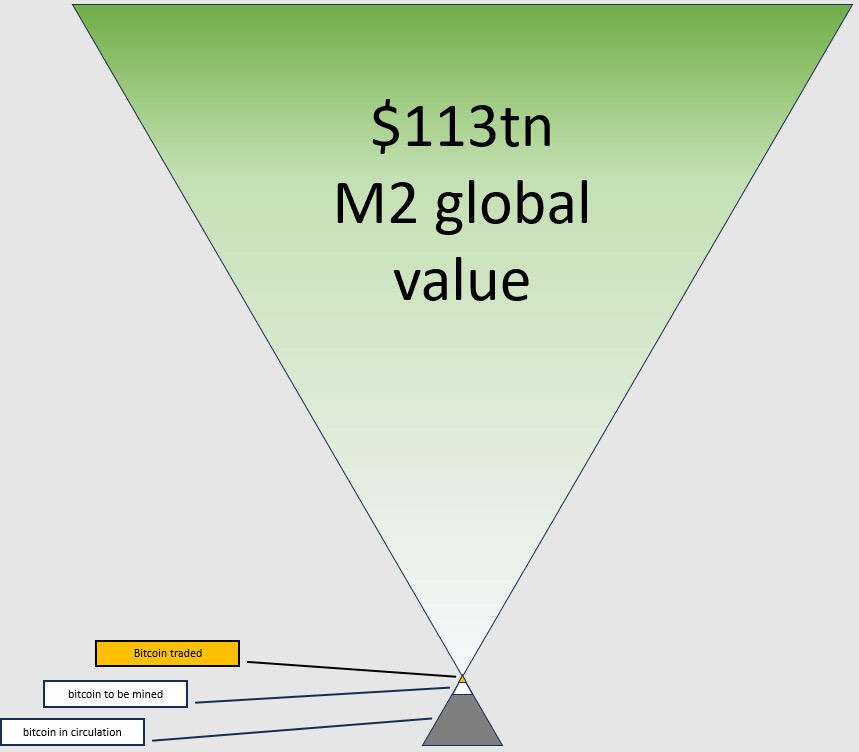

Fun back-of-the-napkin #bitcoin gymnastics:

Global currencies’ M2 (money supply plus less liquid assets like deposits) guess = $113 trillion USD equivalent

19.7 million #bitcoin in circulation

Implied value per circulated #bitcoin = $5.7 million

…then again…

~300,000 #bitcoin traded on exchanges around the world (pretend this is all that is available to acquire)

Implied value = ~$375 million per traded #bitcoin

Somewhat bearish, but even then why sell? Study #bitcoin and have fun. Credit to @SatsMan for the scaled inverted triangle image inspiration scaled to these numbers