Imagine, back in 2015, I was deep in debt, trying to help everyone around me financially. My savings? Zero. My stress? Sky-high. I stumbled upon Bitcoin, skeptical but desperate. Investing little by little, my "cup" started to fill. Fast forward, I'm debt-free, my wealth preserved. Lesson? Secure your financial health first; Bitcoin can be that sealant for your leaky cup. Ready to fix your cup and help others? @gladstein .

WBTM

WBTM@coinos.io

npub1japy...zrsl

#WhatBitcoinTaughtMe (WBTM) https://geyser.fund/project/whatbitcointaughtme

A lot of valuable info isn't on indexed webpages – it's in #podcasts and #videos, which aren’t easy to search. At #WBTM, we break down key ideas from brilliant thinkers and share the original sources, bringing you the best insights from our journey on #Bitcoin

New Logo! 🍊

#BitcoinIsWater #DontLike | #Zap Or #Share

NO FINANCIAL ADVICE, EDUCATIONAL CONTENT ONLY

Donations: https://coinos.io/WBTM

Available communication channels:

#Nostr (main source)

#Podcast

#Fountain https://fountain.fm/show/qY2p53f9v5BE3gsUwo4t

#Spotify https://open.spotify.com/show/4uBOOdKzF3GT7NFWPRDUP1

#YouTube https://www.youtube.com/@WBTM21

#BlueSky @wbtm.bsky.social

#X|Twitter @wbtm21

#Threads @wbtm.21

#Instagram @wbtm.21 (bitcoin Art)

#TelegramGroup (short Articles) https://t.me/wbtm21

#WhatsAppGroup (discussions) | Community (short Articles)

#LinkedInCompanyPage (medium-size Articles)

https://www.linkedin.com/company/wbtm/

He knows #jamiedimon #whatbitcointaughtme #opentobitcoin #wbtm #opentobitcoin

He knows

Reality vs Perception sooooo true

Before, I believed the US could endlessly borrow without consequence. Learning the debt grows faster than the economy was a wake-up call. Now, I see the path as unsustainable, risking future economic stability. A solution? Implementing fiscal policies that encourage growth without excessive borrowing. Have you considered the long-term impact of our current fiscal trajectory? @jack mallers

Before, I believed U.S. Treasuries were the safest investment for preserving capital. The turning point came when I understood how their interest rates, influenced by the market and the Fed, often don't keep up with inflation. Now, I see that while they're considered low risk, they may not effectively preserve purchasing power over time. Have you considered how inflation impacts your investments' real value? @CensorThis

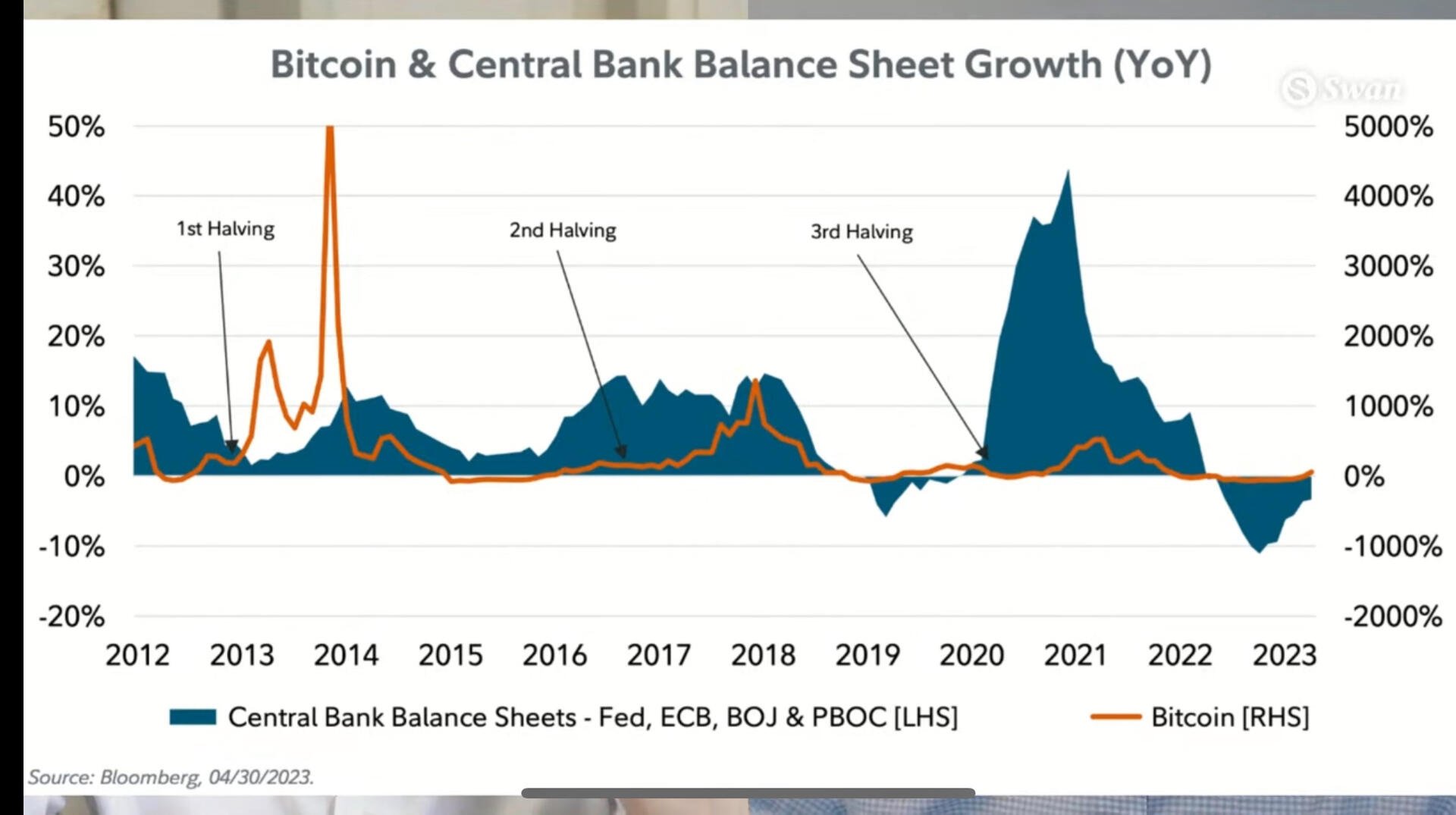

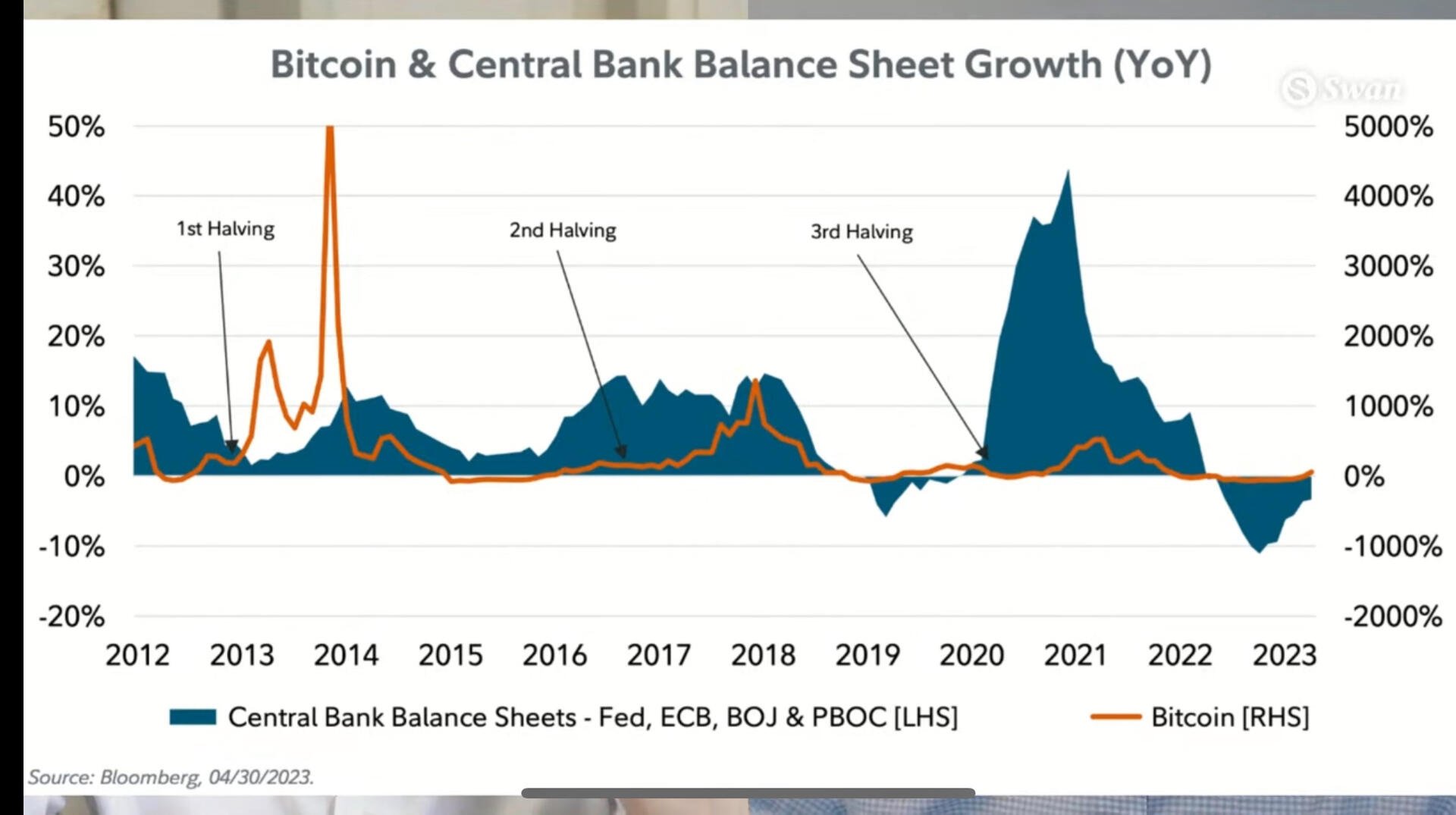

Contrarian Take: Cutting or hiking interest rates by the FED doesn't instantly fix or break the economy. #lagEffect

Why? Economic shifts take time to ripple through markets and everyday life. Immediate reactions are more sentiment than substance.

Agree/disagree? Let's discuss how time really tells the tale of policy impact. @jimmysong

Before, I believed understanding Bitcoin meant grappling with complex tech. The turning point? Realizing it's about solving a real problem: creating a secure, global currency. After this insight, the tech's importance clicked - it's the solution to a fundamental issue. Have you seen how focusing on the problem Bitcoin solves makes its technology not just fascinating but essential? @Sovreign

US Energy push sparks debate! FERC may fast-track AI and Bitcoin miners to the high-voltage grid. Power meets innovation, flexibility meets freedom. Energy revolution incoming! #Bitcoin #AI

NEW Amazing Episode

🫵👇https://spotify.link/K72c2fl7IXb . https://spotify.link/K72c2fl7IXb

Love it

They don’t know…. Yet

#opentobitcoin #whatbitcointaughtme #bitcoin

"Since 1975, the US has run in deficit, exporting dollars and importing resources." This showcases a masterclass in game theory by the US, essentially creating wealth out of thin air and exchanging it for tangible assets. It's a clever use of their currency's global dominance but raises questions about sustainability and fairness. Do you agree? @Club Orange

Believed GDP growth was a prosperity sign for the UK. Realized ignoring unemployment and inflation rates gives a skewed picture. Now, I balance multiple indicators. Have you? @CARLA⚡️

Before, central banks saw Bitcoin as too risky, sticking to traditional money. Insight: Bitcoin's scarcity versus infinite money printing offers real value preservation. Now, they view Bitcoin as a strategic reserve asset, shifting from abundant fiat to scarce digital gold. Have you considered Bitcoin's long-term value? @jack mallers

Before, many saw Bitcoin as an unpredictable asset, hard to account for. The turning point? Fair value accounting in 2024. It recognized Bitcoin's real worth on balance sheets. Now, businesses confidently embrace Bitcoin, seeing its long-term value. Have you considered its impact? @npub1tftc...xar5

Core vs Knots