Before #Bitcoin became a global asset, it needed something simple: a place to trade. Bitcoin Market, launched in early 2010, became the first true exchange where Bitcoin could be bought and sold in real time. It existed before liquidity, before speculation and before anyone knew what Bitcoin would become.

New Liberty Standard was technically the first exchange, but it functioned more like a trust-based OTC service. Bitcoin Market, announced by forum user dwdollar on January 15, 2010, was different. He described it as a real market where users could buy and sell Bitcoin with each other, creating a live exchange rate for the first time.

This marked a shift in Bitcoin’s identity. What began as decentralised digital cash was now becoming a financial commodity, attracting a new demographic: traders. On March 17, 2010, the first trade occurred on Bitcoin Market. A user bought 333 BTC for one dollar. At the time, only nine people were registered on the platform.

Liquidity was almost nonexistent. A fifty-dollar order could double the price. But by the summer, Bitcoin Market was clearing around three hundred dollars per week, quickly overtaking New Liberty Standard and becoming the primary reference point for Bitcoin’s value.

Like its predecessor, Bitcoin Market relied heavily on PayPal, which worked only while PayPal remained unaware of Bitcoin’s existence. As Bitcoin gained attention in 2011, chargeback fraud inevitably followed, and PayPal terminated support, a move that effectively ended Bitcoin Market’s operations. By then, Mt. Gox had launched and was rapidly becoming the dominant exchange.

Despite its short lifespan, Bitcoin Market played a crucial role in Bitcoin’s early evolution. Its price ticker became the community’s standard, even as volatility remained extreme. During its tenure, the price of Bitcoin rose from $0.003 to $0.02, almost a seven-fold increase in six weeks. It formed the bridge between the earliest OTC trades and the order-book exchanges that would later shape Bitcoin’s trading ecosystem.

Read the full article on the link below!

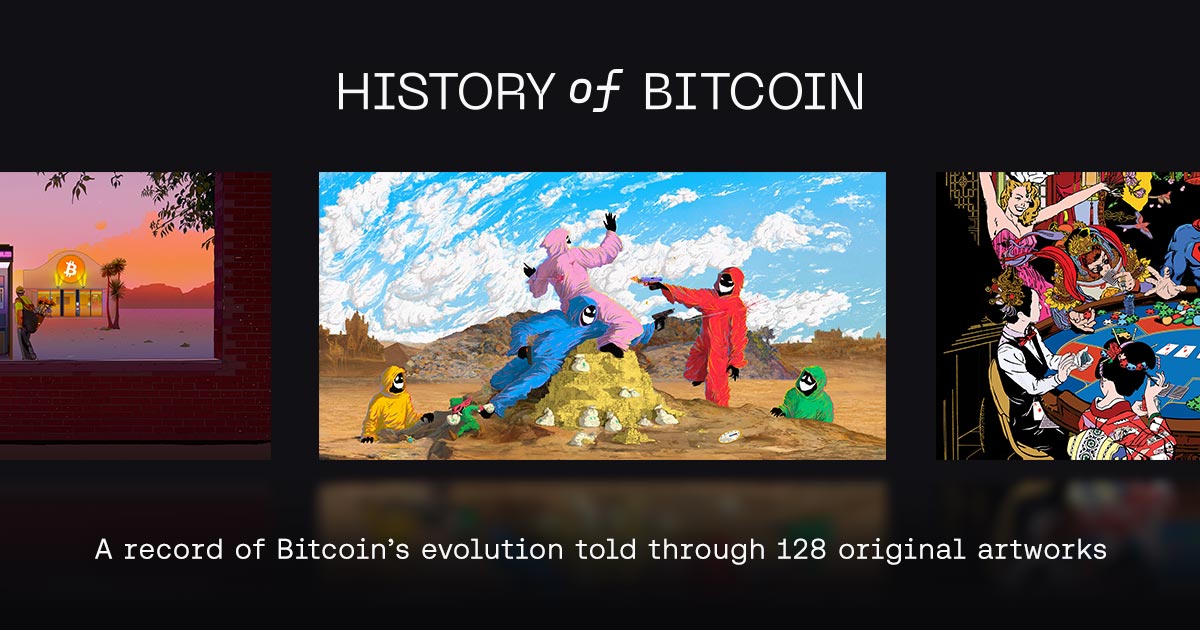

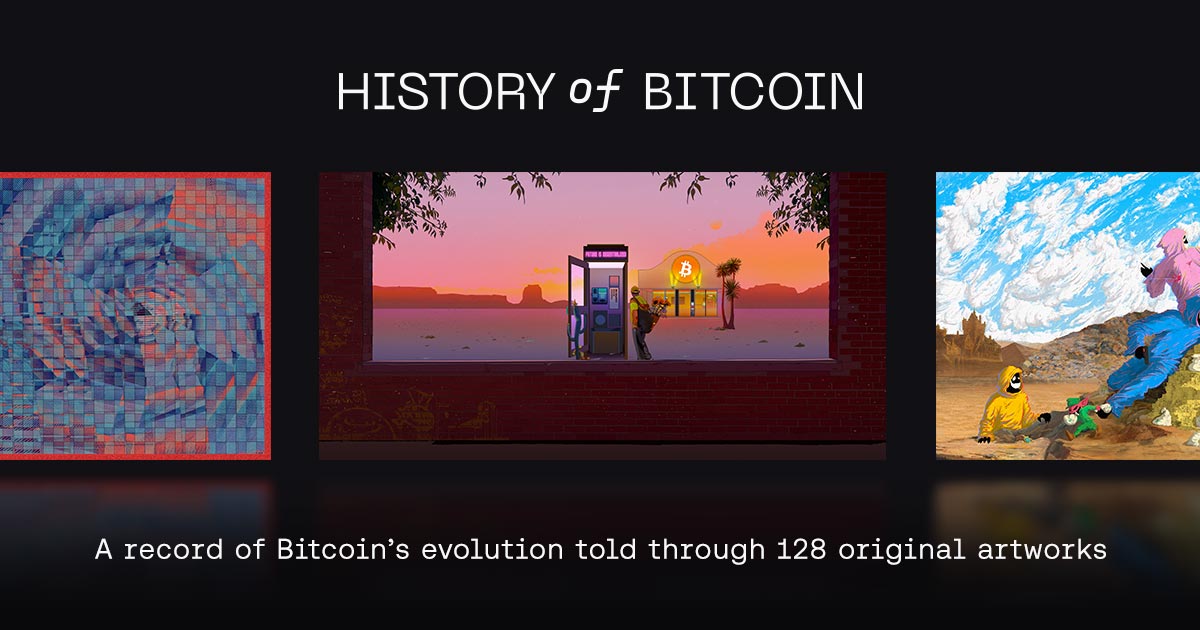

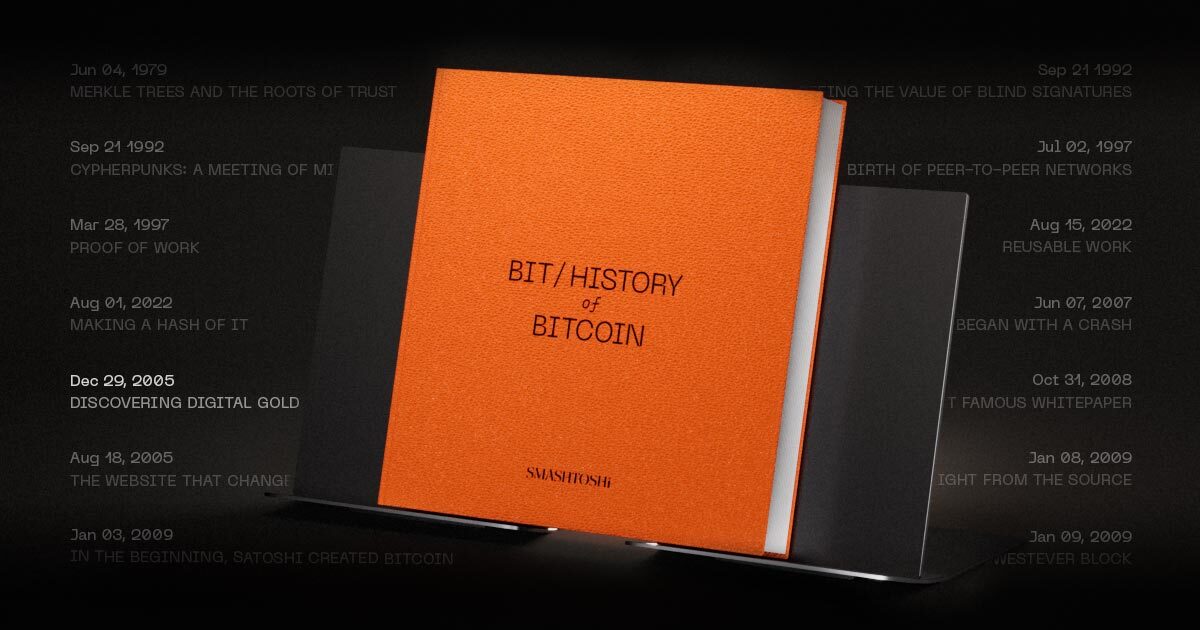

History of Bitcoin

Making a Market

In March 2010, Bitcoin Market launched as the first true exchange. With 333 BTC trading for just $1, it brought liquidity, price discovery, and mar...

The artwork “Making a Market” appears in the History of Bitcoin Collector’s Book and on the interactive timeline.

#BitcoinArt #Art

#BitcoinArt #Art