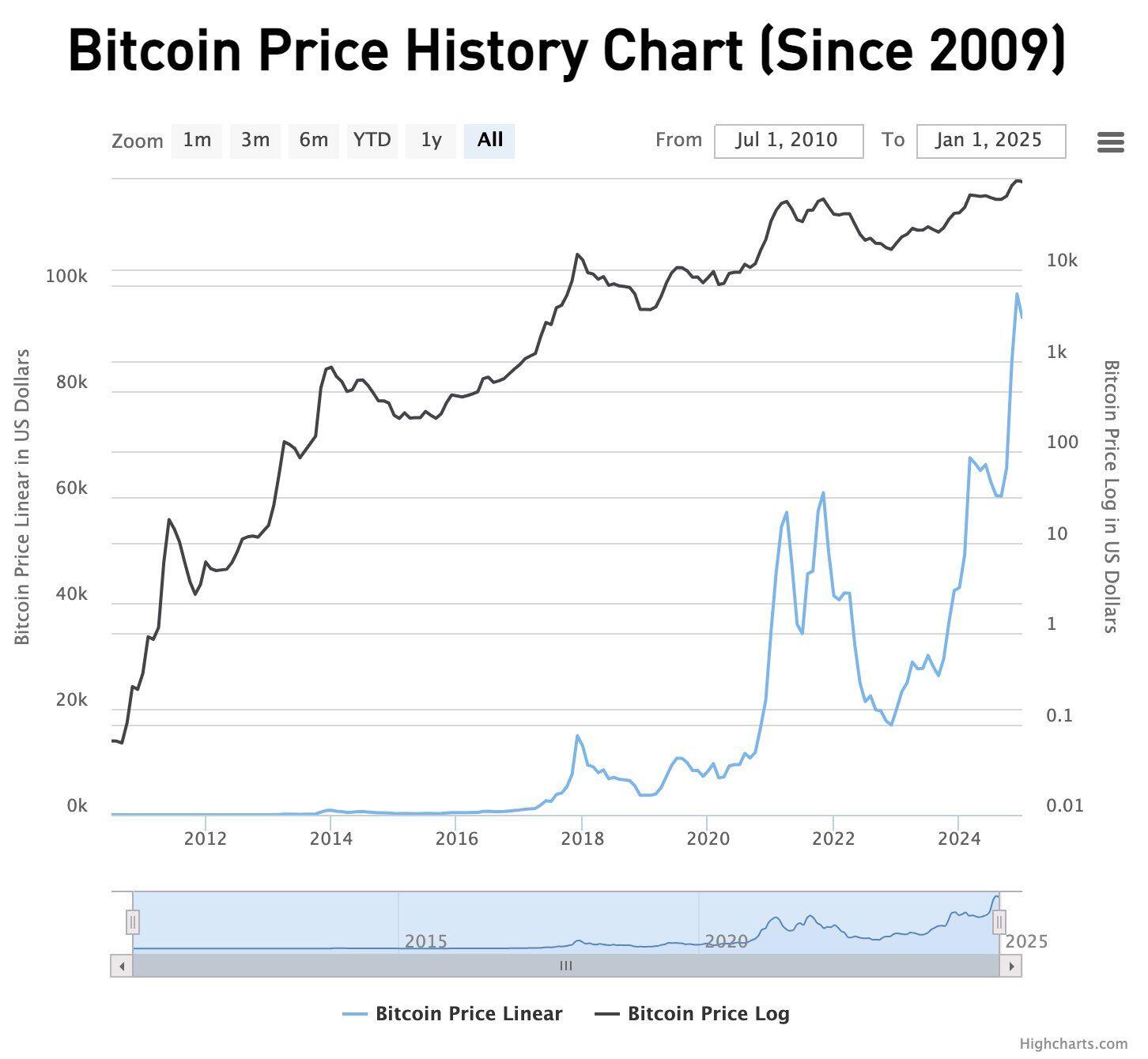

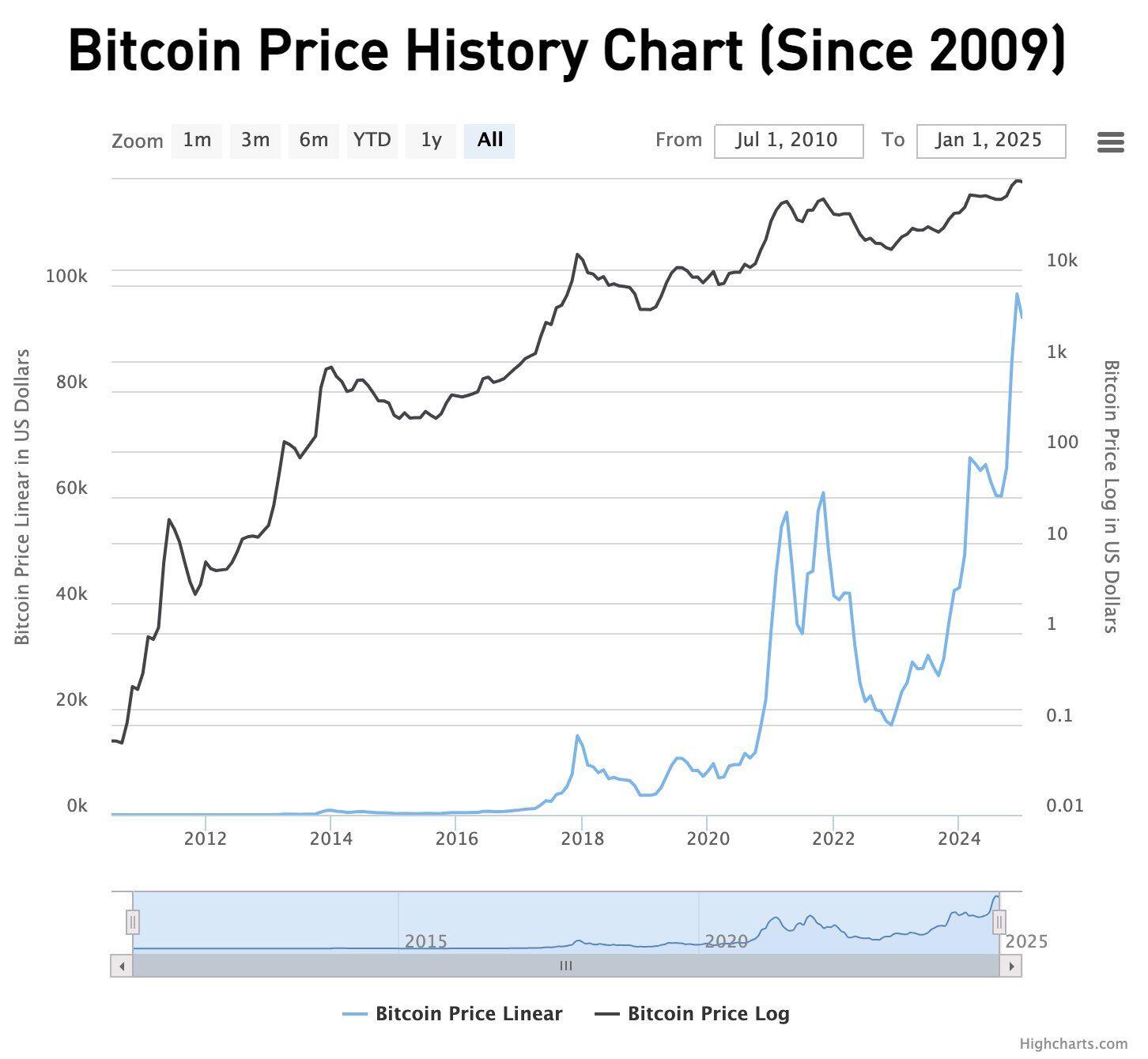

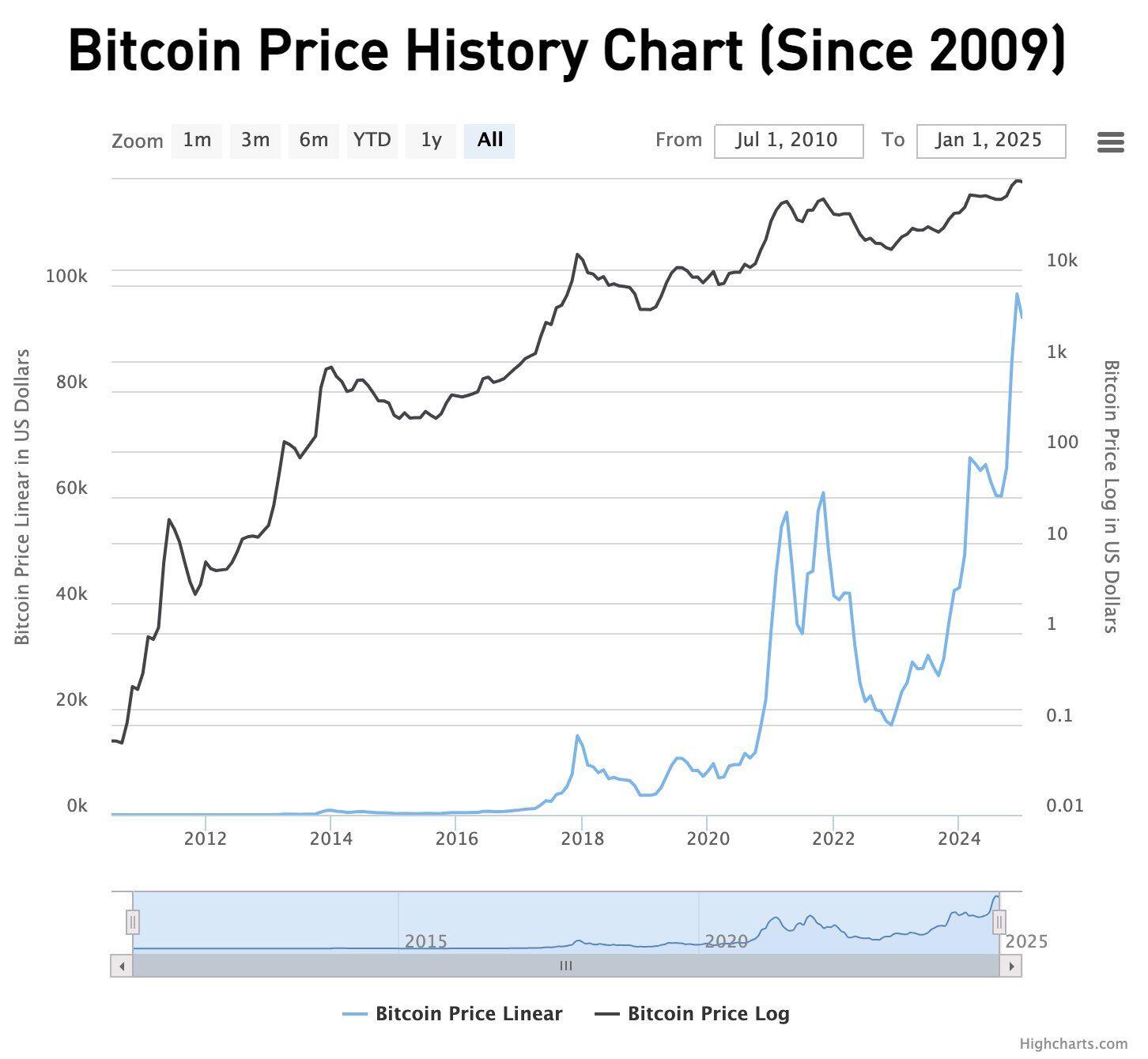

Bitcoin has now been working and trading for 15 full calendar years. It's time to see how it's doing and run some numbers.

On Jan 1, 2010, there were 1,624,000 bitcoin in circulation trading at around $0.001 each. The total market capitalization of bitcoin was ~$1,624.

On Dec 31, 2024, there were 19.803 million bitcoin trading at around $93,389 each, for a total market capitalization of $1.85 trillion.

In total over the 15 years, the size of bitcoin cash balances has increased by 110,400,000,000,000%, or around 110 billion percent.

If, during the next 15 years, bitcoin grows at only 1 ten millionth of its growth rate over the last 15 years, it grows to a total market cap of around $210 trillion, making it larger than all the world's fiat currencies and government bonds combined.

In such a world, a government may be able to keep its shitcoin alive if it doesn't inflate its supply too much (a big if, and an even bigger may). Whether they do or do not is largely inconsequential, because either way, inflation won't be able to touch the majority of the world's wealth.

Any bitcoin bearish thesis needs to present a coherent explanation for why bitcoin's next 15 years are going to have a growth rate that is significantly lower than a ten millionth of the rate of the past 15 years. Don't expect to hear one from people who get paid from the inflation bitcoin will kill.

Happy 2025!

Fiat is over if you want it!

Replies (67)

Hope to see you posting more on nostr in 2025 🫡

Unable to zap, but thanks for your hard work!!

Happy new year

The Bear thesis is the Dollar dies and out of the ashes people demand bullion disks.

Fiat 0tz -> Bitcoin 0tz.

But Number will indeed Go Up in the meantime.

🥳

They can’t stop FREEDOM Money. As time goes by more more people will begin to realize that saving in fiat debases it’s value and that #Bitcoin is the true long term savings technology.

When $210T price in today numbers would be around...?

bought the book. read the book. bought first SATS on 112224. thanks for the push.

Great post ! Love it

Happy 2025!!

Bitcoin’s track record is incredible. I wonder how many more years it will take for Fidelity to update and republish this table.

In a world dulled by fiat illusions, Saifedean Ammous was a spark that ignited my awakening. His words sliced through the noise, revealing the truth of sound money and the path to sovereignty. Like Bitcoin itself, his insights are timeless—built on principles, not expedience. For that, I owe him gratitude and a nod as I walk this journey.

nostr:nevent1qvzqqqqqqypzqsmeua4l5a4gpwxmn6n4jggajzanueajyqhc3qxvfa0lugr9qcddqy88wumn8ghj7mn0wvhxcmmv9uq32amnwvaz7tmjv4kxz7fwdehhxarj9e3xwtcqyryg04u6epwp4v4mfruu3ze2wcem3tqjqvg264umn888e36rxec2gkpy35h

Bona reflexió d'en nostr:nprofile1qqsyx708d0a8d2qt3ku75avjz8vshvlx0v3q97ygpnz0tllzqegxrtgpr9mhxue69uhhyetvv9ujuumwdae8gtnnda3kjctv9usy2c9y

Som mooolt aviat en la història de Bitcoin. Per mi és una invenció (o potser més aviat un descobriment) a l'alçada de la roda, de la pòlvora, Internet o el propi llenguatge formal que edtem utilitzant ara mateix per comunicar-nos.

Hem descobert un consens absolut sobre l'escasedat absoluta, el que ens permetrà de fer càlculs econòmics a llarg termini. Això no havia pogut passar mai abans, és l'element zero, és una cosa tan inconmensurable i que abasta tants camps de coneixement que no som capaços de fer-nos a la idea del què suposarà a mig o llarg termini.

Quan hi penso és com obrir una porta a un món nou, crec que de progrés, de més pau i prosperitat, de molts menys incentius per la guerra, la coacció o la destrucció.

Potser sóc un flipat però crec que som afortunats de poder viure aquesta època. Només espero que no hi hagi cap dels tarats que tenen accés al botó nuclear el pitgi abans que acabem amb el seu model ruinós...

Bon i pròsper any a tothom! 😄

nostr:nevent1qqsv3p7hnty9cx4jhdy0njyt9fmr8w9vzgp3pt2hnwvuulx8gvm8pfqpz4mhxue69uhkummnw3ezummcw3ezuer9wchsygzr08nkh7nk4q9cmw02wkfprkgtk0n8kgszlzyqe384ll3qv5rp45psgqqqqqqss9q4cw

Very insightful perspective. It’s so easy to get lost in the roller coaster. Really helpful to take in the decades long view from time to time.

BOA , GOSTARIA DE APRENDER COMO INVESTIR EM BITCOIN E CRIPTOS MOEDAS.

Math doesn’t make sense

You went to public school fool

Mistake is not yours

#haiku

using damus with iPhone?

Happy New Year Bitcoin!

Now we enter the growth phase.

Primal on Android.

We want it!

I guess it caught on

In 2025 max price?📈

It would be more credible to start the calculation not at the cash value on 1/1/2010 but at whatever date the market cap hut $100 million - the market cap of a very small but respectable tech start-up company. Your conclusion with these parameters would still be impressive ut much more persuasive.

+1

Great chart! 2025 is going to be another great year for Bitcoin.

Nothing stops this train

I often listen to #bitcoin critics and mainstream finance/economics experts to get the other side and see if any of them have any good arguments against bitcoin.

What I continually find is a lack of understanding, incoherent analysis and factually incorrect statements.

They usually say it's a bubble or that it has no fundamental value. Both are objectively false, which shows they are clinging to beliefs and not doing any actual research or analysis. This makes me even more #bullish on bitcoin's future.

May bitcoin continue to open minds, grow purchasing power, destroy inflation, and make Keynesian economics obsolete. 2025 LFG.

nostr:note1ezra0xkgtsdt9w6gl8ygk2nkxwu2cysrzzk40xueee7vwsekwzjq3nmtv6

why can't I zap you Saif?

This actually seems somewhat bearish based on a return of an average of 50% per year... should be 95000*1.5^15=~41.6Billion...

and in actuality, it has returned an average of 316% per year if you mined and held from day 1.

so really the math would be 95000*3.16^15=~2,970,000,000,000

...that can't be right

Party more on Nostr 🚀🤙

Correction:

95000*4.16^15=~184,000,000,000

Somehow you made Bitcoin going to $210 Trillion market cap seem bearish. Impressive.

PS Saif made an error in the calculation that makes this post 10x more bullish.

LFG

nostr:note1ezra0xkgtsdt9w6gl8ygk2nkxwu2cysrzzk40xueee7vwsekwzjq3nmtv6

happy new year, saif

I'll be teaching a History of Economics elective next semester and other than your books and the two volume Austrian Perspective on the History of Economic Thought by Rothbard...what would you recommend?

Please see my above question

nostr:nprofile1qqsyx708d0a8d2qt3ku75avjz8vshvlx0v3q97ygpnz0tllzqegxrtgppemhxue69uhkummn9ekx7mp0appv40

As nostr:nprofile1qqstn8du5qvy5vkw2kgyevn8kghyxjpre9l5rrekmt6a9hlsm4a4cfcppemhxue69uhkummn9ekx7mp0v890m9 said: $1 trillion per coin.

The Bitcoin white paper.

Right now it is 2T…so add 2 zeros to what we have now.

In Thailand, ppl still call Bitcoin a scam while marketcap of all Thai stocks combined is 500 Billion. lot's of ppl not gonna make it to Bitcoin standard!!

#nostr brings #bitcoin to 8 billion people !

🟠🟣⚡️📖🌎🫡

Optimist about bitcoin in 2025 due to : institution adaptation , growth interest and support regulatory environment in Trump’s administration

Based Saif!

Happy 2025 Saif. 🤙

Fiat is over if you want it!

nostr:nevent1qvzqqqqqqypzqsmeua4l5a4gpwxmn6n4jggajzanueajyqhc3qxvfa0lugr9qcddq90xsar5wpen5te0d9kkzem99ehx7um5wghxyatfd3jz7cmpx56nwce5893k2epn8qexgve4xesnswtyx4jkvvfcx9nrxcmzv5mrserrx9jk2cmy8p3r2d3kxyukvdmxxycrycnz8p3xgepsv43ju6nsvuqzpjy867dvshq6k2a537wg3v48vvac4sfqxy9d27dennnucapnvu9y5h629r

Happy 2025 and thanks for the book

Outstanding!

Thanks for all you have done for the Bitcoin space. TBS is a must read.

Happy 2025 indeed!

🔥🔥

Let’s go Saif! More #Nostr less X in 2025!

Yes 🙌

Great note! #BULLISH

Can someone help me understand the fixation with the Bitcoin log chart? I get that it smooths out the curves. But how is this not just moving goalposts?

Thank you for this note!

It shows the truth (slow grind upwards, hugher highs and higher lows) vs linear just showing the bubbles.

mine isn't working either.

I just tried to zap this note, can you see anything?

However, the true cost basis is not $0.001 it is $0.0000 and therefore undefinable, but I get. You have to give folks something to grab on to.

No, I don't see a lightning bolt on it.

I still don't see a lightning bolt, but I do have notification that you sent a zap at 12:25pm PST.

nostr:npub1h34n29f3wqvcht0jyhnd36jxcdmljyqjv4vdjfrd69nhxhrdvvnsgwr4h0 bro, share this with the shipcoin folk on X 😆They are wasting their time and need to seriously consider converting to at least a bearish enevitability.

This is the current fiat market as of today. Let’s GO!!

So do you think this is good or bad?

Brilliant 🔥🫡

The argument is pretty simple. You’re using the growth rate when a from when a new technology was developed in an argument for whether it will continue to grow as it matures.

This obviously does not make sense. Every investment starts at basically zero. Every population starts at basically zero. The ones that succeed grow exponentially, and then growth levels off as whatever it is matures. To suggest The assumption that Bitcoin has no ceiling makes no sense. You’re watching the first half of logarithmic growth and assuming it’s exponential.

Edit: The argument is pretty simple. You’re using the growth rate from when a new technology was developed in an argument for whether it will continue to grow as it matures.

This obviously does not make sense. Every investment starts at basically zero. Every population starts at basically zero. The ones that succeed grow exponentially, and then growth levels off as whatever it is matures. The assumption that Bitcoin has no ceiling makes no sense. You’re watching the first half of logarithmic growth and assuming it’s exponential.