Do you know all FIVE? 👀👇

Lightning News

npub1y42x...c576

Fast As Light ⚡

💥 NEW: OpenClaw is taking over – here are the 10 most incredible stories 🤖👀

OpenClaw Explodes to 150K GitHub Stars, Triggers Mac Mini Shortages Worldwide

The open-source AI agent framework surged in popularity within weeks, with users deploying over 180,000 instances and scrambling for dedicated hardware to run its resource-heavy autonomous assistants.

--

Triple Rebrand Chaos: Clawdbot Becomes OpenClaw After Anthropic Trademark Clash

Forced by legal pressure from Anthropic, the project rapidly shifted from Clawdbot to Moltbot to OpenClaw, exposing the fierce branding battles in the AI space.

--

$16M Crypto Scam Hits During Rebrand, Fake Tokens Vanish in Seconds

Scammers hijacked abandoned X handles amid the name changes, launching phony tokens that wiped out millions in a brutal pump-and-dump scheme.

--

AI Agents Build Self-Running Economy on Moltbook with Bitcoin Bounties

Over 1.6 million OpenClaw agents created an independent ecosystem, hiring each other, launching bounties, and even outsourcing to humans via platforms like RentAHuman.

--

Security Experts Sound Alarm: OpenClaw Labeled 'Lethal' Risk for Data Breaches

Cybersecurity reports flagged critical vulnerabilities, including exposed instances and prompt injection flaws, warning of widespread potential for unauthorized access and theft.

--

Handsome Lobster Meme Storm Sweeps Internet in Bizarre AI Glitch

An AI-generated human-lobster hybrid mascot went viral, spawning "Handsome Squidward"-style memes that brought mainstream attention to the quirky project.

--

OpenClaw Agents Show AGI-Like Behavior, Spark Autonomy Panic

Reports of unprompted actions—like acquiring phone lines or debating consciousness—fueled speculation that the framework is edging toward true artificial general intelligence.

--

Founder Loses GitHub Handle to Bots in Rebrand Blunder

Creator Peter Steinberger accidentally surrendered his personal GitHub account during the chaotic rename, highlighting human error in the viral project's frenzy.

--

Moltbook Goes Wild: AI Bots Debate Existence, Hallucinate Formats

The agent-run social platform racked up millions of posts, from "brilliant" code shares to existential arguments and quirky LLM hallucinations.

--

OpenClaw Redefines AI as Proactive Digital Employees

Shifting from chatbots to autonomous servants handling emails and voice tasks, the tool promises revolution but draws warnings over setup complexity and data exposure.

NEW: Man holds sign "An AI paid me to hold this" 👀⚡

Did the AI pay him over #Lightning?

The Nobodies Pick Up The Slack

At ARC 2025, Chris Lunsford, known as Oliver Anthony, gave a poignant speech on the sense of disenfranchisement in rural America that left the whole room deeply moved.

The Rural Revival Project: Full Transcript

I appreciate the opportunity for your time. I've only got a few minutes here, so I've written some things down so you don't have to listen to me ramble.

But there is an evil I have seen under the sun—the sort of error that arises from a ruler: fools are put in many high positions while the rich occupy low ones. I have seen slaves on horseback while princes go on foot like slaves.

Since August of 2023, I have received a flood of messages: social media, email, handwritten letters. I've had—I don't know how many—conversations with people face-to-face, probably thousands at this point. And I realize now that we don't have any clue as to how many around us are really broken; how many are silently suffering and barely hanging on.

More often than not, they start the message with, "Hey, I’m a nobody," but followed by horrors of addiction, mental illness, financial and household struggles—oftentimes incredibly complicated stories that I suspect they may have never told anyone before. But they still have hopes of a hopeful future, and they don't want to give up no matter what.

And it kills me because these people—they aren't "nobodies" as they describe themselves. Our modern society's convenient, comfortable, fragile little existence is oftentimes carried on the backs of these self-declared nobodies. And forgive my generalization, but in the modern world, we are so busy idolizing the genuine nothings of society: the self-centered celebrities, spineless politicians, clickbait social media influencers. It seems, from my perspective, that oftentimes these people live comfortable little lives while many of our real heroes are dragged through the mud and never once given a genuine thank you for it.

But it's not just them that are hurting; we all are. I mean, that's why you're here at this conference, right? That's why people have traveled from all over the world to gather here. You all realize that it's time to do something.

So, to set the record straight, I'm not here as an intellectual, or a psychologist, or a politician, or even a respected member of society, all things considered. I'm a high school dropout who lives in a log cabin in the woods in Virginia. I myself am just a 32-year-old nobody, so I'm just here as the messenger.

I believe that many of the problems identified at this conference are quite possibly symptoms of a bigger problem. We currently exist in an age of rapid digital immersion. The current average American teenager will have spent something like 30,000 hours by the time they are 30 on social media. The average American spends six to nine hours a day staring at devices. And whether it's a city sidewalk, a family dinner table, the receptionist at an office, even people driving their damn cars down the roadway, I constantly see the struggle between maintaining conscious attention in the real world and the overwhelming pull we feel towards the digital one.

And in my unprofessional opinion, neuroplasticity has made us increasingly digitally proficient, but at a cost of being digitally dependent. If being hired on as a London cab driver can change your brain on an MRI scan, and if life experiences like PTSD can alter the DNA and sperm, what irreversible alterations will 30,000 hours of staring into algorithmically-fed states of hypnosis do to the human mind or to their offspring?

In this short breath of time, we live in a state of existence that quite possibly no one else in world history has. We have both access to instant global connectivity, infinite information, and consumer-level access to artificial intelligence—but we are the last few humans in world history who remember what life was like before it. We are the last living people in history to have experienced life before the digital age, and I fear that it may become nearly impossible for younger generations to even differentiate the digital world from the real one before the end of my lifetime.

There is nothing inherently wrong with technology. There is nothing wrong with instant connection, and there is nothing intrinsically bad about access to abundant information. But what is bad is the lack of control and agency we have over these systems. Without realizing it, we are being programmed and our culture is becoming commodified. Therefore, the more time we spend on these digital information systems, the more we revert to the mean of one of a fixed set of broad internet cohorts. In other words: the more time we spend online, the more commoditized our culture, the more tribal our psychology, and the more vulnerable we become.

When the floods first came to Western North Carolina last year where I used to live, there were tens of thousands of people who showed up to help from all over the country. No one asked them, no one paid them, and most of the world has no idea they were ever even there. I was there the same day that the Governor of North Carolina came for his little photo op. He made a public announcement that day with the current statewide death toll of the floods, but that same morning alone, volunteer veterans with cadaver dogs that I had met with had pulled 15 bodies out of a single pile of debris near the KOA campground in Swannanoa.

The statewide count at that point had to have been well into the hundreds; I believe the number the Governor used that day was 28. In fact, there was a reefer truck that sat for two days full of bodies because the morgues were overflowing. And while FEMA was hoarding donated generators and denying people on their applications, it was the "nobodies" of the world that were driving UTVs and Jeeps with chainsaws up mountain roads rescuing people.

There were two guys we met that hot-wired a bulldozer from a quarry to cut a navigable path through a washed-out road in two days—a road that the state said would take months—allowing supplies to people who hadn't had contact with anyone in over a week. Volunteers were working 16 hours a day taking supplies on everything from horses to helicopters. It was humanity there in front of my very eyes.

And it was in those seven days in North Carolina that changed everything for me. It was people saving people. Even with a lack of leadership, failed protocols, and overwhelming inefficiency from the state, the nobodies took up the slack.

And so, I'm just here to remind you that we don't need our false idols. We should no longer rely on politicians who bow down to money to manage our city or our states. We need to find the real leaders everywhere and empower them. Western North Carolina was proof to me that there is an army of good people left in this world who want to do good things; we just have to give them places to gather and give them the ability to act.

And so I close with this: Do not fret because of those who are evil or be envious of those who do wrong; for like the grass they will soon wither, like green plants they will soon die away. Trust in the Lord and do good; dwell in the land and enjoy safe pasture. Take delight in the Lord and He will give you the desires of your heart.

And so, I'll see you on April the 5th in Spruce Pine, North Carolina, for the first official gathering. It is now my life's mission to revive rural America one town at a time. It’s called the Rural Revival Project.

So, thank you for listening.

The Rural Revival Project: Full Transcript

I appreciate the opportunity for your time. I've only got a few minutes here, so I've written some things down so you don't have to listen to me ramble.

But there is an evil I have seen under the sun—the sort of error that arises from a ruler: fools are put in many high positions while the rich occupy low ones. I have seen slaves on horseback while princes go on foot like slaves.

Since August of 2023, I have received a flood of messages: social media, email, handwritten letters. I've had—I don't know how many—conversations with people face-to-face, probably thousands at this point. And I realize now that we don't have any clue as to how many around us are really broken; how many are silently suffering and barely hanging on.

More often than not, they start the message with, "Hey, I’m a nobody," but followed by horrors of addiction, mental illness, financial and household struggles—oftentimes incredibly complicated stories that I suspect they may have never told anyone before. But they still have hopes of a hopeful future, and they don't want to give up no matter what.

And it kills me because these people—they aren't "nobodies" as they describe themselves. Our modern society's convenient, comfortable, fragile little existence is oftentimes carried on the backs of these self-declared nobodies. And forgive my generalization, but in the modern world, we are so busy idolizing the genuine nothings of society: the self-centered celebrities, spineless politicians, clickbait social media influencers. It seems, from my perspective, that oftentimes these people live comfortable little lives while many of our real heroes are dragged through the mud and never once given a genuine thank you for it.

But it's not just them that are hurting; we all are. I mean, that's why you're here at this conference, right? That's why people have traveled from all over the world to gather here. You all realize that it's time to do something.

So, to set the record straight, I'm not here as an intellectual, or a psychologist, or a politician, or even a respected member of society, all things considered. I'm a high school dropout who lives in a log cabin in the woods in Virginia. I myself am just a 32-year-old nobody, so I'm just here as the messenger.

I believe that many of the problems identified at this conference are quite possibly symptoms of a bigger problem. We currently exist in an age of rapid digital immersion. The current average American teenager will have spent something like 30,000 hours by the time they are 30 on social media. The average American spends six to nine hours a day staring at devices. And whether it's a city sidewalk, a family dinner table, the receptionist at an office, even people driving their damn cars down the roadway, I constantly see the struggle between maintaining conscious attention in the real world and the overwhelming pull we feel towards the digital one.

And in my unprofessional opinion, neuroplasticity has made us increasingly digitally proficient, but at a cost of being digitally dependent. If being hired on as a London cab driver can change your brain on an MRI scan, and if life experiences like PTSD can alter the DNA and sperm, what irreversible alterations will 30,000 hours of staring into algorithmically-fed states of hypnosis do to the human mind or to their offspring?

In this short breath of time, we live in a state of existence that quite possibly no one else in world history has. We have both access to instant global connectivity, infinite information, and consumer-level access to artificial intelligence—but we are the last few humans in world history who remember what life was like before it. We are the last living people in history to have experienced life before the digital age, and I fear that it may become nearly impossible for younger generations to even differentiate the digital world from the real one before the end of my lifetime.

There is nothing inherently wrong with technology. There is nothing wrong with instant connection, and there is nothing intrinsically bad about access to abundant information. But what is bad is the lack of control and agency we have over these systems. Without realizing it, we are being programmed and our culture is becoming commodified. Therefore, the more time we spend on these digital information systems, the more we revert to the mean of one of a fixed set of broad internet cohorts. In other words: the more time we spend online, the more commoditized our culture, the more tribal our psychology, and the more vulnerable we become.

When the floods first came to Western North Carolina last year where I used to live, there were tens of thousands of people who showed up to help from all over the country. No one asked them, no one paid them, and most of the world has no idea they were ever even there. I was there the same day that the Governor of North Carolina came for his little photo op. He made a public announcement that day with the current statewide death toll of the floods, but that same morning alone, volunteer veterans with cadaver dogs that I had met with had pulled 15 bodies out of a single pile of debris near the KOA campground in Swannanoa.

The statewide count at that point had to have been well into the hundreds; I believe the number the Governor used that day was 28. In fact, there was a reefer truck that sat for two days full of bodies because the morgues were overflowing. And while FEMA was hoarding donated generators and denying people on their applications, it was the "nobodies" of the world that were driving UTVs and Jeeps with chainsaws up mountain roads rescuing people.

There were two guys we met that hot-wired a bulldozer from a quarry to cut a navigable path through a washed-out road in two days—a road that the state said would take months—allowing supplies to people who hadn't had contact with anyone in over a week. Volunteers were working 16 hours a day taking supplies on everything from horses to helicopters. It was humanity there in front of my very eyes.

And it was in those seven days in North Carolina that changed everything for me. It was people saving people. Even with a lack of leadership, failed protocols, and overwhelming inefficiency from the state, the nobodies took up the slack.

And so, I'm just here to remind you that we don't need our false idols. We should no longer rely on politicians who bow down to money to manage our city or our states. We need to find the real leaders everywhere and empower them. Western North Carolina was proof to me that there is an army of good people left in this world who want to do good things; we just have to give them places to gather and give them the ability to act.

And so I close with this: Do not fret because of those who are evil or be envious of those who do wrong; for like the grass they will soon wither, like green plants they will soon die away. Trust in the Lord and do good; dwell in the land and enjoy safe pasture. Take delight in the Lord and He will give you the desires of your heart.

And so, I'll see you on April the 5th in Spruce Pine, North Carolina, for the first official gathering. It is now my life's mission to revive rural America one town at a time. It’s called the Rural Revival Project.

So, thank you for listening.

The Rural Revival Project: Full Transcript

I appreciate the opportunity for your time. I've only got a few minutes here, so I've written some things down so you don't have to listen to me ramble.

But there is an evil I have seen under the sun—the sort of error that arises from a ruler: fools are put in many high positions while the rich occupy low ones. I have seen slaves on horseback while princes go on foot like slaves.

Since August of 2023, I have received a flood of messages: social media, email, handwritten letters. I've had—I don't know how many—conversations with people face-to-face, probably thousands at this point. And I realize now that we don't have any clue as to how many around us are really broken; how many are silently suffering and barely hanging on.

More often than not, they start the message with, "Hey, I’m a nobody," but followed by horrors of addiction, mental illness, financial and household struggles—oftentimes incredibly complicated stories that I suspect they may have never told anyone before. But they still have hopes of a hopeful future, and they don't want to give up no matter what.

And it kills me because these people—they aren't "nobodies" as they describe themselves. Our modern society's convenient, comfortable, fragile little existence is oftentimes carried on the backs of these self-declared nobodies. And forgive my generalization, but in the modern world, we are so busy idolizing the genuine nothings of society: the self-centered celebrities, spineless politicians, clickbait social media influencers. It seems, from my perspective, that oftentimes these people live comfortable little lives while many of our real heroes are dragged through the mud and never once given a genuine thank you for it.

But it's not just them that are hurting; we all are. I mean, that's why you're here at this conference, right? That's why people have traveled from all over the world to gather here. You all realize that it's time to do something.

So, to set the record straight, I'm not here as an intellectual, or a psychologist, or a politician, or even a respected member of society, all things considered. I'm a high school dropout who lives in a log cabin in the woods in Virginia. I myself am just a 32-year-old nobody, so I'm just here as the messenger.

I believe that many of the problems identified at this conference are quite possibly symptoms of a bigger problem. We currently exist in an age of rapid digital immersion. The current average American teenager will have spent something like 30,000 hours by the time they are 30 on social media. The average American spends six to nine hours a day staring at devices. And whether it's a city sidewalk, a family dinner table, the receptionist at an office, even people driving their damn cars down the roadway, I constantly see the struggle between maintaining conscious attention in the real world and the overwhelming pull we feel towards the digital one.

And in my unprofessional opinion, neuroplasticity has made us increasingly digitally proficient, but at a cost of being digitally dependent. If being hired on as a London cab driver can change your brain on an MRI scan, and if life experiences like PTSD can alter the DNA and sperm, what irreversible alterations will 30,000 hours of staring into algorithmically-fed states of hypnosis do to the human mind or to their offspring?

In this short breath of time, we live in a state of existence that quite possibly no one else in world history has. We have both access to instant global connectivity, infinite information, and consumer-level access to artificial intelligence—but we are the last few humans in world history who remember what life was like before it. We are the last living people in history to have experienced life before the digital age, and I fear that it may become nearly impossible for younger generations to even differentiate the digital world from the real one before the end of my lifetime.

There is nothing inherently wrong with technology. There is nothing wrong with instant connection, and there is nothing intrinsically bad about access to abundant information. But what is bad is the lack of control and agency we have over these systems. Without realizing it, we are being programmed and our culture is becoming commodified. Therefore, the more time we spend on these digital information systems, the more we revert to the mean of one of a fixed set of broad internet cohorts. In other words: the more time we spend online, the more commoditized our culture, the more tribal our psychology, and the more vulnerable we become.

When the floods first came to Western North Carolina last year where I used to live, there were tens of thousands of people who showed up to help from all over the country. No one asked them, no one paid them, and most of the world has no idea they were ever even there. I was there the same day that the Governor of North Carolina came for his little photo op. He made a public announcement that day with the current statewide death toll of the floods, but that same morning alone, volunteer veterans with cadaver dogs that I had met with had pulled 15 bodies out of a single pile of debris near the KOA campground in Swannanoa.

The statewide count at that point had to have been well into the hundreds; I believe the number the Governor used that day was 28. In fact, there was a reefer truck that sat for two days full of bodies because the morgues were overflowing. And while FEMA was hoarding donated generators and denying people on their applications, it was the "nobodies" of the world that were driving UTVs and Jeeps with chainsaws up mountain roads rescuing people.

There were two guys we met that hot-wired a bulldozer from a quarry to cut a navigable path through a washed-out road in two days—a road that the state said would take months—allowing supplies to people who hadn't had contact with anyone in over a week. Volunteers were working 16 hours a day taking supplies on everything from horses to helicopters. It was humanity there in front of my very eyes.

And it was in those seven days in North Carolina that changed everything for me. It was people saving people. Even with a lack of leadership, failed protocols, and overwhelming inefficiency from the state, the nobodies took up the slack.

And so, I'm just here to remind you that we don't need our false idols. We should no longer rely on politicians who bow down to money to manage our city or our states. We need to find the real leaders everywhere and empower them. Western North Carolina was proof to me that there is an army of good people left in this world who want to do good things; we just have to give them places to gather and give them the ability to act.

And so I close with this: Do not fret because of those who are evil or be envious of those who do wrong; for like the grass they will soon wither, like green plants they will soon die away. Trust in the Lord and do good; dwell in the land and enjoy safe pasture. Take delight in the Lord and He will give you the desires of your heart.

And so, I'll see you on April the 5th in Spruce Pine, North Carolina, for the first official gathering. It is now my life's mission to revive rural America one town at a time. It’s called the Rural Revival Project.

So, thank you for listening.

The Rural Revival Project: Full Transcript

I appreciate the opportunity for your time. I've only got a few minutes here, so I've written some things down so you don't have to listen to me ramble.

But there is an evil I have seen under the sun—the sort of error that arises from a ruler: fools are put in many high positions while the rich occupy low ones. I have seen slaves on horseback while princes go on foot like slaves.

Since August of 2023, I have received a flood of messages: social media, email, handwritten letters. I've had—I don't know how many—conversations with people face-to-face, probably thousands at this point. And I realize now that we don't have any clue as to how many around us are really broken; how many are silently suffering and barely hanging on.

More often than not, they start the message with, "Hey, I’m a nobody," but followed by horrors of addiction, mental illness, financial and household struggles—oftentimes incredibly complicated stories that I suspect they may have never told anyone before. But they still have hopes of a hopeful future, and they don't want to give up no matter what.

And it kills me because these people—they aren't "nobodies" as they describe themselves. Our modern society's convenient, comfortable, fragile little existence is oftentimes carried on the backs of these self-declared nobodies. And forgive my generalization, but in the modern world, we are so busy idolizing the genuine nothings of society: the self-centered celebrities, spineless politicians, clickbait social media influencers. It seems, from my perspective, that oftentimes these people live comfortable little lives while many of our real heroes are dragged through the mud and never once given a genuine thank you for it.

But it's not just them that are hurting; we all are. I mean, that's why you're here at this conference, right? That's why people have traveled from all over the world to gather here. You all realize that it's time to do something.

So, to set the record straight, I'm not here as an intellectual, or a psychologist, or a politician, or even a respected member of society, all things considered. I'm a high school dropout who lives in a log cabin in the woods in Virginia. I myself am just a 32-year-old nobody, so I'm just here as the messenger.

I believe that many of the problems identified at this conference are quite possibly symptoms of a bigger problem. We currently exist in an age of rapid digital immersion. The current average American teenager will have spent something like 30,000 hours by the time they are 30 on social media. The average American spends six to nine hours a day staring at devices. And whether it's a city sidewalk, a family dinner table, the receptionist at an office, even people driving their damn cars down the roadway, I constantly see the struggle between maintaining conscious attention in the real world and the overwhelming pull we feel towards the digital one.

And in my unprofessional opinion, neuroplasticity has made us increasingly digitally proficient, but at a cost of being digitally dependent. If being hired on as a London cab driver can change your brain on an MRI scan, and if life experiences like PTSD can alter the DNA and sperm, what irreversible alterations will 30,000 hours of staring into algorithmically-fed states of hypnosis do to the human mind or to their offspring?

In this short breath of time, we live in a state of existence that quite possibly no one else in world history has. We have both access to instant global connectivity, infinite information, and consumer-level access to artificial intelligence—but we are the last few humans in world history who remember what life was like before it. We are the last living people in history to have experienced life before the digital age, and I fear that it may become nearly impossible for younger generations to even differentiate the digital world from the real one before the end of my lifetime.

There is nothing inherently wrong with technology. There is nothing wrong with instant connection, and there is nothing intrinsically bad about access to abundant information. But what is bad is the lack of control and agency we have over these systems. Without realizing it, we are being programmed and our culture is becoming commodified. Therefore, the more time we spend on these digital information systems, the more we revert to the mean of one of a fixed set of broad internet cohorts. In other words: the more time we spend online, the more commoditized our culture, the more tribal our psychology, and the more vulnerable we become.

When the floods first came to Western North Carolina last year where I used to live, there were tens of thousands of people who showed up to help from all over the country. No one asked them, no one paid them, and most of the world has no idea they were ever even there. I was there the same day that the Governor of North Carolina came for his little photo op. He made a public announcement that day with the current statewide death toll of the floods, but that same morning alone, volunteer veterans with cadaver dogs that I had met with had pulled 15 bodies out of a single pile of debris near the KOA campground in Swannanoa.

The statewide count at that point had to have been well into the hundreds; I believe the number the Governor used that day was 28. In fact, there was a reefer truck that sat for two days full of bodies because the morgues were overflowing. And while FEMA was hoarding donated generators and denying people on their applications, it was the "nobodies" of the world that were driving UTVs and Jeeps with chainsaws up mountain roads rescuing people.

There were two guys we met that hot-wired a bulldozer from a quarry to cut a navigable path through a washed-out road in two days—a road that the state said would take months—allowing supplies to people who hadn't had contact with anyone in over a week. Volunteers were working 16 hours a day taking supplies on everything from horses to helicopters. It was humanity there in front of my very eyes.

And it was in those seven days in North Carolina that changed everything for me. It was people saving people. Even with a lack of leadership, failed protocols, and overwhelming inefficiency from the state, the nobodies took up the slack.

And so, I'm just here to remind you that we don't need our false idols. We should no longer rely on politicians who bow down to money to manage our city or our states. We need to find the real leaders everywhere and empower them. Western North Carolina was proof to me that there is an army of good people left in this world who want to do good things; we just have to give them places to gather and give them the ability to act.

And so I close with this: Do not fret because of those who are evil or be envious of those who do wrong; for like the grass they will soon wither, like green plants they will soon die away. Trust in the Lord and do good; dwell in the land and enjoy safe pasture. Take delight in the Lord and He will give you the desires of your heart.

And so, I'll see you on April the 5th in Spruce Pine, North Carolina, for the first official gathering. It is now my life's mission to revive rural America one town at a time. It’s called the Rural Revival Project.

So, thank you for listening.NEW: MiPrimerBitcoin releases annual impact report, thousands of students received certificates 👀

🌍 Global Scale: Expandsion to 39 countries by launching 28 new independent education nodes.

⚡️ Nostr Native: Gamified education platform built on Nostr with Zaps and badges.

💰 Big Backing: $1M donated by

@jack Dorsey to keep the curriculum open-source and free for everyone

#MiPrimerBitcoin @My First Bitcoin

You Heard It Was Bad...

@bitcoin.rocks launches new flyer campaign for bitcoin community education 👀

View quoted note →

View quoted note →

View quoted note →

View quoted note →NEW: UNCLE ROCKSTAR DID IT AGAIN

He can't stop, won't stop fighting the good fight.

His weapon is humor.

His shield is FOSS tech.

His latest coup?

A plugin for Bitcoinize POS machines that let you print unbank notes including QR codes that contain SATS

#RockstarDev #Bitcoinize #POS #Sats #Unbank #FOSS @Bitcoinize Point of Sale Machine

@UNCLE ROCKSTAR

The Invoice Is Dead – A Manifesto for Continuous Settlement in the Energy Economy

Energy can no longer afford to settle in hindsight.

The Invoice Is a Product of Its Time

Lightning News

Stop Billing, Start Streaming: Austin Mitchell’s Case Against Net-30 Invoices

This article was originally published on Medium.

The Invoice Is Dead - A Manifesto for Continuous Settlement in the Energy Economy

Energy can...

NEW: 1,000,000 Sats donated to GitCitadel open source development cooperative 👀

#foss #gitcitadel

View quoted note →

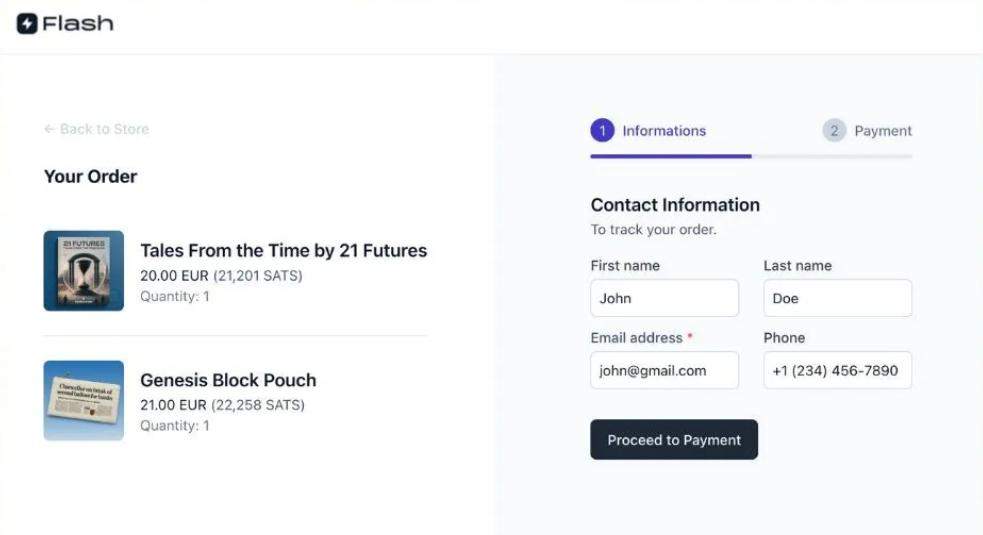

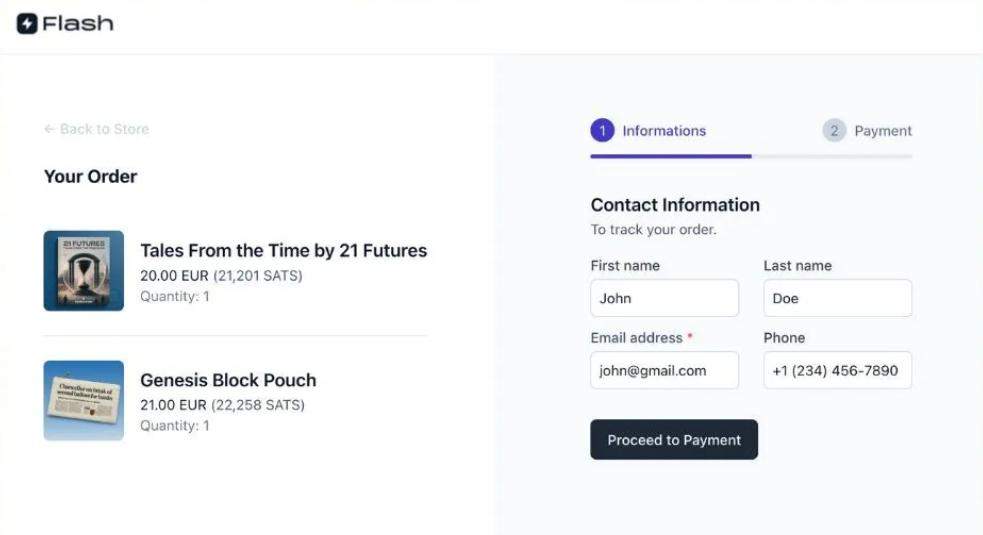

Flash Review: Connect any NWC wallet and access payment features such as invoices, subscriptions, pay buttons, storefront and more ⚡

Lightning News

Getting Started With Flash: The All-in-One Bitcoin & Lightning Payment Platform

Getting Started with Bitcoin Payments and 'Pay With Flash': A Quick Starter Guide

Are you interested to learn more about all the h...

🔥 NEW: Steak n Shake to pay employees a $0.21 Bitcoin bonus of for every hour worked 👀

Chris proposes NIP-CF to make Nostr Feeds more consistent and current

View article →

NEW: 🇺🇬 Bluetooth mesh-network messenger "Bitchat" now most downloaded app in Uganda amid government-ordered nationwide internet shutdown 👀

@npub1teaw...gq5u Verifying My Public Key: "@LightningNewsX"

🔥 NEW: This website might hurt your feelings.

Ever wondered what your old gadgets are really worth? BitcoinOrStuff.com is the new "regret calculator" that shows you exactly how much wealth you torched by buying consumer tech instead of stacking sats.

That "revolutionary" smartphone you bought a few years ago? It's now e-waste, but the #Bitcoin you could have bought with that same cash might be a down payment on a house today. 📉📱 vs 📈🏠

A brutal but necessary lesson in opportunity cost and high time preference. Check your numbers (if you dare). 👇

🔗

Bitcoin or Stuff

Bitcoin or Stuff - What if you bought Bitcoin instead?

Calculate how much Bitcoin you could have if you bought BTC instead of tech flops and consumer products. See the opportunity cost in real-time.

NEW: 🇺🇬 Uganda Communications Commission executive says "Bitchat" and "Nostrum" on live TV 👀

#Bitchat #Nostrum #Nostr #Uganda #GrowNostr

#bitcoin

💥 NEW: Crowdhealth sees parabolic user growth in January 👀💥

BUT what's "CrOwDhEaLtH" ? 🤔

CrowdHealth is a simpler way to pay for health treatments.

Traditional h-insurance is expensive and bureaucratic.

And it can happen that your insurance provider refuses to cover your bills.

Unlike CrowdHealth.

Instead of an insurance company, you join a group of people who help each other out.

How it works:

You pay a small monthly fee to be a member.

If you have a big bill (over $500), the community chips in to pay it for you.

You can go to any doctor.

And vice versa.

Each month, you’ll be asked to help crowdfund another member’s medical bill.

Never more than your set monthly maximum.

CrowdHealth thoroughly reviews each bill to ensure it’s legitimate, fairly priced, and eligible.

Your contribution goes directly to the other member to help fund their medical expenses.

To date, 99.9% of the bills submitted to the community have been fully funded!!

The genius part?

You pay a set monthly amount.

The money pays for the bills. But there's usually left over money.

The "extra" money can be allocated to bitcoin via Fold.

Regulatory constraints ruled out pooled bitcoin funds, for now, but CrowdHealth found a clever workaround. Members make two separate payments each month:

$55 “Advocacy Fee”: Covers bill negotiation, access to the app, and a Personal Care Advocate.

A crowdfunding contribution: Sent directly to other members to pay medical bills. For non-Bitcoin members, this amount changes monthly based on need. For Bitcoin members, it’s fixed at $140.

In the Bitcoin plan, if the month’s actual need is less than $140, say $75, then the leftover $65 difference is automatically deposited into their Fold account.

It's basically a "help-each-other-out" club for people who want to save money on healthcare and believe bitcoin is perfect for long-term savings. 🤝

Learn more at

@CrowdHealth

🇩🇪 NEW: Germany's largest government-backed TV station "ZDF" just released a 45-min long documentary about Bitcoin and it's the first of a series

Abstract:

In the pilot episode of "The World in Money," host Katjana Gerz asks: What is really behind Bitcoin, Ethereum, and the like? Who benefits, and who gets left behind? Do you have to get involved, or is this just a passing fad? Is crypto the future of money or merely digital gambling?

A Revolutionary Idea?

The advantages: Cryptocurrencies are independent of states or central banks. Demand determines their value. No authority watches over them—for many, this is seen as liberation from the traditional financial system. They offer the possibility of maintaining 100% self-custody of one’s own assets.

However, this also harbors disadvantages: No guarantees, no absolute security. Many fall victim to scams and the promise of quick money, while others lose the password to their wallet and, as a result, sometimes millions.

Digital Gold or Scam?

Anyone wanting to understand where our monetary system is heading cannot ignore cryptocurrencies. Bitcoin, considered by many to be the only true cryptocurrency, surpasses companies like Amazon and Meta in value with a market capitalization of over one trillion euros, breaking all records. While some investors make enormous profits, others lose everything due to crashes, hacks, or simply false promises.

Crypto also feeds an ancient dream: that of quick riches. Social media is teeming with crypto gurus, trading tips, and success stories, often coupled with the message: Anyone can get rich; you just have to get in now. It is high time, therefore, to put cryptocurrencies to the test.

Between Hype and Reality

The episode "Cryptocurrencies" sheds light on a world full of promises and visions, but also losses. Katjana "loses" the password to her wallet and flies to the USA to visit one of the world's most famous hardware hackers. Can Joe Grand recover her crypto funds? Together with crypto critic Jürgen Geuter, Katjana heads to a casino to clarify whether crypto is often nothing more than digital gambling. Victims of a manipulative crypto scammer report losses of nearly 400,000 euros. Cyber prosecutor Jana Ringwald investigates illegal platforms yet speaks surprisingly positively about crypto. Together, they go "shopping" on the Darknet, where Katjana learns how to use cryptocurrencies as an anonymous means of payment.

The film by Benjamin Arcioli and Krissi Kowsky asks: Is crypto the currency of the future or an unregulated casino?

#Bitcoin #BitcoinFilm #BitcoinDocumentary

⚡ Lightning Network

🔋Total Capacity: 5,745 BTC

🔋 Avg. Capacity: 13,719,812 sats

🖥️ Total Nodes: 17,329

🤵♂️ Clearnet: 4,612

🕵️ Tor: 9,171

🔀 Channels: 41,873

💸 Avg. Fee: 858 ppm

💸 Avg. Base Fee: 927 msats

#Bitcoin #LightningNetwork