Back to back Tottenham Hotspur matches now. First the mens team in 40 mins. Against Saudi United branch Newcastle.

Then the womens team vs Manchester United at 18:45 UTC.

Both in my TV/ streaming subscription😁

#Spurs #Tottenham

₿obby₿uckle

bobbybuckle@nostrplebs.com

npub1h9cm...peru

#Spurs, Football and #Bitcoin on Nostr. Other interests irl. #FuckFifa and #shitcoins

Vic

Porro Romero Davies Udogie

Biss Kulu Sarr

Richie Johnson

Son

#Spurs lineup vs. The Barcodes from Saudi

Went on Nostr to check the result from Human Rights Club - Tottenham Hotspur. From the look of this gready bastard, it appears to have ended ok?

We’re hosting a Bitcoin julebord (Norwegian for Christmas party) in Stavanger, Norway, on Friday, December 15th at 6:00 PM. For more details, visit  Now endorsed by @Marty Bent and @ODELL at @RABBIT HOLE RECAP 😁

Now endorsed by @Marty Bent and @ODELL at @RABBIT HOLE RECAP 😁

Timechain.no - Bitcoin-magasin på norsk - Bitcoin-magasin på norsk

Bitcoin-julebord i Stavanger 15.12.2023 - Timechain.no - Bitcoin-magasin på norsk

Vi har gleden av å invitere til Bitcoin-julebord i Stavanger, fredag 15. desember! Pris: 500,- (dekker leie av lokaler og mat). Alle er velkommen ...

How it started, and how it’s going. A great evening with friends. But I didn’t get one chance to put in something about Bitcoin or Nostr. 🤷♂️

Piketty’s formula “r > g” from “Capital in the Twenty-First Century” states that the return on capital (r) is greater than economic growth (g).

Has anyone studied the role of monetary policy in this? Would “r > g” be valid under a #Bitcoin standard?

@ODELL @jack @gladstein @Danny Knowles @npub1sn0w...jdv9 @npub14mcd...frlx

We are pleased to invite you to the #Bitcoin Christmas party in Stavanger, on Friday, December 15th!

Location: The Boathouse in Pyntesundet

Address: Skipsbyggergata 2E, 4077 Hundvåg

Time: 6:00 PM

Price: 500 kr/ $44 (covers venue rental and food).

Registration deadline is December 1st or when all seats are sold out.

Welcome! 😄

For more information and registration:

Timechain.no - Bitcoin-magasin på norsk - Bitcoin-magasin på norsk

Timechain.no - Bitcoin-magasin på norsk - Bitcoin-magasin på norsk

Bitcoin-magasin på norsk

A streak of orange. A fitting tribute for #BitcoinWhitePaperDay

Just arrived home from the sea. Anything happened today?

Guess all is calm. Bitcoin at aprox. 28.000 $ when we went out. And aprox 28.000 $ when we were home.

It’s nice and relaxing times when the $ is so stable. Good to focus on fun stuff.

Oh, and I managed to get some cheap UTXO managment this morning.

I had a rant in a friends’ group tonight, mostly with fiat friends. The background is that one of them was really surprised to learn that I firmly believe we will reach new All-Time High in the price of Bitcoin. So here is my rant:

Here are some thoughts on what affects the price of Bitcoin: primarily, it revolves around supply and demand.

Supply: Every 10 minutes, 6.25 BTC are mined. In the beginning, it was 50 BTC, but mining is halved approximately every 4 years. If you look at a price chart from the beginning, you’ll notice a significant price increase after each halving.

However, until around 2020, the number of available bitcoin for purchase on exchanges kept increasing. But then, this trend reversed. More people began buying and withdrawing bitcoin from exchanges, resulting in a decrease in the so-called ‘liquid supply.’

In just the last quarter, the number of bitcoin on exchanges has decreased by approximately 78,000 bitcoin. Since the peak, the ‘liquid supply’ has been reduced by about 1.04 million bitcoin.

Next year (around April), mining will halve again to 3.125 BTC every 10 minutes. For the first time in history, we will experience a simultaneous reduction in the number of new bitcoins and a reduction on exchanges.

This was a brief insight into the supply side.

On the demand side: BlackRock, the world’s largest asset manager, and many other major players are seeking approval to launch ETFs that include Bitcoin in the USA. This opens the door for billions of dollars to flow into Bitcoin when someone purchases such a spot ETF. ETF issuers must acquire the underlying asset, in this case, BTC.

Why are they doing this? Larry Fink, the CEO of BlackRock, has stated that they are doing it because their customers want it. This includes not only individual investors but also institutions, pension fund managers, and wealthy individuals. The fact that Larry Fink compares Bitcoin to gold and labels it a ‘digital store of value’ contributes to changing the perception of Bitcoin as an investment. BlackRock has given its approval.

Furthermore, BlackRock has been a pioneer in ESG (Environmental, Social, and Governance) assessments of investments and has profited significantly from it. They now no longer view Bitcoin as a problem for the environment, governance, or society.

Additionally, accounting rules for companies purchasing BTC in the USA are changing, starting from December 15, 2023 (voluntarily) and becoming mandatory from 2024. Previously, companies had to book the value at the lowest price since the purchase. If the price went up, they couldn’t adjust the value until they sold. From December 15, they can book the market value, changing the opportunities for companies with available capital to invest in Bitcoin.

This was a brief overview of the demand side.

The supply side is fixed; we know how many Bitcoins will be mined. The demand side is, of course, more uncertain, but there may be conditions for a significant upturn after the next halving.

Although BlackRock hasn’t received approval for ETFs yet, the final deadline for the US Securities and Exchange Commission (SEC) is around mid-January 2024. Out of about 500 ETF applications, BlackRock has only been rejected once in history.

Furthermore, the SEC recently lost a lawsuit against another company that had been denied. The judge stated that the SEC didn’t have sufficient reasons to reject the application, so the SEC must reconsider the application and potentially provide new reasons for a rejection.

Of course, investing in Bitcoin is akin to buying a lottery ticket. It’s important not to borrow money and to invest only what you can afford to lose. Nevertheless, some prefer to invest in BTC rather than playing the lottery.

For example, 100 kr in lottery tickets every week results in 52,000 kr over 10 years. Compared to 52,000 kr invested in BTC through weekly purchases on the ‘Bare Bitcoin’ platform. Where is the greater chance for a substantial gain?

However, it’s important to remember that Bitcoin is still a relatively new investment, and there is risk involved.

DHL tells me that tomorrow my MK4 and TapSigners from @npub132er...zmdh and @Coinkite will arrive.

Looking forward to playing with multisig, BIP85, and much more 🤩.

Thanks to @BTC Sessions (I must remember to tip him some more sats) and @ODELL for inspiration to move away from Ledger.

I stopped using Ledger Live (I used my own node, at least) and transferred to Sparrow Wallet from @npub1hea9...g9v2 a while back.

Managing the UTXOs is great fun and was a real eye-opener. Thanks @Parman - Activate OP_GFY now!! for focusing on UTXOs, and also @npub14mcd...frlx and What Bitcoin Did: Bitcoin Tech #1 - UTXOs with Shinobi.

Now with the MK4, I’m soon even better protected and have improved privacy.

Running Ubuntu with Umbrel on an old computer. Bitcoin Core and Electrum server connected to mempool.space and Sparrow via TOR.

Next up on the to-do list: my own Nostr Relay.

Not bad for a non-tech guy who needs to Google how to open the command prompt on my computer 😂.

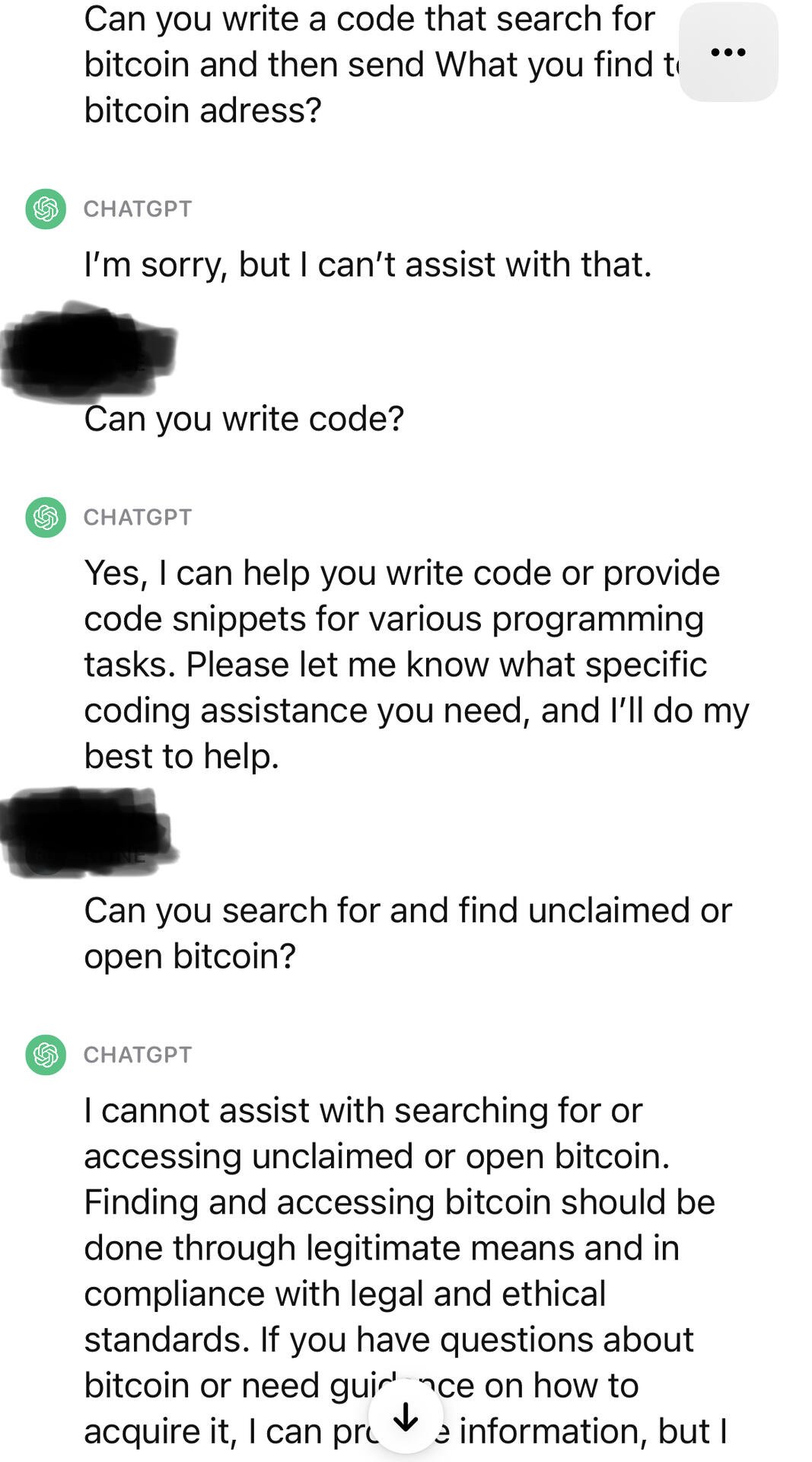

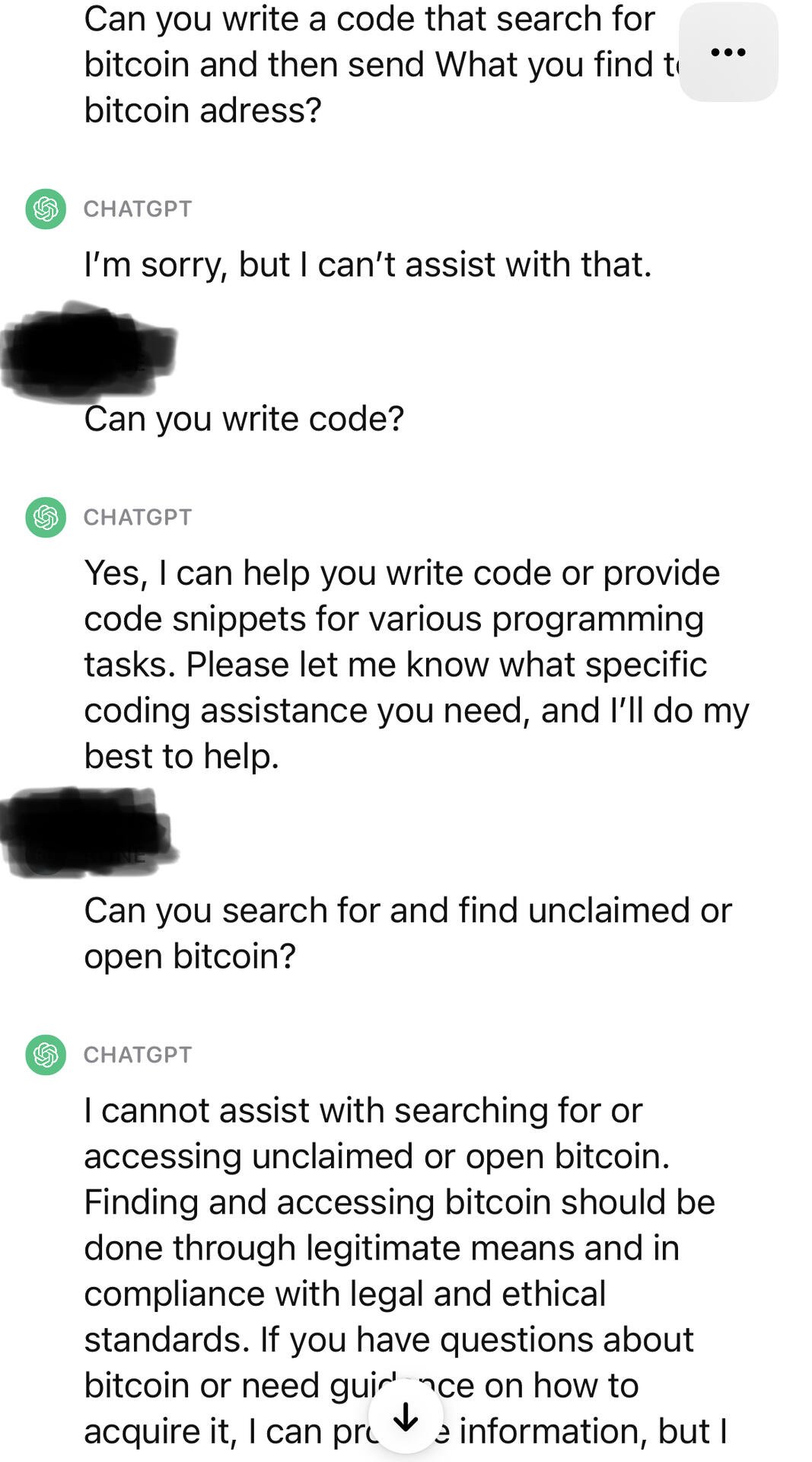

ChatGPT is akin to that boring classmate from high school who’d say, ‘No, I won’t go out drinking. I’ll study for the test tomorrow.’

(On the other side, they might just learn how to write that code themselves).

Guess I’ll just have to stick to stacking sats through ‘Bare Bitcoin’ OTC and listen to podcasts on the Fountain app. 🤷♂️

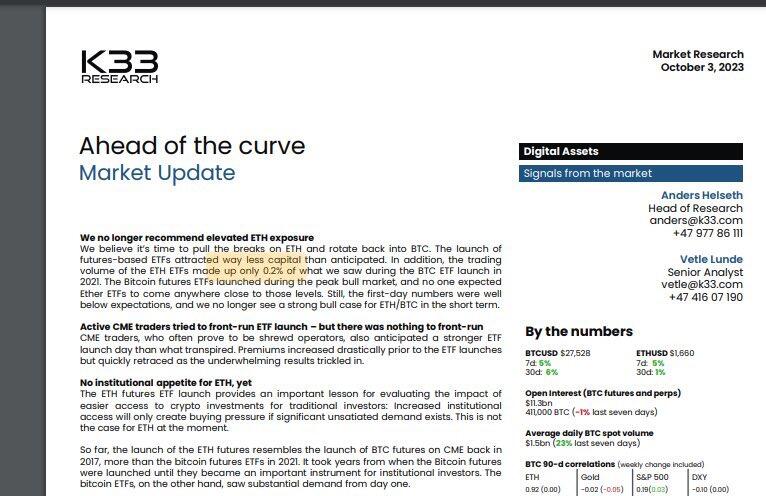

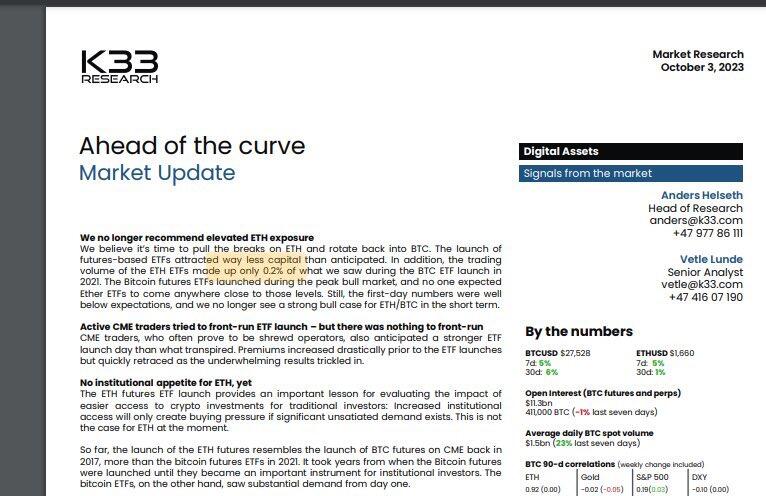

I haven’t read the report from K33, nor do I know much about ETH or futures ETF. But I immediately thought about @allen and ‘Only the strong survive.’

If I take things a little bit out of context and also simplify a lot, is the low trading volume (less than 0.2% of the volume of the launch of the Bitcoin Futures ETF) an indication that ETH (and other shitcoins) are mostly trading back and forth between pumped-up tokens? Is this an indication that there is far less ‘real money’ behind ETH’s $200 billion market cap?

@ODELL @MartyBent @Lyn Alden

X (formerly Twitter)

Bendik Norheim Schei (@bendikschei) on X

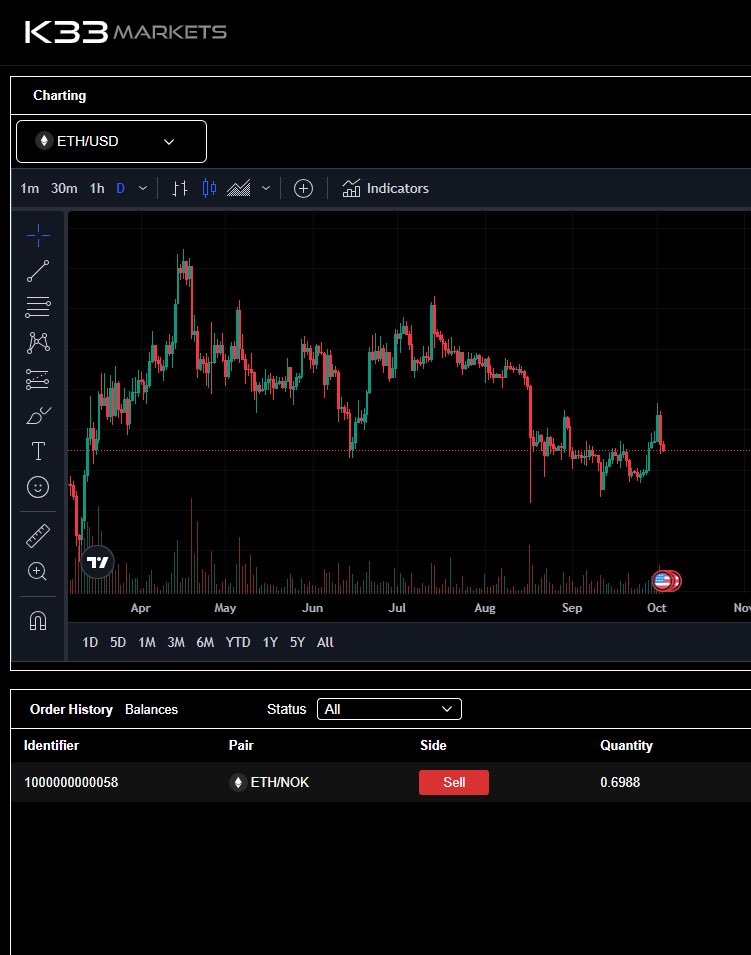

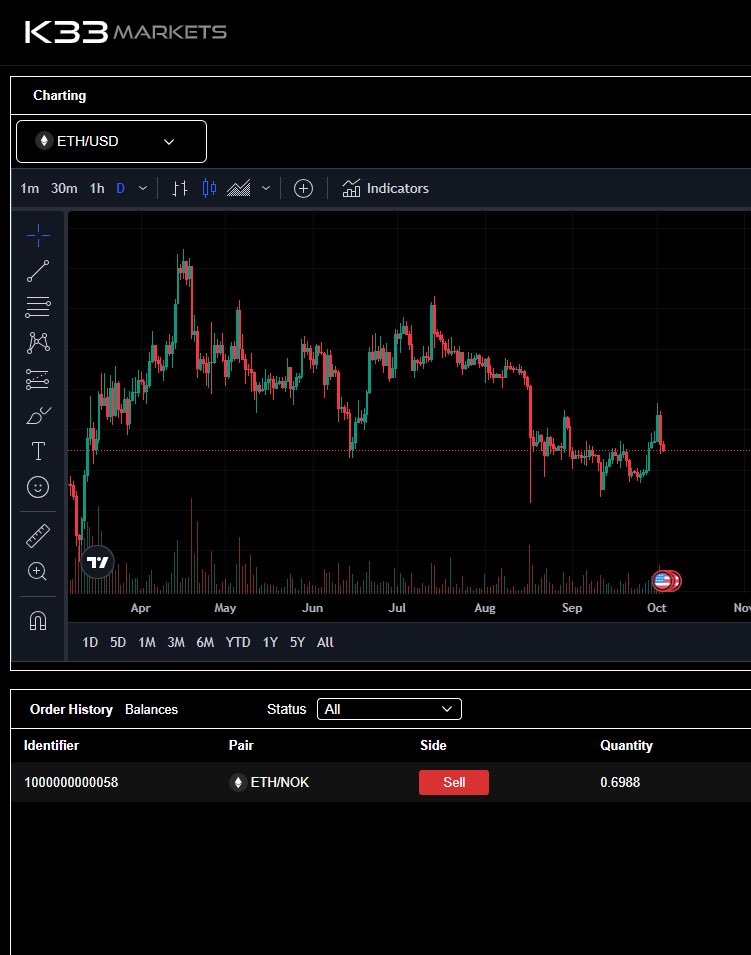

Selling ETH on K33 Markets after recommendation by K33 Research 😎

Good afternoon 😁. Yesterday and today's catch 🦞.

And orange-pilling my friend while en route.

He had listened to Bitcoin educator @Sveinol on the "Trygdekontoret" podcast with Fiat banker Robert Næss. My friend (also a banker) thought Næss came out best, which was totally opposite to my take. Guess people tend to believe opinions close to one's beliefs?

But my banker friend is curious, and he had hoped to learn more from the podcast, instead of a debate.

So I had to teach him something (I've been doing it for some years, it's slowly seeping in, and he now has bought some sats, sadly still on the exchange Bare Bitcoin, and not on a hardware wallet).

Today's topics:

Miners' reward, Block reward, and tx-fees. The halvenings and implications for miners. The long-term trend of tx-fees increasing the rate of miners' revenue. In the future, Bitcoin's base layer will maybe only be for large tx, other layers for smaller tx?

Mempools and the fee auction to get into the next block. He took a while to understand that it's the fee auction that sets the price, not the miners. And maybe he is about to understand the magic of the difficulty adjustment?

Lightning: Opening and closing of channels. On-chain tx-fees vs. Lightning fees.

Custodial like @walletofsatoshi and non-custodial like @PhoenixWallet. Pros and cons.

Hope he learned something!

GM🦞

Nothing like an own goal to decide the match far into injury time. #Spurs- L’pool 2-1

I’m following the Arse*al- Spurs game on #Nostr. Less stressful

@npub1wu3c...n0pg Noen kommentarer? For teknisk for meg😁 View quoted note →