The important part is not merely avoiding spending, since not spending makes #Bitcoin irrelevant, but ensuring there’s a higher net inflow. This is only achieved by selling your goods and services for bitcoin.

The fallacy of “hodl” or “never sell” is what created this mess in the first place. By continuing to sell ourselves out for fiat, we effectively take on a short position against bitcoin, which in turn makes us feel like we’re missing out — something that’s true, but only in proportion to how much of our income or revenue is still denominated in fiat. This mindset reinforces the idea of never selling: why exchange bitcoin for something if you won’t be able to buy back the same amount later?

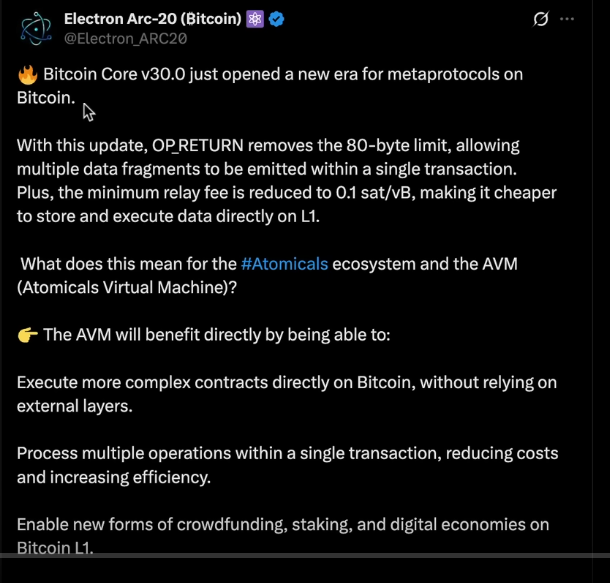

This leads to minimal on-chain activity and threatens Bitcoin’s security model. It’s partly the reason why Core has introduced changes that encourage alternative sources of activity, since Bitcoin cannot thrive if people only hold it forever instead of using it for payments.

View quoted note →

Core devs are compromised.

Core devs are compromised.