Maybe it’s because @Michael Saylor, $trategy and BlackRock haven’t realized the following, @Jor:

1. A Coinbase IOU ≠ Bitcoin

2. "Not your keys. Not your coins"

3. "Your bitcoin having a custodian is like your girlfriend having a boyfriend"

But BTC/USD, $MSTR and $IBIT are trading around the claims that:

- $trategy got 671,268 BTC at Coinbase

- $IBIT got ₿ 772,584 BTC at Coinbase

- The black box Coinbase haven't been hacked, even though Coinbase went down two times in ~8 days in October (when Amazon Web Services broke 1/3 of the internet)

What’s your insights into this matter @jack mallers?

View quoted note →

View quoted note →

View quoted note →

View quoted note →

View quoted note →

View quoted note →

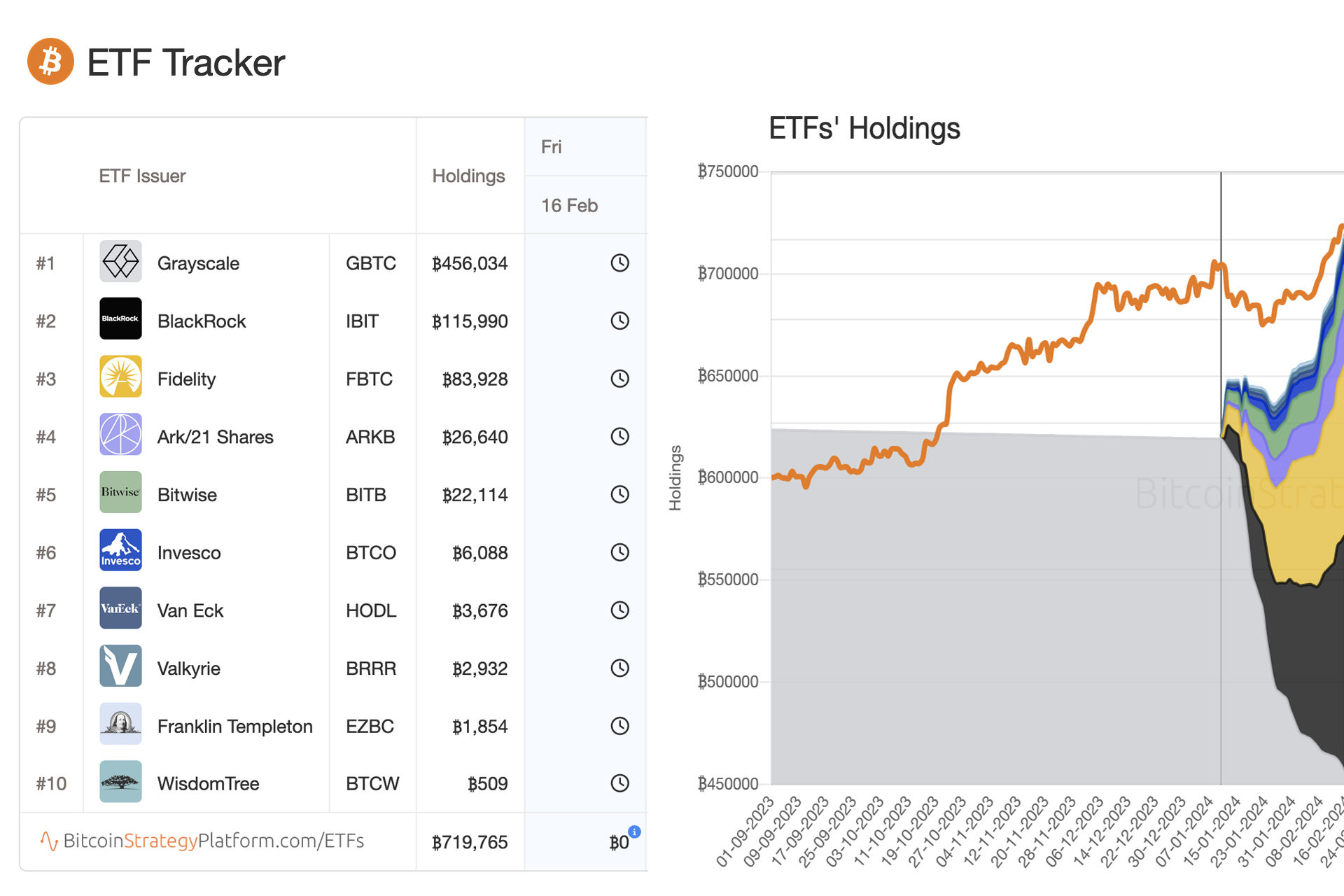

Bitcoin Strategy Platform

ETF Tracker — Bitcoin Strategy

Monitor the flows of ETFs holdings.

BitcoinTreasuries.NET - Top Bitcoin Treasury Companies

Track Bitcoin holdings of public companies, governments, and institutions. Live data on corporate BTC treasuries with real-time valuations.