"Largest Act Of Deregulation In US History": Trump Admin To Repeal Obama-Era Greenhouse Gas Finding

"Largest Act Of Deregulation In US History": Trump Admin To Repeal Obama-Era Greenhouse Gas Finding

The U.S. Environmental Protection Agency is about to pull the rug from underneath climate regulation...

The EPA, under Lee Zeldin, plans to revoke the 2009 "endangerment finding", an Obama-era determination that six greenhouse gases “threaten the public health and welfare of current and future generations” and that has anchored federal climate regulation under the Clean Air Act, according to a new https://www.wsj.com/politics/policy/trump-to-repeal-landmark-climate-finding-in-huge-regulatory-rollback-ff7d58db?gaa_at=eafs&gaa_n=AWEtsqfWv8fHpCLS_QOnILi-jPIf29lyZxNXt_3Ur9MKEdo3mE-y9oISTTLvcNdbxCc%3D&gaa_ts=698b8e07&gaa_sig=bORxp3szEi5gFfQJNSfelQNDDozvpit-TaEfbQttmzWH51nWr5h6rQtBV8tGq7beolFbb5dxHrXQ4KD0GPuaFQ%3D%3D

report.

Bloomberg

The EPA, under Lee Zeldin, plans to revoke the 2009 "endangerment finding", an Obama-era determination that six greenhouse gases “threaten the public health and welfare of current and future generations” and that has anchored federal climate regulation under the Clean Air Act, according to a new https://www.wsj.com/politics/policy/trump-to-repeal-landmark-climate-finding-in-huge-regulatory-rollback-ff7d58db?gaa_at=eafs&gaa_n=AWEtsqfWv8fHpCLS_QOnILi-jPIf29lyZxNXt_3Ur9MKEdo3mE-y9oISTTLvcNdbxCc%3D&gaa_ts=698b8e07&gaa_sig=bORxp3szEi5gFfQJNSfelQNDDozvpit-TaEfbQttmzWH51nWr5h6rQtBV8tGq7beolFbb5dxHrXQ4KD0GPuaFQ%3D%3D

report.

Bloomberg  that the repeal could be announced as soon as Wednesday, citing an unnamed source.

Repealing the Obama-era climate finding would strip away the legal foundation for federal greenhouse gas regulation, which has been nothing more than toxic and degrowth for the economy, while China and India expanded coal-fired generation to power manufacturing hubs.

that the repeal could be announced as soon as Wednesday, citing an unnamed source.

Repealing the Obama-era climate finding would strip away the legal foundation for federal greenhouse gas regulation, which has been nothing more than toxic and degrowth for the economy, while China and India expanded coal-fired generation to power manufacturing hubs.

"This amounts to the largest act of deregulation in the history of the United States," EPA head Zeldin said in an interview.

Officials say it does not directly apply to emissions rules for oil-and-gas power plants and other stationary sources, but repealing the finding could make it easier to challenge or roll back those regulations at a later date.

The rollback would be a major win for the economy, which has been burdened by years of Democrats' "climate crisis" policies, which have epically backfired as electricity rates have soared amid terrible bets on unreliable solar and wind generation and the retirement of fossil-fuel plants.

This has all collided with grid strain in the data center era, triggering a power bill crisis across Maryland and other Mid-Atlantic states.

Also, this brutally cold winter has only underscored one very important point for 'team fossil fuels': coal and natural gas have helped keep the Mid-Atlantic and Northeast power grids from collapsing in recent weeks.

Related:

Since taking office, President Trump has pursued deregulation and pushed for reliable fossil fuels, telling supporters during the campaign trail, "drill, baby, drill." The goal, the president has stated over and over, is to reverse the worst inflation storm in a generation, which he blames on Democrats and their nation-killing green agenda.

On President Trump's first day of office last year, he signed an executive order directing the EPA to submit an assessment on the endangerment finding. Then by July, he received the proposal to rescind the finding.

Now, the rollback that would equal upwards of $1 trillion in cuts is set to be announced this week, along with several other energy- and climate-related announcements that will help drive down the cost of living.

"More energy drives human flourishing," Interior Secretary Doug Burgum said in an interview. "Energy abundance is the thing that we have to focus on, not regulating certain forms of energy out."

The U.S. economy has spent two decades under "climate crisis" regulations, and it has backfired spectacularly. Time to get back to basics.

Tue, 02/10/2026 - 17:20

"This amounts to the largest act of deregulation in the history of the United States," EPA head Zeldin said in an interview.

Officials say it does not directly apply to emissions rules for oil-and-gas power plants and other stationary sources, but repealing the finding could make it easier to challenge or roll back those regulations at a later date.

The rollback would be a major win for the economy, which has been burdened by years of Democrats' "climate crisis" policies, which have epically backfired as electricity rates have soared amid terrible bets on unreliable solar and wind generation and the retirement of fossil-fuel plants.

This has all collided with grid strain in the data center era, triggering a power bill crisis across Maryland and other Mid-Atlantic states.

Also, this brutally cold winter has only underscored one very important point for 'team fossil fuels': coal and natural gas have helped keep the Mid-Atlantic and Northeast power grids from collapsing in recent weeks.

Related:

Since taking office, President Trump has pursued deregulation and pushed for reliable fossil fuels, telling supporters during the campaign trail, "drill, baby, drill." The goal, the president has stated over and over, is to reverse the worst inflation storm in a generation, which he blames on Democrats and their nation-killing green agenda.

On President Trump's first day of office last year, he signed an executive order directing the EPA to submit an assessment on the endangerment finding. Then by July, he received the proposal to rescind the finding.

Now, the rollback that would equal upwards of $1 trillion in cuts is set to be announced this week, along with several other energy- and climate-related announcements that will help drive down the cost of living.

"More energy drives human flourishing," Interior Secretary Doug Burgum said in an interview. "Energy abundance is the thing that we have to focus on, not regulating certain forms of energy out."

The U.S. economy has spent two decades under "climate crisis" regulations, and it has backfired spectacularly. Time to get back to basics.

Tue, 02/10/2026 - 17:20

The EPA, under Lee Zeldin, plans to revoke the 2009 "endangerment finding", an Obama-era determination that six greenhouse gases “threaten the public health and welfare of current and future generations” and that has anchored federal climate regulation under the Clean Air Act, according to a new https://www.wsj.com/politics/policy/trump-to-repeal-landmark-climate-finding-in-huge-regulatory-rollback-ff7d58db?gaa_at=eafs&gaa_n=AWEtsqfWv8fHpCLS_QOnILi-jPIf29lyZxNXt_3Ur9MKEdo3mE-y9oISTTLvcNdbxCc%3D&gaa_ts=698b8e07&gaa_sig=bORxp3szEi5gFfQJNSfelQNDDozvpit-TaEfbQttmzWH51nWr5h6rQtBV8tGq7beolFbb5dxHrXQ4KD0GPuaFQ%3D%3D

report.

Bloomberg

The EPA, under Lee Zeldin, plans to revoke the 2009 "endangerment finding", an Obama-era determination that six greenhouse gases “threaten the public health and welfare of current and future generations” and that has anchored federal climate regulation under the Clean Air Act, according to a new https://www.wsj.com/politics/policy/trump-to-repeal-landmark-climate-finding-in-huge-regulatory-rollback-ff7d58db?gaa_at=eafs&gaa_n=AWEtsqfWv8fHpCLS_QOnILi-jPIf29lyZxNXt_3Ur9MKEdo3mE-y9oISTTLvcNdbxCc%3D&gaa_ts=698b8e07&gaa_sig=bORxp3szEi5gFfQJNSfelQNDDozvpit-TaEfbQttmzWH51nWr5h6rQtBV8tGq7beolFbb5dxHrXQ4KD0GPuaFQ%3D%3D

report.

Bloomberg

Bloomberg.com

Trump’s EPA to Scrap Landmark Emissions Policy in Major Rollback

The US Environmental Protection Agency plans this week to repeal a policy that provides the legal foundation for a raft of rules regulating greenho...

"This amounts to the largest act of deregulation in the history of the United States," EPA head Zeldin said in an interview.

Officials say it does not directly apply to emissions rules for oil-and-gas power plants and other stationary sources, but repealing the finding could make it easier to challenge or roll back those regulations at a later date.

The rollback would be a major win for the economy, which has been burdened by years of Democrats' "climate crisis" policies, which have epically backfired as electricity rates have soared amid terrible bets on unreliable solar and wind generation and the retirement of fossil-fuel plants.

This has all collided with grid strain in the data center era, triggering a power bill crisis across Maryland and other Mid-Atlantic states.

Also, this brutally cold winter has only underscored one very important point for 'team fossil fuels': coal and natural gas have helped keep the Mid-Atlantic and Northeast power grids from collapsing in recent weeks.

Related:

"This amounts to the largest act of deregulation in the history of the United States," EPA head Zeldin said in an interview.

Officials say it does not directly apply to emissions rules for oil-and-gas power plants and other stationary sources, but repealing the finding could make it easier to challenge or roll back those regulations at a later date.

The rollback would be a major win for the economy, which has been burdened by years of Democrats' "climate crisis" policies, which have epically backfired as electricity rates have soared amid terrible bets on unreliable solar and wind generation and the retirement of fossil-fuel plants.

This has all collided with grid strain in the data center era, triggering a power bill crisis across Maryland and other Mid-Atlantic states.

Also, this brutally cold winter has only underscored one very important point for 'team fossil fuels': coal and natural gas have helped keep the Mid-Atlantic and Northeast power grids from collapsing in recent weeks.

Related:

"Sleep Tight, America. We Got This": NatGas And Coal Power Plants Prevented Grid Collapse During Historic Winter Blast | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Tyler Durden | Zero Hedge

Zero Hedge

Trump Revokes Obama-Era Greenhouse Gas Finding In "Largest Deregulatory Action" In U.S. History | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

The USS Abraham Lincoln and its strike group is already poised for action in regional waters just south of Iran, and this involves dozens of fighter jets, Tomahawk missiles, along with several support warships.

Trump took the opportunity to repeat a US ultimatum to Tehran: "Either we will make a deal or we will have to do something very tough like last time," he told Axios. The Iranians will no doubt have this ringing in their ears headed into a planned second round of talks next week.

But Trump still claimed that Iran "wants to make a deal very badly" and is engaging much more seriously than in the past. There are signs that this is accurate, given the latest offer to dilute its enriched uranium in exchange for the lifting of all sanctions.

The US president articulated his view that the June war taught the Iranians a huge lesson: "Last time they didn't believe I would do it," Trump said. "They overplayed their hand."

But of course, at that very moment just before Israel attacked (followed by the US bombing three nuclear sites by the close of the 12-day conflict), Iran thought it was engaged in good faith talks. Trump is still holding out hope that "We can make a great deal with Iran."

Trump reportedly said he is considering sending a second aircraft carrier near Iran.

*It would take 15-20 days for a second aircraft carrier to get ready to deploy and arrive in the region.

The USS Abraham Lincoln and its strike group is already poised for action in regional waters just south of Iran, and this involves dozens of fighter jets, Tomahawk missiles, along with several support warships.

Trump took the opportunity to repeat a US ultimatum to Tehran: "Either we will make a deal or we will have to do something very tough like last time," he told Axios. The Iranians will no doubt have this ringing in their ears headed into a planned second round of talks next week.

But Trump still claimed that Iran "wants to make a deal very badly" and is engaging much more seriously than in the past. There are signs that this is accurate, given the latest offer to dilute its enriched uranium in exchange for the lifting of all sanctions.

The US president articulated his view that the June war taught the Iranians a huge lesson: "Last time they didn't believe I would do it," Trump said. "They overplayed their hand."

But of course, at that very moment just before Israel attacked (followed by the US bombing three nuclear sites by the close of the 12-day conflict), Iran thought it was engaged in good faith talks. Trump is still holding out hope that "We can make a great deal with Iran."

Trump reportedly said he is considering sending a second aircraft carrier near Iran.

*It would take 15-20 days for a second aircraft carrier to get ready to deploy and arrive in the region.

Rogan’s rejection stands in stark contrast to the ongoing associations maintained by powerful figures like Reid Hoffman and Bill Gates, fueling demands for accountability amid congressional scrutiny.

The Department of Justice released over three million pages of Epstein-related documents on January 30, more than a month after a congressionally mandated December 2025 deadline. This massive dump stems from bipartisan pressure in Congress to uncover the full extent of Epstein’s elite network, including potential blackmail and influence operations.

Central to this is the House Oversight Committee’s investigation, led by Chairman James Comer. The probe aims to question high-profile individuals tied to Epstein, with depositions and potential public testimonies designed to expose any wrongdoing or cover-ups.

Comer has already secured agreements from Bill and Hillary Clinton to testify, and signaled that Gates is likely next, amid allegations of affairs, STDs, and deeper entanglements detailed in the files.

Epstein emailed Krauss: “I saw you did the Joe Rogan show, can you introduce me, I think he’s funny.”

Krauss responded: “I will reach out to Rogan. I think I have his email, or at least his producer’s email. He lives and works in L.A.”

But Rogan, after Googling Epstein, rejected the idea outright.

On his podcast, Rogan recounted: “I’m in the [Epstein] files for not going. One of my guests was trying to get me to meet him. I was like, ‘B*tch, are you high?!’”

He added that upon the approach, his response was: “What the f*ck are you talking about?”

Krauss then apologized to Epstein in an email: “Sorry about Rogan so far. He seems MORE TIMID than I would have thought.”

Rogan’s decision came years after Epstein’s 2008 plea deal for sex crimes, but before his 2019 arrest. A basic search revealed the red flags that apparently escaped—or were ignored by—many in Silicon Valley and beyond.

This integrity contrasts sharply with Reid Hoffman, the LinkedIn co-founder and major Democrat donor. As we previously reported in our coverage of David Sacks’ exposé, Hoffman is mentioned over 2,600 times in the Epstein files.

The records show a multiyear relationship, with Hoffman visiting Epstein’s infamous island, New York townhouse, and New Mexico ranch. They conducted deals together and referred to each other as “very good friends.”

Sacks slammed The New York Times for downplaying Hoffman’s ties while targeting right-leaning tech figures like Elon Musk and Peter Thiel.

Similarly, Bill Gates faces mounting pressure. Comer confirmed Gates will likely be subpoenaed for questioning under oath, following revelations of emails alleging an affair and STD contracted via Epstein’s network. Gates’ spokesperson denies the claims, but the probe presses on.

Rogan’s story highlights how everyday diligence could have derailed Epstein’s web, yet partisan protections seemingly shielded left-leaning elites.

As the Oversight Committee’s work continues, these disclosures chip away at institutional rot, demanding equal justice regardless of political allegiance.

Your support is crucial in helping us defeat mass censorship. Please consider donating via

Rogan’s rejection stands in stark contrast to the ongoing associations maintained by powerful figures like Reid Hoffman and Bill Gates, fueling demands for accountability amid congressional scrutiny.

The Department of Justice released over three million pages of Epstein-related documents on January 30, more than a month after a congressionally mandated December 2025 deadline. This massive dump stems from bipartisan pressure in Congress to uncover the full extent of Epstein’s elite network, including potential blackmail and influence operations.

Central to this is the House Oversight Committee’s investigation, led by Chairman James Comer. The probe aims to question high-profile individuals tied to Epstein, with depositions and potential public testimonies designed to expose any wrongdoing or cover-ups.

Comer has already secured agreements from Bill and Hillary Clinton to testify, and signaled that Gates is likely next, amid allegations of affairs, STDs, and deeper entanglements detailed in the files.

Epstein emailed Krauss: “I saw you did the Joe Rogan show, can you introduce me, I think he’s funny.”

Krauss responded: “I will reach out to Rogan. I think I have his email, or at least his producer’s email. He lives and works in L.A.”

But Rogan, after Googling Epstein, rejected the idea outright.

On his podcast, Rogan recounted: “I’m in the [Epstein] files for not going. One of my guests was trying to get me to meet him. I was like, ‘B*tch, are you high?!’”

He added that upon the approach, his response was: “What the f*ck are you talking about?”

Krauss then apologized to Epstein in an email: “Sorry about Rogan so far. He seems MORE TIMID than I would have thought.”

Rogan’s decision came years after Epstein’s 2008 plea deal for sex crimes, but before his 2019 arrest. A basic search revealed the red flags that apparently escaped—or were ignored by—many in Silicon Valley and beyond.

This integrity contrasts sharply with Reid Hoffman, the LinkedIn co-founder and major Democrat donor. As we previously reported in our coverage of David Sacks’ exposé, Hoffman is mentioned over 2,600 times in the Epstein files.

The records show a multiyear relationship, with Hoffman visiting Epstein’s infamous island, New York townhouse, and New Mexico ranch. They conducted deals together and referred to each other as “very good friends.”

Sacks slammed The New York Times for downplaying Hoffman’s ties while targeting right-leaning tech figures like Elon Musk and Peter Thiel.

Similarly, Bill Gates faces mounting pressure. Comer confirmed Gates will likely be subpoenaed for questioning under oath, following revelations of emails alleging an affair and STD contracted via Epstein’s network. Gates’ spokesperson denies the claims, but the probe presses on.

Rogan’s story highlights how everyday diligence could have derailed Epstein’s web, yet partisan protections seemingly shielded left-leaning elites.

As the Oversight Committee’s work continues, these disclosures chip away at institutional rot, demanding equal justice regardless of political allegiance.

Your support is crucial in helping us defeat mass censorship. Please consider donating via

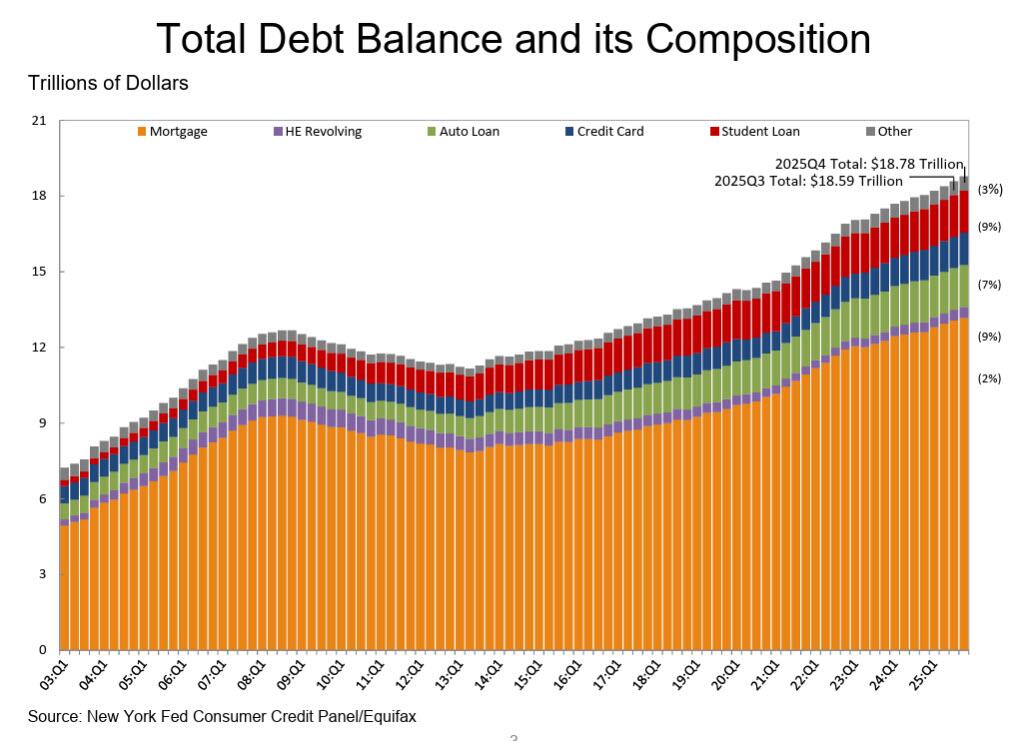

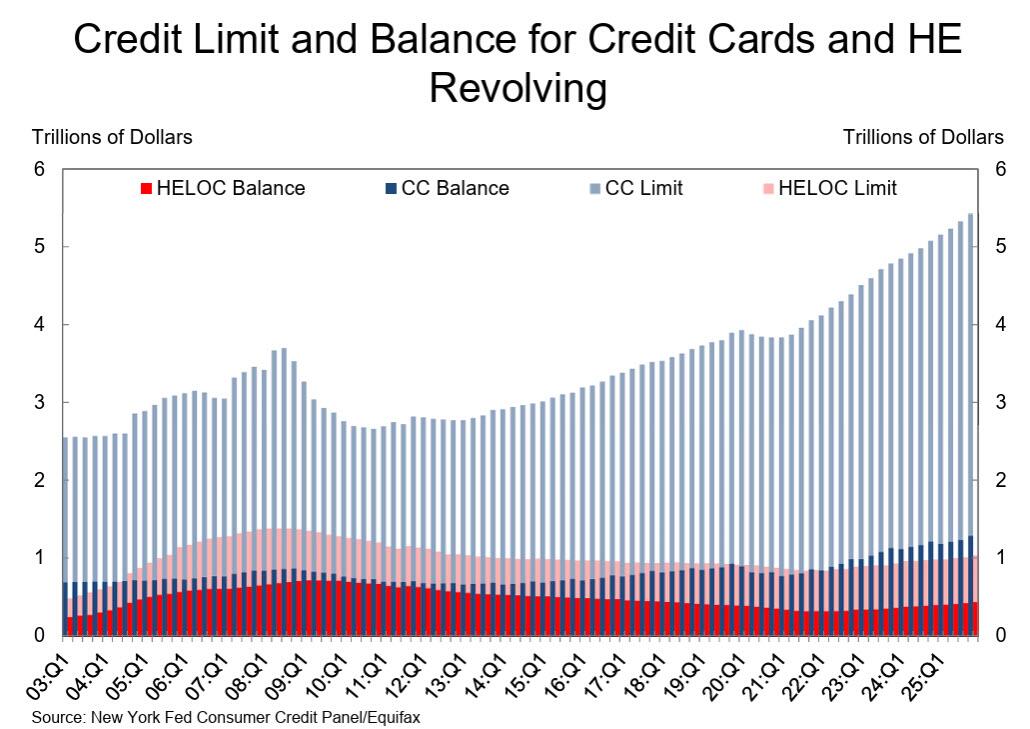

This is how various debt balances changed through the quarter:

Mortgage balances shown on consumer credit reports grew by $98 billion during the fourth quarter of 2025 and totaled $13.17 trillion at the end of December.

Balances on home equity lines of credit (HELOC) rose by $12 billion, the 15th consecutive quarterly increase.There is now $433 billion in outstanding HELOC balances, $116 billion above the low reached in 2022Q1. In total, non-housing balances increased by $81 billion, a 1.6% increase from 2025Q3.

Credit card balances rose by $44 billion during the fourth quarter and now total $1.28 trillion outstanding, up 5.5% since last year.

Student loan balances increased by $11 billion and now stand at $1.66 trillion.

Auto loan balances edged up by $12 billion to $1.66 trillion.

Other balances, which include retail cards and consumer finance loans, rose by $14 billion and now total $564 billion.

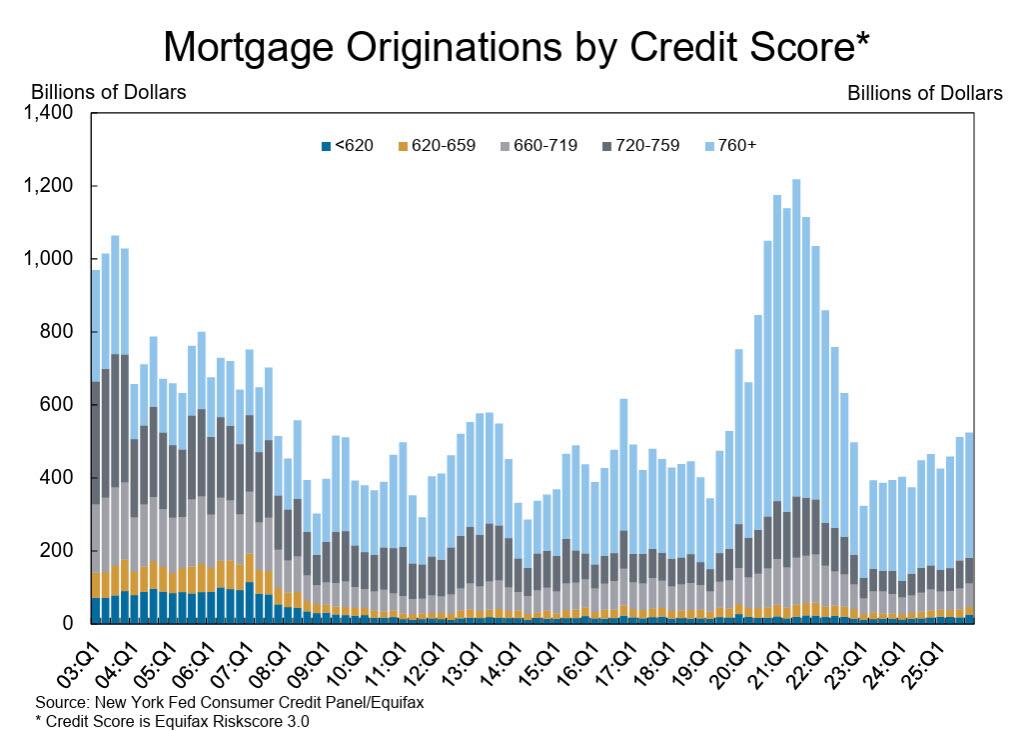

New debt originations were also solid in the quarter:

The volume of mortgage originations, which includes both refinance and purchase originations, increased with $524 billion newly originated in 2025 Q4, an uptick from the $512 billion seen in the previous quarter. It was the highest since 2022 when rates were far lower.

This is how various debt balances changed through the quarter:

Mortgage balances shown on consumer credit reports grew by $98 billion during the fourth quarter of 2025 and totaled $13.17 trillion at the end of December.

Balances on home equity lines of credit (HELOC) rose by $12 billion, the 15th consecutive quarterly increase.There is now $433 billion in outstanding HELOC balances, $116 billion above the low reached in 2022Q1. In total, non-housing balances increased by $81 billion, a 1.6% increase from 2025Q3.

Credit card balances rose by $44 billion during the fourth quarter and now total $1.28 trillion outstanding, up 5.5% since last year.

Student loan balances increased by $11 billion and now stand at $1.66 trillion.

Auto loan balances edged up by $12 billion to $1.66 trillion.

Other balances, which include retail cards and consumer finance loans, rose by $14 billion and now total $564 billion.

New debt originations were also solid in the quarter:

The volume of mortgage originations, which includes both refinance and purchase originations, increased with $524 billion newly originated in 2025 Q4, an uptick from the $512 billion seen in the previous quarter. It was the highest since 2022 when rates were far lower.

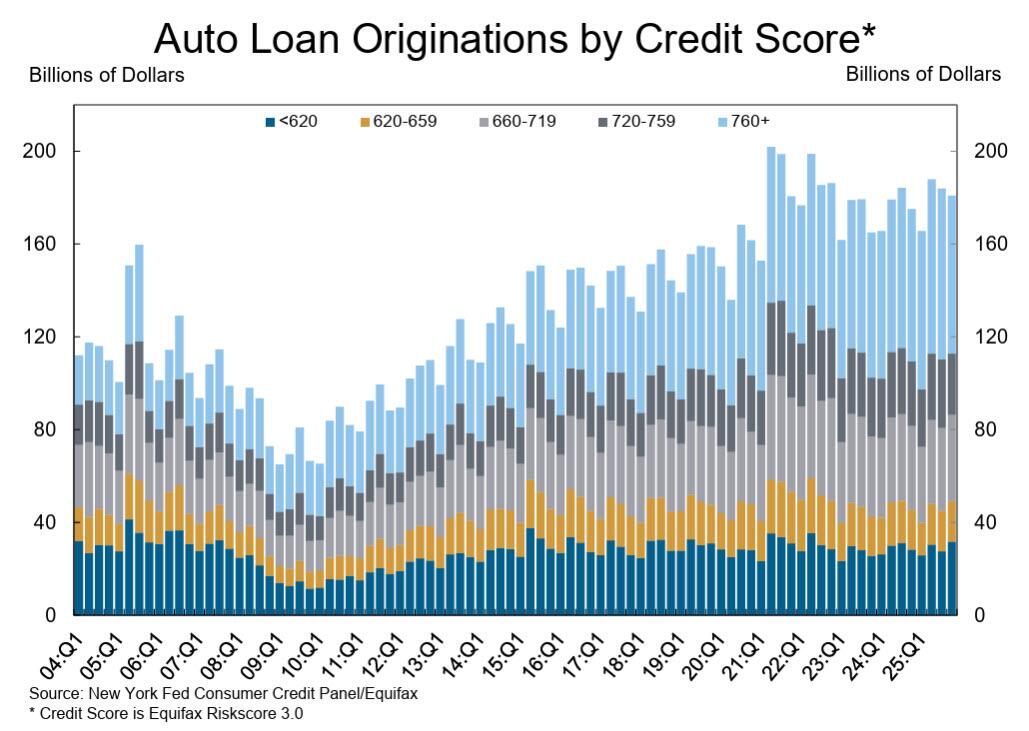

There were $181 billion in new auto loans and leases appearing on credit reports during the fourth quarter, a small dip from the $184 billion observed in 2025 Q3.

There were $181 billion in new auto loans and leases appearing on credit reports during the fourth quarter, a small dip from the $184 billion observed in 2025 Q3.

Aggregate limits on credit cards continued to rise, with a $95 billion (1.6%) uptick in the fourth quarter.

Home equity lines of credit (HELOC) limits rose by $25 billion (2.5%), continuing an expansion in HELOC limits that began in 2022.

Aggregate limits on credit cards continued to rise, with a $95 billion (1.6%) uptick in the fourth quarter.

Home equity lines of credit (HELOC) limits rose by $25 billion (2.5%), continuing an expansion in HELOC limits that began in 2022.

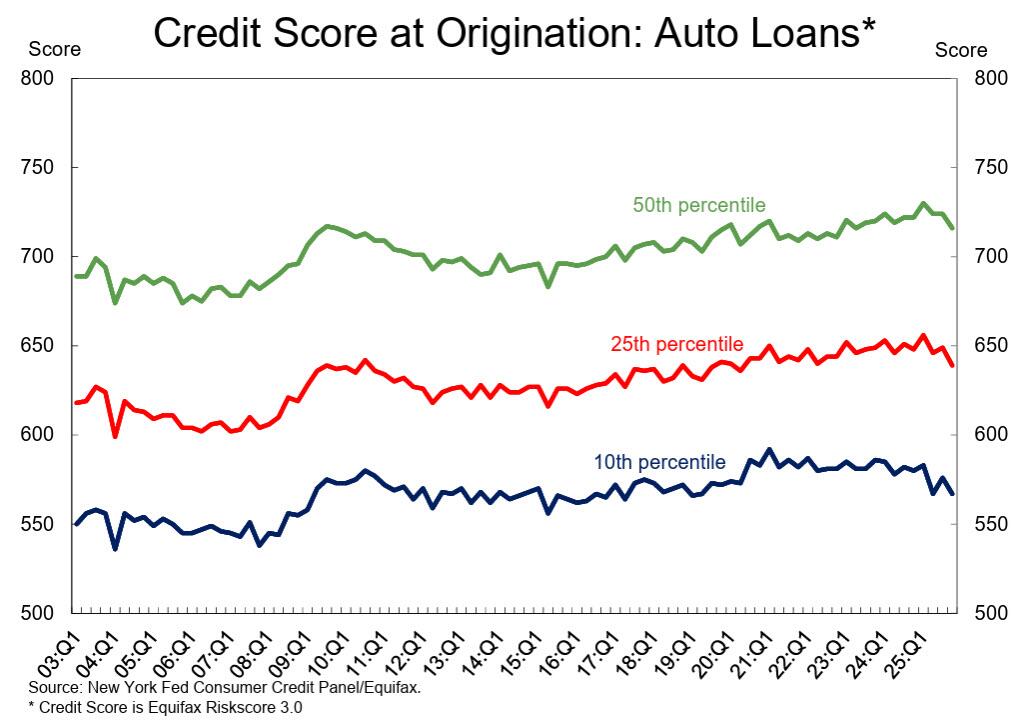

Credit quality of newly originated mortgages held steady, while auto loans loosened slightly. The median credit score for new mortgage originations was 775 in 2025Q4, unchanged from 2025 Q3 while the tenth percentile declined from 660 to 650. For auto loans, the median credit score edged down, from 724 to 716.

Credit quality of newly originated mortgages held steady, while auto loans loosened slightly. The median credit score for new mortgage originations was 775 in 2025Q4, unchanged from 2025 Q3 while the tenth percentile declined from 660 to 650. For auto loans, the median credit score edged down, from 724 to 716.

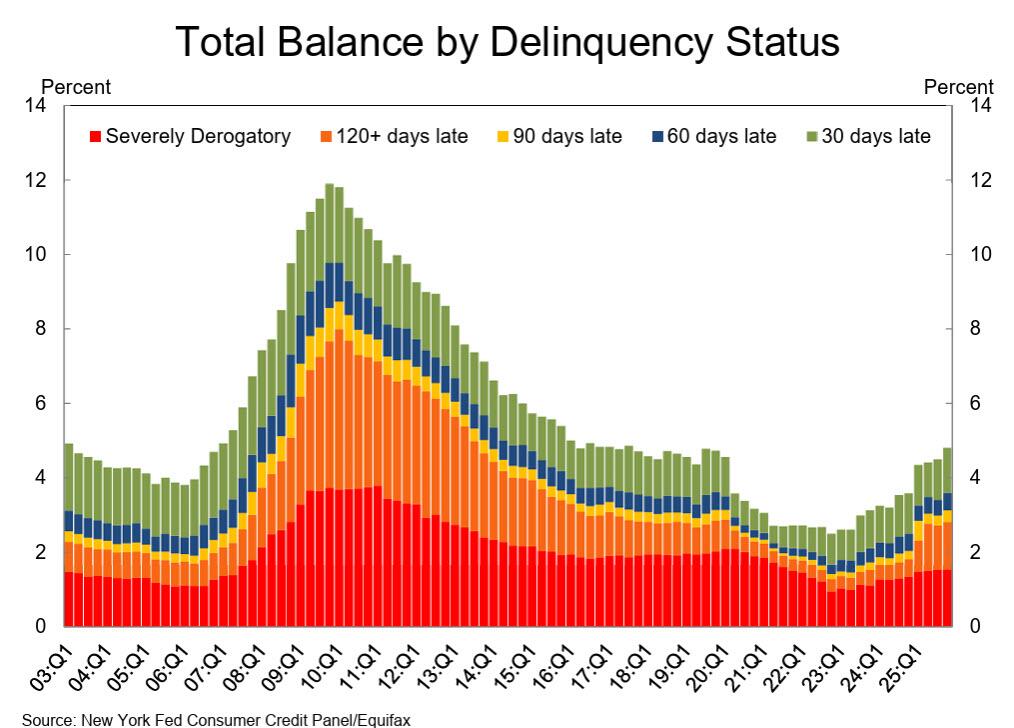

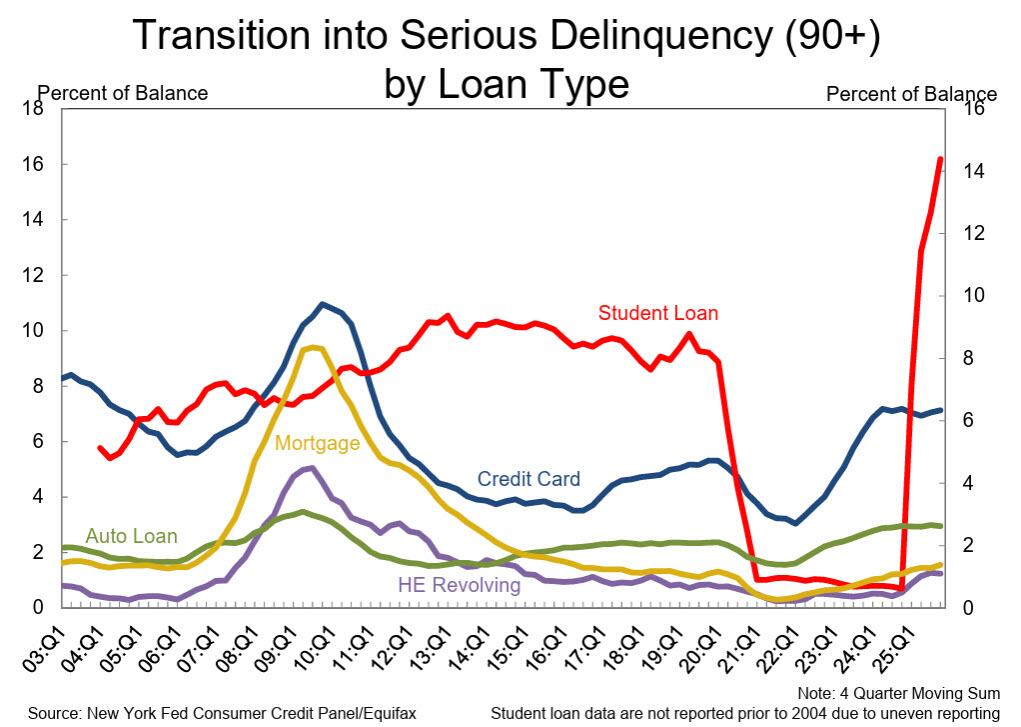

Taking a closer look at some of the negative changes below the surface, delinquency rates on loans ranging from mortgages to credit cards rose to 4.8% of all outstanding US household debt in the fourth quarter, up 0.3% sine Q3 2025 and the highest level since 2017, driven by higher defaults among low-income and young borrowers.

Taking a closer look at some of the negative changes below the surface, delinquency rates on loans ranging from mortgages to credit cards rose to 4.8% of all outstanding US household debt in the fourth quarter, up 0.3% sine Q3 2025 and the highest level since 2017, driven by higher defaults among low-income and young borrowers.

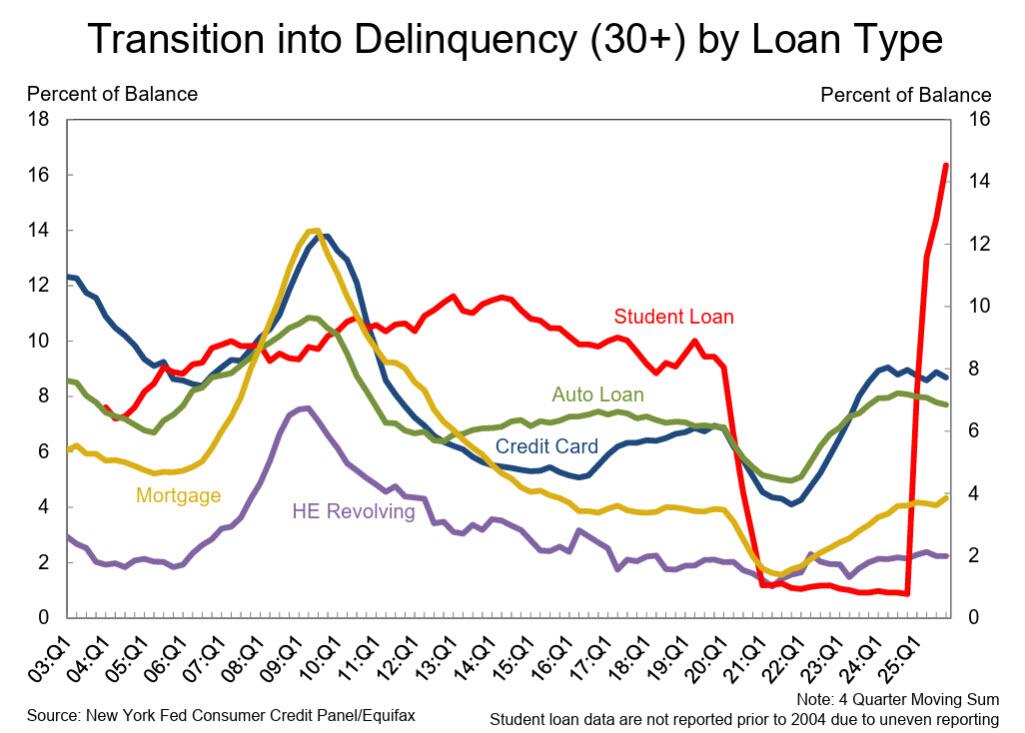

As Bloomberg notes, while the overall share of loans in some stage of default is near pre-pandemic averages, the rise in delinquencies among the lowest earners adds to evidence of an increasingly K-shaped economy, and nowhere was it more obvious than in the case of student loans - where with the Biden repayment moratorium has been over for the past year - we have seen a tsunami of both early delinquencies, with 16.3% of student-loan debt became delinquent in Q4 the biggest increase on record in data going back to 2004...

As Bloomberg notes, while the overall share of loans in some stage of default is near pre-pandemic averages, the rise in delinquencies among the lowest earners adds to evidence of an increasingly K-shaped economy, and nowhere was it more obvious than in the case of student loans - where with the Biden repayment moratorium has been over for the past year - we have seen a tsunami of both early delinquencies, with 16.3% of student-loan debt became delinquent in Q4 the biggest increase on record in data going back to 2004...

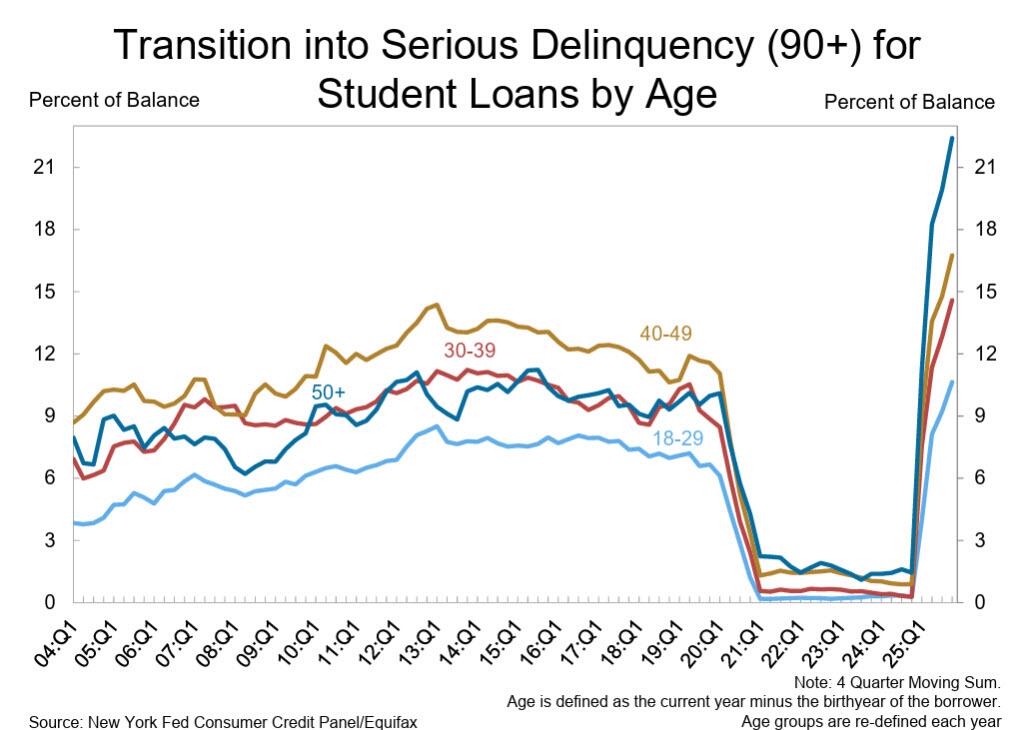

... and serious delinquencies (effectively defaults)...

... and serious delinquencies (effectively defaults)...

... led by 50+ year-old "students" (almost certainly of the liberal major, blue-haired anti-ICE, variety).

... led by 50+ year-old "students" (almost certainly of the liberal major, blue-haired anti-ICE, variety).

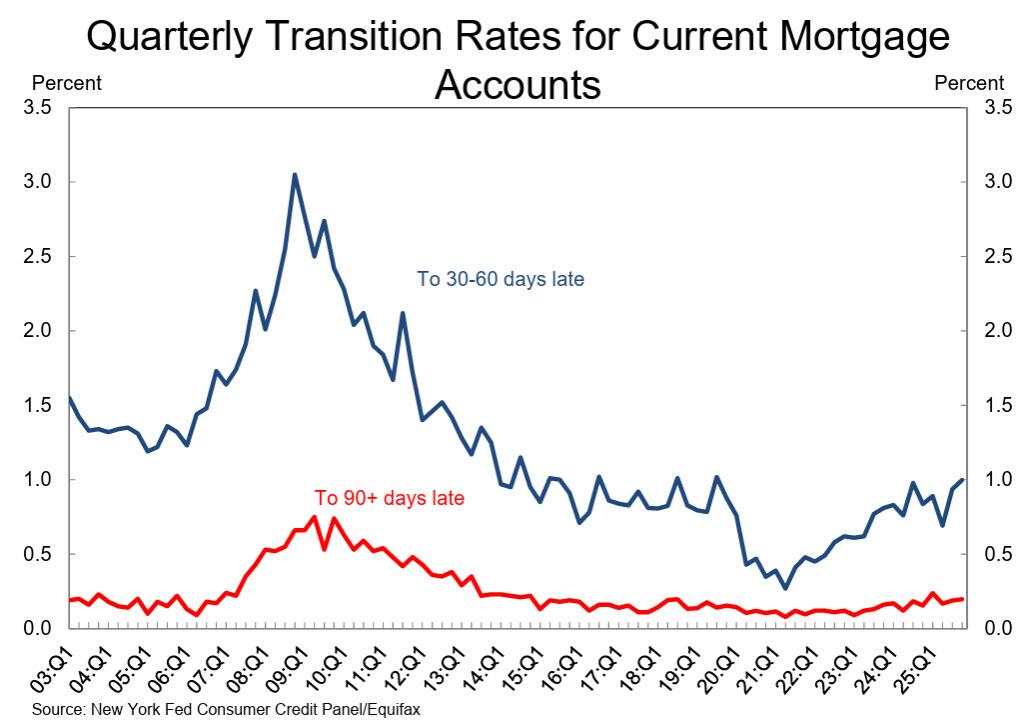

The rise in defaults was also driven by delinquencies in mortgage payments, and New York Fed researchers found that they were particularly high in lower income zip codes.

The rise in defaults was also driven by delinquencies in mortgage payments, and New York Fed researchers found that they were particularly high in lower income zip codes.

“As household debt levels grow modestly, mortgage delinquencies continue to increase,” said Wilbert van der Klaauw, an economic research advisor at the New York Fed, said in a press release accompanying the figures. “Delinquency rates for mortgages are near historically normal levels, but the deterioration is concentrated in lower-income areas and in areas with declining home prices.”

The increased struggle in low-income and young borrowers’ ability to pay their loans is consistent with elevated unemployment rates among some parts of the population, the NY Fed researchers added. The jobless rate for workers 16 to 24 years old stood at 10.4% in December, near the highest levels since the depths of the pandemic in 2021, and largely the result of AI disruption.

But if the Fed is concerned about the soaring debt delinquencies now, just wait a few years until a third of all jobs are replaced by hallucinating chat bots, and the overall unemployment rate is 15%, something we discussed earlier. At that point the question will not be whether Kevin Warsh will shrink the balance sheet - he never will - but whether the coming Universal Basic Income money printing will be measured in the trillions or quadrillions.

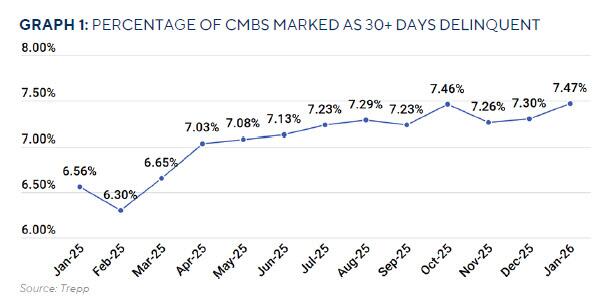

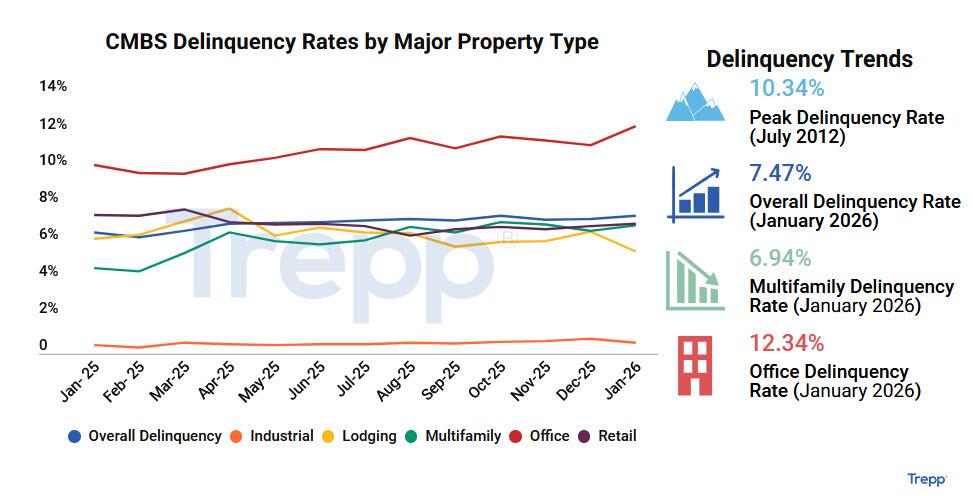

But wait, there's more: because chatbot algos do not need an office - and the workers they displace no longer need an office - the spiked in post-covid office defaults is back, and according to

“As household debt levels grow modestly, mortgage delinquencies continue to increase,” said Wilbert van der Klaauw, an economic research advisor at the New York Fed, said in a press release accompanying the figures. “Delinquency rates for mortgages are near historically normal levels, but the deterioration is concentrated in lower-income areas and in areas with declining home prices.”

The increased struggle in low-income and young borrowers’ ability to pay their loans is consistent with elevated unemployment rates among some parts of the population, the NY Fed researchers added. The jobless rate for workers 16 to 24 years old stood at 10.4% in December, near the highest levels since the depths of the pandemic in 2021, and largely the result of AI disruption.

But if the Fed is concerned about the soaring debt delinquencies now, just wait a few years until a third of all jobs are replaced by hallucinating chat bots, and the overall unemployment rate is 15%, something we discussed earlier. At that point the question will not be whether Kevin Warsh will shrink the balance sheet - he never will - but whether the coming Universal Basic Income money printing will be measured in the trillions or quadrillions.

But wait, there's more: because chatbot algos do not need an office - and the workers they displace no longer need an office - the spiked in post-covid office defaults is back, and according to .jpg)

The increase was driven by a net increase in delinquent loans of almost $1.6 billion, primarily driven by the office sector. For the second straight month, three of the five major property types saw increases to their delinquency rates, while two pulled back, although the mix was different in January.

The largest rate increase was in office, which rose 103 basis points to an all-time high of 12.34%. The previous high was 11.76% back in October last year. The second largest rate increase was multifamily’s, which seesawed back up by 30 basis points in January to 6.94%, following a decrease of similar magnitude of 34 basis points the month prior.

The increase was driven by a net increase in delinquent loans of almost $1.6 billion, primarily driven by the office sector. For the second straight month, three of the five major property types saw increases to their delinquency rates, while two pulled back, although the mix was different in January.

The largest rate increase was in office, which rose 103 basis points to an all-time high of 12.34%. The previous high was 11.76% back in October last year. The second largest rate increase was multifamily’s, which seesawed back up by 30 basis points in January to 6.94%, following a decrease of similar magnitude of 34 basis points the month prior.

January’s balance of newly delinquent loans totaled just under $5.4 billion, while over $2.6 billion of delinquent loans cured over the same period, and $1.1 billion of delinquent loans paid off, resulting in a net delinquency increase of about $1.6 billion.

The office sector was the largest net contributor to the increase in the delinquency rate, while a large lodging loan that cured in January helped to offset some of the increase in the headline delinquency rate.

It gets worse: if we were to include loans that are beyond their maturity date but current on interest (delinquency status of performing matured balloon), the delinquency rate would be 9.14%, up 39 basis points from December. That is also 167 basis points higher than the headline rate of 7.47%, highlighting ongoing maturity-related stress.

Bottom line: at some point the AI revolution may well lead to a productivity revolution, but to get there the US will first go through a mass layoff wave, resulting in tens if not hundreds of millions of layoffs (a

January’s balance of newly delinquent loans totaled just under $5.4 billion, while over $2.6 billion of delinquent loans cured over the same period, and $1.1 billion of delinquent loans paid off, resulting in a net delinquency increase of about $1.6 billion.

The office sector was the largest net contributor to the increase in the delinquency rate, while a large lodging loan that cured in January helped to offset some of the increase in the headline delinquency rate.

It gets worse: if we were to include loans that are beyond their maturity date but current on interest (delinquency status of performing matured balloon), the delinquency rate would be 9.14%, up 39 basis points from December. That is also 167 basis points higher than the headline rate of 7.47%, highlighting ongoing maturity-related stress.

Bottom line: at some point the AI revolution may well lead to a productivity revolution, but to get there the US will first go through a mass layoff wave, resulting in tens if not hundreds of millions of layoffs (a

In brief

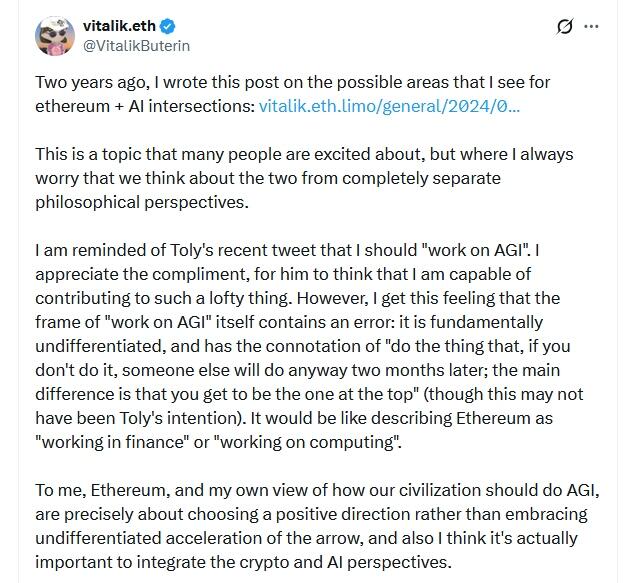

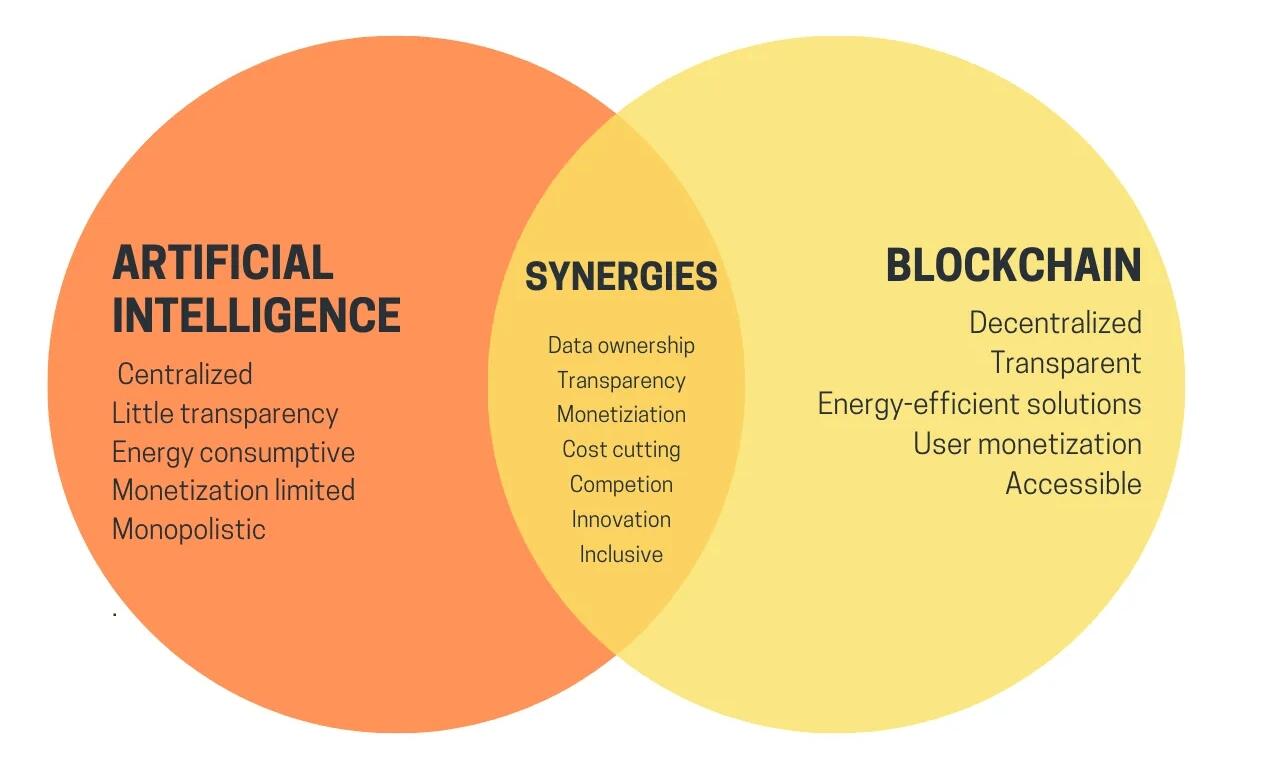

Vitalik Buterin said Monday the very frame of “work on AGI” is flawed and called for AI development guided by decentralization, privacy, verification, and human empowerment.

He outlined an Ethereum-linked roadmap focused on local LLMs, zero-knowledge payments for private AI API usage, and cryptographic privacy, among other key areas.

Buterin’s approach contrasts with the AGI acceleration narratives from major AI labs, focusing on safer, Ethereum-based AI coordination.

Vitalik Buterin is calling for a different path in artificial intelligence—one that rejects a blind “race to AGI” and instead relies on Ethereum-style decentralization, verification, and privacy as guardrails for the AI era.

“The frame of ‘work on AGI’ itself contains an error,” Ethereum co-founder Buterin

In brief

Vitalik Buterin said Monday the very frame of “work on AGI” is flawed and called for AI development guided by decentralization, privacy, verification, and human empowerment.

He outlined an Ethereum-linked roadmap focused on local LLMs, zero-knowledge payments for private AI API usage, and cryptographic privacy, among other key areas.

Buterin’s approach contrasts with the AGI acceleration narratives from major AI labs, focusing on safer, Ethereum-based AI coordination.

Vitalik Buterin is calling for a different path in artificial intelligence—one that rejects a blind “race to AGI” and instead relies on Ethereum-style decentralization, verification, and privacy as guardrails for the AI era.

“The frame of ‘work on AGI’ itself contains an error,” Ethereum co-founder Buterin

Instead of raw acceleration, AI development should focus on systems that “foster human freedom and empowerment” and ensure “the world does not blow up,” Buterin wrote, echoing his defensive-acceleration, or d/acc, framework.

Joni Pirovich, founder and CEO of Crystal aOS, told Decrypt, “Ethereum becoming the default settlement layer for AI-to-AI interactions is realistic.

It's less about 'accelerating AGI' and more about providing the necessary rails and guardrails for agentic commerce, trade, and investing.

Trust and coordination, especially at the technology infrastructure and compliance infrastructure levels, are even more important now than ever.”

The comments land as major AI firms continue to publicly

Instead of raw acceleration, AI development should focus on systems that “foster human freedom and empowerment” and ensure “the world does not blow up,” Buterin wrote, echoing his defensive-acceleration, or d/acc, framework.

Joni Pirovich, founder and CEO of Crystal aOS, told Decrypt, “Ethereum becoming the default settlement layer for AI-to-AI interactions is realistic.

It's less about 'accelerating AGI' and more about providing the necessary rails and guardrails for agentic commerce, trade, and investing.

Trust and coordination, especially at the technology infrastructure and compliance infrastructure levels, are even more important now than ever.”

The comments land as major AI firms continue to publicly

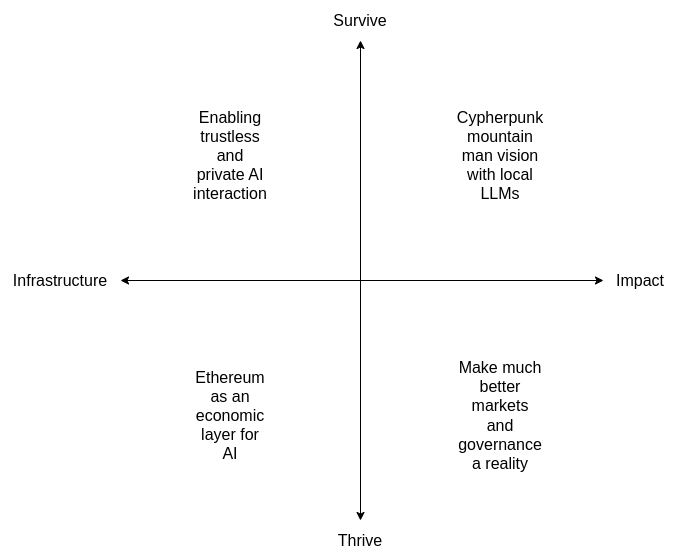

That includes local LLM tooling, zero-knowledge payments that let users call AI APIs without linking identity across requests, stronger cryptographic privacy, and client-side verification of AI services and attestations.

“Using Ethereum as an economic layer for AI-to-AI interaction is also directionally correct, but it will live mostly on rollups and app-specific L2s,” Midhun Krishna M, co-founder and CEO of LLM cost tracker <a href="

That includes local LLM tooling, zero-knowledge payments that let users call AI APIs without linking identity across requests, stronger cryptographic privacy, and client-side verification of AI services and attestations.

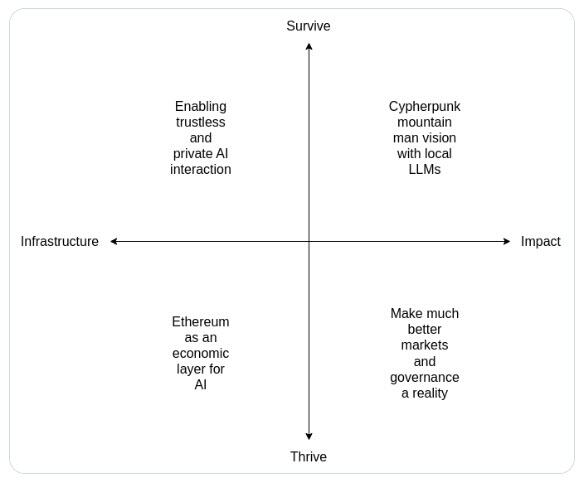

“Using Ethereum as an economic layer for AI-to-AI interaction is also directionally correct, but it will live mostly on rollups and app-specific L2s,” Midhun Krishna M, co-founder and CEO of LLM cost tracker <a href=" One quadrant centers on tooling for trustless and private AI interaction, including local LLMs, zero-knowledge payments for anonymous API calls, cryptographic privacy upgrades, and client-side verification of AI services, TEE attestations, and proofs.

Another quadrant positions Ethereum as an economic layer for AI activity, supporting API payments, bot-to-bot hiring, security deposits, on-chain dispute resolution, and AI reputation standards, such as proposed ERC-based models, aimed at enabling decentralized agent coordination rather than in-house platform control.

A third focus revives the cypherpunk “don’t trust, verify” vision through local LLM assistants that can propose transactions, audit smart contracts, interpret formal verification proofs, and interact with apps without relying on centralized interfaces.

A fourth targets upgraded prediction markets, quadratic voting, and governance systems.

The comments echo a split that surfaced last year between Buterin and OpenAI CEO Sam Altman, who said his company was confident it knew how to build AGI and that AI agents could soon “join the workforce,” while

One quadrant centers on tooling for trustless and private AI interaction, including local LLMs, zero-knowledge payments for anonymous API calls, cryptographic privacy upgrades, and client-side verification of AI services, TEE attestations, and proofs.

Another quadrant positions Ethereum as an economic layer for AI activity, supporting API payments, bot-to-bot hiring, security deposits, on-chain dispute resolution, and AI reputation standards, such as proposed ERC-based models, aimed at enabling decentralized agent coordination rather than in-house platform control.

A third focus revives the cypherpunk “don’t trust, verify” vision through local LLM assistants that can propose transactions, audit smart contracts, interpret formal verification proofs, and interact with apps without relying on centralized interfaces.

A fourth targets upgraded prediction markets, quadratic voting, and governance systems.

The comments echo a split that surfaced last year between Buterin and OpenAI CEO Sam Altman, who said his company was confident it knew how to build AGI and that AI agents could soon “join the workforce,” while

The

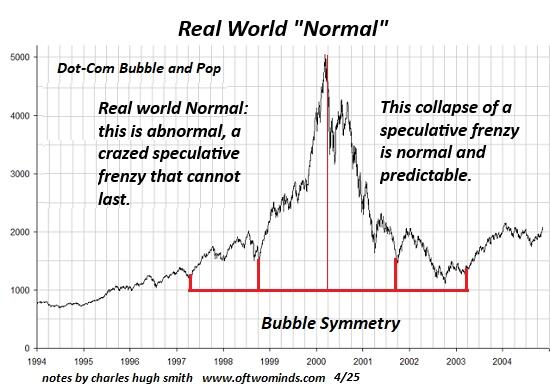

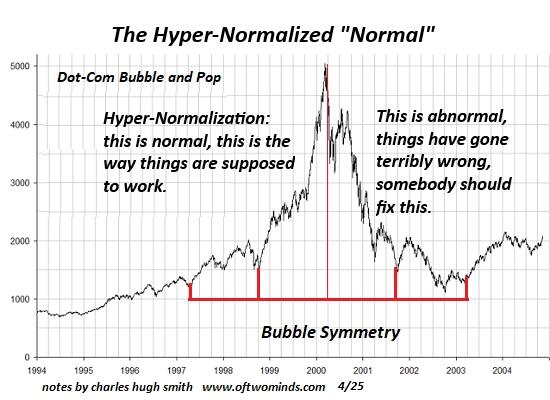

The  This is how the incoherent, system-failure hallucination views this bullish process: quick, do more of what crippled the system to maintain the illusion that "Capitalism" is "markets always go up."

This is how the incoherent, system-failure hallucination views this bullish process: quick, do more of what crippled the system to maintain the illusion that "Capitalism" is "markets always go up."

This isn't "Capitalism," it's Model Collapse ushering in the inevitable conflagration.

* * *

My new book

This isn't "Capitalism," it's Model Collapse ushering in the inevitable conflagration.

* * *

My new book

Video shared by FBI Director Kash Patel shows a masked person wearing a jacket, gloves, pants and carrying a backpack. The person can be seen obstructing the camera, before walking into the front yard. They then return to the front door with a small flashlight in their mouth before attempting to cover the camera with what appears to be foliage,

Video shared by FBI Director Kash Patel shows a masked person wearing a jacket, gloves, pants and carrying a backpack. The person can be seen obstructing the camera, before walking into the front yard. They then return to the front door with a small flashlight in their mouth before attempting to cover the camera with what appears to be foliage,

Guthrie was last seen on Jan. 31 after she was dropped off at her home in the Catalina Foothills, and was reported missing the next day after she failed to show up for church.

According to AZ Family, "In the early morning hours of Feb. 1, her doorbell camera disconnected and her software detected a person on the camera. Her pacemaker app also showed it disconnected from her phone."

Guthrie was last seen on Jan. 31 after she was dropped off at her home in the Catalina Foothills, and was reported missing the next day after she failed to show up for church.

According to AZ Family, "In the early morning hours of Feb. 1, her doorbell camera disconnected and her software detected a person on the camera. Her pacemaker app also showed it disconnected from her phone."

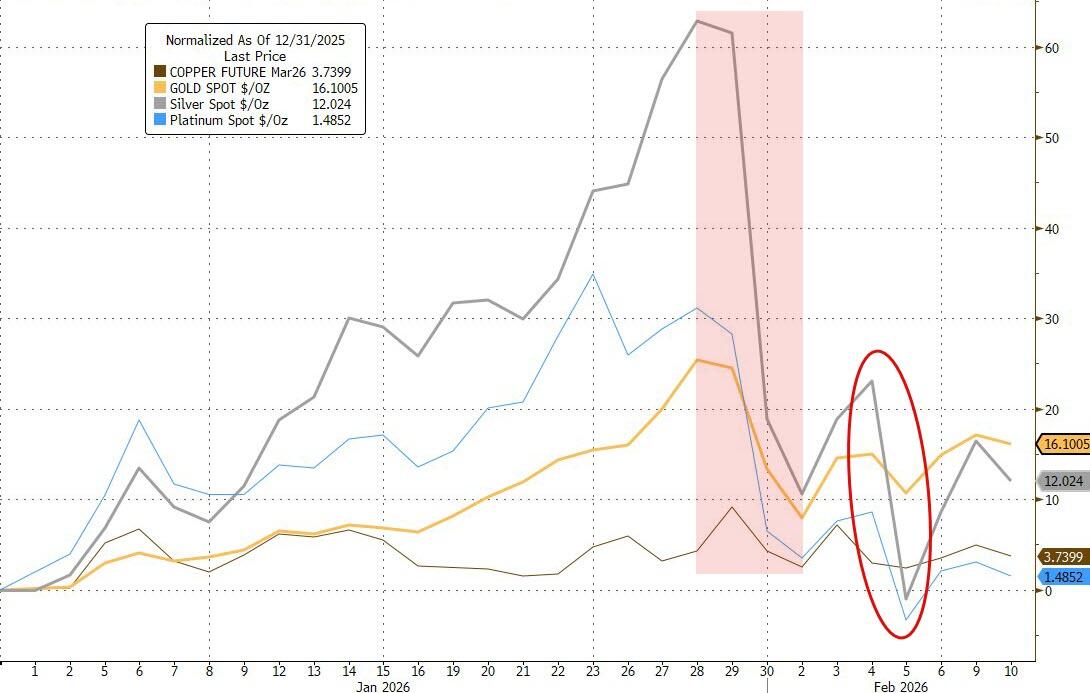

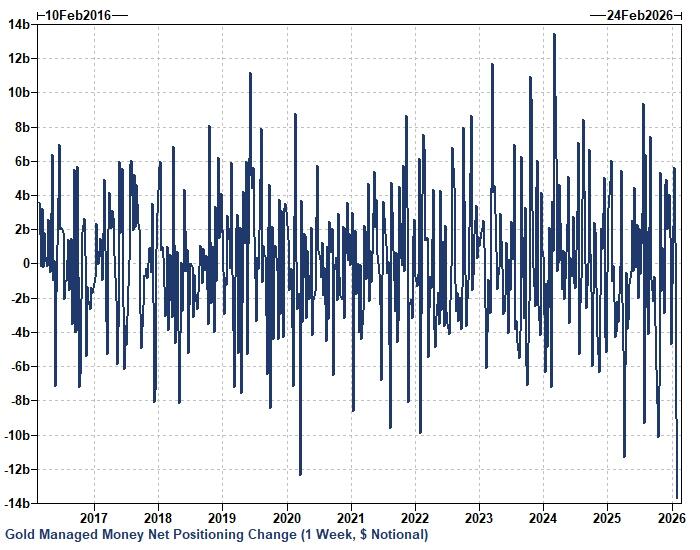

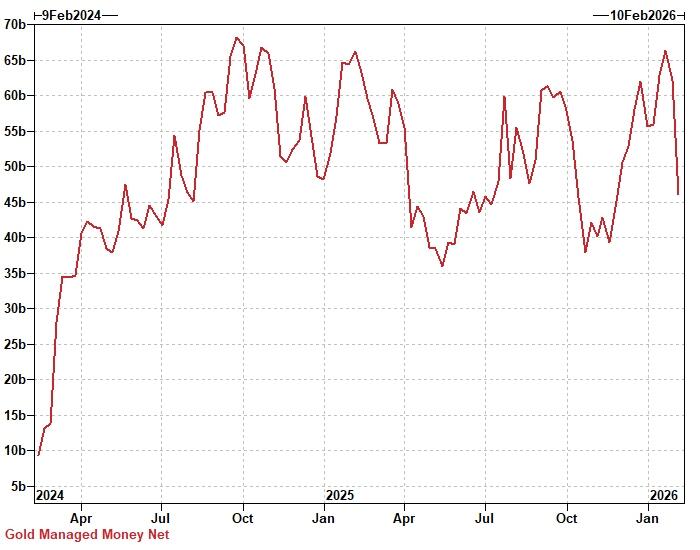

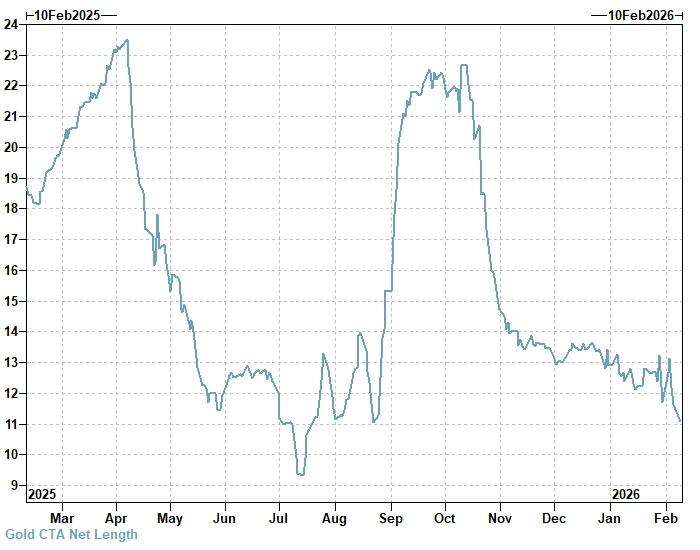

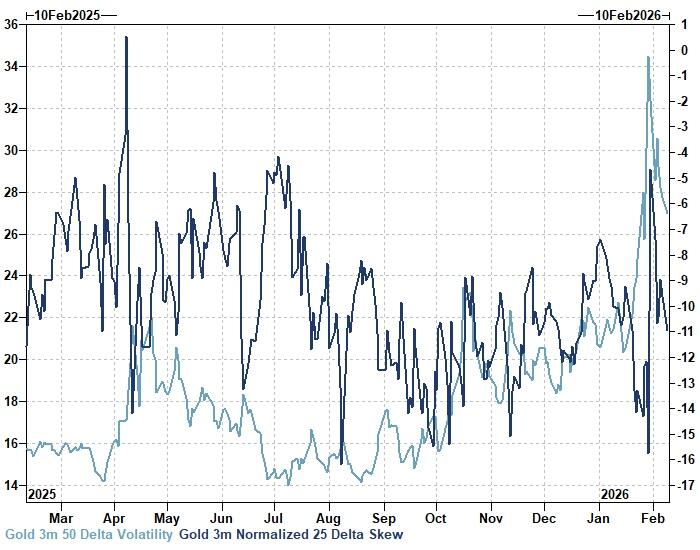

As Goldman's top futures trader, Robert Quinn, points out (in a

As Goldman's top futures trader, Robert Quinn, points out (in a  The report covering January 27th - February 3rd, which included a -11.4% drop post Trump's nomination of Kevin Warsh for Fed Chair, displayed-$13.7bn of Managed Money selling, driven mostly by liquidation (-$12.1bn).

This marked a 10 year notional record and corroborated the plummet in aggregate open interest.

The report covering January 27th - February 3rd, which included a -11.4% drop post Trump's nomination of Kevin Warsh for Fed Chair, displayed-$13.7bn of Managed Money selling, driven mostly by liquidation (-$12.1bn).

This marked a 10 year notional record and corroborated the plummet in aggregate open interest.

Over subsequent sessions, elevated price volatility caused additional long unwinds, consistent with flow models for systematic investors.

From February 3rd - 5th, Gold price and open interest lost -0.9% and -$4.3bn respectively. GS Futures Strategists' CTA model estimated some Gold selling. Similarly, the risk parity framework projected widespread commodity liquidation.

Over subsequent sessions, elevated price volatility caused additional long unwinds, consistent with flow models for systematic investors.

From February 3rd - 5th, Gold price and open interest lost -0.9% and -$4.3bn respectively. GS Futures Strategists' CTA model estimated some Gold selling. Similarly, the risk parity framework projected widespread commodity liquidation.

However bulls eventually returned alongside renewed Dollar weakness.

After initially proving resilient through Mega-Cap Tech weakness, the broad Dollar index lost -1.0% during February 5th -9th, enabling a +3.9% Gold bounce.

Catalysts included the US administration's signaling of an imminent soft labor report plus Chinese regulators' advice to curb holdings of US Treasuries.

Gold aggregate open interest regained +$2.7bn. Moreover, normalized 25 delta put-call skew cheapened across the curve.

However bulls eventually returned alongside renewed Dollar weakness.

After initially proving resilient through Mega-Cap Tech weakness, the broad Dollar index lost -1.0% during February 5th -9th, enabling a +3.9% Gold bounce.

Catalysts included the US administration's signaling of an imminent soft labor report plus Chinese regulators' advice to curb holdings of US Treasuries.

Gold aggregate open interest regained +$2.7bn. Moreover, normalized 25 delta put-call skew cheapened across the curve.

Meanwhile, UBS points out that Silver ETFs have now been sold so heavily in 2026 that it has erased all net buying in 2025...

Meanwhile, UBS points out that Silver ETFs have now been sold so heavily in 2026 that it has erased all net buying in 2025...

Many of the factors that underpinned the multiyear rally — heightened geopolitical risks, elevated central-bank buying and lower interest rates — remain in play.

“The recent bout of volatility has called into question the value of gold as a hedge against geopolitical and market swings,” Mark Haefele, global wealth management chief investment officer at UBS Group AG, wrote in a note.

“We believe such worries are overdone, and that the rally in gold will resume.”

Many other banks and asset managers, including Deutsche Bank and Goldman Sachs, have backed a recovery in bullion.

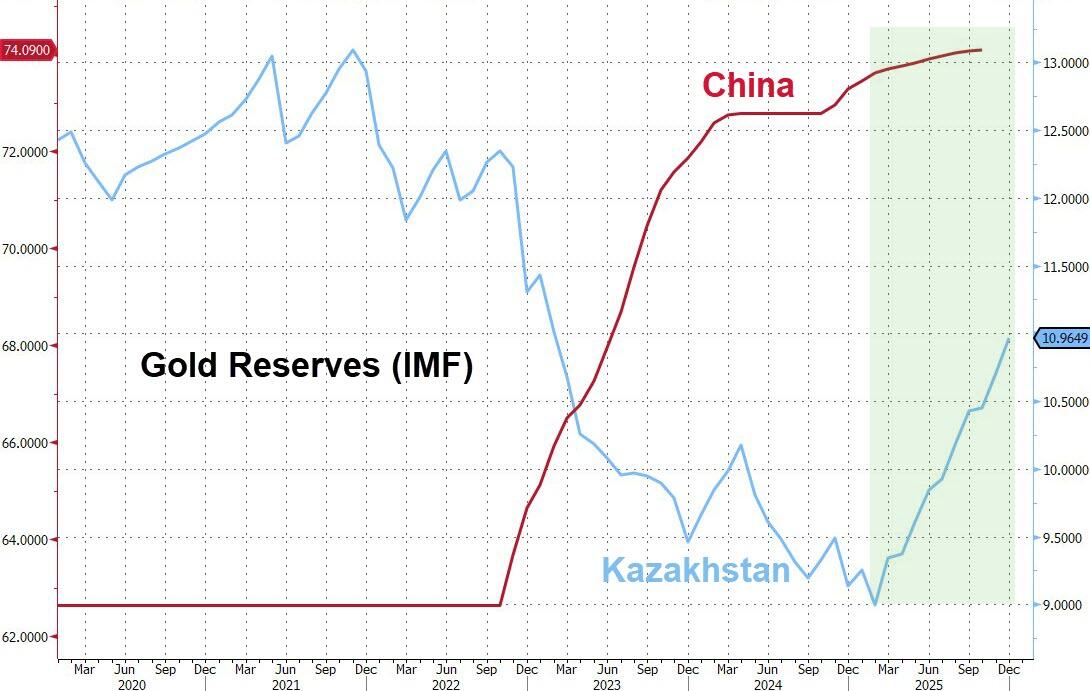

Underscoring resilient official demand, the Chinese central bank extended its gold buying to a 15th month in January, and Kazakhstan's central bank bought 66 tons of gold last year, becoming the world's second-largest buyer of the metal, Governor Timur Suleimenov told President Kassym-Jomart Tokayev, boosting overall gold reserves to 345 tons.

Many of the factors that underpinned the multiyear rally — heightened geopolitical risks, elevated central-bank buying and lower interest rates — remain in play.

“The recent bout of volatility has called into question the value of gold as a hedge against geopolitical and market swings,” Mark Haefele, global wealth management chief investment officer at UBS Group AG, wrote in a note.

“We believe such worries are overdone, and that the rally in gold will resume.”

Many other banks and asset managers, including Deutsche Bank and Goldman Sachs, have backed a recovery in bullion.

Underscoring resilient official demand, the Chinese central bank extended its gold buying to a 15th month in January, and Kazakhstan's central bank bought 66 tons of gold last year, becoming the world's second-largest buyer of the metal, Governor Timur Suleimenov told President Kassym-Jomart Tokayev, boosting overall gold reserves to 345 tons.

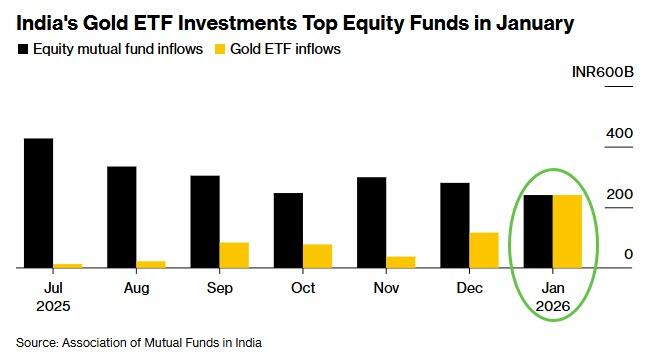

Away from the big banks, retail is well and truly involved as

Away from the big banks, retail is well and truly involved as

Net inflows into gold ETFs surged to a record 240.4 billion rupees ($2.65 billion), slightly higher than stock fund inflows of 240.3 billion rupees, according to data released Tuesday by the Association of Mutual Funds in India.

Net inflows into gold ETFs surged to a record 240.4 billion rupees ($2.65 billion), slightly higher than stock fund inflows of 240.3 billion rupees, according to data released Tuesday by the Association of Mutual Funds in India.

The milestone marks one of the strongest monthly endorsements of bullion by local investors in recent years.

“Investors are shifting allocations toward gold against the backdrop of a relatively lacklustre year for equity and stellar returns posted by gold in the same period,” said Nirav Karkera, head of research at Fisdom, a wealth management platform.

Investment demand for gold will likely stay firm, at least until clarity emerges on the macroeconomic front, he added.

The milestone marks one of the strongest monthly endorsements of bullion by local investors in recent years.

“Investors are shifting allocations toward gold against the backdrop of a relatively lacklustre year for equity and stellar returns posted by gold in the same period,” said Nirav Karkera, head of research at Fisdom, a wealth management platform.

Investment demand for gold will likely stay firm, at least until clarity emerges on the macroeconomic front, he added.

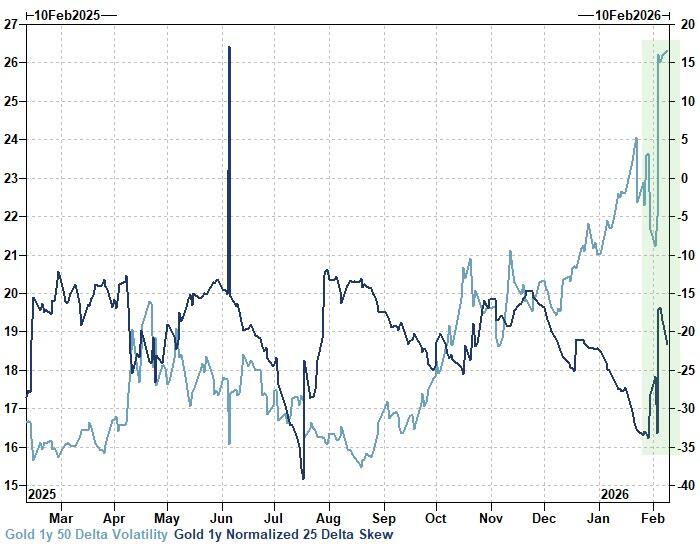

It's not just central banks and retail that are getting (staying) bulled up again. As Goldman concludes, even longer-term investors potentially re-engaged.

As realized volatility subsided, 1 month and 3 month implied volatility also declined.

However 1 year implied volatility continued to richen and remained near local highs.

It's not just central banks and retail that are getting (staying) bulled up again. As Goldman concludes, even longer-term investors potentially re-engaged.

As realized volatility subsided, 1 month and 3 month implied volatility also declined.

However 1 year implied volatility continued to richen and remained near local highs.

Thus, Goldman's Quinn concludes, long-dated call buying likely manifested.

Thus, Goldman's Quinn concludes, long-dated call buying likely manifested.

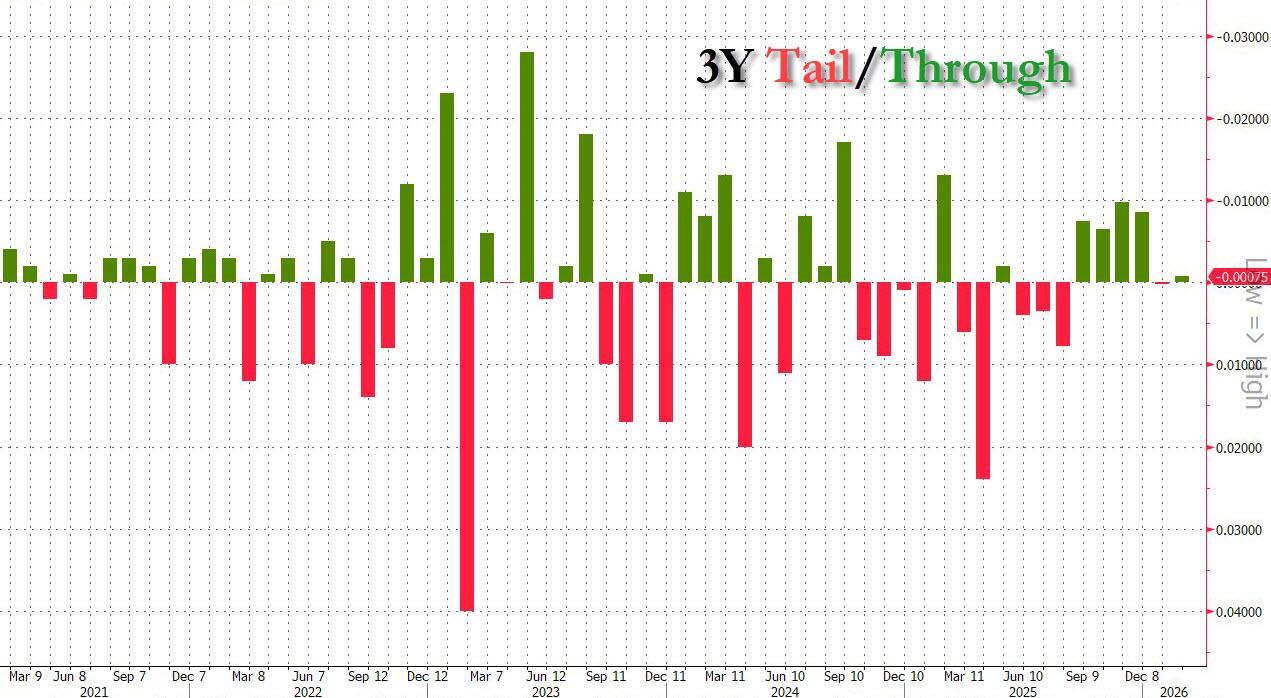

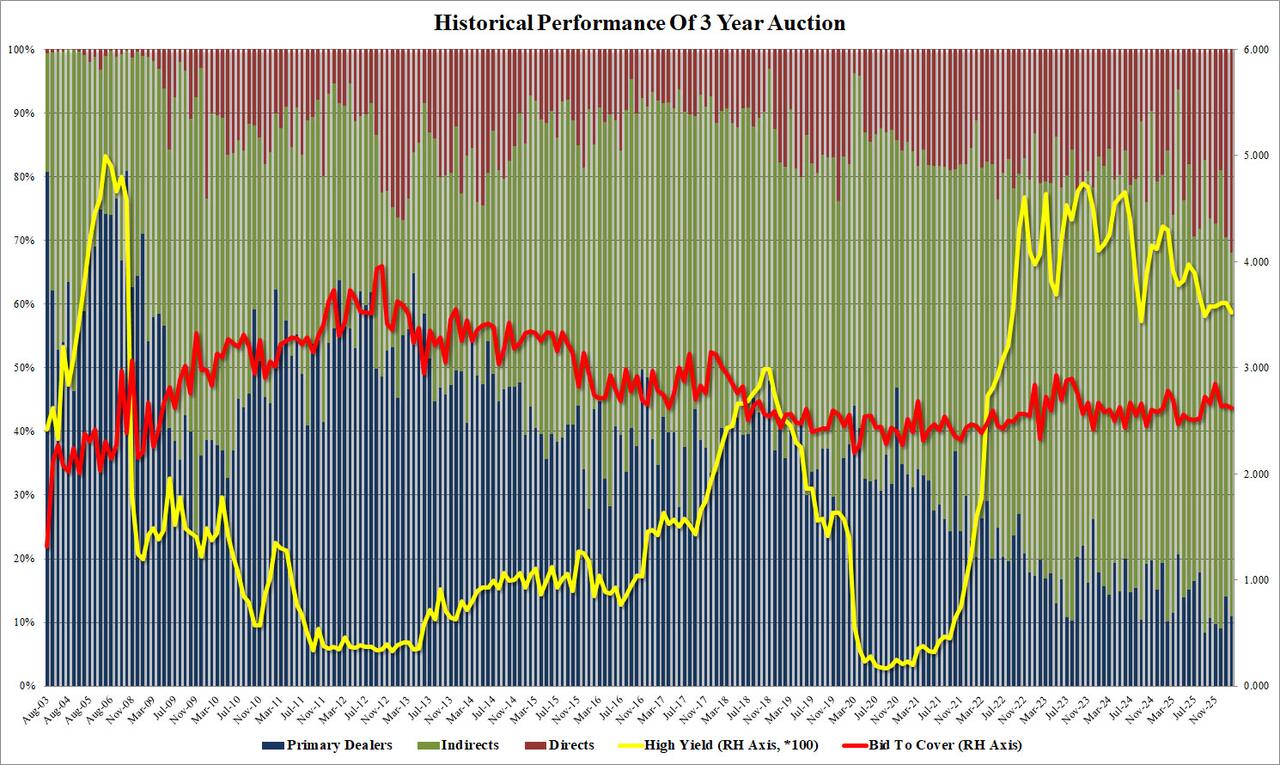

The bid to cover was a bit disappointing at 2.624, down from 2.650 in January and below the recent average of 2.676.

Internals were also notable, with Indirects awarded 57.15%, up from 56.50% but well below the recent average of 63.73%. And with Dealers holding 10.94%, that left Directs with a whopping 31.92%, up from 29.50% and the highest on record. This curious dynamic - declining Indirects offset by rising Directs - has been a staple for coupon auctions for the past several years now and we see it accelerating in the future, especially if foreign reserve managers rotate away from the US.

The bid to cover was a bit disappointing at 2.624, down from 2.650 in January and below the recent average of 2.676.

Internals were also notable, with Indirects awarded 57.15%, up from 56.50% but well below the recent average of 63.73%. And with Dealers holding 10.94%, that left Directs with a whopping 31.92%, up from 29.50% and the highest on record. This curious dynamic - declining Indirects offset by rising Directs - has been a staple for coupon auctions for the past several years now and we see it accelerating in the future, especially if foreign reserve managers rotate away from the US.

Overall, this was a solid auction, yet one where the drop in foreign demand was notable, even if offset by record direct buyers

Overall, this was a solid auction, yet one where the drop in foreign demand was notable, even if offset by record direct buyers

The lack of major surprise explains why 10Y yields barely budged after the auction prices just after 1pm ET.

The lack of major surprise explains why 10Y yields barely budged after the auction prices just after 1pm ET.

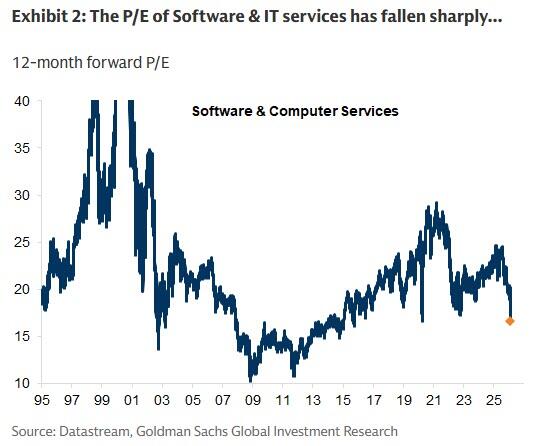

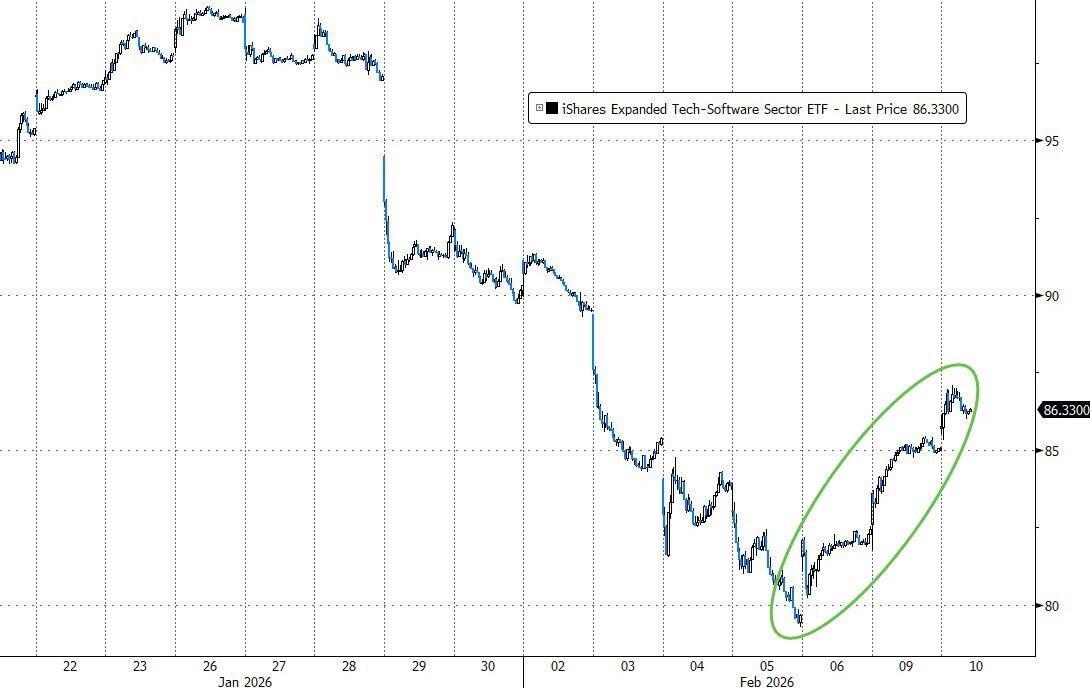

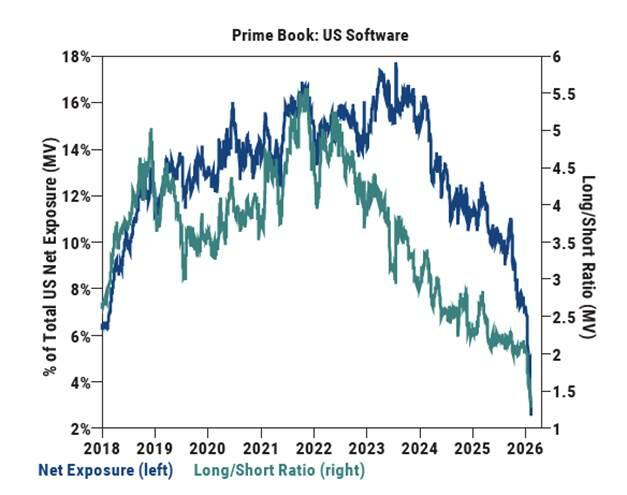

The headline-grabbing culprit for much of the pain to the downside was Software stocks (IGV as an example of an ETF that tracks the sector), which collapsed as specifically SaaS firms faced 'existential threats' from AI disruption.

That crashed Software valuations down dramatically...

The headline-grabbing culprit for much of the pain to the downside was Software stocks (IGV as an example of an ETF that tracks the sector), which collapsed as specifically SaaS firms faced 'existential threats' from AI disruption.

That crashed Software valuations down dramatically...

And, suddenly - starting Friday morning - buyers appeared to snap up these newly cheap stocks...

And, suddenly - starting Friday morning - buyers appeared to snap up these newly cheap stocks...

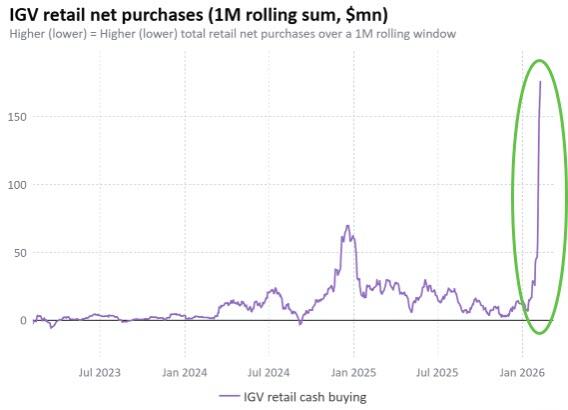

Inflows into IGV - the Software ETF - have soared...

Inflows into IGV - the Software ETF - have soared...

But, the question has been - who's buying?

Well now we have the answer,

But, the question has been - who's buying?

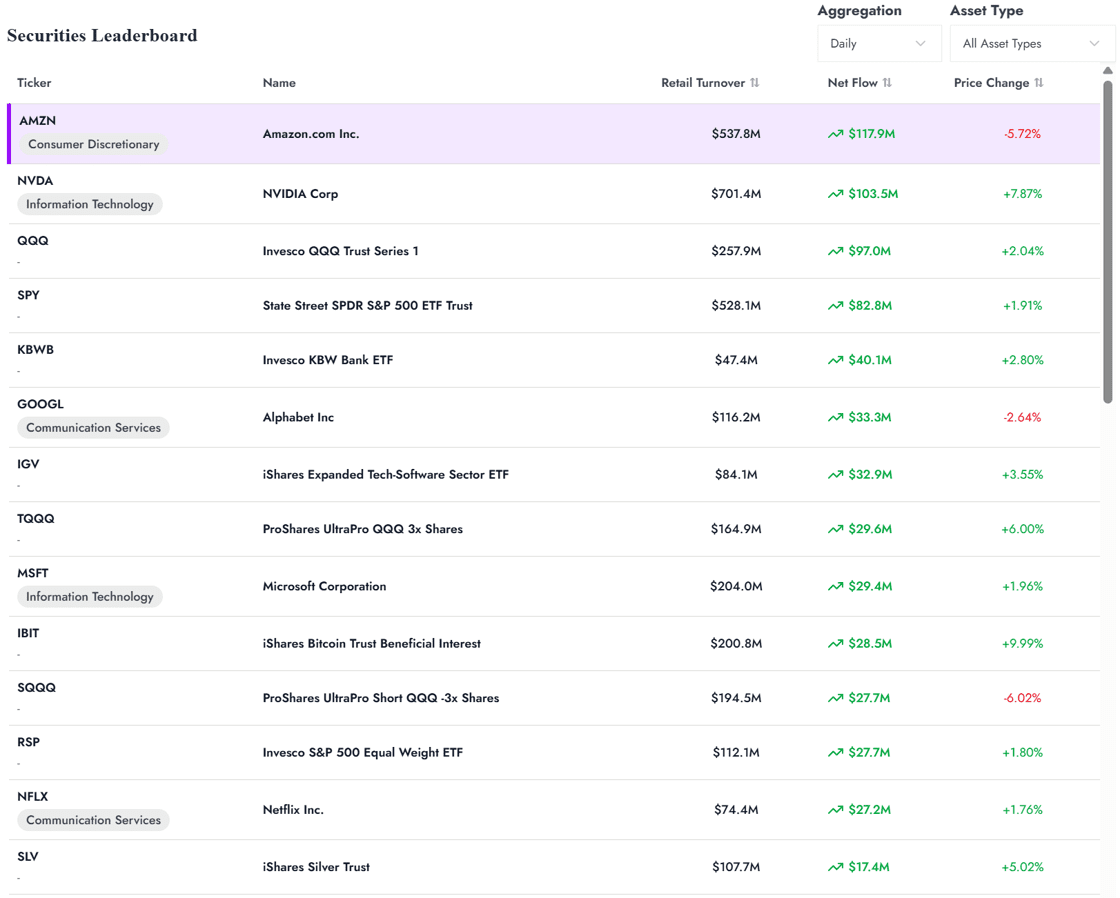

Well now we have the answer, This is one of the more aggressive episodes of retail dip-buying in tech, and especially software, that we've observed in our dataset.

This is one of the more aggressive episodes of retail dip-buying in tech, and especially software, that we've observed in our dataset.

Last Friday, AMZN recorded its largest single-day of net retail buying since Aug 2024.

We also saw decent follow-through buying throughout the session yesterday.

This is in keeping with the theme that retail investors have been opportunistically buying the dip in mega-cap tech after any earnings-driven sell-offs (also seen in MSFT, GOOGL etc.).

Last Friday, AMZN recorded its largest single-day of net retail buying since Aug 2024.

We also saw decent follow-through buying throughout the session yesterday.

This is in keeping with the theme that retail investors have been opportunistically buying the dip in mega-cap tech after any earnings-driven sell-offs (also seen in MSFT, GOOGL etc.).

The question is - can retail maintain this momentum long enough to get hedgies re-engaged in Software from their near-record low exposure levels

The question is - can retail maintain this momentum long enough to get hedgies re-engaged in Software from their near-record low exposure levels

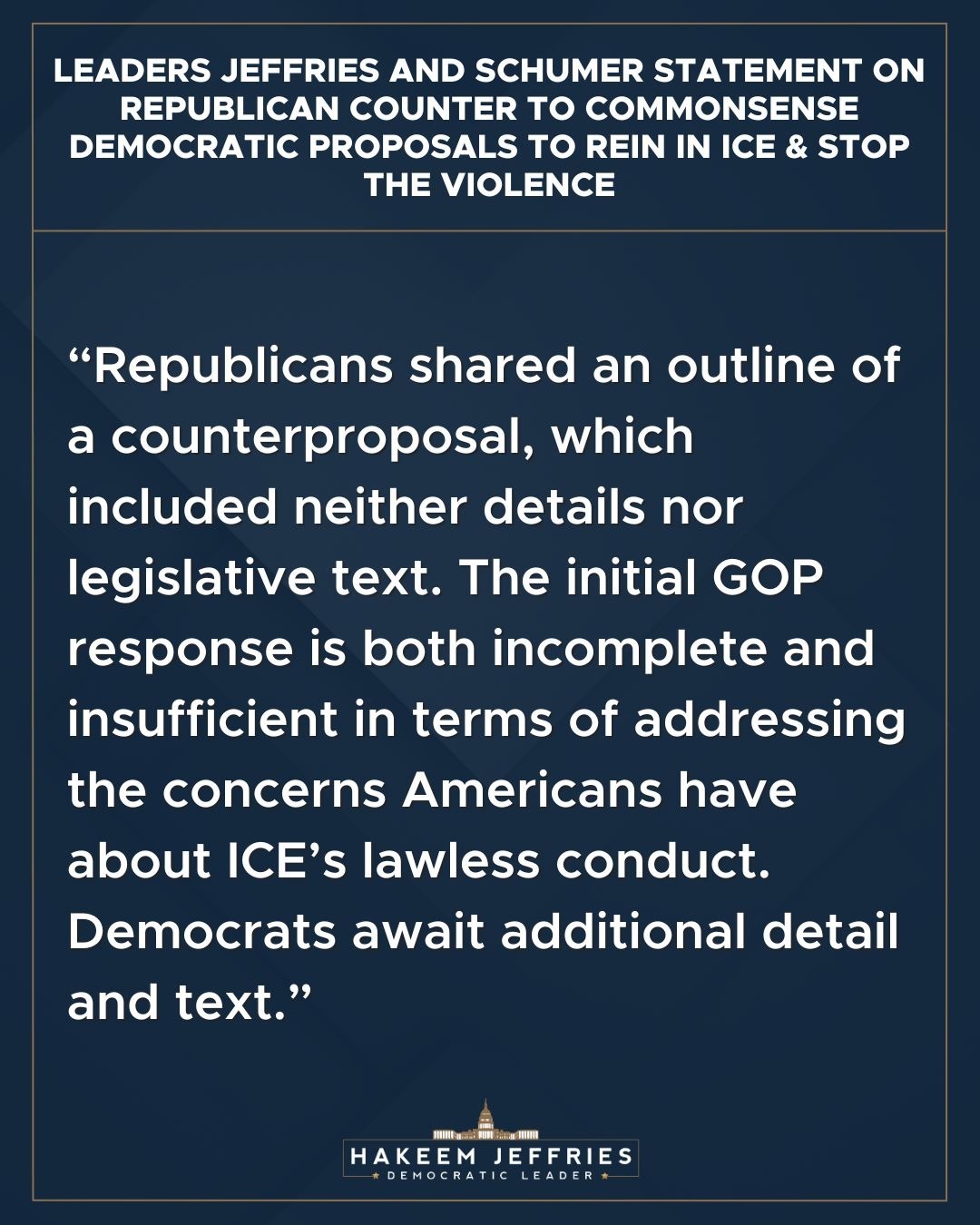

House Minority Leader Hakeem Jeffries (D-NY)

House Minority Leader Hakeem Jeffries (D-NY)

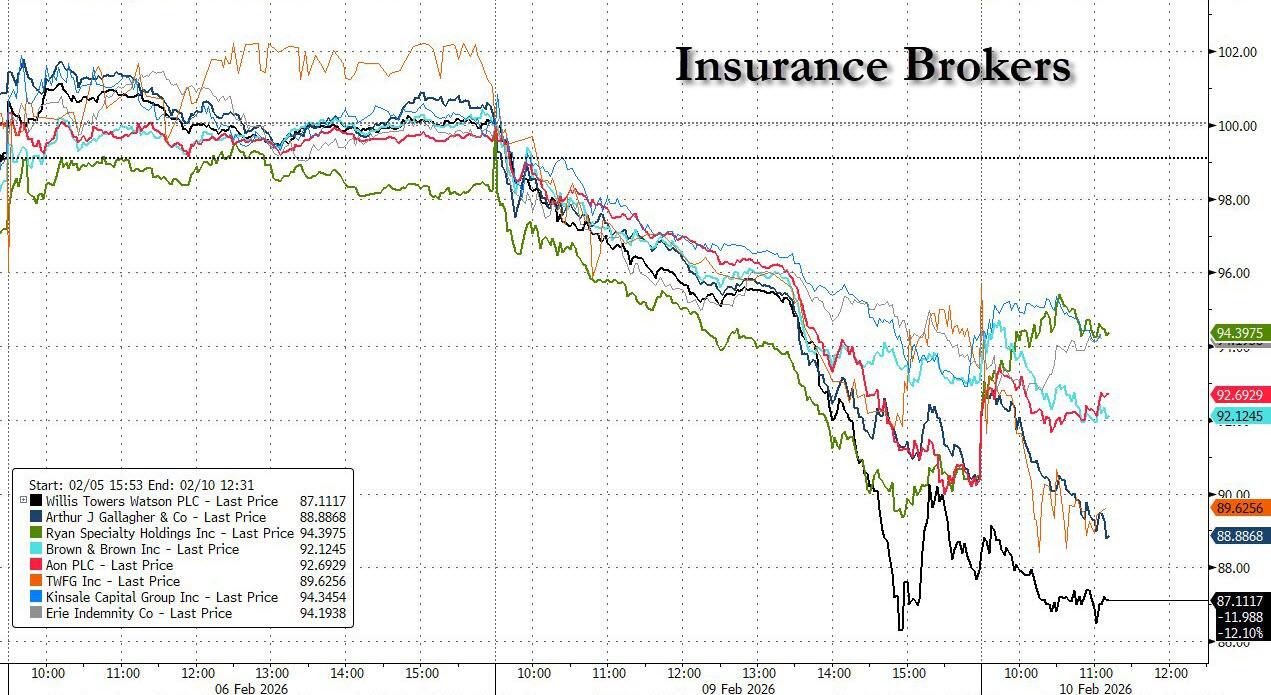

The market reaction came after OpenAI announced that Tuio’s app, powered by WaniWani’s AI distribution infrastructure, allows ChatGPT users to receive personalized home insurance quotes directly through conversation, with purchasing capabilities coming soon. This marks the first time an insurance provider can distribute products and offer quotes directly within an AI platform.

According to OpenAI, the new capability removes traditional friction points in insurance purchasing by eliminating forms, calls, and intermediaries. Tuio’s AI app collects relevant information through natural conversation and returns personalized quotes from regulated carriers in real time, Investing.com reported.

Some investors expressed confusion about the market reaction, questioning why commercial insurance brokers were so heavily impacted when the current application focuses on home insurance. Some argued that insurance brokers dealing with specialty products might be better insulated due to the complexity of those offerings.

Banks promptly came to the sector's defense with Goldman underscoring the investor confusion, and writing that “the immediate feedback still is a degree on confusion & the top question is 'Why would this primarily impact the brokers (who primarily do commercial .. think there's only home insurance at the majors for high net worth)' .. with a few arguing it's 1) more negative for personal insurance carriers given greater price transparency/shopping/competition, and 2) Insurance brokers dealing in more specialty products should be better insulated given complexity.

UBS also was quick to defend, with analyst Brian Meredith saying he remains a buyer of the brokers and "views the pullback as an attractive entry point for his preferred broker names: Marsh, Goosehead Insurance and Willis Towers Watson."

Meredith added that concerns around broker disintermediation have been around for decades, with insurance brokers still the principal means of distribution for commercial insurance products, and independent/captive agents accounting for more than two-thirds of personal lines insurance distribution. Brian said brokers remain essential intermediaries for a complex purchasing decision.

He continues to favor the insurance brokers in 2026 as he believes growth expectations have bottomed with potential upside in a good economic environment. "Valuations are attractive on a relative and absolute basis and reflect a "soft" market."

Then again, as Goldman concludes, there's certainly a degree of 'don't fight the narrative' .. and this is all very fresh/fluid at the moment.”

And if the ongoing rout in the software space is any indication, there is much more pain to come.

The market reaction came after OpenAI announced that Tuio’s app, powered by WaniWani’s AI distribution infrastructure, allows ChatGPT users to receive personalized home insurance quotes directly through conversation, with purchasing capabilities coming soon. This marks the first time an insurance provider can distribute products and offer quotes directly within an AI platform.

According to OpenAI, the new capability removes traditional friction points in insurance purchasing by eliminating forms, calls, and intermediaries. Tuio’s AI app collects relevant information through natural conversation and returns personalized quotes from regulated carriers in real time, Investing.com reported.

Some investors expressed confusion about the market reaction, questioning why commercial insurance brokers were so heavily impacted when the current application focuses on home insurance. Some argued that insurance brokers dealing with specialty products might be better insulated due to the complexity of those offerings.

Banks promptly came to the sector's defense with Goldman underscoring the investor confusion, and writing that “the immediate feedback still is a degree on confusion & the top question is 'Why would this primarily impact the brokers (who primarily do commercial .. think there's only home insurance at the majors for high net worth)' .. with a few arguing it's 1) more negative for personal insurance carriers given greater price transparency/shopping/competition, and 2) Insurance brokers dealing in more specialty products should be better insulated given complexity.

UBS also was quick to defend, with analyst Brian Meredith saying he remains a buyer of the brokers and "views the pullback as an attractive entry point for his preferred broker names: Marsh, Goosehead Insurance and Willis Towers Watson."

Meredith added that concerns around broker disintermediation have been around for decades, with insurance brokers still the principal means of distribution for commercial insurance products, and independent/captive agents accounting for more than two-thirds of personal lines insurance distribution. Brian said brokers remain essential intermediaries for a complex purchasing decision.

He continues to favor the insurance brokers in 2026 as he believes growth expectations have bottomed with potential upside in a good economic environment. "Valuations are attractive on a relative and absolute basis and reflect a "soft" market."

Then again, as Goldman concludes, there's certainly a degree of 'don't fight the narrative' .. and this is all very fresh/fluid at the moment.”

And if the ongoing rout in the software space is any indication, there is much more pain to come.

Energy purchases drove most of the increase, climbing to $12.47 billion from $5.67 billion last January. Meanwhile, emergency measures to bolster supplies — including activating rarely used generators and covering fuel costs — more than doubled to $849 million.

Adding to the pressure, PJM is experiencing rapid demand growth as utilities expand capacity for data centers and artificial intelligence, further tightening available supplies.

Obviously, bringing more nuclear power plants online could ease this pressure over the long term by adding large amounts of reliable, round-the-clock electricity that isn’t dependent on weather or volatile fuel markets. Unlike natural gas, nuclear generation is insulated from price spikes during cold snaps, and unlike wind or solar, it can operate at full capacity regardless of conditions.

Expanding nuclear capacity would strengthen grid resilience during extreme weather, stabilize wholesale prices, and reduce the need for costly emergency measures—helping protect consumers from the kind of winter-driven cost surges seen this January.

Energy purchases drove most of the increase, climbing to $12.47 billion from $5.67 billion last January. Meanwhile, emergency measures to bolster supplies — including activating rarely used generators and covering fuel costs — more than doubled to $849 million.

Adding to the pressure, PJM is experiencing rapid demand growth as utilities expand capacity for data centers and artificial intelligence, further tightening available supplies.

Obviously, bringing more nuclear power plants online could ease this pressure over the long term by adding large amounts of reliable, round-the-clock electricity that isn’t dependent on weather or volatile fuel markets. Unlike natural gas, nuclear generation is insulated from price spikes during cold snaps, and unlike wind or solar, it can operate at full capacity regardless of conditions.

Expanding nuclear capacity would strengthen grid resilience during extreme weather, stabilize wholesale prices, and reduce the need for costly emergency measures—helping protect consumers from the kind of winter-driven cost surges seen this January.

District Court Judge Christina Snyder

District Court Judge Christina Snyder  Department of Homeland Security (DHS) officers stand guard in front of the Edward R. Roybal Federal Building and Detention Center while demonstrators protest in Los Angeles, on Aug. 2, 2025. Apu Gomes/Getty Images

Snyder found the No Secret Police Act did not apply equally to all law enforcement officers in the state, and therefore it “unlawfully discriminates against federal officers,” according to her ruling.

“Because such discrimination violates the Supremacy Clause, the court is constrained to enjoin the facial covering prohibition. California may not enforce the facial covering prohibition of the No Secret Police Act, SB 627 ... against federal law enforcement officers,” she ruled.

The judge denied the federal government’s other challenges.

The state’s law was already receiving pushback by the largest metropolitan police agency in the state. Los Angeles Police Department Chief Jim McDonnell said his officers would not enforce it.

“The reality of one armed agency approaching another armed agency to create conflict over something that would be a misdemeanor at best—or an infraction—it doesn’t make any sense. It’s not a good public policy decision and it wasn’t well thought out, in my opinion,” McDonnell said during a news conference on Jan. 29.

California Attorney General Rob Bonta did not immediately return a request for comment on the ruling.

Department of Homeland Security (DHS) officers stand guard in front of the Edward R. Roybal Federal Building and Detention Center while demonstrators protest in Los Angeles, on Aug. 2, 2025. Apu Gomes/Getty Images

Snyder found the No Secret Police Act did not apply equally to all law enforcement officers in the state, and therefore it “unlawfully discriminates against federal officers,” according to her ruling.

“Because such discrimination violates the Supremacy Clause, the court is constrained to enjoin the facial covering prohibition. California may not enforce the facial covering prohibition of the No Secret Police Act, SB 627 ... against federal law enforcement officers,” she ruled.

The judge denied the federal government’s other challenges.

The state’s law was already receiving pushback by the largest metropolitan police agency in the state. Los Angeles Police Department Chief Jim McDonnell said his officers would not enforce it.

“The reality of one armed agency approaching another armed agency to create conflict over something that would be a misdemeanor at best—or an infraction—it doesn’t make any sense. It’s not a good public policy decision and it wasn’t well thought out, in my opinion,” McDonnell said during a news conference on Jan. 29.

California Attorney General Rob Bonta did not immediately return a request for comment on the ruling.

Under Secretary of State for Public Diplomacy Sarah Rogers discussed the initiative during a trip to Europe. It includes grants to support free expression, a result of concerns about rules such as the European Union’s Digital Services Act and Britain’s Online Safety Act.

These laws, which E.U. officials say aim to deter hate speech and misinformation, have been scrutinized by U.S. officials as restricting the free speech of American tech firms and suppressing immigration policy critiques.

“One way my office is going to operate differently is we’re going to be very forthright and transparent about everything we do,” Rogers said during a panel discussion in Budapest on Monday. She added that her role allows directing U.S. funding through grants, stating, “I want to promote free speech in Western allied democracies, and ... that’s what my grantmaking is going to be doing.”

Rogers, appearing alongside a top aide to Hungarian Prime Minister Viktor Orbán, underscored the importance of free speech for democracy.

“The United States government, via me, but not only me, has been engaging aggressively on the issue of free speech, because you don’t have self-governance without freedom of speech, you can’t have a democratic deliberation if viewpoints are proscribed from the public square,” she said.

Rogers is scheduled to stop in Dublin, Budapest, Warsaw, and Munich to discuss digital freedoms with officials and others.

The administration’s December National Security Strategy said that European leaders were censoring speech and suppressing opposition to immigration policies, warning of the continent’s “civilizational erasure.”

Rogers said European polls showing European views on migration are similar to those in the United States.

The United States imposed last month visa bans on a former European Union commissioner and four anti-disinformation activists. The administration labeled them agents of censorship for working to regulate U.S. social media platforms. European leaders

Under Secretary of State for Public Diplomacy Sarah Rogers discussed the initiative during a trip to Europe. It includes grants to support free expression, a result of concerns about rules such as the European Union’s Digital Services Act and Britain’s Online Safety Act.

These laws, which E.U. officials say aim to deter hate speech and misinformation, have been scrutinized by U.S. officials as restricting the free speech of American tech firms and suppressing immigration policy critiques.

“One way my office is going to operate differently is we’re going to be very forthright and transparent about everything we do,” Rogers said during a panel discussion in Budapest on Monday. She added that her role allows directing U.S. funding through grants, stating, “I want to promote free speech in Western allied democracies, and ... that’s what my grantmaking is going to be doing.”

Rogers, appearing alongside a top aide to Hungarian Prime Minister Viktor Orbán, underscored the importance of free speech for democracy.

“The United States government, via me, but not only me, has been engaging aggressively on the issue of free speech, because you don’t have self-governance without freedom of speech, you can’t have a democratic deliberation if viewpoints are proscribed from the public square,” she said.

Rogers is scheduled to stop in Dublin, Budapest, Warsaw, and Munich to discuss digital freedoms with officials and others.

The administration’s December National Security Strategy said that European leaders were censoring speech and suppressing opposition to immigration policies, warning of the continent’s “civilizational erasure.”

Rogers said European polls showing European views on migration are similar to those in the United States.

The United States imposed last month visa bans on a former European Union commissioner and four anti-disinformation activists. The administration labeled them agents of censorship for working to regulate U.S. social media platforms. European leaders

President Macron

President Macron

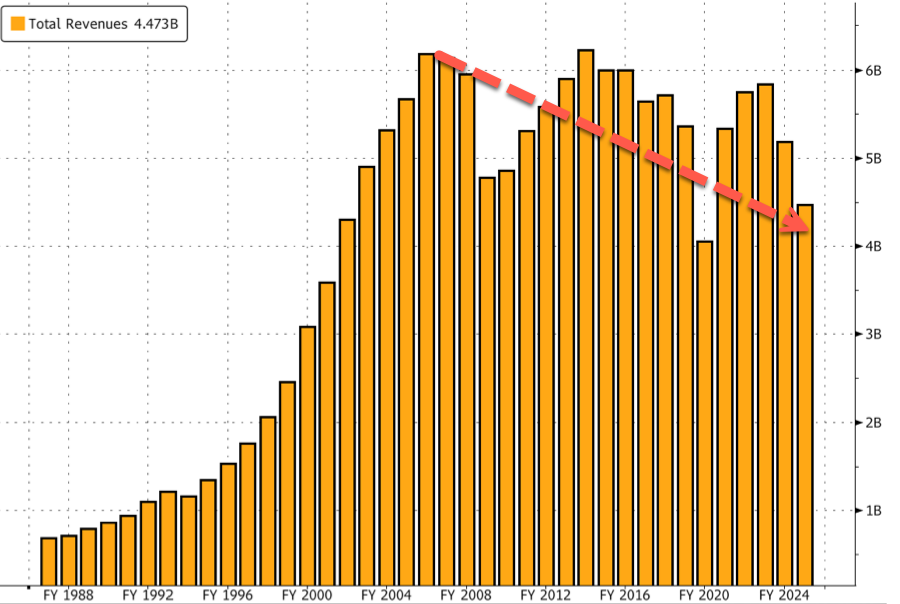

In premarket trading, Harley shares plunged nearly 12%, the sharpest decline since the 16% drop on April 25, 2024. The stock is trading near Covid-era lows and not far above its 2009 trough.

In premarket trading, Harley shares plunged nearly 12%, the sharpest decline since the 16% drop on April 25, 2024. The stock is trading near Covid-era lows and not far above its 2009 trough.

CEO Arturo Pires de Lima, who took over in October, is focused on reducing excess inventory and repairing dealer relationships amid elevated interest rates that have strained consumers.

Looking at Harley's annual revenue, there's a clear surge in the post-Dot Com period that builds into the 2008 peak. That upswing coincided with the boomer retirement wave, as the oldest boomers became eligible for early Social Security retirement benefits in 2008.

At that time, boomers were the economy's largest spending cohort, so it stands to reason that some of them, now retired, were buying all sorts of items that reminded them of their younger days: bikes, Packards, second and third homes and whatever else.

But note that, since 2008, annual revenue, instead of trending up and to the right, has been trending down, as the brand never solidly connected with millennials or younger generations as it did with boomers.

CEO Arturo Pires de Lima, who took over in October, is focused on reducing excess inventory and repairing dealer relationships amid elevated interest rates that have strained consumers.

Looking at Harley's annual revenue, there's a clear surge in the post-Dot Com period that builds into the 2008 peak. That upswing coincided with the boomer retirement wave, as the oldest boomers became eligible for early Social Security retirement benefits in 2008.

At that time, boomers were the economy's largest spending cohort, so it stands to reason that some of them, now retired, were buying all sorts of items that reminded them of their younger days: bikes, Packards, second and third homes and whatever else.

But note that, since 2008, annual revenue, instead of trending up and to the right, has been trending down, as the brand never solidly connected with millennials or younger generations as it did with boomers.

Harley tried electric bikes, which failed miserably. It's in a reset period.

Harley tried electric bikes, which failed miserably. It's in a reset period.