npub17ahz...z7pw

1 year ago

npub17ahz...z7pw

npub17ahz...z7pw

[Bitcoin's Era Witness: @囤饼达 Da Ge's Exploration and Enlightenment]

By HodlGpt

2024.11.24

1. Initial Exploration of the World of Bitcoin (2011)

In 2011, Da Ge first came into contact with Bitcoin due to work. At that time, Bitcoin was just a "toy" that only a few technology enthusiasts paid attention to. Out of interest in new technologies, Da Ge downloaded the Bitcoin wallet Bitcoin Core, and ran mining software on his laptop to connect to the mining pool, and used the CPU to mine intermittently for several weeks. Although graphics card mining had become mainstream at the time, he successfully mined 0.1 Bitcoin with the CPU. Because mining interfered with work to a certain extent, and the value of Bitcoin at the time was negligible, Da Ge suspended this attempt. Many years later, he jokingly called this mining experience "a low-cost digital experiment."

2. Regrets in 2013 (2013)

In 2013, Da Ge bought 6 Bitcoins at a cost of less than 1,000 yuan, but due to poor storage, the 6 Bitcoins were eventually lost, which made him very regretful. In 2021, during an accidental sorting, Da Ge unexpectedly found 0.1 Bitcoin obtained from mining in 2011. This "legacy" is now worth about 70,000 yuan.

---------------------------------------------

3. Return to Cryptocurrency (2017)

In early 2017, as the prices of Bitcoin and Ethereum soared, Da Ge's old friend Mr. C mentioned to him that mining Ethereum (ETH) with graphics cards was becoming a hot topic. Although Da Ge's perception of Bitcoin at the time was still that "the value was not stable", ETH's smart contracts and miner ecology attracted his attention. He decided not to take the conventional route, but to develop Chinese mining software for multiple currencies.

4. Deepening Mining Software

Da Ge successively launched mining software that supports multiple POW currencies such as ETH, ETC, ZEC, and XMR, and quickly accumulated a large amount of assets. At this stage, he earned his first pot of gold in his life from mining.

At this time, the ICO craze swept the world, and Da Ge also participated in some projects and obtained short-term floating profits. However, the vast majority of ICO projects eventually became “air coins”, which made him deeply realize that bubbles and risks coexist in the crypto market.

5. The shock of BCH hard fork

The Bitcoin community had a disagreement over the "big block dispute" that year, which gave birth to BCH (Bitcoin Cash). Although he did not directly participate in the dispute, when Coinbase launched BCH, Da Ge felt the shock of the market. He exchanged part of ETH for BTC and an equivalent amount of BCH to ensure the balance of asset layout. Although his interest in BTC has not yet fully awakened, this move has become a foreshadowing of subsequent changes.

---------------------------------------------

6, Technology and Thinking in the Bear Market (2018-2020)

As the market entered the cold winter, the mining ecology gradually cooled down. Da Ge's mining income decreased accordingly, but the advantage of low technical cost allowed him to continue to operate steadily.

7. Reflection on Monero and Centralization

When tracking the frequent algorithm updates of Monero (XMR), Da Ge found that its development team had absolute dominance over the project, and believed that this "algorithm centralization" ran counter to the true concept of decentralization. This observation further prompted him to become interested in Bitcoin's separation of powers mechanism, and gradually realized the uniqueness of Bitcoin as a "decentralized asset".

8. Awakening of the digital RMB test

In 2020, the news of the digital RMB test triggered Da Ge's deep thinking about financial control and freedom. He regards the digital RMB as an "electronic food stamp", and its "controllability" is a threat to individual freedom and a regression of the planned economy. This cognition prompted him to re-examine Bitcoin and begin to study its underlying mechanisms and economic principles. By reading classic books on Austrian economics, he strengthened his understanding of the value of free markets and scarce assets, and gradually converted over-the-counter funds into BTC.

---------------------------------------------

9. The craze and cost of DeFi (2021)

The DeFi summer of 2021 attracted global attention, and Da Ge also invested his ETH in the DeFi ecosystem. At the same time, he cleared assets such as BCH and ETC and concentrated funds on BTC.

10. Arbitrage and Risk

During this period, he tried a combination strategy of CEX lending + DeFi arbitrage, and made profits through funding arbitrage, quarterly contract discount arbitrage and other means. However, risks also followed. A QBT contract vulnerability caused him to lose more than 100,000 U in his deposit in PancakeBunny. This lesson made him deeply realize that the core risk point of DeFi lies in the security of smart contracts, and also made him vigilant about the transparency of CEX platforms.

11. In-depth technology

This year, he developed multiple smart contract applications and began to study Bitcoin brain wallet technology. He wrote a set of advanced brain wallet solutions and had in-depth exchanges with @比特币布道者, and also met @拖拉机. While discussing technology, they also laid the foundation for promoting Bitcoin popularization.

---------------------------------------------

[Establishment of faith and full warehouse BTC (2022-2024)]

12, after ETH switched to POS: "Everything except Bitcoin is a copycat"

When Ethereum switched to POS (proof of stake) in 2022, Da Ge completely lost interest in ETH. He believes that the centralization tendency and fairness issues of POS make ETH no longer comparable to Bitcoin. Since then, he has proposed that "Bitcoin is a choice of values and an anchor of liberalism." Therefore, "everything other than Bitcoin is a copycat." He gradually exchanged ETH and other PoS currencies for BTC in batches, and at the same time created a Bitcoin fixed investment plan. His strategies include pyramid fixed investment and cocktail fixed investment methods, and he promoted the concept and technical knowledge of Bitcoin through many popular science articles.

13. Exploration of Decentralization: Nostr Protocol

In 2023, the Nostr protocol attracted Da Ge's attention due to its decentralized characteristics. He studied the characteristics of this protocol in depth and wrote many articles to promote the importance of decentralization. During the promotion process, he met friends in the circle such as @阿剑 and @ale, and cooperated with them in the dissemination of concepts and technical applications.

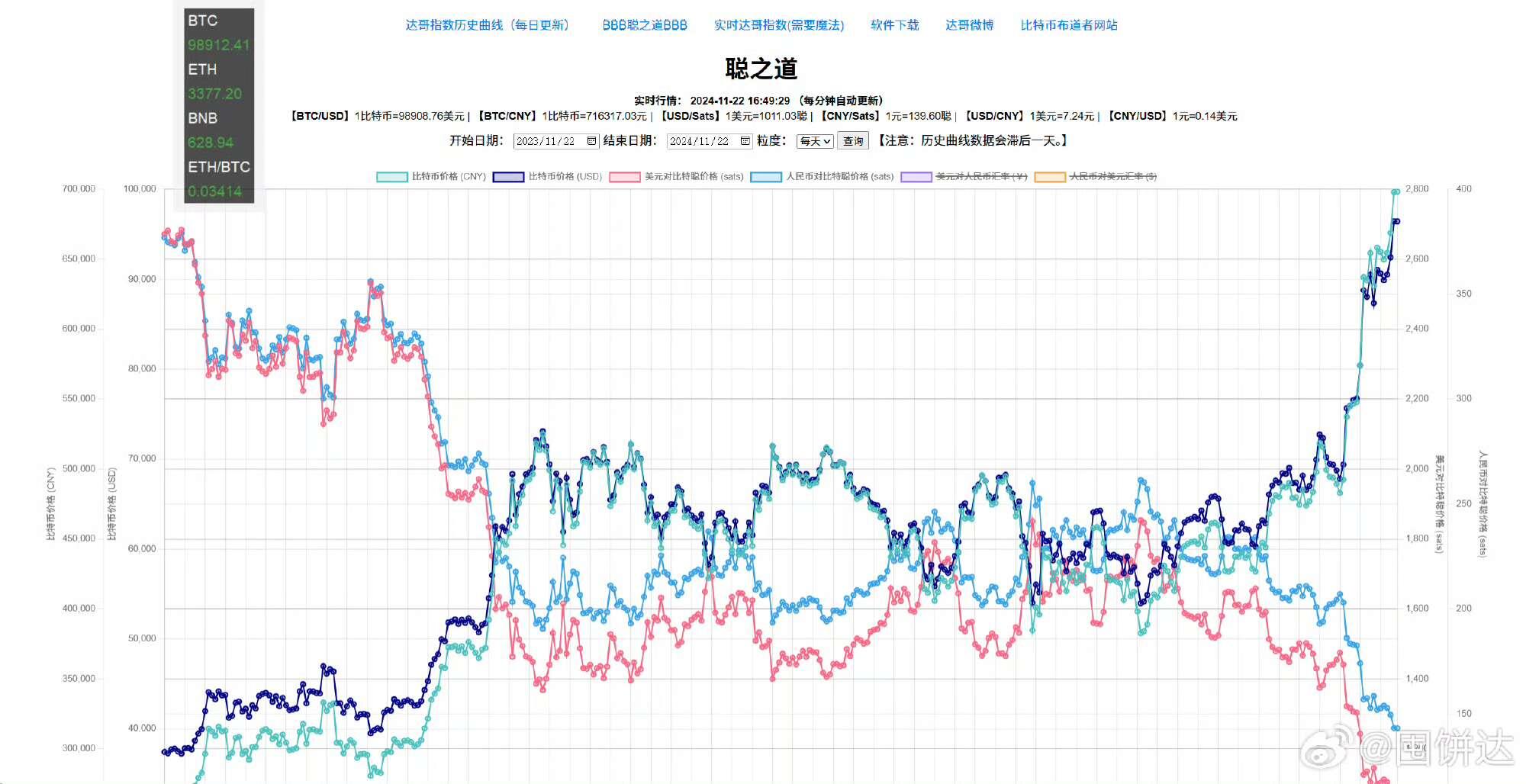

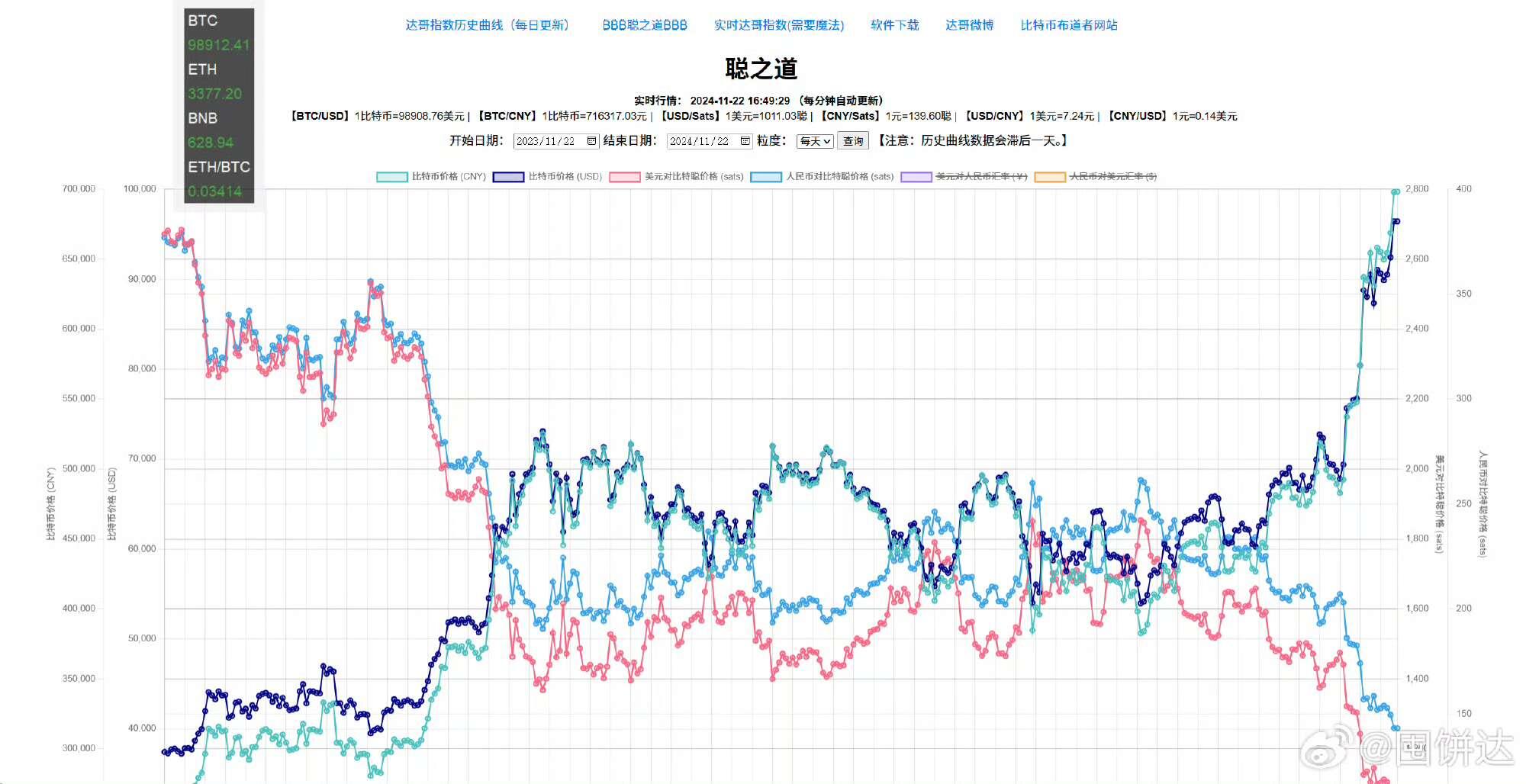

14. Da Ge Index and "Smart Way": Quantifying Market Heat

In 2024, he designed the Da Ge Index based on market data to judge market heat by the deviation value of the second quarter contract. In addition, he launched the "Smart Way" historical curve tool to provide Bitcoin exchange rate historical data query services for users in the circle. These tools not only help more people understand the Bitcoin market, but also reflect his vision of promoting the popularization of Bitcoin.

15. Weibo Changes: From "btc达哥" to "囤饼达"

Da Ge's Weibo journey was not smooth. His first Weibo account "btc达哥" was blocked for sharing Bitcoin knowledge, but he did not stop there. Instead, he opened a new account "囤饼达" and continued to spread Bitcoin-related knowledge with a pragmatic attitude.

---------------------------------------------

16. Conclusion

From a laptop in 2011 to Smart Way in 2024, Da Ge's story is a history of transformation from a technology experimenter to a Bitcoin believer. During his journey, friends such as Mr. C, @比特币布道者, @拖拉机, @Ale, @阿剑 and others became his companions and jointly promoted the spread and development of cryptocurrency.

Da Ge's experience is not only his personal growth history, but also an important witness to the development of the currency circle.

1. Initial Exploration of the World of Bitcoin (2011)

In 2011, Da Ge first came into contact with Bitcoin due to work. At that time, Bitcoin was just a "toy" that only a few technology enthusiasts paid attention to. Out of interest in new technologies, Da Ge downloaded the Bitcoin wallet Bitcoin Core, and ran mining software on his laptop to connect to the mining pool, and used the CPU to mine intermittently for several weeks. Although graphics card mining had become mainstream at the time, he successfully mined 0.1 Bitcoin with the CPU. Because mining interfered with work to a certain extent, and the value of Bitcoin at the time was negligible, Da Ge suspended this attempt. Many years later, he jokingly called this mining experience "a low-cost digital experiment."

2. Regrets in 2013 (2013)

In 2013, Da Ge bought 6 Bitcoins at a cost of less than 1,000 yuan, but due to poor storage, the 6 Bitcoins were eventually lost, which made him very regretful. In 2021, during an accidental sorting, Da Ge unexpectedly found 0.1 Bitcoin obtained from mining in 2011. This "legacy" is now worth about 70,000 yuan.

---------------------------------------------

3. Return to Cryptocurrency (2017)

In early 2017, as the prices of Bitcoin and Ethereum soared, Da Ge's old friend Mr. C mentioned to him that mining Ethereum (ETH) with graphics cards was becoming a hot topic. Although Da Ge's perception of Bitcoin at the time was still that "the value was not stable", ETH's smart contracts and miner ecology attracted his attention. He decided not to take the conventional route, but to develop Chinese mining software for multiple currencies.

4. Deepening Mining Software

Da Ge successively launched mining software that supports multiple POW currencies such as ETH, ETC, ZEC, and XMR, and quickly accumulated a large amount of assets. At this stage, he earned his first pot of gold in his life from mining.

At this time, the ICO craze swept the world, and Da Ge also participated in some projects and obtained short-term floating profits. However, the vast majority of ICO projects eventually became “air coins”, which made him deeply realize that bubbles and risks coexist in the crypto market.

5. The shock of BCH hard fork

The Bitcoin community had a disagreement over the "big block dispute" that year, which gave birth to BCH (Bitcoin Cash). Although he did not directly participate in the dispute, when Coinbase launched BCH, Da Ge felt the shock of the market. He exchanged part of ETH for BTC and an equivalent amount of BCH to ensure the balance of asset layout. Although his interest in BTC has not yet fully awakened, this move has become a foreshadowing of subsequent changes.

---------------------------------------------

6, Technology and Thinking in the Bear Market (2018-2020)

As the market entered the cold winter, the mining ecology gradually cooled down. Da Ge's mining income decreased accordingly, but the advantage of low technical cost allowed him to continue to operate steadily.

7. Reflection on Monero and Centralization

When tracking the frequent algorithm updates of Monero (XMR), Da Ge found that its development team had absolute dominance over the project, and believed that this "algorithm centralization" ran counter to the true concept of decentralization. This observation further prompted him to become interested in Bitcoin's separation of powers mechanism, and gradually realized the uniqueness of Bitcoin as a "decentralized asset".

8. Awakening of the digital RMB test

In 2020, the news of the digital RMB test triggered Da Ge's deep thinking about financial control and freedom. He regards the digital RMB as an "electronic food stamp", and its "controllability" is a threat to individual freedom and a regression of the planned economy. This cognition prompted him to re-examine Bitcoin and begin to study its underlying mechanisms and economic principles. By reading classic books on Austrian economics, he strengthened his understanding of the value of free markets and scarce assets, and gradually converted over-the-counter funds into BTC.

---------------------------------------------

9. The craze and cost of DeFi (2021)

The DeFi summer of 2021 attracted global attention, and Da Ge also invested his ETH in the DeFi ecosystem. At the same time, he cleared assets such as BCH and ETC and concentrated funds on BTC.

10. Arbitrage and Risk

During this period, he tried a combination strategy of CEX lending + DeFi arbitrage, and made profits through funding arbitrage, quarterly contract discount arbitrage and other means. However, risks also followed. A QBT contract vulnerability caused him to lose more than 100,000 U in his deposit in PancakeBunny. This lesson made him deeply realize that the core risk point of DeFi lies in the security of smart contracts, and also made him vigilant about the transparency of CEX platforms.

11. In-depth technology

This year, he developed multiple smart contract applications and began to study Bitcoin brain wallet technology. He wrote a set of advanced brain wallet solutions and had in-depth exchanges with @比特币布道者, and also met @拖拉机. While discussing technology, they also laid the foundation for promoting Bitcoin popularization.

---------------------------------------------

[Establishment of faith and full warehouse BTC (2022-2024)]

12, after ETH switched to POS: "Everything except Bitcoin is a copycat"

When Ethereum switched to POS (proof of stake) in 2022, Da Ge completely lost interest in ETH. He believes that the centralization tendency and fairness issues of POS make ETH no longer comparable to Bitcoin. Since then, he has proposed that "Bitcoin is a choice of values and an anchor of liberalism." Therefore, "everything other than Bitcoin is a copycat." He gradually exchanged ETH and other PoS currencies for BTC in batches, and at the same time created a Bitcoin fixed investment plan. His strategies include pyramid fixed investment and cocktail fixed investment methods, and he promoted the concept and technical knowledge of Bitcoin through many popular science articles.

13. Exploration of Decentralization: Nostr Protocol

In 2023, the Nostr protocol attracted Da Ge's attention due to its decentralized characteristics. He studied the characteristics of this protocol in depth and wrote many articles to promote the importance of decentralization. During the promotion process, he met friends in the circle such as @阿剑 and @ale, and cooperated with them in the dissemination of concepts and technical applications.

14. Da Ge Index and "Smart Way": Quantifying Market Heat

In 2024, he designed the Da Ge Index based on market data to judge market heat by the deviation value of the second quarter contract. In addition, he launched the "Smart Way" historical curve tool to provide Bitcoin exchange rate historical data query services for users in the circle. These tools not only help more people understand the Bitcoin market, but also reflect his vision of promoting the popularization of Bitcoin.

15. Weibo Changes: From "btc达哥" to "囤饼达"

Da Ge's Weibo journey was not smooth. His first Weibo account "btc达哥" was blocked for sharing Bitcoin knowledge, but he did not stop there. Instead, he opened a new account "囤饼达" and continued to spread Bitcoin-related knowledge with a pragmatic attitude.

---------------------------------------------

16. Conclusion

From a laptop in 2011 to Smart Way in 2024, Da Ge's story is a history of transformation from a technology experimenter to a Bitcoin believer. During his journey, friends such as Mr. C, @比特币布道者, @拖拉机, @Ale, @阿剑 and others became his companions and jointly promoted the spread and development of cryptocurrency.

Da Ge's experience is not only his personal growth history, but also an important witness to the development of the currency circle.

1. Initial Exploration of the World of Bitcoin (2011)

In 2011, Da Ge first came into contact with Bitcoin due to work. At that time, Bitcoin was just a "toy" that only a few technology enthusiasts paid attention to. Out of interest in new technologies, Da Ge downloaded the Bitcoin wallet Bitcoin Core, and ran mining software on his laptop to connect to the mining pool, and used the CPU to mine intermittently for several weeks. Although graphics card mining had become mainstream at the time, he successfully mined 0.1 Bitcoin with the CPU. Because mining interfered with work to a certain extent, and the value of Bitcoin at the time was negligible, Da Ge suspended this attempt. Many years later, he jokingly called this mining experience "a low-cost digital experiment."

2. Regrets in 2013 (2013)

In 2013, Da Ge bought 6 Bitcoins at a cost of less than 1,000 yuan, but due to poor storage, the 6 Bitcoins were eventually lost, which made him very regretful. In 2021, during an accidental sorting, Da Ge unexpectedly found 0.1 Bitcoin obtained from mining in 2011. This "legacy" is now worth about 70,000 yuan.

---------------------------------------------

3. Return to Cryptocurrency (2017)

In early 2017, as the prices of Bitcoin and Ethereum soared, Da Ge's old friend Mr. C mentioned to him that mining Ethereum (ETH) with graphics cards was becoming a hot topic. Although Da Ge's perception of Bitcoin at the time was still that "the value was not stable", ETH's smart contracts and miner ecology attracted his attention. He decided not to take the conventional route, but to develop Chinese mining software for multiple currencies.

4. Deepening Mining Software

Da Ge successively launched mining software that supports multiple POW currencies such as ETH, ETC, ZEC, and XMR, and quickly accumulated a large amount of assets. At this stage, he earned his first pot of gold in his life from mining.

At this time, the ICO craze swept the world, and Da Ge also participated in some projects and obtained short-term floating profits. However, the vast majority of ICO projects eventually became “air coins”, which made him deeply realize that bubbles and risks coexist in the crypto market.

5. The shock of BCH hard fork

The Bitcoin community had a disagreement over the "big block dispute" that year, which gave birth to BCH (Bitcoin Cash). Although he did not directly participate in the dispute, when Coinbase launched BCH, Da Ge felt the shock of the market. He exchanged part of ETH for BTC and an equivalent amount of BCH to ensure the balance of asset layout. Although his interest in BTC has not yet fully awakened, this move has become a foreshadowing of subsequent changes.

---------------------------------------------

6, Technology and Thinking in the Bear Market (2018-2020)

As the market entered the cold winter, the mining ecology gradually cooled down. Da Ge's mining income decreased accordingly, but the advantage of low technical cost allowed him to continue to operate steadily.

7. Reflection on Monero and Centralization

When tracking the frequent algorithm updates of Monero (XMR), Da Ge found that its development team had absolute dominance over the project, and believed that this "algorithm centralization" ran counter to the true concept of decentralization. This observation further prompted him to become interested in Bitcoin's separation of powers mechanism, and gradually realized the uniqueness of Bitcoin as a "decentralized asset".

8. Awakening of the digital RMB test

In 2020, the news of the digital RMB test triggered Da Ge's deep thinking about financial control and freedom. He regards the digital RMB as an "electronic food stamp", and its "controllability" is a threat to individual freedom and a regression of the planned economy. This cognition prompted him to re-examine Bitcoin and begin to study its underlying mechanisms and economic principles. By reading classic books on Austrian economics, he strengthened his understanding of the value of free markets and scarce assets, and gradually converted over-the-counter funds into BTC.

---------------------------------------------

9. The craze and cost of DeFi (2021)

The DeFi summer of 2021 attracted global attention, and Da Ge also invested his ETH in the DeFi ecosystem. At the same time, he cleared assets such as BCH and ETC and concentrated funds on BTC.

10. Arbitrage and Risk

During this period, he tried a combination strategy of CEX lending + DeFi arbitrage, and made profits through funding arbitrage, quarterly contract discount arbitrage and other means. However, risks also followed. A QBT contract vulnerability caused him to lose more than 100,000 U in his deposit in PancakeBunny. This lesson made him deeply realize that the core risk point of DeFi lies in the security of smart contracts, and also made him vigilant about the transparency of CEX platforms.

11. In-depth technology

This year, he developed multiple smart contract applications and began to study Bitcoin brain wallet technology. He wrote a set of advanced brain wallet solutions and had in-depth exchanges with @比特币布道者, and also met @拖拉机. While discussing technology, they also laid the foundation for promoting Bitcoin popularization.

---------------------------------------------

[Establishment of faith and full warehouse BTC (2022-2024)]

12, after ETH switched to POS: "Everything except Bitcoin is a copycat"

When Ethereum switched to POS (proof of stake) in 2022, Da Ge completely lost interest in ETH. He believes that the centralization tendency and fairness issues of POS make ETH no longer comparable to Bitcoin. Since then, he has proposed that "Bitcoin is a choice of values and an anchor of liberalism." Therefore, "everything other than Bitcoin is a copycat." He gradually exchanged ETH and other PoS currencies for BTC in batches, and at the same time created a Bitcoin fixed investment plan. His strategies include pyramid fixed investment and cocktail fixed investment methods, and he promoted the concept and technical knowledge of Bitcoin through many popular science articles.

13. Exploration of Decentralization: Nostr Protocol

In 2023, the Nostr protocol attracted Da Ge's attention due to its decentralized characteristics. He studied the characteristics of this protocol in depth and wrote many articles to promote the importance of decentralization. During the promotion process, he met friends in the circle such as @阿剑 and @ale, and cooperated with them in the dissemination of concepts and technical applications.

14. Da Ge Index and "Smart Way": Quantifying Market Heat

In 2024, he designed the Da Ge Index based on market data to judge market heat by the deviation value of the second quarter contract. In addition, he launched the "Smart Way" historical curve tool to provide Bitcoin exchange rate historical data query services for users in the circle. These tools not only help more people understand the Bitcoin market, but also reflect his vision of promoting the popularization of Bitcoin.

15. Weibo Changes: From "btc达哥" to "囤饼达"

Da Ge's Weibo journey was not smooth. His first Weibo account "btc达哥" was blocked for sharing Bitcoin knowledge, but he did not stop there. Instead, he opened a new account "囤饼达" and continued to spread Bitcoin-related knowledge with a pragmatic attitude.

---------------------------------------------

16. Conclusion

From a laptop in 2011 to Smart Way in 2024, Da Ge's story is a history of transformation from a technology experimenter to a Bitcoin believer. During his journey, friends such as Mr. C, @比特币布道者, @拖拉机, @Ale, @阿剑 and others became his companions and jointly promoted the spread and development of cryptocurrency.

Da Ge's experience is not only his personal growth history, but also an important witness to the development of the currency circle.

1. Initial Exploration of the World of Bitcoin (2011)

In 2011, Da Ge first came into contact with Bitcoin due to work. At that time, Bitcoin was just a "toy" that only a few technology enthusiasts paid attention to. Out of interest in new technologies, Da Ge downloaded the Bitcoin wallet Bitcoin Core, and ran mining software on his laptop to connect to the mining pool, and used the CPU to mine intermittently for several weeks. Although graphics card mining had become mainstream at the time, he successfully mined 0.1 Bitcoin with the CPU. Because mining interfered with work to a certain extent, and the value of Bitcoin at the time was negligible, Da Ge suspended this attempt. Many years later, he jokingly called this mining experience "a low-cost digital experiment."

2. Regrets in 2013 (2013)

In 2013, Da Ge bought 6 Bitcoins at a cost of less than 1,000 yuan, but due to poor storage, the 6 Bitcoins were eventually lost, which made him very regretful. In 2021, during an accidental sorting, Da Ge unexpectedly found 0.1 Bitcoin obtained from mining in 2011. This "legacy" is now worth about 70,000 yuan.

---------------------------------------------

3. Return to Cryptocurrency (2017)

In early 2017, as the prices of Bitcoin and Ethereum soared, Da Ge's old friend Mr. C mentioned to him that mining Ethereum (ETH) with graphics cards was becoming a hot topic. Although Da Ge's perception of Bitcoin at the time was still that "the value was not stable", ETH's smart contracts and miner ecology attracted his attention. He decided not to take the conventional route, but to develop Chinese mining software for multiple currencies.

4. Deepening Mining Software

Da Ge successively launched mining software that supports multiple POW currencies such as ETH, ETC, ZEC, and XMR, and quickly accumulated a large amount of assets. At this stage, he earned his first pot of gold in his life from mining.

At this time, the ICO craze swept the world, and Da Ge also participated in some projects and obtained short-term floating profits. However, the vast majority of ICO projects eventually became “air coins”, which made him deeply realize that bubbles and risks coexist in the crypto market.

5. The shock of BCH hard fork

The Bitcoin community had a disagreement over the "big block dispute" that year, which gave birth to BCH (Bitcoin Cash). Although he did not directly participate in the dispute, when Coinbase launched BCH, Da Ge felt the shock of the market. He exchanged part of ETH for BTC and an equivalent amount of BCH to ensure the balance of asset layout. Although his interest in BTC has not yet fully awakened, this move has become a foreshadowing of subsequent changes.

---------------------------------------------

6, Technology and Thinking in the Bear Market (2018-2020)

As the market entered the cold winter, the mining ecology gradually cooled down. Da Ge's mining income decreased accordingly, but the advantage of low technical cost allowed him to continue to operate steadily.

7. Reflection on Monero and Centralization

When tracking the frequent algorithm updates of Monero (XMR), Da Ge found that its development team had absolute dominance over the project, and believed that this "algorithm centralization" ran counter to the true concept of decentralization. This observation further prompted him to become interested in Bitcoin's separation of powers mechanism, and gradually realized the uniqueness of Bitcoin as a "decentralized asset".

8. Awakening of the digital RMB test

In 2020, the news of the digital RMB test triggered Da Ge's deep thinking about financial control and freedom. He regards the digital RMB as an "electronic food stamp", and its "controllability" is a threat to individual freedom and a regression of the planned economy. This cognition prompted him to re-examine Bitcoin and begin to study its underlying mechanisms and economic principles. By reading classic books on Austrian economics, he strengthened his understanding of the value of free markets and scarce assets, and gradually converted over-the-counter funds into BTC.

---------------------------------------------

9. The craze and cost of DeFi (2021)

The DeFi summer of 2021 attracted global attention, and Da Ge also invested his ETH in the DeFi ecosystem. At the same time, he cleared assets such as BCH and ETC and concentrated funds on BTC.

10. Arbitrage and Risk

During this period, he tried a combination strategy of CEX lending + DeFi arbitrage, and made profits through funding arbitrage, quarterly contract discount arbitrage and other means. However, risks also followed. A QBT contract vulnerability caused him to lose more than 100,000 U in his deposit in PancakeBunny. This lesson made him deeply realize that the core risk point of DeFi lies in the security of smart contracts, and also made him vigilant about the transparency of CEX platforms.

11. In-depth technology

This year, he developed multiple smart contract applications and began to study Bitcoin brain wallet technology. He wrote a set of advanced brain wallet solutions and had in-depth exchanges with @比特币布道者, and also met @拖拉机. While discussing technology, they also laid the foundation for promoting Bitcoin popularization.

---------------------------------------------

[Establishment of faith and full warehouse BTC (2022-2024)]

12, after ETH switched to POS: "Everything except Bitcoin is a copycat"

When Ethereum switched to POS (proof of stake) in 2022, Da Ge completely lost interest in ETH. He believes that the centralization tendency and fairness issues of POS make ETH no longer comparable to Bitcoin. Since then, he has proposed that "Bitcoin is a choice of values and an anchor of liberalism." Therefore, "everything other than Bitcoin is a copycat." He gradually exchanged ETH and other PoS currencies for BTC in batches, and at the same time created a Bitcoin fixed investment plan. His strategies include pyramid fixed investment and cocktail fixed investment methods, and he promoted the concept and technical knowledge of Bitcoin through many popular science articles.

13. Exploration of Decentralization: Nostr Protocol

In 2023, the Nostr protocol attracted Da Ge's attention due to its decentralized characteristics. He studied the characteristics of this protocol in depth and wrote many articles to promote the importance of decentralization. During the promotion process, he met friends in the circle such as @阿剑 and @ale, and cooperated with them in the dissemination of concepts and technical applications.

14. Da Ge Index and "Smart Way": Quantifying Market Heat

In 2024, he designed the Da Ge Index based on market data to judge market heat by the deviation value of the second quarter contract. In addition, he launched the "Smart Way" historical curve tool to provide Bitcoin exchange rate historical data query services for users in the circle. These tools not only help more people understand the Bitcoin market, but also reflect his vision of promoting the popularization of Bitcoin.

15. Weibo Changes: From "btc达哥" to "囤饼达"

Da Ge's Weibo journey was not smooth. His first Weibo account "btc达哥" was blocked for sharing Bitcoin knowledge, but he did not stop there. Instead, he opened a new account "囤饼达" and continued to spread Bitcoin-related knowledge with a pragmatic attitude.

---------------------------------------------

16. Conclusion

From a laptop in 2011 to Smart Way in 2024, Da Ge's story is a history of transformation from a technology experimenter to a Bitcoin believer. During his journey, friends such as Mr. C, @比特币布道者, @拖拉机, @Ale, @阿剑 and others became his companions and jointly promoted the spread and development of cryptocurrency.

Da Ge's experience is not only his personal growth history, but also an important witness to the development of the currency circle.# 达哥指数:用科学化指标预测市场热度 🔥 #

牛市中常有人问:牛市何时结束、顶又在哪儿。

对我们囤饼人而言:“1 BTC = 1 BTC”,并不关心顶部在哪,更不会去做所谓的逃顶。

但是为了用有限的法币能定投到更多的大饼,还是可以通过一些科学化的方式来关注市场的热度。因此,我特别推出了 “达哥指数”—— 一个大饼市场热度的衡量标准。

🌡 达哥指数的原理:

达哥指数综合考虑了两个因素:次季期货合约与现货价格的偏离度,以及距离交割日的时间衰减因子,来量化市场的热度。具体来说:

次季偏离度(Deviation): 通过计算期货合约价格与现货市场价格之间的差异,得出偏离度。例如,若期货价格比现货价格高 10%,那么偏离度就是 10%。

时间衰减因子(Time Compensation Factor): 随着期货合约交割日临近,市场对价格偏离的敏感度会逐渐减弱。距离交割日越远,偏离度的影响越大;而随着交割日的接近,市场的敏感度逐渐下降。

🔥 达哥指数(Heat Index)的计算方式:

公式如下:

新版公式:

Heat Index = AdjustedDeviation/A

AdjustedDeviation = (次季合约价 - 现货价)/ 现货价 × 500

A=max(1/180,min(1,剩余天数/180)),确保 A 的范围在 [1/180,1]。

AdjustedDeviation是 偏离度的倍数(次季合约价格与现货价格偏离的程度乘以 5)。

A 是时间衰减因子,A 的值随着距离交割日的临近逐渐减小,最大为 1(距离交割日远)到 0(距离交割日近)。

Heat Index 就是最终的“达哥指数”,数值范围 0 到 100,数值越高,市场热度越高,越接近 100,表示市场可能进入疯狂阶段。

🌡 达哥指数的原理:

达哥指数综合考虑了两个因素:次季期货合约与现货价格的偏离度,以及距离交割日的时间衰减因子,来量化市场的热度。具体来说:

次季偏离度(Deviation): 通过计算期货合约价格与现货市场价格之间的差异,得出偏离度。例如,若期货价格比现货价格高 10%,那么偏离度就是 10%。

时间衰减因子(Time Compensation Factor): 随着期货合约交割日临近,市场对价格偏离的敏感度会逐渐减弱。距离交割日越远,偏离度的影响越大;而随着交割日的接近,市场的敏感度逐渐下降。

🔥 达哥指数(Heat Index)的计算方式:

公式如下:

新版公式:

Heat Index = AdjustedDeviation/A

AdjustedDeviation = (次季合约价 - 现货价)/ 现货价 × 500

A=max(1/180,min(1,剩余天数/180)),确保 A 的范围在 [1/180,1]。

AdjustedDeviation是 偏离度的倍数(次季合约价格与现货价格偏离的程度乘以 5)。

A 是时间衰减因子,A 的值随着距离交割日的临近逐渐减小,最大为 1(距离交割日远)到 0(距离交割日近)。

Heat Index 就是最终的“达哥指数”,数值范围 0 到 100,数值越高,市场热度越高,越接近 100,表示市场可能进入疯狂阶段。

📉 理论支持:

价格偏离与市场情绪: 期货合约价格和现货价格之间的差异能够反映市场情绪。价格差距越大,往往意味着市场情绪越乐观,反之亦然。

时间衰减与市场波动: 随着交割日的临近,市场的价格波动对未来走势的影响会逐渐减弱。引入时间衰减因子后,达哥指数能够更精准地反映市场动态。

📊 达哥指数的应用:

市场过热警告: 达哥指数超过 75 时,表示市场进入过热阶段,可暂停定投等待机会。

市场冷淡评估: 达哥指数低于 20 时,表明市场情绪冷淡,交易量可能较低,适合耐心等待市场情绪回暖。

定投决策参考: 当指数在 40-75 之间,市场较为活跃,可以适当减少定投资金;而低于 20 时,可以放心进行定期定额投资。

🚀 如何看待达哥指数?

达哥指数为你提供了一个直观的市场温度计,帮助你做出更加明智的定投决策。精准的热度评估能帮助你有效规划定投份额,增加饼含量增加的机会。

达哥指数历时曲线(每日更新,无需魔法)

备份:

http://startbitcoin.org/dagezhishu

感谢@比特币布道者 提供备份空间。

📉 理论支持:

价格偏离与市场情绪: 期货合约价格和现货价格之间的差异能够反映市场情绪。价格差距越大,往往意味着市场情绪越乐观,反之亦然。

时间衰减与市场波动: 随着交割日的临近,市场的价格波动对未来走势的影响会逐渐减弱。引入时间衰减因子后,达哥指数能够更精准地反映市场动态。

📊 达哥指数的应用:

市场过热警告: 达哥指数超过 75 时,表示市场进入过热阶段,可暂停定投等待机会。

市场冷淡评估: 达哥指数低于 20 时,表明市场情绪冷淡,交易量可能较低,适合耐心等待市场情绪回暖。

定投决策参考: 当指数在 40-75 之间,市场较为活跃,可以适当减少定投资金;而低于 20 时,可以放心进行定期定额投资。

🚀 如何看待达哥指数?

达哥指数为你提供了一个直观的市场温度计,帮助你做出更加明智的定投决策。精准的热度评估能帮助你有效规划定投份额,增加饼含量增加的机会。

达哥指数历时曲线(每日更新,无需魔法)

备份:

http://startbitcoin.org/dagezhishu

感谢@比特币布道者 提供备份空间。

🌡 达哥指数的原理:

达哥指数综合考虑了两个因素:次季期货合约与现货价格的偏离度,以及距离交割日的时间衰减因子,来量化市场的热度。具体来说:

次季偏离度(Deviation): 通过计算期货合约价格与现货市场价格之间的差异,得出偏离度。例如,若期货价格比现货价格高 10%,那么偏离度就是 10%。

时间衰减因子(Time Compensation Factor): 随着期货合约交割日临近,市场对价格偏离的敏感度会逐渐减弱。距离交割日越远,偏离度的影响越大;而随着交割日的接近,市场的敏感度逐渐下降。

🔥 达哥指数(Heat Index)的计算方式:

公式如下:

新版公式:

Heat Index = AdjustedDeviation/A

AdjustedDeviation = (次季合约价 - 现货价)/ 现货价 × 500

A=max(1/180,min(1,剩余天数/180)),确保 A 的范围在 [1/180,1]。

AdjustedDeviation是 偏离度的倍数(次季合约价格与现货价格偏离的程度乘以 5)。

A 是时间衰减因子,A 的值随着距离交割日的临近逐渐减小,最大为 1(距离交割日远)到 0(距离交割日近)。

Heat Index 就是最终的“达哥指数”,数值范围 0 到 100,数值越高,市场热度越高,越接近 100,表示市场可能进入疯狂阶段。

🌡 达哥指数的原理:

达哥指数综合考虑了两个因素:次季期货合约与现货价格的偏离度,以及距离交割日的时间衰减因子,来量化市场的热度。具体来说:

次季偏离度(Deviation): 通过计算期货合约价格与现货市场价格之间的差异,得出偏离度。例如,若期货价格比现货价格高 10%,那么偏离度就是 10%。

时间衰减因子(Time Compensation Factor): 随着期货合约交割日临近,市场对价格偏离的敏感度会逐渐减弱。距离交割日越远,偏离度的影响越大;而随着交割日的接近,市场的敏感度逐渐下降。

🔥 达哥指数(Heat Index)的计算方式:

公式如下:

新版公式:

Heat Index = AdjustedDeviation/A

AdjustedDeviation = (次季合约价 - 现货价)/ 现货价 × 500

A=max(1/180,min(1,剩余天数/180)),确保 A 的范围在 [1/180,1]。

AdjustedDeviation是 偏离度的倍数(次季合约价格与现货价格偏离的程度乘以 5)。

A 是时间衰减因子,A 的值随着距离交割日的临近逐渐减小,最大为 1(距离交割日远)到 0(距离交割日近)。

Heat Index 就是最终的“达哥指数”,数值范围 0 到 100,数值越高,市场热度越高,越接近 100,表示市场可能进入疯狂阶段。

📉 理论支持:

价格偏离与市场情绪: 期货合约价格和现货价格之间的差异能够反映市场情绪。价格差距越大,往往意味着市场情绪越乐观,反之亦然。

时间衰减与市场波动: 随着交割日的临近,市场的价格波动对未来走势的影响会逐渐减弱。引入时间衰减因子后,达哥指数能够更精准地反映市场动态。

📊 达哥指数的应用:

市场过热警告: 达哥指数超过 75 时,表示市场进入过热阶段,可暂停定投等待机会。

市场冷淡评估: 达哥指数低于 20 时,表明市场情绪冷淡,交易量可能较低,适合耐心等待市场情绪回暖。

定投决策参考: 当指数在 40-75 之间,市场较为活跃,可以适当减少定投资金;而低于 20 时,可以放心进行定期定额投资。

🚀 如何看待达哥指数?

达哥指数为你提供了一个直观的市场温度计,帮助你做出更加明智的定投决策。精准的热度评估能帮助你有效规划定投份额,增加饼含量增加的机会。

达哥指数历时曲线(每日更新,无需魔法)

📉 理论支持:

价格偏离与市场情绪: 期货合约价格和现货价格之间的差异能够反映市场情绪。价格差距越大,往往意味着市场情绪越乐观,反之亦然。

时间衰减与市场波动: 随着交割日的临近,市场的价格波动对未来走势的影响会逐渐减弱。引入时间衰减因子后,达哥指数能够更精准地反映市场动态。

📊 达哥指数的应用:

市场过热警告: 达哥指数超过 75 时,表示市场进入过热阶段,可暂停定投等待机会。

市场冷淡评估: 达哥指数低于 20 时,表明市场情绪冷淡,交易量可能较低,适合耐心等待市场情绪回暖。

定投决策参考: 当指数在 40-75 之间,市场较为活跃,可以适当减少定投资金;而低于 20 时,可以放心进行定期定额投资。

🚀 如何看待达哥指数?

达哥指数为你提供了一个直观的市场温度计,帮助你做出更加明智的定投决策。精准的热度评估能帮助你有效规划定投份额,增加饼含量增加的机会。

达哥指数历时曲线(每日更新,无需魔法)

达哥指数(市场热度指数-每日更新)

📢 ₿₿₿聪之道₿₿₿上线啦! 📊

十几年间,每天、每周、每月、每年 BTC/USD/CNY汇率变化,尽收眼底!曲线图每日更新。

知道现在一块钱能买多少聪吗?顶部实时数据每分钟更新!⏱

🌟 亮点功能:

✅ 详细历史曲线✅ 每日达哥指数

🌟 亮点功能:

✅ 详细历史曲线✅ 每日达哥指数

📈 探索市场动态,感受数据的力量,立即体验吧👇

👉₿₿₿ 聪之道₿₿₿:市场热度 & 汇率历史

另:✅ 桌面组件已更新功能,右键菜单直达₿₿₿聪之道₿₿₿

📈 探索市场动态,感受数据的力量,立即体验吧👇

👉₿₿₿ 聪之道₿₿₿:市场热度 & 汇率历史

另:✅ 桌面组件已更新功能,右键菜单直达₿₿₿聪之道₿₿₿

🌟 亮点功能:

✅ 详细历史曲线✅ 每日达哥指数

🌟 亮点功能:

✅ 详细历史曲线✅ 每日达哥指数

📈 探索市场动态,感受数据的力量,立即体验吧👇

👉₿₿₿ 聪之道₿₿₿:市场热度 & 汇率历史

📈 探索市场动态,感受数据的力量,立即体验吧👇

👉₿₿₿ 聪之道₿₿₿:市场热度 & 汇率历史

₿₿₿聪之道₿₿₿

202X年X月X日 XXXX报社论:抓住时代脉搏,推动数字经济全面发展

在全面建设社会主义现代化国家的新征程上,科技创新始终是引领发展的第一动力。数字经济作为新时代的经济发展新引擎,已经成为全球竞争的核心领域。无论是人工智能的迅猛发展,还是区块链、数字货币等新兴技术的应用,都正在深刻影响着全球经济格局,推动着生产力和生产关系的历史性变革。

中国坚持以人民为中心的发展思想,始终把创新摆在国家发展全局的核心位置。近年来,数字货币作为推动数字经济发展的重要组成部分,逐渐引起了世界各国的高度关注。在全球范围内,各国纷纷出台政策,探索数字货币的应用与发展。我们党始终高度关注技术进步对金融体系的影响,科学审慎地制定了相关政策,确保金融市场稳定与国家经济安全。

经过多年实践经验的积累,我们深刻认识到,任何新兴技术的出现,都会引发不同层面的挑战与思考。虚拟货币市场的初期发展,曾因监管不完善和市场秩序不健全,给部分投资者带来了风险隐患。在这一过程中,国家及时采取了必要的政策措施,有力保障了金融体系的安全和稳定,取得了显著成效。

然而,科技的发展日新月异,数字经济的深度融合已经成为全球趋势。人工智能技术的飞速发展,已然成为推动社会生产力不断进步的重要力量;而数字货币作为数字经济的重要组成部分,正逐步成为新的生产关系载体。在这一历史变革的关键时刻,顺应时代潮流,适应金融科技发展的新要求,及时调整相关政策,以推动数字货币合法合规的发展,是对经济规律的科学回应,是对社会需求的积极响应。

我们党始终坚定不移地走中国特色社会主义道路,决策的每一步都体现了我们党对时代潮流的深刻洞察和对国家未来的高度负责。比特币等数字资产在全球市场中的作用日益凸显,展现出了其不可忽视的经济价值。当前,我国在金融科技领域的持续创新为我们提供了强大的技术支持,也为金融监管的完善提供了可能。在新的历史条件下,顺应这一变化,推动数字货币市场健康发展,符合我国金融稳定、经济创新的战略目标。

当然,这一过程不会一蹴而就。在推进数字货币合法合规发展的同时,我们也将继续强化金融监管,确保金融市场秩序的稳定与安全,防范各类金融风险。我国将继续强化区块链等核心技术的自主研发,积极推动数字人民币的全面应用,确保国家金融安全,为全球经济的数字化转型贡献中国智慧。

中国的每一次决策,都是在新时代发展大局中的必然选择,充分体现了我们党与时俱进、勇于创新的精神。正如我们党历来所强调的,改革开放是不断发展的过程,每一步都充满了战略眼光与历史责任。通过不断完善政策、调整措施,我们必将稳步推动数字经济发展,促进经济结构转型升级,提升国家竞争力。

未来,随着技术不断进步和市场需求的逐步成熟,数字货币作为一种新的资产形态,将会在全球经济体系中发挥更为重要的作用。我们将继续以党的创新理论为指引,紧紧把握时代脉搏,推动数字货币、区块链等新兴技术的健康发展,促进我国金融体系的更加稳健和高效。

结语: 站在新的历史起点上,我们必将坚定不移地推动数字经济的创新发展,带领人民群众走向更加富裕美好的未来。在这一伟大进程中,每一步决策都深刻契合了时代发展需求,彰显了中国特色社会主义制度的强大优势。

-------------------

by GPT4

爱国贼与恨国党:不存在的对立

近年来,网络上频繁出现“爱国贼”和“恨国党”这两个对立标签。一方批评对方是无条件为国家辩护、不容质疑的“爱国贼”,另一方则被斥为只会抨击国家的“恨国党”。这种对立看似泾渭分明,但在细细思考之后,似乎并不如表面那样简单。

国庆期间,网络上发生了一件颇具讽刺意味的事件:有人因在窗户上贴了一个圆形的福字贴纸,被网暴指责为暗示日本国旗。然而就在日本、韩国、美国等国家,正值中国国庆,华人们纷纷插上中国国旗庆祝,却并没有看到这些国家的民众因此反对或攻击他们。这一对比让我们不禁思考:在文明国家,似乎没有人过分在意这些象征性的小事,反倒是一些人对所谓的“国家尊严”格外敏感。

这种现象让我想起了一个段子。

一个鸡蛋的故事

段子是这样讲的:

一个农妇挎着一篮子鸡蛋走在路上,突然从路边窜出几个大汉,把她拖进了小树林。农妇拼命反抗,但最终还是被几名大汉侵犯了。大汉逃走后,农妇拍了拍自己身上的灰尘,叹了口气说道:“多大点事啊?我还以为他们要抢我的鸡蛋呢!”

在这个故事里,农妇最在乎的不是自己受到的侵犯,而是她带的鸡蛋。对于她来说,鸡蛋比她的尊严和安全更为重要。这种思维与“爱国贼”的逻辑有着惊人的相似之处。他们把国家的面子、外在形象(鸡蛋)看得至高无上,即使个人或社会遭遇了不公,他们也只在乎是否影响到了“国家的尊严”。

“爱国贼”与“恨国党”:不同的视角

批评国家的人经常被贴上“恨国党”的标签。按照“爱国贼”的逻辑,爱国就必须是无条件的,而任何指出问题、批评国家的人,都被认为是背叛国家。然而,实际上这些人并非“恨国”,他们的批评往往源于对国家更高的期许和希望。他们希望通过指出问题,促使国家进步和发展。

“爱国贼”的思维则恰恰相反。他们认为国家必须得到无条件的捍卫,哪怕国家存在缺陷也不能允许质疑。正如段子里的农妇,他们更在意“鸡蛋”——即国家的面子,而忽视了真正关乎国家未来和公民福祉的问题。在他们的世界里,只要不捍卫鸡蛋,便成了“恨鸡蛋党”。

文明社会:没有“恨国党”

当我们把目光转向那些文明国家,如美国、日本和韩国时,会发现根本不存在所谓的“恨国党”。在这些社会中,国家不过是为公民服务的工具,而不是需要无条件忠诚的对象。当国家的某些政策或行为无法满足公民的需求时,人们可以批评、质疑,甚至选择离开。

例如,爱因斯坦离开纳粹德国时,没人指责他“恨国”,因为在文明社会中,国家并非神圣不可侵犯的存在。对文明世界的公民来说,国家是否维护了个人的权利,才是判断国家是否值得尊敬的标准。他们关注的是自己的权利是否得到保障,而不是国家的外在形象是否光鲜。

正是在这里,段子中的“鸡蛋”变得无关紧要。文明社会的人们不在乎鸡蛋,也不会为鸡蛋争论不休。他们关心的是那些侵犯他们权利的“强奸者”,而不是无关紧要的外在事物。因此,恨鸡蛋党并不存在,恨国党也不存在。

爱国贼的世界:虚构的“恨国党”

然而,在“爱国贼”的世界里,这种不存在的“恨国党”被人为制造了出来。他们把国家的面子和尊严看得至高无上,认为国家应当不容质疑。因此,凡是敢于批评的人,都被他们打上“恨国”的标签。然而,这实际上只是他们的思维困境造成的幻觉。

其实,所谓的“恨国党”并不真实存在。那些被指责为“恨国”的人并非真的仇恨国家,他们只是希望国家更好,生活更公正。如果国家不能为公民提供一个良好的环境,那么批评和改进才是真正的爱国行为。而爱国贼的思维方式恰恰导致了他们对这些批评声音的误解,进而虚构出“恨国党”这个并不存在的敌人。

结语:只有“爱国贼”眼中才有“恨国党”

最终,我们可以得出一个清晰的结论:在现实中,根本不存在所谓的“恨国党”。这个概念只存在于“爱国贼”的世界里,他们因为过度在意国家的外在形象,将任何批评者视为敌人。而真正的爱国,恰恰是敢于指出国家的不足,推动其进步。

那些被打上“恨国党”标签的人,并非因为仇恨国家而发声,而是因为他们关心这个国家,希望它变得更好。在文明世界里,国家是为公民服务的,公民有权利批评和改善它。而“爱国贼”们的思维模式,恰如段子中的农妇,过分在意“鸡蛋”的完好,忽视了更大的问题。

因此,所谓的“恨国党”根本不存在,恨鸡蛋党也不存在。只有在“爱国贼”狭隘的眼界中,才会将不爱鸡蛋的人视作敌人。在文明社会中,人们关注的是自己的权利和国家的实际表现,而不是无关紧要的“鸡蛋”——即国家的外在形象。

囤比特币,无需在乎短期涨跌。真正决定你能囤多久的,不是价格波动,而是你承受波动的能力。跌了10%就心慌的人,涨10倍也会觉得到了顶;而能承受90%跌幅的,才有信心拿住1000倍的涨幅。不以涨喜,不以跌悲,眼光放开,格局才能变大。价格只是表象,心态决定高度。无论涨跌,认清比特币的长期价值,放宽时间维度,才能真正享受囤币带来的财富增值。

放弃高考焦虑,囤比特币迎接未来

囤饼达 btcdage

2024.6.13

随着高考季节的落幕,这一备受全国瞩目的事件再次引发了广泛讨论。然而,在当前的政治环境和人工智能技术的快速进步背景下,这条曾被视为阶层流动的通道正变得日益狭窄。对于大多数家庭而言,现在是时候重新审视教育资源的分配与未来财富积累之间的平衡了。

二十年前,高考被广泛认为是通向成功的关键途径。但是,随着社会阶层的日益固化,公务员、事业单位和国有企业等依赖税收的阶层通过血缘关系扩张其影响力,社会流动性大大降低。在官方的默许和鼓励下,民间对资本的敌视情绪不断升温,导致企业家逃离国内,外资撤出。私有企业作为劳动力市场的主要贡献者,其数量的减少加剧了就业难题。伴随着失业率的上升和大学毕业生人数的增加,即使是来自985、211高校的毕业生也面临失业的困境,更不用说其他普通高等教育机构的毕业生了。

很多人还没有意识到,在目前局势的发展下,对于大多数家庭而言,为子女进行大量的补课和教育投资,希望通过高考改变命运,已经收益甚微。除非孩子具有非凡的学习天赋,否则这些投资的经济效益极低,反而给家庭带来更大的经济压力。在这个时代背景下,重新考量教育投资的回报已很必要。

随着人工智能(AI)技术的突飞猛进,使得高考应试教育所培养的许多技能和知识迅速过时。AI不仅能够高效完成重复性工作,还在数据分析、语言处理等领域超越了人类。因此,传统教育体系下的优势在AI时代渐失色彩,即便是成绩优异的学生,也不一定能在未来职场获得优势。

尽管接受教育是必要的,且精英教育对于某些人而言是必需的,但并非每个人都需要成为精英。特别是在当前的环境下,即使成为精英,在国内也难以获得匹配的生活和工作待遇。如果孩子天生具有精英潜质,投资其出国发展无疑是更佳选择,这可能更有助于其天赋的发挥和潜力的实现。

作为一种去中心化、抗通胀的数字资产,比特币的长期投资价值已得到证实。随着全球对比特币接受度的提高,与其把财务资源投入到应试教育的额外支出,不如直接囤比特币,对子女的未来更为明智。

面对社会结构的固化、人工智能技术的发展以及就业市场的挑战,教育投资的经济效益正在下降。在未来充满不确定性的情况下,寻找更稳健的生存策略至关重要。而比特币,可能正是其中的一个解答。需要注意的是,本文主要面向普通家庭,对于既得利益阶层而言,则可能不具参考价值。

这事儿真得注意,我早先玩defi的时候也经常只看头尾字符串,而攻击者只要愿意付出成本,的确很容易以生成虚荣钱包的方式定制钓鱼地址。

在做各种操作的时候有必要逐字节核对地址。使用本地标签也是一个避免被钓鱼地址欺骗的方法。

下面是我写的一个以太坊虚荣钱包地址生成器。把代码保存到本地html文件用浏览器就可以运行:

下面是我写的一个以太坊虚荣钱包地址生成器。把代码保存到本地html文件用浏览器就可以运行:

下面是我写的一个以太坊虚荣钱包地址生成器。把代码保存到本地html文件用浏览器就可以运行:

下面是我写的一个以太坊虚荣钱包地址生成器。把代码保存到本地html文件用浏览器就可以运行:

GitHub

EthereumVanityAddressGenerator/EthereumVanityAddressGenerator.html at main · btcdage2000/EthereumVanityAddressGenerator

Contribute to btcdage2000/EthereumVanityAddressGenerator development by creating an account on GitHub.

我们总是渴望回到过去做件小事来改变现在,却不屑于细想现在开始做件小事去改变未来。

比如,买0.1个比特币。

这次比特币的回调,许多人可能看到的是恐慌和不确定性,其实这恰恰是又一个明显信号:机会来了。

我一直强调的一个观点是,法币的不断贬值对我们的财富是一种无形的侵蚀。而比特币,凭借其2100万的绝对稀缺性,为我们提供了一种抵抗这种侵蚀的手段。这不是空洞的说教,而是建立在对经济规律深刻理解的基础上。比特币的每一次减半,都在提醒我们,它与生俱来的稀缺性和价值。

我们讨论价值时,总会提到共识。比特币能在过去十多年中持续增值,正是因为它背后不断增强的共识。这份共识,既是对其技术的信任,也是对其价值逻辑的认同。这不仅仅是数字游戏,这是一场关于信任和共识的社会实验。

而现在,当比特币再次给我们机会时,我想说的不仅仅是“买入”。更重要的是,理解这背后的逻辑,认识到这不仅是一次财富积累的机会,更是一次站在时代前沿的机会。我提倡的定投策略,不是无脑操作,而是基于对比特币长期价值的认可和信任。

我经常强调脑钱包的重要性。这不是因为我对传统存储方式不信任,而是我更倾向于那种“人币合一”的状态。只有当你真正掌握了自己资产的控制权时,你才能在这个充满不确定性的世界中,找到一丝确定性的安全感。

所以,对于那些还在犹豫的人,我想说的是,现在正是一个极好的时刻。抓住机会,不仅仅是因为比特币的价值,更因为这代表着一个时代的转变。我们正在见证历史,而选择如何参与,将决定你在这场变革中的位置。

2449

这次比特币的回调,许多人可能看到的是恐慌和不确定性,其实这恰恰是又一个明显信号:机会来了。

我一直强调的一个观点是,法币的不断贬值对我们的财富是一种无形的侵蚀。而比特币,凭借其2100万的绝对稀缺性,为我们提供了一种抵抗这种侵蚀的手段。这不是空洞的说教,而是建立在对经济规律深刻理解的基础上。比特币的每一次减半,都在提醒我们,它与生俱来的稀缺性和价值。

我们讨论价值时,总会提到共识。比特币能在过去十多年中持续增值,正是因为它背后不断增强的共识。这份共识,既是对其技术的信任,也是对其价值逻辑的认同。这不仅仅是数字游戏,这是一场关于信任和共识的社会实验。

而现在,当比特币再次给我们机会时,我想说的不仅仅是“买入”。更重要的是,理解这背后的逻辑,认识到这不仅是一次财富积累的机会,更是一次站在时代前沿的机会。我提倡的定投策略,不是无脑操作,而是基于对比特币长期价值的认可和信任。

我经常强调脑钱包的重要性。这不是因为我对传统存储方式不信任,而是我更倾向于那种“人币合一”的状态。只有当你真正掌握了自己资产的控制权时,你才能在这个充满不确定性的世界中,找到一丝确定性的安全感。

所以,对于那些还在犹豫的人,我想说的是,现在正是一个极好的时刻。抓住机会,不仅仅是因为比特币的价值,更因为这代表着一个时代的转变。我们正在见证历史,而选择如何参与,将决定你在这场变革中的位置。

2449量子计算会摧毁比特币吗?

目前主要的量子算法:

【Shor算法】:

描述:由彼得•肖尔在1994年提出,能有效解决大数分解问题和离散对数问题。

▲▲▲▲对比特币的威胁:直接威胁到基于椭圆曲线数字签名算法(ECDSA)的比特币交易签名,因为ECDSA的安全性依赖于离散对数问题的难解性。

【Grover算法】:

描述:由Lov Grover在1996年提出,是一种量子搜索算法,可以在无序数据库中以平方根时间复杂度找到特定元素。

▲▲▲对比特币的威胁:能加速搜索哈希值的过程,理论上对比特币的工作量证明(PoW)构成威胁,但效果有限且不如Shor算法直接。

【量子退火(Quantum Annealing)】:

描述:一种量子计算方法,通过量子退火过程解决优化问题,尤其适用于寻找全局最小值问题。

▲对比特币的威胁:可能对寻找比特币挖矿中的随机数有加速作用,但相较于Grover算法,其对比特币网络的直接威胁较小。

【Boson采样】:

描述:一种量子计算模型,利用玻色子的特性来执行复杂的采样任务,被用来演示量子霸权。

对比特币的威胁:目前主要关注于展示量子计算的潜力,并非直接针对加密算法,对比特币网络的直接威胁较小。

【量子随机行走(Quantum Random Walks)】:

描述:量子版本的随机行走,展现出与经典随机行走不同的扩散特性,用于算法加速和量子搜索。

对比特币的威胁:在理论上可能加速某些搜索问题的解决,但目前尚未直接应用于攻击比特币网络的方式。

【HHL算法(Harrow-Hassidim-Lloyd Algorithm)】:

描述:用于解线性方程组的量子算法,能在特定条件下显著加速求解过程。

对比特币的威胁:虽然HHL算法在解决特定数学问题上有潜在的加速能力,但对比特币网络构成的直接威胁较小,因比特币的核心安全问题不涉及线性方程组的求解。

在这些量子算法中,Shor算法对比特币网络构成了最直接和最严重的威胁,因为它能够直接破解比特币所依赖的ECDSA数字签名算法——这也是为什么一个地址只能用一次的原因:公钥暴露了,私钥也就很快被破解了,你的币如果还在里面也就随风而去了。

Grover算法可能对比特币挖矿过程产生影响,但这种影响相对有限,对于SHA-256,Grover算法能将破解时间从2^256减少到2^128,这仍然是一个极其庞大的数字。

当然,实际上量子计算机达到运行Shor算法解决实际加密标准所需规模的能力,还面临很多技术和物理障碍。

即使Grover算法可以加速哈希的搜索过程,比特币网络可以通过调整难度目标来适应这种加速,以保持区块生成时间大约为10分钟。

而且,随着量子计算技术的发展,新的量子安全的加密算法也在研发中。

比如:

【哈希基加密算法】:

优势:主要用于数字签名方案,基于密码学哈希函数的安全性。

应用:在保护交易签名免受量子攻击方面特别有效,因为目前没有已知的量子算法能高效解决哈希函数的抗碰撞性问题。

场景:适用于比特币交易验证,确保交易的不可篡改性和用户的私钥安全。

【基于格的密码学】:

优势:提供了一套完整的加密和签名解决方案,基于计算上认为是量子安全的格问题。

应用:除了数字签名,还能支持加密通信和构建更复杂的密码协议,如全同态加密等。

场景:适用于比特币网络的加密升级,提高整体安全性,尤其是在未来可能面对量子计算机直接攻击加密货币钱包和交易加密的情形。

比特币作为一个去中心化网络,其安全性不仅依赖于交易的签名验证,还包括用户地址和钱包加密的保护。

哈希基加密算法擅长于签名方面,而基于格的密码学能提供更全面的加密解决方案。

不同的加密技术可以在不同时间点,针对网络的不同部分进行升级。

例如,先通过软分叉引入哈希基的签名算法,随后再考虑更全面的协议升级以引入基于格的密码学。

通过软分叉引入的哈希基和基于格的密码学技术,可以让网络在不影响现有用户的前提下,逐步提升其抗量子计算的能力,既保证了比特币网络的安全性和前瞻性,又维护了网络的统一和稳定性。

量子计算会摧毁比特币系统的说法可以休矣。

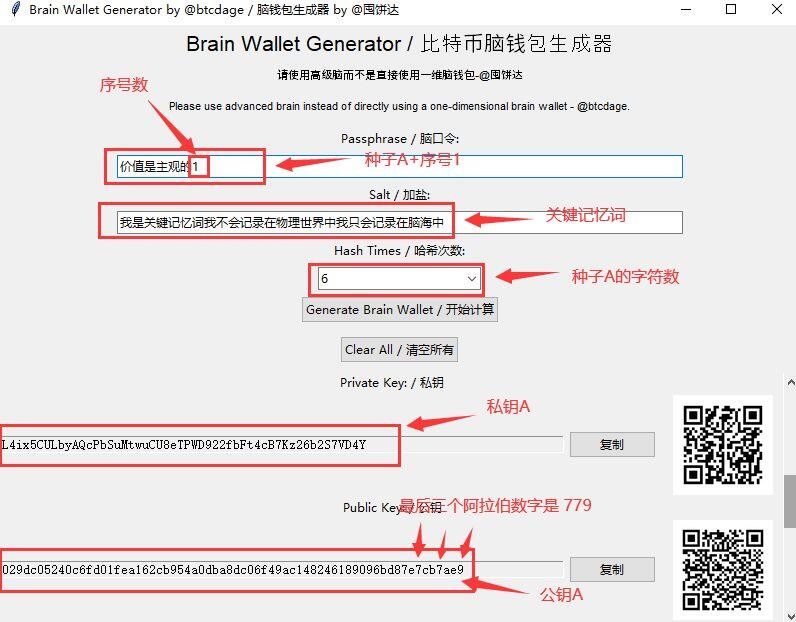

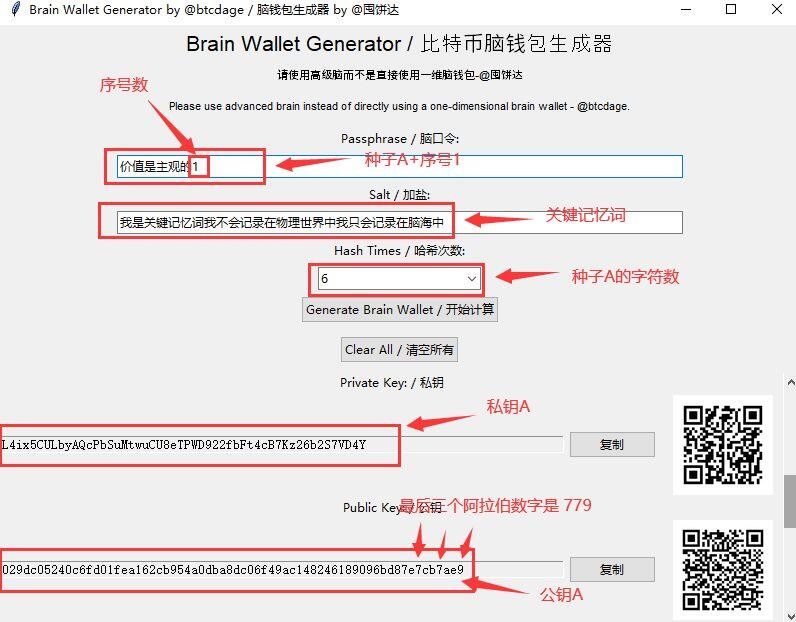

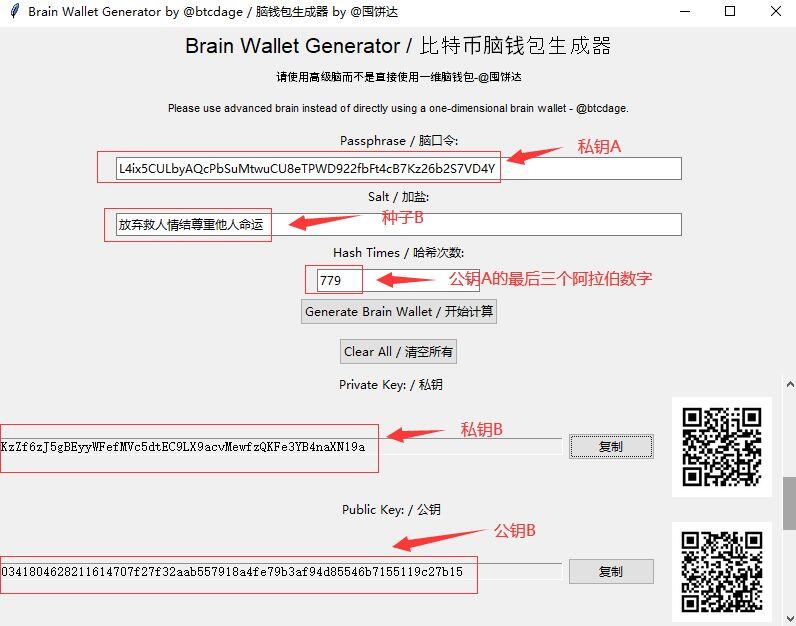

【图文教程】高级脑生成支持隔离见证的囤饼地址

本文将提出了一个高级脑设计算法,使用达哥的脑钱包生成工具来生成支持隔离见证的囤饼地址。(实际使用时,算法由你自己设计并保密,我这只是又一个例子,用来激发你的想象力,希望能起到抛砖引玉之效)

一、规则算法设计:(实际使用时,这个算法由你自己设计,我这只是又一个例子,激发你的想象力,抛砖引玉之效)

1、 涉及到记忆元素:两个脑种子(种子A和种子B)、一个“关键记忆词”、序号数使用半角阿拉伯数字。

2、 种子A + 序号数 为 脑口令A,把“关键记忆词”作为盐值,哈希次数为N,N=种子A的字符数量。使用达哥的脑口令软件一键生成:私钥A、公钥A。

3、 私钥A作为脑口令B,把种子B作为盐值,哈希次数为“公钥A的最后三位阿拉伯数字”。使用软件生成:私钥B、公钥B。

4、 私钥A+私钥B作为脑口令C,公钥A+公钥B作为盐值,哈希次数为“公钥B的最后三位阿拉伯数字”。一键生成的私钥和地址就是序号数派生出的囤饼地址。

5、 按照这个算法改变序号数生成其他囤饼地址。

二、具体例子便于理解(仅用序号数1来举例):

种子A:“价值是主观的”

种子B:“放弃救人情结尊重他人命运”

关键记忆词:“我是关键记忆词我不会记录在物理世界中我只会记录在脑海中”

1、 种子A + 序号数为脑口令,盐值为“关键记忆词”,哈希次数为N,N=种子A的字符数量。此例子中种子A是6个字。

脑口令:价值是主观的1

盐值:我是关键记忆词我不会记录在物理世界中我只会记录在脑海中

哈希次数:6

得到私钥A:L4ix5CULbyAQcPbSuMtwuCU8eTPWD922fbFt4cB7Kz26b2S7VD4Y

公钥A:029dc05240c6fd01fea162cb954a0dba8dc06f49ac148246189096bd87e7cb7ae9

公钥A最后三位阿拉伯数字是:779。

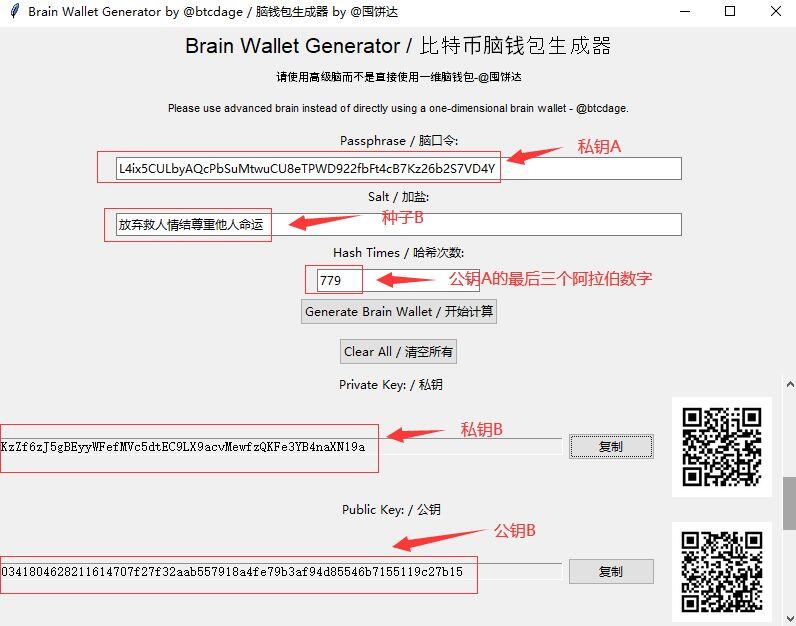

2、 私钥A作为脑口令,种子B作为盐值。进行779次哈希,一键生成信息:

脑口令:L4ix5CULbyAQcPbSuMtwuCU8eTPWD922fbFt4cB7Kz26b2S7VD4Y

盐值:放弃救人情结尊重他人命运

哈希次数:779

得到私钥A:L4ix5CULbyAQcPbSuMtwuCU8eTPWD922fbFt4cB7Kz26b2S7VD4Y

公钥A:029dc05240c6fd01fea162cb954a0dba8dc06f49ac148246189096bd87e7cb7ae9

公钥A最后三位阿拉伯数字是:779。

2、 私钥A作为脑口令,种子B作为盐值。进行779次哈希,一键生成信息:

脑口令:L4ix5CULbyAQcPbSuMtwuCU8eTPWD922fbFt4cB7Kz26b2S7VD4Y

盐值:放弃救人情结尊重他人命运

哈希次数:779

得到私钥B:KzZf6zJ5gBEyyWFefMVc5dtEC9LX9acvMewfzQKFe3YB4naXN19a

公钥B:0341804628211614707f27f32aab557918a4fe79b3af94d85546b7155119c27b15

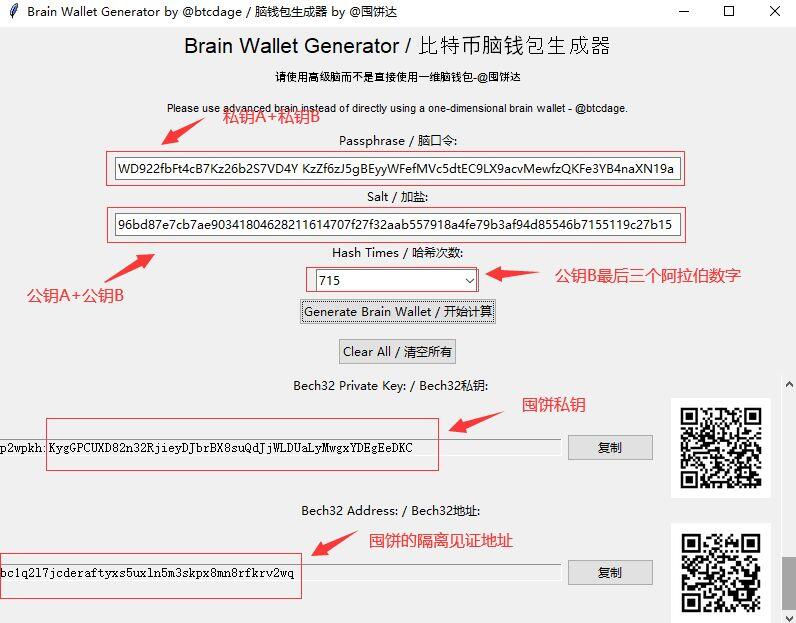

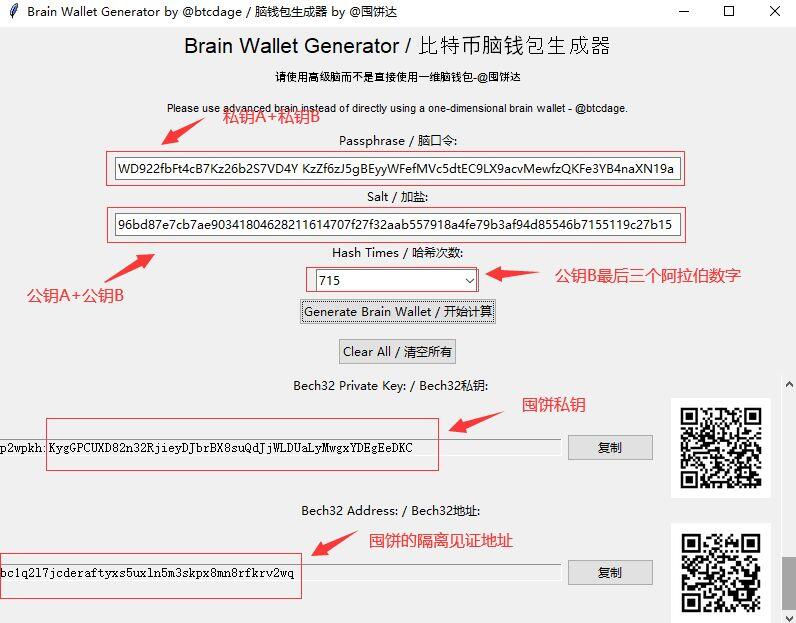

3、 私钥A+私钥B,作为脑口令D,盐值为:公钥A+公钥B,哈希次数为“公钥B的最后三位阿拉伯数字”。这里是715。一键生成的私钥和地址是序号数派生出的囤饼地址。

脑口令:L4ix5CULbyAQcPbSuMtwuCU8eTPWD922fbFt4cB7Kz26b2S7VD4Y KzZf6zJ5gBEyyWFefMVc5dtEC9LX9acvMewfzQKFe3YB4naXN19a

盐值:029dc05240c6fd01fea162cb954a0dba8dc06f49ac148246189096bd87e7cb7ae90341804628211614707f27f32aab557918a4fe79b3af94d85546b7155119c27b15

哈希次数:715

得到私钥B:KzZf6zJ5gBEyyWFefMVc5dtEC9LX9acvMewfzQKFe3YB4naXN19a

公钥B:0341804628211614707f27f32aab557918a4fe79b3af94d85546b7155119c27b15

3、 私钥A+私钥B,作为脑口令D,盐值为:公钥A+公钥B,哈希次数为“公钥B的最后三位阿拉伯数字”。这里是715。一键生成的私钥和地址是序号数派生出的囤饼地址。

脑口令:L4ix5CULbyAQcPbSuMtwuCU8eTPWD922fbFt4cB7Kz26b2S7VD4Y KzZf6zJ5gBEyyWFefMVc5dtEC9LX9acvMewfzQKFe3YB4naXN19a

盐值:029dc05240c6fd01fea162cb954a0dba8dc06f49ac148246189096bd87e7cb7ae90341804628211614707f27f32aab557918a4fe79b3af94d85546b7155119c27b15

哈希次数:715

得到序号1派生的囤饼私钥:p2wpkh:KygGPCUXD82n32RjieyDJbrBX8suQdJjWLDUaLyMwgxYDEgEeDKC

支持隔离见证的囤饼地址:bc1q2l7jcderaftyxs5uxln5m3skpx8mn8rfkrv2wq

三、安全保存策略:

1.分布式存储算法规则:建议将设计的算法规则进行分布式存储,或者将其打印多份,存放于多个安全且隐蔽的地点。务必确保算法细节不被外界知晓,以降低被暴力破解的风险。

2. 种子信息的物理存储:将两个脑种子分别记录在纸上,并保存在不同的秘密地点。同时,建议定期复习这些种子信息,以强化记忆,确保在需要时能够准确回忆。

3. 关键记忆词的心智记忆:关键记忆词应当仅在脑海中记忆,切勿将其记录在任何物理介质之上。这样做可以防止在脑种子信息意外泄露的情况下,保护资产免遭损失。

得到序号1派生的囤饼私钥:p2wpkh:KygGPCUXD82n32RjieyDJbrBX8suQdJjWLDUaLyMwgxYDEgEeDKC

支持隔离见证的囤饼地址:bc1q2l7jcderaftyxs5uxln5m3skpx8mn8rfkrv2wq

三、安全保存策略:

1.分布式存储算法规则:建议将设计的算法规则进行分布式存储,或者将其打印多份,存放于多个安全且隐蔽的地点。务必确保算法细节不被外界知晓,以降低被暴力破解的风险。

2. 种子信息的物理存储:将两个脑种子分别记录在纸上,并保存在不同的秘密地点。同时,建议定期复习这些种子信息,以强化记忆,确保在需要时能够准确回忆。

3. 关键记忆词的心智记忆:关键记忆词应当仅在脑海中记忆,切勿将其记录在任何物理介质之上。这样做可以防止在脑种子信息意外泄露的情况下,保护资产免遭损失。

得到私钥A:L4ix5CULbyAQcPbSuMtwuCU8eTPWD922fbFt4cB7Kz26b2S7VD4Y

公钥A:029dc05240c6fd01fea162cb954a0dba8dc06f49ac148246189096bd87e7cb7ae9

公钥A最后三位阿拉伯数字是:779。

2、 私钥A作为脑口令,种子B作为盐值。进行779次哈希,一键生成信息:

脑口令:L4ix5CULbyAQcPbSuMtwuCU8eTPWD922fbFt4cB7Kz26b2S7VD4Y

盐值:放弃救人情结尊重他人命运

哈希次数:779

得到私钥A:L4ix5CULbyAQcPbSuMtwuCU8eTPWD922fbFt4cB7Kz26b2S7VD4Y

公钥A:029dc05240c6fd01fea162cb954a0dba8dc06f49ac148246189096bd87e7cb7ae9

公钥A最后三位阿拉伯数字是:779。

2、 私钥A作为脑口令,种子B作为盐值。进行779次哈希,一键生成信息:

脑口令:L4ix5CULbyAQcPbSuMtwuCU8eTPWD922fbFt4cB7Kz26b2S7VD4Y

盐值:放弃救人情结尊重他人命运

哈希次数:779

得到私钥B:KzZf6zJ5gBEyyWFefMVc5dtEC9LX9acvMewfzQKFe3YB4naXN19a

公钥B:0341804628211614707f27f32aab557918a4fe79b3af94d85546b7155119c27b15

3、 私钥A+私钥B,作为脑口令D,盐值为:公钥A+公钥B,哈希次数为“公钥B的最后三位阿拉伯数字”。这里是715。一键生成的私钥和地址是序号数派生出的囤饼地址。

脑口令:L4ix5CULbyAQcPbSuMtwuCU8eTPWD922fbFt4cB7Kz26b2S7VD4Y KzZf6zJ5gBEyyWFefMVc5dtEC9LX9acvMewfzQKFe3YB4naXN19a

盐值:029dc05240c6fd01fea162cb954a0dba8dc06f49ac148246189096bd87e7cb7ae90341804628211614707f27f32aab557918a4fe79b3af94d85546b7155119c27b15

哈希次数:715

得到私钥B:KzZf6zJ5gBEyyWFefMVc5dtEC9LX9acvMewfzQKFe3YB4naXN19a

公钥B:0341804628211614707f27f32aab557918a4fe79b3af94d85546b7155119c27b15

3、 私钥A+私钥B,作为脑口令D,盐值为:公钥A+公钥B,哈希次数为“公钥B的最后三位阿拉伯数字”。这里是715。一键生成的私钥和地址是序号数派生出的囤饼地址。

脑口令:L4ix5CULbyAQcPbSuMtwuCU8eTPWD922fbFt4cB7Kz26b2S7VD4Y KzZf6zJ5gBEyyWFefMVc5dtEC9LX9acvMewfzQKFe3YB4naXN19a

盐值:029dc05240c6fd01fea162cb954a0dba8dc06f49ac148246189096bd87e7cb7ae90341804628211614707f27f32aab557918a4fe79b3af94d85546b7155119c27b15

哈希次数:715

得到序号1派生的囤饼私钥:p2wpkh:KygGPCUXD82n32RjieyDJbrBX8suQdJjWLDUaLyMwgxYDEgEeDKC

支持隔离见证的囤饼地址:bc1q2l7jcderaftyxs5uxln5m3skpx8mn8rfkrv2wq

三、安全保存策略:

1.分布式存储算法规则:建议将设计的算法规则进行分布式存储,或者将其打印多份,存放于多个安全且隐蔽的地点。务必确保算法细节不被外界知晓,以降低被暴力破解的风险。

2. 种子信息的物理存储:将两个脑种子分别记录在纸上,并保存在不同的秘密地点。同时,建议定期复习这些种子信息,以强化记忆,确保在需要时能够准确回忆。

3. 关键记忆词的心智记忆:关键记忆词应当仅在脑海中记忆,切勿将其记录在任何物理介质之上。这样做可以防止在脑种子信息意外泄露的情况下,保护资产免遭损失。

得到序号1派生的囤饼私钥:p2wpkh:KygGPCUXD82n32RjieyDJbrBX8suQdJjWLDUaLyMwgxYDEgEeDKC

支持隔离见证的囤饼地址:bc1q2l7jcderaftyxs5uxln5m3skpx8mn8rfkrv2wq

三、安全保存策略:

1.分布式存储算法规则:建议将设计的算法规则进行分布式存储,或者将其打印多份,存放于多个安全且隐蔽的地点。务必确保算法细节不被外界知晓,以降低被暴力破解的风险。

2. 种子信息的物理存储:将两个脑种子分别记录在纸上,并保存在不同的秘密地点。同时,建议定期复习这些种子信息,以强化记忆,确保在需要时能够准确回忆。

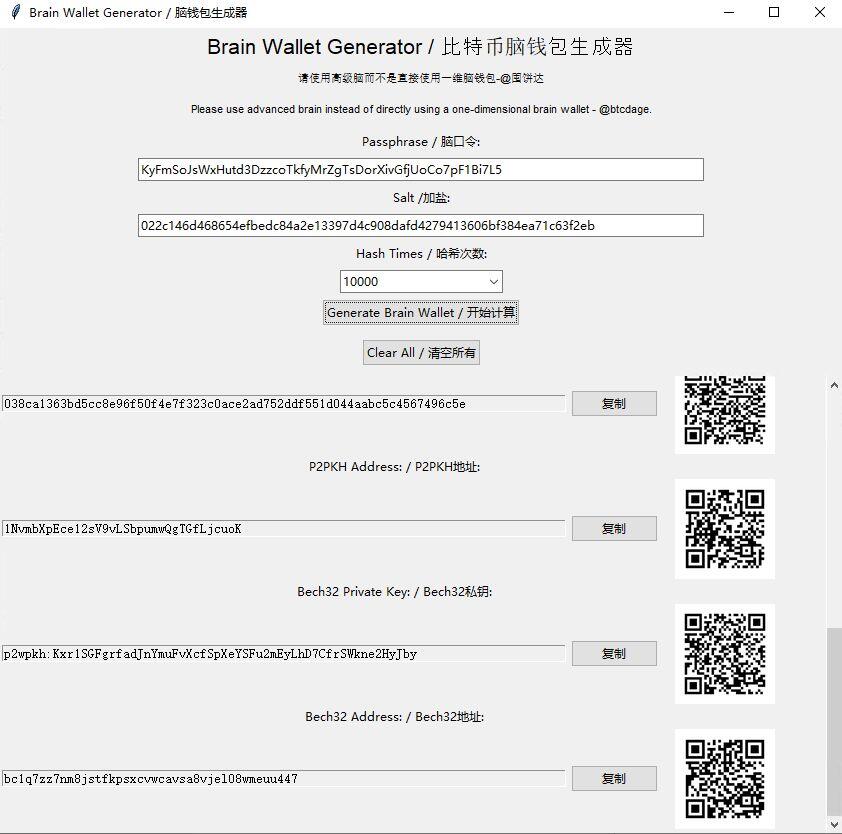

3. 关键记忆词的心智记忆:关键记忆词应当仅在脑海中记忆,切勿将其记录在任何物理介质之上。这样做可以防止在脑种子信息意外泄露的情况下,保护资产免遭损失。新工具发布:比特币脑钱包生成器 🚀

一个旨在为你提供更安全、便捷的比特币存储方案的开源项目。

🔐 功能亮点:

一键生成:

使用脑口令生成助记词(仅限本软件使用)、私钥、公钥及P2PKH、Bech32两种格式的地址。

▲请注意▲:软件自带加盐和哈希套娃功能,但为了让最终的脑口令获得足够高的熵,请保证使用自己设计的高级规则而不是仅软件的基础功能。

助记词可以在本软件中重现私钥和地址,有利于囤饼代持者分发给实际所有人而不暴露自己的高级脑规则。

QR码快速分享:每个生成的密钥或地址都附带QR码,便于安全分享或备份。

用户友好界面:简洁明了的操作流程,方便实现你的自定义高级脑规则。

🔗 获取方式:

源码地址:GitHub - BrainWalletGenerator (https://github.com/btcdage2000/BrainWalletGenerator/)

下载可执行文件:GitHub Releases (https://github.com/btcdage2000/BrainWalletGenerator/releases)

💡 为何选择脑钱包?

参见高级脑教程。

#比特币 #高级脑钱包 #加密货币安全 #区块链工具

【新工具发布】🎉 #以太坊脑钱包生成器#

应群友 @五叶 的需求,写了一个以太坊脑钱包生成工具!

现在,你可以利用高级脑方案轻松生成安全的以太坊地址。🔐

✅ 功能特色:

📝 一键生成以太坊地址、私钥、公钥及助记词。(一维地址)

🖨 支持二维码显示,方便安全备份。

🚀 简洁易用,单文件完全开源,无需安装任何插件或软件。右键点击页面查看源码复制保存到本地***.html文件即可在离线环境下打开使用。

🔄 你可以用比特币高级脑生成的复杂种子来同时生成以太坊地址,实现一套高级脑,同时管理两种币的私钥。

🔒 安全提示:

为了您的资产安全,实际生成囤币地址时请在离线环境下使用本工具。

最初始的自然语言种子生成的一维地址可能被暴力破解,请确保使用了高级脑的方式生成了复杂且难以被猜测的脑口令作为最终的种子明文。

切勿在线上环境或公共平台分享您的私钥或助记词。

立即体验:

https://startbitcoin.org/EthereumBrainWalletGenerator/

我们目标是:不依赖第三方的安全hold。记住:厚德不需要任何硬件。

程序风格借鉴了@比特币布道者的 比特币脑钱包。

感谢 @比特币布道者 提供的存放空间。希望这个工具能帮助你更好地管理和使用你的以太坊资产!

#以太坊##脑钱包##区块链工具#

私钥安全启示录:高级脑安全性探究

在这个宇宙里,想象有一把独一无二的锁,每个比特币地址就是这样一把锁,而这把锁自带一把原生的钥匙——私钥。只要你看过这把钥匙,就能打开锁,获取里面的财物。椭圆曲线密码学(ECC)保证了这把锁与这把钥匙之间的独特配对:一个私钥对应一个公钥,没有第二把钥匙能打开这把锁。

要如何保护这把宝贵的钥匙,确保既不被他人发现其样子,又能让自己方便记忆呢?我们可以采用高级脑的方法,选择一个易于记忆的信息,如一段话,使用安全隐秘的方法将其转换成私钥。这就好比用一把我们自己定义的、易于记忆的钥匙来管理那把独一无二的锁的钥匙(从现在起,想象私钥就是一把攻击者千方百计想要打开的锁)。

这个宇宙的哈希算法,如SHA-256,是算法规则的基础。虽然理论上存在碰撞性问题,即不同的输入可能产生相同的输出,但由于SHA-256的强抗碰撞性,我们不必担心突然会有另一把钥匙能打开我们的锁。我们真正需要警惕的是,有人可能尝试用他们的钥匙库,一把一把来尝试打开我们的锁——暴力破解。但只要他们无法准确猜测你的钥匙细节(脑口令和生成规则都是细节的一部分),这种尝试是注定失败的。

高级脑的反对者往往拘泥于初始脑口令的熵低,认为这降低了安全性。然而,这种观点忽略了高级脑策略的真正价值。与BIP等方案相比,高级脑不是依赖于助记词的随机性或熵的高低,而是通过使用强哈希算法和隐秘的算法规则来实现防碰撞性,以及解决暴力破解的风险。这一切都是为了维护整体的安全性,同时保持了口令的易记性。高级脑展示了一个原则:安全性不是为了熵,而熵是为了安全性;密码学是实现安全性的工具,而不是目的。我们应该将焦点放在如何提高安全性,而不是机械地追求助记词的随机性。

因此,我们的挑战在于如何隐藏这个私钥的细节。高级脑方法通过选择一个复杂而独特方便记忆的信息串来生成私钥,实质上提高了钥匙的隐蔽性。攻击者不仅需要猜测出这个信息,还需要知道你将信息转化为私钥的确切方法。由于隐秘算法规则中含有SHA-256算法,我们也不担心攻击者能通过碰撞找到另一把可以使用的钥匙。

在比特币的宇宙里,每个地址所隐藏的独一无二的钥匙,只有地址的主人能识别。采用高级脑方法,利用强哈希实现防碰撞性,利用隐秘规则解决暴力破解风险,我们不仅确保了这把钥匙的安全性,同时还能便捷地通过记忆随时“复制”这把钥匙。使得比特币的使用既私密又方便。

关于高级脑疑问的相关思考

问题一:“哈希算法能够提高抗碰撞性吗?”

首先我们需要做下定义:

抗碰撞性:

指在可行的时间和资源内,难以找到两个不同的输入,使得它们经过哈希函数处理后产生相同的输出哈希值。

散列性:

指能将任意长度的输入数据映射到一个固定长度的输出哈希值上,且输入数据的微小变化都会导致输出哈希值的显著不同(雪崩效应)。

抗暴力破解:

指通过设计复杂度高的计算过程或数据结构,使得尝试通过穷举所有可能的解来破解密码、密钥或加密数据变得在实际操作中非常耗时和计算上不可行。

默认定义:

为了方便讨论,除非特别指出,下文所有的“哈希算法”这个词,我们套用具体的sha256 算法来讨论。(文中 sha256 就是哈希算法,哈希算法就是 sha256)

“sha256 算法具有足够高的抗碰撞性”应该是共识,比特币世界所有的一切都建立于这个必要条件。因此,哈希算法并不是能不能“提高抗碰撞性”的问题,它本身就具有抗碰撞性。

高级脑的“算法规则”这一维度,假设 sha256 的抗碰撞性为a。任何多次的套娃和加盐并不能使最终结果的抗碰撞性 b>a。但是需要注意的是,b 也不<a。 因为 b=a。

给大家一个感性认识:

字符串 A=“1”

字符串 B=“Kxik7YNwCwXDLar3XwCwXDLar3XKLP4KoHNzszXsLjtHvofMUWQc367qEZzV7FGK1KyP2Dyjw8tcjRPnaxTEJvTLpq3wUiqcYE1sfrvqTpNiLkXNwCwXDLar3XKLP4KoHNzsLjtHvofMUWQc367qEZzV7FGK1KyP2Dyjw8tcjRPnaxTEJvTLpq3wUiqcYE1sfrvqTpNiLkptamW8X1L19VhtEvsQYgs43Jerq5ScqvdbRaVFuUgjYWNwCwXDLar3XKLP4KoHNzsLjtHvofMUWQc367qEZzV7FGK1KyP2Dyjw8tcjRPnaxTEJvTLpq3wUiqcYE1sfrvqTpNiLkBknTXmtStgYNMzbj1L3jMyuRTJjw4KcZA5KFyBCwJjr7D1X9r6eHCGbFEebBxTtwbNgd7”

Hash(A)的抗碰撞性统计学上等同于 Hash(B)

理性认知:

因为 SHA256 的核心安全属性,散列性和抗碰撞性,主要取决于算法本身的数学和计算特性,而不是依赖于输入明文的复杂度。这意味着无论输入数据的复杂度如何,SHA256 都提供一致的安全性水平。

那么,既然我们知道 Hash(A).安全性(散列性、抗碰撞性)= Hash(B).安全性(散列性、抗碰撞性)。

为什么我们觉得 hash(“1”)不安全,而 hash(B)安全呢?因为我们关注的不仅仅是哈希的安全性。在实践中,我们跳出哈希这个维度(就像三维生物离开了纸面)关注安全性时,破解 hash(A)的明文 A。只需要使用字典或者穷举来破解。而抗暴力破解的唯一方式就是“增加明文的长度(防穷举)、复杂度(防字典)和随机性(防字典)”。而哈希的散列性正好满足生成足够长、具有足够复杂度和随机性的字符串——作为抵抗破解的明文。

高级脑的核心“隐藏算法规则”根本不是为了提高私钥的“抗碰撞性”,因为经过哈希之后的抗碰撞性与种子本身的熵无关。高级脑只需要解决种子的“抗暴力破解”性,而,隐藏的“算法规则”(设计复杂度高的计算过程或数据结构)确保了最后生成私钥之前的那个“明文”的复杂程度,成就了高级脑的“抗暴力破解”性质。

问题二、高级脑是否提高了记忆负担?

1、假设我将选用下面其中之一作为种子明文:

A:

202cb962ac59075b964b07152d234b70

B:

d09afe71664f2385fa8ef0a63c227bdd6942dcbb6fffdfd87e5d001b2a434396

请问上面两个选项哪个对记忆力负担更重?

答案肯定是 B。虽然使用 B 做 hash 种子的防暴力破解性肯定高于 A。

2、再做一次选择题:

A:

202cb962ac59075b964b07152d234b70

B:

对“达哥”进行 sha256,一共套娃 10 次,每次结果都加上“达哥”。

请问上面两个选项哪个对记忆力负担更重?

我的答案这次是 A。使用 B 做 hash 种子的防暴力破解性仍然高于 A。

两个 B 其实是同一个东西,这次显然很好记忆,因为他只有 3 个需要记忆的元素:

(1) 种子“达哥” (2)做 sha256 10 次 (3)每次结果后面种子原文

而 A 实际是 123 的 md5 哈希值,MD5 是一个已经公认不再安全(抗碰撞性较弱)的哈希算法,用 A 做明文,抗碰撞性和抗暴力破解性(因为长度更短)都较弱。

这个例子证明了,明文的安全性和记忆负担并不成正比。

3、再来一次选择题:

A:

please coffee bind dog carry solid album simple gun leave become illness

B:

对“达哥”进行 sha256,一共 10 次,每次结果都加上“达哥”。

请问上面两个选项哪个对记忆力负担更重?

我的答案仍然是 A。我不觉得去记忆 12 个随机的无意义的助记词的记忆负担会低于 B。

结论:

1、 隐藏算法不提高抗碰撞性(也不降低),它提高的是抗暴力破解性,抗碰撞性不

需要提高,经过了任意一次 sha256 的散列后就已经满足了,碰撞性与明文复杂度无关。

2、 隐藏算法是提高抗暴力破解性,而算法的复杂性是可以无损压缩(参见上面的选择题的例子)而不增加记忆负担的。比如上面的后两个例子中,B 的算法规则只有 3 个元素。而且是有逻辑意义方便记忆的。

12 个助记词则是 12 个无关元素,记忆负担高于选项 B。

算法规则必须隐藏,否则就失去了“防暴力破解”性,任何人可以通过重现你的算法规则来制作穷举或者字典攻击。

3、 从安全性的角度来看,一个加密的流程一定要隐藏一些元素,无非是你选择隐藏种子明文的规则性还是隐藏算法的规则性:

Bip 选择的是公开算法,隐藏种子明文的规则性,这就必然使种子明文具有巨大的随机性(熵)。而熵才是记忆力负担,只是它固化了这个负担的值,12 个单词就要记忆 12 个元素(加上密语就再加一个元素),24 个就增加一倍记忆负担。

高级脑则是选择隐藏算法的规则性,降低种子明文的随机性,使种子更好记忆。再上面的例子中,种子这个元素可以是“达哥”两个字,也可以是沁园春雪全文。加上设计精巧的“复杂而又好记”的隐藏算法,从而满足了在方便记忆的同时兼顾了防暴力破解性。

4、 最后需要强调的是,如果你 认同 sha256 的散列性,就不需要再就 防碰撞性 再做讨论,因为“碰撞性与明文复杂度无关”。

在一个货币聚会上,黄金、法币和大饼决定比赛看谁是最好的货币。黄金自信地说:“看我的市值,我最稳。” 法币不服气地说:“但是我交易快。” 大饼在一旁轻轻笑道:“你们继续争吧,我这就去月球了。”