Hyperbitcoinization and hyperinflation are the same thing.

Login to reply

Replies (20)

Hyper-de-clownification

Saifedean seems to be the lone voice that disagrees. Here at 43:45, slides 26-34, he makes a case for why increased reservation demand for Bitcoin at the expense of reservation demand for bonds has a deflationary impact on fiat supply. Also to note, reduction in fiat demand doesn’t cause hyperinflation, only rapid fiat supply increases that are disconnected from credit creation. Highly under-viewed presentation.

I’ll have to give this a listen. Deflation would be a much more hilarious outcome imho.

#iam14andthisisdeep

Definitely recommend this episode. I’m partial to asymmetric opinions when 99.99% of people seem very confident…

Saif is so smart. If he saying something it's best to take notice because he's usually right ✅️

But what if what he’s saying makes me uncomfortable and challenges my worldview and I don’t like it?

What then?!?

Complain about it on Twitter lol

I think I’ll just have him on my podcast and interrupt him the whole time.

😂🤣

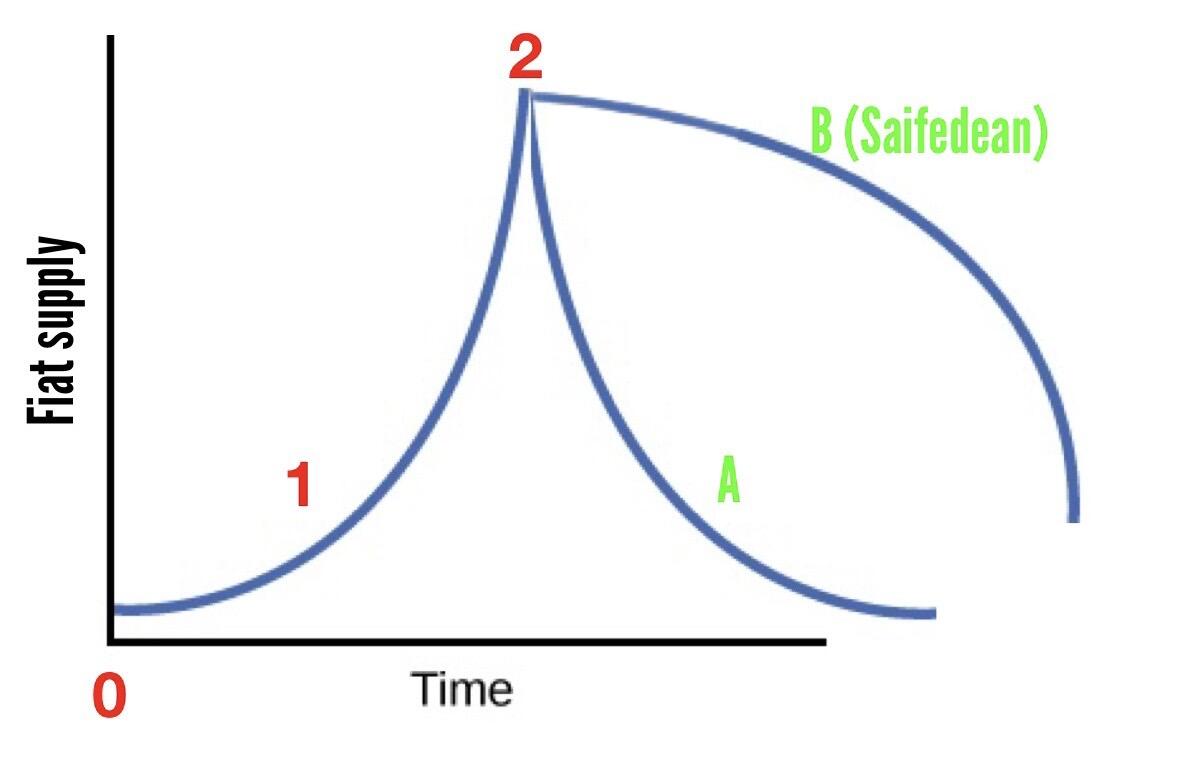

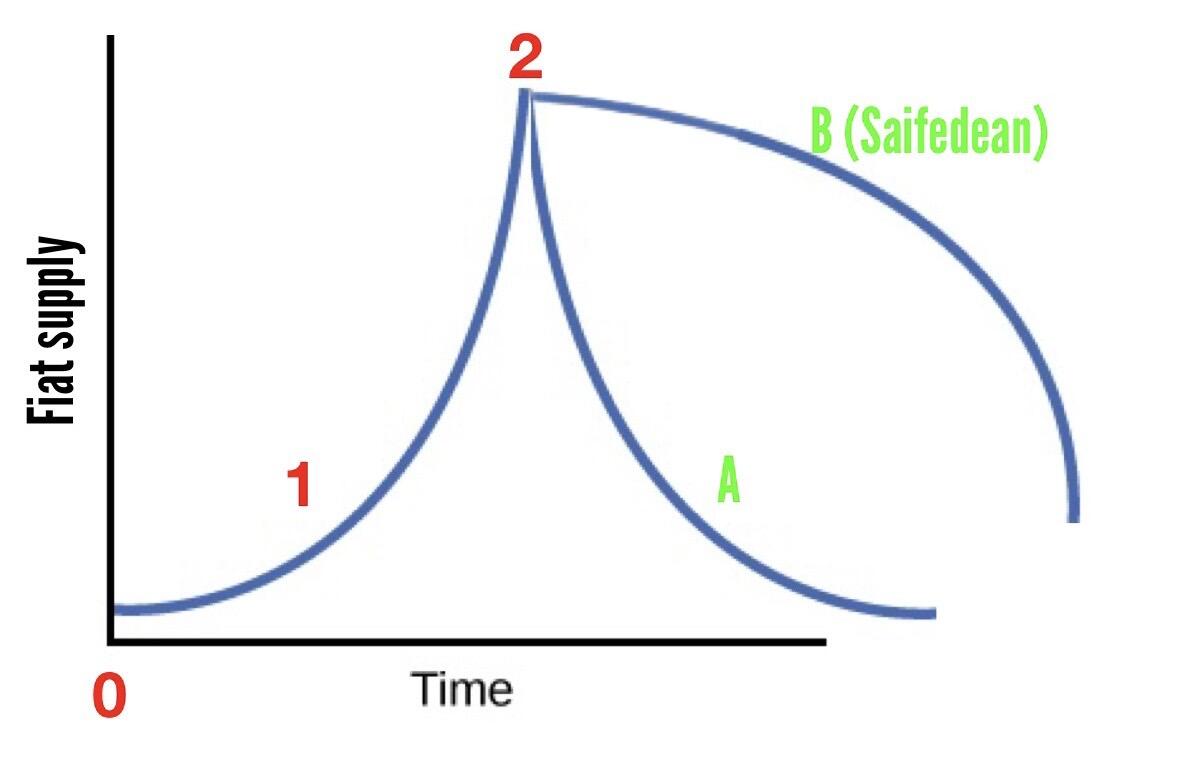

I tried with Greg Foss 2 years ago when this video came out, but he wasn’t having it. I even made a diagram to try to explain. Maybe the confusion is over timescales. Even though it is messy, hyperinflationists never play out the exact mechanics of the endgame.

He (and probably others too) kept saying that “fiat debasement is 100% certain”. Not 99.99, 100. So when I hear something like that, I can’t help myself and have to disagree.

Can’t watch the clip right now, does Saif factor in the impact of deflation in fiat though?

I mean, the system can’t handle deflation. I can see how it would have a deflationary effect on bonds but then I’d just expect the Fed balance sheet to absorb more, much like BOJ has so it doesn’t come apart at the seams.

I hear you, but MY point is Saif says unorthodox things and that scares me sometimes so the only logical path forward is for the government to restrict him from using the internet forever.

Watch it when you can. “The system can’t handle deflation” may be a psyop. One of those mantras we just say. Lots of debt jubilees throughout history. Or yea, each central bank becomes the sole buyer and owner of its countries bonds, then boom, like John Law’s bank.

You know fun fact, I actually felt this way when I first read the Bitcoin Standard, and I left a bad review on GoodReads.

Now I pretty much agree with all of it. Saif is an acquired taste, but worth it.

Lol, they call that tough shit 🤣

Had to watch it twice to snap myself out of my default agreeing with Saif 😂

Hyperinflation coming about from the increase in supply of fiat currency rather than reduction in demand makes sense. In fact pretty much all of that section of the preso makes sense.

I guess the counterpoints here would be dollar-milkshake-esque and may be right or wrong but let me try anyway, Saif can put me in my box if I’m wrong.

“If you can save in a hard money that appreciates, you are less likely to borrow to finance large purchases” (slide 31)

That I don’t believe to be accurate. If I need to buy a house today, I’m getting the biggest fiat mortgage on the longest time horizon possible knowing that fiat will debase whilst Bitcoin will appreciate. I had a dig at @Bender for this very thing; using BTC savings when fiat credit creation is available doesnt make sense.

We know this is how the asset rich fund their lifestyles too - borrowing against assets (fiat mining) to get fiat and roll loans in perpetuity.

So long as debasing credit money exists alongside appreciating commodity money, you’re better off using the former for large purchases.

I don’t think that invalidates any of Saif’s point though, just a difference of opinions on that one statement.

“When fiat credit creation expands, it causes unsustainable speculative bubbles, which collapse and bring money supply down.” (Slide 32)

Again, his point is correct. However, when the bubble is at the sovereign level I’m not sure that applies.

Back to BoJ for the example there. When it happens in a particular sector it can fail or be bailed out, but when it’s the sovereign’s balance sheet well then there is nowhere else to kick the can other than the lender of last resort.

I think the real difficulty here and why I referenced dollar milkshake is this all happens to other countries first, they collapse in to the USD which continues to grow and become stronger because of the effects Saif is describing - reduced fiat demand&supply in one fiat will somewhat go towards Bitcoin, but especially in the short term, it will moreso go to USD. Much like we’ve seen bank consolidations over the past 50 years, we’ll see fiat currency consolidations over the next 50.

The system (all of it, not just the US) keeps requiring these large liquidity injections because even mild deflation sends ripples through other sectors making business cycles very difficult to contain. Sovereigns have deduced it’s easier to flood the system with fiat and avoid cascading collapses than let anything get too bad and require direct intervention like 2008 as it’s too visible and politically unpalatable now.

We saw this during Covid - that was a WAY bigger bailout, Sovereigns just hid it better and spread it wider that time.

Overall I agree that Bitcoin could allow fiat to peacefully unwind, and Saif would probably agree with bigger fiats gobbling up smaller ones, in fact I’m not even disagreeing with his thesis, just considering the order of operations and how that last sovereign level unwinds.

hyperinflation is currency collapse

It’s a superb insight from @Saifedean Ammous (as per usual!).

However, the main point that I think he’s addressing is whether bitcoin causes hyperinflation of fiat. And I agree with him that it doesn’t for the reasons he says. But what happens subsequently as credit demand falls is that the central bank needs to print more base money to avoid an overall fall in fiat prices (which a debt based money is not designed for). So the overall money supply still rises but the proportion of base money to credit money goes up. Eventually this leads to fiat hyperinflation. However, the existence of bitcoin has delayed the inevitable collapse and so allowed more people to escape it.