Just a random thought: Hollywood and the music industry.

They are the show… One giant psyop.

So you aren’t paying attention and ignore the truth.

Kane McGukin

kane@NostrVerified.com

npub13j76...s940

#Bitcoin + Monetary Innovation. My opinions are my own and not financial advice. Navigating Bitcoin’s Noise 🎙️http://apple.co/3wFbiiq

Time is the most scarce monetizable asset we all have.

Money, in whatever form, is merely the medium of exchange we buy or spend time.

Chasing money = spending time.

Creating flexibility = buying time.

Either way, time is the only finite resource available to us.

Since January 2024 - Bitcoin has paired up with DXY.

It has traded directionally with it. Breaking the trend of trading opposite.

i.e. we are seeing “yield curve control” but across Global Macro Asset classes not just the bond curve.

🚨UPDATE🚨

One of my favorite things to do in 2007 was to correlate current prices/days to past major drawdowns in assets.

We’re currently most correlated to S&P 👉1937 (88%), 1973 (81%), & 1976 (78%).

It’s important bc previously, we experienced 4️⃣ historic market events across several different decades.

1913 - paradigm shift / Central Banks

1920s-40s - geopolitical issues & wars

1944 - new world monetary order

1960/70s - inflation/deflation

Life altering times but were spread across six decades.

💡 Today, the data confirms my view that what is “different” is that we are experiencing all 4️⃣ events in one decade, or in the past 5 years.

Capital stacks, balance sheets, and allocation of capital are what drive economic systems.

Hoarded stacks of capital create piles of debt that eventually become worthless, clogging the pipes.

Until… a new capital stock is created and re-deployed, unclogging the plumbing and moving liquidity once again.

The Forgotten Foundation: Why Capital Formation is the Cornerstone of Any Financial System

Without trusted capital stock, financial systems break down

Bonds with #bitcoin kickers (included in payouts at maturity) is the ultimate inflation hedge.

This would be the 21st Century version of TIPs - Treasury Inflation Protected Securities or in this case — BIPs — Bitcoin Inflation Protected Securities.

Thoughts @Pierre Rochard?

@less add this to your Macro bingo card. Put it on the free space.

X (formerly Twitter)

BitKane (@kanemcgukin) on X

Bonds with #bitcoin kickers (included in payouts at maturity) is the ultimate inflation hedge.

This would be the 21st Century version of TIPs - Tr...

This is actually a phenomenal chart that tells the history of rates AND the challenges we’ve created in banking.

💡High rates = functioning economy

🚫Low rates = broken economy

Here’s how Central Banks and Derivatives distorted this.

For about 100yrs rates easily stayed between 6-9% and never really went below 6 (1790 to 1880).

Charts below.

🏦💸Enter Central Banking Era and things drastically changed.

The battle to establish the Central Banking Era created an environment where rates RARELY went above 6% — for the next 100yrs.

This was abnormal relative to the past.

In this low rate period we had more bank failures and wars.

The 1960s/80s brought the Derivatives Era.

As financialization and debt became the norm, rates became bi-polar.

For the next 55 yrs (charts stops 2010). Rates were erratic (too high and too low), creating more tension, more defaults and liquidity issues.

Outside of manipulation and intervention, high rates provide stability and growth (6-9%).

They cause piles of capital to move from unproductive to productive use cases — where the profit is higher than the hurdle *rate*.

Low allow unproductive use case to survive on low rates.

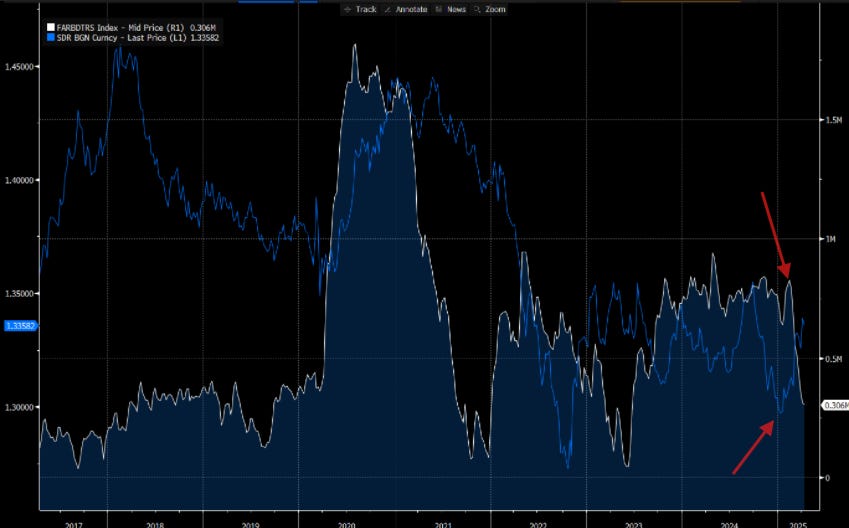

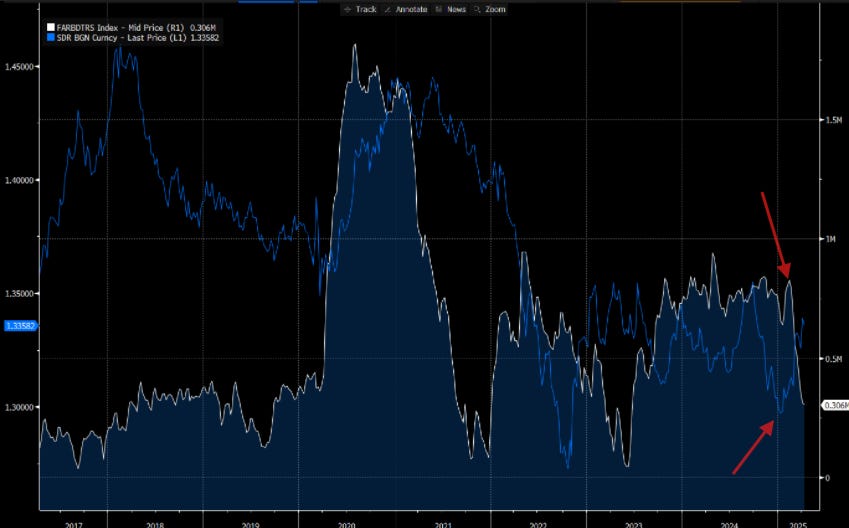

Everyone is watching the FED and their TGA account. But what is the divergence in SDRs telling us?

Is this the real liquidity signal?

In a squeeze the stuff no one talks about moves first. 🥇

Is this the broken model #bitcoin/stablecoins replace?

The Primary Problem in the Global Financial System Today: Trapped Liquidity

Trapped liquidity is the systemic fragility beneath the surface of global finance

Bitcoin isn’t just another asset — it’s a system following the power law curve.

In this episode w/ @Sina_21st / @21st_capital we explore:

⚡️ Bitcoin as a black hole for monetary energy

⚡️ How power laws explain growth & collapse

⚡️ Evolution beyond “store of value”

👂🎙️

Apple Podcasts

EP59 - Bitcoin, Power Law, and the Value of Systems with Sina

Podcast Episode · Navigating Bitcoin

Out of context but… why do so few still not see the problem here and the correlation to the US

“Fundamentally, the UK was, it’s an island who’s industrial base had been largely hollowed out, with a big financial system, highly financialized, highly interest rate sensitive; as a share of GDP. … You can kind of do the math, you can kind of see the options and constraints the Bank of England had” - @LukeGromen

Full Luke video below.

Base case for me in 2020-2021 👇

Would it have been really fun for me to come in and just keep issuing a lot of debt? and… it’s almost like a bodybuilder taking steroids. Outside looks great, you’re muscular. Inside you’re killing your organs. That’s what was going on here.” -@SecScottBessent

As a teen, diving deep into MLB’s steroid issue (late 90s) taught me a lot about our current issues and how what appears like a good thing is really damaging to the system.

Reflected on those lessons with @Marty Bent / @TFTC ( Glad to see Bessent making a similar connection (around 19min - https://x.com/tuckercarlson/status/1908204378613248067) . There is a lot to be learned from this relationship.

🚨Friendly REMINDER: Internet Hysteria had the following happen “next week”.

1. Europe was going to run out of energy & freeze over (2022)

2. JPYUSD was going to completely collapse (2022/2025)

3. #Bitcoin was going to zero (pick a year)

4. Gold was a worthless Boomer rock (2021)

Apply principles. Fear is your greatest enemy. Have a plan.

Return is a function of: time, volatility and probability.

Return = f(time, volatility, probability)

While I dislike Marx… it’s hard to argue he did not nail this.

Very well said 👏. A quote that requires a long ponder… from everyone.

“The high velocity trash economy is so high time preference that we're not even allowed to experiment with bold actions before they're deemed a failure. This is funny because we know for a cold hard fact that continuing with the status quo was destined for catastrophic failure.” - @Marty Bent / @TFTC

An example of timeless value written in classic text.

References to @TheBubbleBubble & @MisterSlammy’s silver manipulation (#bitcoin sees it too, IMO) -

We also see the natural behaviors of maxi’s getting enticed each 4 yr cycle to go and chase ✨ crypto & meme coins.

The Mechanics of Silver Price Suppression | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

🚩 The Greatest Contrarian Move at the Moment🚩

Lengthening your attention span > focus more intentionally and do more deep work.

This will pay *many multiples* more than continuing to swipe, scroll, or bounce from one headline to the next.

It’s the most undervalued trade in the market. Give it time to work.

“What it is, is the first actual scientific and highly precise, standard for monetary technology in the history of mankind.

The ideal money should be, it’s a standard and it’s the interface between other sources of value and it allows you to exchange value from one type to another type.” - @npub1lhqd...awg8

Nails it 🎯

Work by @Matthew Mezinskis shows debasement of USD is about 12.7%.

@Michael Saylor uses 8-9% (inflation) to calculate loss of purchasing power.

This tells us the hurdle rate for maintaining a quality lifestyle.

Grok shows #Bitcoin ‘s compound annual growth is 86.9% & the S&P is 14.2%, since 2010.

That is why BTC is import. It is well above the rate at which money is being debased while stocks are more or less equal.

In periods of high inflation, like the last five years of 20-30% grocery, gas, clothing and essentials inflation. This pain is even more obvious.

What the Bitcoin Strategic Reserve proves is that we are finally beginning to understand money on the same level as our Founding Fathers.

Life, Liberty, and the pursuit of #Bitcoin.

@jack mallers @Bitcoin Policy Institute / @btcpolicyorg (RSS Feed)

“History shows that the digital version of everything is always much more powerful and much more valuable than the analog version of everything.” - @Michael Saylor

#bitcoin  HT: @npub1p3hf...49pk @Pierre Rochard

HT: @npub1p3hf...49pk @Pierre Rochard

X (formerly Twitter)

Documenting ₿itcoin 📄 (@DocumentingBTC) on X

Michael @Saylor explains why you should buy Bitcoin on America’s most watched television news station