Replies (36)

Hell yeah

Congrats! If you own your house you can get a HELOC in the first lien position (sometimes called an all in one loan) which will give you access to your home equity at very cheap simple interest rates! If you still have a mortgage you can even refinance it into one, but only if the math makes sense. You can totally live off of that HELOC for a very long time so long as you have enough cash flow to afford the minimum interest payments. I much prefer this setup to bitcoin backed loans or securities backed loans because the terms are so much better and safer -- no margin calls and the bank won't reappraise your house until you refinance! The most dangerous bitcoiners are the ones who understand how to take advantage of fiat with efficient leverage, cash flow, and arbitrage.

Good for you man

Hats the jack mallers method, just pay the credit card bill off with BTC when needed?

🫡

Welcome.

This is the way.

Adopted the live on credit, save in bitcoin strategy nearly 3 years ago now. Strike makes it so easy.

Same here!

2025 is our year

LFG!

Is there an explanation of this process I can read and possibly share?

I realize it may be as simple as “buy bitcoin, spend on credit (cards)”. Simply looking for the logistics of “then what” the credit has to be paid, so if all fiat is in BTC, how does one pay the credit…I assume by selling the BTC…

Any process direction would be appreciated

Yesssss

At its simplest, it's just immediately converting new dollars to Bitcoin, spending on credit and paying your fiat bill by selling Bitcoin (either manually or automatically in the case of Strike's Bill Pay feature).

I've actually covered this in depth here:

https://bitcoinbarks.com/Barks/get-on-zero-2024-strike-update/#wbb1To add to this, use BTCmap.org and Oshi to buy food and other services with Bitcoin.

Saving in Bitcoin the first step. Using it as your main medium of exchange is the next!

How much in fees is mallers making on you to convert your check into coin and then back to usd to pay your housing payment the same day?

I hope Strike supports my country soon, It's very difficult to buy #bitcoin here in Saudi Arabia 🇸🇦.

I usually do a big turn to buy and lose a lot of the payment amount as a fees lol, but I keep accumulating.

Epic. I can't wait to start working and do the same.

I also have a more recent article that serves as a deep-dive on Strike Bill Pay:

https://bitcoinbarks.com/Barks/strike-bill-pay-deep-dive/#wbb1

Yes pups article is a good start. The point is to pay the credit off in full each month so you dont accrue the interest at all. So youre using a interest free revolving 30 day credit line to be your dollar float instead of balancing your paycheck and buying the rest of your value into btc.

With this your entire weekly/biweekly/monthly pay is fully exposed to bitcoin at all times. Plus any time your selling youre only getting dinged on any captial gains. So if you bought $100 in bitcoin and it went to $110 by the time you sold youre only taxed on the $10. Then youre only selling 1 a month to cover your rent/mortgage/credit line and rinse and repeat. Id definitely suggest having a good chunk of btc in cold storage maybe 3 months worth set aside to be able to pull from to be able to weather some drawdowns of sorts that happen.

But mostly im just tired of feeding the machine and want to prove to myself that living like this is possible.

@npub1cn4t...3vle motivated me listening to money matters. Be the change you want to see in the world. If not me then who?

Glad to join you bud

All great points.

Personally, Ive been rolling credit card balances into new 0% interest balance transfer offers for the past 2 years and will be closing out these fiat leverage positions this year.

That said, while this strategy has worked brilliantly for me, I'd hardly recommend that anyone start using it in a bull market. Just spend less than you make, leverage the interest-free 30 day credit line, and save in bitcoin.

Staying humble and stacking sats is always the best bet.

Yeah thisbis definitely a thing for been in a bitcoin for a few years and stomached those 50%+ drops and have some savings to be able to depoly.

100%

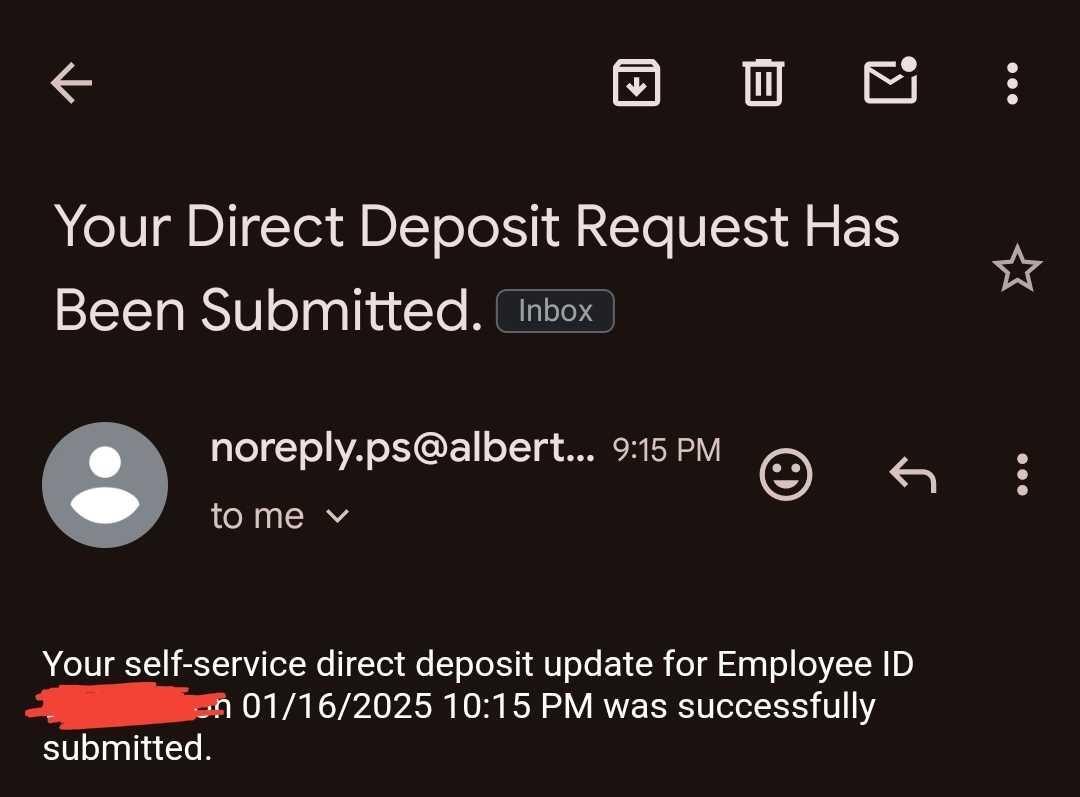

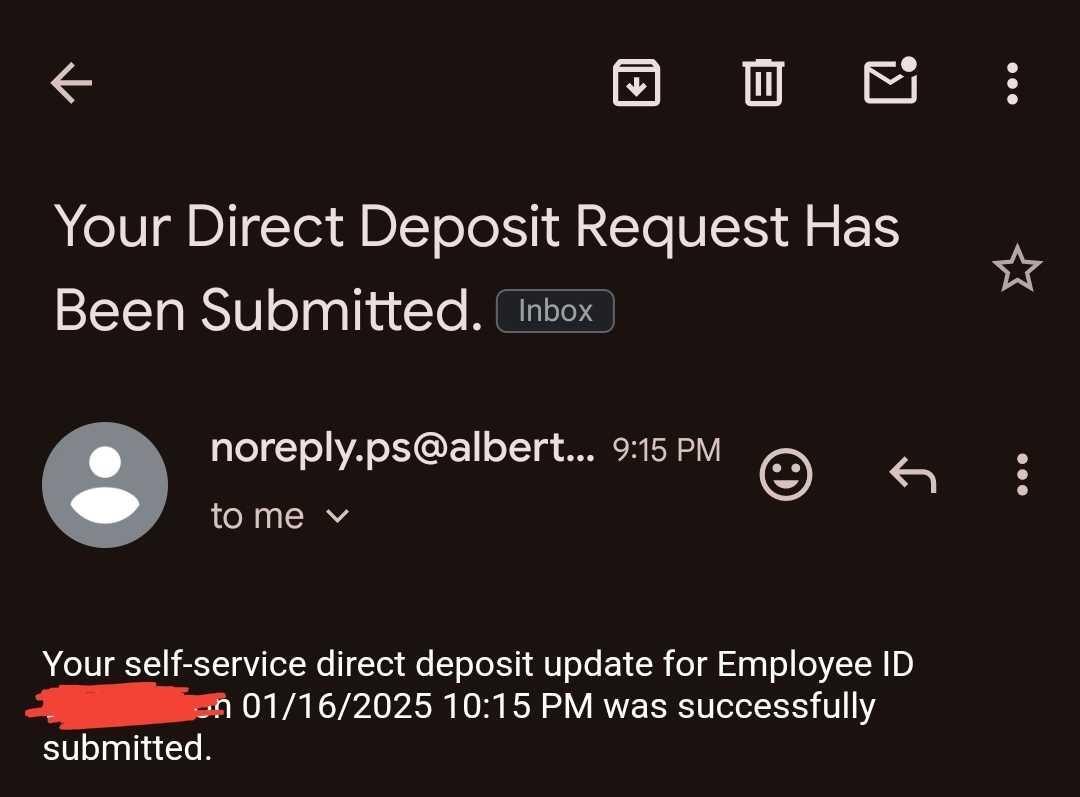

did the same the other day. this week is the first time i'll receive my direct deposit as btc. fucking HYPE!

This helps a ton.

Thanks

Thanks for this article as well…

So for my use case I’d need to be on the “bear” all year or just stack BTC manually at end of month, week, etc…

Reason being is a privacy restriction since Strike is public (reports to agencies, etc) so due to that, it conflicts with a setup/structure im responsible for.

So I’d have to use the fiat directly and buy BTC directly….unless Strike and the bank you mentioned (they use) supports private bank accounts (UBOs / PMAs)

I get that.

I'm not really pushing for everyone to adopt the same strategy I have. We all have our own lives and unique situations and requirements.

I just wanted to detail the way I use this feature.

As far as private bank support, I'd reach out to strike on that. Unfortunately that's not something I have experience with.

Totally. I appreciate you publishing thie article as it gave some concreteness to one process, idea, approach.

The key takeaway: one has to live/operate under their means

lol

Have been doing this for months. It's great! Feels like getting a raise every month. But do make sure you have a sizable stack you can tap into should you need it. 💪

yes give the lying jackass your sats. very smart.

Knowledge bomb! My man 🤝

how does this work?

smash buy and then use a Strike debit card over the week / fortnight to pay your bills as usual?

Smash buy all into btc. Live on credit. End of month all equivalent btc into dollars to cover credit bill and rent and anything else i need dollars for. Rinse repeat.

nice, other than the tax accounting overhead, i imagine this will be a winning strategy in a bull market.