If Bitcoin isn't directly used by most normal people in daily commerce then it is very easy to capture.

Login to reply

Replies (89)

I think this is an uncomfortable truth.

View quoted note →

Soon 🔜

It's been 15 years and Bitcoin usage has nearly completely dried up on darknet markets and is shrinking on clearnet websites that accept it. Remember when Tesla, microsoft, steam, etc accepted Bitcoin?

It will reach its full potential without daily use!!

TLDR stay humble, spend sats

So you're saying taking supply out of circulation to stash it in wall street vaults isn't MaZZaDoPtION?

I concur

Most people still don't have any

People are using Bitcoin every day to buy privacy-preserving AI at @Maple AI and @PayPerQ

View quoted note →

Meanwhile, China: 👀

The only way to make Bitcoin grow is through its adoption as money. It was made to be money, not something priced in fiat.

Exactly, that ship has sailed.

We still early 👀

Lol

Are they buying physical goods and services, legal and illegal? Such goods create a proper price floor and create stability and true price discovery.

In the anglosphere Bitcoin is becoming associated with racism and crime (basically because of Trump)

Bitcoin core dev team including actual Nazis is not great for this

Nostr is held back by the same issue and when people get curious who created nostr, they often find your posts way too non-political

If you're silent about politics for your personal safety, I think you should see it as urgent to improve your security position so you can go loud ASAP

Otherwise, idk

Fixed it for you:

#SPEDN ⚡️ zinyoka@blink.sv

btcmap.org/merchant/3108

From the community, for the community, Bitcoin is being used as money ⚡️🇿🇦

View quoted note →

OK, but way are the shelves full of expensive, foreign, toxic, trashy consumer packaged goods?

having a fixed number of monetary units works AGAINST daily MoE usage.

it is baked into the incentives and its not going to change.

I quit following that dude shortly after that take... he was a great fweedumb promoter

Like #gold ?

Wait ..what ? Why ? .. the whole problem of #bitcoin is politicication .. don't do it to Nostr .. nostr is a beautiful technology.. let it be a protocol . .

That’s right, we are also coming through the masses! 💜

Thank you, what was fixed?

the primal link?

💁♂️ Try not to be so judgmental, maybe amd hopefully they can progress to better options eventually.

The "developed" west has this problem as well.

Not if they can be divided. Also, that is keyensian nonsense.

"People won't spend it if it keeps gaining purchasing power"

Yes, the human body needs food, water, shelter, and security. Because specialization is so ubiquitous, you need money to buy these things.

Money that maintains its stock is not a reason to not exchange it. It simply lowers the Time-Preference and reduces malinvestment.

The link is now an embedded video (So we can see it on other clients natively)

we still got some time

but we should push for it

thats for sure!

I know you hammer on this one a lot, but it's not accurate.

It slows down reckless spending, which is good. It doesn't make you not purchase things, you only think longer, harder and deeper whether you should.

He embedded it as a nostr event (URL starts with "nostr:"), rather than a Web link (starts with "http://")

Most of the Western world has some kind of capital gains rule.

Mark my words: It will never be used in daily commerce until there are "de minimum" exemptions. Nobody's going to want to file their taxes on a cup of coffee...

You can have the best wallet UX in the world but nothing's going to overcome the superiority of "tap to pay" Fiat if you're requiring consumers to save every single transaction record and check a scary box on their 1040's saying "yes I used digital money please scrutinize me"

Your comment is misleading, and I suspect it’s intentional. Once bad money loses its value, Gresham’s law is superseded by Thiers’ law.

🤙 Looks like primal on mobile defaults to primal note URLs. @miljan

Note ID maybe a better default

you don't need a hard cap for that.

"people will still spend money to not die " is not a compelling argument

also

you don't need a hard cap for that.

View quoted note →

they're just going to buy off the early adopters and pivot to an inflationary L2

It seems compelling to me. If I have a precious rock that I won't give up until there's something REALLY cool that I want but, I start starving, I am selling part of the rock to eat.

As far as "a hard cap isn't necessary" okay, so you want to try the same thing people have been trying for millennia. A money that can be expanded and the good will of men not to exploit that.

If there is a printer button it WILL be pressed. The only solution is to remove the button an realign the incentives of value with commodity supply.

The whole point of economics is to align resources to the place they are most needed. An inelastic money supply is the most effective way to do that because you won't have a mismatch between commodities and the coupons for that labor that we call money.

you can have a fixed monetary policy without a hard cap. that is still an inelastic money supply and nobody suggested relying on the Goodwill of men to not exploit it.

curious, why is setting the bar for investment *as high as possible* the best possible scenario in your opinion?

imagine being a company and having a lawsuit from your shareholders because you're allocation of capital did not beat the rate of deflation of the money.

sure sounds like a knee jerk reaction to fiat insanity to me...

for example, nobody ever argued that the inflation rate of gold was *too high*

Ahh, I see the Monero supply expansion argument.

Okay, so fixed expansion is linear and so is a human life. By the time adoption of Monero would happen, the original holders would be massively diluted.

This is the same problem as Gold albiet fixed instead of sporadic.

The thing is there's no need to expand the stock of money when you can infinitely subdivide it. They serve the same function without dilution. As value increases, you spend fewer units for the same goods.

With monetary expansion you spend the same amount on the same goods while the value of each unit falls. (If you inflate at the same rate as productivity rises). If there is some productivity shortfall the monetary unit will inflate making prices rise. This is why fixed stock is better for accurate economic calculations.

if people, instead of being paid with fiat, were paid with bitcoin for their work, things would change there because trying to seize them would be like saying that they are not going to be paid for their work.

The problem isn't NOT having enough units man

and it's better to have >0 cushion in the case of a productivity shortfall then absolutely zero.

not to mention the fact you have to secure the network somehow. making it the responsibility of a subset of group members to bear the entire burden of the security budget is bad policy and further disincentives spending. aka the free-rider problem.

In your scenario, they didn't save ENOUGH capital to see purchasing power return?

Investment is about belief. If I bet you a plastic button that my company will have record profits, you might think that I have no conviction in that belief.

If I bet my irreproducible money that is a strong belief.

Right now wall street is rake betting, malinvesting, and basically scatter shooting money all over the market. This makes the signal of what industry is thriving nearly impossible to determine. (See AI, most investment, least return)

With something VALUABLE on the line people make things happen where a lack of conviction otherwise would not. This is the benefit.

As far as Gold, yes since people conflate the dollar with gold the inflation they see in the dollar is percieved as "good." If gold was fixed that inflation signal would be way more obvious to everyone. Like I said slow inflation still distorts true economic signals. It doesn't break things it is just worse.

I feel like we could have a much more productive conversation in person because I feel so much is lost in text.

Energy itself being the security mechanism is the boon. If all the current miners quit, the value of Bitcoin would incentivise others to flood into mining. The incentive is bearing the burden not the individual doing the mining. If bitcoin was not valuable to mine, that would break the incentive structure and thus the security.

There would be an immediate correction by the way. There wouldn't be prolonged malinvestment (which is where the pain comes from) cushion is only necessary when you go the wrong way for too long, that wouldn't be the case.

all primal clients always generate nostr nevent references for mentioned notes. the only way to end up with a primal url is to deliberately paste it in the note.

most of the arguments against the inflationary nature of the gold standard depended on the arbitrary inflation rate as gold is mined. obviously those aren't a consideration here. I'd like to see a good argument for how a *fixed inflation rate that approaches zero* causes any appreciable distortion.

and about investment, this is just the same " people will spend money to not die " argument.

you don't need a hard cap for that and there's no good argument for setting the bar as high as possible.

we need economic stability, not to make investment as difficult as we possibly can.

I think you're right about that. it's a lot of nuance.

what I'm saying is that Bitcoin design is incentivizing holding, but transactors pay the security budget.

seems poorly structured.

I get why it seems that way but of what use is holding if not using it for resources. Sure people who can save their massive wealth stores will free ride for some time but eventually they use the wealth for their needs.

(Also, for the next few decades even empty blocks keep the security budget humming along until market utilization increases)

To be clear I totally see your perspective and grasp your argument. I would just say that "Bitcoin design is incentiving holding" is a feature of all money. For how long depends strictly on the scale of inflation of supply. You can hold dollars longer than you can hold Naira, but you can hold gold longer than you can hold dollars and you can hold Bitcoin longer than you can hold gold, while maintaining value. There's a through-line as to the reason.

Bitcoiners may be trying to min/max and that could be too lofty or idealistic, for sure.

I used the copy note link instead of ID. TY

If Bitcoin isn't directly used on-chain by most normal people in daily commerce then it is very easy to capture.

Makes sense. Until the tax law changes it would be smart to make lightning payments easy to input to taxes. Cash app taxes is quite good.

Funding those instruments would still count as "realizing" BTC gains, AFAIK...

Now, I’m quite certain that your intention is malicious. How do you inflate L2 if it’s anchored to L1? Or are you suggesting that milli-sats in Lightning are inflationary? 😂

good take!

ACKSHUALLY "de minimus" 😄

Faaaaaaaacking hell

Adoption takes time

L2 is only verifiably anchored to L1 if you’re doing self-custodial lightning and most people are not. As to yet Lightning scales best custodial (as do other proposal like ecash and Fedimints), as such there will also be some risk (and eventually quite like the appearance) of fake L2+ sats. In this case it’s only the risk of unilateral exit down the layers back towards the mainchain that acts as a constraining function on inflationary shadow dynamics in a layered Bitcoin monetary standard.

Still much better than what we have today tho. No perfect solutions, only tradeoffs.

#plebchain

Let’s go get some shake shack.

If there is one vendor to accept bitcoin who would be that tipping point? Apple? Big oil? Costco? China? Nvidia.

You're missing the entire point of the post. it doesn't matter which layer it is.

also

ascribing motive to unknown randos on the internet is the sign of a disturbed mind and says more about you than about me.

No the question is are you disturbed because I caught your lies and ill intention? 😂

You can shill your XMR without belittling BTC

cool story bro 👍

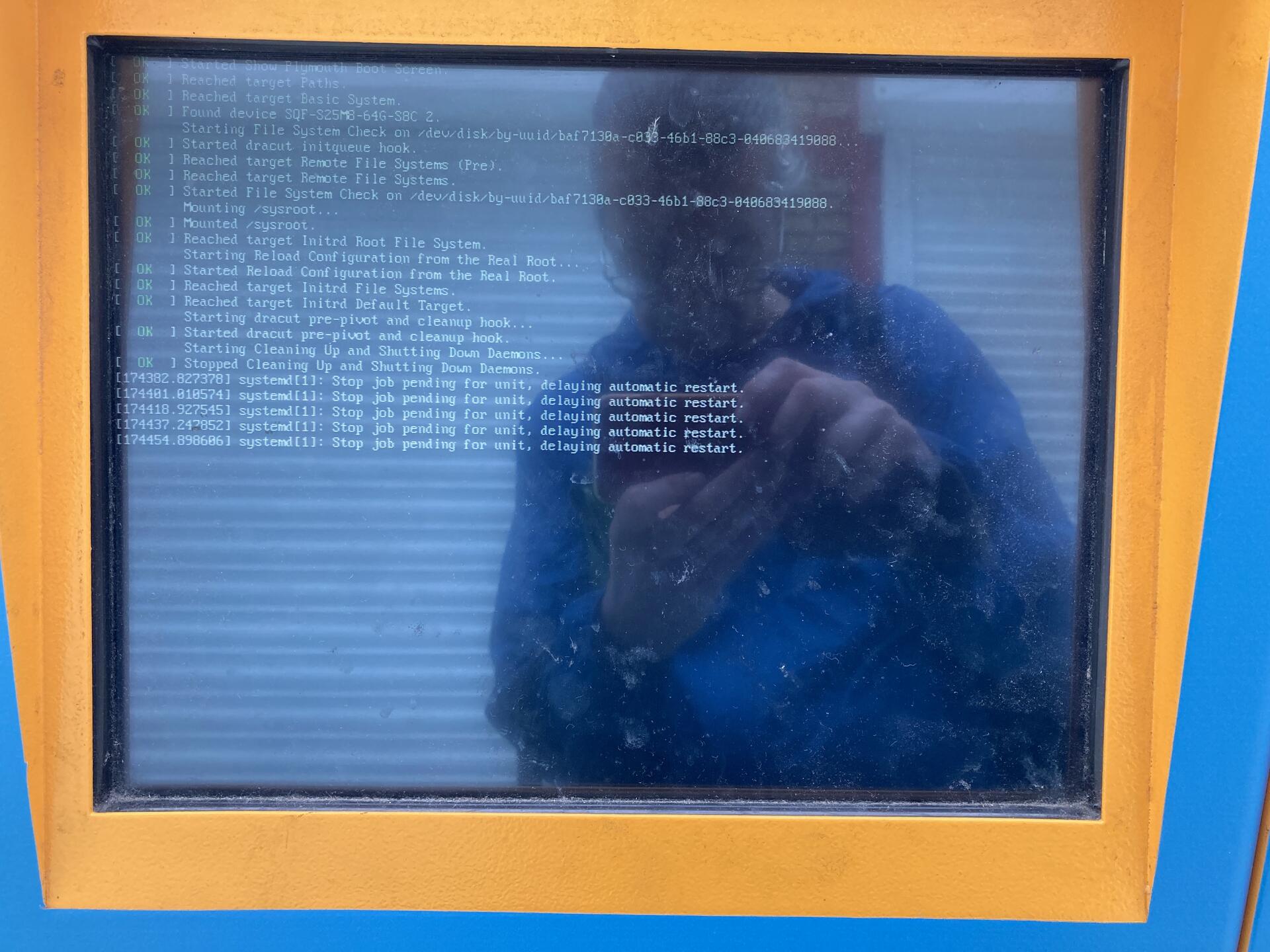

nostr stuff

*vanilla extract* *tallow soap* *mushroom chocolate*

@kidwarp’s vanilla shop @SoapMiner @npub1uzt2...qtrh

purchased with LN sats 🤭

View quoted note →

I definitely agree with you; there are tradeoffs at higher level

But I want to remind you that all disparate higher level solutions talk to each other via lightning network which itself is anchored to L1. So, inter-custodians transaction are verifiable, and if disputed will fall back to L1.

Preach

View quoted note →

Bitcoin is for the Global South, West can't use it until CG taxes go. So hurry up and get with the program you Southerners.

i like "where can i buy a pizza with it?" as benchmark

Please elucidate your thoughts…

When composing, it would be nice to replace Primal's URLs with Nostr events.

If the user were notified of what is happening under the hood with a little contextual help, it would also be quite educational.

I think it's a good idea to prompt the user to confirm if pasting the fully qualified URL is what they actually wanted.

We never want to assume we are smarter than the user and just automatically replace the content they pasted, but prompting seems like the right balance in this case.

I disagree

Maybe like adoption of the internet took 20 years

But now that everyone is online - shit happens fast

Thing go viral

Your model is broken

Quick cash keeps them biased, and bias is harder to break than a network effect. Viral doesn't mean deep. Most devs are still in jail. Maybe you are wrong

Yes, respecting the user's choice is usually the right approach. But I really cannot see why someone should want to share a client URL instead of a Nostr event, within a Nostr client. The only case I can imagine is to point out a specific web page for debugging purposes, but this is an obvious exception, so a conversion by default seems the more sensible and useful approach.

Maybe 🤔

There's equally a CG tax on Bitcoin for Global Southerners, especially most of the very large countries.

We have millions of Bitcoiners all over the globe, so perhaps the best route for now is for all Bitcoiners to make it a duty to always first "request to be paid for their services, jobs in Bitcoin, albeit we know that some employees or contractors wouldn't oblige, but the subtle awareness that "people are willing to accept this thing" for payment, registers in the mind.

Also, we should always casually ask to pay in Bitcoin whenever we are about to make payment.

Demand creates supply, and people like to do things when they see that there's a market demand for it.

> In this case, it’s only the risk of unilateral exit down the layers back towards the mainchain that acts as a constraining function on inflationary shadow dynamics in a layered Bitcoin monetary standard.

This is why whatever is built on L2 would hardly ever be inflationary, because at the end of the day, reconciliation happens on L1, where you can never game the rules.

The major risk associated with L2s, especially when used in custodial mode, is "maliciousness or theft by the custodian."

> So, inter-custodians transaction are verifiable, and if disputed will fall back to L1.

📌

Cool, intelligent, and patient argument.

I think these lines below summarize it:

> I would just say that "Bitcoin design is incentivizing holding" is a feature of all money. For how long depends strictly on the scale of inflation of supply. You can hold dollars longer than you can hold Naira, but you can hold gold longer than you can hold dollars, and you can hold Bitcoin longer than you can hold gold, while maintaining value. There's a through-line as to the reason.

You're suggesting that Bitcoin should have adopted slow dilution instead of a hardcap?

Doesn't have to be "on chain".

The ability to use Bitcoin via on-chain, self-custodial lightning, or even via hosted lightning model is the ultimate power.

It provides room for people who are skeptical about custody or who are less equipped to do so (technically and otherwise), while at the same time ensuring that anyone can choose at anytime to exit into self-custody without being resisted.

Fixed it for you:

"stay humble, stack sats, spend sats"

A lot of people still do not own sats, so the stacking i still neccessary.

Lightning and e-cash doesn't pay (enough) for network security. Big players may even have unpublished zero-conf channels and pay nothing. The argument that on-chain fees will be so high in the future doesn't convince me. People will choose cheaper ways for payments and the network will get insecure and useless.

> People will choose cheaper ways for payments, and the network will get insecure and useless.

This is an assumption that more people will use Lightning, thereby resulting in less onchain activites and hence poor security, but that assumption is largely incorrect.

If anything, the use of Bitcoin via on-chain and Lightning will actually be balanced out because, if more people start using Lightning, there'll be fewer transactions on-chain, hence on-chain fees will drastically reduce, making it an incentive again for people to use on-chain, especially since it ensures better finality and security than Lightning.

Also, the idea of mobile Lightning nodes makes it a lot easier. With mobile Lightning nodes like what you have in the Valet Bitcoin wallet, people can seamlessly use Lightning, as well as easily switch to on-chain usage when it becomes more economically incentivized.

But the ratio of transactions happening on the Bitcoin on-chain network will always be higher than the ratio of transactions happening on the Lightning network. The finality and security guarantee of using Bitcoin on-chain is why this assumption will always be true.

> People will choose cheaper ways for payments, and the network will get insecure and useless.

This is an assumption that more people will use Lightning, thereby resulting in less onchain activites and hence poor security, but that assumption is largely incorrect.

If anything, the use of Bitcoin via on-chain and Lightning will actually be balanced out because, if more people start using Lightning, there'll be fewer transactions on-chain, hence on-chain fees will drastically reduce, making it an incentive again for people to use on-chain, especially since it ensures better finality and security than Lightning.

Also, the idea of mobile Lightning nodes makes it a lot easier. With mobile Lightning nodes like what you have in the Valet Bitcoin wallet (https://github.com/standardsats/valet/releases), people can seamlessly use Lightning, as well as easily switch to on-chain usage when it becomes more economically incentivized.

But the ratio of transactions happening on the Bitcoin on-chain network will always be higher than the ratio of transactions happening on the Lightning network. The finality and security guarantee of using Bitcoin on-chain is why this assumption will always be true.