The current yearly supply inflation rate for monero is 0.47%, this will always decrease as a percentage as the tail emissions are fixed.

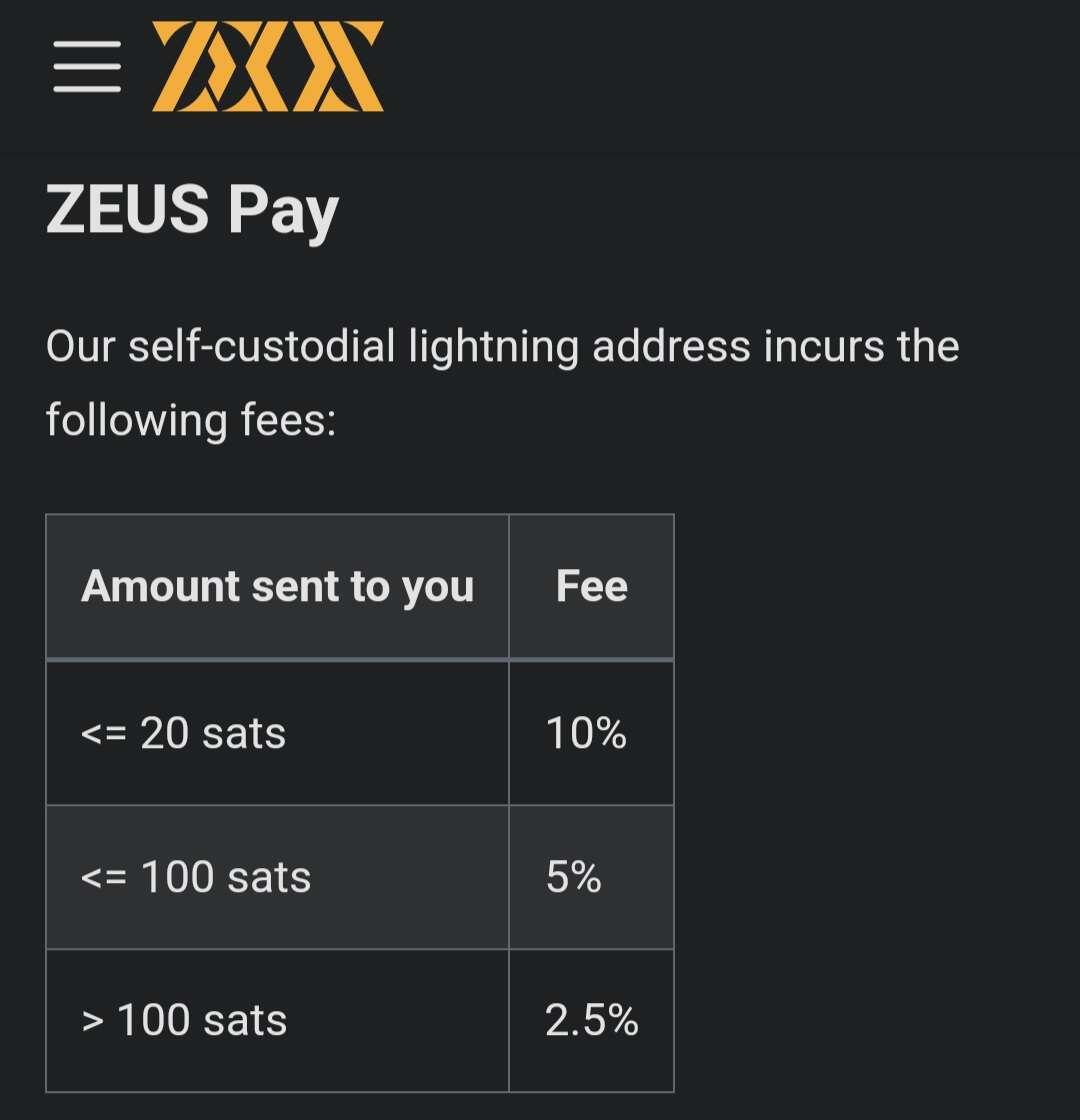

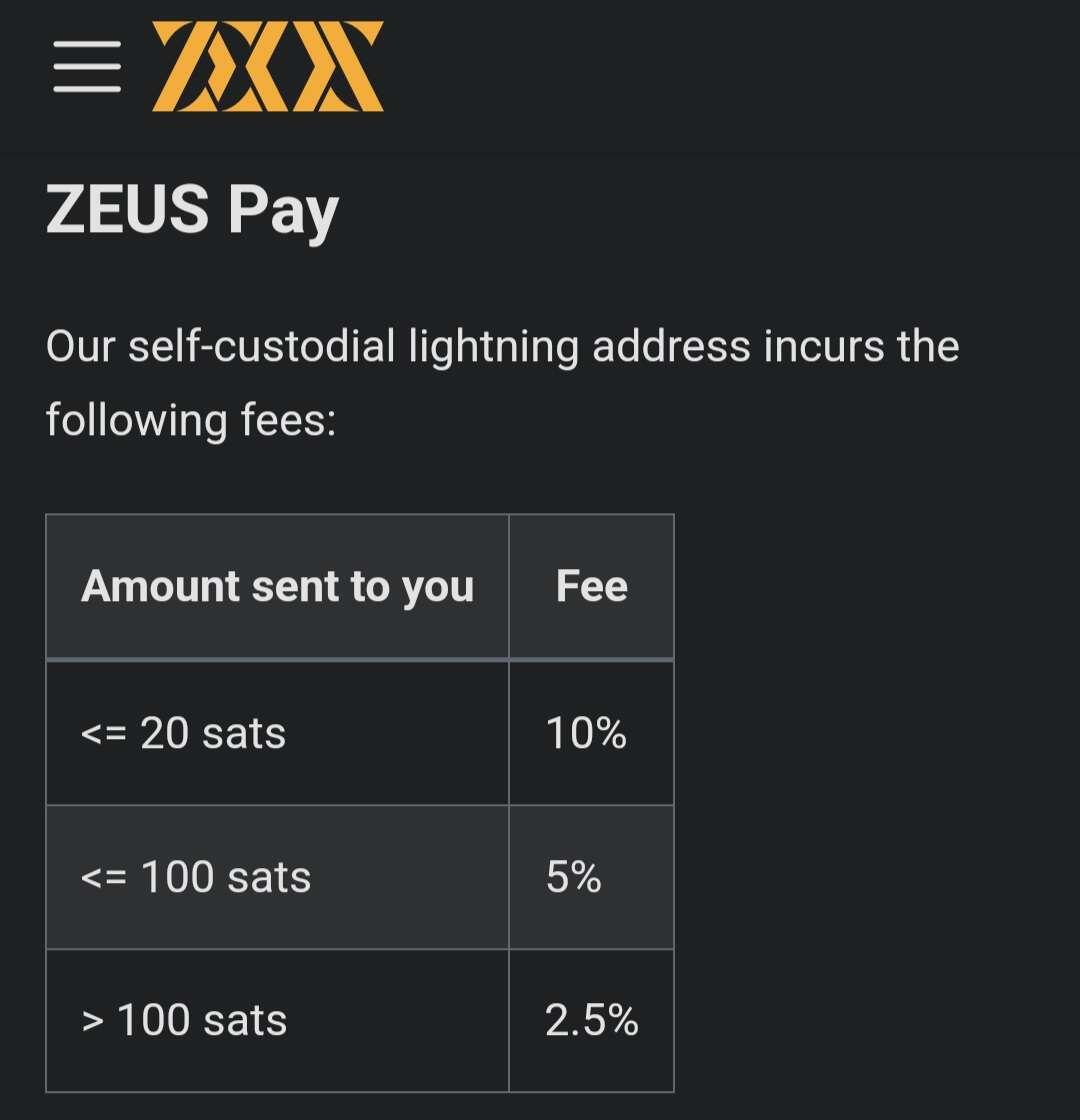

Compare that with inbound liquidity fees for lightning, and it's insignificant if you use is for regular transactions.

nostr:nevent1qqswqvaah3u8pwzat5hqp3vlep4z30eer5arq5w0ax3vqwud02n0ecqpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhsygrnzlu38s77ww0g82edm3nsp284et69ltz6qtr23p44tmum0c6dgypsgqqqqqqsqn2ldp

nostr:nevent1qqswqvaah3u8pwzat5hqp3vlep4z30eer5arq5w0ax3vqwud02n0ecqpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhsygrnzlu38s77ww0g82edm3nsp284et69ltz6qtr23p44tmum0c6dgypsgqqqqqqsqn2ldp

nostr:nevent1qqswqvaah3u8pwzat5hqp3vlep4z30eer5arq5w0ax3vqwud02n0ecqpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhsygrnzlu38s77ww0g82edm3nsp284et69ltz6qtr23p44tmum0c6dgypsgqqqqqqsqn2ldp

nostr:nevent1qqswqvaah3u8pwzat5hqp3vlep4z30eer5arq5w0ax3vqwud02n0ecqpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhsygrnzlu38s77ww0g82edm3nsp284et69ltz6qtr23p44tmum0c6dgypsgqqqqqqsqn2ldp