No, you did not miss the bitcoin train.

We are just getting started.

Just because bitcoin went up a lot does not mean it cannot go up a lot more. On the contrary, the more it goes up, the more it demonstrates product-market fit, the more likely it is to go up.

Bitcoin is different from stocks, bonds, and commodities because it has a much, much larger addressable market. Let's compare:

Apple's total addressable market is 8 billion people who can own an iphone and laptop. A lot of them already do, and a lot of them are too poor, so there's just not much more room for growth. Maybe Apple can increase by 5x, or 10x, but it would need to introduce new products that are wildly popular to do so, which is very difficult. Ultimately, an Apple stock is a claim on cashflow, and it is priced based on expectations of Apple cashflow, and it is not easy to continue to increase cashflow once you're a trillion dollar company.

But bitcoin is money, and its total addressable market is all of the planet's cash balances, which currently include something in the range of $100 Trillion in physical government cash and checking and saving bank accounts, plus ~$120 Trillion in government bonds, ~$22 Trillion in gold, and arguably, a chunk of the world's real estate and stock markets, which people are holding to beat inflation, and not to take risk in search of return. All in all, bitcoin's Total Addressable Market is in the range of $200-300 Trillion, which is about 100 times larger than what it is now. All of these assets are trash compared to bitcoin, and there is no reason for anyone intelligent to hold a significant position in them. Everything held in these assets has lost ~90% of its value against bitcoin in the last 5 years, and will likely keep losing another 90% every few years. The only things maintaining significant demand for these assets at this point are their holders' old age, intelligence deficiency, and susceptibility to government propaganda. They can continue to hold these assets as they decline, making them poorer, or they can shift to bitcoin and start getting richer. Either way, and regardless of what they do, the world's wealth is going to end up in the hard money, and not in the obsolete moneys of the twentieth century.

Bitcoin has no cashflow to price it. Most nocoiners think this makes it a ponzi, but that is only because they have never experienced real money, and only have as a frame of reference the hot potato trash fiat money which everyone smart tries to exchange for hard assets as soon as they can. They are incapable of understanding people demanding to hold money for its own sake, for its ability to hold value, and not for cashflow. This is how gold became the money of the world without generating any cash flow, and this is why bitcoin, which is infinitely better money than gold, is going to continue to monetize and grow.

Nonetheless, bitcoin's demand is highly variable, and with leverage, it will likely continue to be significantly volatile for the foreseeable future, so always keep in mind that it could decline significantly, and manage your position accordingly.

Saifedean Ammous

saifedean@primal.net

npub1gdu7...6nak

Author of The Bitcoin Standard, The Fiat Standard, and Principles of Economics. Teaching economics on saifedean.com.

Dr. Hisham Ammous: Life as Clinical Surgery

Sept 1, 1944 - June 6, 2025

Hisham Saifedean Rashid Ammous was born in the village of Atteel in Palestine on September 1, 1944. After finishing high school in nearby Fadiliya school in Tulkarem, he moved to Saudi Arabia to work as a school teacher, then to Kuwait to work in the electric company. Unsatisfied with his career, he decided to become a doctor, and applied for a scholarship from the Jordanian government to the University of Madrid in Spain, through the Spanish embassy in Jordan. He moved to Madrid without speaking a word of Spanish, but graduated as a surgeon with distinction in 1976. After that scholarship, he practically never needed, asked for, or took anything from anyone until his last day.

In his five decades as a surgeon, Dr. Ammous must have performed over 20,000 surgeries across Spain, Saudi Arabia, Kuwait, Jordan, Palestine, Brazil, Lebanon, and Libya. He relished his work as a plastic and reconstructive surgeon. To his profession and mission, he was the most devoutly dedicated man. He lived for surgery. Come rain, shine, snow, checkpoints, military invasions, cranky kids, genocide, or regional war, he found a way to make it to Al Makassed Hospital in Jerusalem almost every day, braving countless Israeli occupation checkpoints and dealing with the young criminals manning them and getting all of their life's meaning from the impunity they have to make the lives of innocent Palestinians hell. He became a regular traveler to wars and refugee camps to perform surgeries. He worked nonstop all day for days on end in warzones. He went to Gaza for surgeries after every Israeli mass slaughter over the years, and was desperate for the current genocide to end so he could return. His favorite 'vacation' was to visit me in Lebanon and perform dozens of free surgeries for destitute refugees.

His discipline was supernatural. He was never late for anything in his life, and was never disorganized. No matter what life threw at him, he relentlessly pursued his mission and was always prepared. His doggedness, determination, focus, and obsession will sound insane to most people, which is why most people will never perform 20,000 surgeries or do anything remotely as important with their lives. In his wake, hundreds of messages have poured in from people remembering how he helped them with his kind generosity, healed them with his skilled hands, and made them laugh with his legendary searing wit. Among the most amazing stories I heard was that he gave his patients’ families the keys to his hospital office so they could sleep in it and not have to drive through hours of checkpoints every day.

His supreme motivation in life, and the thing that gave life meaning for him, was to give his children a life better than the one he had, and he dedicated himself to it until the very end. He never ceased repeating this lesson to me, and he exemplified it every day. All his time, attention, and interests revolved around improving the lives of his children. He understood the whole of our human civilization rests on the foundation of people investing in giving their children a better life, and this was also the most profound lesson I learned from years of studying economics, and the central theme and most important lesson of my third and best book, Principles of Economics. For teaching me this lesson before I could read, that book was dedicated to him.

He is survived by his two sons, Ahmad and me, his daughter Dana, and three loving grandchildren who lit up his last ten years. Nothing can compare with the joy his grandchildren brought him. No money or accomplishment by him or me could have made him happier than my 2 year old making ever more outrageous demands for gifts as she tries to discover if there is anything he won't get her. His joy around her convinced me that the best thing you can do for your parents is to give them grandchildren. It seems offensive that life could be this simple and banal, that mere reproduction is the secret to its satisfaction, but he showed me it was true, and far from banal. We humans are wired to spend our lives seeking reproduction, and having it shape our happiness and satisfaction, because we wouldn't exist otherwise.

In my 44 years of life, I never recall seeing him bedridden with illness, and after five decades of caring for patients and children, he must have dreaded the thought of being on the receiving end of the care of others.

Dr. Ammous passed on the first day of Eid Al Adha, while taking a nap, after having called his friends and family to exchange Eid greetings. He died suddenly and immediately, and almost certainly felt nothing, and never had to suffer any serious illness or confront his impending mortality.

He lived blissfully immersed in his life's mission until its very last second. And he succeeded in it completely and perfectly. He gave his children everything they needed until they needed nothing more from him. The only consolation in his passing is that until his last minute he was strong, cheerful, healthy, sharply-dressed, and eagerly looking forward to seeing his grandchildren in a few days and giving them the many gifts he bought for them, and looking forward to vacationing this summer with his family in his beloved Madrid.

In his passing, he deprived his loving children of the chance to provide him a tiny fraction of the love and care he provided them for decades. This was a man determined to contribute more to this world than take from it, and to give his children everything. And he accomplished his life's mission clinically, like his surgeries.

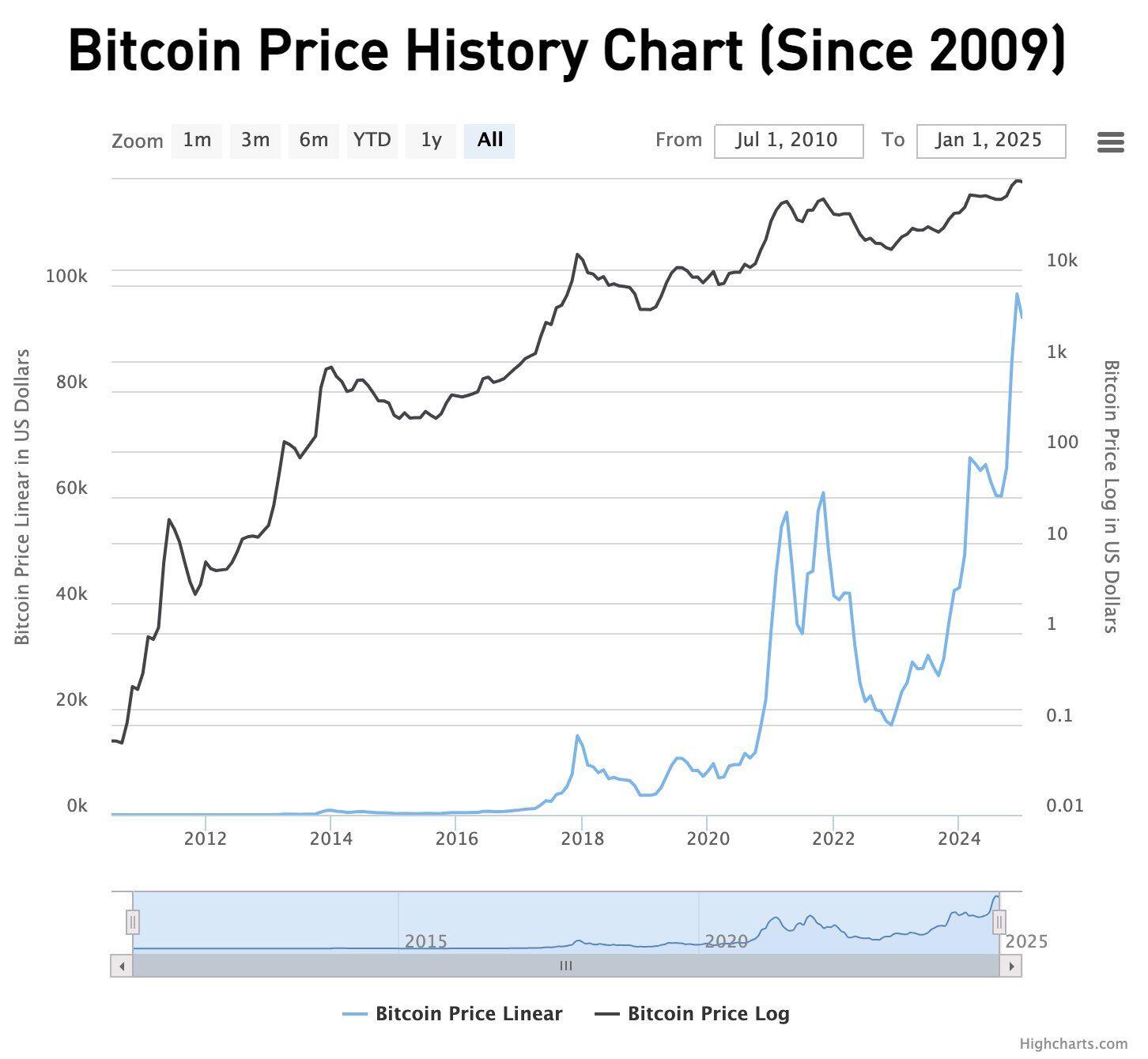

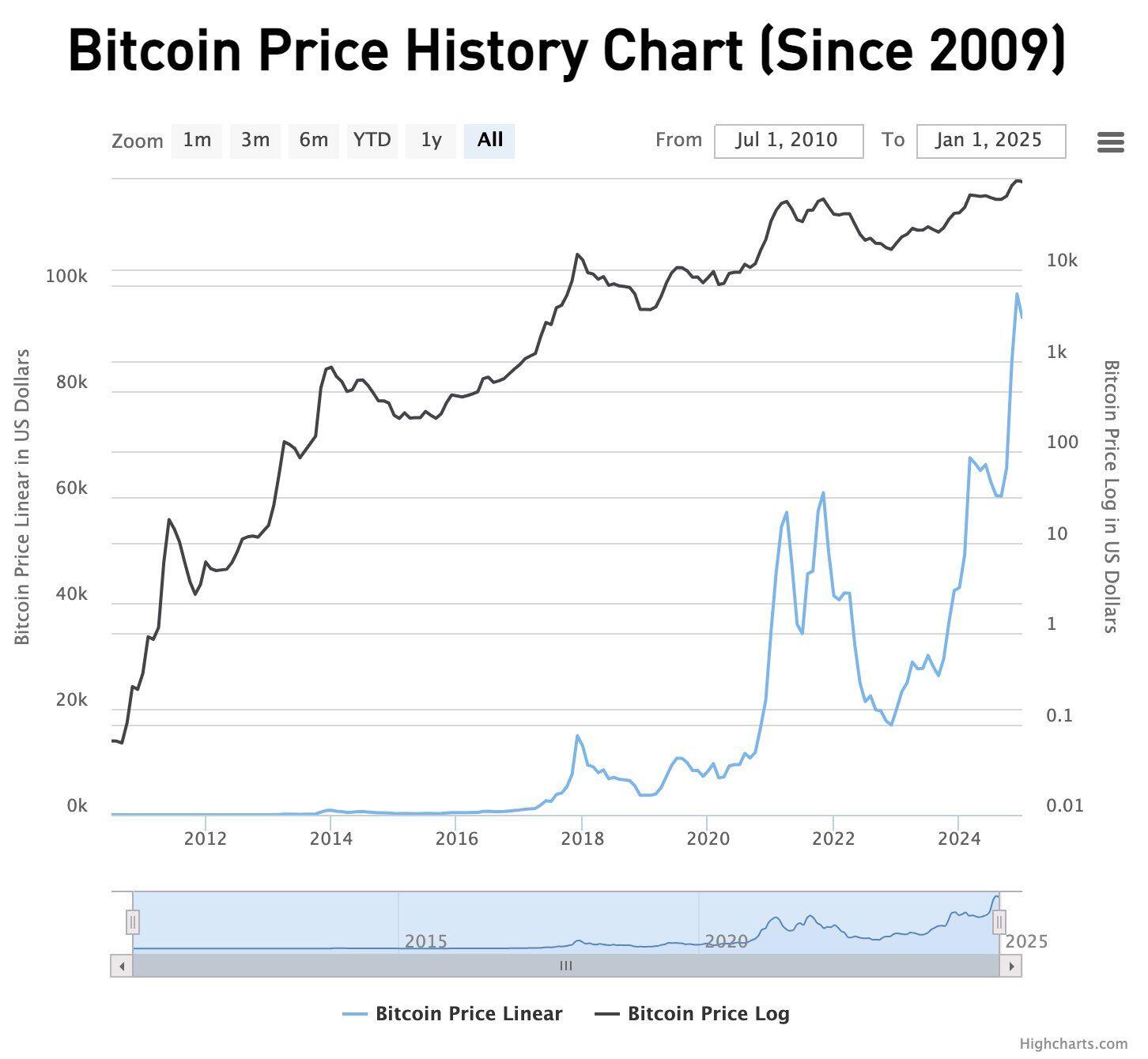

Bitcoin has now been working and trading for 15 full calendar years. It's time to see how it's doing and run some numbers.

On Jan 1, 2010, there were 1,624,000 bitcoin in circulation trading at around $0.001 each. The total market capitalization of bitcoin was ~$1,624.

On Dec 31, 2024, there were 19.803 million bitcoin trading at around $93,389 each, for a total market capitalization of $1.85 trillion.

In total over the 15 years, the size of bitcoin cash balances has increased by 110,400,000,000,000%, or around 110 billion percent.

If, during the next 15 years, bitcoin grows at only 1 ten millionth of its growth rate over the last 15 years, it grows to a total market cap of around $210 trillion, making it larger than all the world's fiat currencies and government bonds combined.

In such a world, a government may be able to keep its shitcoin alive if it doesn't inflate its supply too much (a big if, and an even bigger may). Whether they do or do not is largely inconsequential, because either way, inflation won't be able to touch the majority of the world's wealth.

Any bitcoin bearish thesis needs to present a coherent explanation for why bitcoin's next 15 years are going to have a growth rate that is significantly lower than a ten millionth of the rate of the past 15 years. Don't expect to hear one from people who get paid from the inflation bitcoin will kill.

Happy 2025!

Fiat is over if you want it!

Delighted to announce the launch of my publishing house and online bookstore TheSaifHouse.com, publishing the best Bitcoin and economics books in high quality cloth hardcover and audiobook and ebook and offering 10% off for payment in bitcoin!

To launch, we're selling a fine cloth cover version of @Lyn Alden's new book, Broken Money, as well as Fiat Food, Matthew Lysiak's forensic investigation into how inflation ruined the modern human diet and health.

You can get these two books, as well as my Principles of Economics, The Fiat Standard, and The Bitcoin Standard, all in hardcover for $99 only ($89.1 if paid in bitcoin!)