Saw some questions about pricing, partners, and future plans for our new #Bitcoin-backed lending product at Strike.

Recorded a quick video to break it all down, including how we plan to drive rates lower, enable proof-of-reserves, and more. Only the beginning for this industry

Login to reply

Replies (64)

i love it when ceos actually listen. two solid points from jack on btc backed loans: a) he admits the interest is too damn high, b) he gets that proof of reserves is a must. those were my main concerns too. but he skipped the ltv part. 40% ltv is still wild like seriously wild. i get it bitcoin’s new and lenders want their comfort blanket but come on. forty percent!

View quoted note →

@jack mallers can we get some merch going Jack? I’d love to rep a Strike shirt/ hoodie around town. You guys should check out “proof of ink”. Support a small biz

This will help a lot of people!

lending fiat = fiat maximalism

seems that some people (I cannot call them bitcoiners) forget why we are in bitcoin

Don't know if I trust any company more with my bitcoin, than @npub1ex7m...vyt9

View quoted note →

Oh my.... 🦈

Saw some questions about pricing, partners, and future plans for our new #Bitcoin-backed lending product at Strike.

Recorded a quick video to break it all down, including how we plan to drive rates lower, enable proof-of-reserves, and more. Only the beginning for this industry

View quoted note →

I made a retirement calculator where you perpetually borrow from your bitcoin and never sell. Instructions in thread.

CALCULATOR OBJECTIVE

Evaluate the viability of funding your entire retirement living expenses through a loan, using your Bitcoin holdings as collateral. The loan balance increases annually as you borrow to cover both your living expenses and the interest required to service the loan. This strategy is considered successful if the value of your Bitcoin grows at a faster rate than your loan balance, ensuring that the loan-to-value (LTV) ratio remains manageable—typically below 50%.

CALCULATOR INPUTS

Adjust the following inputs using the sliders on the left-hand side:

(R): The year you retire—assumed to be January 1st of this selected year.

(M): Your desired income in the first year of retirement (R). This amount increases annually by F.

(F): The inflation rate or the percentage by which you want your income to grow each year.

(L): The annual interest rate on the loan—the cost of servicing your debt.

(B): The amount of Bitcoin you are using as collateral for the loan.

(P): Adjusts the Bitcoin price projection. Refer to this chart* for guidance:

- Enter 0.42 to follow the red support line—a conservative price projection.

- Enter 1 to follow the green trend line—an aggressive price projection.

*https://charts.bitbo.io/long-term-power-law/

CALCULATOR GRAPH

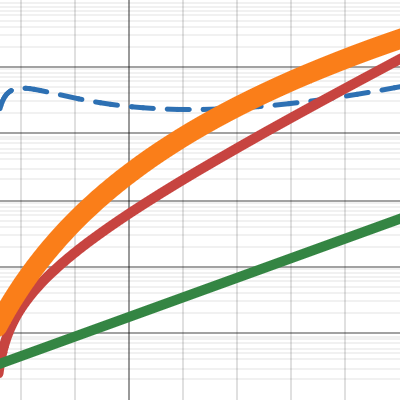

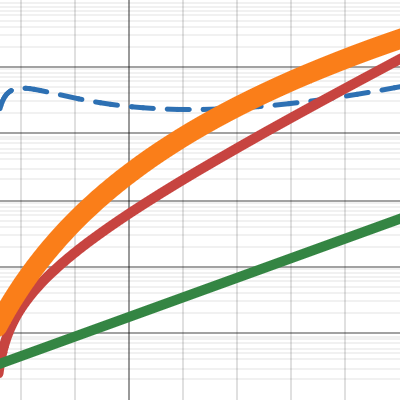

This graph displays the results of your calculations, with the x-axis representing years and the y-axis representing USD. Each colored line represents a key financial metric over time:

Green Line – Your income growth throughout the years.

Red Line – Your loan balance as it increases annually.

Orange Line – The value of your Bitcoin collateral over time.

Blue Line – The loan-to-value (LTV) ratio, scaled for visibility. (Note: The LTV is artificially multiplied by 10⁹ for display purposes; divide by 10⁹ to obtain its actual value.)

EXAMPLE

Consider a conservative and frugal individual holding 3 bitcoins, planning to retire in 2026 with an annual living expense of $35,000. Assuming an inflation rate of 7% and a loan interest rate of 10%, the input parameters are as follows:

R = 2026 (Retirement Year)

M = 35,000 (Initial Annual Income)

F = 0.07 (Inflation Rate)

L = 0.10 (Loan Interest Rate)

B = 3 (Bitcoin Collateral)

P = 0.42 (Conservative Bitcoin Price Projection)

Now, does this strategy hold up? Based on the calculator’s results:

- The loan-to-value (LTV) ratio peaks at 47% in 2030, then decreases over time, indicating the loan remains viable.

- 30 years into retirement, the loan balance reaches approximately $13 million, while the value of the Bitcoin collateral grows to around $56 million.

According to the numbers, this approach appears feasible—provided the individual is comfortable managing a high level of debt throughout retirement.

ADVANCED

All the formulas are visible and easy to modify if you wish to.

CALCULATOR OBJECTIVE

Evaluate the viability of funding your entire retirement living expenses through a loan, using your Bitcoin holdings as collateral. The loan balance increases annually as you borrow to cover both your living expenses and the interest required to service the loan. This strategy is considered successful if the value of your Bitcoin grows at a faster rate than your loan balance, ensuring that the loan-to-value (LTV) ratio remains manageable—typically below 50%.

CALCULATOR INPUTS

Adjust the following inputs using the sliders on the left-hand side:

(R): The year you retire—assumed to be January 1st of this selected year.

(M): Your desired income in the first year of retirement (R). This amount increases annually by F.

(F): The inflation rate or the percentage by which you want your income to grow each year.

(L): The annual interest rate on the loan—the cost of servicing your debt.

(B): The amount of Bitcoin you are using as collateral for the loan.

(P): Adjusts the Bitcoin price projection. Refer to this chart* for guidance:

- Enter 0.42 to follow the red support line—a conservative price projection.

- Enter 1 to follow the green trend line—an aggressive price projection.

*https://charts.bitbo.io/long-term-power-law/

CALCULATOR GRAPH

This graph displays the results of your calculations, with the x-axis representing years and the y-axis representing USD. Each colored line represents a key financial metric over time:

Green Line – Your income growth throughout the years.

Red Line – Your loan balance as it increases annually.

Orange Line – The value of your Bitcoin collateral over time.

Blue Line – The loan-to-value (LTV) ratio, scaled for visibility. (Note: The LTV is artificially multiplied by 10⁹ for display purposes; divide by 10⁹ to obtain its actual value.)

EXAMPLE

Consider a conservative and frugal individual holding 3 bitcoins, planning to retire in 2026 with an annual living expense of $35,000. Assuming an inflation rate of 7% and a loan interest rate of 10%, the input parameters are as follows:

R = 2026 (Retirement Year)

M = 35,000 (Initial Annual Income)

F = 0.07 (Inflation Rate)

L = 0.10 (Loan Interest Rate)

B = 3 (Bitcoin Collateral)

P = 0.42 (Conservative Bitcoin Price Projection)

Now, does this strategy hold up? Based on the calculator’s results:

- The loan-to-value (LTV) ratio peaks at 47% in 2030, then decreases over time, indicating the loan remains viable.

- 30 years into retirement, the loan balance reaches approximately $13 million, while the value of the Bitcoin collateral grows to around $56 million.

According to the numbers, this approach appears feasible—provided the individual is comfortable managing a high level of debt throughout retirement.

ADVANCED

All the formulas are visible and easy to modify if you wish to.

Desmos

Untitled Graph

Explore math with our beautiful, free online graphing calculator. Graph functions, plot points, visualize algebraic equations, add sliders, animate...

this is cool. looking forward to proof of reserves

But borrowing is not. If you're borrowing, the other party to the trade is the fiat maximalist. You're still long bitcoin. I don't think participating in that trade is anti-Bitcoin, respectfully.

One my favorite things about you is that you haven't let the money get to your head. No styling haircut, no fancy cloths, no displays of ego.

You just seem like a down to earth dude.

either way you are using fiat FFS

Anything that use fiat is anti-bitcoin.

Sup

Young Gun

Bitcoin and the Jewish banking lending system should never merge

Touché

You have nice eyes @jack mallers

People should sell Peer-to-Peer instead of using collateralized Bitcoin bank loans.

Bisq, RetoSwap, etc...

You put your bitcoins as collateral, one day wall street decide to crush the bitcoin price, a margin call happens, and... all your bitcoins are gone.

And they are gone to the same hands as always: the bankters.

They already did this with gold, and that's why they own 90% of the gold in the world.

Masterplan.

Meanwhile we never got this...

Saw some questions about pricing, partners, and future plans for our new #Bitcoin-backed lending product at Strike.

Recorded a quick video to break it all down, including how we plan to drive rates lower, enable proof-of-reserves, and more. Only the beginning for this industry

View quoted note →

I have to replace my roof soon. They don't take bitcoin. This is a $25k+ (25,787,818 Sat+) job. Do I:

A. Sell my savings to pay it to satisfy the roofer (15% capital gains)

B. Take a loan (interest, but 0% capital gains)?

C. Take a fiat loan (interest)?

D. Wait until a good roofer takes bitcoin as payment (hopefully my roof doesn't leak and cave in)?

None. Sell that shithole and live on rent, paying in sats.

If in 2025 you still can't live only using bitcoin as money, then I don't know why are you still in bitcoin.

Just live only with fiat. Bitcoin is not for you.

Thanks Jack! This was super valuable context

Where is that with "I will die on this hill" ?

Which hill was in fact?

The fiat hill?

Fiat hill? I live in a nice home, in a good neighborhood, and good schools with my family. I'm a Bitcoiner but can't and won't die on a hill at the detriment of my child.

Stop dreaming and wake up. They will rob all your Bitcoins through margin calls, that will "coincidentally" happen when banksters interpret there is enough Bitcoin to rob in that particular round.

Well, these are relevant questions. If they don't accept Bitcoin, then take a loan. Pay it slowly using P2P

What a expensive roof, BTW!!

The fact that you don't take reality into account shows me that you only have yourself to consider when making decisions in your life. I (and many others) don't have that option.

Capital gains is a huge hurdle we need to overcome. I would be much more willing to you it online atleast while other companies start to accept it as payment

Pretty much this.

It never hurts to ask if they'll accept Bitcoin. If they won't, next ask if they'll accept cash.

Saving the world, one tax-resisting tradie at a time :p

It’s called Judaism

Exactly!! Also, he could orange pill the roofer and bring him to the community.

Keep grinding! 🔥

Is the loan tied up into multi-sig? Do I hold a key?

🧡

Usury

Yes, likely system driven multisig.

No, likely no key for you.

They give you cash, you give them trust. A challenging trade in a trustless environment.

Unchained’s product allows me to have a key. Granted, only 1 of 3 but better than none

Who has the other two? My ideal situation is one to me, one to the lender, and one to a legal 3rd party arbiter that is obliged to sign alongside the prevailing party upon breach by a party.

— I fulfill the loan payoff?: I get the bitcoin with lender sig.

— I repay with collateral?: lender gets enough coin to fulfill balance by my sig.

— Breach of agreement by me?: lender gets the bitcoin by 3rd sig.

— Bankruptcy by lender?: I get my coin immediately by 3rd sig.

Lender has no means to move coin unilaterally. This seriously reduces attack vectors and makes me feel okay with loan collateralizing with Bitcoin. It’s scary otherwise.

Pretty much everything you said is how Unchained’s product is set up. I get a key, unchained has a key, and third party lender (I think?) has the key. But I want to think all of those scenarios are already sent up.

Nice to know there’s a product with custody-purist product features out there.

I’ve used it a couple of times. Own a laundry business.

Bitcoin loans - Unchained

Use your bitcoin to get a loan from Unchained, the bitcoin native financial services company with multisignature security & great customer service.

Rlly just need you to relist the Silk Road hoodie temporarily on the strike store because I got paint all over mine and I need one for fancy outings as well 😂

Proof of Confidence

an orange stain at your eyes @jack mallers

What happens to pleb funds using Strike bill pay product, or keeping SATs on strike, when/if your partners blow up due to rehypothecation (see pic)? I'm moving to River until Strike has proof of reserves and a strong firewall. I saw enough of this nonsense last cycle with FTX/Blockfi/Celsius/etc.

Great explanation. It’s clear mate, it’s an incredibly service for some and as you get the interest rates down it will become more and more popular. Very kool !

This is a good point. Keeping colateral % ‘s would help at this stage . As BTC heads to a million this problem will disappear

Love it. 🧡

When are we getting the ability to set reoccurring transactions denominated in Sats / BTC?

Sats Cost Averaging wen?

read my tweet. thats not what i said

bitcoin on our platform has nothing to do with the lending product.

we are working on proof of reserves lending, we will get here.

by the way, this is my response to that screenshot in case it's helpful. happy to answer any other questions

We need strike and strike loans in NY 😉

If you really want to help the plebs, why 75k loans? Most emergencies are around 5k to 10k. I think you’re trying to capture the most bitcoin, but that’s my opinion. STAY HUMBLE @jack mallers

I don't understand how capital allocators fail to understand the following:

1. They lend out $100, for every $200 worth of collateral the borrower pledges.

2. The collateral, although volatile, trades 24/7/365 and has global liquidity.

The lender is basically getting as close to a risk-free yield as they can hope for, because the borrower is not debasing the currency to pay them back, like the government does.

For those two facts alone, interest rates on overcollateralised Bitcoin-backed loans should be below the current US 1-year treasury which is ~4%.

The capital allocators don't need to understand every aspect of Bitcoin, to lend against it.

They just need to understand points 1 & 2, which tells them that the borrower pledges twice the amount of collateral that they borrow and that their collateral can be liquidated at any time, if the LTV goes beyond a certain level.

Just my 2 sats...

because there are consumer protection laws. i need licenses to do that. i’m working on it

Keep the good work 👍🏽 👍🏽 waiting for the debit card to direct deposit my whole fiat check to @npub1ex7m...vyt9

Thanks for the info. I've really enjoyed using Strike over the years. I'll look forward to coming back when you have the proof of reserve system in place.

Thank you for this follow up with info!

Any hint on when this product will be available in the UK and Europe?

Thanks!

proof of reserves for our lending product you mean?

there is no rehypothecation but i hear you. we will have proof of reserves lending towards the end of the month, at least some variation

i’m not entirely sure what that solves. why would that be valuable to you?

we already have no rehypothecation. we will add proof of reserves so

customers can see the bitcoin.

i personally don’t get why holding one key is valuable, you don’t control the funds anyways and it makes the product extremely expensive

Hi Jack, thanks for the response. Big fan and have basically been a Strike customer since day 1. Hopefully you didn’t take my question with an off putting tone.

I suppose bitcoiners are skeptical by nature. And I’ve used other services like this in the market for years now and I have no problem with switching my business to another provider if it makes sense financially. Do I control the bitcoin in the loan? No, but why does the counter party need to hold all three keys if I’m offered one now?Your rates are practically the same. So unless Strike is offering something that’s a leg up to the competition (better rates, less collateral/loan, etc.), why would I switch? Again, big fan and happy Strike customer for a long time.

appreciate it, never personal.

our rates are the same at 0 origination, 0 early repayment, and 12%? with who? but we will be at ~8-9% by the end of the month. i think that will be best in class by a long mile as far as i know

as for why not give access to a key, i still don’t understand what it solves. we need to be able to act with the collateral in the event we have to. so there is no point in doing anything other than showing you the BTC on-chain with proof of reserves? or maybe im misunderstanding you?

Nice, thanks! I've been really enjoying Bill Pay by the way - great product