Marc Andreessen's appearance on Joe Rogan discussing the debanking of crypto entrepreneurs and political opponents loosens the tongues of the many victims on X.

Did you know banks' power to close accounts without reason stems from KYC/AML regulations? And these rules are completely ineffective.

Imagine this: Your bank asks where your funds came from, where they're going, and demands your tax return and the size of your socks for a simple transfer.

"But does my money even belong to me?" you wonder.

Spoiler: It's worse than you think.

KYC (Know Your Customer) and AML (Anti-Money Laundering) were introduced as noble warriors to fight fraud, money laundering, and terrorism.

Sounds great, right? Who doesn’t want a safer financial world? Well, the reality is grim.

Let’s start with their effectiveness.

Studies show AML/KYC helps authorities recover less than 0.05% of criminal funds.

Yep, 99.95% of dirty money slips through. That’s like emptying the ocean with a teaspoon. 🌊🫙

Globally, AML/KYC compliance costs ~$300B/year while $3B of criminal assets are recovered.

We spend $100 to save $1. Let that sink in.

What about reducing crime? Drug trafficking was a major target for AML/KYC.

Since these regulations began:

Global drug use has increased.

Drug-related deaths have tripled.

Access to drugs is easier than ever.

It gets worse. These rules open the door for discrimination.

Nigel Farage had his accounts closed after 43 years—no explanation, no recourse. Banks cited vague "politically exposed person" concerns. He’s not alone, As the many victims' testimonials shared over the past few hours on X show

Account closures are rising globally. Often arbitrary, these decisions hit political dissidents, minority groups, or anyone banks deem "risky."

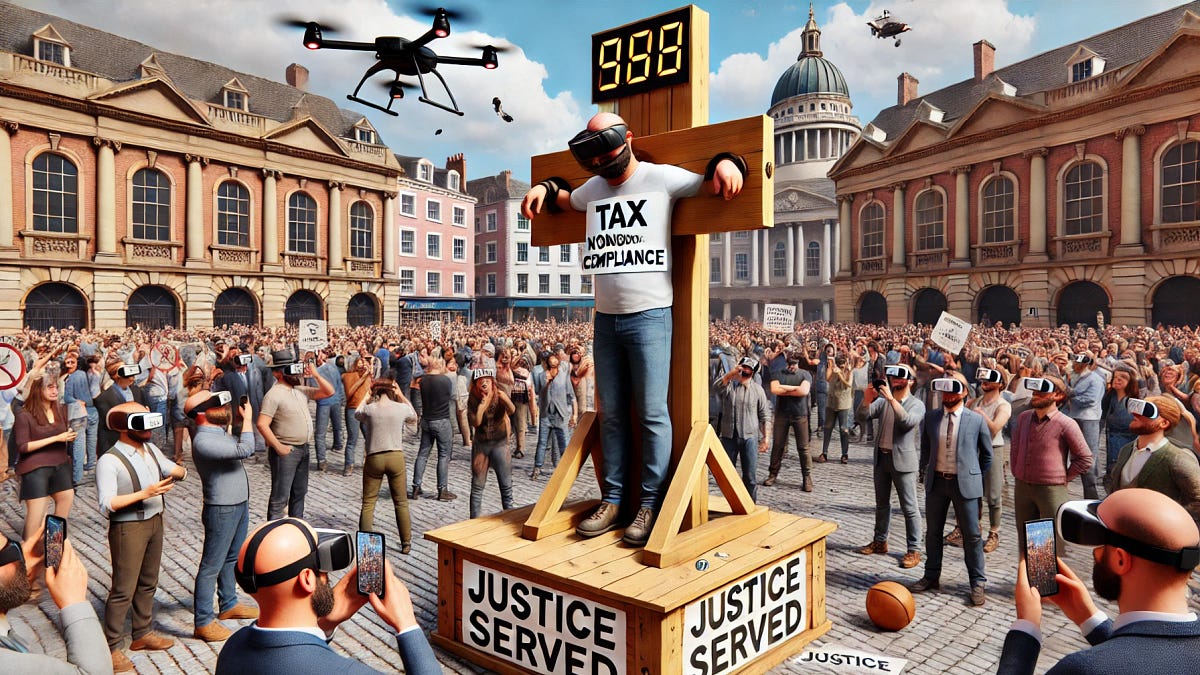

Once flagged, you're guilty until proven innocent—violating core democratic principles.

And let’s not forget the massive privacy risks.

KYC requires companies to hoard customer data, making them prime targets for hackers.

- JP Morgan (2014): 76M+ accounts breached.

- Equifax (2017): 147M+ personal records stolen.

- Desjardins (2019): 9.7M+ accounts hacked.

And many more

What’s fueling this madness?

A $BILLION industry thrives on enforcing these rules:

Banks fear fines more than serving customers.

Consultants profit from “solutions” for inefficient regulations.

Entire agencies exist to oversee this broken system.

Banks spend fortunes to comply. Fines for non-compliance hit $10.4B in 2020 alone—more than authorities recover annually from criminals.

And who pays for this?

You. In fees, taxes, and lost freedoms.

We need a radical rethink.

Demand cost-benefit analyses for regulations.

Challenge the status quo.

Push for smarter, effective policies—not parasitic frameworks enriching a select few while suffocating society.

Let’s stop pretending AML/KYC is about fighting crime. It’s about control—and it’s broken.

If you found this thread insightful, please share and follow for more on how nation-states and their systems are disrupted by the Internet, globalization, and emerging technologies.

The full article, with sources, is here :

How KYC and AML are destroying the world

The road to hell is paved with good intentions

#AML #KYC #Crypto #Bitcoin #Ethereum

View quoted note →

View quoted note →