Greetings Central PA Bitcoiners!

We're pleased to announce that we have two meetups slated for July, both happening in the middle of the month. The first is a pizza meetup at 6pm on Thursday July 17th, hosted by Business Cat, at DaVinci Italian Eatery in Mechanicsbug. The second is a new and much anticipated format for us, a hiking event. That'll be at 7:30am on Sunday July 20th at the Pole Steeple Trailhead, which is located in Pine Grove Furnace state park. See attached flyer. Note: there's no fourth Sunday coffee meetup for July.

It was great seeing all those who came out to last coffee meetup. One topic that we broached: What's the current recommended wallet for a newcoiner who's looking to make lightning payments? Today we're going to talk about two such wallets, Muun and Aqua.

Both of these wallets are available on both Android and iOS, and can make both on-chain and lightning bitcoin transactions. Unfamiliar with lightning? It's a second layer on top of bitcoin that's become the customary way to make day to day payments. To make an analogy to legacy banking, on-chain bitcoin is to a wire transfer as lightning is to a tap to pay credit card payment. Small, day to day payments are increasingly best served by lightning, whereas larger, infrequent transactions such as buying a house/car, or moving one's cold storage sats, are best served by on-chain. On-chain offers maximum security, reliability, and redundancy, whereas lightning makes some tradeoffs that allow for faster and cheaper payments.

Both Muun and Aqua are very user friendly, and can have you (or the person you're helping) making lightning payments very quickly without the need connect to a personal lightning node. In order to provide this smooth process, both of these wallets do make some tradeoffs against what seasoned bitcoiners expect from a sovereign setup, which we'll delve into.

Muun:

When you open Muun and use a new wallet for the first time, you can begin sending and receiving payments immediately, without the need to deal with any kind of backup process right away. When you eventually choose to back it up (highly recommended) you can either give them an email and password for recovery, or generate a PDF recovery kit that also includes a security code. This backup/recovery process is unique to Muun. On the plus side, it's very easy and fast; on the downside, it can only be recovered via their app or using their tools on github.

Sending is simple in Muun...there's only one send button for both on-chain and lightning payments. You can scan or paste in either a bitcoin address or lightning invoice, and it'll figure out which one it is automatically. For receiving, you can toggle between lightning and on-chain bitcoin.

Muun actually uses on-chain bitcoin transactions under the hood when you're sending a lightning transaction. This is abstracted away from users and can introduce drawbacks to the experience, namely when on-chain fees happen to be high. When that's the case, the fee to send a lightning payment can get quite high. Historically, on-chain fees tend to be on the low end for the majority of time and have occasional spikes. There's always the risk that you'll go to make a lightning payment in Muun and the fee will be very high, though. Since low fee transactions is one of lightning's benefits and selling points, this is a sore spot for Muun users.

Pros:

off and running right away with sending/receiving

email backup available

one balance and one send button for both lighting and on-chain

Cons:

doesn't use 12 or 24 work backups like almost every other wallet

high fees are a possibility

Aqua:

When you open Aqua for the first time, you'll have the experience that bitcoiners have come to expect, which is to either make a new wallet, or import an existing one. If you create a new wallet, it will generate a 12 word seed phrase, which you can backup by writing down and keeping in a safe place. By following the current standard for wallet initialization and backup, BIP-39 seed phrases, this is a big pro for Aqua in my book. These seed word backups make for a wonderfully robust and sovereign setup.

Both Muun and Aqua can send and receive lightning payments. Whereas Muun uses on-chain bitcoin transactions under the hood, Aqua uses liquid bitcoin transactions. What is liquid bitcoin? Although that's a topic for another day, for now let's just say it's a way to make some tradeoffs in order to get faster and cheaper transactions. Because Aqua made this design choice, you don't run the risk of your lightning payment being costly to make due to a high-fee environment on the bitcoin network.

Unlike Muun, Aqua treats on-chain bitcoin and L2 (layer 2) bitcoin separately. Aqua can hold a balance of either, and allows you to convert between the two. When sending or receiving, you're given four options: on-chain bitcoin, lightning bitcoin, liquid bitcoin, and tether USD on liquid. Although this offers more choices than Muun, it does take away from approachability and simplicity. Incorporation of tether functionality is a touchy subject. Aqua's promotion among bitcoiners argues that lots of people, especially outside the US, use fiatcoins, AKA stablecoins, to hold value in USD instead of their local (more inflationary) currency. Aqua argues that since such people are going to be using a wallet that handles fiatcoins anyway, it's better for them to be doing it in a more bitcoin-centric wallet. Americans don't have much use for fiatcoins, IMHO.

Pros:

off and running right away with sending/receiving

uses seed phrase backups that bitcoiners know and trust

fees are low and consistent

Cons:

four choices of assets when doing a send or receive

integrates tether, which is a faux pas in the eyes of many bitcoiners

treats L1 and L2 bitcoin as separate assets

In closing, Aqua and Muun are both great choices if someone's looking to get up and running with lightning payments. Like most technologies that abstract certain functionality away from users to make for a smoother experience, they do make certain tradeoffs.

~ @Lonelypumpkins

Central PA Bitcoiners

Central Pennsylvania Bitcoiners

npub1uul8...wevx

A #Bitcoin focused group located in Pennsylvania. Join us at one of our BitPlebs events on the 3rd Thursday of the month

Greetings Central PA Bitcoiners!

We've got two meetup events upcoming in the next week. On Thursday, May 22nd at 6pm, @Business Cat is hosting a pizza day celebration meetup at DaVinci Italian Eatery on 6617 Carlisle Pike in Mechanicsburg. Then, on Sunday, the 25th at 1pm, we've got our monthly coffee meetup at Denim Coffee in Mechanicsburg.

We're also working on plans for a hiking event in the near future... stay tuned for that.

Op-return debate heats up: Reminiscent of the infamous block-size wars of 2016-17, the op-return debate has been increasingly gaining traction. What is op-return? Basically a way to store data on the Bitcoin blockchain that's not financial transactions. This is a deep and nuanced discussion, but basically one side wants to be less restrictive over what kind of data nodes pass around, and the other wants to optimize for financial data only by attempting to filter out non-financial data. An educated, feisty user base that fights for what they want is what keeps Bitcoin running the way it does, and the difficulty in getting changes through are one of its most valuable attributes. In 2017, a majority of the most powerful and prevalent companies in Bitcoin wanted to make changes to the protocol that the community didn't want, and the users won. Contrast this with if there were a desire to change a key property of the internet, and Google, Facebook, Amazon, Apple, Comcast, Verizon, and Samsung were all in agreement over the change, yet most internet users wanted to keep the status quo. Then when it came time to execute this change, it turned out all of those massive companies were powerless to effect the change they wanted. Bitcoin changes the world by not changing.

If you're interested in learning more about the five constituents of Bitcoin governance (developers, miners, exchanges, wallet software, and node runners) I suggest reading The Blocksize War by Jonathan Bier.

JP Morgan acquiesces to offering bitcoin ETF to clients: JP Morgan, or rather, Jamie Dimon, its long-standing CEO, has been one of the most harsh and consistent critics of Bitcoin for years. He's called Bitcoin a "pet rock" on several occasions, and has said that he'd fire JP Morgan employees who use or trade it. Dimon has said that he considers its use case to be sex trafficking and money laundering. It's hard to argue with his credentials in making such a statement; as Jeffrey Epstein's personal banker, Dimon is indeed an expert on those topics. Considering that he's made billions of dollars from sitting in one of the highest positions in the fiat castle, it's unsurprising why he's taken such a hostile stance toward a technology and asset that undermines and disrupts the system that's made him rich.

If you're interested in learning more about the five constituents of Bitcoin governance (developers, miners, exchanges, wallet software, and node runners) I suggest reading The Blocksize War by Jonathan Bier.

JP Morgan acquiesces to offering bitcoin ETF to clients: JP Morgan, or rather, Jamie Dimon, its long-standing CEO, has been one of the most harsh and consistent critics of Bitcoin for years. He's called Bitcoin a "pet rock" on several occasions, and has said that he'd fire JP Morgan employees who use or trade it. Dimon has said that he considers its use case to be sex trafficking and money laundering. It's hard to argue with his credentials in making such a statement; as Jeffrey Epstein's personal banker, Dimon is indeed an expert on those topics. Considering that he's made billions of dollars from sitting in one of the highest positions in the fiat castle, it's unsurprising why he's taken such a hostile stance toward a technology and asset that undermines and disrupts the system that's made him rich.

He likely understands it more than he leads on. Despite his years of bitcoin bashing, all of his competitors are offering bitcoin investing products to their clients, and his thirst for market share has exceeded his desire to remain consistent in his public opinions.

Coinbase data breach exposes user data: Brian Armstrong, the CEO of shitcoin casino Coinbase (which also happens to sell bitcoin), announced a recent data breach. Apparently, overseas support agents that they employ were bribed by hackers to reveal account data, and the bribes worked. The hackers offered to keep that sensitive info a secret if Coinbase paid them a $20 million ransom. Instead, Coinbase offered a reward of $20 million for helping to catch the hackers. The information that was obtained wasn't bitcoin itself, or shitcoins themself, rather it was user data such as home addresses and account balances. This might not seem like that sensitive of information, however, physical attacks targeting bitcoiners and crypto investors are on the rise, and this leaked information is just what attackers would want. The lesson to be learned from this: be judicious with who you give your personal information out to, especially for bitcoin related services. Also, if you're using Coinbase, stop. Dropping the ball with protecting user data aside, they don't cater to people looking to stack bitcoin. Rather, their business model is flashing yoyocoin and dentacoin at you and getting you to trade in and out of this junk, which generates their trading fees. There are several bitcoin-only exchanges, including CashApp, Strike, River, Swan to name a few. Bitcoin can also be obtained without handing over your data to a big company, via working for it or trading dollars for it with someone you know.

He likely understands it more than he leads on. Despite his years of bitcoin bashing, all of his competitors are offering bitcoin investing products to their clients, and his thirst for market share has exceeded his desire to remain consistent in his public opinions.

Coinbase data breach exposes user data: Brian Armstrong, the CEO of shitcoin casino Coinbase (which also happens to sell bitcoin), announced a recent data breach. Apparently, overseas support agents that they employ were bribed by hackers to reveal account data, and the bribes worked. The hackers offered to keep that sensitive info a secret if Coinbase paid them a $20 million ransom. Instead, Coinbase offered a reward of $20 million for helping to catch the hackers. The information that was obtained wasn't bitcoin itself, or shitcoins themself, rather it was user data such as home addresses and account balances. This might not seem like that sensitive of information, however, physical attacks targeting bitcoiners and crypto investors are on the rise, and this leaked information is just what attackers would want. The lesson to be learned from this: be judicious with who you give your personal information out to, especially for bitcoin related services. Also, if you're using Coinbase, stop. Dropping the ball with protecting user data aside, they don't cater to people looking to stack bitcoin. Rather, their business model is flashing yoyocoin and dentacoin at you and getting you to trade in and out of this junk, which generates their trading fees. There are several bitcoin-only exchanges, including CashApp, Strike, River, Swan to name a few. Bitcoin can also be obtained without handing over your data to a big company, via working for it or trading dollars for it with someone you know.

Hope to see you at one of the upcoming meetups!

@Lonelypumpkins

@Central Pennsylvania Bitcoiners

Hope to see you at one of the upcoming meetups!

@Lonelypumpkins

@Central Pennsylvania Bitcoiners

OP_RETURN Debate Sparks Rift Among Bitcoin Developers – Bitbo

Peter Todd's proposal to remove size limits on Bitcoin's OP_RETURN function has triggered fierce debate over Bitcoin's purpose and future.

JPMorgan Opens Bitcoin ETF Access, Dimon Still Skeptical – Bitbo

Jamie Dimon says JPMorgan clients can now invest in Bitcoin ETFs, but the bank won't custody the asset or promote it to clients.

Yahoo Finance

JPMorgan CEO Jamie Dimon Said He

Jamie Dimon, the CEO of JPMorgan Chase & Co (NYSE:JPM), is known for his no-holds-barred attacks on Bitcoin (CRYPTO: BTC), despite the banking giant

Coinbase Leak Exposes User Addresses Amid $400M Fallout – Bitbo

A recent Coinbase data breach exposed home addresses and account balances, raising serious safety concerns as violent Bitcoin-related crimes escalate.

Greetings Central PA Bitcoiners!

We've got our monthly coffee meetup on deck for this coming Sunday, April 27th, at Denim Coffee in Mechanicsburg. Hope to see you there! Come find us in the back room at 1pm.

A very insightful and accessible video was put out recently by Joe Bryan, called "What's the Problem?". He lays out the consequences of fiat money systems via a kind of storytelling, which makes it much more engaging than you'd expect from an explanation of economic incentives and effects. Worth a listen and a share! It will give you a new appreciation for a money that no one else can create for free.

We're looking to get a bitcoiner hiking event on the books in the coming months...stay tuned.

@Lonelypumpkins

@Central Pennsylvania Bitcoiners

Meetup with @Business Cat talking about Blockchain Navigation will start within the next hour!

We hope to see you there!

#Bitcoin #Meetup

Greetings Central PA Bitcoiners!

We had a great "Bitcoin vs Crypto" educational session last Saturday. Thanks to all that were able to participate.

During the session, a three step principle for the big picture of one's financial life was brought up and discussed:

1. Provide value to others

2. Spend less than you earn

3. Save part of the difference in a money that no one else can create for free

There are many, myself included, who wish we understood this when we were finished with school and started making financial decisions for ourselves. Like dieting, the difficulty usually lies in the execution, not the understanding. As they say, simple, but not easy. This distillation of ideas represents great principles to build upon.

"As to methods there may be a million and then some, but principles are few. The man who grasps principles can successfully select his own methods. The man who tries methods, ignoring principles, is sure to have trouble"

— Harrington Emerson

We have two events lined up for April. On Thursday the 17th at 6pm, we have a learning session, "Blockchain Navigation", hosted by @Business Cat, which is taking place at Jojo's Pizza in Mechanicsburg. The second is our monthly bitcoin & coffee meetup on Sunday the 27th at Denim Coffee in Mechanicsburg.

Lastly, I'd like to make a shout-out to @Bassload, one of our Central PA Bitcoiners. He gave a talk at @PUBKEY in NYC last month on energy, and is also the featured speaker at the upcoming Philly Jawn meetup on Monday the 7th. Great to see one of our own out there representing!

@Lonelypumpkins

@Central Pennsylvania Bitcoiners

GM Central PA Bitcoiners!

Join us for our quarterly educational meetup tomorrow! It's at the Simpson Library in Mechanicsburg at 1pm, on Saturday March 29th.

The topic is "bitcoin vs crypto". As we approach this phase of bitcoin's cycle, the noise can get louder and louder, with new projects and voices vying for both your attention and your value. Arm yourself with knowledge and resources that'll help you parse the signal from the noise.

Beginners are welcome and encouraged to attend!

@Lonelypumpkins

@Central Pennsylvania Bitcoiners

Greetings Central PA Bitcoiners!

The United States made the Louisiana Purchase in 1803, purchasing a third of the area of the current US (828,000 square miles) from France, for $15m. Whether or not it was France's to sell in the first place is up for debate, but nevertheless, the trade with the US happened, and it paved the way for expansion west.

It was perilous for settlers willing to head west via such routes as the Oregon and California Trails, but there were incentives for doing so. The Homestead Acts gave away 250,000 square miles of land, which is about 10% of the area of the US. They were more generous at the beginning: 640 acres of farmland was available to every couple who applied initially. Over time, this amount decreased to 320 acres, then 160, then went away. Thereafter, if you wanted land, you'd have to pay for it.

Making the journey in the early years was a treacherous endeavor, and had a high mortality rate for early settlers. In the beginning, settlers were comprised of the most rugged of mountain men, who set up primitive infrastructure. As time passed, the paths became more passable, and the journey became less formidable. Better infrastructure was put in place, and new settlers enjoyed increasingly better amenities.

Contrast this with early bitcoiners. One could be paid 50 new bitcoin per block in the early years, known as the first mining epoch. The infrastructure was much less built out: you'd have to either learn how to mine yourself, or sign up with a sketchy foreign exchange to trade fiat for bitcoin. Either way, the easy to use and secure self-custody tools we enjoy today, hardware wallets, didn't exist yet, so you were on your own securing those coins. If you order a mining rig today, there's a very high chance that you're going to receive it, and when promised. In the early days, if you wanted to order a mining rig, the one you order might arrive 6 months late, after which time the network difficulty has doubled, or it might never arrive at all. After four years, that mining reward dropped from 50 new bitcoin per block, down to 25, 12.5, 6.25, and now sits at 3.125.

Eventually, the West approached parity with the East in terms of civil engineering, city life, the arts, and lifestyle. As Bitcoin's ecosystem gets more built out, it becomes less treacherous of a journey and less treacherous of a destination to become a bitcoiner. We're in a place now where amazing tools exist for those hungry enough to learn to use them, at the same time that bitcoin's market cap only makes up less than 0.2% of global assets.

In the 19th century, we had "go west, young man". In the 21st century, it's "stay humble, stack sats".

Hope to see you at one of our March meetups! We have a coffee meetup at 1pm on Sunday the 23rd at Denim Coffee in Mechanicsburg, and an educational meetup at 1pm on Saturday the 29th at Simpson Library, with the topic "Bitcoin vs Crypto".

@Lonelypumpkins

@Central Pennsylvania Bitcoiners

Greetings Central PA Bitcoiners!

Our monthly coffee meetup is tomorrow at 1pm at Denim Coffee in Mechanicsburg. We'll be commandeering the back room, as usual. Hope to see you there! If you can't make it, we meet there on the fourth Sunday of every month.

Also, our next educational meetup is taking place at 1pm on Sat, March 28th, at the Simpson Library. Educational meetups feature a presentation and theme, and next month's is Bitcoin vs. Crypto. We like to say "let your education drive your allocation"...this educational meetup is a great opportunity to stack some skills, even if you're already stacking sats.

Hope everyone's having a great weekend! Keep stacking those sats, and keep stacking those skills.

@Lonelypumpkins

@Central Pennsylvania Bitcoiners

Greetings Central PA Bitcoiners!

We just posted the meetup announcement for our next quarterly educational meetup, entitled "Bitcoin vs. Crypto". It'll be at the Simpson Library in Mechanicsburg, at 1pm on Saturday, March 29th.

If you're new to bitcoin or new to our meetup group, this is a great first function for you to attend. We're at the point of the market cycle when many shiny things start coming out of the woodwork, competing for our time and our value. What principles can we use to distinguish things that are worth dedicating our time learning about and worth dedicating our value in, vs things that are effectively 1920's-era pump and dump schemes dressed up in a cheap tuxedo?

Topics...

Why distinguish between bitcoin and crypto?

What distinguishes bitcoin education and crypto education?

How new bitcoin come into existence vs how new crypto tokens come into existence

Stacking sats & stacking skills

Ideas for leveling up your skills and setup

We hope to see you there!

Reminder...in addition to our quarterly educational meetups, we have monthly coffee meetups the fourth Sunday of every month, 1pm, at Denim Coffee in Mechanicsburg.

@Lonelypumpkins

@Central Pennsylvania Bitcoiners

#Bitcoin #Meetup

CURRENT UPCOMING EVENTS:

• Coffee Meetup - February 23rd 13:00-15:00

@ Denim Coffee in Mechanicsburg, Pennsylvania

• Educational Meetup - March 29th 13:00-15:00

@ Simpson Library in Mechanicsburg, Pennsylvania

Greetings Central PA Bitcoiners!

I hope you're having a great weekend. I started to write an explanation of what mempools are, and why they exist, and decided to add it to the end of the newsletter.

TL;DR: The mempool cleared this weekend. Mempools are where your bitcoin transaction lives in the time between when you broadcast it to the network and the time when it makes it into a block of the ledger. What is the consequence of it clearing this weekend? Nothing much...business as usual. Network use ebbs and flows, and it'll probably mean revert in the near future.

FASB change...the Financial Accounting Standards Board made a rule change that became effective in December, 2024.

If you're like me, your ears probably don't perk up when the FASB is announcing a rule change. This one, however, affects businesses who hold bitcoin on their balance sheet. Prior to this rule change, if a company held bitcoin, it was accounted for in a strange way. If they bought $1m worth of bitcoin, and the USD value increased to $1.5m, they were not allowed to account for the appreciation; the dollar value of their bitcoin had to stay marked as worth $1m. However, if the USD value decreased to $500k, they had to mark the loss. If they wanted to mark a price appreciation on their books, they'd have to convert it to dollars, which adds a step and can have negative tax ramifications. This was a wonky way to do things, and reflects the disconnect between the old analog world and bitcoin. Now with this new rule taking effect, companies will no longer have a wonky accounting disincentive keeping them from stacking sats on their balance sheet.

Our next coffee meetup is scheduled for 1pm on Sunday, Feb 23rd, at Denim Coffee in Mechanicsburg. Stay tuned for details about our next educational meetup...the topic is going to be "Bitcoin vs Crypto".

@Lonelypumpkins

@Central Pennsylvania Bitcoiners

If you're like me, your ears probably don't perk up when the FASB is announcing a rule change. This one, however, affects businesses who hold bitcoin on their balance sheet. Prior to this rule change, if a company held bitcoin, it was accounted for in a strange way. If they bought $1m worth of bitcoin, and the USD value increased to $1.5m, they were not allowed to account for the appreciation; the dollar value of their bitcoin had to stay marked as worth $1m. However, if the USD value decreased to $500k, they had to mark the loss. If they wanted to mark a price appreciation on their books, they'd have to convert it to dollars, which adds a step and can have negative tax ramifications. This was a wonky way to do things, and reflects the disconnect between the old analog world and bitcoin. Now with this new rule taking effect, companies will no longer have a wonky accounting disincentive keeping them from stacking sats on their balance sheet.

Our next coffee meetup is scheduled for 1pm on Sunday, Feb 23rd, at Denim Coffee in Mechanicsburg. Stay tuned for details about our next educational meetup...the topic is going to be "Bitcoin vs Crypto".

@Lonelypumpkins

@Central Pennsylvania Bitcoiners

New Fair Value Accounting Rules Simplify Bitcoin Reporting – Bitbo

The FASB's new fair value accounting rules, effective Dec. 15, 2024, improve transparency and ease corporate Bitcoin adoption.

Our next meetup will be on February 23rd from 1:00pm to 3:00pm at Denim Coffee in Mechanicsburg, Pennsylvania.

We hope to see you there!

#Bitcoin #Meetup

The next @Central Pennsylvania Bitcoiners Meetup is scheduled for this upcoming Sunday (2025-01-26) at Denim Coffee in Mechanicsburg, Pennsylvania from 13:00 to 15:00

Greetings Central PA Bitcoiners!

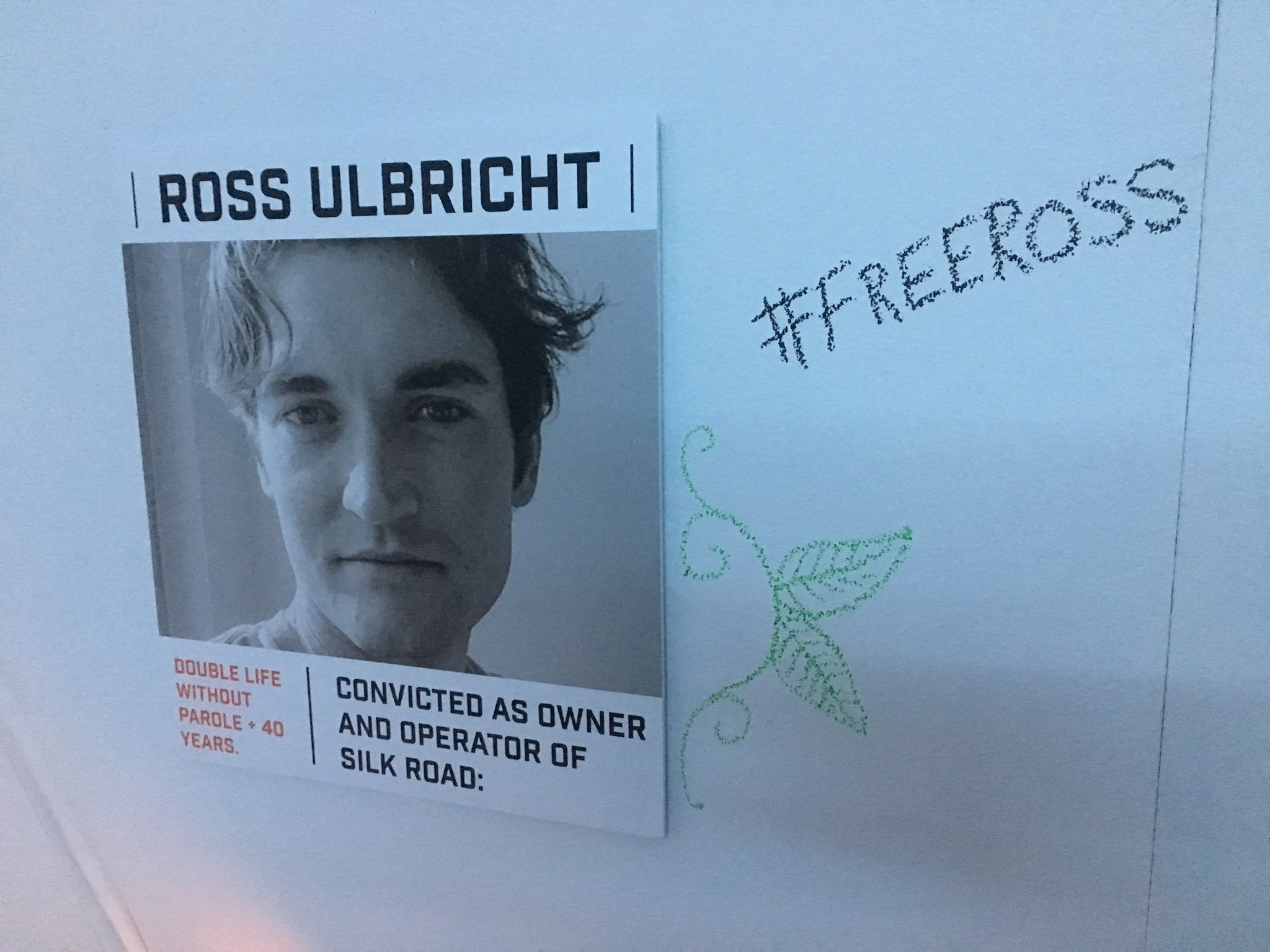

Last night we learned that Ross Ulbricht, creator of the original Silk Road marketplace, is receiving a full pardon.

This is a case that was closely watched by many bitcoiners and libertarians. The Silk Road was an online marketplace that was only accessible by using the tor browser, also known as a dark net market. This site served as an eBay for illicit items, mostly drugs. Like eBay, it used a user reputation system as well as an escrow system, minimizing the risk of purchasers getting scammed. Also, bitcoin served as the method of payment and escrow. Visa, Mastercard, Paypal and (if it had existed then) Venmo aren't options in such places on the internet.

Bitcoin has come a long way since its days keeping the Silk Road machine running over a decade ago. Many nocoiners still bring up its historic association with dark net markets as a negative, as something that should make people reluctant to acquire or interact with bitcoin.

This is a case that was closely watched by many bitcoiners and libertarians. The Silk Road was an online marketplace that was only accessible by using the tor browser, also known as a dark net market. This site served as an eBay for illicit items, mostly drugs. Like eBay, it used a user reputation system as well as an escrow system, minimizing the risk of purchasers getting scammed. Also, bitcoin served as the method of payment and escrow. Visa, Mastercard, Paypal and (if it had existed then) Venmo aren't options in such places on the internet.

Bitcoin has come a long way since its days keeping the Silk Road machine running over a decade ago. Many nocoiners still bring up its historic association with dark net markets as a negative, as something that should make people reluctant to acquire or interact with bitcoin.

Silk Road, as seemingly negative an association as it might be, was instrumental in bitcoin finding a use case early on in its history.

The best money shouldn't pass judgement on what it's being used for, whether that's making a purchase on the Silk Road, donating to protesting Canadian truckers, paying a female employee in much of the Arab world, or buying a Bible in North Korea. Local laws prohibit those transactions, and third party payment companies won't facilitate them for you. Is your money really yours if you have to ask someone else's permission on who you can pay with it, or what you can spend it on?

Fast forward 12 years from the Silk Road days, and both federal and state governments are making moves to add bitcoin onto their treasury balance sheets. California, Massachusetts, and Wyoming are the most recent announcements.

Silk Road, as seemingly negative an association as it might be, was instrumental in bitcoin finding a use case early on in its history.

The best money shouldn't pass judgement on what it's being used for, whether that's making a purchase on the Silk Road, donating to protesting Canadian truckers, paying a female employee in much of the Arab world, or buying a Bible in North Korea. Local laws prohibit those transactions, and third party payment companies won't facilitate them for you. Is your money really yours if you have to ask someone else's permission on who you can pay with it, or what you can spend it on?

Fast forward 12 years from the Silk Road days, and both federal and state governments are making moves to add bitcoin onto their treasury balance sheets. California, Massachusetts, and Wyoming are the most recent announcements.

As more and more entities recognize and admit that their cash reserves are consistently getting hammered by inflation, they'll want to adopt a similar strategy.

As more and more entities recognize and admit that their cash reserves are consistently getting hammered by inflation, they'll want to adopt a similar strategy.

Looking forward to our next meetup, which is at 1pm on this Sunday, Jan 26th, at Denim Coffee in Mechanicsburg. Hope to see you there!

@Lonelypumpkins

@Central Pennsylvania Bitcoiners

Looking forward to our next meetup, which is at 1pm on this Sunday, Jan 26th, at Denim Coffee in Mechanicsburg. Hope to see you there!

@Lonelypumpkins

@Central Pennsylvania Bitcoiners

Trump Pardons Silk Road Founder Ross Ulbricht – Bitbo

President Trump granted a full pardon to Ross Ulbricht, founder of the Silk Road, vacating his life sentences and fulfilling a campaign promise.

Jamie Dimon Doubles Down:

JPMorgan CEO Jamie Dimon reiterates his harsh stance on Bitcoin, citing its alleged misuse in illegal activities and maintaining skepticism despite...

California, Massachusetts, and Wyoming Advance Bitcoin Reserve Plans – Bitbo

Wyoming, Massachusetts, and California are moving toward establishing state Bitcoin reserves, with proposed investments ranging from 3% to 10% of p...

BitcoinTreasuries.com

Track Bitcoin Treasuries of companies, miners and countries at BitcoinTreasuries.com.

(Apologizes for Delayed Post)

Greetings Central PA Bitcoiners!

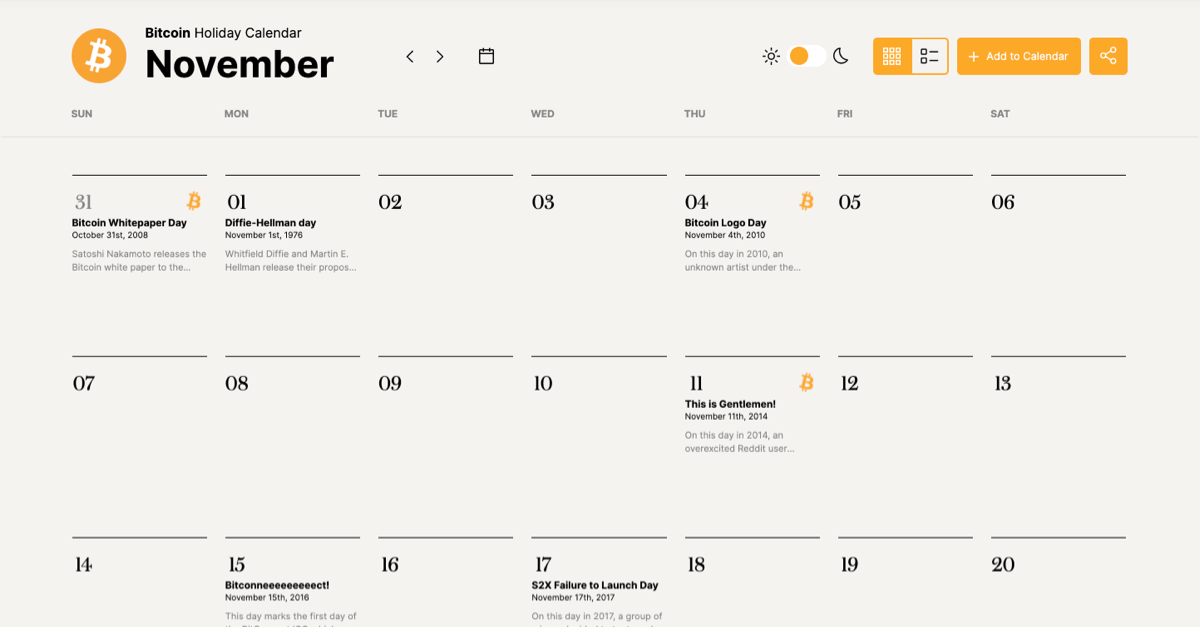

Happy Genesis Block Day!

Sixteen years ago today, Satoshi mined the first bitcoin block, known as the genesis block.

Sixteen years ago today, Satoshi mined the first bitcoin block, known as the genesis block.

When a miner finds a block, there's a small text field in which they can put whatever message in it they want. Modern mining pools usually use the name of their pool. Satoshi chose the following for block #0:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

There are two reasons for this. By including that day's headline from a major newspaper (London's The Times), Satoshi timestamped the block that he cast. This proved that he/she/they hadn't been mining on their own, keeping the mined blocks a secret, and preventing others from competing to mine for those new bitcoin. The crux of this reason is that it shows that it was launched fairly and on the date that he broadcast it to the network. The second reason is more symbolic: the 2008 financial crisis, and the government bailout interventions that followed, represented a breach of trust and alienated many, including Satoshi:

"The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

The white paper laid out the framework for bitcoin: a new digital asset and decentralized payment network that doesn't rely on having to trust entities that have repeatedly proven themselves untrustworthy.

https://bitcoin.org/bitcoin.pdf

Several years ago, bitcoin educator and podcaster Trace Mayer first proposed and promoted Proof of Keys Day, corresponding with the anniversary of the genesis block.

When a miner finds a block, there's a small text field in which they can put whatever message in it they want. Modern mining pools usually use the name of their pool. Satoshi chose the following for block #0:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

There are two reasons for this. By including that day's headline from a major newspaper (London's The Times), Satoshi timestamped the block that he cast. This proved that he/she/they hadn't been mining on their own, keeping the mined blocks a secret, and preventing others from competing to mine for those new bitcoin. The crux of this reason is that it shows that it was launched fairly and on the date that he broadcast it to the network. The second reason is more symbolic: the 2008 financial crisis, and the government bailout interventions that followed, represented a breach of trust and alienated many, including Satoshi:

"The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

The white paper laid out the framework for bitcoin: a new digital asset and decentralized payment network that doesn't rely on having to trust entities that have repeatedly proven themselves untrustworthy.

https://bitcoin.org/bitcoin.pdf

Several years ago, bitcoin educator and podcaster Trace Mayer first proposed and promoted Proof of Keys Day, corresponding with the anniversary of the genesis block.

The idea is that whoever has bitcoin on exchanges should withdraw them on January 3rd every year, and in doing so, force exchanges who might be running a fractional reserve to be exposed.

IMHO, Proof of Keys Day is a great idea, and every bitcoiner should know the difference of what it means to hold their own wealth vs some exchange's IOU for bitcoin. However, bitcoiners who know this important distinction very likely don't keep sats on an exchange in the first place. If you do happen to have bitcoin on an exchange and want to celebrate Proof of Keys Day by making the exchange prove that they have the bitcoin they say they do, and you are comfortable and familiar with your self-custody setup, by all means please celebrate and withdraw! I do wonder about how many people realistically (1) have a bitcoin balance on an exchange, (2) are comfortable with self-custody and have software or hardware wallet, and (3) have Proof of Keys Day on their radar. Cheers nonetheless!

Remember, friends...treat bitcoin exchanges like you treat public bathrooms. Walk in, do your business, wash your hands, and walk right back out.

Our next monthly coffee meetup is at 1pm at Denim Coffee on Sunday, Jan 26th (1pm every fourth Sunday).

Happy Genesis Block Day and Happy Proof of Keys Day!

@Lonelypumpkins

@Central Pennsylvania Bitcoiners

The idea is that whoever has bitcoin on exchanges should withdraw them on January 3rd every year, and in doing so, force exchanges who might be running a fractional reserve to be exposed.

IMHO, Proof of Keys Day is a great idea, and every bitcoiner should know the difference of what it means to hold their own wealth vs some exchange's IOU for bitcoin. However, bitcoiners who know this important distinction very likely don't keep sats on an exchange in the first place. If you do happen to have bitcoin on an exchange and want to celebrate Proof of Keys Day by making the exchange prove that they have the bitcoin they say they do, and you are comfortable and familiar with your self-custody setup, by all means please celebrate and withdraw! I do wonder about how many people realistically (1) have a bitcoin balance on an exchange, (2) are comfortable with self-custody and have software or hardware wallet, and (3) have Proof of Keys Day on their radar. Cheers nonetheless!

Remember, friends...treat bitcoin exchanges like you treat public bathrooms. Walk in, do your business, wash your hands, and walk right back out.

Our next monthly coffee meetup is at 1pm at Denim Coffee on Sunday, Jan 26th (1pm every fourth Sunday).

Happy Genesis Block Day and Happy Proof of Keys Day!

@Lonelypumpkins

@Central Pennsylvania Bitcoiners

Bitcoin Holidays

Subscribe and learn more about Bitcoin’s important events.

The Mempool Open Source Project®

Explore the full Bitcoin ecosystem with The Mempool Open Source Project®. See the real-time status of your transactions, get network info, and more.

Proof of Keys

Proof of Keys

Annual January 3rd Proof of Keys Celebration of the Genesis Block

Happy New Year to all you wonderful Bitcoiners who have come to the meetups throughout 2024! Thank you for contributing to the ecosystem we are building together with #Bitcoin in Central Pennsylvania. I look forward to making 2025 another excellent year. Keep building!

@Pickle Dan 🥒

@Central Pennsylvania Bitcoiners

#NewYear

@Phundamentals dropping music now!?!

Wavlake

We made it 100K • Fundamentals

Play, boost, and more on Wavlake ⚡️🎵

Greetings Central PA Bitcoiners!

Happy Hodl Day!

What's Hodl Day, you might ask? It's the anniversary of when the meme "hodl" was born. Eleven years ago today, on the bitcointalk.org forum (Source Link Below), user GameKyuubi, frustrated by his failed trading attempts, went on a drunken and profanity-laden rant. He lamented that he kept making bad trades, and regretted that he didn't just hold his bitcoin position rather than trying to outsmart the market. The title of his post was "I AM HODLING". Little did he know that his typo would go down in history as a favorite term of bitcoiners.

There are some misconceptions about what hodl means. One has been propagated by corporate news, who created the backronym "hodl = hold on for dear life". Not one of the more dastardly pieces of misinformation they've tried to disseminate about bitcoin, however hodl's creation stems from the aforementioned post on the bitcointalk forum, not an acronym.

The other big misconception is that hodl means to never spend one's bitcoin. A crucial function of a money is spending it at a later date, hopefully on something that improves your life or the lives of those you care about. One can still be a hodler and spend some of their bitcoin...the process of hodling does make one more choosy about what they spend their money on, however.

Hodl can also be used as a noun, ie "I keep my spending sats in Blue Wallet and my hodl on a Passport hardware device". An analogy to fiat would be making the distinction between dollars in a checking account and dollars in a 401k. Your hodl is the stack that is in its forever home, so to speak.

When you expect your money to consistently go down in value, you want to spend it quickly to realize its maximum value. The dollar bill in your pocket will never be worth more than it is right now...its value will only go down. When you expect your money to consistently go up in value, you want to spend it more conservatively...you want to hodl it.

Happy Hodl Day!

@Lonelypumpkins

@Central Pennsylvania Bitcoiners

Origin Story:

I AM HODLING

I AM HODLING

New episode of @Rock Paper Bitcoin released early?!

Shout-out to our guys @Phundamentals and @Business Cat. Thank you, gentlemen!

Fountain

Rock Paper Bitcoin • 54 - Lights In The Sky • Listen on Fountain

Recorded Dec 14, 2024 - 874729If you like the show and want to support us, you can stream sats by listening with any podcasting 2.0 app.Follow Rock...