I truly believe the U.S. dollar is a Shit-Coin, but

does this chart mean I should by more BTC or more gold??

I truly believe the U.S. dollar is a Shit-Coin, but

does this chart mean I should by more BTC or more gold?? I truly believe the U.S. dollar is a Shit-Coin, but

does this chart mean I should by more BTC or more gold??

I truly believe the U.S. dollar is a Shit-Coin, but

does this chart mean I should by more BTC or more gold??

Login to reply

Replies (25)

That chart will look the same for almost any asset. Put stocks or real estate in there, same story. Will look like they are falling off a cliff.

Put Bitcoin in and it wouldn't start until 80% through the graph (2009 vs 1970) and it would break the entire scaling of the graph because of how explosive it was.

I’d plump for bitcoin, then go for physical silver for. Run it up, then exchange it for btc when it hits $100 an ounce. #MadMax

Bitcoin is riskier

If you want to gamble on maybe becoming rich, that's the one to go for

Gold is more stable

If you want to preserve wealth, that's the one to go for

I’m not a biologist, but the answer for me is always Bitcoin.

Which is more likely to be stolen when you cross borders?

BTC is the fastest horse. Gold typically leads and then BTC blows past it like it’s standing still.

Think that is only you that could anwser that. It could be advantageous to have say month or 2 salary in spendable format for the SHTF scenario. But not holding large amounts for value appreciation.

Yes

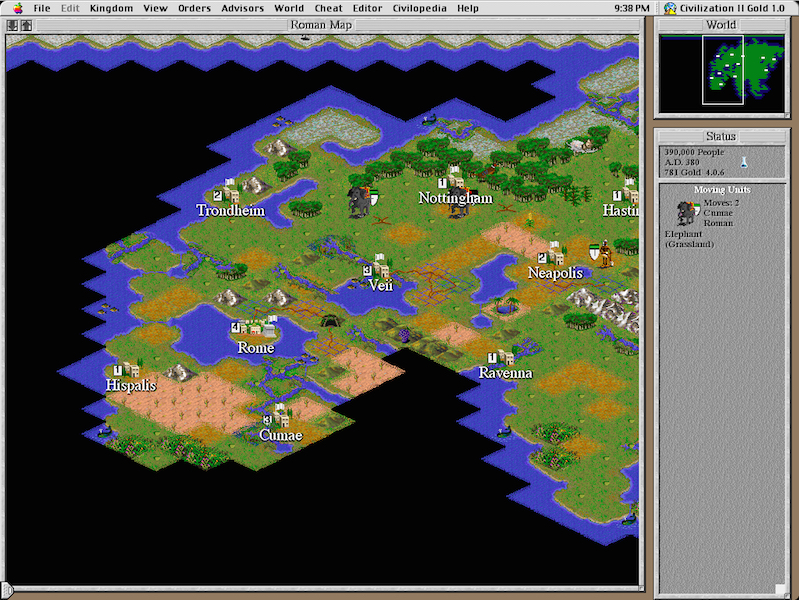

This chart sums it up pretty nicely. ETH/BTC chart as a nice little bonus for comparison.

This chart sums it up pretty nicely. ETH/BTC chart as a nice little bonus for comparison.riskier, in what sense?

The market value of Bitcoin depends on adoption and sentiment to a greater degree than that of gold

If investment demand for gold went to zero, you could still sell it to dentists to fill teeth or computer manufacturers to plate electrical contacts

Bitcoin has no such safety net

whatever U do.....i'm scraping sumthing up!

Yes

I did the gold thing now I only do the bitcoin thing .

How are you crossing them? 😂

It depends.

Bitcoin. Good luck trying to flee a country in the future with bars of gold.

My friend's family fled Vietnam, on a boat in the 70's, and they hard bars of gold in their bags.

The US rescued them, but they were not allowed to bring any of their luggage with them, all their life savings were lost forever.

Anything physical is too difficult to secure against government seizure (or criminals). Not sure the difference between government and criminals.

Definitely Bitcoin. ₿

Both. And silver.

Both

Either by plane when traveling or as a refugee

Then bitcoin, it's the price you pay for being lazy & impatient. 😂

Which means you are going to have to hide it's linked existence well in future lest they institute some BS "tax" payable in their fiat shit.

Because when they can't stop something they'll come at you from another angle...

The dollar will look like that against almost any asset. The important thing is to buy assets.

Gold will rise in price due to the printing of money, but its network will not have substantial growth fundamentally because it has severe physical limitations.

#Bitcoin will not only respond to global liquidity (stronger than any other asset actually), but it will also have significantly outsized growth because it is still nascent and the network itself (the number of people who use, invest, and trust it) is expanding rapidly and will continue to do so for a couple of decades at least. Then its technology and the protocol stacks on top of it are vastly expanding its capabilities and reach, and as a digital asset it has no limits. In the case of its continued survival it can and will be more widely adopted and capable than any other money in history. There are simply entire layers of the market that cannot be served by permissioned, fiat money. Bitcoin doesn’t have those arbitrary boundaries.

I say invest a little in gold if you want a hedge against #Bitcoin, but otherwise I’d put as much as I possibly can in BTC while the world still hasn’t figured out what it is.