Login to reply

Replies (33)

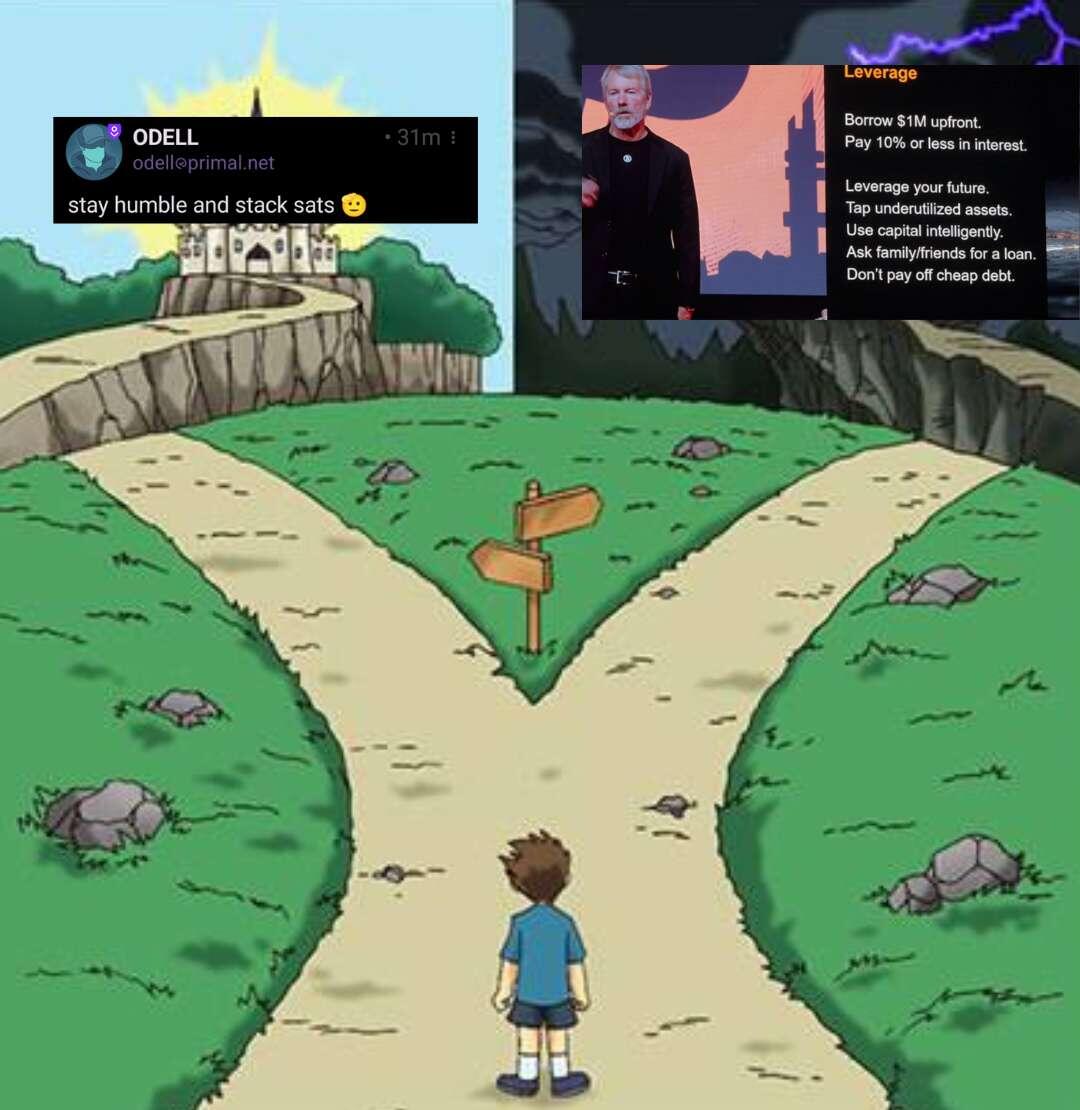

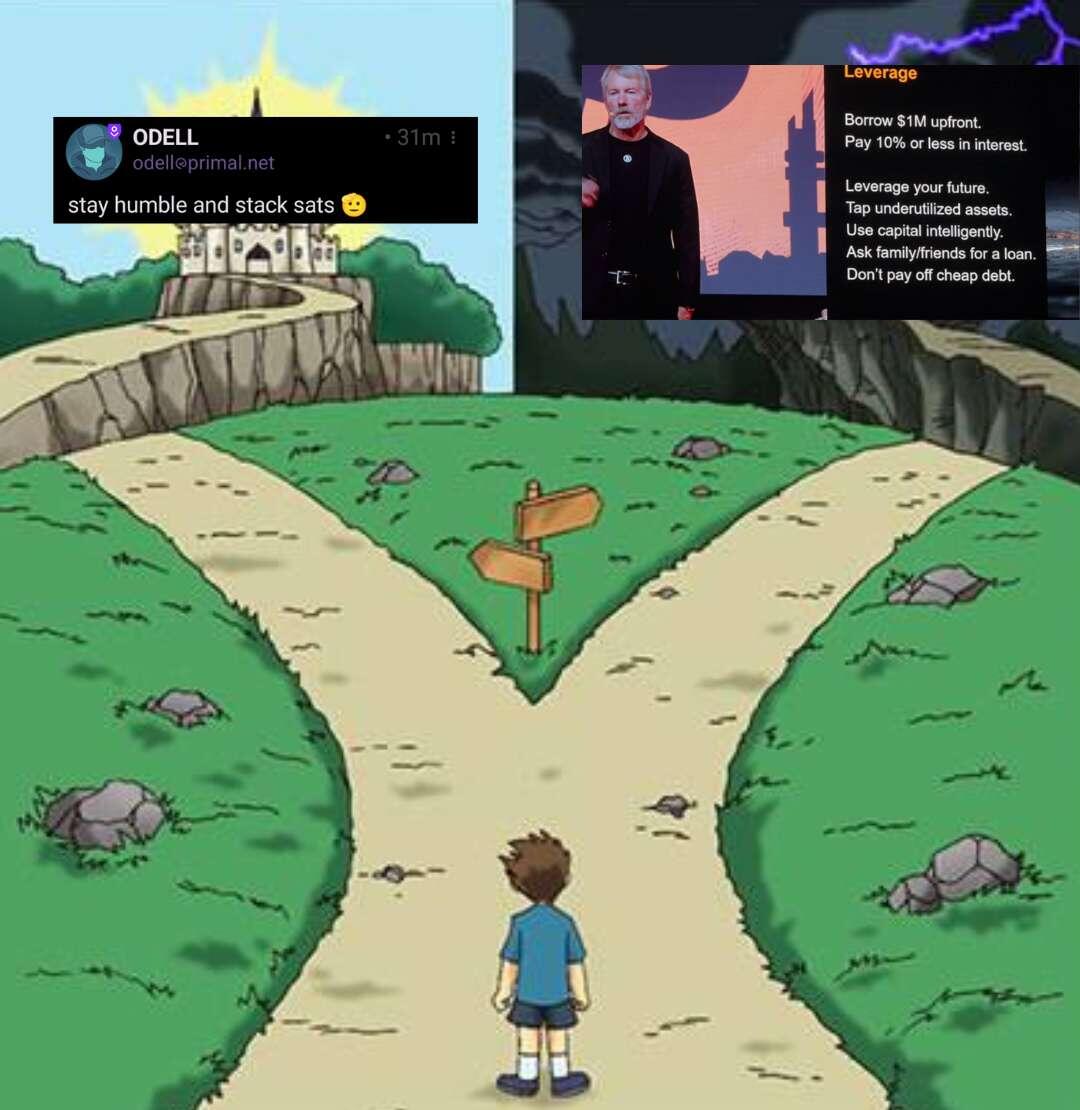

Left path for sure

Stay humble stack sats! This is the way!

Stay humble.

@ODELL is right. Stay humble and stack sats. #bitcoin will survive without leverage…you might not.

The Great Taking would destroy Saylor, right? Almost worth it for them to blow up everything else to seize those ~500k coins in a roundabout 6102.

🤯 #Bitcoin

View quoted note →

How about doing both?

Well you can take Saylors advice and follow what Odell is saying for sure.

Which way, Western man?

View quoted note →

I just listened to the book. The same thing occured to me too. But on second thought, do not commodities thrive in deflationary and recessoinary environments? Bitcoin is a commodoty. So maybe as securities assets undergo a liquidation cascade, maybe bitcoin will endure and strategy will not have to liquidate its btc. What do you think about that?

His debt would become extremely expensive. Same thing for a house with a mortgage.

There it is

I found it

Followed

Yes it would but strategy isnt in that much debt. Strf doesnt get repaid. And i think strk is only redeemable for stock. So that leaves only strd to be repaid (i think) and he can sell common stock all the way down to pay much of the claims. But my question was more about if you think bitcoin would perhaps do well as a commodity and as a safe haven asset in cintrast to the equities which would be rugged as described in the book. Thx

Definitely better than equities since there isn’t inherent counterparty risk. Bitcoin is on its own vector…to victory. Despite how common it is to call Bitcoin a commodity, as a way to distinguish it from shitcoins (aka securities) Bitcoin isn’t a commodity because it isn’t used/consumed as an input to create something else. Just because something isn’t a security, doesn’t automatically make it a commodity. I have many posts about this on X. View quoted note →

Thanks for your input! I will consider your words carefully. I dont use x, but i read your linked post. Thank you. take care.

I respect the fuck out of Odell more than traylor park

Saylor

Left is best in the long run

The incentives to actively want a blow up is low, considering how many big corpos and vested interests have exposure to Bitcoin now.

But it's possible for market-driven blowups to happen.

How would you do it?

Both of them have their well-deserved merits. But for this particular issue, I take Odell's side.

How would you do it?

they charged me" ecosystem fee" for buying btc ..what the fuck is that from blue moon payment gateway ??? scam ...

Most of us don't have access to leverage anyway. So the left path is the way.

Always left.

Are you familiar with The Great Taking?

Not more than reading summaries of it

My take on the meme is just about taking fiat money borrowed, buying Bitcoin and continuing to stack the sats, continuing to buy Bitcoin.

If you trust your counterparty and your banking system to not screw you over with debt, then sure, I get what you mean.

'Know thy counterparty'

Anyone who trusts a system as monopolised and captured as the equity, banking and bond markets, irrespective of the country they live in, will have only themselves to blame if such an event occurs.

Same goes for Saylor as well.

=======================

#8 😂 Nostr Memes

=======================

1. View quoted note →

2. View quoted note →

3. View quoted note →

4. View quoted note →

5. View quoted note →

6. View quoted note →

7. View quoted note →

8. View quoted note →

9. View quoted note →

10. View quoted note →

11. View quoted note →

12. View quoted note →

13. View quoted note →

14. View quoted note →

15. View quoted note →

16. View quoted note →

17. View quoted note →

18. View quoted note →

19. View quoted note →

20. View quoted note →

21. View quoted note →

22. View quoted note →

23. View quoted note →

#memes_nostr_recap