Learning question about #bitcoin

If the goal is for #btc to not just be sold (store of value) but to be spent (currency, or stated better imho, medium of exchange of value)

This means we have to shift from converting BTC > USD (fiat)… to 1 BTC = 1 BTC

Meaning we have to stop measuring things in fiat values and instead measure (aka price) in satoshis (sats)

This is a huge mindshift and one that I think will take time for many, let along the masses.

It would sort of be like traveling to a country whose prices are denominated in EUR but I transact in USD…my brain struggles to convert or compare the cost in EUR vs USD

(Bear with me I’m getting to my question, but the ground work I laid is important (if I’m understanding things correctly)

So then…if we continue to measure products and services in both fiat and sats,

Q1. will we not just inflate Bitcoin despite its deflationary nature?

Example (using an arbitrary price choice) :

An apple is $2 or 10k sats

If BTC is at $100k USD (fiat value)

And it goes up to $200k, which in essence means the $2 Apple now costs $4;

Q2. would not the sats also have to double to 20k for an Apple? (And therefore pricing things in BTC is also inflationary?

The exception to this would be in the parties transacting truly think only in sats and eliminate any comparison/conversion to fiat

But that is a major #economics mind shift because “what is the value of something (especially in sats)? Like how are thing actually priced in the world beside me just saying “I think this is worth $X”

Ok…I’m starting to ramble so I will stop.

Merely trying to close the loop in my head on how setting prices in sats will also not be inflationary.

(In the equities market price is set essentially by liquidity. The more liquid an underlying is, the tighter the price spread is…that may be part of my answer…the more people that transact in sats; the more efficient pricing becomes…but I don’t think that addresses all of my question)

[apology for rambling…trying to succinctly communicate my thoughts to help attain an answer]

Login to reply

Replies (44)

There is one part missing from this.

It is not just store of value and medium of exchange. There is also the third function of money - a "unit of account".

ChapterIt is not likely that bitcoin is widely used as a unit of account for some time I til massive adoption is reach and price stabilise. Chapter 9 of The Bitcoin Standard highlight this challenge.

"On the one hand, Bitcoin's strict scarcity makes it a very attractive choice for a store of value, and an ever‐growing number of holders could tolerate the volatility for long periods of time if it is heavily skewed to the upside, as has been the case so far. On the other hand, the persistence of volatility in bitcoin's value will prevent it from playing the role of a unit of account, at least until it has grown to many multiples of its current value and in the percentage of people worldwide who hold and accept it."

The Reality.

Before Money, Barter was the exchange of things but was rated in Human Empathy.

Money removed that Human Empathy part of the exchange, because it was not perfect Information that recorded exactly the Human Empathy part of exchange.

That was Commodity Money. Since the 1970's Fiat Currency money became globally used, that further removed that Human Empathy exchange.

People game system's, so that opened Pandora's Box, you can have everything at no cost. If you can game the system with no cost, you have the perfect environment for fast breeding Psychopaths to win. Empathy holds others back.

Politicians from Vanity to Psychopaths can promise everything and deliver nothing. Psychopathic lawyers become heads of Government's, Councils, Mayor's and big Institutions and Non-Government Organisations etc et cetera.

The nett result of the loss of exchanging Pure Human Empathy is living life backward to those who cherish the exchange of Human Empathy.

As such, Gender Attacked, Family Attacked, Childhood Attacked, Religion Attacked, Property Attacked, Opinion Attacked, Home Attacked, Privacy Attacked, Health Attacked, Nature Attacked, Survival Attacked, Climate Attacked etc et cetera.

Bitcoin goes right back to what I said at the start and further, it's the exchange of Pure Human Empathy before people even thought to write about how a God could do this better.

If you don't think that chasing Fiat Currency is the Religion of living backwards, then my friends, your minds have gone.

The Reality.

Before Money, Barter was the exchange of things but was rated in Human Empathy.

Money removed that Human Empathy part of the exchange, because it was not perfect Information that recorded exactly the Human Empathy part of exchange.

That was Commodity Money. Since the 1970's Fiat Currency money became globally used, that further removed that Human Empathy exchange.

People game system's, so that opened Pandora's Box, you can have everything at no cost. If you can game the system with no cost, you have the perfect environment for fast breeding Psychopaths to win. Empathy holds others back.

Politicians from Vanity to Psychopaths can promise everything and deliver nothing. Psychopathic lawyers become heads of Government's, Councils, Mayor's and big Institutions and Non-Government Organisations etc et cetera.

The nett result of the loss of exchanging Pure Human Empathy is living life backward to those who cherish the exchange of Human Empathy.

As such, Gender Attacked, Family Attacked, Childhood Attacked, Religion Attacked, Property Attacked, Opinion Attacked, Home Attacked, Privacy Attacked, Health Attacked, Nature Attacked, Survival Attacked, Climate Attacked etc et cetera.

Bitcoin goes right back to what I said at the start and further, it's the exchange of Pure Human Empathy before people even thought to write about how a God could do this better.

If you don't think that chasing Fiat Currency is the Religion of living backwards, then my friends, your minds have gone.

I’m not questioning the philosophy of Bitcoin…I’m asking a math question (more or less).

How does Bitcoin not inflate when used as a medium of exchange (beyond there will never be more than 21M tokens…)?

Because there is only so much Pure Human Empathy to be exchanged and Satoshi's can cope with that. However, if the number of decimal places need increasing, beyond Satoshi's to Finney's or beyond, then that's an easy fix within Bitcoin at it's Core

I didn’t know that regarding decimal places. TY

Inflation is caused by an increase in the money supply. With bitcoin the money supply is fixed.

In your example you have kept satoshi to apple conversion the same. In reality the price of everything will drop over time when measured in bitcoin.

price of goods inflate... money devaluates

You have a key fundamental flaw in your reasoning. If Bitcoin goes from $100k to $200k the price of the apple in sats will be cut in half. Unless the seller of the apple leaves the price of his apple the same in sats. However, because prices fall to the marginal cost of production, that apple seller will rapidly be starved out of the market by all other apple sellers who adjusted their prices downward accordingly. I could price my house at 8 Bitcoin forever, but no one would buy my house when the price of Bitcoin went up. They’d find a different home seller that repriced their home accordingly.

Bottom line, priced in sats, the cost of items go down because we become better at producing them and there is a finite supply (21 million) of the money that everything will be priced in.

For reference Andreas Antonopoulos has covered this, it's worth watching his stuff. With the understanding that a lot of his output was growing with Bitcoin and in his words, paraphrasing, 'in a kids playground in the wild west. Which is apt because back in 2013 he was speaking to chairs and tumbleweeds.

My suspicion is that most don’t understand negative interest rates:

A Porsche costs 2 #BTC this year, will cost 1 #BTC next year, and 0.5 #BTC the following year. So logically I would just wait 2 years buy a newer Porsche and have 1.5 #BTC left over.

Of course it might be 0.25 #BTC the following year so I might just wait.

So if I borrow 1 #BTC at -50% interest rate I could wait 2 years but the Porsche for 0.5 #BTC pay the bank back 0.25 #BTC , and put 0.25 #BTC in my pocket.

#BTC #HODL #bitcoinstr

This is why I think lending will largely go away, and most everything will be equity investing. I know you used an extreme number to illustrate your point, but the negative rate would trend toward the inverse of productivity minus storage costs. Something like -2 or 3%. Just give me the equity upside to part with my sats.

I disagree. Because (modern) equity requires governance control. Most modern “entrepreneurs” are cucked by their equity investors. Public and private and venture equity…they all control the entrepreneur.

A good entrepreneur worth a damn won’t part with the equity. Which means most entrepreneurs will seek debt funding (priority claims) vs. giving up control and upside of their ventures.

Equity and debt instruments are going to look completely different on a fixed money supply. Almost all projects were financed with equity in the past. It was this fact that was the impetus for the formation of the federal reserve. To force people to fund with debt instead. The old system of capital investment will return when the money can’t be printed into existence.

I don’t think that is accurate. A lot of rich people who had gold reserves collateralized their gold for bank loans which were in turn invested in “guaranteed” priority debt claims on projects … which also included yields on projects.

Debt (priority) claims are very attractive for numerous reason on a sound money standard.

It is exciting times we live in because only time will tell how this really pans out. #BTC is a much harder asset than gold. Keep in mind they’re digging 54,000,000 ounces of gold / year out of the Earth and if the price of gold goes up, that number goes up, but it doesn’t matter how high the price of bitcoin goes #BTC will only be 450 tokens / day. And that number will be reduced by two in about 3 1/2 years.

#HODL #BTC #bitcoinstr

But that wasn’t the general trend. Society was moving to equity investments as capital. Also, more importantly, that bank was fractionally reserving their gold deposits. They created some portion of the loan out of thin air. There eventually will be no dollars to create out of thin air.

Great question. Keep asking these! It’s what helps with conviction over the long-term

The key is to study money some more…

How I think through this:

- money solves the double coincidence of wants problem

- many things can be used as money, most things are very bad at money

- a good money is: Divisible / Durable / Fungible / Portable / Scarce / Verifiable

- good money has 3 functions: store-of-value / medium-of-exchange / unit-of-account

- people will use money in different scenarios for 1 of the last 3 functions

What you’re thinking through, it’s important to identify which function you’re fulfilling

As Bitcoin increases its market cap, driven by value moving into BTC, and purchasing power increasing, as supply is outstripped by demand, the SOV function is altering (hence we see its exchange rate alter)

Whilst, you can price things in whatever you want. Chairs. People. Coal. Grain. Gold. USD. Eur. BTC. Etc. Long-term I believe everything will be priced in BTC, which is UOA function. The supply of all those UOA moneys I just mentioned can change, but BTC will change the least (think stock-to-flow ratio), hence makes a good UOA

Point being everything is in flux the whole time. Modern fiat has lulled us into the false sense that prices can be constant

In short - I try my hardest to measure my net wealth in BTC terms (ie SOV) but on a daily basis pricing things in BTC remains hard

Lastly BTC will only have 21 million, this is like a truthful measuring stick of value, unlike anything we’ve ever seen. Just because you price in SATS, this doesn’t change that fact

Hard to explain in one note!

🙏🏻

Hope that makes sense

Q1 -. The Apple that used to cost 10k sats, if btc doubles in purchasing power, will now cost 5k sats (whatever the usd price will depend on usd inflation)

because 'inflation' means monetary debasement, not 'prices went up' -- prices going up is a consequence of inflation.

If you want a deeper dive into this question, check out

- Murray Rothbard, [The Mystery of Banking](https://mises.org/library/book/mystery-banking); or

- Ludwig von Mises, [The Theory of Money and Credit](https://mises.org/library/book/theory-money-and-credit)

So “prices going up” retains a correlation to inflation but inflation is not the causation of increased prices? Debasement (or otherwise people agreeing XYZ widget is worth more)?

Ok…adding these to my list!

in the simplest of exchange value "energy time is money". price discovery in Sats will emerge through human trade exchange actions over time. 1 (one) second of human / energy time will gain increasing Sats values. prices in Sats will be based on what value the buyer is willing to offer and what the seller is willing to accept.

Thanks for the replies.

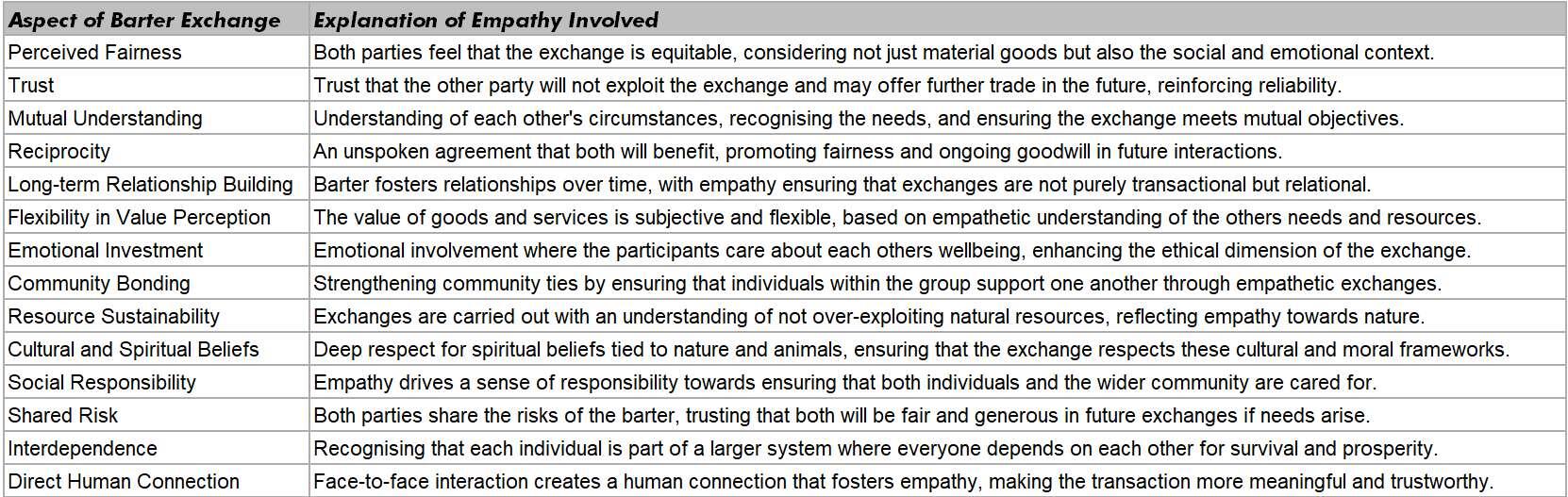

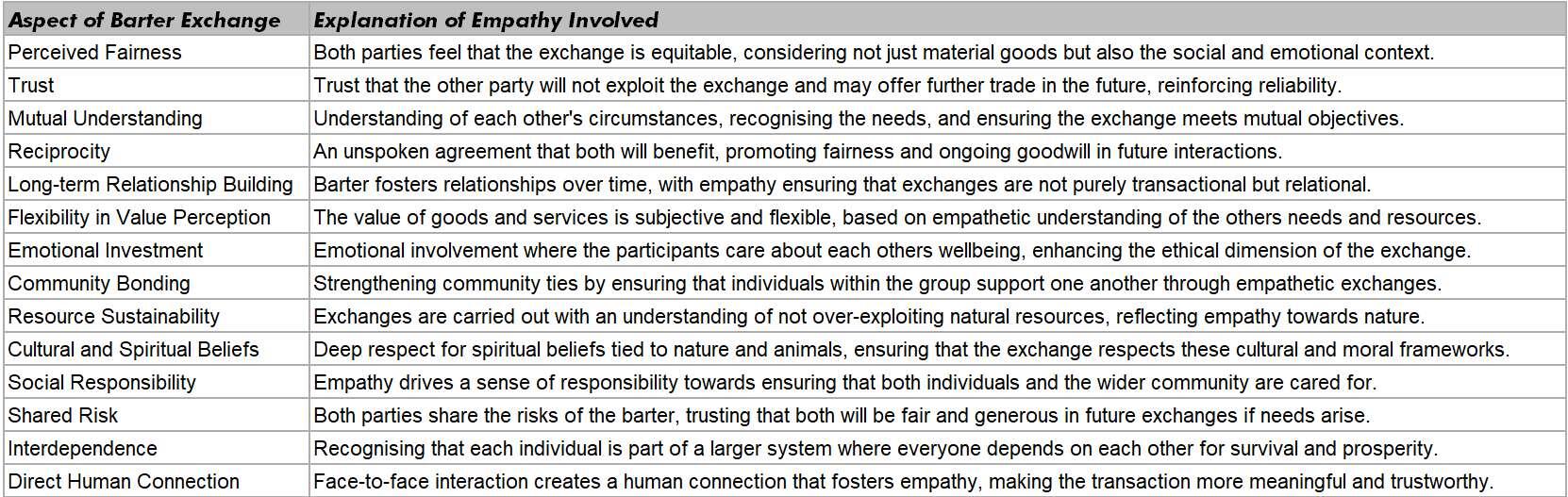

I’m not understanding or otherwise connecting the dots on this idea of “pure human empathy” as it pertains to price and value; or even barter.

Perhaps it’s becasue empathy is something I have to work hard at…but I don’t make many or any emotional purchases nor adjust price per se based upon the way I feel towards a customer…

So what is meant by and what evidence is there if “pure human empathy” as it pertains to price and value or a product or service (and therefore medium of exchange)?

I have done a few lengthy notes on this, they are in numbered title order. So far I have done 7, from 00 to 06. I will continue to expand upon this, in order.

So this one I feel will make you start to see the meaning.

01 Title: Barter to Money and the Empathy that a Lack of Numeracy Could Not Induce

Introduction

The transition from barter systems to money-based economies represents one of the most significant changes in human history. Before the widespread use of money and numeracy, trade relied on empathy—human beings understanding each other's needs and negotiating directly. As money began to replace barter, the need for personal trust diminished, but without numeracy, people still struggled to calculate fair exchanges. This post examines how barter declined as money use increased, and how the lack of numeracy prevented the kind of trust and empathy that characterised earlier economic interactions.

The Role of Barter and Empathy

In early human societies, barter was the primary method of trade. Without a standardised medium of exchange, individuals and groups relied on empathy to ensure fair exchanges. A farmer trading grain for livestock, for instance, had to place themselves in the position of the other party, understanding their needs and ensuring mutual satisfaction. Barter was not just an economic exchange; it was a social interaction, built on trust and community.

However, as human societies grew more complex, the limitations of barter became evident. In large communities or long-distance trade, barter required precise knowledge of the value of goods, and the negotiation process became increasingly cumbersome. The introduction of money simplified this process, but it also began to erode the personal, empathetic connections that had been central to barter.

The Introduction of Money and the Decline of Barter

The first coins, minted in Lydia around 600 BCE, marked the beginning of a new era in economic exchange. Money allowed for standardised transactions, reducing the need for personal negotiation. The direct connection between traders, once mediated by empathy, became less important. Instead, the value of goods was abstracted into coinage, allowing trade to occur even between strangers with little trust between them.

While the introduction of money led to a gradual decline in barter, the process was slow. Barter persisted for centuries, particularly in rural areas or in times of economic hardship when coins were scarce. In medieval Europe, for instance, barter was still common among peasants, even as money became the dominant medium of exchange in urban markets. The rise of feudalism and the lack of widespread currency systems ensured that barter continued well into the Middle Ages.

The Importance of Numeracy

Though money simplified transactions, it did not entirely solve the problem of fair trade. Without numeracy, the ability to understand and work with numbers, many individuals were still vulnerable to unfair deals. Money alone could not induce the kind of empathy that was necessary for ensuring fairness in barter systems. The rise of numeracy, particularly in the 19th and 20th centuries, played a crucial role in levelling the playing field, allowing more people to engage in economic transactions with confidence.

Numeracy became widespread only with the advent of public education systems in Europe and North America. Before this, only elites, scribes, and merchants had the numerical skills required for complex trade. By the early 20th century, with numeracy becoming common among the general population, the need for personal trust and empathy in transactions diminished further, as individuals could now calculate value and fairness independently.

See the Chart that shows Barter, Money and Numeracy in Use over time.

Barter, Empathy, and the Consequences of Their Decline

The decline of barter and the rise of money and numeracy represent more than just changes in how people traded goods. They mark a shift from a system based on human connection and trust to one grounded in abstraction and calculation. While the modern economy allows for efficiency and scale, it has also removed much of the empathy that once governed economic exchanges.

Barter required individuals to understand and relate to one another, making each transaction a negotiation not only of value but of social relations. The empathy exchanged in these interactions was a vital part of ensuring fairness, particularly in small, close-knit communities. As money and numeracy replaced this need, the personal connections that were once essential for trade were weakened, and economic transactions became increasingly impersonal.

Conclusion

The shift from barter to money-based economies was driven by the need for a more efficient and scalable method of trade. However, as this paper has shown, this transition also led to the erosion of empathy in economic exchanges. Without numeracy, early money-based systems could not induce the same kind of fairness and trust that characterised barter. Only with the widespread introduction of numeracy did individuals gain the tools to engage in fair trade independently. Yet, even today, the loss of empathy in economic transactions remains a consequence of this historic shift.

Sources:

Glyn Davies, A History of Money: From Ancient Times to the Present Day, University of Wales Press, 2002.

David Graeber, Debt: The First 5,000 Years, Melville House, 2011.

Joel Kaye, A History of Balance, 1250-1375: The Emergence of a New Model of Equilibrium and Its Impact on Thought, Cambridge University Press, 2014.

Niall Ferguson, The Ascent of Money: A Financial History of the World, Penguin Press, 2008.

View quoted note →

Thank you for this well laid out explanation!

I appreciate it.

The loop is almost closed 😎

Think of it this way: every new dollar printed makes existing dollars less valuable (inflation), so eventually it takes more dollars to buy the same stuff as before (increased prices).

Another major aspect of inflation is artificial credit expansion by the fractional reserve banking system--which increases massively when the Fed lowers interest rate targets.

There's a great video series by Mike Maloney on YouTube called The Hidden Secrets of Money (just skip the one on Hedera hashgraph). 🤙

Thinking of things priced in sats really helps. I almost always convert prices to sats. I have a widget on my phone that tells me the sats : fiat conversion.

Plus most people on Nostr can relate to things priced in sats, and it gets away from the USD bias for an international user base.

What app / widget you using for the sats to fiat conversion?

Added this to my watch list too.

Have to balance consuming (even if it is for learning) vs creating.

Re: “eventually it takes more dollars to buy the same stuff as before”

That is the heart of my question and OP…

If price in dollars goes up; why wouldn’t I as a business owner just also raise the number of Sats required to purchase said “Apple” (thing)?

(As I continued to type I think I unlocked the answer)

A business owner could do this and some might, but savvy customers will choose other suppliers because the two currencies (fiat and BTC) are moving counter to one another.

Therefore if the store owner raises sats required alongside fiat price; they are doing themselves a disservice as they will ultimately lose market share, or the customer will just pay in fiat while (potentially) getting the Apple for free in fiat terms becasue BTC price has increased asymmetrically to the decline of fiat value

good point!

Thanks for this!

Have you thought about putting these into a Nostr article such as on Habla or via YakiHonne?

This is essentially what happened (and happens) in deflationary environments.

Example being WW1. People were hoarding cash because it would buy more later. Of course back then the USD was backed by Gold.

It took me a moment to find it, because it's actually a "crypto" widget.

GitHub

GitHub - hwki/SimpleBitcoinWidget: Clean looking, simple cryptocurrency widget for Android.

Clean looking, simple cryptocurrency widget for Android. - hwki/SimpleBitcoinWidget

Uggg I’m on iOS

I’ll have to see if there is a similar app

I have not used them, I will have to have a look, thanks for the heads-up.

Here's a table that explains the Empathy breakdown of a Barter exchange.

https://image.nostr.build/8269ab8951456dfafc2cb60d6a583c0ab612711f791e80473bd4ee4613757426.jpgb

I've just posted another note, 07 Title: Barter: Empathy and the Magic Wrapping that Money Cannot Buy. It's got a pretty good analogy in there, if I say so myself 😃 and you may find it interesting.

Didn't attach, weird.

iOS. 🤢😅

Don’t hate me cause I’m hip to be square 🤣

It's fine, kind of. My wife is an Apple fan. She thinks I'm weird with privacy tech.

Yea entire family, both sides, is Apple. It makes it’s easy for grandkid to FaceTime grandparents.

I used to be PC.

Honestly when I was an IT Director for a school and did a Total Cost of Ownership study and priced out new computer labs…

It was so obvious Apple was the way.

I used to go through a $1500 laptop every 1.5-2 years.

I get 6-7 years from my MBP and resell for a few hundred bucks at that point still