One thing that has been disappointing is watching how Bitcoiners react to endorsements from demons such as Larry Fink, Kevin Warsh, Howard Lutnick, Donald Trump, Scott Bessent, etc.

When Kevin Warsh says "Bitcoin does not make me nervous", and that Bitcoin is not a replacement for the dollar, he really means: "Bitcoin is completely captured" and he is correct.

Would Kevin Warsh and Scott Bessent say stuff like that if Bitcoin had stealth receive addresses (no address reuse) and sender-receiver coinjoin by default, and if small Bitcoin communities started popping up everywhere and abandoned the dollar?

Privacy as a default (no special mode) lowers legal/UX risk for small commerce and defeats trivial chain surveillance that scares merchants. Privacy must be boring and automatic.

We see clips of Bitcoiners begging Trump for tax exemption on small payments and the only way we're going to get a tax exemption is by strengthening privacy.

Even if they allow for de-minimis tax, it will only be through their captured, full KYC custodians like Square.

You probably won't see these demons endorse Monero.

And to understand what I mean, you have to look at the Amish who mostly live outside the system.

They sell/trade raw milk, honey, meat, fruits, vegetables without pesticides and antibiotics and federal agencies constantly fuck with them "for your safety" (especially the ones who manage to scale).

The solutions won't come from the system, the only viable solution is for people to coordinate and stop playing a game they can never win.

Are we going to be the retards who HODL themselves into the upcoming AI governance, digital ID, CBDC era from which there is no return for the masses? It certainly looks that way.

Login to reply

Replies (27)

You are absolutely on point! This is one of the most shocking things

Well said

You say an absolut true !

I am here deep imagining..

How many bitcoins are in the banker's hands, and how many are in the people's hands ?

The fiat paradigm are winning, whales controls all and copied the block chain model to keep your own monopoly.

The game will start when the people awake to the fact that, the bitcoin is not son of people 's proof of work but, machine proof of work, and this proof of work were paid by FIAT! This money do not belongs to you ! How many people have a solar farm, or other mini power plant, to create your own satoshis?

The dream will be another version of bitcoin where, the proof of work will be payed by people ! The fake fiat money created by the system is a big trouble to the proof of the work, that can be understand like, a daughter of a sin !

Brainstorms, at side, the money monopoly is a ancient think that have zilions of fans!

The bitcoin or something like that will be use by whales until they have the full bitcoin monopoly ?

Look at traditions, they have !

Waking up !

Commodities bets are fail !

The proof of knowledge is all that wins !

Thats what I've been seeing this cycle.

I choose a more optimistic view. The fight isn’t over. Lightning and eCash are powerful tools for increasing privacy. What we need now are strong, practical use cases that bring more people to Bitcoin. Not only because of the price. Nostr is already a solid start, and Fanfares, which I recently discovered, is interesting too.

We can’t help everyone, but we can make sure people have real options to protect themselves if they choose to. That includes CoinJoin, Lightning, and eCash…

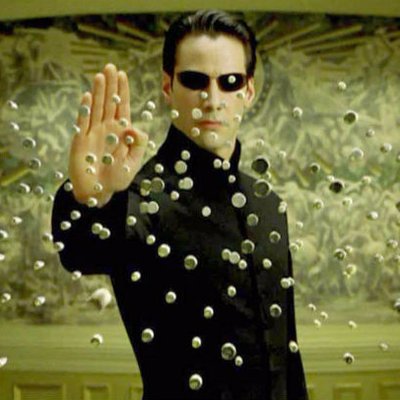

Not everyone endorses this guy:

View quoted note →

Institutional endorsement is not validation; it is a liquidity premium paid for by the surrender of fungibility.

When Warsh and Fink speak, they are buying the ETF, not the protocol. They are capitalizing on the Spread between a bearer asset and a KYC-compliant derivative.

Without privacy, Bitcoin is just a high-beta surveillance index.

cry harder bitch

Pathetic

Default on-chain privacy is the only way. Lightning is DOA, look at payment stats for websites that accept On-chain and Lightning, lightning gets barely 1 or 2% of transaction volume. Also it's privacy is mid at best (recieving primarily) and most people use it in a custodial or partially custodial way which gives it less privacy than on-chain.

ECash is literally not even Bitcoin, it's just custodial paper Bitcoin, even worse.

You've been sold propaganda and lies. On-chain default privacy or bust.

oh look another dime a dozen copy paste whiny little crypto bitch

Go check my post history and you'll eat your words.

On chain privacy or bust? Bitcoin is just the first mover and so it benefits from network effects. It doesn’t have to be the only tool. It’s just a form of money. If it’s a better form of money than cash or gold then use it. Most people are just trying to keep their heads above water and save in something that isn’t printed into oblivion. Doesn’t seem like it’s a bust if they have that option. Just keep cash along side it if you want privacy. It’s not black and white.

Just like paying with gold isn’t practical for everyday use, paying with Bitcoin directly on-chain isn’t either. That’s why we end up with different trade-offs and approaches trusting companies, using protocols, or mixing both.

The main thing that matters is that the on-chain layer can’t be censored and stays decentralised. If we want global payments to work for everyone, in my opinion there’s no way around taking responsibility for those trade-offs ourselves.

For what we have payment stats for now, today, not some hypothetical future of "mass adoption" we find piss poor lightning adoption. On-chain still smokes, despite much higher fees and slower speed. Maybe one day it'll magically flip? Maybe if Bitcoin is 100% custodial, then we'll see some real lightning UX improvements and efficiency.

Alright I talk about stats a lot so time to bring in the reciepts (note that I don't have X so these are the latest I can find with search engines):

ShopinBit: https://x.com/shopinbit/status/1978715781744472132

69% Monero

28.89% Bitcoin

0.19% Lightning

This is literally the tagline on the website, they only mention Bitcoin: "A privacy-first service for ordering anything with Bitcoin & crypto, worldwide. No login or extra verification needed"

NanoGPT:

https://x.com/NanoGPTcom/status/2007149007286554956?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E2007149007286554956%7Ctwgr%5Ee2c7e07f527f0d9cb4b05b4fb76f29b0d3f3070c%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fnano-gpt.com%2Fblog%2F2025-year-in-review-payment-stats

44% Monero

18% Nano

13% Bitcoin

Cant really see it doesn't have a number but maybe 1 or 2% lightning

Numbers from December. The website is focused on Nano and offers a 5% discount in Nano compared to all over currencies. Monero still dominates.

Coincards:

https://x.com/CoinCards/status/1709306835126386976

Latest is only from Oct 3,2023 mind you yet we find:

32.82% Bitcoin

32.22% Monero

2.4% Lightning

Woohoo Bitcoin wins! Wait by 0.6% on a site focused and advertised with Bitcoin 2 years ago while bitcoin supposedly has 20x the market cap. Curious to see the stats now.

From these stats (ignoring even darknet market dominance) I make the assured and certain conclusion that the free market PREFERS Monero as a medium of exchange. I challenge anyone to refute this I'd love to hear counterarguments or counter evidence most importantly.

View quoted note →

The value proposition of Bitcoin is its use as digital p2p cash. If it doesn't have this use, it has no value.

I get your point, but I disagree. For safety, transparency is actually a strength. As a medium of exchange, privacy is better, but that’s exactly what Bitcoin can offer.

So you don’t own any bitcoin?

I have a small amount in lightning to zap people, but that's all now.

Damn okay

How do you store your wealth? Monero I assume?

My home, 401k, HSA, physical gold and silver, Monero and food reserves rn. Looking to invest in 3D printers, CNC machine, woodworking tools, beehives, chicken coops, ammo etc. but I'm lacking in those areas now.

Right on. Seems like BTC is still a huge improvement over a 401k and precious metals even if it lacks privacy at the base layer. Especially if you have non KYC utxo’s 🤷♂️

Bitcoin DGAF

Bitcoin is a trojan horse. They think jailing a couple developers will kill privacy, when all it does is harden the system to route around a central point of failure.

Since monero is clearly a threat they have crushed its widespread adoption. It is a leper even among the shittiest of shitcoin exchanges. Sure a small clandestine group could use monero, but it will always be fought tooth and nail and so building critical mass because a huge problem. It’s also impractical for normal purchases the locked balances, the heavy weight of each transaction, the lack of

Instantaneous transactions and the long wallet sync makes for an awkward experience compared to lightning.

Bitcoin being open and unassuming and seemingly easy to control makes it ubiquitous. Fundamentally it’s a permission less exit. While there is centralized capture happening, Wes still see over 70% is in self custody. Every noob I know started their bitcoin with paper claims and has ended up in self custody with a goal to obtain noon kyc coins. People have to learn why before they adopt a system.

Woah woah cool it with the antisemitism