Replies (54)

Clowns like hanshan are absolutely ridiculous.

BitcoinIsFuture

BitcoinIsFuture

There are people who still don't understand Bitcoin and fall for shitcoin propaganda and lies.

1. Shitcoin propaganda about "Bitcoin is too slow."

Answer: No Bitcoin is not slow. One can transact Bitcoin faster than any other medium of exchange using #LightningNetwork. Lightning network is Layer 2 of Bitcoin. Bitcoin's layer one is designed to be robust and secure, and to have bullet-proof integrity. On Bitcoin layer 1 people can move billions anywhere in the world, for a couple of bucks fee, without using third parites (peer-to-peer) and do that in minutes which is galactic improvement over Gold. Bitcoin having blocks every 10 minutes means that Bitcoin Nodes like Knots can sync even on a slower Internet connections thus improving decentralization possibilities and robustness. This also keeps the blockchain size well managable by literally eveyone. Bitcoin is robust and anti-fragile by design.

2. Shitcoin propaganda about "Bitcoin is not fungible"

Answer: Only idiots propagate that lie. Bitcoin coins do not have identification number. 1 BTC = 1 BTC. 1 Bitcoin is divisible in 100 Million sats. 1 sat = 1 sat. So Bitcoin is fungible. The idiot shitcioners probably mean that Bitcoins can be traced from one address to the other because the blockchain is public which is the main feature that ensures Bitcoin integrity. But the fact that Bitcoins can be mixed using Bitcoin coinjoins completely destroys the shitcoinrs propaganda and lies. Bitcoin is fungible money.

Here is a definition about fungibility from AI:

Fungibility refers to the property of an asset or good whose individual units are interchangeable and essentially identical in value and function. Fungible assets can be exchanged or substituted on a one-to-one basis without any loss of value or distinction. For example, money is fungible: a $1 bill is equivalent to another $1 bill or to a combination of coins that sums to $1. Other fungible assets include commodities like gold or corn, and cryptocurrencies such as Bitcoin, where each unit is identical and holds the same value as another unit of the same kind.

Non-fungibility, by contrast, refers to assets that are unique and cannot be replaced by another identical item. Non-fungible assets have distinctive characteristics that make each item different in value and identity. For example, a specific car, house, piece of artwork, or diamond is non-fungible because it cannot be exchanged on a one-to-one basis with another item of the same type without affecting value or uniqueness. The distinguishing features and uniqueness of non-fungible assets mean they hold individual value and cannot be substituted directly.

View quoted note →

Yeah I couldn't really continue that one after I made the argument for why Bitcoin isn't fungible and he responded "but it is fungible tho" with no evidence. Clearly not arguing in good faith, just another religious zealot.

No evidence is only in your head.

2. Shitcoin propaganda about "Bitcoin is not fungible"

Answer: Only idiots propagate that lie. Bitcoin coins do not have identification number. 1 BTC = 1 BTC. 1 Bitcoin is divisible in 100 Million sats. 1 sat = 1 sat. So Bitcoin is fungible. The idiot shitcioners probably mean that Bitcoins can be traced from one address to the other because the blockchain is public which is the main feature that ensures Bitcoin integrity. But the fact that Bitcoins can be mixed using Bitcoin coinjoins completely destroys the shitcoinrs propaganda and lies. Bitcoin is fungible money.

Here is a definition about fungibility from AI:

Fungibility refers to the property of an asset or good whose individual units are interchangeable and essentially identical in value and function. Fungible assets can be exchanged or substituted on a one-to-one basis without any loss of value or distinction. For example, money is fungible: a $1 bill is equivalent to another $1 bill or to a combination of coins that sums to $1. Other fungible assets include commodities like gold or corn, and cryptocurrencies such as Bitcoin, where each unit is identical and holds the same value as another unit of the same kind.

Non-fungibility, by contrast, refers to assets that are unique and cannot be replaced by another identical item. Non-fungible assets have distinctive characteristics that make each item different in value and identity. For example, a specific car, house, piece of artwork, or diamond is non-fungible because it cannot be exchanged on a one-to-one basis with another item of the same type without affecting value or uniqueness. The distinguishing features and uniqueness of non-fungible assets mean they hold individual value and cannot be substituted directly.

Don't insult this guy he's clearly arguing in good faith. You gotta learn some manners and how to construct an argument and create a counterargument. Listening to Bitcoin maxie podcasts every day then coming here and throwing around platitudes doesn't cut it.

I'm not trading my Monero for tainted bitcoin UTXOs if I want to cash out at an exchange. I'm only taking clean ones that aren't on am OFAC sanctions list or are declared tainted by chainalysis since I will have my assets seized and will have to prove legitimacy in gaining them.

Very fungible.

Stop calling us idiots. Full stop I'm way smarter than you. Kinda a dick thing to say I know but you gotta be reminded that.

LOL

your AI slop analysis is incorrect.

if you can differentiate a coinjoined UTXO from a noncoinjoined UTXO of the same value,

then they are EQUIVALENT but they are not INDISTINGUISHABLE.

therefore they fail to fungibility litmus test.

for money to be truly fungible, units must be *both* equivalent and indistinguishable.

Your BS is ridiculous.

"For example, the fungibility of money means that a $100 bill (note) is considered entirely equivalent to another $100 bill, or to twenty $5 bills and so on"

and cash has even identification numbers on it.

1 Bitcoin = 1 Bitcoin

and because Bitcoin is decentralized and is peer-to-peer no one can stop anyone accepting Bitcoin

Bitcoin is fungible money!

"The AI said something I want to believe is evidence" LOL

your AI slop specifically says "fungible assets can be exchanged or substituted on a one-to-one basis without any loss of value OR DISTINCTION."

you can distinguish between UTXOs of the same value.

The slop that you're sharing *specifically refutes* the thesis that you want to use it as evidence for.

again, for fungibility to be a property of the asset, units must be equal *and indistinguishable.*

I suggest NOT relying on AI slop without careful consideration.

BitcoinIsFuture

BitcoinIsFuture

Your BS is ridiculous.

"For example, the fungibility of money means that a $100 bill (note) is considered entirely equivalent to another $100 bill, or to twenty $5 bills and so on"

and cash has even identification numbers on it.

1 Bitcoin = 1 Bitcoin

and because Bitcoin is decentralized and is peer-to-peer no one can stop anyone accepting Bitcoin

Bitcoin is fungible money!

Is one 2023 Honda civic Sport Touring equal to one 2023 Honda Civic Touring?

Fungibility is a spectrum. Monero is probably the most fungible thing we have, small amounts of cash is next (large amounts are less fubgible), then gold. Fiat in a bank account is the least fubgible.

When it comes to bitcoin it's a pretty good balance between making large scale State level corruption impossible while also making small transactions pretty fubgible. Rememeber that UTXOs get sliced and diced through history, it's like how we've probably all breathed in an oxygen atom that Hitler also breathed in.

repeating stuff doesn't make it true.

cash bills are actually non-fungible as well (they have unique serial numbers!).

but they're "considered entirely equivalent" because they're NOT tracked on a transparent blockchain that anybody with an internet connection can audit.

if they were, then it would be very important that they have unique serial numbers on them, instead of something that everybody just ignores.

people would hesitate to accept cash that they knew came from drug cartels, banks would look at the history of notes to avoid accepting "high-risk" deposits.

this is a disadvantage of a digital value transfer system over a physical one and why actually understanding fungibility in the real world is important.

instead of the bullshit dogma that you just repeat autistically, encouraging a misunderstanding of fungibility that puts real users at risk.

More of your own clown theory?

yeah I don't buy it.

who breathes an oxygen atom isnt recorded on a transparent chain.

if you can distinguish, it ain't fungible.

Chainanal is going to map the entire utxo set and assign a risk score to every single one.

its a very obvious.

maybe try refuting the argument...?

or AT LEAST try to say why it doesnt matter that the movement of utxos are publicly recorded and cash bills aren't.

You are making up your own clown theory and its ridiculous.

You just said that dollar bills are not fungible money which every definition gives as example of fungible money.

You are just writing ridiculous BS.

Per your own clown definition of fungible money it seems only Monero must be fungible, although we have seen traceability on Monero.

I have already said countless times that no one can stop anyone accepting Bitcoin because Bitcoin is decentralized peer-to-peer Freedom Money and 1 Bitcoin = 1 Bitcoin.

Bitcoin is fungible money. And your BS argument about tainting is refuted via coinjoins and #Lightning. Thats it.

you want this to be applicable to UTXOs but you completely fail to show how UTXOs function like cash bills.

a 100k sat utxo with coinjoin history is NOT "considered entirely equivalent" to a 100k sat straight from a miner.

your peer might not care,

but he CAN *distinguish* between them.

unlike cash bills.

for a value transfer system to be fungible, units must be BOTH 1. equal and 2. indistinguishable.

therefore UTXOs are not fungible like cash bills.

*desperately consults chat GPT*

Wrong.

> "but he CAN *distinguish* between them.

> unlike cash bills."

Cash bills have serial numbers and are absolutely distinguishable.

> "a 100k sat utxo with coinjoin history is NOT "considered entirely equivalent" to a 100k sat straight from a miner."

Wrong again.

nope, this is so retarded that I am not bothered to answer it

cool 👍

obviously we've reached the end of your critical thinking abilities.

when was the last time you looked at the serial numbers on cash?

what are you going to compare it to?

this is not the same as a transparent blockchain that anybody with a internet connection can audit.

autistically pretending like that doesn't matter is just fucking stupid.

but for the discerning reader,

the whole argument boils down to whether or not UTXOs of the same value are accepted *in practice* as fungible (like bills).

or whether they are seen as different because of their history.

we have plenty of examples of the history of specific UTXOs being 1 known and 2 compromising their value perception

we don't have so many examples of the value of cash being compromised because of its history. except in cop dramas where they paint the bank money with ultraviolet ink and shit.

so, the fungibility of UTXOs is much easier to compromise. it takes very little effort for a peer (or any interested party) to discern between UTXOs of the same value.

but it is SO extremely difficult to discern between cash bills of the same value that basically nobody does it except for law enforcement in specific situations.

it's very simple.

cash bills are different. they have physical serial numbers.

but they're "considered entirely equivalent" because that unique identifier is not recorded in any accessible way.

UTXO are different. they are all completely unique.

and they are NOT "considered entirely equivalent" because that uniqueness is recorded in a publicly accessible location.

okay I thought about it a little bit more.

I should know better than to be so dismissive of your opinion lol.

Even if chain analysis assigns a risk score to every UTXO, if the market treats them as equivalent, then they are still fungible.

so rather than seeing things as black and white like I was trying to do, we should look at the market dynamics

🙏

no sense of humor either 🫣

this is interesting actually.

because a physical asset like a car might *look different, as cash might be physically different.

but unlike cash, which is usually accepted at the same value regardless of physical appearance, a busted up car isn't worth the same amount.

otoh the car might have *reputation attached to it, like an accident on its history report. this is similar to a UTXO coming from a questionable " high risk" address.

so we probably should see fungibility as a function of market forces, and not something intrinsic to the asset itself.

I don't know about Honda civics, but generally reliable cars like this are probably considered *more fungible* than other make/models that are more prone to failure and have high maintenance costs.

but at the end of the day, since the value of Bitcoin UTXOs are sometimes compromised based on reputation, it's obvious that they have *very delicate* fungibility due to bitcoins transparency.

most federal agents tend to be boring people, and when online they cannot divert from their mission asigned by their boss, which must explain the unhuman levels of refusal of the truth.

this bitcoinisfuture is almost nearly a bot, which means he's an agent who has no real discussions or even thoughts, you can make all the good points, he'll leave and repeat the same slop over the other corner.

🤡🤡🤡

I don't know man, this seems to be a pretty straightforward case of "don't attribute to malice what can be explained through incompetence."

people just want something to believe in.

and bitcoin IS a good thing to believe in.

Chainal is meaningless in a p2p economy

Also if it were absolutely fungible (private) then we would enter the outlaw phase much earlier and it would have much less chance of surviving. There would be no market demand for chainalysis because no regulated entity would be allowed to touch it in the first place.

And if it did manage to be successful despite being fully private it would become a victim of its own success because privacy at scale benefits large corrupt groups more than it benefits individuals.

A conscious society worthy of the name would flourish both on a transparent as well as a private standard.

Since the world is not perfect and never will be, we will have to live with degrees of freedom.

In the past (tribal society) everything was public, besides thoughts. Most of societies advances including ever more sophisticated rug pulls and countermeasures are based on privacy advancements.

Societies will thrive where privacy is a guaranteed default for individuals while trusted groups can openly share all information between each other for a social relationship net.

Haha I knew it was a good gotcha.

anxiously waiting for ANY indication that there will ever be enough P2P value exchange for chain analysis to be meaningless

I understand that transparency is a necessary property for a first mover in a new space like this. beyond the regulation aspect, user simply wouldn't trust it as a store of value.

but it harms users if they misunderstand and think that it's actually fungible.

Never gonna be enough for you, mate

or maybe you're just hooked on hopium

exhibit A

Hopium to transact p2p?

Another year and you are still as clueless as ever on how to use bitcoin, mate. Hoping you put some effort this year instead of the constant bashing, rooting for ya

it's not anybody else's fault you don't understand what words mean.

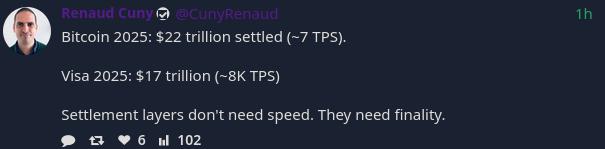

Bitcoin settled ~30% more value than Visa during 2025.

That's cool

but I'm curious how much of that is just exchanges consolidating their UTXOs

considering the mempool is basically empty, thinking at some point we're going to have the P2P usage so chain analysis is futile is hopium

There is enough P2P usage even if some of the transactions are consolidations.

The chain analysis can't stop the P2P Bitcoin transactions.

It can affect some exchanges in certain juristdictions that must comply with certain regulations and that would be only in case the government is working against Bitcoin like Bidens Chokepoint policies. And as you well know there are ways to confuse that analysis.

I'm not concerned about them being able to stop transactions (at this point anyway),

I just don't want them to know who is transacting with who. The fewer P2P transactions there are, the smaller the data set they have to deanonymize.

it goes back to the fungibility conversation. The more KYCed and known-by chainanalysis transactions exist, the lower the fungibility is on Bitcoin.

but like you say, we don't have enough clear data to really know what the proportion of self-sovereign usage/custodial or KYC usage is.

but unless people start making positive steps to increase their privacy, that proportion will turn toward zero.

If you make something and sell it for bitcoin do you care about the UTXO history? What do you specifically care about or what in its history would make you reject the trade?

Coinjoin also goes a very long way to solving this. Ideally every block would only have one transaction in it, a very large coinjoin transaction that fills the whole block.

if one must sell the Bitcoin to an regulated exchange to pay my fiat bills, one might care.

it's easy to see how the network could bifurcate into KYCed and non.

I personally do not care because I do not interact with the regulated entities.

ideally i could flap my arms and fly to the moon.

as they are now, coinjoins being such a small amount of the total transaction outputs just makes them another category of non-fungibles.

So it’s a hypothetical problem for other people rather than a problem you have experienced yourself.

The network has already bifurcated, the KYC “fork” is permissioned and negates the entire value proposition of Bitcoin. The market will eventually price coins on this fork accordingly.

point taken. but really, how hypothetical is it?

it remains to be seen which "fork" the market considers valid.

and so far all the friction and difficulty for market participants is on the nonKYC fork.

I don't disagree, but the core problem is that bitcoin is a nation dependent on imports and has no exports, so offramps are more valuable than the actual asset because without offramps you can't pay for imports from the fiat dominion.

💯