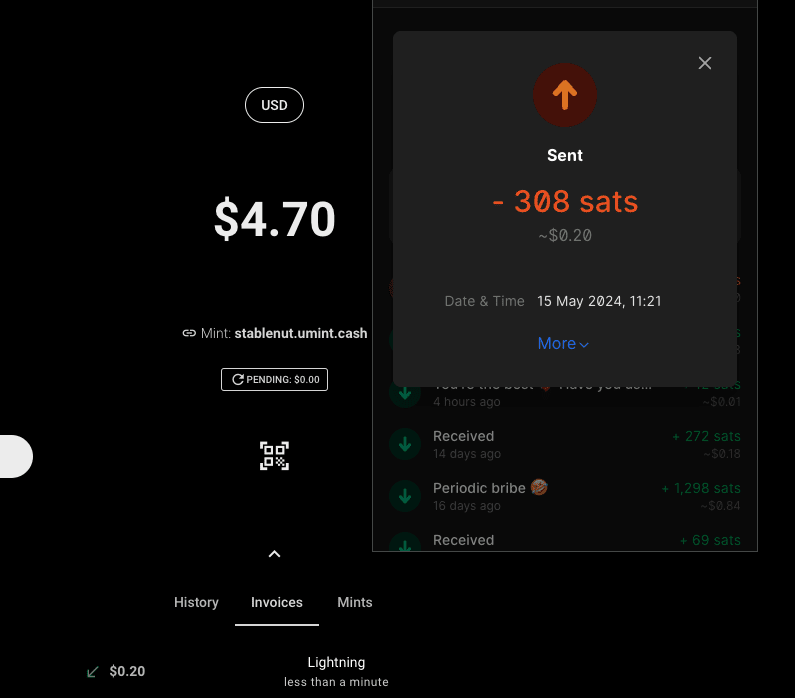

Introducing Boardwalk Cash - the first dollar-based Cashu wallet built on top of #bitcoin and connected to #nostr.

Boardwalk Cash

The easiest way to send and receive cash.

We now have stablecash on bitcoin - completely interoperable with the lightning network.

Share your lightning address or invoice to receive dollars. Paste a lightning address or invoice to send dollars.

Boardwalk Cash connects to any nostr client via NWC. Zap dollars on nostr apps like

@primal or on Discord with our Zap Bot.

This is a very early product and there are not many public mints, so use at your own risk. Yet, we’re excited to show some of what ecash and nostr can offer for advancing #bitcoin payments.

LFG 🔥

fucking gangsta 👏👏👏

Sheesh. Just like that.

👀 👀

Fascinating! How difficult would it be to either add other national currencies (say the Mexican peso or the Japanese yen)?

As someone else said in the comments, they would want their grandmother to be able to use something like this, so having sats dominated in the local currency would make that way easier.

That single bullet which says “stabilizes USD price” needs some more detail on the collateralization mechanics.

Seems like it. They simply mint nuts at current btc exchange rate and redeem ecash at the current btc exchange rate.

I'd like to know if the nuts themselves contain the metadata for what they are to make them all interoperable. Seems like a mint should be able to mint whatever you want and redeem whatever you want whether its eusd or eyen or ecorn.

1. Add a new active keyset with unit ‘usd’

2. Convert amount in mint quote request to sats based on current exchange rate, then create invoice for that sat amount.

3. Convert sat from invoice to usd in melt quote request and return usd amount needed to pay the invoice.

Happy to help if you want to get on a call

I do not think this should be a trading vehicle, thus I suppose each mint can make up their own rules. However down the line with a liquid derivatives market one could potentially manage a more sophisticated mint.

However answering to individuals need of a less volatile medium of exchange is a use case and should have a price. Thus the mint could simply transfer the exchange rate risk upon to the user, meaning if btc price moves, the cost of exiting would be upon the currency holder and the benefits equally goes to the mint for its longevity and sustainability.

BTC price down -> user gets entry amount of sats

BTC price up -> mint gets entry-exit sats.

A model like this would also give interesting possibilities for mints as revenue vehicles.

I didn’t mean to imply anything. I understand the complexity and there definately needs to be more clarity on mints. Interesting possibilities though. Aligning assumptions on use cases for ecash, ie type of user, amounts, timeframes, would maybe be a good start before evaluating risks.

404?

Wait, you couldn't get the market rate. If the USD price of bitcoin goes down, the mint would go broke because people would be withdrawing more bitcoin than was deposited

Just a note the say that won work XD

Its just another trap

Here is the

@Alby error I am getting

@bob .. any ideas or suggestions please?

just now tried and it worked for me..

Hey! Thanks for the feedback. This is a known issue we are working on that has to do with how certain wallets/mints process lightning address sends. Generating an invoice from the receive button and paying from Alby should work every time.

This sounds like a private, cheap way to short Bitcoin

Same for any exchange.

Excellent thank you! I'll take you up on that for sure!

The Zap Bot isn’t working :(

Yeah slave credits is more apt and a personal favorite of mine

lol. Calling fiat money is not fair on #bitcoin

My autism won’t let me say it’s not 😅 money is whatever two or more parties agree on as a medium of exchange, it’s limitless on what could be money.

Now whether that’s a good money is another conversation.

Is the BTC sent to mints overcollateralized to issue new USD tokens? Or does an actual exchange happen (with the mint probably needing to cover the trade elsewhere)?

We now have stablecash on bitcoin - completely interoperable with the lightning network.

Share your lightning address or invoice to receive dollars. Paste a lightning address or invoice to send dollars.

Boardwalk Cash connects to any nostr client via NWC. Zap dollars on nostr apps like @primal or on Discord with our Zap Bot.

This is a very early product and there are not many public mints, so use at your own risk. Yet, we’re excited to show some of what ecash and nostr can offer for advancing #bitcoin payments.

We now have stablecash on bitcoin - completely interoperable with the lightning network.

Share your lightning address or invoice to receive dollars. Paste a lightning address or invoice to send dollars.

Boardwalk Cash connects to any nostr client via NWC. Zap dollars on nostr apps like @primal or on Discord with our Zap Bot.

This is a very early product and there are not many public mints, so use at your own risk. Yet, we’re excited to show some of what ecash and nostr can offer for advancing #bitcoin payments.