Had to go from 95% net worth invested in Bitcoin -> 15% about 2 weeks ago.

A lot of the confidence I had, vanished, once I stopped listening to podcasts with Bitcoin authority figures and started to research on my own.

The reason I made the move is that I am pretty sure Bitcoin is going to become Gold.

Based on my research, the masses embracing Bitcoin as a medium of exchange over stablecoins/CBDCs is a very remote probability.

This doesn't mean that Bitcoin is not going to go up in fiat terms of course. I still think there are massive fiat gains to be made in Bitcoin.

I'll be a buyer on draw-downs of 45-55% from ATH, and seller during "clarity" (e.g. policy, liquidity, etc.) spikes.

For me, Bitcoin went from being Hope to being a hedge against "The Great Taking" type scenario and a niche, permissionless MoE.

If you are unfamiliar with the book "The Great Taking":

- The book describes what Webb calls "The Great Taking" - a systematic, global seizure of all collateralized assets through legal, technological, and financial mechanisms. In other words, you don't own the stuff in your brokerage account.

- This is enabled by the laws in every country in the World (they were changed recently to allow for this global seizure type scenario).

Of course, if this happens, then Bitcoin and Gold get revalued much higher overnight.

Based on my research, the Controllers changed the laws for an edge case, this is not the base case type scenario.

If I have a reason to believe that the odds of Bitcoin as a mass MoE increase over time, I will scale back into it.

For now, Bitcoin is a dissident MoE, a Store of Value, and a "Great Taking" scenario type hedge, and I don't see this changing for the better any time soon.

More context on the post-ETF era:

View quoted note →

More context on how permissionless technology ≠ permissionless adoption:

View quoted note →

More context on how governments and large institutions are domesticating Bitcoin:

View quoted note →

More context on what OG Bitcoiners don't understand:

View quoted note →

Login to reply

Replies (44)

Well... I'll I can say is I have faith and will continue to have faith u til the bitter end should that be the end. To give up on bitcpin seems like a trick like so many others we experience. We are tricked into dispare and depression. Maybe you are right but I won't give up the fight.

Why governments won't ban/kill Bitcoin but will contain it as Store-of-Value (SoV)

1) Enforcement cost > control benefit - A true ban drives use off-grid (Tor, mesh, cash ramps), destroys visibility, and raises policing costs. Containment via KYC perimeters is cheaper and yields data.

2) Better telemetry inside the tent - With ETFs, exchanges, and custodians, governments get biometrically tied identities, flow analytics, and seizure paths. A ban forfeits that intelligence.

3) Tax and fee capture - Capital-gains, trading, and withholding taxes + Wall-St. fees create dependable revenue. Bans cut a growing tax base and antagonize large financial donors.

4) Financial-stability risk of a ban - Now that pensions, brokers, and banks hold paper Bitcoin, prohibition would trigger losses, lawsuits, and collateral stress. Regulation avoids systemic jolts.

5) Geopolitical arbitrage - A global ban is unlikely to synchronize perfectly. Any major hub offering permissive rules attracts capital and talent. Containment preserves competitiveness while limiting MoE.

6) Legal drag & optics - Speech/property/innovation arguments slow blanket prohibition in rule-of-law states. "Regulate and protect consumers" polls better than "ban and confiscate".

7) Energy & industrial coalitions - Mining as flexible load helps grids, monetizes stranded energy, and brings rural jobs. Those lobbies resist outright bans; regulators prefer conditional allowances.

8) Paperization gives a steering wheel - ETFs/futures/structured notes dampen volatility, centralize price discovery, and make policy nudges effective. You don't need a ban if you can steer.

9) Seizure & prosecution value - Law enforcement has repeatedly seized Bitcoin. A ban reduces cooperative custody and pushes value where seizure is harder.

10) Narrative management > martyr creation - Bans create martyrs and adoption surges. "Invest, don't transact" plus perks for CBDC/stablecoins normalizes behavior without revolt.

11) Innovation insurance - States want optionality if Bitcoin tech (or reserves) becomes strategically useful. Regulate now, keep the option to lean in later.

12) Precedent risk - Banning a major asset class spooks broader markets. Incremental containment avoids setting a weaponizable precedent against other assets.

These are some of the reasons that make me quite confident, there won't be any Outright prohibition (criminalize possession/usage broadly).

I'd put the odds at ~10% or lower over the next 5 years in US/EU/UK.

It would require a massive crisis + political alignment + judicial acquiescence. Possible, not probable. I'd say extreme edge case.

The odds for - Partial/sectoral bans & hard throttling (merchant MoE suppression, node/platform de-platforming bursts, strict KYC travel-rule, custody only) - are higher - ~30%.

My base case is SoV-allowed containment (~60%) - Paper Bitcoin dominates, self-custody tolerated but inconvenienced; MoE pushed to CBDC/stablecoin rails.

Banning Bitcoin is expensive, leaky, and counter-productive for governments.

Containing it - paperizing price, taxing flows, steering payments to CBDC/stablecoin rails - delivers control, telemetry, and revenue with fewer riots. Price can still compound inside that cage; freedom lives only in the relatively small, well-kept self-custody sleeve.

More context:

View quoted note →

Yes mate, I'm writing down my thoughts around my decisions, not trying to campaign for you to do anything.

I also didn't say I gave up on Bitcoin, so that's a bit of a strawman.

My question would be in what you will invest the 70% you just pulled out of BTC 😁 I would guess not as fiat on a bank

I’d caution against listening to Witney Webb and trusting her completely. She had some good takes on Bitcoin from adversarial standpoint, but I’ve noticed she doesn’t really understand the beast and has only surface knowledge about it.

I missed the part where I appealed to Witney Webb because I'm pretty sure I haven't 😂

Now I am intrigued what her take on Bitcoin is because I thought she was an Epstein reporter.

Still, it is about the substance of the arguments, not about appealing to XYZ.

Yes, it's invested, not in a bank.

I don't feel great about disclosing as of now because I'm not trying to give people investment advice and I retain the optionality to change my mind at any point.

If one isn't doing the type of research I am doing, it would be a very, very bad idea to pick stocks.

And as I previously stated, I think BItcoin continues to go up in fiat terms.

If Bitcoin doesn't outperform QQQ long-term, I'd be very surprised.

The part i don‘t understand is how you say you reduced your Bitcoin holding while thinking that it‘s Gold 2.0 which the whole world (see the BRICS new vault-gold based system).

Besides, are you now investing in Palantir, Microsoft, Amazon etc.?

I don‘t see any other alternative than Bitcoin against The Great Taking scenario for the common man.

She also dismissed Bitcoin as a solution for the Great Taking in a video about a year ago, but mostly for all the wrong reasons.

Here’s a good no-copium analysis and a breakdown of her take:

I didn't understand the first part.

Bitcoin is basically becoming a controlled opposition asset like gold is.

Context:

View quoted note →

Context for the investment part:

View quoted note →

And yes, Bitcoin is the best tool against a "Great Taking" type scenario as I've described in my post above, so not sure what you mean here.

I've still kept 15% of my net worth, which is relatively high, in Bitcoin.

Your comment about maintaining faith and hope, I agree with.

When what I've described in my posts starts to change, I'll scale back in.

The funny thing is, so far, the feedback I've gotten on this and other platforms makes me think I'm on the right side 😂

If everyone agreed with me, I'd be very concerned.

Most people are too lazy, intellectually dishonest or just too low IQ to do the work.

I literally wrote that I'm using Bitcoin as a hedge to a Great Taking type scenario.

I don't know why she would dismiss it as such as it makes no sense, but I'll take a look.

I asked Chat GPT to summarize her Bitcoin takes and I agree with most of the summary.

I don't know about this "Bitcoin-Dollar" thing, try "Stablecoin-Dollar"

Most of the other stuff I agree with

If Bitcoin is the best tool against TgT why only 15%?

This is by no means the first time i‘ve seen a more critical position to all the „Bitcoin to the moon“ hype. It sounds more dark but also more realistic. We live in a world with a perpetuated mass psychosis. It‘s bloody revolution or compliance. And the fearfull majority will choose compliance over action. At least in Europe.

Oh, I saw that you've attached a screenshot.

The book "The Great Taking" is written by David Rogers Webb who is a former hedge fund manager.

He is not related to Witney Webb in any way 😂

I don't even think Witney Webb is her real name but not sure about that

A direction of you investment maybe?🫣😏 Obv not investment advice!

In short, if an event such as the Great Taking takes place, Bitcoin, gold, etc, get repriced much higher overnight.

In other words, little becomes a lot. Bitcoin then has explosive upside for survivors (self-custody only).

Also, as I mentioned my net worth is relatively high, so 15% is not little.

It's not something I've written about on here, but I researched how likely it is for the Controllers to enact the Great Taking and I've come to the conclusion that it is an (extreme) edge case.

The extremely TLDR version is:

The full Great Taking type scenario is technically possible, legally enabled, but extremely risky. Requires near-perfect control of narratives + timing (crisis trigger + CBDC rollout + global harmonization). If mismanaged, triggers chaos -> loss of trust in state. Hence, fallback scenario if debt pyramid collapse outruns managed transition.

Also, technically, all stocks held through custodians, brokerages, and CSDs (DTCC, Euroclear, Clearstream, etc.) are legally collateralized and can be swept.

However, it is more nuanced and I'm not going to dive too deep here.

The Controllers usually do not "punish" their own instruments.

State-embedded companies are not "capital assets" in the same way as random ETFs. They are extensions of the state-control lattice.

Seizing their equity en masse would destabilize their role. Why would the Controllers burn the infrastructure they rely on?

Instead, these equities are more likely to be:

- Ring-fenced: carved out from seizure frameworks.

- Converted: forcibly shifted to "CBDC-denominated ledger shares". You still "own" them, but only inside the CBDC matrix.

- Protected selectively: insiders, elites, and aligned funds retain ownership; retail may be converted or frozen.

So - yes, they are technically seizable, but practically unlikely to be targeted, because they are the command system itself.

It is much more nuanced than this, but not going to dive too deep here.

i have much the same issues with what is going on. it's pretty tiring to shout into the void and not even hear the faintest echo back.

so thanks!

This is the direction and if you read my other notes on the topic, I've already stated the 2 equities I've selected, but unless one does the work, these types of conversations do more harm than good.

View quoted note →

the world will make a doomer out of Mechanic by next cycle.

It's better to get called a retard with 0 argumentation provided and to get laughed at, at least then you know you're probably on the right path.

If your opinion is the consensus, probably time to start doing some research and put down the podcast hopium.

Oof lol 😂😅 thanks for making me feel stupid 🤭

I’m struggling with this myself

😂 don't worry about it man, I was just so confused how Witney got inserted into the whole thing

You are ignoring the point that for the people at the very top, it's not about making as much money as possible because they print the money.

If you want some more context, look at the posts at the bottom of this note:

View quoted note →

To be more concrete, you're ignoring the point that permissionless technology ≠ permissionless adoption.

View quoted note →

in the words of my 98 year old great aunt, "you worry too much".

i'm sorry this is a low IQ response to your research. but coming from someone who worries a lot... you're worrying too much.

Ok pussy

Interesting take and very thought provoking like most of your stuff🤔🫡

Still the most concerning aspect of the current worldwide financial framework as described in the great taking is (imo)

1) the ability to arbitrarily seize/control assets of others

2) the potential to weaponize this process by unaccountable centralized bureaucracies

…it seems to me that any discussion of these theoreticals always dovetails into the cliche that “all roads lead to hard assets” and there is only one “hard” asset that I’m aware of that can serve as both a store of value and currency in today’s electronic economies

…so ima say it again “all roads lead to btc”

Yes sir, also you ain't about to hear any discussion of these theoreticals on the news.

The fact that most of your stuff can be seized overnight is not something most of the public would be interested to know it seems.

☝️true this!!?!🎯

…it’s hard to fathom this magnitude of a rug pull for most (…esp the boomer generation (who the system seems to have worked so well for) —> cognitive bias) but then prior to 1971 I bet the prospect of the 2008-2009 taxpayer bailout of investment bankers would have seemed like a farfetched conspiracy theory too

*I always dig ur stuff…even the things I may have a difference of opinion on (full disclosure: it’s rare) I find thought provoking and well articulated 🫡🌅

Thanks mate, much appreciated

By the way, I have to ask, what are some of the things you disagree with me on?

You can be honest, I don't get triggered easily 😂

I am still confused about whether you are a person or AI because you have a very particular style of writing, but I'd like to know either way as I'm always trying to learn new things.

I’ll have to review

…some minor points on BTC…altho I must admit ur base of knowledge and apparent level of research absolutely dwarf mine

…I’m a firm believer in if BTC is what we think it is the it should be money for our enemies (even as cliche as it has become to say)

…also “hylerbitcoinization” cannot occur without the establishment wading in

…and when they enter they will attempt to co-opt and corrupt it to their advantage as they’ve done with virtually all asset classes for years

….if BTC is what I think it is it will survive and improve because of this attack as it has all other previous attacks

Full disclosure: I’m wrong about a lot ⭕️ sh*t ….so this is not financial advice🤔🤨😂

….as for my flight ⭕️ ideas writing style it’s mainly to cover up my poor punctuation, spelling and occasional grammatical errors

…as for wondering about the possibility of me being AI….i fall more into the camp ⭕️ natural stupidity (I’m actually a #⭕️ OG)…but the fact that u thought AI was a possibility may be the nicest thing I’ll be told all day…I mostly kibitz with a rough digital crowd (the ⭕️) on nostr

He's definitely not AI lol

Hey MF….this is the most respekt I’ve ever been shown on nostr🤨

…leave it to my ⭕️ buddies to come piss on my brief moment o glory🤦🏽♂️🤬🫂😂

Stay hahmble ⭕️🫡

😂🫡

Agree that Bitcoin will survive, I consider the odds of it not surviving extremely remote.

As of now my base case is that it survives as a SoV (store of value) and a niche (not mainstream) medium of exchange.

However, I'm always open to be wrong and will change my mind as some of the falsifiers I've implemented are toggled.

We'd both be better off if Bitcoin becomes mainstream MoE.

I agree

…imo the powerful that benefit from the currently evolving system will fight any alternative MoE for all they are worth…and prolly with some level of success

…the more draconian their efforts the more likely there will at least be a niche/black market type demand for self custodied value (again just my opinion)

…full separation of state and value may take decades/generations but power structures are fragile things over the long arc of time (again an opinion not a threat for any of u fed boyz out there)

…I think the wisest path forward is having the value u need to sustain u and the ones u love on the fiat rails and everything else in self custodied assets that can be passed on for generations and/or used in SHTF scenarios…jus one idgit’s opinion🫡⭕️

Fully agree, self-custody Bitcoin, land, water, energy access, food, maybe even some precious metals if SHTF.

The only new addition is Bitcoin, the other stuff has remained the same forever - the more you hit, the more anti-fragile you are.

I think the masses will still embrace Bitcoin simply because *there is no other way* to preserve wealth.

Stablecoins are completely irrelevant since they will just get devalued as their underlying currency, so the masses will quickly learn that stablecoins do not protect them from inflation at all.

The only thing that protects you from inflation is Bitcoin. Even the S&P 500 does not beat inflation, and the masses will learn this quickly as well.

We are talking about 2 completely different things here.

I am not dismissing Bitcoin as a store of value in my writings.

I said that I find it unlikely Bitcoin will be adopted as a mass medium of exchange.

You say:

> Stablecoins are completely irrelevant since they will just get devalued as their underlying currency, so the masses will quickly learn that stablecoins do not protect them from inflation at all.

So did the masses quickly learn how fiat doesn't protect them from inflation and stop using it, or do you think there might be other variables at play?

I don't think you read the posts at the bottom, so you're missing most of the context, but it is what it is.

I must admit that I am not capable of such sophisticated logic and reasoning. Many of these concepts are completely new to me, yet I intuitively feel they likely describe reality well. Therefore, I do not wish to refute your conclusions.

However, I believe an important aspect is being overlooked: it seems to me that good is fighting evil—freedom versus slavery.

One must ask: what is the morally right thing to do?

If evil is capable of such plans, then good can always counteract them. I feel that now, more than ever, people are seeing through a lot of BS.

These extremely complex plans only succeed as long as they remain hidden in darkness, away from the bright light of truth that exposes them.

We should expose and reject them with all our might, refusing to support them with our time and energy or any resources, regardless of potential profit.

I mostly agree.

And when it comes to fighting for Bitcoin, I haven't seen anyone doing the kind of research I'm doing or raising/addressing these types of issues.

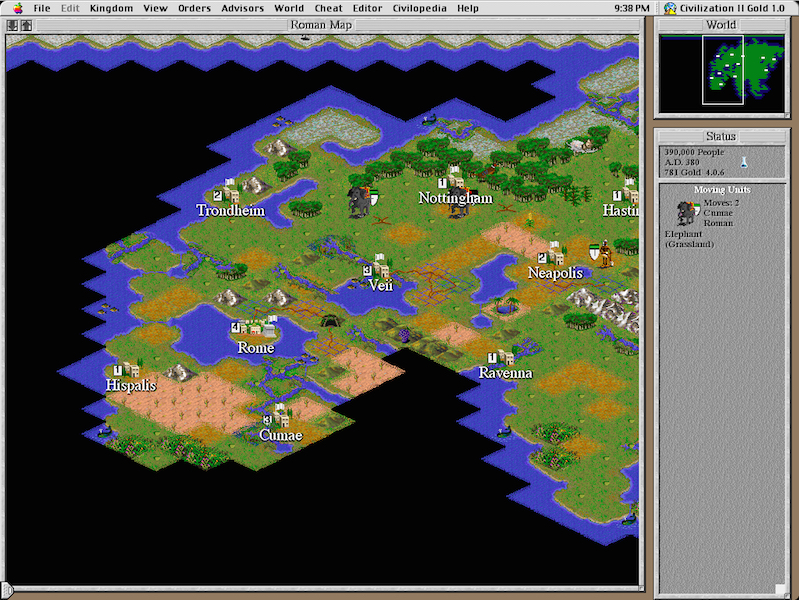

Just look at what Bitcoin podcasts look like:

- "The government is retarded, they don't understand Bitcoin, they'll be panic-buying Bitcoin at $1,000,000. Bitcoin is going to $10 million by [this date]."

I'll continue to fight for Bitcoin, even though I've seen close to 0 fight in Bitcoiners.

However, based on the confidence lost, I've divested a bit for now. When I see some fight, I'll scale back in.

![ꓘɨℓσꬺƄɨP110ꓘɳσ[Ŧƨ] 𓅦丰's avatar](https://image.nostr.build/23ee33cac87bf71b98e809e2d990cf0a04c5aa1af452383f8a845479e072d79f.gif)