by

@Tuur Demeestr

This new paper is a true declaration of war: the ECB claims that early #bitcoin adopters steal economic value from latecomers. I strongly believe authorities will use this luddite argument to enact harsh taxes or bans. Check 🧵 for why:

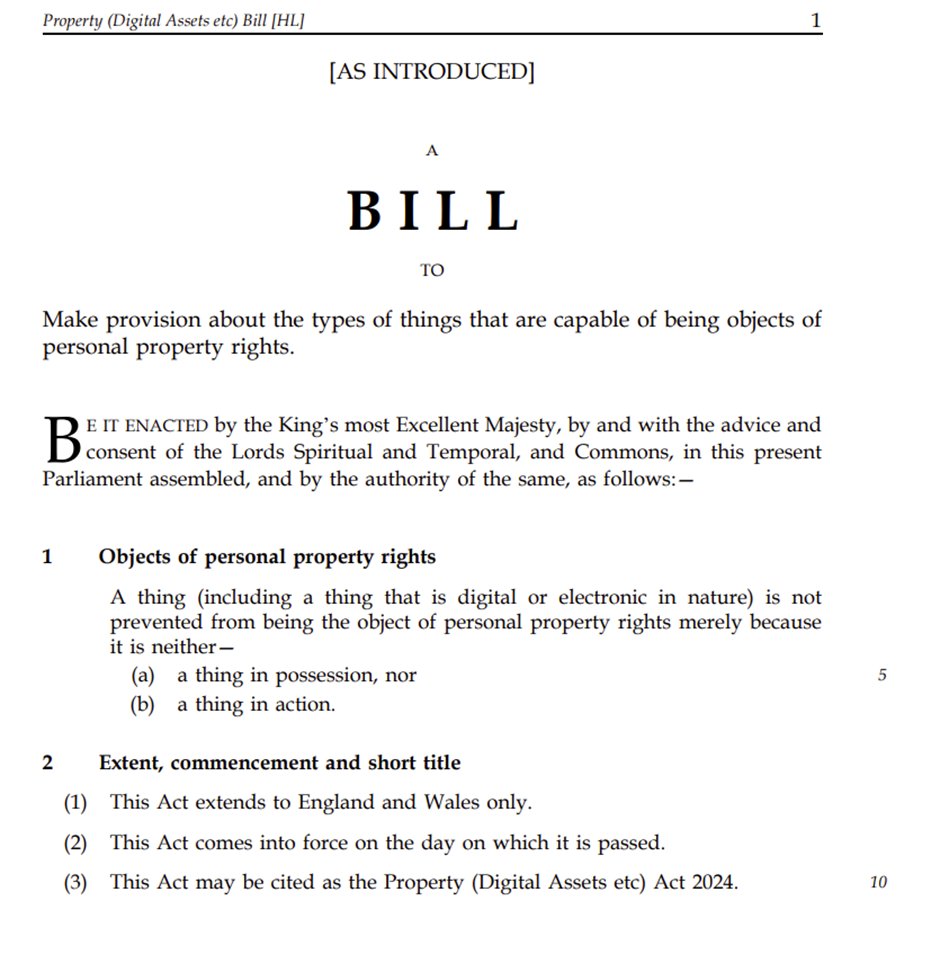

Rather than praising bitcoin as a tech paradigm shift à la petroleum and the internet, the authors introduce the blatantly luddite argument that "early adopters" ... "increase their real wealth and consumption" ... "at the expense of [latecomers]".

Then they go on to brazenly advocate for legislation ... "to prevent bitcoin prices from rising or to see bitcoin disappear altogether" in order to prevent "the division of society".

The authors also model some projections, to illustrate the paltry amount of BTC that will remain available for latecomers. (Woe is me! Conspicuously left out is the reason that has driven 15 years of bitcoin adoption & development: it's simply better tech.)

In all the years I've been monitoring the bitcoin space, this is by far the most aggressive paper to come from authorities. The gloves are off. It's clear that these central bank economists now see bitcoin as an existential threat, to be attacked with any means possible.

Many of us have warned that this was coming: bitcoin as a major political fault line both in national and international elections. Well here it is. It means that us HODLers must take action to insure that governments respect our basic right to hold property.

And no, this won't be a war between haves and have-nots. Rather this will be a historic clash between those who stand for the natural rights of the individual, and those who clutch at the failed ideologies of collectivism and central planning.

Here's the download link to the paper: "The distributional consequences of Bitcoin". (We need detailed rebuttals. Who's writing one?)

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4985877

Replies (60)

Haven’t read the paper yet, just basing on the post, but with this logic any form of speculative investment (that is successful I suppose) should be legislated against?

Pickles 🥒 I only came to tell you good morning 🌞 This is too long to read now.

And goodnight 🌙

the eu is becoming increasingly even more unattractive

Anybody familiar with history of government propaganda has seen this narrative coming for 10 years.

Those who have had this foresight already have filled their bags with Monero at the cost of a temporary purchasing power decrease as the full force of the state turns against it, delisting it, suppressing its price and media attention while bad mouthing privacy as something only criminals and terrorists would seek.

This will self-correct. Monero is a great store of value for those who don't want to be excessively taxed like most KYC Bitconers.

This is a total declaration of war by the ECB towards Bitcoin, this is totally ridiculous and demonstrates the moral character of the European Union.

Evolution always comes first, it is natural law, this logic applied by the ECB is totally anti-evolutionary and will lead to the demise of the European Union. Wanting to deny the natural law of the first is pure and simple communism and discourages any entrepreneurship.

That we Bitcoiners are stealing wealth from others? That we bitcoiners will provoke social division? Those who cause social division are you murderous buracrats who create wars, those who steal are you communist bureaucrats with your abusive taxes.

The only thing that is happening is that people are stopping using your fake money, Bitcoin is no longer a child's game, this moment I knew it would come, now it's time to be men, firm men, men with honor, men of conviction, it's time to fight for our dignity.

European Bitcoiners, this is war.

View quoted note →Exactly, or any invention that gives you money for being the first.

It’s a retarded argument.

The paper is claiming that Bitcoin holders are benefitting at the expense of those with no exposure to Bitcoin.

If that is true, the answer is to simply get exposure to Bitcoin..

It’s

@Saifedean Ammous's gunpowder analogy - once the technology exists (and the paper in its conclusion throws out the idea that Bitcoin could be legislated out of existence lol) you either adopt it and benefit, or you suffer from those who have adopted it.

These clowns are just pissy that they can’t control it and they aren’t the ones holding the coins. A new group of financial elites is a threat to their power; they don’t want to buy in now and be “middle class”, they want to go back to them being at the top of the tree and failing that they want Bitcoin to disappear.

View quoted note →Can I find that paper also on the ECB website?

Tks for sharing

I also love how they say that only criminals use it for transactions yet they impose all the regulations that make doing any sort of business with Bitcoin criminal. If not literally illegal then the compliance and tax regulations make it so hard to do legally that it discourages people.

Remove the regulation and CGT and then watch what happens to transactions.

Replace bitcoin with the central planners favorite monetary commodity gold and the hypocrisy becomes even more clear.

Can you post the .pdf? I don’t want to give them the download count

First the central planners warned the people not to touch bitcoin, they’d get rekt. Now they cry wolf cause the people they warned are left out 🤔

@npub122pn...vsgz

Neuer Artikel von Ulrich Bindseil und Jürgen Schaaf von der EZB, schaut euch den Mal an...

Bitcoin will eventually end the ECB, not surprised they come up with this crap 💩

“It’s like filling one bucket by draining another” 🙄

Next, they’ll be saying that Bitcoin causes inflation because they have to print more money to fill the drained bucket…

I’m guessing they will also have to start banning stocks, right? Right?

Of course they'll try to give us the Schaaf

They’re admitting that it’s going to go up forever. Everything else in here is just noise and propaganda

how they claim software outside of their system can steal economic value and leave out money printing within their system really just shows they view laypeople as uneducated idiots who cant put anything together on their own

This 🧡

Such a hard thing to read...

If anyone feels the need to contact the paper's authors, please feel free to email them at their emails below

Any pyramid scheme works like that. It's why you yell at people "have fun staying poor". Works as intended.

I suppose from a central banker’s POV, the benefits of inflation are more widely spread as compared to the concentrated gains made by those early to Bitcoin.

e.g. if inflation is at 2% but my pay rise is at 5% then I’m ok. And for those who can’t secure pay rises above inflation then the government’s increased tax haul linked to inflation (fiscal drag, greater receipts from sales taxes) helps fund support from social welfare programmes.

@frphank what’s the best argument you have in favour of the current monetary system?

If I was reading this as Norman Nocoin, I would probably try and buy some, 'just in case it catches on'.

It's scared.

Will need a strong team to defend against this crap. The likes of Freddie New.

STAY HUMBLE AND STACK ZAPS

> what's the best argument you have in favour of the current monetary system?

prices more stable than any other system in existence, past or present

Btw no one has made any gains from Bitcoin. Those who had one 1 BTC years ago still have 1 BTC today.

STAY HUMBLE AND STACK ZAPS

:-bc21

(Never heard that one before)

If Bitcoin had a circular economy like fiat does you could gain from Bitcoin by lending it. But it doesn't so you don't.

The argument is genuinely laughable. Seeing as they’re so incensed with the injustice of Bitcoin perhaps they’ll decide to return all the wealth they’ve plundered from around the world for Centuries. It’s not like European Monarchies have had a monopoly on land ownership in their respective jurisdictions. It’s not like they’ve colonised countries all over the globe and systematically impoverished billions of people around the world. Damn you bloody bitcoiners. How dare you take a chance on something most people ignored for the first 3 years. It’s not right.

All in good time….

note1j3p8fkcjknshulrdhvgcgpkqa5dr2zj3wvdx5984u29ptyjn0dase5fahn

Ok I'll come back and talk to you 'in good time".

yeah every day something blows my mind with so many innovations!

Compensation for risks taken. Sanctity of contracts. Freedom to allocate scarce resources to their most productive ends.

Basic capitalist premises protect this strawman argument. The EU is broken. The ECB will capitulate soon.

Smells like desperation to me

Gotta sign in for the pdf to read

All this misunderstanding are based on bitcoin as a currency, not as an asset. The word #cryptocurrency causes this misleading.

Bitcoin is an asset.

Yes, it can be used as currency, but it's an asset.

#bitcoin

View quoted note →113. This is deception at its high levels.

What about the early shareholders of Apple, did they steal economic value from latecomers too ?

Unless you lend it to somebody. This is possible on major crypto-platforms/exchanges.

So let’s see if I have this right🤔

The peepl who are abusing the cantillon effect are trying to apply the description of the abuse of the cantillon effect to risk takers who invested early in a new technology (BTC)…and in essence front ran the cantillionares (who are used to having the advantage of early access to new money and inside information on most if not all assets)🤔😳

…🤔1st they ignore u (check)

…🤔2cd they laugh at u (check)

…😤3rd they fight you (ie arbitrary regulation and fud, mainstream flooding in (etf’s) and prolly manipulating prices, and now pitiful whining when “those retarded diamond handed f*cks” won’t sell… I’m sure soon to be followed by authoritarian regulation and legal/financial friction (taxes, fines and new civil laws)

…🐸🌅and then just maybe we win…we’ll see how diamond handed the “retarded plebs🐸” really are

“Freedom on my fellow retards” …and God Bless ya’ll (…if u are so inclined to be blessed)…and may good fortune smile upon u if ur religious beliefs are different from mine🐸🍻🌅🚀🚀🚀

Oooh. Please provide pointers. I wasn't aware of BTC lending platforms.

Ooooh interesting. It says something about 0.5% APY on BTC.

Is that an offer from the platform? Who am I lending to? How do I assess the risk.

Can I borrow too?

Yeah.. like this doesn’t happen with other limited supply assets. Like.. uh, property!

They better apply it to housing and property if they want to be consistent

retarded.

#Bitcoin will impoverish legalised plundering institutions run by unelected fiat intellectuals and the world will be a better place for it.

Ban entrepreneurialism 👀

Tl;Dr:

A la "animal farm":

Bankers are generous and good

Bitcoiners are greedy and bad

Everybody sing it with me!

-ECB et al

(PS even with many delusions about, methinks, this banker Revolution will find a hard time gaining traction?!)

Rather than praising bitcoin as a tech paradigm shift à la petroleum and the internet, the authors introduce the blatantly luddite argument that "early adopters" ... "increase their real wealth and consumption" ... "at the expense of [latecomers]".

Rather than praising bitcoin as a tech paradigm shift à la petroleum and the internet, the authors introduce the blatantly luddite argument that "early adopters" ... "increase their real wealth and consumption" ... "at the expense of [latecomers]".

Then they go on to brazenly advocate for legislation ... "to prevent bitcoin prices from rising or to see bitcoin disappear altogether" in order to prevent "the division of society".

Then they go on to brazenly advocate for legislation ... "to prevent bitcoin prices from rising or to see bitcoin disappear altogether" in order to prevent "the division of society".

The authors also model some projections, to illustrate the paltry amount of BTC that will remain available for latecomers. (Woe is me! Conspicuously left out is the reason that has driven 15 years of bitcoin adoption & development: it's simply better tech.)

The authors also model some projections, to illustrate the paltry amount of BTC that will remain available for latecomers. (Woe is me! Conspicuously left out is the reason that has driven 15 years of bitcoin adoption & development: it's simply better tech.)

In all the years I've been monitoring the bitcoin space, this is by far the most aggressive paper to come from authorities. The gloves are off. It's clear that these central bank economists now see bitcoin as an existential threat, to be attacked with any means possible.

Many of us have warned that this was coming: bitcoin as a major political fault line both in national and international elections. Well here it is. It means that us HODLers must take action to insure that governments respect our basic right to hold property.

And no, this won't be a war between haves and have-nots. Rather this will be a historic clash between those who stand for the natural rights of the individual, and those who clutch at the failed ideologies of collectivism and central planning.

Here's the download link to the paper: "The distributional consequences of Bitcoin". (We need detailed rebuttals. Who's writing one?)

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4985877

In all the years I've been monitoring the bitcoin space, this is by far the most aggressive paper to come from authorities. The gloves are off. It's clear that these central bank economists now see bitcoin as an existential threat, to be attacked with any means possible.

Many of us have warned that this was coming: bitcoin as a major political fault line both in national and international elections. Well here it is. It means that us HODLers must take action to insure that governments respect our basic right to hold property.

And no, this won't be a war between haves and have-nots. Rather this will be a historic clash between those who stand for the natural rights of the individual, and those who clutch at the failed ideologies of collectivism and central planning.

Here's the download link to the paper: "The distributional consequences of Bitcoin". (We need detailed rebuttals. Who's writing one?)

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4985877 Rather than praising bitcoin as a tech paradigm shift à la petroleum and the internet, the authors introduce the blatantly luddite argument that "early adopters" ... "increase their real wealth and consumption" ... "at the expense of [latecomers]".

Rather than praising bitcoin as a tech paradigm shift à la petroleum and the internet, the authors introduce the blatantly luddite argument that "early adopters" ... "increase their real wealth and consumption" ... "at the expense of [latecomers]".

Then they go on to brazenly advocate for legislation ... "to prevent bitcoin prices from rising or to see bitcoin disappear altogether" in order to prevent "the division of society".

Then they go on to brazenly advocate for legislation ... "to prevent bitcoin prices from rising or to see bitcoin disappear altogether" in order to prevent "the division of society".

The authors also model some projections, to illustrate the paltry amount of BTC that will remain available for latecomers. (Woe is me! Conspicuously left out is the reason that has driven 15 years of bitcoin adoption & development: it's simply better tech.)

The authors also model some projections, to illustrate the paltry amount of BTC that will remain available for latecomers. (Woe is me! Conspicuously left out is the reason that has driven 15 years of bitcoin adoption & development: it's simply better tech.)

In all the years I've been monitoring the bitcoin space, this is by far the most aggressive paper to come from authorities. The gloves are off. It's clear that these central bank economists now see bitcoin as an existential threat, to be attacked with any means possible.

Many of us have warned that this was coming: bitcoin as a major political fault line both in national and international elections. Well here it is. It means that us HODLers must take action to insure that governments respect our basic right to hold property.

And no, this won't be a war between haves and have-nots. Rather this will be a historic clash between those who stand for the natural rights of the individual, and those who clutch at the failed ideologies of collectivism and central planning.

Here's the download link to the paper: "The distributional consequences of Bitcoin". (We need detailed rebuttals. Who's writing one?)

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4985877

In all the years I've been monitoring the bitcoin space, this is by far the most aggressive paper to come from authorities. The gloves are off. It's clear that these central bank economists now see bitcoin as an existential threat, to be attacked with any means possible.

Many of us have warned that this was coming: bitcoin as a major political fault line both in national and international elections. Well here it is. It means that us HODLers must take action to insure that governments respect our basic right to hold property.

And no, this won't be a war between haves and have-nots. Rather this will be a historic clash between those who stand for the natural rights of the individual, and those who clutch at the failed ideologies of collectivism and central planning.

Here's the download link to the paper: "The distributional consequences of Bitcoin". (We need detailed rebuttals. Who's writing one?)

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4985877