Why Network States are inevitable if we assume hyperbitcoinization:

1). Nation States are all pretty much bankrupt already.

2). Btc accumulation takes a long time for nation state level actors without the price running away.

3). In a Bitcoin backed world, printing money is no longer an option, therefore current Nation States will get outcompeted due to their wasteful spending. Either they will adopt and become Networks or die.

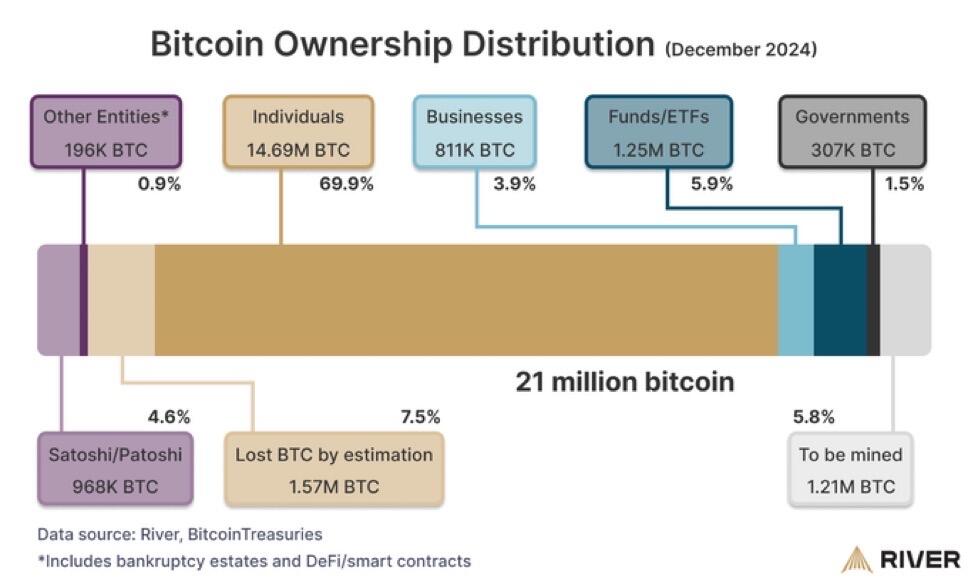

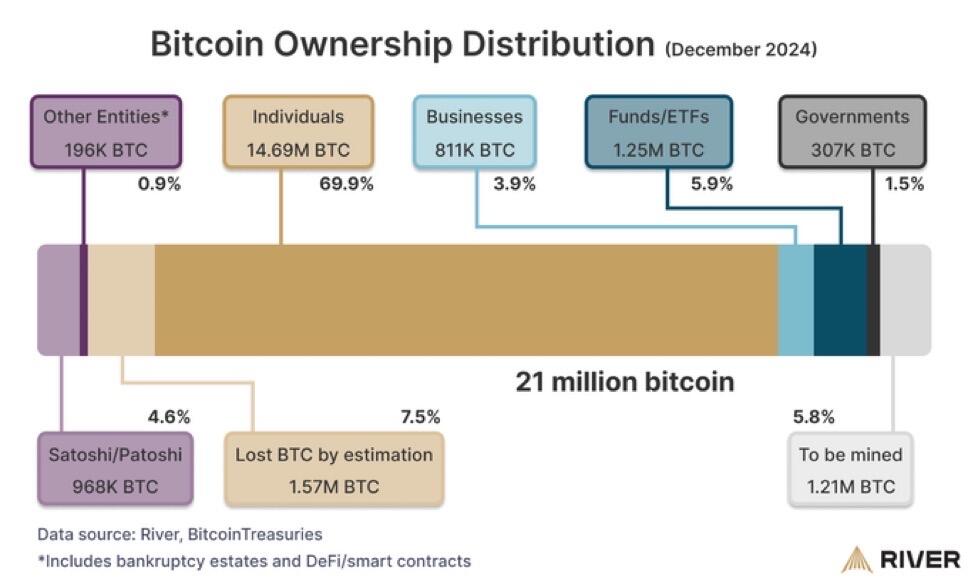

4). As you can see below, individuals own most of the supply, so we will instantly see the rise of the sovereign individual.