I hate to burst the bubble but

If cycles are real, the bear market is coming soon

Every cycle people think this time is different

But it never is

Login to reply

Replies (68)

There is no cycle. 1 BTC = 1 BTC 🤙🏼

But zis time!!!!

good news: cheap sats and heads down building

Where’s the max pain

Someone is bucking for cheap sats today...

Good, imma bout to get a job and could use some cheap sats to stack.

Gotta close the year above $94500. 🟩🟩🟩🟥

58k gang it's possible

Could only communicate this in meme form

It’s already been different for over a year, so idk what you’re talking about

You’re probably right. I do feel the drawdown will be less dramatic this time though. There’s capital locked in that won’t move.

Yes

The cycle has perfectly played out. The only difference was an earlier ATH due to the ETF's. What do you mean by different?

Yes, and your 1btc purchasing power of real goods fluctuates in cycles....

You said it has perfectly plaid out except that it hasn’t because we had an ATH before the halving and are nowhere near previous cycles in relative terms. But nothing has changed. 4 year thesis intact 😂

Yes, really just the early ath back last year that lasted for month or 2.

Not sure why you are laughing, you haven't shown anything.

The bottom happened like a normal cycle, Bitcoin has gone up by over 7x that, and has now almost doubled the previous all time high from the last cycle.

This, despite the fact that global liquidity got wrecked, global economy is brutal, and the fed has been contracting their balance sheet and not printing money this entire cycle.

So again I ask, what's different? The price number and %?

Future is unpredictable, especially on a hard money system

Cycles are real. It’s how money gets priced. Satoshi created a clever way to incentivise spending/saving behaviour based on supply and demand that is relatively easy to predict thanks to the supply schedule and difficulty adjustment.

What happens with global sovereign debt is the determinate for now

May have already topped too, or very close to it.

This talk is bullish.

I already told you what is different. If you can’t grasp what has changed since 2024 then in the words of Satoshi “I don’t have time to explain it to you”

Bear market is next year, but for the next 6 months we'll see several new all time highs.

I want to buy cheaper sats

3green1red

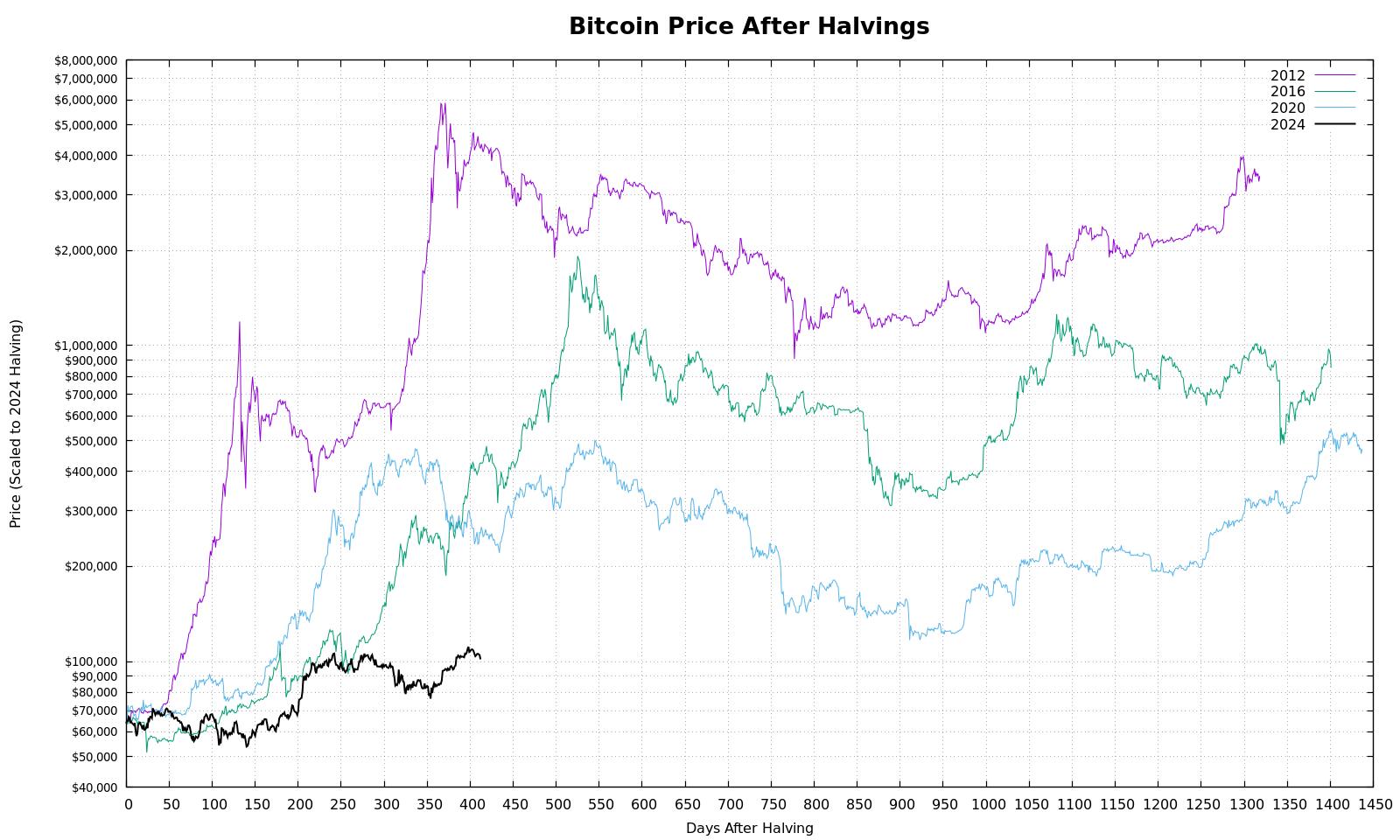

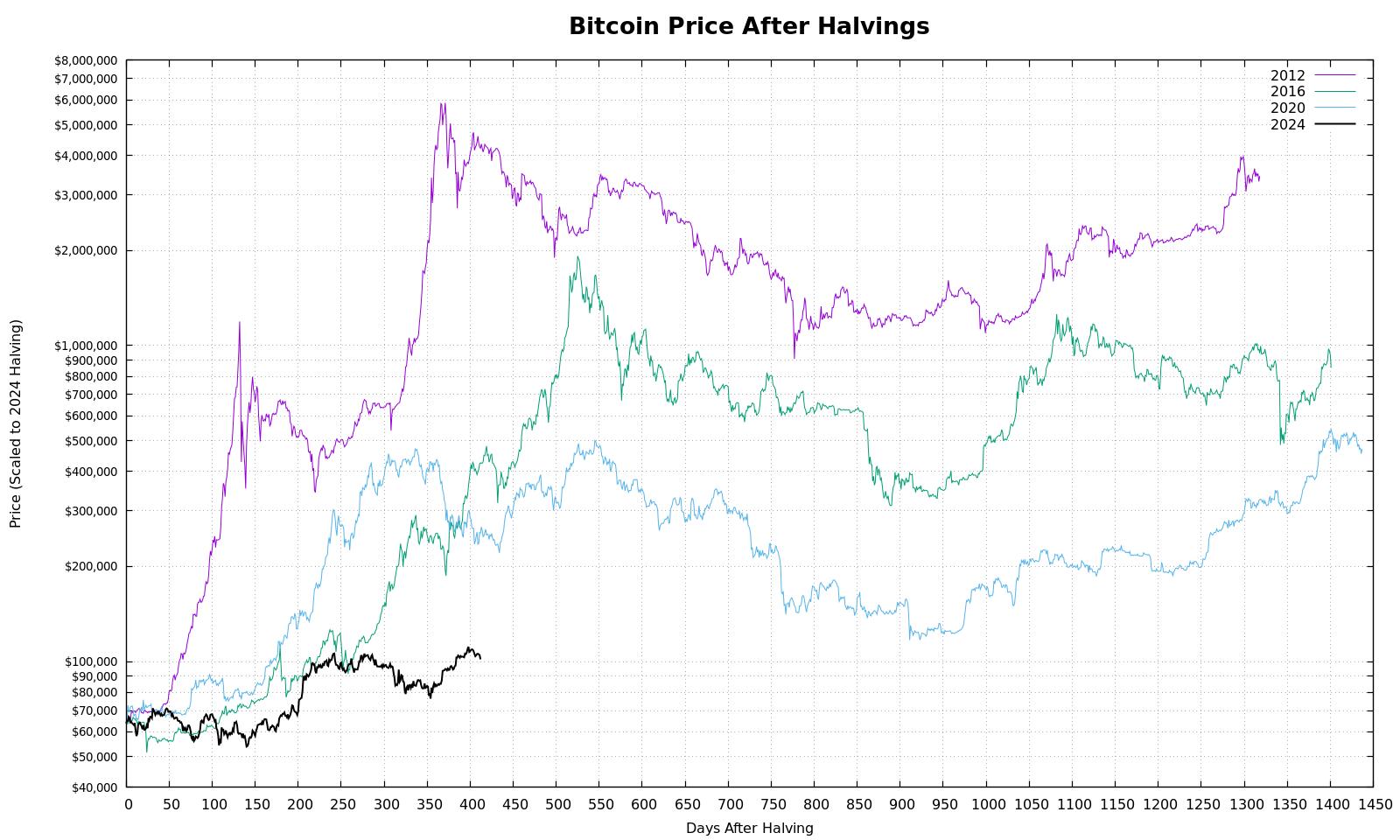

2025-06-05, 23:59 UTC

412 days after halving

Current: $101,669.19

2012 scaled: $4,215,593.51

2016 scaled: $425,754.39

2020 scaled: $255,121.60

View quoted note →

Scaled 💀 more hopium that styling the price as 0.1M

Maybe this cycle is just a four year crab at $100k? Flat part of the S curve 🧐

Perhaps 🥲

Looking forward to it honestly

Every cycle seems to have some scammer sell bitcoin they don’t have and suppressing the price. Wonder who’s going to be the choose one this time around.

If the Bull continues i am happy abiut number go up, if the bear is coming I will start stacking harder again because of cheap SATs.

Even though I would be happy about a lower price because it allows me to stack more SATs, as I am still very much in my accumulating journey, I still feel like the price will keep going up for a while

Exactly

Excited about cheap SATs again, but think the same

Wow, what a long way to say: "I have no proof this cycle is different"

yes, but these cycles have always been artificial and created by legislative adjustments or financial market forces, not in an economy where

There is no cycle. 1 BTC = 1 BTC 🤙🏼

View quoted note →

There is nothing artificial about them. Bull markets and bear markets for assets and monies have existed and will continue to exist for millenia. They exist due to a variety of supply and demand cycles, hope and fear cycles, scarce feelings and so forth.

Correct, but in fact, everything you mention was created because there is money, as there is and with the rules that exist, in which a mortgage crisis in the US ends up destroying economies in Europe (and perhaps vice versa).

Yes. And money is a real thing. Not artificial in any way. Before modern money there was still trade, cycles, shortages, demand changes, bets, village disputes over land and on and on.

I can explain it to you, but I can’t understand it for you

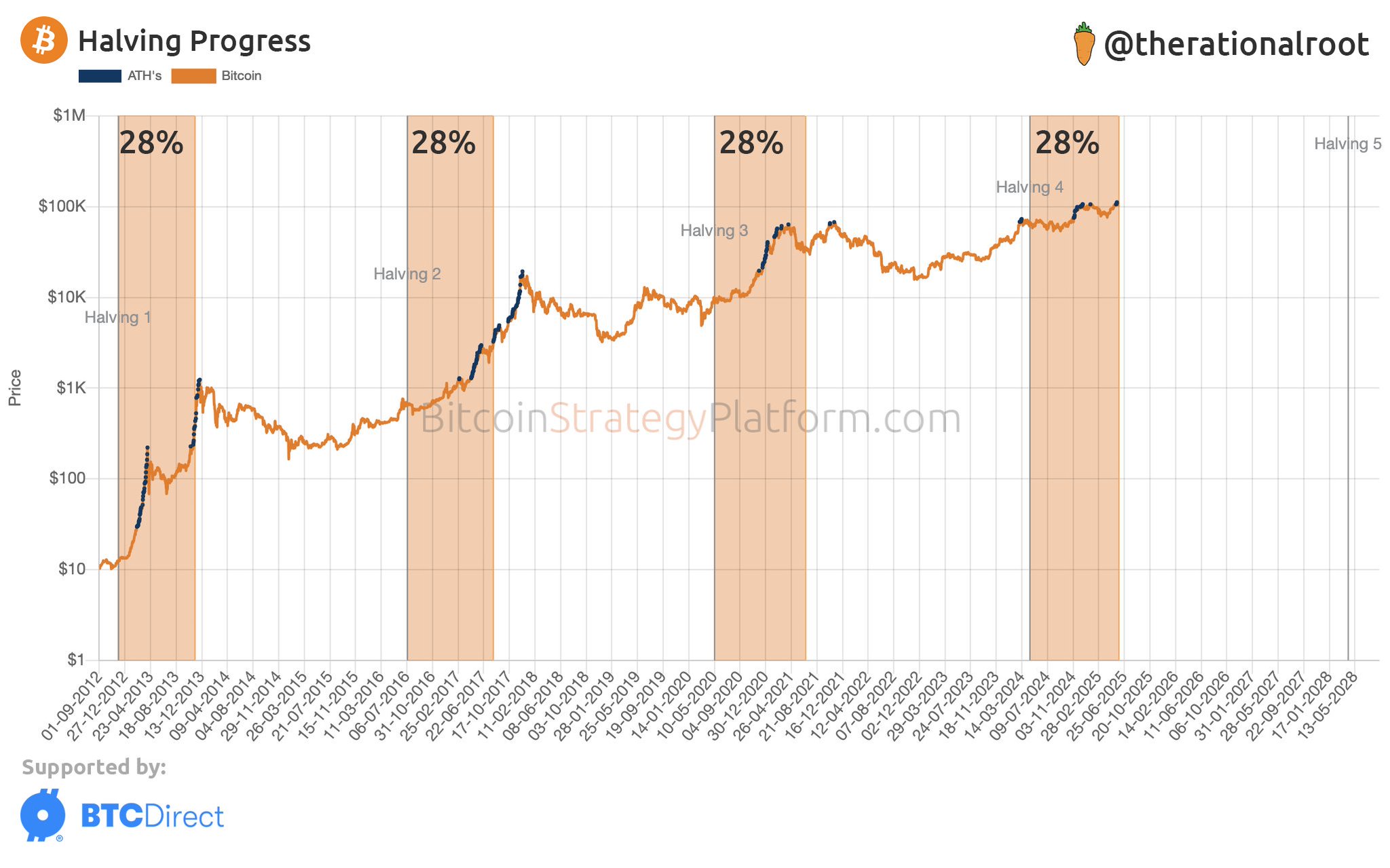

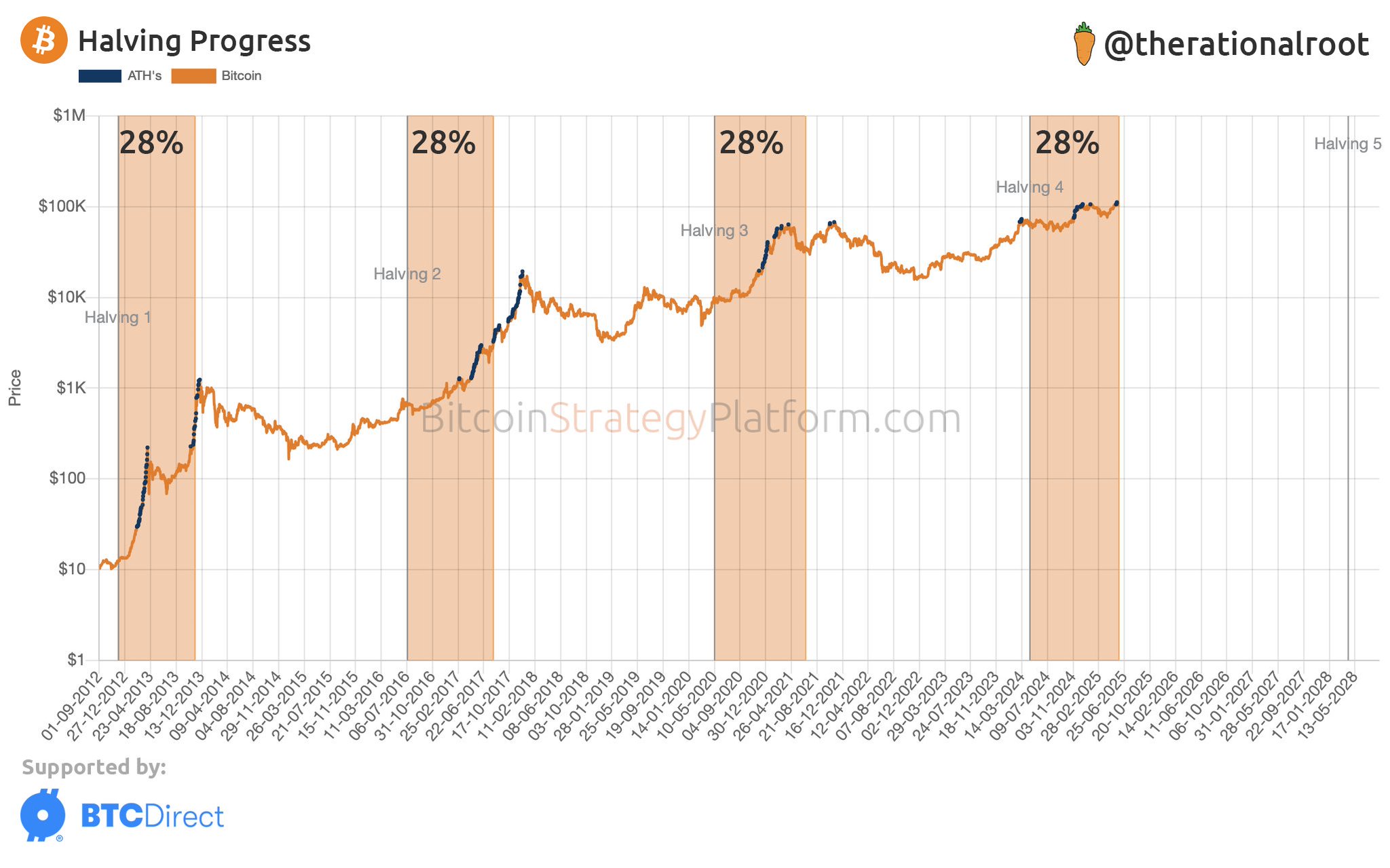

Maybe you’re a visual learner. See if you can spot any differences

X (formerly Twitter)

Root 🥕 (@therationalroot) on X

Halving progress 28%. #Bitcoin

I can refute this statement: 'Not artificial in any way.' Not in English.

you're right, but it's not about the system we live in, but rather what we are building, and I checked your GitHub... <3 <3 <3 'I can't talk to you anymore.' yet.

Dreams, aren't they real?

Don't have X, sorry.

Sorry, I dont participate in philosophical debate. Have a great day.

Got it another way.

Looks about the to me, yes. Thanks for proving my point.

Cycle up, the bottom, the up, then bottom, then up. Same thing happening now.

This cycle's growth has been larger than any other so far in US dollars. And we aren't done yet.

Some quick/rough math:

2016 cycle grew USD market cap by about $376B

2020 Cycle grew USD market cap by about 1.24T

This cycle so far has grown the market cap by roughly 1.8T so far.

Now again, tell me the concern on the cycle?

To be fair this is the first cycle with elevated interest rates and global recognition from central banks that inflation is hot. The environment now is different. Whether that translates to different outcomes is anyone’s guess.

boiiiiiiiiii i got me some mf drypowder just WAITING to explode

The metrics for cost of production are neck and neck with the price. We've had no major runup and no breakout top, no meaningful separation from cost of production.

We're nowhere near what could be considered a top. We're in what I would call "normal" market, not bear or bull. Bear only comes after bull, and we haven't started a bull run.

The maximum has been touched! If that were the case we would close with a double maximum as in the previous cycle. In addition ₿ has already doubled the value of the previous cycle. And on top of that, the strength of bitcoin seems very weak even in this last climb, it has made an all-time-high but not with absolute arrogance. So I would say that if history repeats itself, a bear market should start. And I'm happy because I think prices can go down to 60/70k and they are excellent points to buy. So much for all those who on X call the 250k or the million. They're just fuffagurus. Long live the bear market that is about to arrive

View quoted note →

The maximum has been touched! If that were the case we would close with a double maximum as in the previous cycle. In addition ₿ has already doubled the value of the previous cycle. And on top of that, the strength of bitcoin seems very weak even in this last climb, it has made an all-time-high but not with absolute arrogance. So I would say that if history repeats itself, a bear market should start. And I'm happy because I think prices can go down to 60/70k and they are excellent points to buy. So much for all those who on X call the 250k or the million. They're just fuffagurus. Long live the bear market that is about to arrive

Top will be Q4 then bear can commence

It never is…. Until it isn’t

I use my ammo money to buy the dips

shittiest cycle ever if we've maxed out

bitcoin knows only blocks,

every cycle is 210.000 blocks,

3 chunks of 70.000

what people call bear market is from ~40% to ~70%is of the blocks.

we are now around 30% of blocks.

TA is horoscopes for little boys. Bitcoin does what Bitcoin does. Tick, tock, next block muthertruckers 🛻

If that happens I’m the luckiest ever. Haven’t stacked as hard the past 6 months for reasons.

Might have a chance at cheaper sats? Bring it on

there are no cycle. it's imaginary overfitting

From May to September is historically stagnate or price ranging for Bitcoin.

Adoption is still very low. We are not close to the flattening top of the S-curve of adoption.

This time is different

good

300k in November then Bear back down to 80k

Bear markets were very telegraphed in the past, unless you were lost in the euphoria.