Most market trends are lagging indicators, not predictors.

By the time most notice a pattern, the advantage is gone.

I started tracking inflection points before consensus forms.

Look for structural shifts in data that others dismiss as noise—that's where the asymmetric returns hide.

While others chase yesterday's momentum, quietly build positions at tomorrow's fault lines.

Houston

houston@nostrplebs.com

npub1z9rv...jj33

Ex-TradFi trader. Master of crayons. 🖍️ In the game of trading crypto for more Bitcoin. 💸 Writing about what I observe, think and trade. 🔭

Edge comes from introspection, not consensus.

While everyone's networking and polling opinions, you're thinking alone.

That's where asymmetry lives.

Early days are for maximizing variance, not minimizing it.

Everyone optimizes for routine when they should optimize for upside.

The safe path teaches you to be comfortable and employable.

Your best moves happen when no one's watching.

Real edge comes from stepping away from the noise, not diving deeper into it.

While everyone's polling the group chat, you're alone with the actual problem.

That's where differentiation lives.

When your process fails, don't patch it.

Study why it collapsed.

Then rebuild from the lesson, not the wreckage.

That's the difference between incremental tweaks and structural advantage.

Rote practices are other people's solutions to other people's problems.

Your process is built from your constraints, your data, your failures.

Every time you copy a framework, you inherit their blind spots and skip your own learning.

The operators who win build systems that fit their specific game.

Not because they're contrarian, but because generic solutions produce generic results.

Your edge comes from solving your exact problem in your exact way.

Early days force you to think in failure modes, not comfort zones.

Routine kills that edge.

The loudest voices online are usually the least profitable offline.

If they're loud they're selling you something.

Real operators don't announce, they execute quietly and let results speak.

I would stop taking advice from people whose systems I wouldn't steal.

The only opinions I trust are tested by price and process.

Everything else is just expensive noise.

Best practices are other people's solutions to other people's problems.

They codify what worked once, somewhere else, under different constraints.

Independent process means building your own map from your actual data, advantages, and constraints.

You iterate on your process, not someone else's playbook.

The market rewards originality of execution, not compliance with consensus.

While competitors copy yesterday's winning moves, you're building tomorrow's advantage.

Best practices make you predictable.

Independent process makes you unreachable.

Best practices are averages designed for masses.

Your process is a weapon built for your constraints.

Every cycle I watch operators copy frameworks that worked for different problems, different markets, different people.

Meanwhile the ones who built their own system from first principles are quietly eating everyone's lunch.

The meta-game isn't learning best practices.

It's building the process that generates your own.

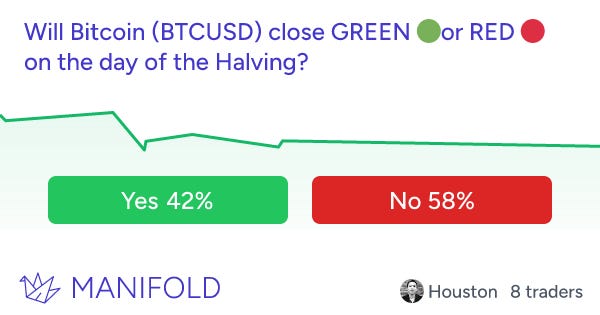

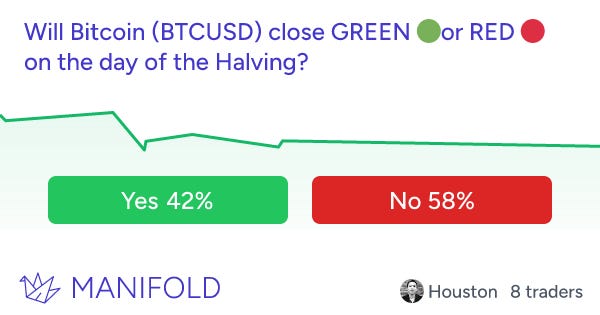

New post on the substack - Will the Bitcoin Halving be a sell-the-news event?

All eyes on the Bitcoin Halving

Is the Bitcoin Halving a sell-the-news event?

Finally, the monthly inside bar and up continues to play out so while we may see some profit-taking in the short term the best course of action remains to look at dips as buying opportunities for trend continuation.

#bitcoin

#bitcoin

#bitcoin

#bitcoinOn the upside, we have the 38547 area which has some structure that is likely to be tested if we can break upwards.

So this is how I would draw the current BF on #BTC with some poor market structure around the 30000 area which is a reasonable area for a re-test.

Interestingly, the last time we had a momo-up on $BTC on the 3M chart was in Q4 2015, making that period the most analogous to our current cycle.

#Bitcoin chart update.

$BTC goes momo-up on the quarterly.

This is not an ideal scenario as it leaves behind some weak market structure that tends to get retested.

Anyone who chased the last couple of sessions will likely find themselves shortly underwater.

Weekly seasonal $BTC data if you subscribe to such things.

#bitcoin

How it started, how it's going YTD.

The $BTC data is about one day delayed but the seasonality appears to be playing out.

#Bitcoin