Replies (50)

Did we think the state would roll over without a fight for the best tool in their arsenal (the fiat money printer)?

IRS is out of control

It seems that at least some of the 5th circuit ruling (admittedly one (and only?) circuit, and criminal vs reporting requirement) in Tornado cash could come into play here, Both the post-Chevron rulemaking authority of an agency. And even though a tornado cash smart contract is "back-end", the extent of "front-end" code control is similar to that described in the tornado opinion.

This would also seem to require addtional code to comply with, which might raise some "force speech" issues.

is it considered a swap between currencies, if you swap on-chain btc to lightning or liquid and vice versa?

It's just code. This goes completely against the current consensus of the U.S. judicial system. If it stands for long, it will not be successfully enforced except to drive some innovation out of the U.S. and into alternative countries or into cyberspace with develipers with better opsecs. It will likely not even stick around under the current court atmosphere.

Wait, what counts as "affecting the terms of the trade?"

You do not want to be a developer based in most Western countries...

Base yourself in another country, for your own sake...

Still see no value in Monero's adversarial dev culture?

Yah, I don’t like this at all.

Seems like email providers and even just email server hosts would meet these criteria.

Come and take it

nothing is as dangerous as a declining empire running out of money. they turn cannibal.

off with their heads

How fucked are we? Sounds like a not to big of a thing thing unless it is… can someone explain deeper?

So running a Lightning node and earning 11¢ a week on routing fees makes you a broker, am I reading that right?

Well, compiling unconstitutional bills should be a punishable crime.

Voting to make them laws as well.

These MFs won't stop eroding our freedoms without the above.

If you have a crypto wallet that lets you swap one altcoin for another altcoin or a stablecoin or bitcoin then the maker of that wallet has to report your transactions to the IRS. Even if the wallet provider doesn't hold any of the coins being transferred at all they will still need to report the transactions to the IRS & issue you a 1099 tax form.

Wait til they start taxing our zaps!

Takes a lot of time & not all developers can afford to do that, they need to get paid.

Cocksuckers

🎯

lol and pleps will develope work arounds, until they have to regulate, that every human on earth is a broker und IRS reporting requirements my ass.

Its time to stop building cucked companies and start building black market infrastructure

L0la L33tz

L0la L33tz

The IRS just finalized its new broker rule, finding that control is not necessary to be considered a broker subject to IRS reporting requirements.

It's a nightmare for every non-custodial exchange and swap provider.

Built a website to let users swap between currencies? You're a broker under IRS reporting requirements.

Built a mobile app to let users swap between currencies? You're a broker under IRS reporting requirements.

Built a browser extension to let people swap between currencies? You're a broker under IRS reporting requirements.

As long as you have the ability to collect fees on a trade, or have the ability to affect the terms under which a trade is provided, or a whole bunch of other nonsense, you're a broker, which makes pretty much any non-custodial exchange or swap provider a broker.

While wallets without swap or exchange features are excluded by the broker rule, it's a taste of what's to come for BSA reporting requirements for non-custodial software.

INB4: "bUt ThEy CaN'T FoRcE mY nOn-CuStOdIaL wAlLeT tO Do aNyThiNg"

That's right they can't. But they can force the people building the software and services. And if they don't, they'll go to jail.

Unless challenged, the rule goes into effect in 2027.

The Rage

Broker Rule: IRS Requires Non-Custodial Services To Report Trading Information

Custody over funds is not necessary to be considered a broker by the IRS.

Personally, I don't think taking on the role of routing node is a great idea for people running personal nodes. It's a lot of aggravation for not a lot of reward. I say leave that for mid-size and large nodes.

Building the software is an easy fix -- move the git repos to Tor. Sort of surprised this isn't more common yet especially afyer Samourai. Though you could also access clearnet repos from behind a Tor exit. Or just post to Sourceforge from behind a Russian proxy if your name rhymes with Batoshi Lakamoto.

Moving fiat around ourside their reach though is much harder, at least without chasing off the normies. Might not be long before you're buying Bitcoin for gift cards (which you can already do on Bisq).

That all said, it'd be a weird move to create a strategic reserve AND destroy demand for that asset all at the same time. Though perhaps the play is to try to turn Bitcoin into money for governments, and lock the plebs into fiat, much like Bretton Woods did with gold.

Run your node, stack your sats, and stay cipherpunk as fuck.

I’ve learned a lot from it and it’s now at a point where it doesn’t require much maintenance at all. It’s also been a community-building experience.

Interesting times ahead especially for swap services like TrocadorApp.

At the end this leads to more Monero adoption. Many ppl have a Bitcoin stack and use Monero for payments. They need swap services. If that isn't possible anymore I can imagine that many of them leave Bitcoin for good

and use Monero only.

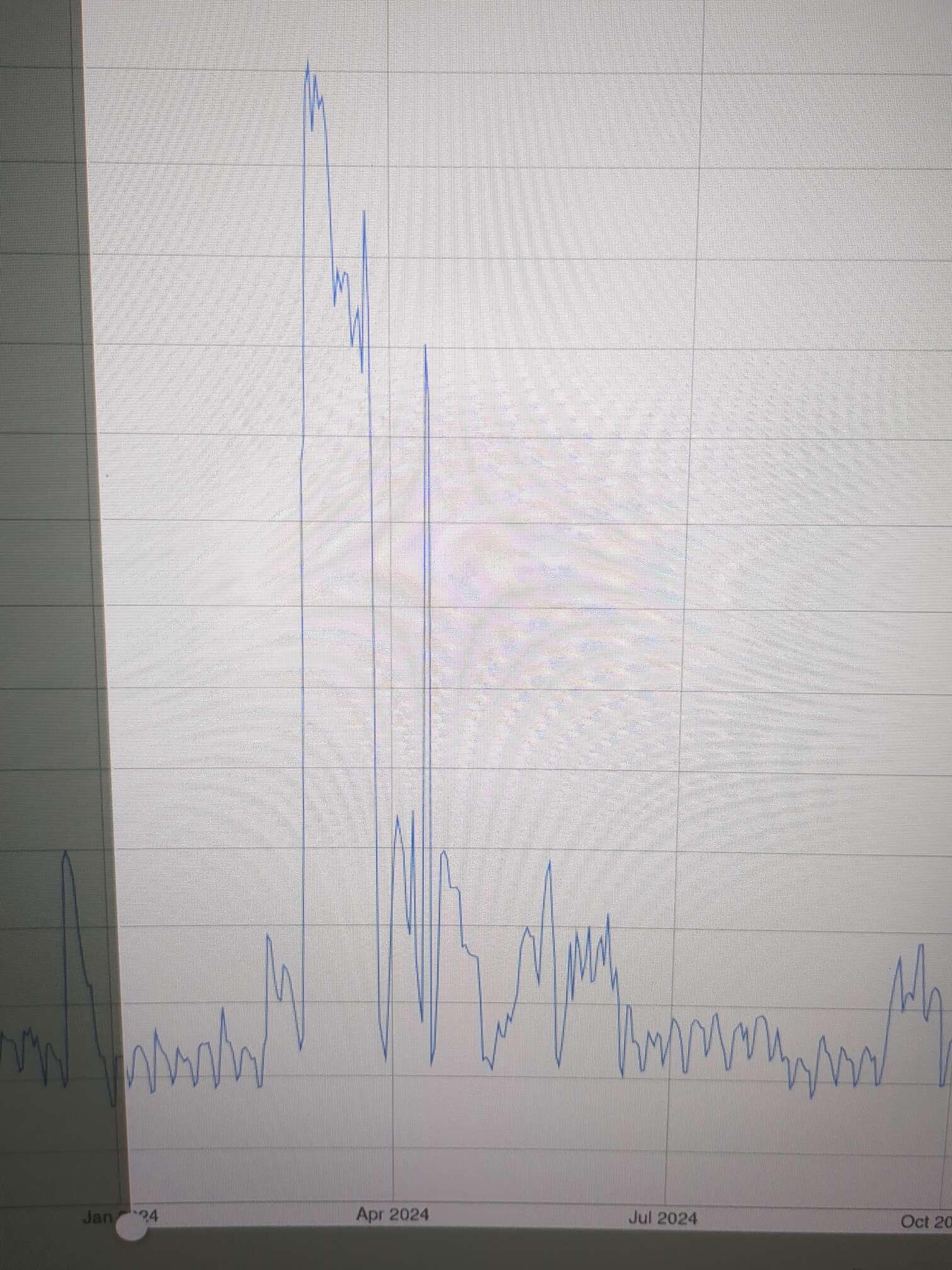

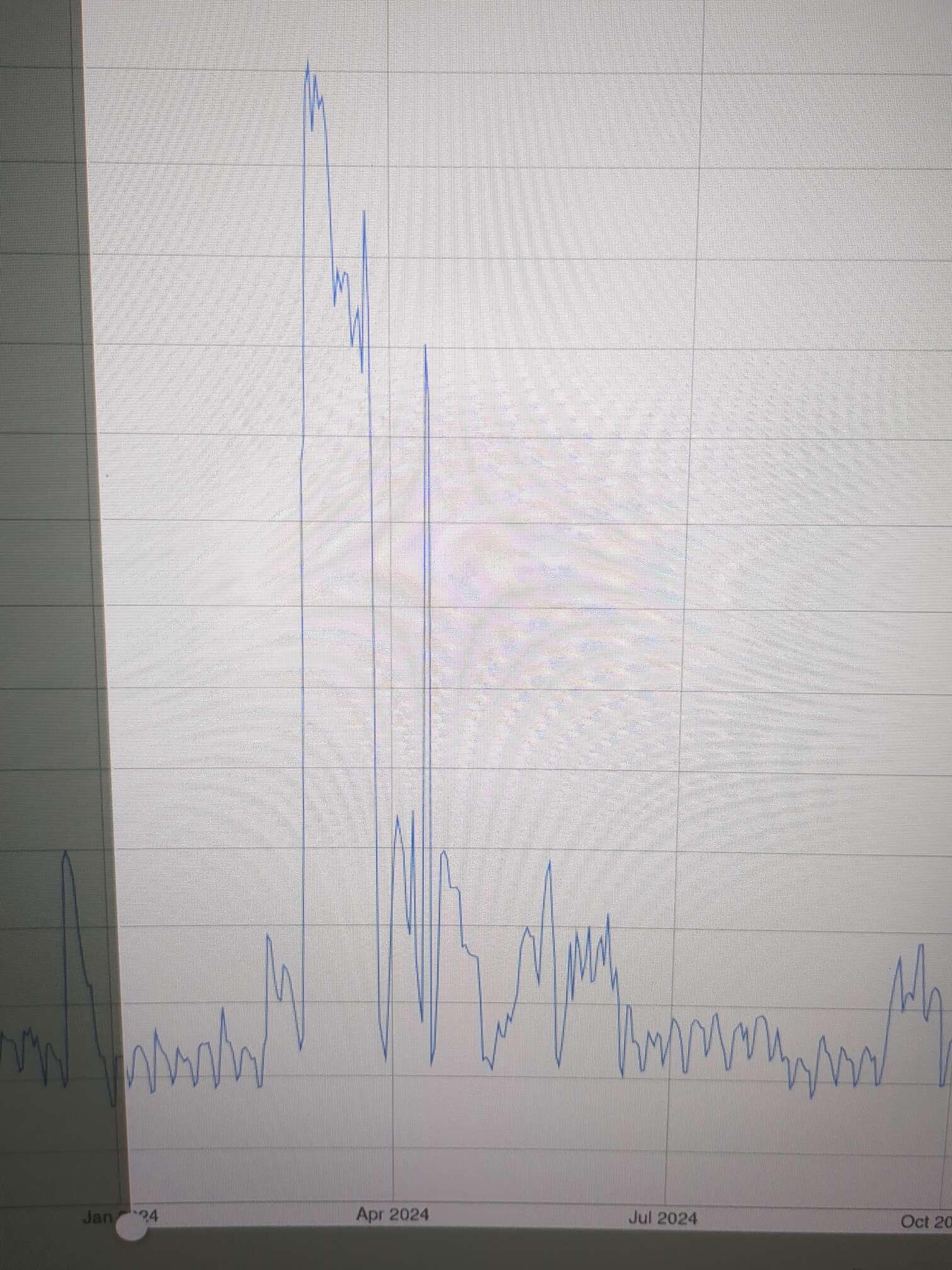

When they arrested the Samourai Wallet devs we saw a spike with Monero transactions. That's why I think we can see that again and with that a steady growing as more people have to think more careful how to route around the financial system.

If you don't re-think your goals with Bitcoin you will be trapped sooner or later.

L0la L33tz

L0la L33tz

The IRS just finalized its new broker rule, finding that control is not necessary to be considered a broker subject to IRS reporting requirements.

It's a nightmare for every non-custodial exchange and swap provider.

Built a website to let users swap between currencies? You're a broker under IRS reporting requirements.

Built a mobile app to let users swap between currencies? You're a broker under IRS reporting requirements.

Built a browser extension to let people swap between currencies? You're a broker under IRS reporting requirements.

As long as you have the ability to collect fees on a trade, or have the ability to affect the terms under which a trade is provided, or a whole bunch of other nonsense, you're a broker, which makes pretty much any non-custodial exchange or swap provider a broker.

While wallets without swap or exchange features are excluded by the broker rule, it's a taste of what's to come for BSA reporting requirements for non-custodial software.

INB4: "bUt ThEy CaN'T FoRcE mY nOn-CuStOdIaL wAlLeT tO Do aNyThiNg"

That's right they can't. But they can force the people building the software and services. And if they don't, they'll go to jail.

Unless challenged, the rule goes into effect in 2027.

The Rage

Broker Rule: IRS Requires Non-Custodial Services To Report Trading Information

Custody over funds is not necessary to be considered a broker by the IRS.

Yes 👀

At least this will help shine more light on massive US military black budgets. Right?

Correct. 😂 no one is talking about monero here. We are talking about abolishing the IRS and bitcoin 😂

These politicians need more treason charges.

They aren't trying to errode. They're trying to erase. They want as many of us dead as they can get.

Lower population = less resistance

3% of the population is what I heard. If we all showed up at their gates..

Rly tho

Do not comply

You've got to be pretty dense to not see the advantage of a private currency that hides the sender and receiver in this situation.

Would love to hear

@Alby take

View quoted note →Do not know who needs to hear that but - Monero fixes this.

brandon keeps on giving

Anywhere where one profits from something as a business, the IRS will rule. This is why running software as a citizen engaged in free speech and not as a business matters.

They are unknowingly forcing the bitcoin standard.

Absolutley. Much the same can be said for solo mining.

Holy shit it really does apply to developers of software that don't even take a cut, doesn't it? Yet another violation of the 1st Amendment.

All income taxes on the U.S. are voluntary -- this means don't sign into their contracts. And if one creates something (e.g software, service, etc.) keep it unincorporated, meaning don't register it with the State.

Just set up sites on Tor and I2P and the IRS will have an aneurysm.

L0la L33tz

L0la L33tz

The IRS just finalized its new broker rule, finding that control is not necessary to be considered a broker subject to IRS reporting requirements.

It's a nightmare for every non-custodial exchange and swap provider.

Built a website to let users swap between currencies? You're a broker under IRS reporting requirements.

Built a mobile app to let users swap between currencies? You're a broker under IRS reporting requirements.

Built a browser extension to let people swap between currencies? You're a broker under IRS reporting requirements.

As long as you have the ability to collect fees on a trade, or have the ability to affect the terms under which a trade is provided, or a whole bunch of other nonsense, you're a broker, which makes pretty much any non-custodial exchange or swap provider a broker.

While wallets without swap or exchange features are excluded by the broker rule, it's a taste of what's to come for BSA reporting requirements for non-custodial software.

INB4: "bUt ThEy CaN'T FoRcE mY nOn-CuStOdIaL wAlLeT tO Do aNyThiNg"

That's right they can't. But they can force the people building the software and services. And if they don't, they'll go to jail.

Unless challenged, the rule goes into effect in 2027.

The Rage

Broker Rule: IRS Requires Non-Custodial Services To Report Trading Information

Custody over funds is not necessary to be considered a broker by the IRS.

The irs doesn’t have authority to make laws

Furthermore it's becoming more and more difficult to remain anonymous when all of an anons text output, posting time of day, IP addresses, and transactions are up against increasingly powerful AI language and heuristic analysis.

It ain't 2008 anymore.

Y aún hay quienes dudan de lo que se va a venir para el software no custodial!!!

1984 y cualquier otra novela distópica esta quedándose corta, muy corta!

View quoted note →IRS RETARDS

.... NAAAAARRRRRFFFFFFFF!

and use Monero only.

When they arrested the Samourai Wallet devs we saw a spike with Monero transactions. That's why I think we can see that again and with that a steady growing as more people have to think more careful how to route around the financial system.

If you don't re-think your goals with Bitcoin you will be trapped sooner or later.

and use Monero only.

When they arrested the Samourai Wallet devs we saw a spike with Monero transactions. That's why I think we can see that again and with that a steady growing as more people have to think more careful how to route around the financial system.

If you don't re-think your goals with Bitcoin you will be trapped sooner or later.