Harley-Davidson Shares Plunge As Bike Demand Stalls

Harley-Davidson Shares Plunge As Bike Demand Stalls

Harley-Davidson shares plunged in premarket trading after the company reported an unexpected decline in motorcycle shipments and a far deeper-than-expected sales miss in the fourth quarter. The results suggest the company is still battling soft demand, with the brand having peaked with boomers and struggling to connect with younger riders.

Global fourth-quarter bike deliveries fell 4% to 13,515 bikes versus expectations of 16,408, while revenue came in at $496 million compared with about $749 million expected (per Bloomberg Consensus estimates). The adjusted loss of $2.44 for the period was more than twice the expected amount.

In premarket trading, Harley shares plunged nearly 12%, the sharpest decline since the 16% drop on April 25, 2024. The stock is trading near Covid-era lows and not far above its 2009 trough.

In premarket trading, Harley shares plunged nearly 12%, the sharpest decline since the 16% drop on April 25, 2024. The stock is trading near Covid-era lows and not far above its 2009 trough.

CEO Arturo Pires de Lima, who took over in October, is focused on reducing excess inventory and repairing dealer relationships amid elevated interest rates that have strained consumers.

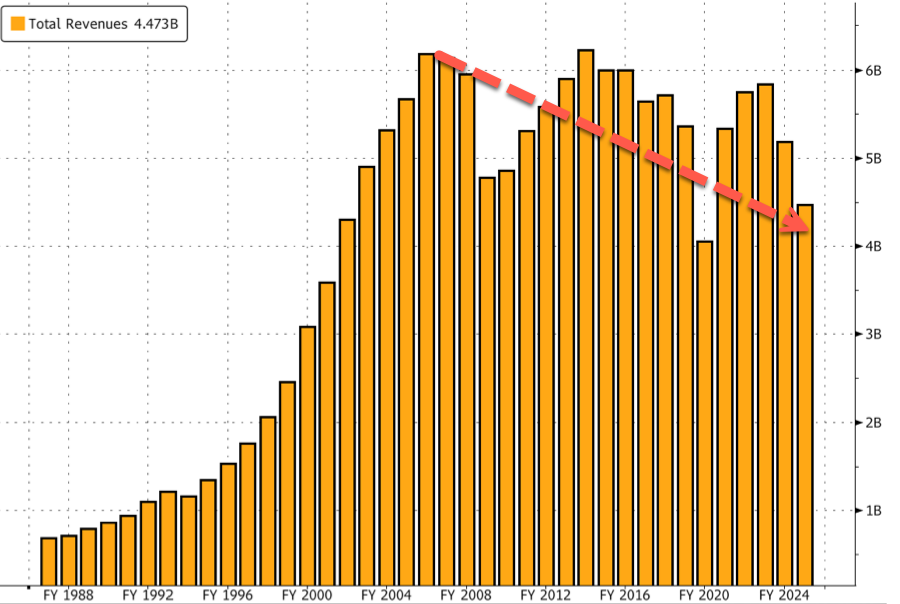

Looking at Harley's annual revenue, there's a clear surge in the post-Dot Com period that builds into the 2008 peak. That upswing coincided with the boomer retirement wave, as the oldest boomers became eligible for early Social Security retirement benefits in 2008.

At that time, boomers were the economy's largest spending cohort, so it stands to reason that some of them, now retired, were buying all sorts of items that reminded them of their younger days: bikes, Packards, second and third homes and whatever else.

But note that, since 2008, annual revenue, instead of trending up and to the right, has been trending down, as the brand never solidly connected with millennials or younger generations as it did with boomers.

CEO Arturo Pires de Lima, who took over in October, is focused on reducing excess inventory and repairing dealer relationships amid elevated interest rates that have strained consumers.

Looking at Harley's annual revenue, there's a clear surge in the post-Dot Com period that builds into the 2008 peak. That upswing coincided with the boomer retirement wave, as the oldest boomers became eligible for early Social Security retirement benefits in 2008.

At that time, boomers were the economy's largest spending cohort, so it stands to reason that some of them, now retired, were buying all sorts of items that reminded them of their younger days: bikes, Packards, second and third homes and whatever else.

But note that, since 2008, annual revenue, instead of trending up and to the right, has been trending down, as the brand never solidly connected with millennials or younger generations as it did with boomers.

Harley tried electric bikes, which failed miserably. It's in a reset period.

Tue, 02/10/2026 - 08:50

Harley tried electric bikes, which failed miserably. It's in a reset period.

Tue, 02/10/2026 - 08:50

In premarket trading, Harley shares plunged nearly 12%, the sharpest decline since the 16% drop on April 25, 2024. The stock is trading near Covid-era lows and not far above its 2009 trough.

In premarket trading, Harley shares plunged nearly 12%, the sharpest decline since the 16% drop on April 25, 2024. The stock is trading near Covid-era lows and not far above its 2009 trough.

CEO Arturo Pires de Lima, who took over in October, is focused on reducing excess inventory and repairing dealer relationships amid elevated interest rates that have strained consumers.

Looking at Harley's annual revenue, there's a clear surge in the post-Dot Com period that builds into the 2008 peak. That upswing coincided with the boomer retirement wave, as the oldest boomers became eligible for early Social Security retirement benefits in 2008.

At that time, boomers were the economy's largest spending cohort, so it stands to reason that some of them, now retired, were buying all sorts of items that reminded them of their younger days: bikes, Packards, second and third homes and whatever else.

But note that, since 2008, annual revenue, instead of trending up and to the right, has been trending down, as the brand never solidly connected with millennials or younger generations as it did with boomers.

CEO Arturo Pires de Lima, who took over in October, is focused on reducing excess inventory and repairing dealer relationships amid elevated interest rates that have strained consumers.

Looking at Harley's annual revenue, there's a clear surge in the post-Dot Com period that builds into the 2008 peak. That upswing coincided with the boomer retirement wave, as the oldest boomers became eligible for early Social Security retirement benefits in 2008.

At that time, boomers were the economy's largest spending cohort, so it stands to reason that some of them, now retired, were buying all sorts of items that reminded them of their younger days: bikes, Packards, second and third homes and whatever else.

But note that, since 2008, annual revenue, instead of trending up and to the right, has been trending down, as the brand never solidly connected with millennials or younger generations as it did with boomers.

Harley tried electric bikes, which failed miserably. It's in a reset period.

Harley tried electric bikes, which failed miserably. It's in a reset period.

Tyler Durden | Zero Hedge

Zero Hedge

Harley-Davidson Shares Plunge As Bike Demand Stalls | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

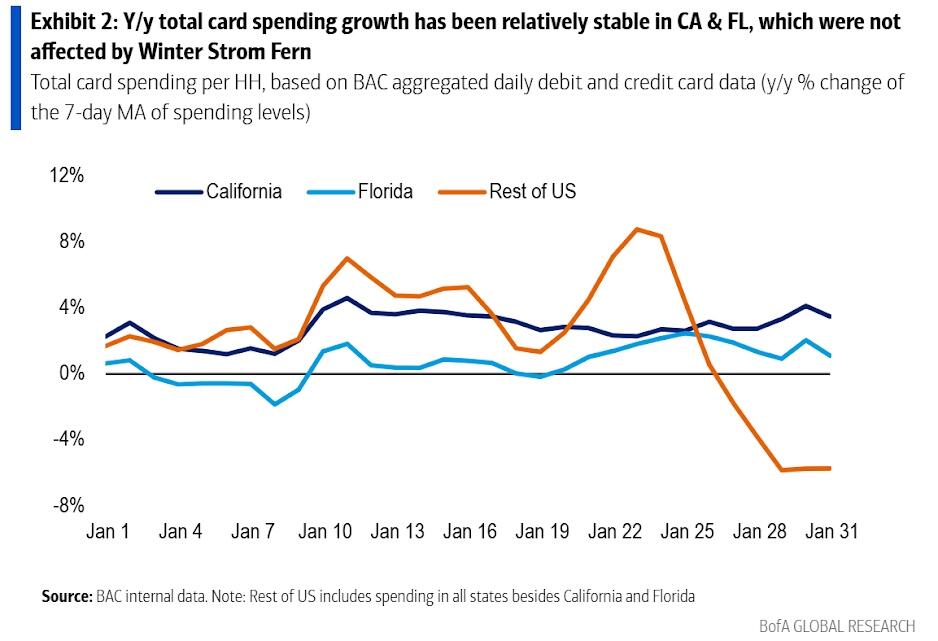

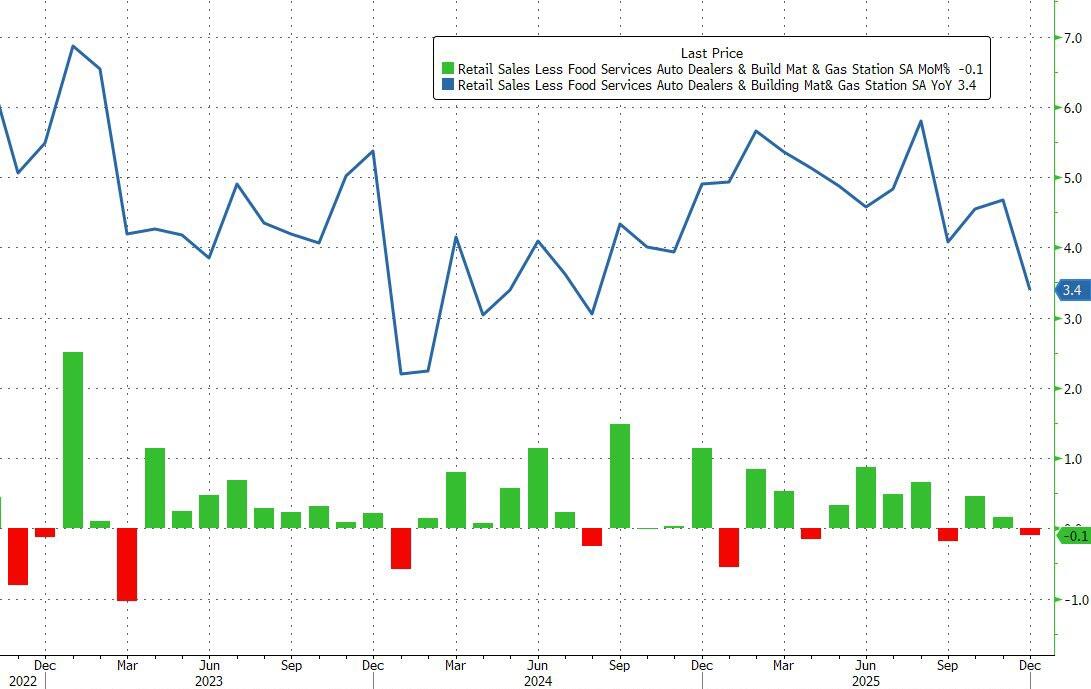

After a big bounce in November, expectations were for a decent 0.4% MoM rise in retail sales to end the year (despite the plunge in consumer confidence signaled by UMich), but the actual print was a big disappointment with headline retail sales unchanged MoM in December. That is the weakest YoY retail sales growth since Sept 2024...

After a big bounce in November, expectations were for a decent 0.4% MoM rise in retail sales to end the year (despite the plunge in consumer confidence signaled by UMich), but the actual print was a big disappointment with headline retail sales unchanged MoM in December. That is the weakest YoY retail sales growth since Sept 2024...

Source: Bloomberg

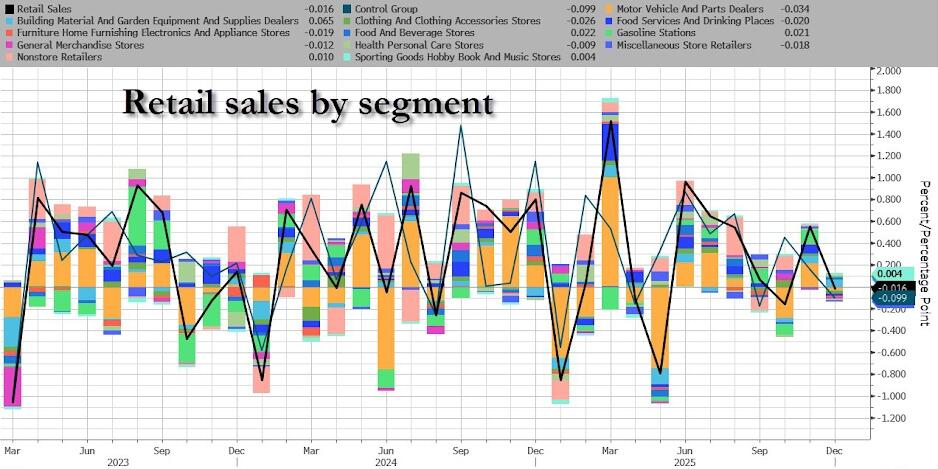

Motor Vehicle and Clothing sales tumbled the most while spending on Building Materials and Food & Beverage rose the most...

Source: Bloomberg

Motor Vehicle and Clothing sales tumbled the most while spending on Building Materials and Food & Beverage rose the most...

Core Retail sales was also unchanged MoM (a big miss from ther +0.4% MoM exp)...

Worse still the 'Control Group' which plugs into the GDP calculation, fell 0.1% MoM (far worse than the 0.4% MoM expected).

Core Retail sales was also unchanged MoM (a big miss from ther +0.4% MoM exp)...

Worse still the 'Control Group' which plugs into the GDP calculation, fell 0.1% MoM (far worse than the 0.4% MoM expected).

Of course, this December disappointment comes after a strong November so before you panic, perhaps some smoothing and seasonals are at play.

Interestingly, 'real' retail sales (admittedly crudely adjusted via CPI) actually decline on a YoY basis in December...

Of course, this December disappointment comes after a strong November so before you panic, perhaps some smoothing and seasonals are at play.

Interestingly, 'real' retail sales (admittedly crudely adjusted via CPI) actually decline on a YoY basis in December...

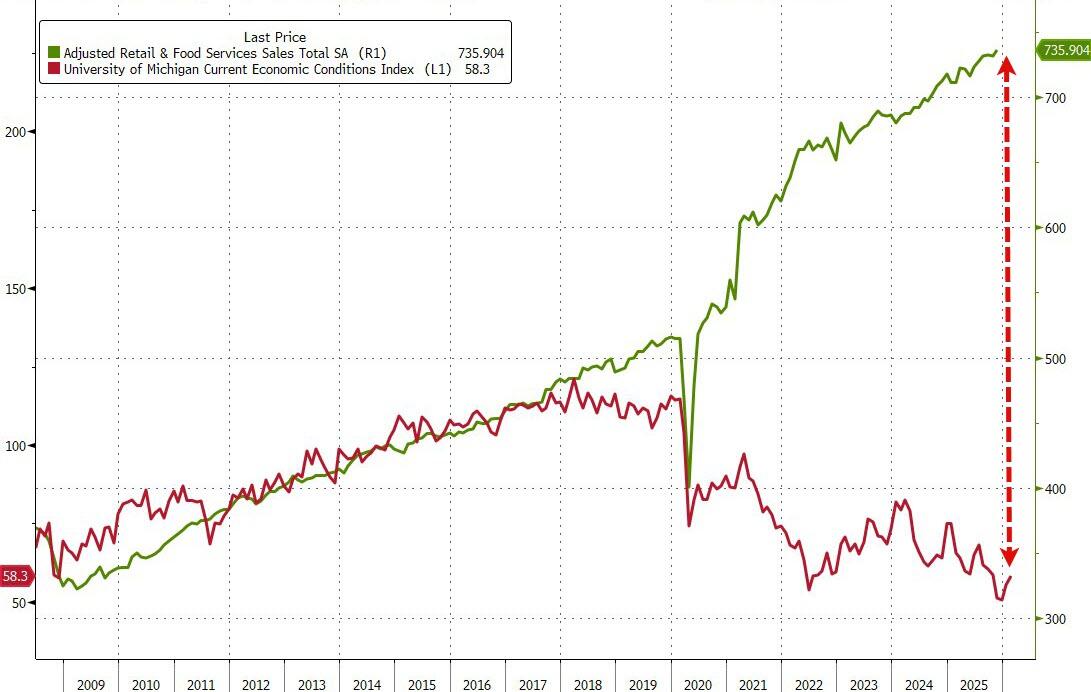

Perhaps it's time for this alligator's mouth to snap shut?

Perhaps it's time for this alligator's mouth to snap shut?

Source: Bloomberg

In addition to disappointing retail spending, sentiment among US small-business owners edged down in January for the first time in three months as optimism about the economic outlook eased. The NFIB Optimism index slipped 0.2 point to 99.3, with 7 of the 10 components that make up the gauge decreased, while three increased.

Source: Bloomberg

In addition to disappointing retail spending, sentiment among US small-business owners edged down in January for the first time in three months as optimism about the economic outlook eased. The NFIB Optimism index slipped 0.2 point to 99.3, with 7 of the 10 components that make up the gauge decreased, while three increased.

Taxes continued to rank as the single most important problem for small firms, followed by quality of labor.

However, a net 16% of owners said they expect inflation-adjusted sales to improve in the next three months, up 6 percentage points from December and the largest share in a year. Also, a net 15% of owners reported that now would be a good time to expand their business, a six-month high.

Taxes continued to rank as the single most important problem for small firms, followed by quality of labor.

However, a net 16% of owners said they expect inflation-adjusted sales to improve in the next three months, up 6 percentage points from December and the largest share in a year. Also, a net 15% of owners reported that now would be a good time to expand their business, a six-month high.

Bloomberg noted that in the fourth quarter, activist investor Elliott Investment Management was pushing for drastic change, culminating in Chairman Albert Manifold ousting CEO Murray Auchincloss.

The shakeup at BP comes after it pulled back from failed green ventures and refocused BP on its core oil and gas business.

The shift was correct, but "increased rigor and diligence are required to make the necessary transformative changes to maximize value for our shareholders," Chairman Manifold told investors in late 2025.

Barclays Plc analyst Lydia Rainforth told clients earlier that the "story for BP from here is about the focus on rebuilding trust in capital allocation."

At UBS, analyst Josh Stone maintained his "neutral" rating on the stock.

Bloomberg noted that in the fourth quarter, activist investor Elliott Investment Management was pushing for drastic change, culminating in Chairman Albert Manifold ousting CEO Murray Auchincloss.

The shakeup at BP comes after it pulled back from failed green ventures and refocused BP on its core oil and gas business.

The shift was correct, but "increased rigor and diligence are required to make the necessary transformative changes to maximize value for our shareholders," Chairman Manifold told investors in late 2025.

Barclays Plc analyst Lydia Rainforth told clients earlier that the "story for BP from here is about the focus on rebuilding trust in capital allocation."

At UBS, analyst Josh Stone maintained his "neutral" rating on the stock.

RBC analyst Piral Dadhania told clients results "confirmed modest further improvements," and the focus now shifts to "the extent to which Kering can engineer a return to growth in a still fairly challenging luxury environment."

At UBS, analyst Justinus Steinhorst told clients that Kering's results "boosted hopes of a turnaround," lifting the UBXELUX basket.

Here's more from Steinhorst:

The UBS Luxury basket {UBXELUX} is up 1.9% on Kering results after Q4 sales fell less than anticipated, boosting hopes of a turnaround. Positioning exacerbating the move, Kering scored as a 2 sigma crowded short. The Luxury basket scores as a 0.5 sigma crowded short down from neutral at the start of the year.

Jefferies analyst James Grzinic said the results were likely "fractionally" better than the buy side expected. He added the latest numbers "confirm gradually reducing pressures at a time of more supportive industry conditions."

Deutsche Bank analyst Adam Cochrane said the earnings should be enough to remind investors of the "direction of travel," citing a decent sequential improvement from Q3 to Q4.

Cochrane highlighted management's expectation of returning to growth and improving margins, though there was no explicit commentary on the 2026 outlook. He added that valuation already prices in sales and margin recovery, but still leaves some potential upside in the stock.

Here's the earnings snapshot of the fourth quarter (courtesy of Bloomberg):

Comparable revenue -3%, estimate -4.77% (Bloomberg Consensus)

Gucci revenue on a comparable basis -10%, estimate -10.4%

Yves Saint Laurent revenue on a comparable basis 0%, estimate -2.58%

Bottega Veneta revenue on a comparable basis +3%, estimate +0.64%

Other Houses revenue on a comparable basis +3%, estimate -2.35%

Eyewear & corporate revenue on a comparable basis +2%, estimate +3.34%

Revenue EU3.91 billion, -9.1% y/y

Gucci revenue EU1.62 billion, -16% y/y, estimate EU1.61 billion

Yves Saint Laurent revenue EU735 million, -4.5% y/y, estimate EU710 million

Bottega Veneta revenue EU467 million, -2.7% y/y, estimate EU458.3 million

Other Houses revenue EU789 million, -3.5% y/y, estimate EU766.2 million

Eyewear & corporate revenue EU329 million, -2.7% y/y, estimate EU377.9 million

2025 Results:

Recurring operating income EU1.63 billion, -33% y/y, estimate EU1.68 billion

Gucci recurring operating income EU966 million, -40% y/y, estimate EU911 million

Yves Saint Laurent recurring operating income EU529 million, -11% y/y, estimate EU504.5 million

Bottega Veneta recurring operating income EU267 million, +4.7% y/y, estimate EU257.8 million

Other Houses recurring operating loss EU112 million vs. loss EU9 million y/y, estimate loss EU83.2 million

Recurring operating margin 11.1% vs. 14.5% y/y, estimate 12.1%

Dividend per share EU3, estimate EU3.71

Kering shares in Paris jumped as much as 14%, the biggest intraday since March 2020. Luxury rivals also got a boost.

RBC analyst Piral Dadhania told clients results "confirmed modest further improvements," and the focus now shifts to "the extent to which Kering can engineer a return to growth in a still fairly challenging luxury environment."

At UBS, analyst Justinus Steinhorst told clients that Kering's results "boosted hopes of a turnaround," lifting the UBXELUX basket.

Here's more from Steinhorst:

The UBS Luxury basket {UBXELUX} is up 1.9% on Kering results after Q4 sales fell less than anticipated, boosting hopes of a turnaround. Positioning exacerbating the move, Kering scored as a 2 sigma crowded short. The Luxury basket scores as a 0.5 sigma crowded short down from neutral at the start of the year.

Jefferies analyst James Grzinic said the results were likely "fractionally" better than the buy side expected. He added the latest numbers "confirm gradually reducing pressures at a time of more supportive industry conditions."

Deutsche Bank analyst Adam Cochrane said the earnings should be enough to remind investors of the "direction of travel," citing a decent sequential improvement from Q3 to Q4.

Cochrane highlighted management's expectation of returning to growth and improving margins, though there was no explicit commentary on the 2026 outlook. He added that valuation already prices in sales and margin recovery, but still leaves some potential upside in the stock.

Here's the earnings snapshot of the fourth quarter (courtesy of Bloomberg):

Comparable revenue -3%, estimate -4.77% (Bloomberg Consensus)

Gucci revenue on a comparable basis -10%, estimate -10.4%

Yves Saint Laurent revenue on a comparable basis 0%, estimate -2.58%

Bottega Veneta revenue on a comparable basis +3%, estimate +0.64%

Other Houses revenue on a comparable basis +3%, estimate -2.35%

Eyewear & corporate revenue on a comparable basis +2%, estimate +3.34%

Revenue EU3.91 billion, -9.1% y/y

Gucci revenue EU1.62 billion, -16% y/y, estimate EU1.61 billion

Yves Saint Laurent revenue EU735 million, -4.5% y/y, estimate EU710 million

Bottega Veneta revenue EU467 million, -2.7% y/y, estimate EU458.3 million

Other Houses revenue EU789 million, -3.5% y/y, estimate EU766.2 million

Eyewear & corporate revenue EU329 million, -2.7% y/y, estimate EU377.9 million

2025 Results:

Recurring operating income EU1.63 billion, -33% y/y, estimate EU1.68 billion

Gucci recurring operating income EU966 million, -40% y/y, estimate EU911 million

Yves Saint Laurent recurring operating income EU529 million, -11% y/y, estimate EU504.5 million

Bottega Veneta recurring operating income EU267 million, +4.7% y/y, estimate EU257.8 million

Other Houses recurring operating loss EU112 million vs. loss EU9 million y/y, estimate loss EU83.2 million

Recurring operating margin 11.1% vs. 14.5% y/y, estimate 12.1%

Dividend per share EU3, estimate EU3.71

Kering shares in Paris jumped as much as 14%, the biggest intraday since March 2020. Luxury rivals also got a boost.

CEO Luca de Meo took over at Kering in September and plans to unveil his strategic plan for the luxury group in April. He has already reshaped Gucci's leadership and announced a $4.8 billion sale of Kering's beauty business to L'Oréal SA to reduce debt.

CEO Luca de Meo took over at Kering in September and plans to unveil his strategic plan for the luxury group in April. He has already reshaped Gucci's leadership and announced a $4.8 billion sale of Kering's beauty business to L'Oréal SA to reduce debt.

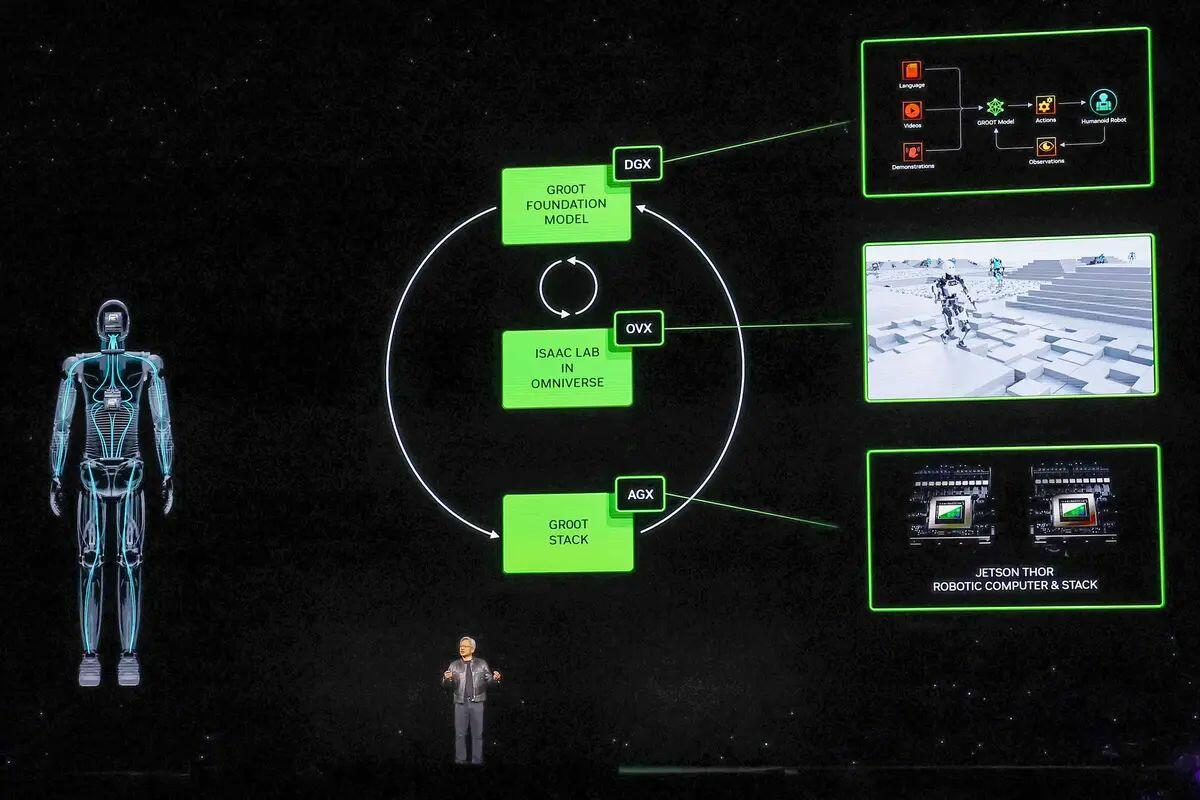

Economists and financial institutions describe these firms as “zombie” companies—businesses that can’t cover their debt, operating costs, or generate sufficient returns, yet continue to survive through repeated injections of fresh capital, debt restructuring, or investor reluctance to accept losses.

Venture capital, financial, and AI insiders say that signs of these zombie companies are increasingly visible in the AI startup community.

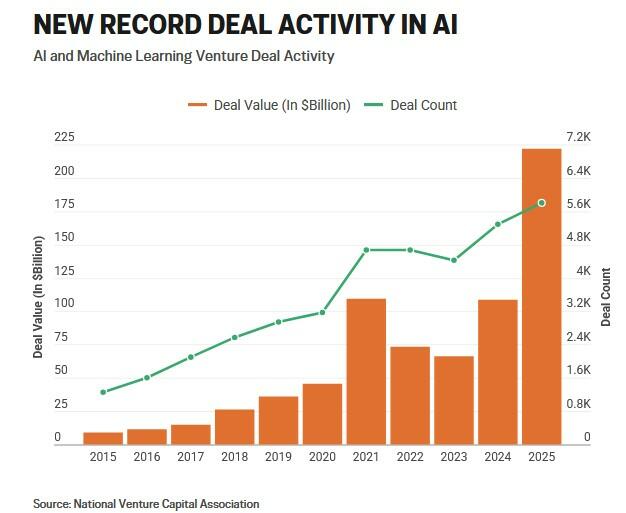

AI and machine learning venture capital deals accounted for more than 65 percent of all U.S. venture capital project funding in 2025, totaling $222 billion, according to the National Venture Capital Association. This represents an increase from 47 percent in 2024 and 10 percent in 2015.

That’s a lot of money flooding into an investment market with a high rate of failure. Approximately 90 percent of startups fail, according to analysis by data analytics company Demand Sage.

While a universally accepted count of U.S.-based AI firms operating as zombies is unavailable, a recent Fortune report put the number of venture capital zombies at 574. An analysis by management consulting firm Kearney reported that the number of zombie companies worldwide has grown by around 9 percent annually since 2010, with a total of 2,370 as of 2024.

Economists and financial institutions describe these firms as “zombie” companies—businesses that can’t cover their debt, operating costs, or generate sufficient returns, yet continue to survive through repeated injections of fresh capital, debt restructuring, or investor reluctance to accept losses.

Venture capital, financial, and AI insiders say that signs of these zombie companies are increasingly visible in the AI startup community.

AI and machine learning venture capital deals accounted for more than 65 percent of all U.S. venture capital project funding in 2025, totaling $222 billion, according to the National Venture Capital Association. This represents an increase from 47 percent in 2024 and 10 percent in 2015.

That’s a lot of money flooding into an investment market with a high rate of failure. Approximately 90 percent of startups fail, according to analysis by data analytics company Demand Sage.

While a universally accepted count of U.S.-based AI firms operating as zombies is unavailable, a recent Fortune report put the number of venture capital zombies at 574. An analysis by management consulting firm Kearney reported that the number of zombie companies worldwide has grown by around 9 percent annually since 2010, with a total of 2,370 as of 2024.

Concern is no longer limited to investor losses but also broader economic effects, such as misdirected capital and talent being tied up in underperforming companies. Some believe this could slow AI productivity and future innovation.

“Typically, unproductive entities would fail quickly due to the inability to secure further funding and service debt. But with the AI boom, nearly half of the venture capital funding is going into all things AI, and it’s extended their lifespan beyond what normally would be expected,” Joseph Favorito, founder of Landmark Wealth Management, told The Epoch Times.

Favorito believes that prolonged support for debt-financed or insolvent AI firms can slow innovation and create broader economic ripples.

“At any given point in time, there is a limit to how much capital will be allocated towards innovation. If capital is allocated to an insolvent entity, those dollars could have been put to better use elsewhere in a place that would promote innovation and productivity,” he said.

“But this always happens on some level. That is the nature of capitalism. ... The challenge is that every entity starts off in debt. It is up to those that are allocating their capital to determine if they are throwing good money after bad, or there is a valuable longer-term reward,” Favorito said.

Concern is no longer limited to investor losses but also broader economic effects, such as misdirected capital and talent being tied up in underperforming companies. Some believe this could slow AI productivity and future innovation.

“Typically, unproductive entities would fail quickly due to the inability to secure further funding and service debt. But with the AI boom, nearly half of the venture capital funding is going into all things AI, and it’s extended their lifespan beyond what normally would be expected,” Joseph Favorito, founder of Landmark Wealth Management, told The Epoch Times.

Favorito believes that prolonged support for debt-financed or insolvent AI firms can slow innovation and create broader economic ripples.

“At any given point in time, there is a limit to how much capital will be allocated towards innovation. If capital is allocated to an insolvent entity, those dollars could have been put to better use elsewhere in a place that would promote innovation and productivity,” he said.

“But this always happens on some level. That is the nature of capitalism. ... The challenge is that every entity starts off in debt. It is up to those that are allocating their capital to determine if they are throwing good money after bad, or there is a valuable longer-term reward,” Favorito said.

Pay the Piper

“When the subsidy era ends, the companies that survive will be the ones that saw it coming,” Abdur Rehman Arshad, CEO of Capidel Consulting, told The Epoch Times.

Arshad said that cheap venture capital, along with potentially state-backed AI startup grants, hides the “real unit economics” and gives businesses a three- to six-year stretch of artificially low costs.

He also anticipates costs related to AI to climb threefold to tenfold. “Many will face an $800 billion revenue shortfall by 2030, turning them into ‘zombie’ outfits,” Arshad said.

However, he stressed that factors such as venture capital, grants, and cloud credits—a type of virtual currency offered by cloud service providers—can also make the difference between a “bankrupt founder and the next unicorn.”

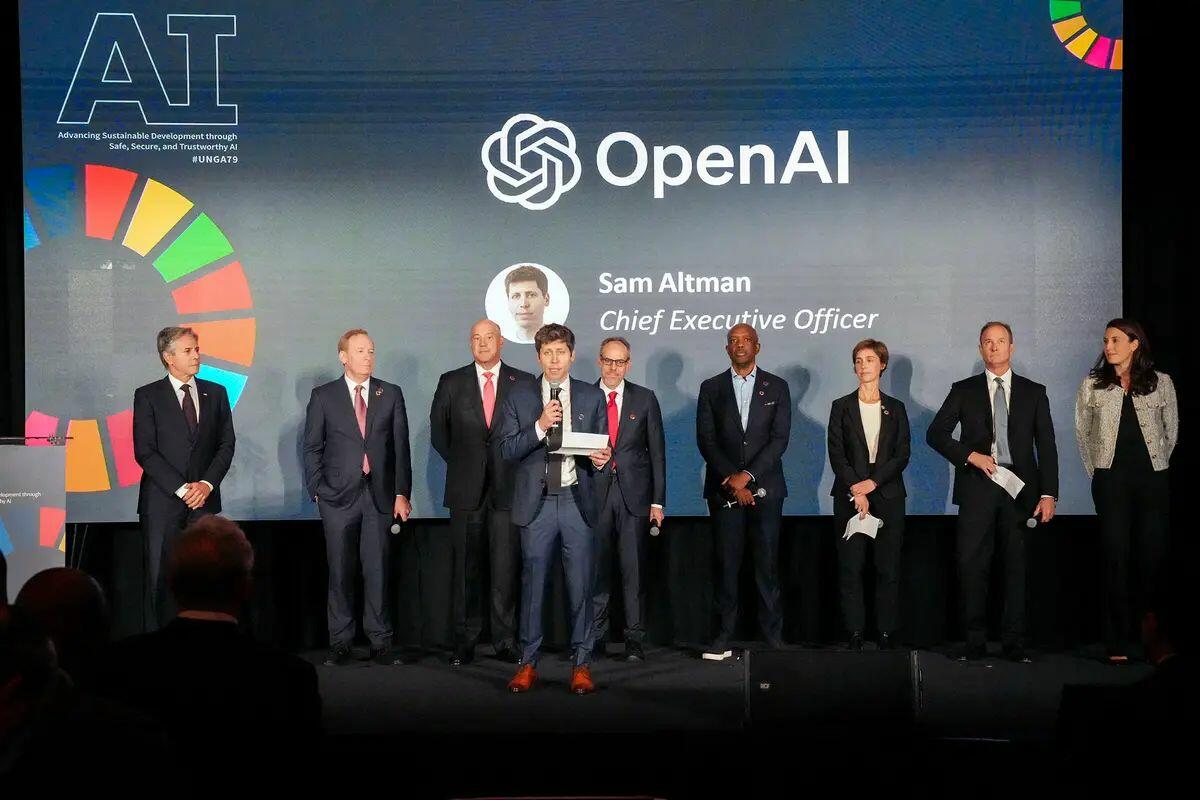

Companies that qualify as AI “unicorns” are those valued at more than $1 billion. As of December 2025, there are 308 AI unicorns, including OpenAI, which owns ChatGPT.

In Arshad’s assessment, seed money is essential for AI startups, but it requires discretion.

“Startups often burn 30 [to] 40 percent of cash on infrastructure before they even find product market fit, and that burn rate can cripple a fledgling team. Federal AI funding is projected to hit $32 billion a year by 2026, stretching runways without diluting equity but also keeping unproductive ventures afloat,” he said.

Brayan Londono, founder of Resume Tailor AI and former venture capital analyst, suspects that many of the AI “efficiency gain” claims are mixed in with speculative growth. The result is a need to scale and push for more “fertile stories” to continue funding nonviable businesses.

Pay the Piper

“When the subsidy era ends, the companies that survive will be the ones that saw it coming,” Abdur Rehman Arshad, CEO of Capidel Consulting, told The Epoch Times.

Arshad said that cheap venture capital, along with potentially state-backed AI startup grants, hides the “real unit economics” and gives businesses a three- to six-year stretch of artificially low costs.

He also anticipates costs related to AI to climb threefold to tenfold. “Many will face an $800 billion revenue shortfall by 2030, turning them into ‘zombie’ outfits,” Arshad said.

However, he stressed that factors such as venture capital, grants, and cloud credits—a type of virtual currency offered by cloud service providers—can also make the difference between a “bankrupt founder and the next unicorn.”

Companies that qualify as AI “unicorns” are those valued at more than $1 billion. As of December 2025, there are 308 AI unicorns, including OpenAI, which owns ChatGPT.

In Arshad’s assessment, seed money is essential for AI startups, but it requires discretion.

“Startups often burn 30 [to] 40 percent of cash on infrastructure before they even find product market fit, and that burn rate can cripple a fledgling team. Federal AI funding is projected to hit $32 billion a year by 2026, stretching runways without diluting equity but also keeping unproductive ventures afloat,” he said.

Brayan Londono, founder of Resume Tailor AI and former venture capital analyst, suspects that many of the AI “efficiency gain” claims are mixed in with speculative growth. The result is a need to scale and push for more “fertile stories” to continue funding nonviable businesses.

“It has been my experience that credits from the cloud, government, or enterprise contracts, while delaying infrastructure costs, have hidden the weaknesses in fundamentals,” Londono told The Epoch Times.

“I have observed how a lot of money is trapped in low-trajectory AI start-ups, and the moment it unwinds would result in a sudden devaluation, as those distortions will also have been exposed, partly through having risk mispriced for so long,” he said.

Hollow Shell

There are a couple of ways AI companies can end up treading water and become zombies.

The Harvard Business Review noted AI companies are high-cost, but many lack a clear revenue plan, calling the path to profit “murky.”

“The problem is that generative AI today has a high variable cost and low variable revenue,” Andy Wu, the Arjun and Minoo Melwani Family Associate Professor of Business Administration, said in an article.

Estimates of pre-seed AI startup costs in 2026 range from $50,000—for those who want to use “bootstrap” methods—and $2 million.

Read the rest

“It has been my experience that credits from the cloud, government, or enterprise contracts, while delaying infrastructure costs, have hidden the weaknesses in fundamentals,” Londono told The Epoch Times.

“I have observed how a lot of money is trapped in low-trajectory AI start-ups, and the moment it unwinds would result in a sudden devaluation, as those distortions will also have been exposed, partly through having risk mispriced for so long,” he said.

Hollow Shell

There are a couple of ways AI companies can end up treading water and become zombies.

The Harvard Business Review noted AI companies are high-cost, but many lack a clear revenue plan, calling the path to profit “murky.”

“The problem is that generative AI today has a high variable cost and low variable revenue,” Andy Wu, the Arjun and Minoo Melwani Family Associate Professor of Business Administration, said in an article.

Estimates of pre-seed AI startup costs in 2026 range from $50,000—for those who want to use “bootstrap” methods—and $2 million.

Read the rest

The data comes from the

The data comes from the

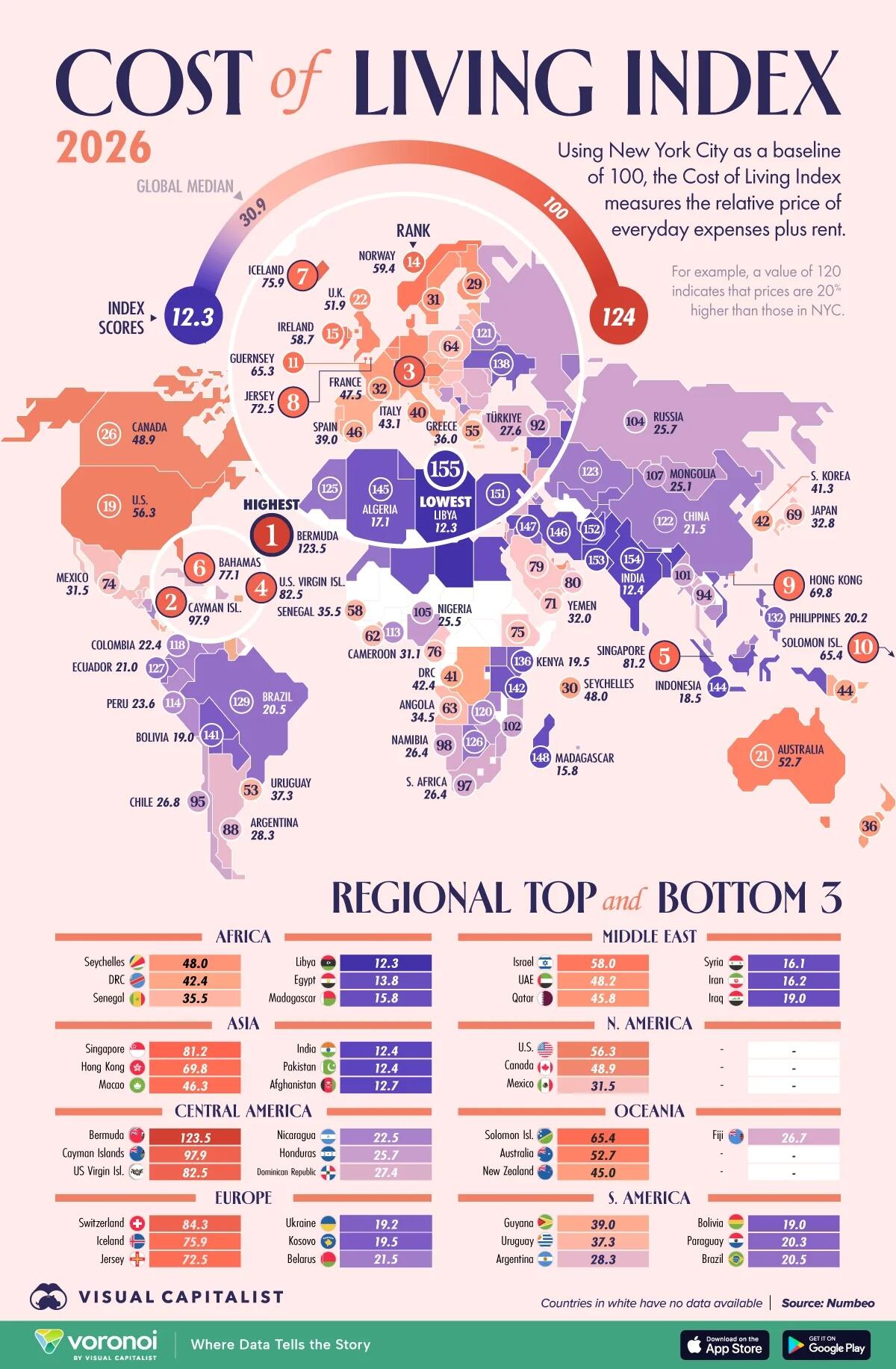

If a country has an index score of 80, prices are 20% lower than in New York. Scores above 100 indicate higher everyday costs.

While inflation has eased in many regions, the cost of living remains a major global challenge. Across 28 countries, home prices have risen more than 50% since 2020, and grocery costs have risen sharply in countries such as Mexico, Germany, and Malaysia, continuing to strain household budgets worldwide.

Global Cost of Living by Country

Below, we show the cost of living index for 155 countries or territories in 2026, highlighting stark differences in everyday costs around the world.

Bermuda has the highest cost of living worldwide, a British Overseas Territory synonymous with high-end real estate, luxury tourism, and offshore wealth.

RankCountryCost of Living Index 2026

1🇧🇲 Bermuda123.5

2🇰🇾 Cayman Islands97.9

3🇨🇭 Switzerland84.3

4🇻🇮 U.S. Virgin Islands82.5

5🇸🇬 Singapore81.2

6🇧🇸 Bahamas77.1

7🇮🇸 Iceland75.9

8🇯🇪 Jersey72.5

9🇭🇰 Hong Kong 69.8

10🇸🇧 Solomon Islands65.4

11🇬🇬 Guernsey65.3

12🇱🇺 Luxembourg65.2

13🇬🇮 Gibraltar63.9

14🇳🇴 Norway59.4

15🇮🇪 Ireland58.7

16🇮🇱 Israel58

17🇳🇱 Netherlands57.9

18🇩🇰 Denmark56.6

19🇺🇸 United States56.3

20🇮🇲 Isle Of Man55.7

21🇦🇺 Australia52.7

22🇬🇧 United Kingdom51.9

23🇦🇹 Austria50.7

24🇬🇩 Grenada49.4

25🇩🇪 Germany49

26🇨🇦 Canada48.9

27🇧🇪 Belgium48.6

28🇦🇪 United Arab Emirates48.2

29🇫🇮 Finland48

30🇸🇨 Seychelles48

31🇸🇪 Sweden47.8

32🇫🇷 France47.5

33🇲🇴 Macao (China)46.3

34🇶🇦 Qatar45.8

35🇦🇩 Andorra45.2

36🇳🇿 New Zealand45

37🇨🇾 Cyprus44.6

38🇵🇷 Puerto Rico44.3

39🇲🇹 Malta44.1

40🇮🇹 Italy43.1

41🇨🇩 Democratic Republic of the Congo42.4

42🇰🇷 South Korea41.3

43🇪🇪 Estonia40.5

44🇵🇬 Papua New Guinea39.2

45🇸🇮 Slovenia39.1

46🇪🇸 Spain39

47🇬🇾 Guyana39

48🇯🇲 Jamaica38.7

49🇨🇿 Czech Republic38.6

50🇨🇷 Costa Rica38.3

51🇵🇹 Portugal38.3

52🇲🇻 Maldives38.1

53🇺🇾 Uruguay37.3

54🇭🇷 Croatia37.1

55🇬🇷 Greece36

56🇧🇭 Bahrain35.9

57🇵🇦 Panama35.6

58🇸🇳 Senegal35.5

59🇱🇹 Lithuania35.3

60🇹🇹 Trinidad And Tobago35.2

61🇸🇰 Slovakia35.2

62🇨🇮 Ivory Coast34.5

63🇦🇴 Angola34.5

64🇵🇱 Poland34.4

65🇱🇻 Latvia34.3

66🇹🇼 Taiwan33.9

67🇧🇳 Brunei33.6

68🇰🇼 Kuwait33.3

69🇯🇵 Japan32.8

70🇭🇺 Hungary32.3

71🇾🇪 Yemen32

72🇧🇿 Belize32

73🇦🇱 Albania31.7

74🇲🇽 Mexico31.5

75🇪🇹 Ethiopia31.3

76🇨🇲 Cameroon31.1

77🇲🇪 Montenegro31

78🇵🇸 Palestine30.9

79🇸🇦 Saudi Arabia30.4

80🇴🇲 Oman30

81🇨🇻 Cape Verde29.6

82🇷🇸 Serbia29.5

83🇱🇧 Lebanon29.5

84🇦🇲 Armenia29.5

85🇬🇹 Guatemala29.5

86🇸🇻 El Salvador29.4

87🇨🇺 Cuba28.3

88🇦🇷 Argentina28.3

89🇸🇷 Suriname28.2

90🇧🇬 Bulgaria28

91🇷🇴 Romania27.8

92🇹🇷 Turkey27.6

93🇩🇴 Dominican Republic27.4

94🇹🇭 Thailand27.2

95🇨🇱 Chile26.8

96🇫🇯 Fiji26.7

97🇿🇦 South Africa26.4

98🇳🇦 Namibia26.4

99🇲🇩 Moldova26.4

100🇲🇺 Mauritius26.1

101🇲🇲 Myanmar26

102🇲🇿 Mozambique25.9

103🇭🇳 Honduras25.7

104🇷🇺 Russia25.7

105🇳🇬 Nigeria25.5

106🇯🇴 Jordan25.3

107🇲🇳 Mongolia25.1

108🇧🇦 Bosnia And Herzegovina25

109🇿🇼 Zimbabwe24.2

110🇻🇪 Venezuela24

111🇬🇪 Georgia24

112🇰🇭 Cambodia23.7

113🇬🇭 Ghana23.7

114🇵🇪 Peru23.6

115🇲🇰 North Macedonia23.2

116🇲🇾 Malaysia22.9

117🇳🇮 Nicaragua22.5

118🇨🇴 Colombia22.4

119🇱🇰 Sri Lanka22

120🇿🇲 Zambia22

121🇧🇾 Belarus21.5

122🇨🇳 China21.5

123🇰🇿 Kazakhstan21.4

124🇦🇿 Azerbaijan21.3

125🇲🇦 Morocco21.1

126🇧🇼 Botswana21

127🇪🇨 Ecuador21

128🇺🇿 Uzbekistan20.6

129🇧🇷 Brazil20.5

130🇰🇬 Kyrgyzstan20.4

131🇵🇾 Paraguay20.3

132🇵🇭 Philippines20.2

133🇹🇯 Tajikistan19.8

134🇺🇬 Uganda19.6

135🇽🇰 Kosovo (Disputed Territory)19.5

136🇰🇪 Kenya19.5

137🇷🇼 Rwanda19.4

138🇺🇦 Ukraine19.2

139🇻🇳 Vietnam19.1

140🇮🇶 Iraq19

141🇧🇴 Bolivia19

142🇹🇿 Tanzania18.8

143🇹🇳 Tunisia18.5

144🇮🇩 Indonesia18.5

145🇩🇿 Algeria17.1

146🇮🇷 Iran16.2

147🇸🇾 Syria16.1

148🇲🇬 Madagascar15.8

149🇧🇩 Bangladesh13.8

150🇳🇵 Nepal13.8

151🇪🇬 Egypt13.8

152🇦🇫 Afghanistan12.7

153🇵🇰 Pakistan12.4

154🇮🇳 India12.4

155🇱🇾 Libya12.3

Many of the world’s most expensive places, in terms of cost of living, are islands and often tax shelters or financial centers. The U.S. Virgin Islands, Jersey, and Cayman Islands all make the top 10 in the cost of living index. High concentrations of wealth, combined with heavy reliance on imports, push up prices across these island economies.

Switzerland ranks third overall, with Zurich named the world’s most expensive city in 2026. Beyond a

If a country has an index score of 80, prices are 20% lower than in New York. Scores above 100 indicate higher everyday costs.

While inflation has eased in many regions, the cost of living remains a major global challenge. Across 28 countries, home prices have risen more than 50% since 2020, and grocery costs have risen sharply in countries such as Mexico, Germany, and Malaysia, continuing to strain household budgets worldwide.

Global Cost of Living by Country

Below, we show the cost of living index for 155 countries or territories in 2026, highlighting stark differences in everyday costs around the world.

Bermuda has the highest cost of living worldwide, a British Overseas Territory synonymous with high-end real estate, luxury tourism, and offshore wealth.

RankCountryCost of Living Index 2026

1🇧🇲 Bermuda123.5

2🇰🇾 Cayman Islands97.9

3🇨🇭 Switzerland84.3

4🇻🇮 U.S. Virgin Islands82.5

5🇸🇬 Singapore81.2

6🇧🇸 Bahamas77.1

7🇮🇸 Iceland75.9

8🇯🇪 Jersey72.5

9🇭🇰 Hong Kong 69.8

10🇸🇧 Solomon Islands65.4

11🇬🇬 Guernsey65.3

12🇱🇺 Luxembourg65.2

13🇬🇮 Gibraltar63.9

14🇳🇴 Norway59.4

15🇮🇪 Ireland58.7

16🇮🇱 Israel58

17🇳🇱 Netherlands57.9

18🇩🇰 Denmark56.6

19🇺🇸 United States56.3

20🇮🇲 Isle Of Man55.7

21🇦🇺 Australia52.7

22🇬🇧 United Kingdom51.9

23🇦🇹 Austria50.7

24🇬🇩 Grenada49.4

25🇩🇪 Germany49

26🇨🇦 Canada48.9

27🇧🇪 Belgium48.6

28🇦🇪 United Arab Emirates48.2

29🇫🇮 Finland48

30🇸🇨 Seychelles48

31🇸🇪 Sweden47.8

32🇫🇷 France47.5

33🇲🇴 Macao (China)46.3

34🇶🇦 Qatar45.8

35🇦🇩 Andorra45.2

36🇳🇿 New Zealand45

37🇨🇾 Cyprus44.6

38🇵🇷 Puerto Rico44.3

39🇲🇹 Malta44.1

40🇮🇹 Italy43.1

41🇨🇩 Democratic Republic of the Congo42.4

42🇰🇷 South Korea41.3

43🇪🇪 Estonia40.5

44🇵🇬 Papua New Guinea39.2

45🇸🇮 Slovenia39.1

46🇪🇸 Spain39

47🇬🇾 Guyana39

48🇯🇲 Jamaica38.7

49🇨🇿 Czech Republic38.6

50🇨🇷 Costa Rica38.3

51🇵🇹 Portugal38.3

52🇲🇻 Maldives38.1

53🇺🇾 Uruguay37.3

54🇭🇷 Croatia37.1

55🇬🇷 Greece36

56🇧🇭 Bahrain35.9

57🇵🇦 Panama35.6

58🇸🇳 Senegal35.5

59🇱🇹 Lithuania35.3

60🇹🇹 Trinidad And Tobago35.2

61🇸🇰 Slovakia35.2

62🇨🇮 Ivory Coast34.5

63🇦🇴 Angola34.5

64🇵🇱 Poland34.4

65🇱🇻 Latvia34.3

66🇹🇼 Taiwan33.9

67🇧🇳 Brunei33.6

68🇰🇼 Kuwait33.3

69🇯🇵 Japan32.8

70🇭🇺 Hungary32.3

71🇾🇪 Yemen32

72🇧🇿 Belize32

73🇦🇱 Albania31.7

74🇲🇽 Mexico31.5

75🇪🇹 Ethiopia31.3

76🇨🇲 Cameroon31.1

77🇲🇪 Montenegro31

78🇵🇸 Palestine30.9

79🇸🇦 Saudi Arabia30.4

80🇴🇲 Oman30

81🇨🇻 Cape Verde29.6

82🇷🇸 Serbia29.5

83🇱🇧 Lebanon29.5

84🇦🇲 Armenia29.5

85🇬🇹 Guatemala29.5

86🇸🇻 El Salvador29.4

87🇨🇺 Cuba28.3

88🇦🇷 Argentina28.3

89🇸🇷 Suriname28.2

90🇧🇬 Bulgaria28

91🇷🇴 Romania27.8

92🇹🇷 Turkey27.6

93🇩🇴 Dominican Republic27.4

94🇹🇭 Thailand27.2

95🇨🇱 Chile26.8

96🇫🇯 Fiji26.7

97🇿🇦 South Africa26.4

98🇳🇦 Namibia26.4

99🇲🇩 Moldova26.4

100🇲🇺 Mauritius26.1

101🇲🇲 Myanmar26

102🇲🇿 Mozambique25.9

103🇭🇳 Honduras25.7

104🇷🇺 Russia25.7

105🇳🇬 Nigeria25.5

106🇯🇴 Jordan25.3

107🇲🇳 Mongolia25.1

108🇧🇦 Bosnia And Herzegovina25

109🇿🇼 Zimbabwe24.2

110🇻🇪 Venezuela24

111🇬🇪 Georgia24

112🇰🇭 Cambodia23.7

113🇬🇭 Ghana23.7

114🇵🇪 Peru23.6

115🇲🇰 North Macedonia23.2

116🇲🇾 Malaysia22.9

117🇳🇮 Nicaragua22.5

118🇨🇴 Colombia22.4

119🇱🇰 Sri Lanka22

120🇿🇲 Zambia22

121🇧🇾 Belarus21.5

122🇨🇳 China21.5

123🇰🇿 Kazakhstan21.4

124🇦🇿 Azerbaijan21.3

125🇲🇦 Morocco21.1

126🇧🇼 Botswana21

127🇪🇨 Ecuador21

128🇺🇿 Uzbekistan20.6

129🇧🇷 Brazil20.5

130🇰🇬 Kyrgyzstan20.4

131🇵🇾 Paraguay20.3

132🇵🇭 Philippines20.2

133🇹🇯 Tajikistan19.8

134🇺🇬 Uganda19.6

135🇽🇰 Kosovo (Disputed Territory)19.5

136🇰🇪 Kenya19.5

137🇷🇼 Rwanda19.4

138🇺🇦 Ukraine19.2

139🇻🇳 Vietnam19.1

140🇮🇶 Iraq19

141🇧🇴 Bolivia19

142🇹🇿 Tanzania18.8

143🇹🇳 Tunisia18.5

144🇮🇩 Indonesia18.5

145🇩🇿 Algeria17.1

146🇮🇷 Iran16.2

147🇸🇾 Syria16.1

148🇲🇬 Madagascar15.8

149🇧🇩 Bangladesh13.8

150🇳🇵 Nepal13.8

151🇪🇬 Egypt13.8

152🇦🇫 Afghanistan12.7

153🇵🇰 Pakistan12.4

154🇮🇳 India12.4

155🇱🇾 Libya12.3

Many of the world’s most expensive places, in terms of cost of living, are islands and often tax shelters or financial centers. The U.S. Virgin Islands, Jersey, and Cayman Islands all make the top 10 in the cost of living index. High concentrations of wealth, combined with heavy reliance on imports, push up prices across these island economies.

Switzerland ranks third overall, with Zurich named the world’s most expensive city in 2026. Beyond a

But once you dissect the data and strip out large orders, a very different picture emerges. The apparent surge in orders shrinks to a mere 0.9%.

What happened? Experience shows that this comes from “Other Vehicle Manufacturing,” which jumped roughly 9.5%. This category is dominated by defense equipment. In short: the federal government’s debt-financed special fund has found its way into German military production.

Or put differently: the government can now take a public victory lap after plunging citizens into massive debt to generate a short-term statistical effect in the super-election year 2026. Nobody wants to appear a total failure.

What is celebrated as an economic turnaround is in reality a statistical masking of the transition from market-based order to a debt-fueled administrative economy.

The military buildup is basically the last gasp of a policy that, in stubborn Keynesian mode, keeps trying to replace the gaps in Germany’s industrial economy with a “managed economy.” This strategy ties up resources and personnel, diverting exactly the capital needed for real investment under better conditions.

Goods are produced that no one demands on the market. A few pockets get richer. It’s classic client politics in the Berlin–Brussels style. Nothing new in the West, really.

The Real Situation

The real state of the German economy is shown in construction. The HCOB Germany Construction PMI, a monthly leading indicator, fell in January to 44.7 points. Values below 50 signal contraction.

After a brief uptick in December to 50.3, mostly due to energy network investments, the German construction sector plunged back into recession in January—mirroring the entire Eurozone.

For four years now, this central economic sector has been essentially frozen. Investments are held back; new projects, especially commercial ones, are nowhere to be found. The sector remains in prolonged stagnation.

Excessive energy costs, Kafkaesque regulation from Brussels and Berlin, and stifling interventions like rent caps are the recipe for a recession set in stone.

Expect billion-euro programs for subsidized public housing soon, purely to create a statistical illusion of recovery.

System-Compatible Criticism

The federal government can finally breathe. Expensive for taxpayers, but apparently worth it politically. Applying Keynesianism to the defense industry is among the dumbest of political moves. Driving a nation deeper into debt to produce goods that either rust or are used destructively is maximal political nihilism—bordering on madness.

The fact that the state-friendly media celebrates this “recovery” implies two things: complete media submission to government goals, and statistical validation to continue reshaping German society into a green, militarized command economy.

Silence from German business leadership confirms that politics has morally inoculated this strategy. The perpetuated narrative of an imminent Russian invasion now legitimizes the defense buildup.

Similarly, under the Green Deal, years of effort have embedded the fairy tale of saving the world via CO₂ reduction deep in public consciousness, with most voters still supporting the course. Criticism now appears climate-hostile, irresponsible, and anti-scientific.

Compliance is no longer enforced through coercion, but through reshaping business rationality. Every new regulation or CO₂ levy creates companies that survive only within the state’s subsidy architecture.

Result: media-friendly, calibrated language dominates discussions of “bureaucracy relief.” It is system-compatible fine-tuning, subtly orchestrated by Brussels. No one risks reputational loss in this highly repressive media environment.

Business has learned to couch criticism to avoid upsetting the Kaiser while remaining eligible for support. We see conditioned obsequiousness leading us steadily toward a new socialism.

* * *

About the author: Thomas Kolbe, a German graduate economist, has worked for over 25 years as a journalist and media producer for clients from various industries and business associations. As a publicist, he focuses on economic processes and observes geopolitical events from the perspective of the capital markets. His publications follow a philosophy that focuses on the individual and their right to self-determination.

But once you dissect the data and strip out large orders, a very different picture emerges. The apparent surge in orders shrinks to a mere 0.9%.

What happened? Experience shows that this comes from “Other Vehicle Manufacturing,” which jumped roughly 9.5%. This category is dominated by defense equipment. In short: the federal government’s debt-financed special fund has found its way into German military production.

Or put differently: the government can now take a public victory lap after plunging citizens into massive debt to generate a short-term statistical effect in the super-election year 2026. Nobody wants to appear a total failure.

What is celebrated as an economic turnaround is in reality a statistical masking of the transition from market-based order to a debt-fueled administrative economy.

The military buildup is basically the last gasp of a policy that, in stubborn Keynesian mode, keeps trying to replace the gaps in Germany’s industrial economy with a “managed economy.” This strategy ties up resources and personnel, diverting exactly the capital needed for real investment under better conditions.

Goods are produced that no one demands on the market. A few pockets get richer. It’s classic client politics in the Berlin–Brussels style. Nothing new in the West, really.

The Real Situation

The real state of the German economy is shown in construction. The HCOB Germany Construction PMI, a monthly leading indicator, fell in January to 44.7 points. Values below 50 signal contraction.

After a brief uptick in December to 50.3, mostly due to energy network investments, the German construction sector plunged back into recession in January—mirroring the entire Eurozone.

For four years now, this central economic sector has been essentially frozen. Investments are held back; new projects, especially commercial ones, are nowhere to be found. The sector remains in prolonged stagnation.

Excessive energy costs, Kafkaesque regulation from Brussels and Berlin, and stifling interventions like rent caps are the recipe for a recession set in stone.

Expect billion-euro programs for subsidized public housing soon, purely to create a statistical illusion of recovery.

System-Compatible Criticism

The federal government can finally breathe. Expensive for taxpayers, but apparently worth it politically. Applying Keynesianism to the defense industry is among the dumbest of political moves. Driving a nation deeper into debt to produce goods that either rust or are used destructively is maximal political nihilism—bordering on madness.

The fact that the state-friendly media celebrates this “recovery” implies two things: complete media submission to government goals, and statistical validation to continue reshaping German society into a green, militarized command economy.

Silence from German business leadership confirms that politics has morally inoculated this strategy. The perpetuated narrative of an imminent Russian invasion now legitimizes the defense buildup.

Similarly, under the Green Deal, years of effort have embedded the fairy tale of saving the world via CO₂ reduction deep in public consciousness, with most voters still supporting the course. Criticism now appears climate-hostile, irresponsible, and anti-scientific.

Compliance is no longer enforced through coercion, but through reshaping business rationality. Every new regulation or CO₂ levy creates companies that survive only within the state’s subsidy architecture.

Result: media-friendly, calibrated language dominates discussions of “bureaucracy relief.” It is system-compatible fine-tuning, subtly orchestrated by Brussels. No one risks reputational loss in this highly repressive media environment.

Business has learned to couch criticism to avoid upsetting the Kaiser while remaining eligible for support. We see conditioned obsequiousness leading us steadily toward a new socialism.

* * *

About the author: Thomas Kolbe, a German graduate economist, has worked for over 25 years as a journalist and media producer for clients from various industries and business associations. As a publicist, he focuses on economic processes and observes geopolitical events from the perspective of the capital markets. His publications follow a philosophy that focuses on the individual and their right to self-determination.

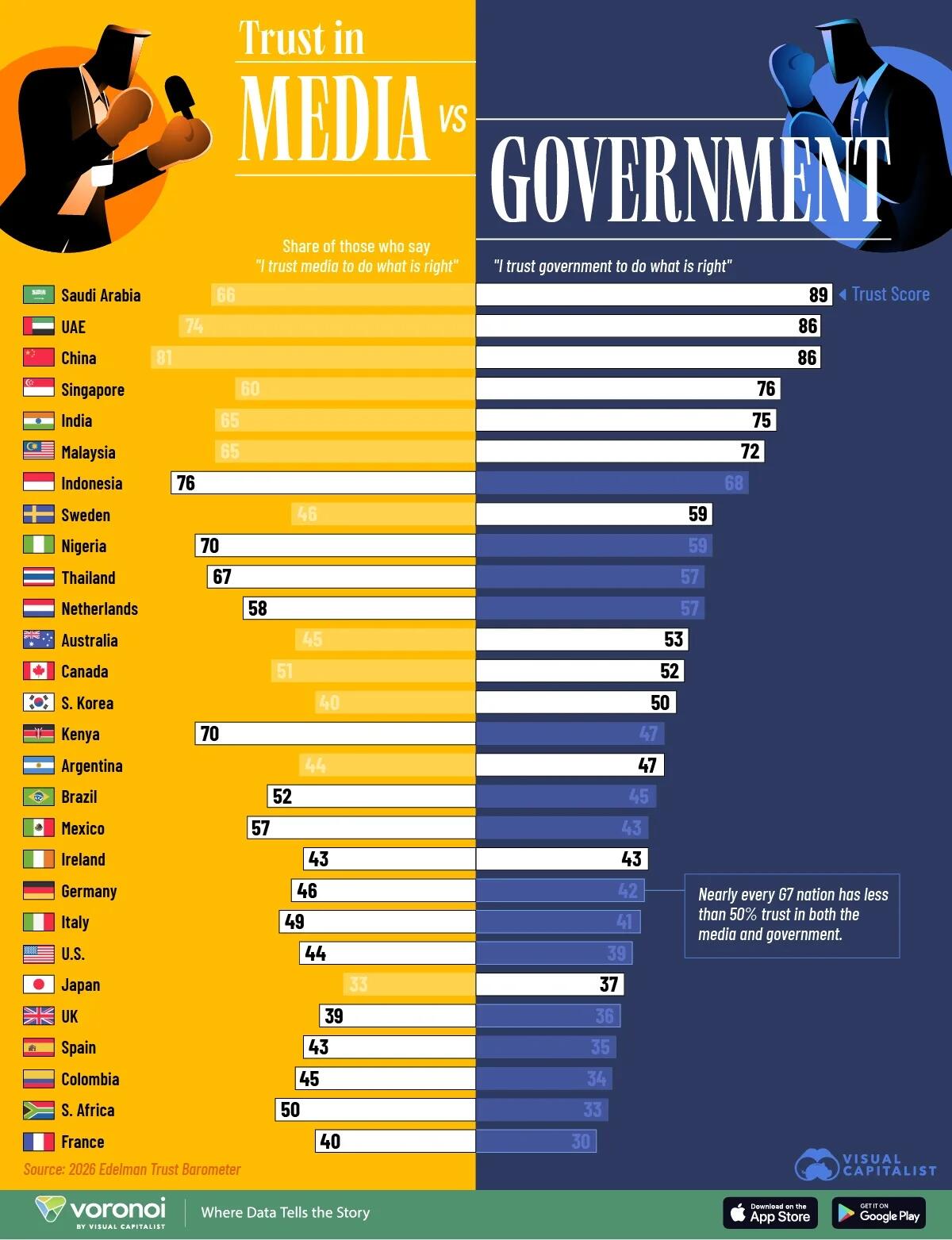

The data for this visualization comes from

The data for this visualization comes from

:format(webp)/nginx/o/2025/06/28/16959707t1hb747.jpg)

Katz said the aim was to give settlers equal "legal and civil rights", while Smotrich said the move would "normalize life in the West Bank" and vowed to "continue to kill the idea of a Palestinian state."

Palestinian President Mahmoud Abbas said the policy was designed to deepen annexation of the West Bank and violated agreements signed with Israel, including the Oslo Accords, according to the

Katz said the aim was to give settlers equal "legal and civil rights", while Smotrich said the move would "normalize life in the West Bank" and vowed to "continue to kill the idea of a Palestinian state."

Palestinian President Mahmoud Abbas said the policy was designed to deepen annexation of the West Bank and violated agreements signed with Israel, including the Oslo Accords, according to the

Schiff insists Trump plans on subverting the midterms by suppressing votes and

Schiff insists Trump plans on subverting the midterms by suppressing votes and

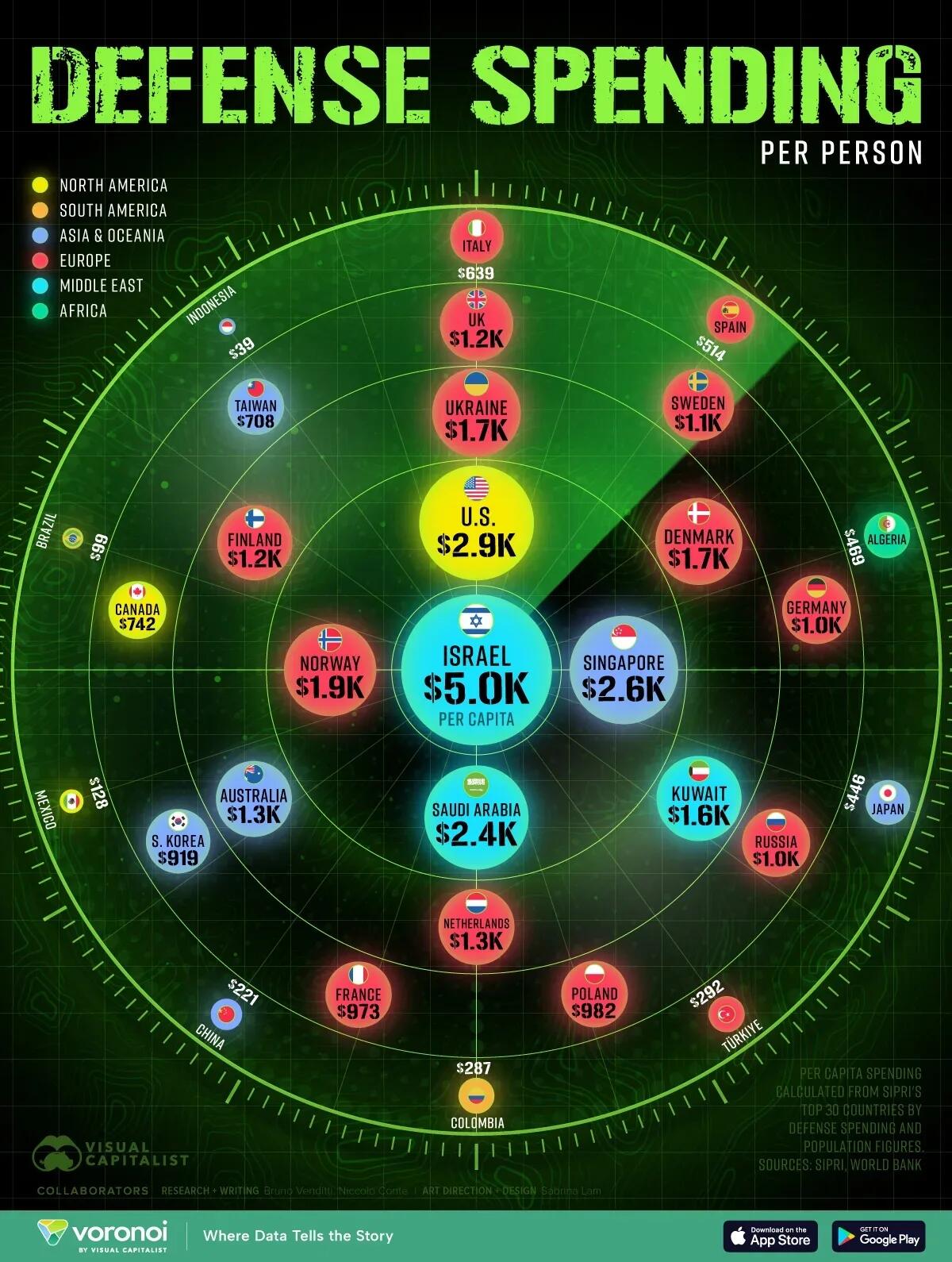

Data comes from the Stockholm International Peace Research Institute (

Data comes from the Stockholm International Peace Research Institute (

At the time, IOC chief Thomas Bach

At the time, IOC chief Thomas Bach

This is after he's already spent over five years in prison, and the trial alone lasted two years. He was first detained in August 2020 under Hong Kong’s Beijing-imposed national security law, in wake of large-scale student protests which at times brought whole sectors of the city to a standstill.

The city’s High Court said in its

This is after he's already spent over five years in prison, and the trial alone lasted two years. He was first detained in August 2020 under Hong Kong’s Beijing-imposed national security law, in wake of large-scale student protests which at times brought whole sectors of the city to a standstill.

The city’s High Court said in its

This is what’s known as the state’s “jock tax,” in which they tax non-resident professional athletes based on the number of “duty days” they spend in the state—traveling, practicing, attending meetings, or playing in a game.

Both teams arrived in California last Sunday, so each player will log at least eight duty days in the state just for the Super Bowl.

They then divide those California duty days over the entire season, and you end up with a percentage. If a player spends, say, 7% of his duty days in California over the season, then the state claims the right to tax 7% of his entire annual salary— at California’s top marginal rate of 13.3%!

This is pretty crazy given that the players only earned $178,000 for that game.

But in the case of Seattle quarterback Sam Darnold, he’ll end up owing Gavin Newsom roughly $249,000 in state taxes this year.

In other words, Sam Darnold will LOSE over $70,000.

I doubt anyone will shed any tears over this (including Darnold). But it’s perfectly consistent with California’s general attitude: dig into absolutely everything they can get their hands on and take as much as humanly possible.

Sam Darnold didn’t have a choice about the venue. But a growing number of people and businesses who are free to choose whether or not to remain in California are getting the hell out.

California has recorded a net loss of residents for six consecutive years— roughly 216,000 people in 2025 alone. Since 2019, more than 200 major businesses have relocated out of the state, including Oracle, Hewlett Packard Enterprise, Charles Schwab, and Chevron.

Even Hollywood is crumbling; on-location film and TV production in Los Angeles hit its lowest level since the pandemic shutdown— down 16.1% in 2025—with 42,000 entertainment jobs vanishing in just two years. Production has scattered to Georgia, the UK, Canada, and Australia, where tax incentives are far more generous. California now ranks sixth among preferred filming locations.

And California’s response is almost comically predictable. Rather than examine why people and businesses keep leaving, they propose ever more medieval measures to squeeze those who remain— or punish those who try to go.

There’s a ballot measure in the works for a “one-time” 5% wealth tax on billionaires, retroactive to January 1, 2026. Exit tax proposals have been floated to penalize wealthy residents who dare to leave.

And how does California spend all this money they confiscate?

The state budget is a nearly $500 billion—one of the largest in the country. Yet they can’t manage to make ends meet. Ever. And they squander it on some of the most insane programs.

Over the past five years, the state has poured $24 billion into homelessness programs— and a state audit found they didn’t even bother to track whether the spending reduced homelessness.

(Homelessness actually got worse.)

The state’s high-speed rail project, now more than 15 years behind schedule, has burned through $15 billion without laying a single mile of high-speed track. The latest cost estimate to complete the project has ballooned to as much as $128 billion.

Meanwhile, California is spending an estimated $9.5 billion this year alone on healthcare— for illegal immigrants through Medi-Cal.

And rather than cooperate with federal immigration enforcement, Governor Newsom and Attorney General Rob Bonta launched an online portal where Californians can report federal ICE agents for “misconduct”— essentially using tax dollars to help obstruct immigration enforcement.

Crazy that this man—Gavin Newsom—is the current front-runner for the 2028 Democratic presidential nomination. He is THE standard bearer for the political Left.

Housing is unaffordable. Crime has surged. Unemployment is above the national average. Businesses and billionaires are fleeing.

His only real policy is to confiscate as much as possible from productive people, waste it on obscene levels of misspending, and then gaslight everyone about what a spectacular job he’s doing.

Now he wants to do for the entire country what he’s done to California.

And if that happens, there will be no Texas or Florida to escape to. The jock tax mentality— reach into every pocket, stake a claim on everything, punish anyone who tries to leave—becomes national policy.

This is what’s known as the state’s “jock tax,” in which they tax non-resident professional athletes based on the number of “duty days” they spend in the state—traveling, practicing, attending meetings, or playing in a game.

Both teams arrived in California last Sunday, so each player will log at least eight duty days in the state just for the Super Bowl.

They then divide those California duty days over the entire season, and you end up with a percentage. If a player spends, say, 7% of his duty days in California over the season, then the state claims the right to tax 7% of his entire annual salary— at California’s top marginal rate of 13.3%!

This is pretty crazy given that the players only earned $178,000 for that game.

But in the case of Seattle quarterback Sam Darnold, he’ll end up owing Gavin Newsom roughly $249,000 in state taxes this year.

In other words, Sam Darnold will LOSE over $70,000.

I doubt anyone will shed any tears over this (including Darnold). But it’s perfectly consistent with California’s general attitude: dig into absolutely everything they can get their hands on and take as much as humanly possible.

Sam Darnold didn’t have a choice about the venue. But a growing number of people and businesses who are free to choose whether or not to remain in California are getting the hell out.

California has recorded a net loss of residents for six consecutive years— roughly 216,000 people in 2025 alone. Since 2019, more than 200 major businesses have relocated out of the state, including Oracle, Hewlett Packard Enterprise, Charles Schwab, and Chevron.

Even Hollywood is crumbling; on-location film and TV production in Los Angeles hit its lowest level since the pandemic shutdown— down 16.1% in 2025—with 42,000 entertainment jobs vanishing in just two years. Production has scattered to Georgia, the UK, Canada, and Australia, where tax incentives are far more generous. California now ranks sixth among preferred filming locations.

And California’s response is almost comically predictable. Rather than examine why people and businesses keep leaving, they propose ever more medieval measures to squeeze those who remain— or punish those who try to go.

There’s a ballot measure in the works for a “one-time” 5% wealth tax on billionaires, retroactive to January 1, 2026. Exit tax proposals have been floated to penalize wealthy residents who dare to leave.

And how does California spend all this money they confiscate?

The state budget is a nearly $500 billion—one of the largest in the country. Yet they can’t manage to make ends meet. Ever. And they squander it on some of the most insane programs.

Over the past five years, the state has poured $24 billion into homelessness programs— and a state audit found they didn’t even bother to track whether the spending reduced homelessness.

(Homelessness actually got worse.)

The state’s high-speed rail project, now more than 15 years behind schedule, has burned through $15 billion without laying a single mile of high-speed track. The latest cost estimate to complete the project has ballooned to as much as $128 billion.

Meanwhile, California is spending an estimated $9.5 billion this year alone on healthcare— for illegal immigrants through Medi-Cal.

And rather than cooperate with federal immigration enforcement, Governor Newsom and Attorney General Rob Bonta launched an online portal where Californians can report federal ICE agents for “misconduct”— essentially using tax dollars to help obstruct immigration enforcement.

Crazy that this man—Gavin Newsom—is the current front-runner for the 2028 Democratic presidential nomination. He is THE standard bearer for the political Left.

Housing is unaffordable. Crime has surged. Unemployment is above the national average. Businesses and billionaires are fleeing.

His only real policy is to confiscate as much as possible from productive people, waste it on obscene levels of misspending, and then gaslight everyone about what a spectacular job he’s doing.

Now he wants to do for the entire country what he’s done to California.

And if that happens, there will be no Texas or Florida to escape to. The jock tax mentality— reach into every pocket, stake a claim on everything, punish anyone who tries to leave—becomes national policy.

Caught on camera and subsequently gone viral, the confrontation unfolded inside the CorePower studio lobby after a class let out. The video, posted by regular yogi Heather Anderson, 51, shows more than a dozen spandex-clad patrons “spontaneously” demanding answers from two visibly uncomfortable staffers over the company’s stance on Immigration and Customs Enforcement (ICE).

“Why are you being silent? Let’s hear it - loud and proud, baby!” Anderson demands, as she films a blonde staffer identified only as “Delaney,” amid approving snaps and cheers from the crowd.

Anderson repeatedly presses the staffer for a corporate position on ICE, dismissing the employee’s attempt to “take a pause” as unacceptable. When a second employee tries to speak, the group grows louder, with one student accusing the company of being “complicit” in violent federal immigration actions.

This is the raw video of the incident in a CorePower yoga location in Minneapolis, women members throwing a tantrum bc corporate would not denounce ICE. We have a program with white women in this country. The indoctrination and programming runs deep. Note they even snap fingers…

Caught on camera and subsequently gone viral, the confrontation unfolded inside the CorePower studio lobby after a class let out. The video, posted by regular yogi Heather Anderson, 51, shows more than a dozen spandex-clad patrons “spontaneously” demanding answers from two visibly uncomfortable staffers over the company’s stance on Immigration and Customs Enforcement (ICE).

“Why are you being silent? Let’s hear it - loud and proud, baby!” Anderson demands, as she films a blonde staffer identified only as “Delaney,” amid approving snaps and cheers from the crowd.

Anderson repeatedly presses the staffer for a corporate position on ICE, dismissing the employee’s attempt to “take a pause” as unacceptable. When a second employee tries to speak, the group grows louder, with one student accusing the company of being “complicit” in violent federal immigration actions.

This is the raw video of the incident in a CorePower yoga location in Minneapolis, women members throwing a tantrum bc corporate would not denounce ICE. We have a program with white women in this country. The indoctrination and programming runs deep. Note they even snap fingers…

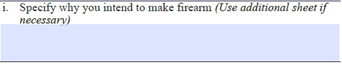

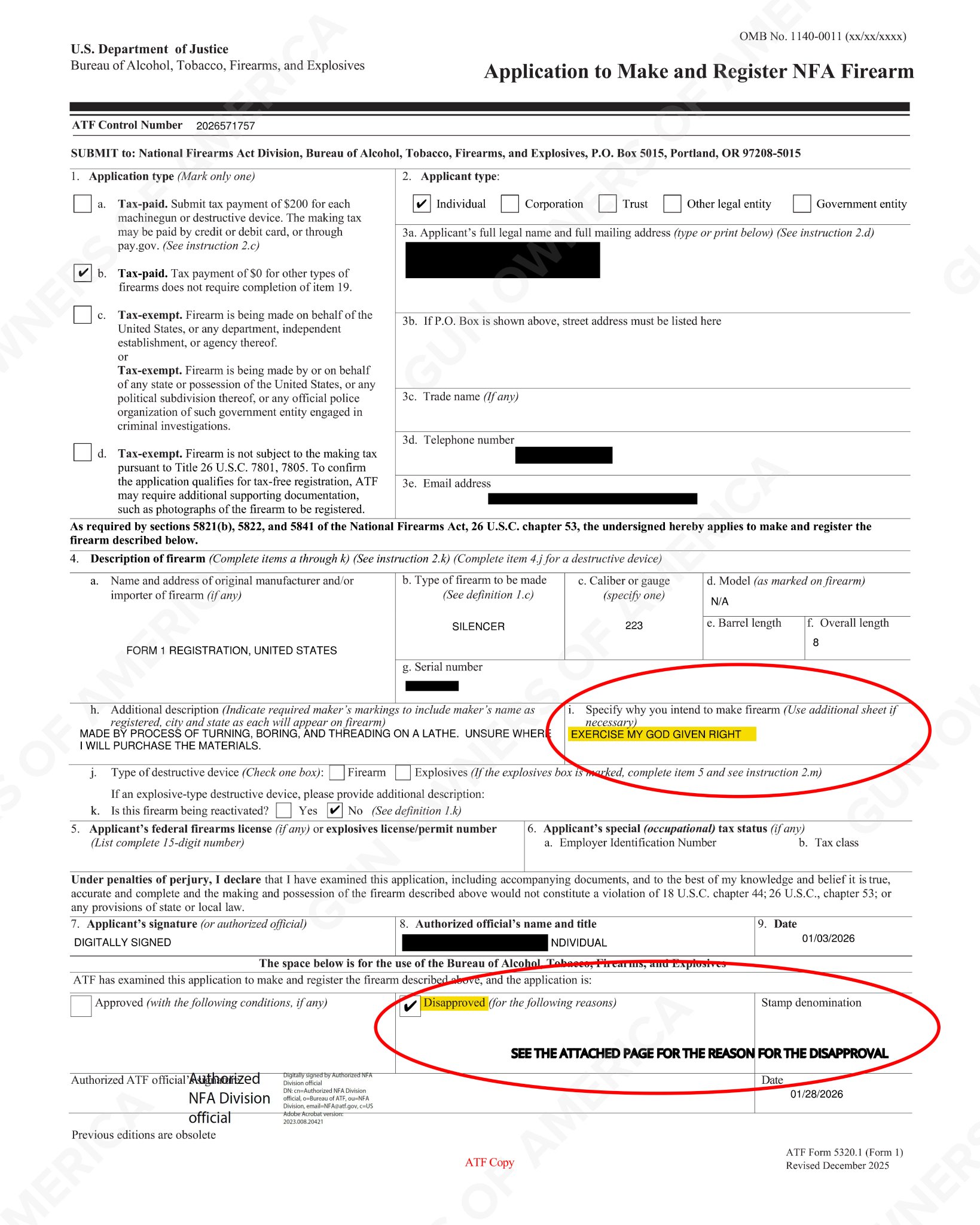

This GOA member wrote:

This GOA member wrote:

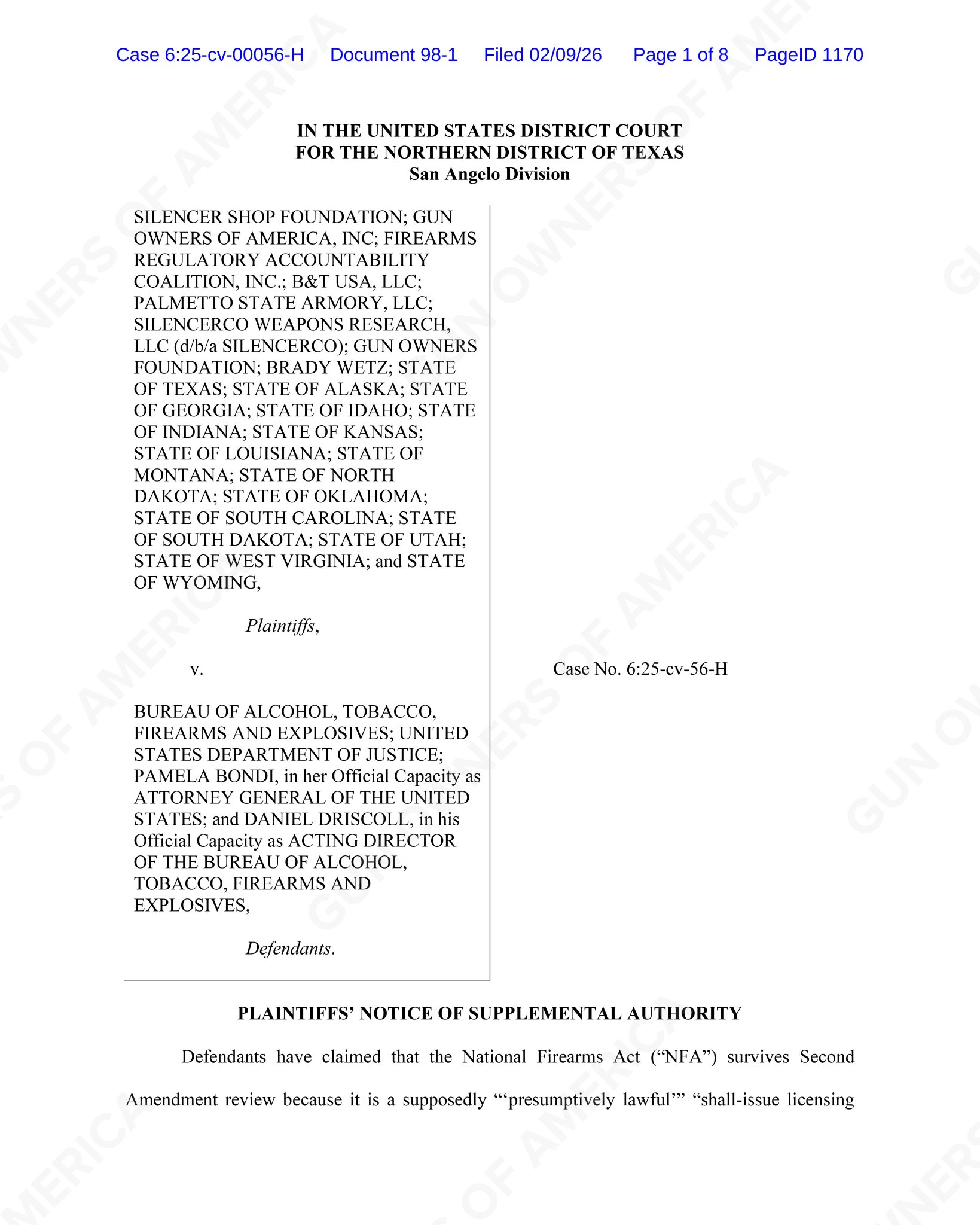

As a law-abiding US citizen with no criminal record, you don’t need a reason to purchase or manufacture a firearm. That’s what the Second Amendment is for. Yet ATF denied our member’s application for this exact reason.

Of course, ATF always forgets the “shall not be infringed” part.

As you can clearly see, our member’s Second Amendment rights were denied by bureaucrats because of an “insufficient reason.”

How is the desire to exercise one’s God-given rights an insufficient justification to exercise one’s God-given rights?

This is yet another clear reason why the ATF needs to be defunded and abolished entirely. The Second Amendment guarantees the exercise of our God given right to keep and bear arms.

Stating otherwise is a complete tyrannical falsehood.

That’s why we at Gun Owners of America just filed a notice of supplemental authority in our One Big Beautiful Lawsuit, using this as an example of government weaponizing the NFA against law abiding gun owners.

In our filing, we dismantle the government’s assertions that the National Firearms Act creates only a “modest burden” on the Second Amendment and that the NFA’s registration requirements are comparable to a “shall-issue” permitting system in pro-gun states.

ATF’s blatant denial of our member’s Second Amendment rights shatters this narrative completely.

Instead, the government treats the NFA’s registration requirements as a “may-issue” system - a subjective determination on who is allowed to own these firearms by government employees.

These “may-issue” systems were explicitly declared to be unconstitutional by the Supreme Court thanks to the Bruen decision. We think SCOTUS should rule the same here and abolish the NFA’s registration requirements forever.

We just reported this misbehavior by

As a law-abiding US citizen with no criminal record, you don’t need a reason to purchase or manufacture a firearm. That’s what the Second Amendment is for. Yet ATF denied our member’s application for this exact reason.

Of course, ATF always forgets the “shall not be infringed” part.

As you can clearly see, our member’s Second Amendment rights were denied by bureaucrats because of an “insufficient reason.”

How is the desire to exercise one’s God-given rights an insufficient justification to exercise one’s God-given rights?

This is yet another clear reason why the ATF needs to be defunded and abolished entirely. The Second Amendment guarantees the exercise of our God given right to keep and bear arms.

Stating otherwise is a complete tyrannical falsehood.

That’s why we at Gun Owners of America just filed a notice of supplemental authority in our One Big Beautiful Lawsuit, using this as an example of government weaponizing the NFA against law abiding gun owners.

In our filing, we dismantle the government’s assertions that the National Firearms Act creates only a “modest burden” on the Second Amendment and that the NFA’s registration requirements are comparable to a “shall-issue” permitting system in pro-gun states.

ATF’s blatant denial of our member’s Second Amendment rights shatters this narrative completely.

Instead, the government treats the NFA’s registration requirements as a “may-issue” system - a subjective determination on who is allowed to own these firearms by government employees.

These “may-issue” systems were explicitly declared to be unconstitutional by the Supreme Court thanks to the Bruen decision. We think SCOTUS should rule the same here and abolish the NFA’s registration requirements forever.

We just reported this misbehavior by

The

The