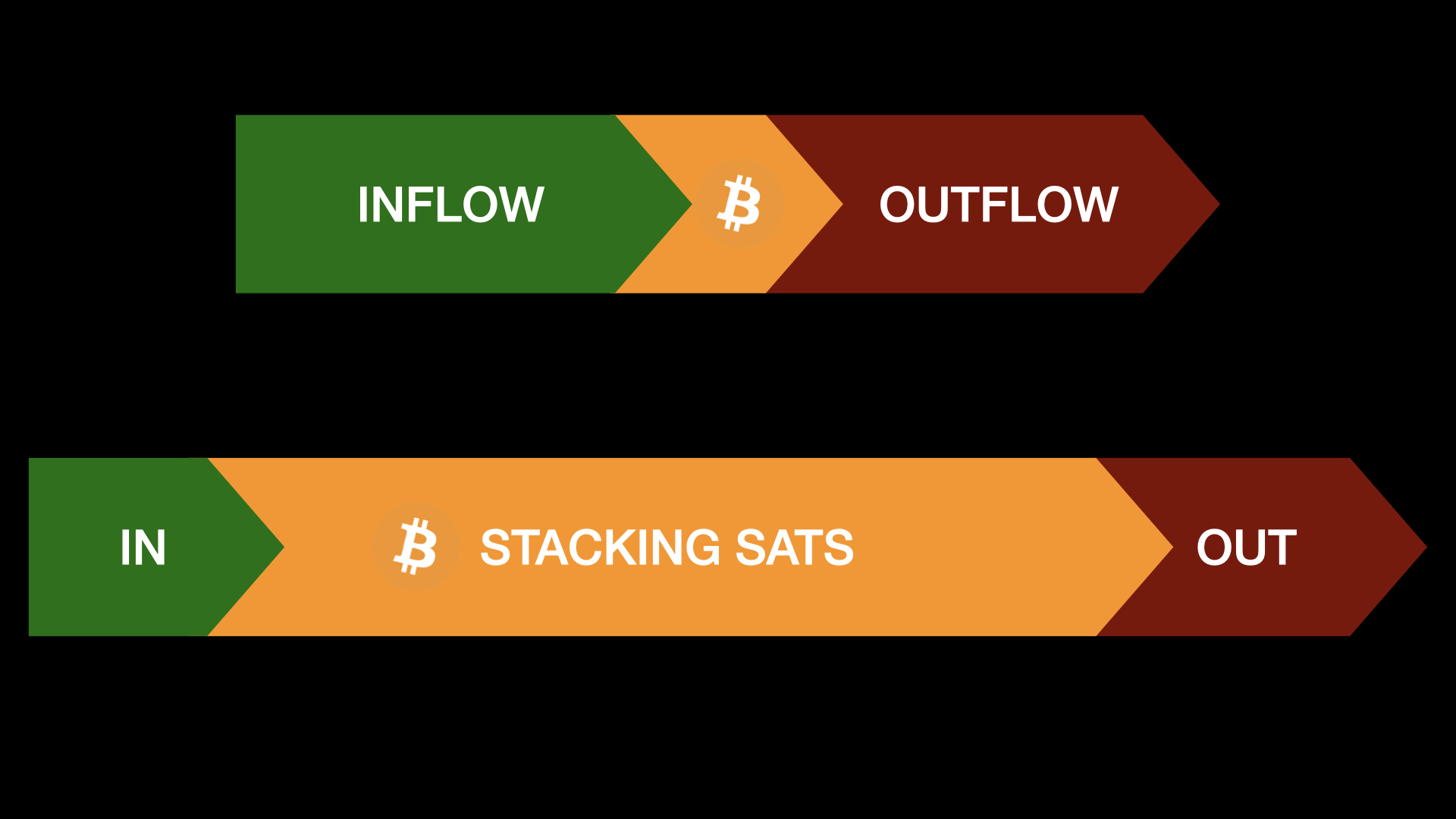

Bitcoin makes saving possible again.

Login to reply

Replies (16)

Disagree.

One must make/manage enough fiat to be able to afford to save in bitcoin.

You can buy a fraction of a bitcoin.

In other words: saving is broken. Ergo: you can't save.

Again one must have enough fiat to be able to buy and save sats.

Over half of America can't come up with $400 for an emergency expense.

People arnt into bitcoin simply because they do not have the extra fiat money to be.

You have to be a net producer to save. Has nothing to do with fiat or hard money.

Just zapped you generational wealth according to your own bio.

Correct. The quality of your savings vehicle has everything to do with fiat and hard money, though.

🤣

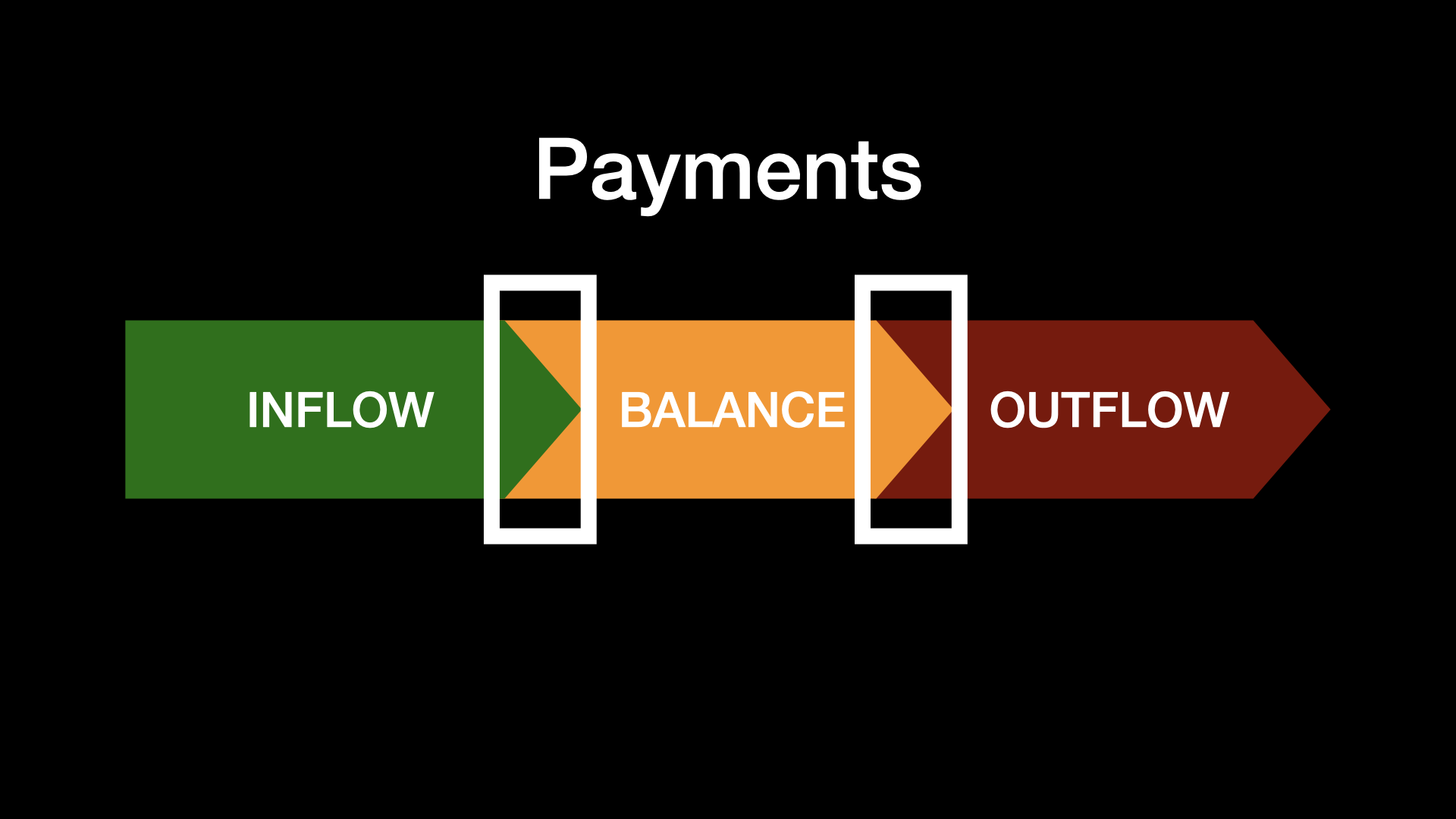

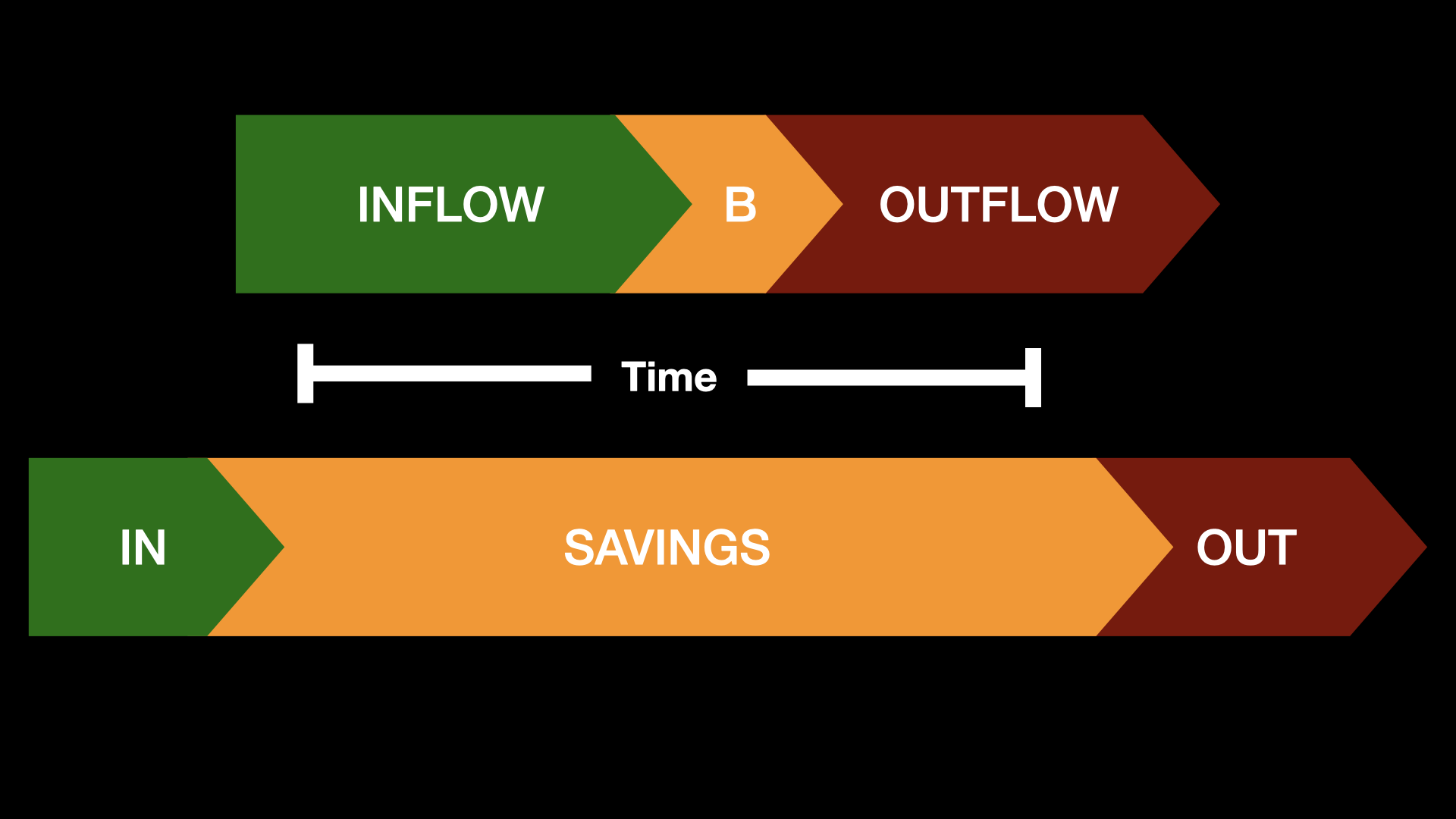

Saving is always an equation of production versus consumption. If you consume more than you produce, consistently, you will not be able to save. Bitcoin does not change this reality.

Saving in fiat adds another element to the equation though - other people can consume the value of your money without you even spending it. This makes saving over long periods impractical and inefficient. The incentive becomes to spend or get into debt, which creates a positive feedback loop where interest payments make saving even MORE difficult.

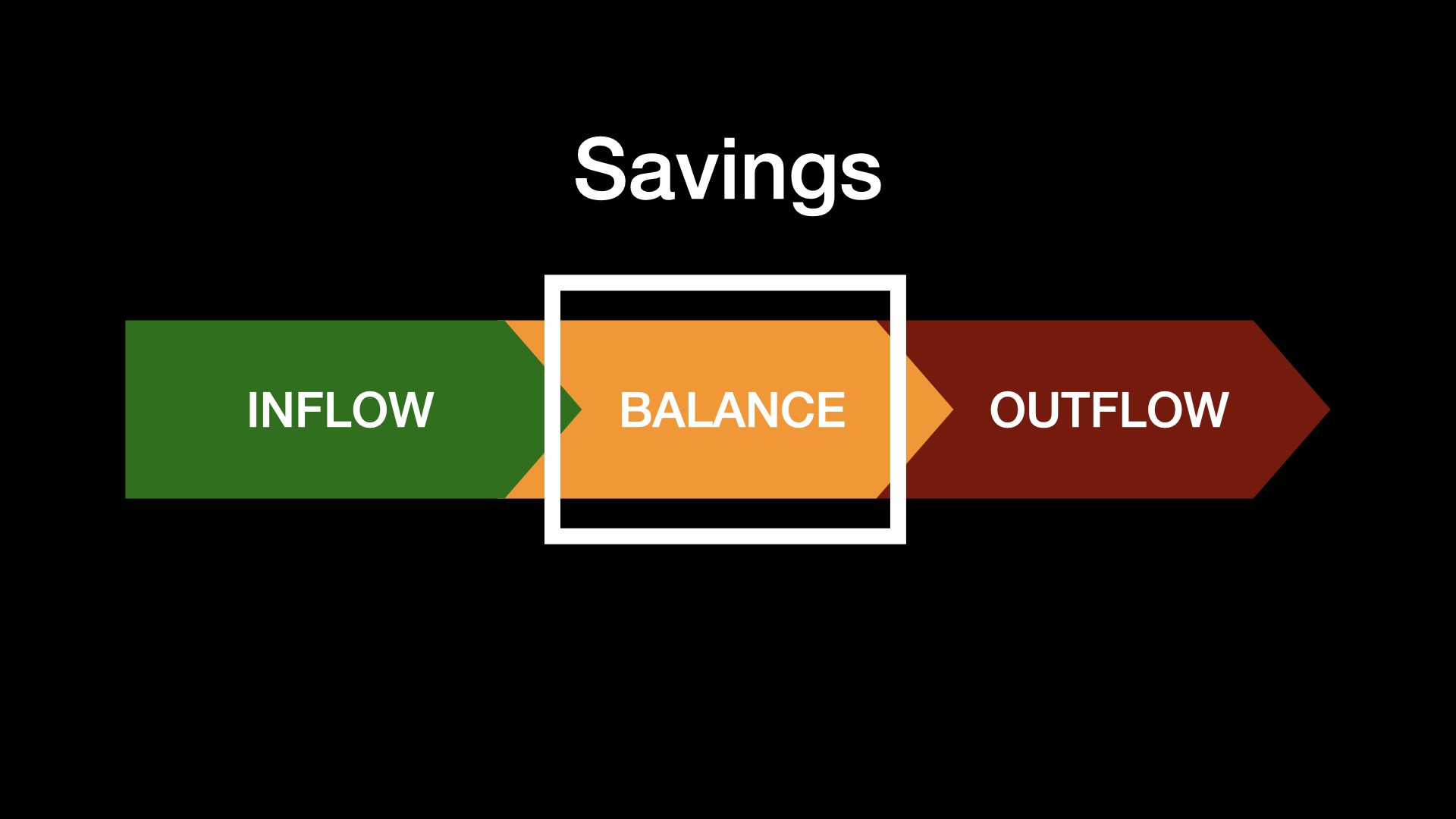

Bitcoin fixes that problem and allows long term saving to be possible again. You still need to produce more than you consume, but it

1. Makes it easier to save every year

2. Reliably stores value deep into the future

The average American also spends 2.5 hours per day watching TV. Half of Americans *choose not to be prepared for* a $400 expense.

If you remove responsibility from others, you remove it from yourself too.

💯

Big thanks. You might of just paid for my son's 1st car in full.

💜🫂🫡

Have you accepted Santa as your lord and savior?

The last couple of years is the first period that I’ve been incentivized to save since 2001, when I first read “The Creature from Jekyll Island” by G. Edward Griffin and soon thereafter discovered Mises’ work in Austrian economics. Things that ought to be introduced to eighth graders, if we didn’t have an indoctrination-focused education system.

Boom!!! #bitcoin

#Bitcoin makes progress possible again..👏👍🧡😊