Adding 2% bitcoin to a classic 60/40 portfolio vastly improves performance. But most investors are too focused on Sharpe-ratio (based on st.deviation). They see that Sharpe declines a bit. Calmar-ratio (based on drawdown) is a better metric and it improves a lot! Using Calmar: ditching stocks and bonds entirely and invest 4% in BTC while holding 96% in cash, yields superior investment performance. It will take years for large traditional investors to change their risk perspective from st.deviation to drawdown and their risk/return perspective from Sharpe to Calmar. Perspective matters.

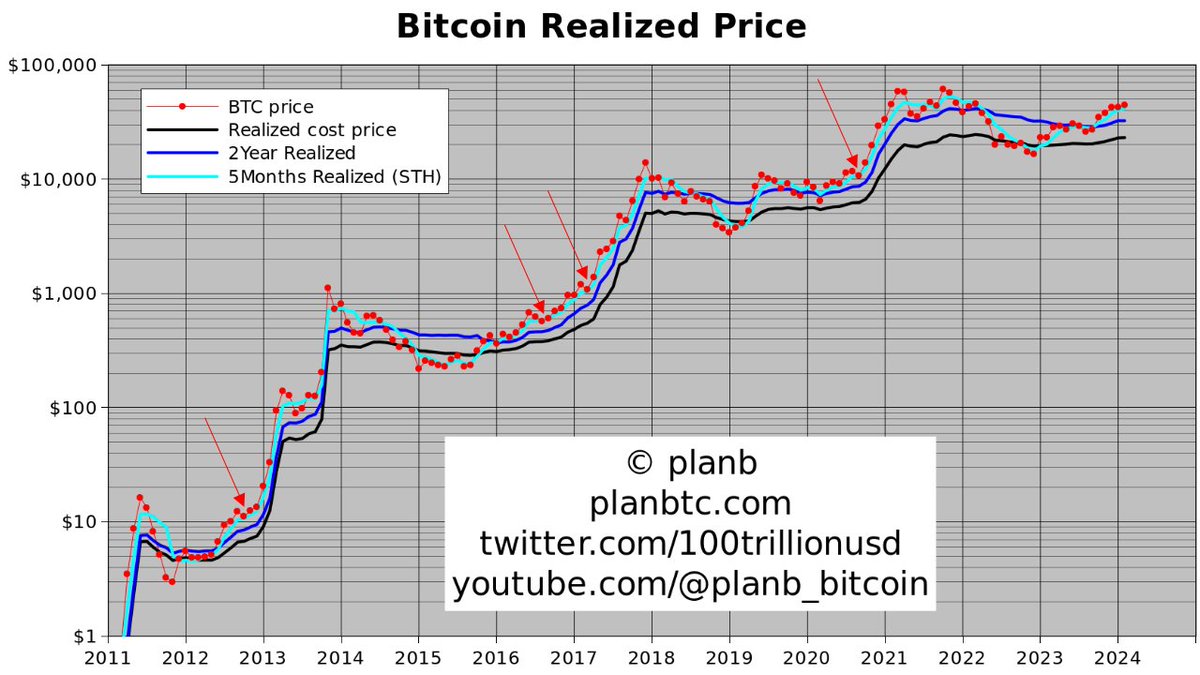

More info here:

More info here:

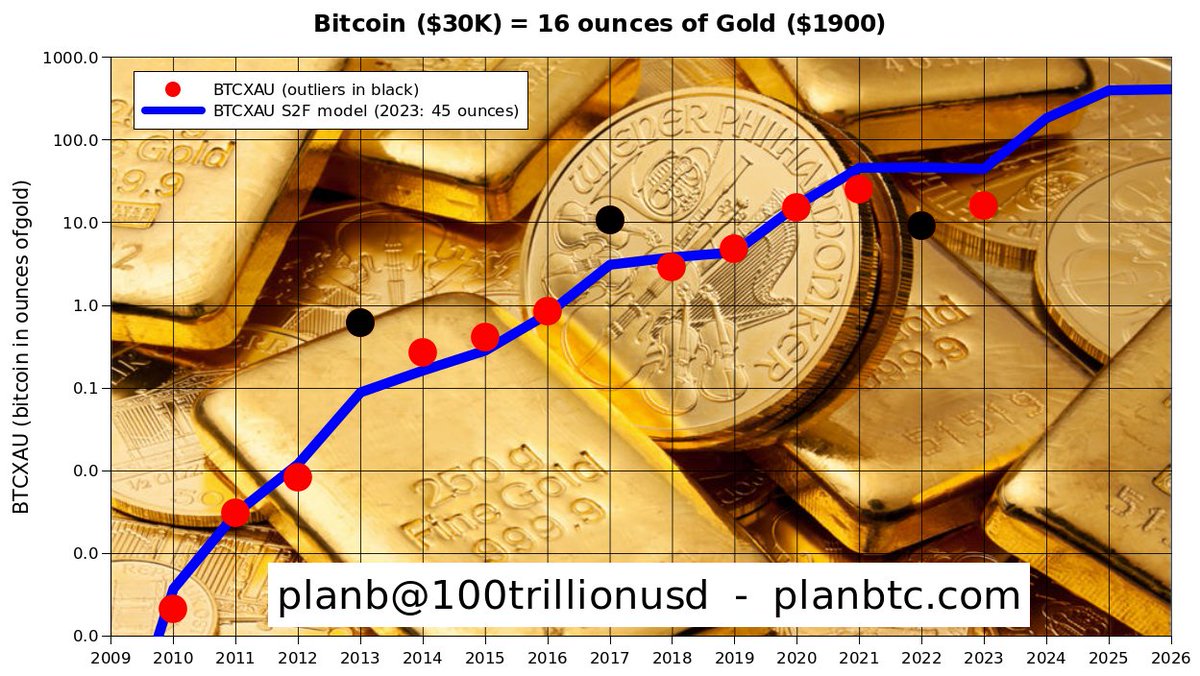

Let's take $ out of the equation:

BTC = 16 ounces of gold🚀

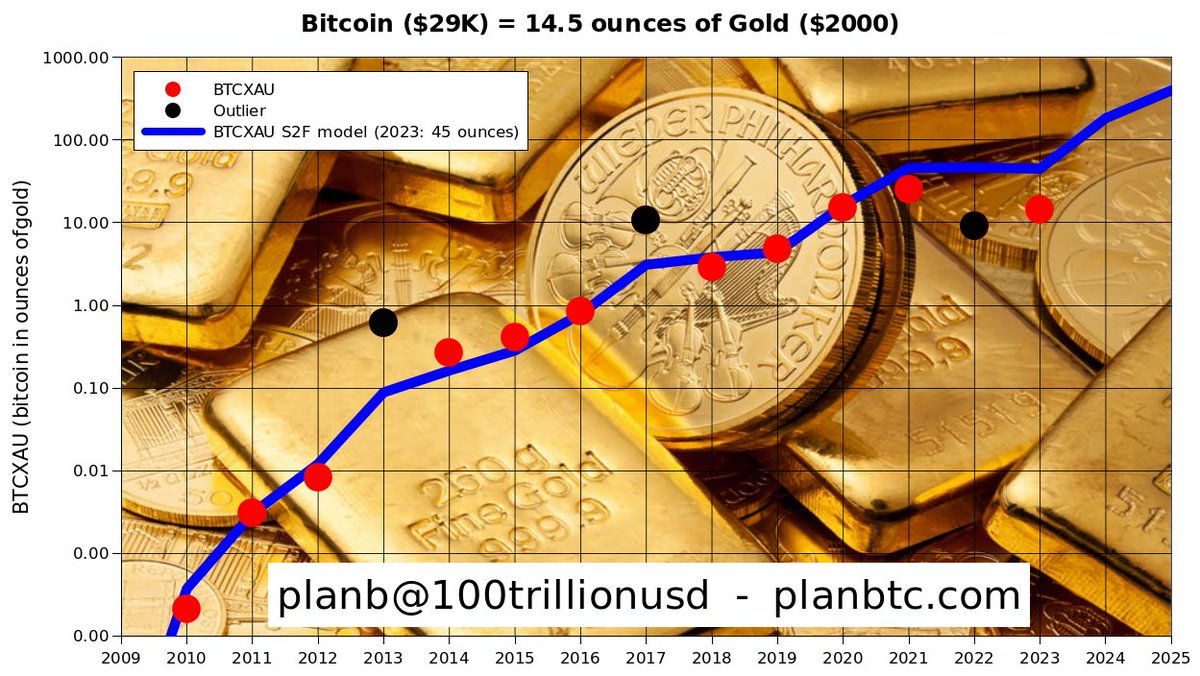

Let's take $ out of the equation:

BTC = 16 ounces of gold🚀

Let's take USD out of the equation.

Bitcoin (BTC) priced in ounces of gold (XAU).

Will 2023 be another outlier or revert to model?🔥

Let's take USD out of the equation.

Bitcoin (BTC) priced in ounces of gold (XAU).

Will 2023 be another outlier or revert to model?🔥