1/ In this thread 🧵 I want to show you some good on chain #Bitcoin indicators to know where the price is at the cycle.

I’ll do in the order the indicator was triggered.

Remember 11-09-22 Bitcoin bottom was $15,682 (I think it’s this cycle bottom, I hope so)

Login to reply

Replies (12)

2/ SOPR (SPENT OUTPUT PROFIT RATIO): it is the ratio between the value of the UTXO when created and when the UTXO is spent.

Greater than 1 -> Bullish

Lower than 1 -> Bearish

On 01-11-23 this indicator is triggered. Chart shows a changing trend from less than 1 to more than 1.

I use 14D moving average. For more noise try 7D

Glassnode Studio - Digital Asset Analytics

Glassnode Studio delivers trusted digital assets analytics, helping investors and teams analyze market trends, asset activity, and ecosystem dynami...

3/ REALIZED PRICE: it is the value of all bitcoins at the price they were bought divided by the number of bitcoins in circulation.

It shows clearly the long timeframe trend.

On 01-11-23 this indicator is triggered

Bitcoin Magazine Pro

Realized Price | BM Pro

Realized Price Free Bitcoin Live Chart showing Realized Price versus Market Price.

4/ 200D SMOOTHED MOVING AVERAGE

Moving average on daily timeframe

On 01-16-23 this indicator is triggered.

For less noise, try 200W MOVING AVERAGE

Actually triggered this week, BUT wait for the closed week candle to confirm.

Bitcoin Magazine Pro

200 Week Moving Average Heatmap | BM Pro

200 week moving average (WMA) heatmap for Bitcoin investing. Uses a colour heatmap based on the % increases of that 200 week moving average.

5/ GOLDEN CROSS

When EMA25 exceeds EMA100 on daily

On 02-07-23 this indicator is triggered.

6/ DELTA TOP - TERMINAL PRICE

They use to show the top of the cycle. DELTA TOP didn’t touch the price line while TERMINAL PRICE did.

Bitcoin Magazine Pro

Delta Top | BM Pro

Delta Top free live chart identifying Bitcoin cycle tops

Bitcoin Magazine Pro

Terminal Price | BM Pro

Terminal Price free live chart identifying Bitcoin market cycle tops.

7/ BALANCED PRICE - CVDD

They use to show the bottom of the cycle. BALANCED PRICE didn’t touch the price line. CVDD did.

Similar to DELTA PRICE.

Bitcoin Magazine Pro

Balanced Price | BM Pro

Balanced Price free live chart identifying Bitcoin market cycle lows.

Bitcoin Magazine Pro

CVDD | BM Pro

CVDD (coin value days destroyed) free live chart identifying Bitcoin market cycle lows.

8/ MVRV Z-SCORE

It shows overvalued zone (red) and undervalued (green). MVRV more than 3 used to show the top of the cycle.

Bitcoin Magazine Pro

MVRV Z-Score | BM Pro

MVRV Z-Score uses a z-score standard deviation between market value and realised value (MVRV) to identify $BTC market tops and bottoms.

9/ This’s not financial advice, just for educational purpose.

If you liked this thread, please reply, share or even zap⚡

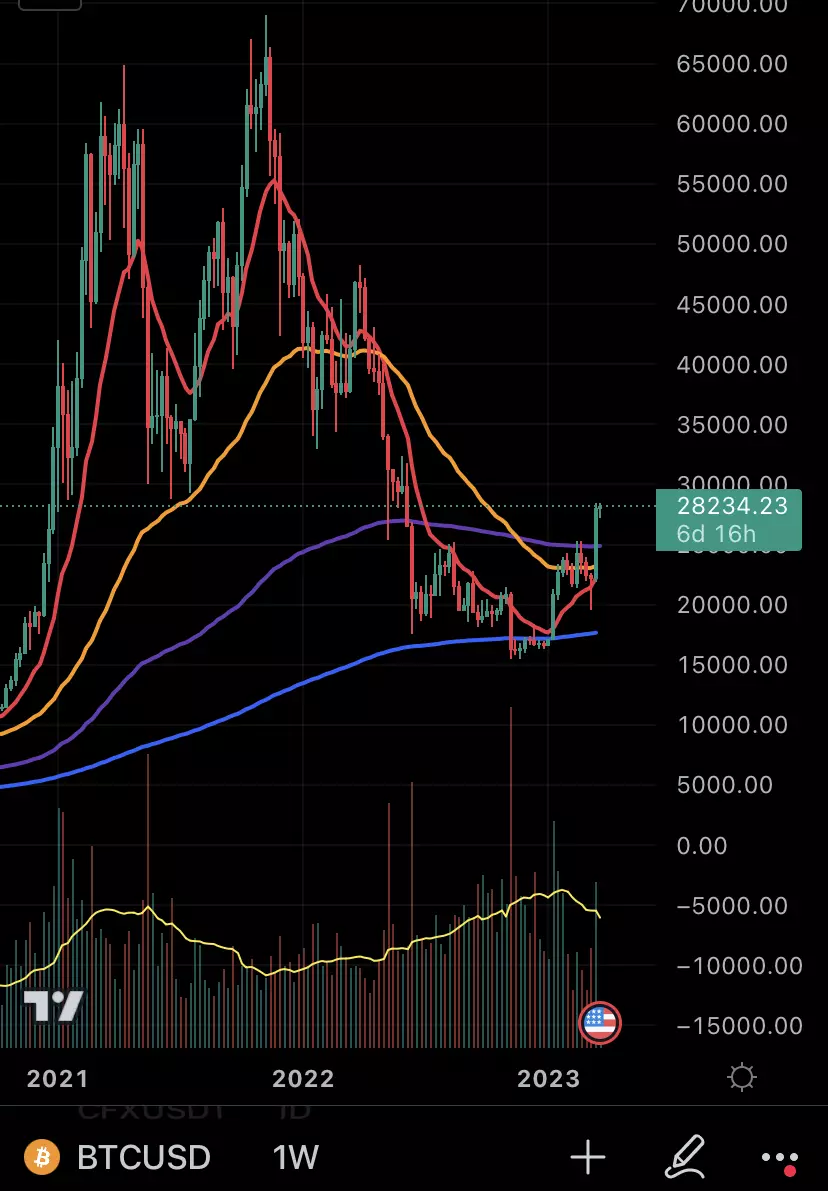

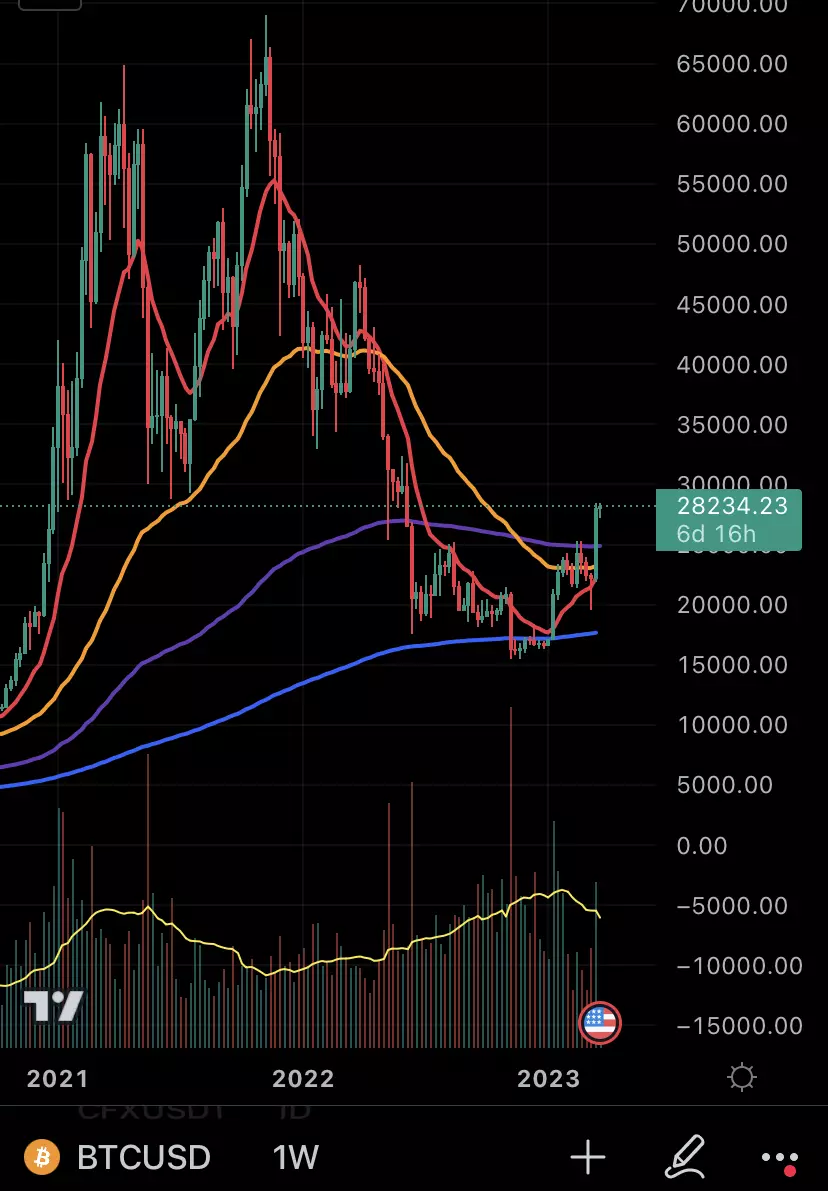

10/ 200W MOVING AVERAGE

When 200 WEEKLY MOVING AVERAGE is crossed by the price that’s bullish

On 03-19-23 this indicator is triggered.

11) RSI MONTHLY

RSI MONTHLY > 50

Lagged indicator, it confirms accumulation time is over. It doesn’t mean bullish short term but long.

On 03-31-23 this indicator is triggered.

View quoted note →

Just zoom out and having a look at those indicators.

It seems that Institutions have not full filled bags yet, so back to acummulation zone instead of keep up trending, maybe till end of 2023 (supposed ETF approval 2024 Q1).

RSI and SOPR don't want to keep trending at the moment.

Max pain Bitcoin Open Interest August 25th at $28.500, so maybe a green candle in few days to reach it (actually $26.000).

Still in range for few months till Institutions are ready to 🚀

Just below 9 #Bitcoin indicators to follow regularly to know at which part of the cycle we are

View quoted note →