We do not need banks

We do not need on/off-ramps

Just start asking #bitcoin for your products & services

Just start using products that can be bought with BTC

Just stop using banks and fiat (USD, EUR etc)

PlanB

planb@planbtc.com

npub15wcv...qy0q

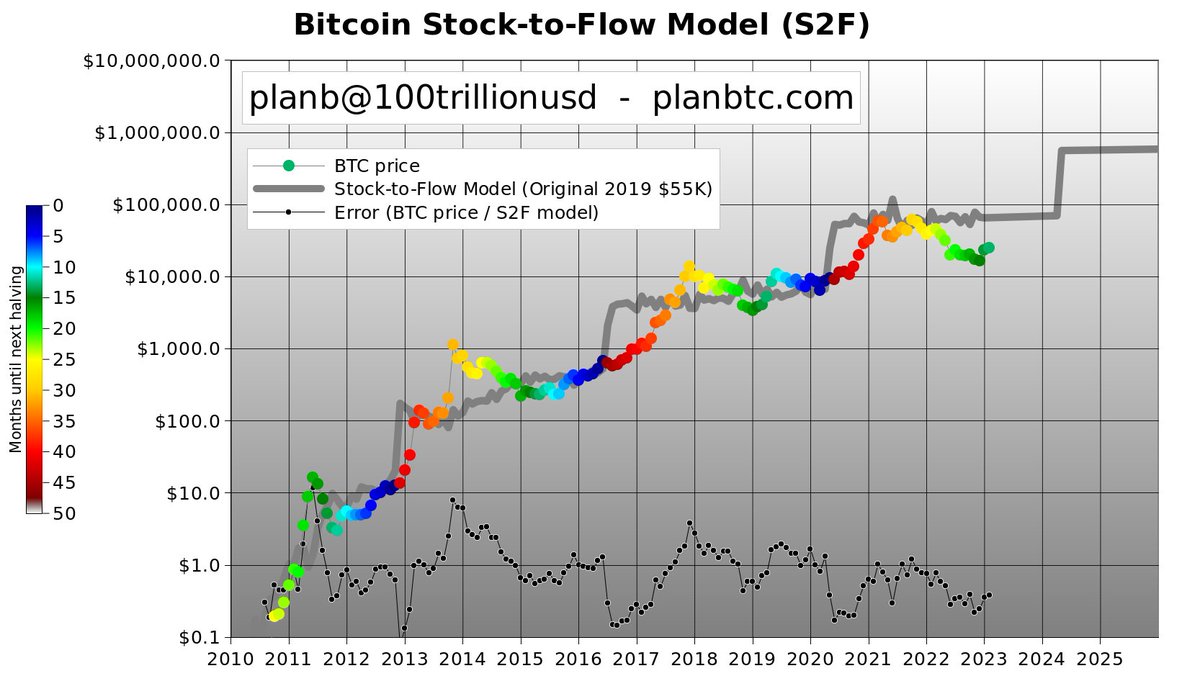

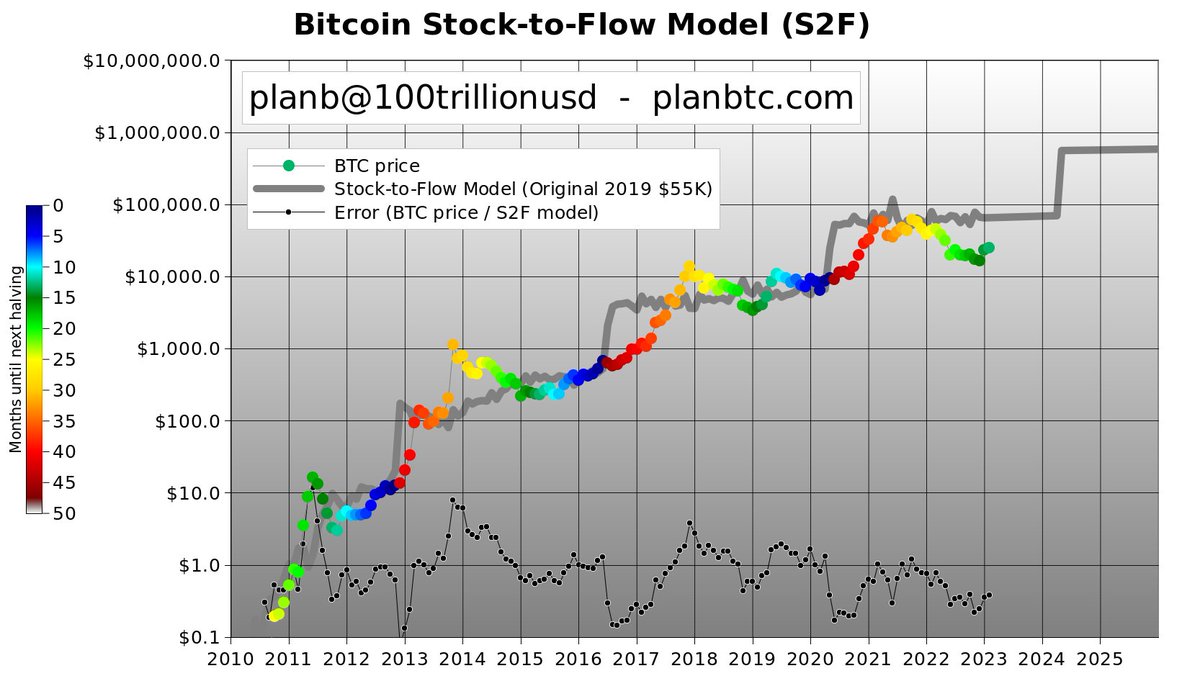

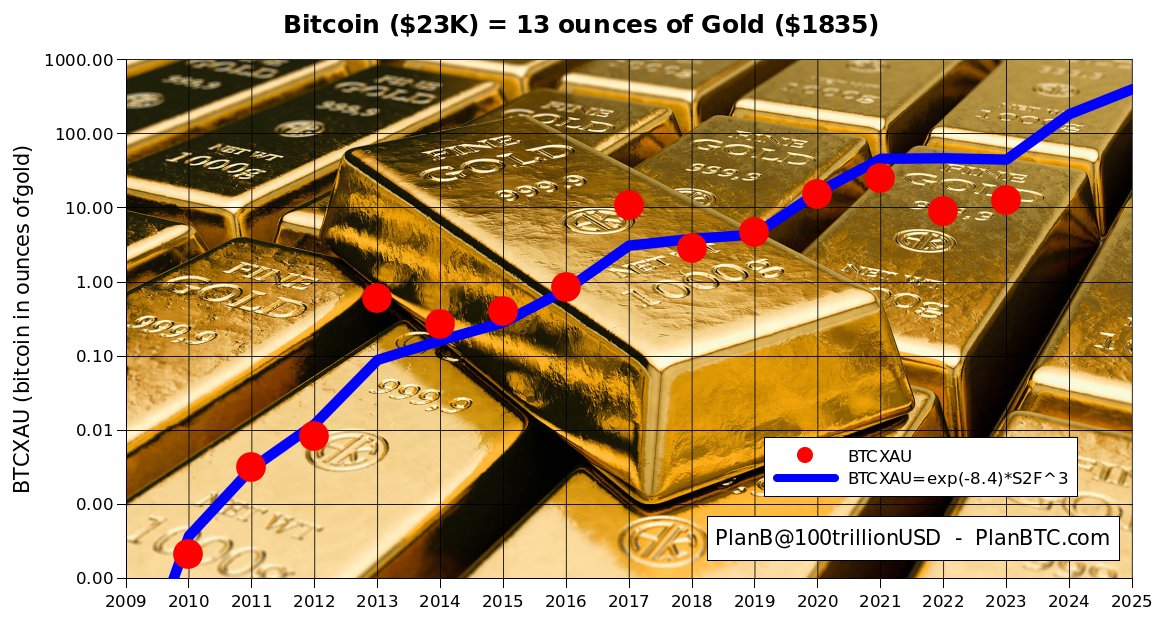

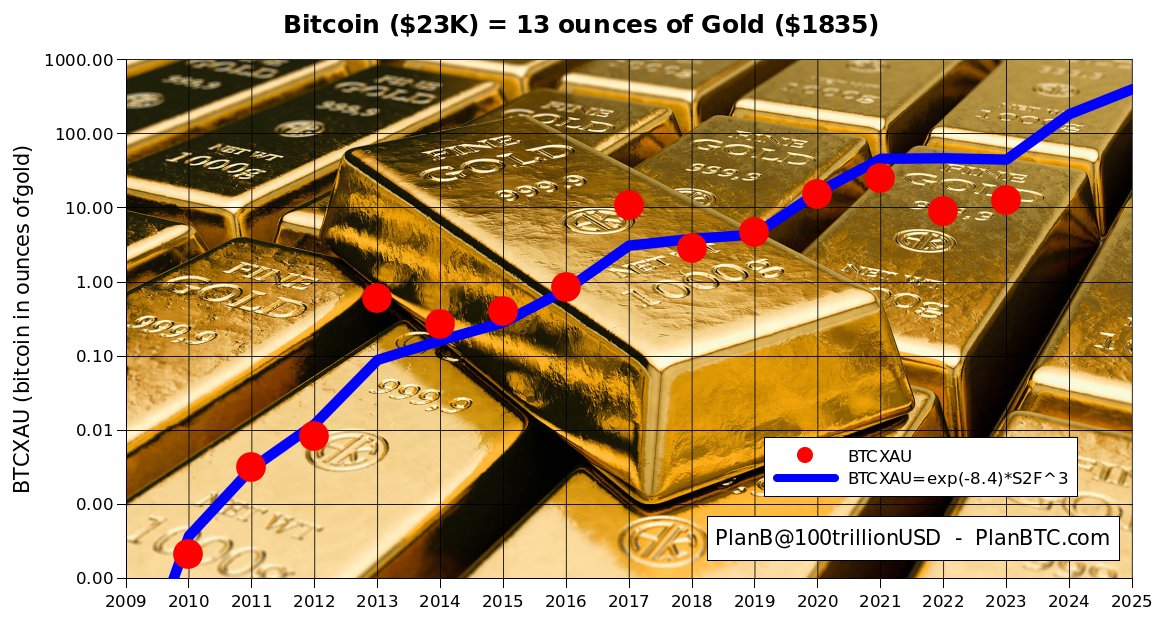

Creator of the stock-to-flow model

My experience with paid relays: I tried nostr .wine (18,888 sats) and eden .nostr .land (5000 sats) next to my 12 free relays (e.g. damus, nos) and it makes no noticeable difference. Wine is at least relaying many messages. Eden does absolutely nothing, zero messages relayed. So, idk, maybe I do something wrong here.. All tips/help is welcome!

After March 2024 halving, bitcoin will be the scarcest asset in the world.

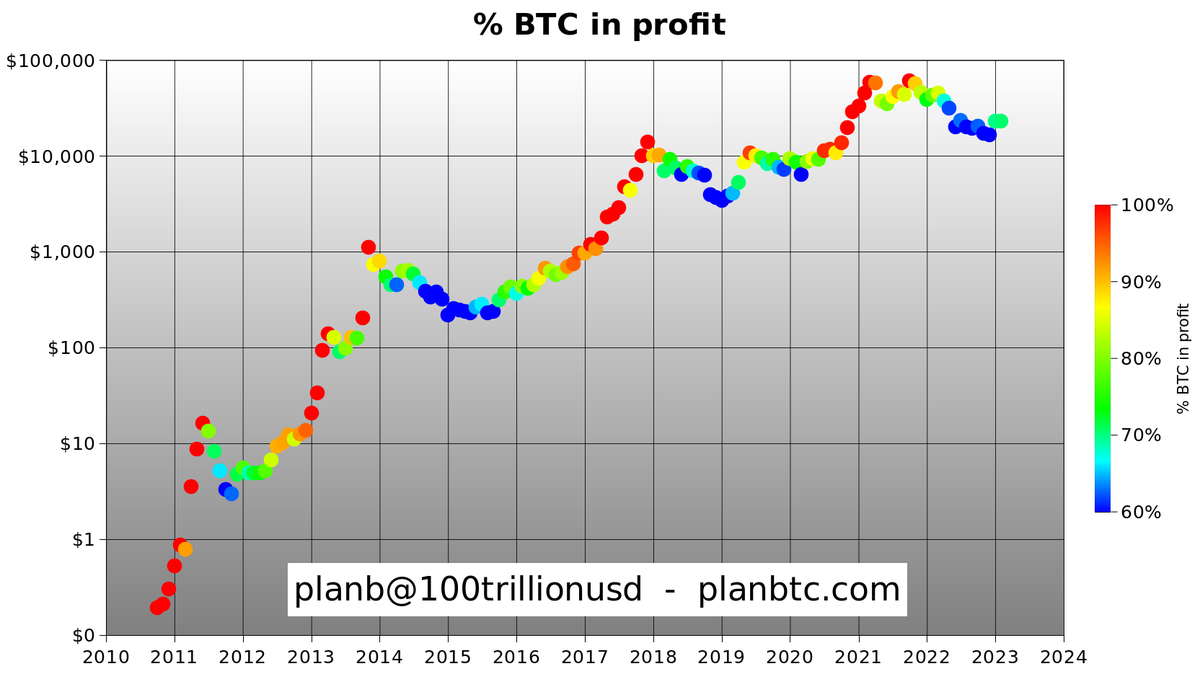

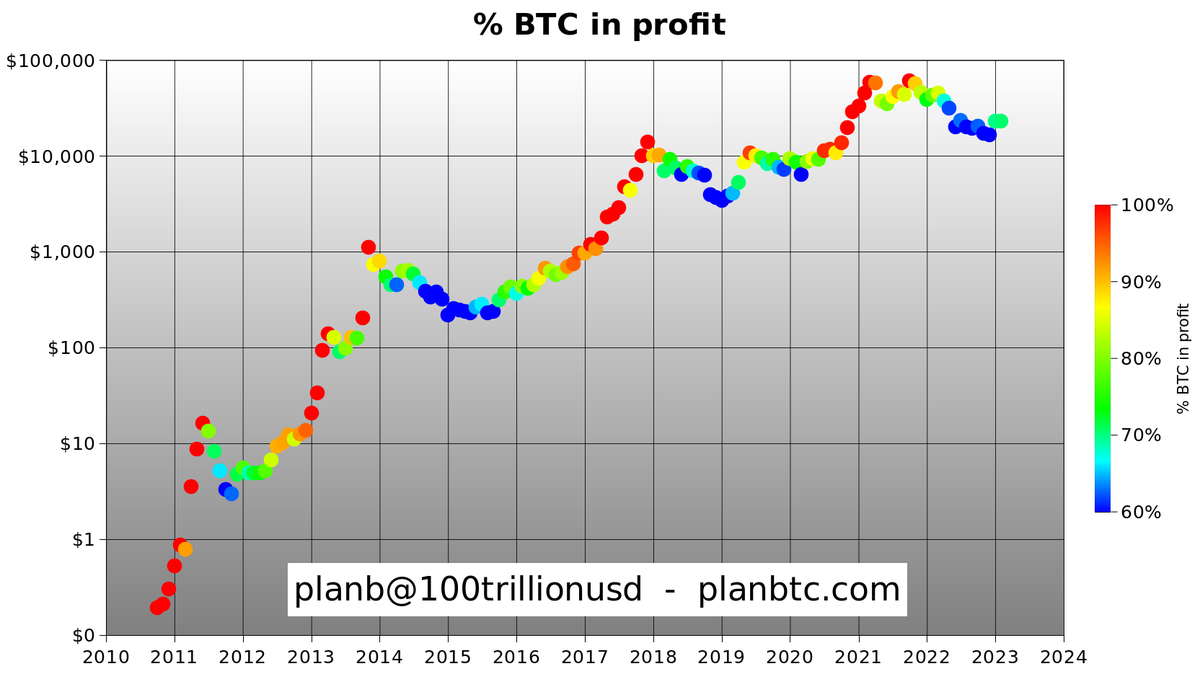

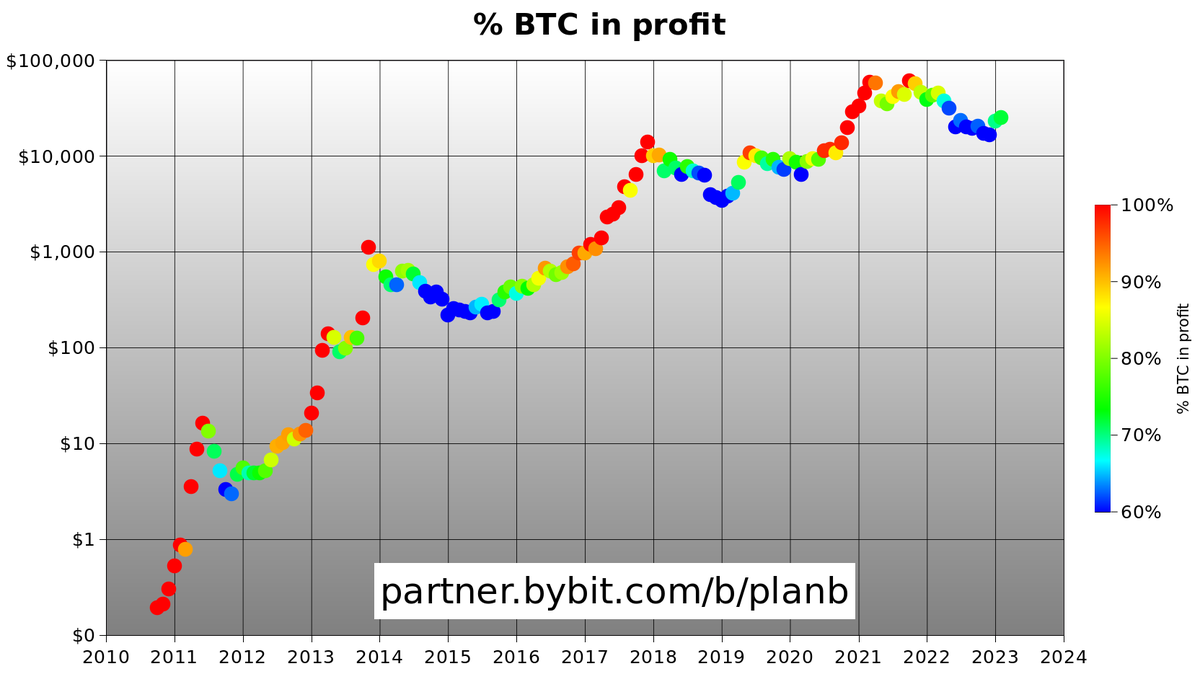

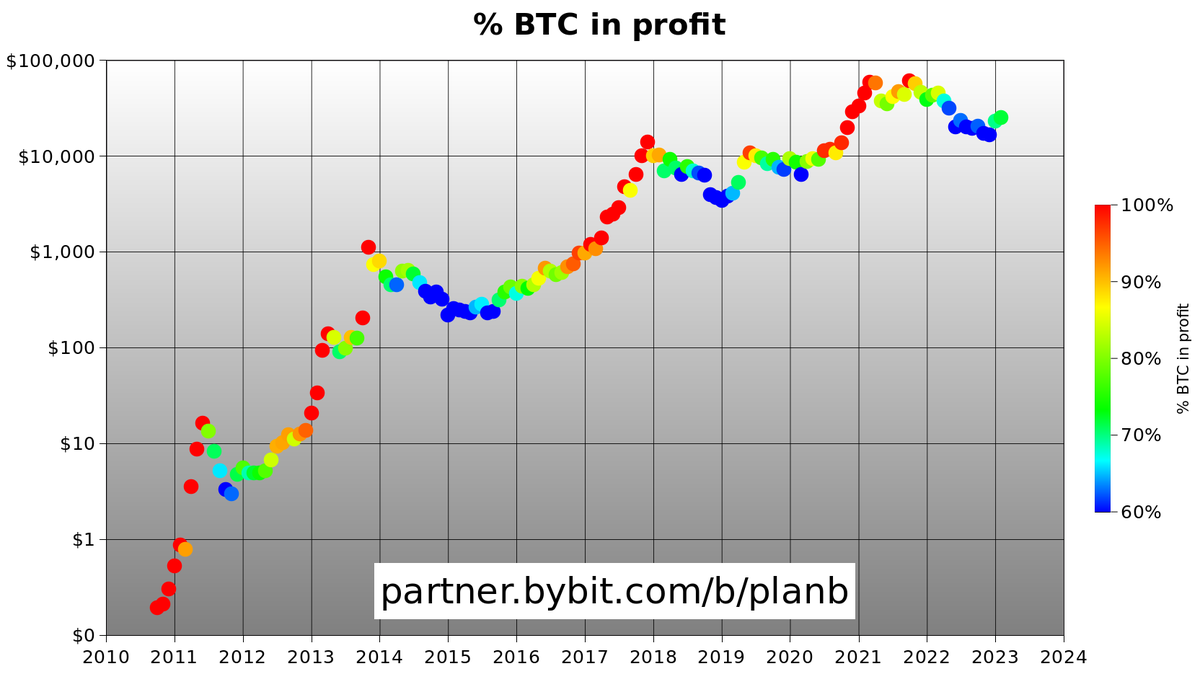

70% of all bitcoin is in profit. More detailed analysis:

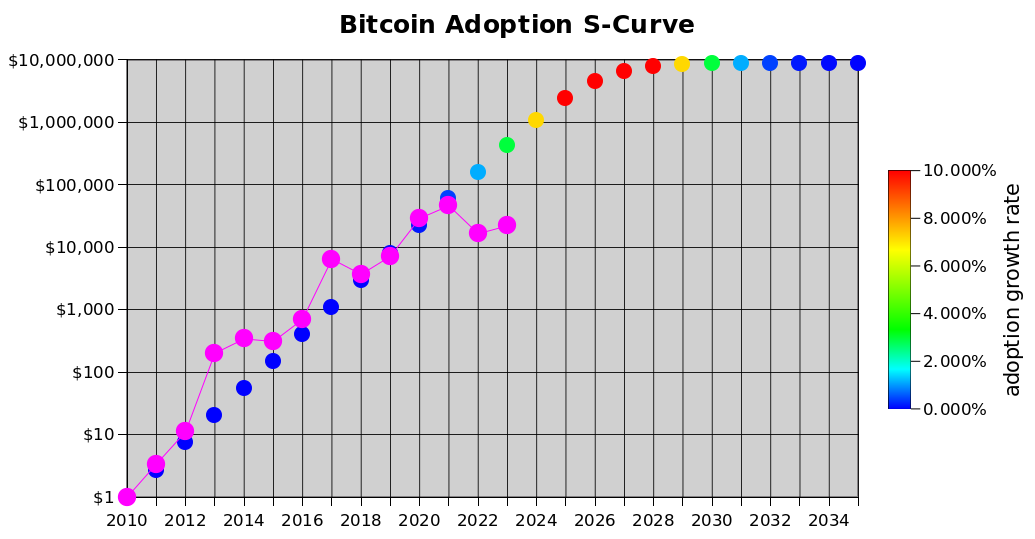

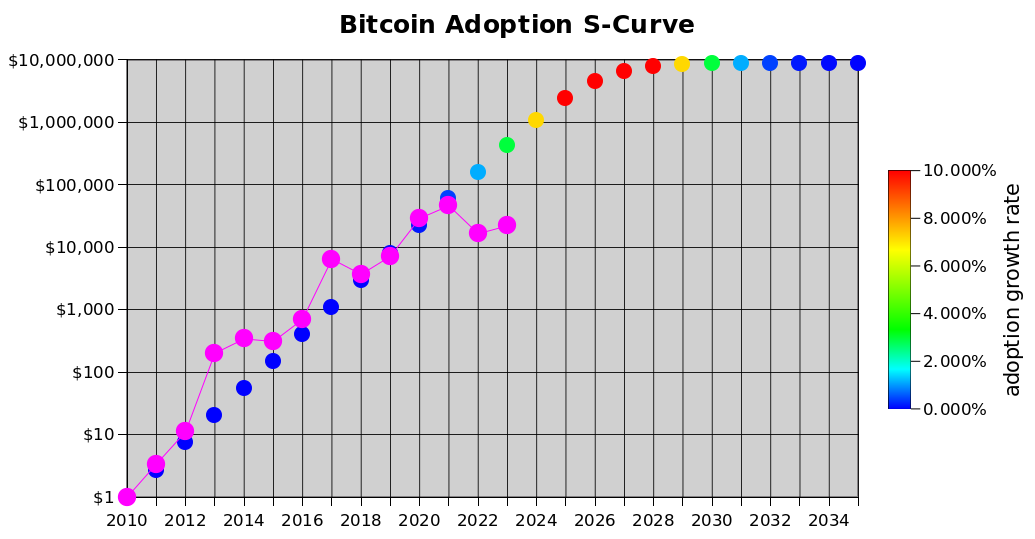

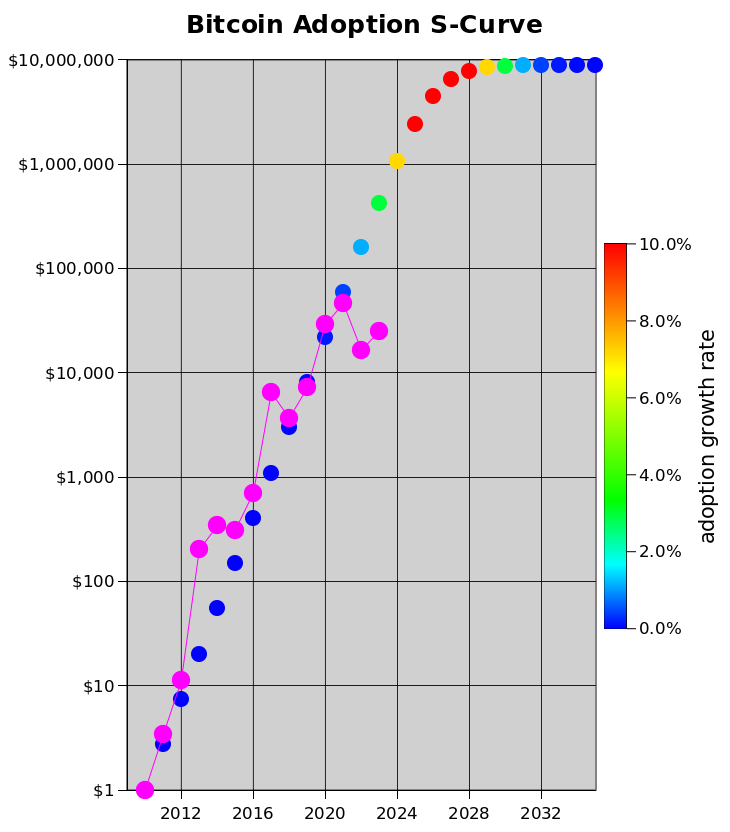

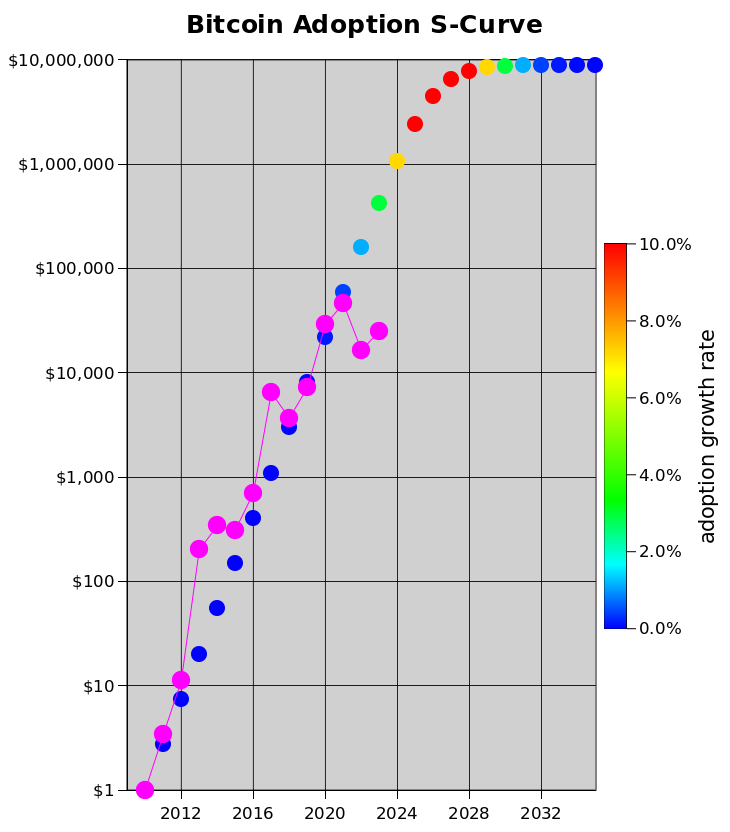

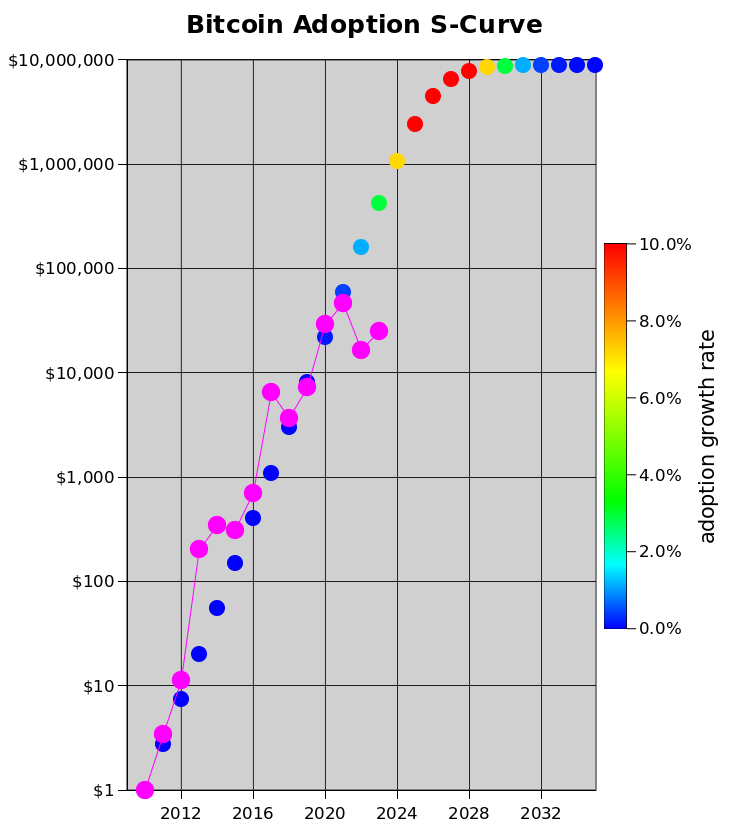

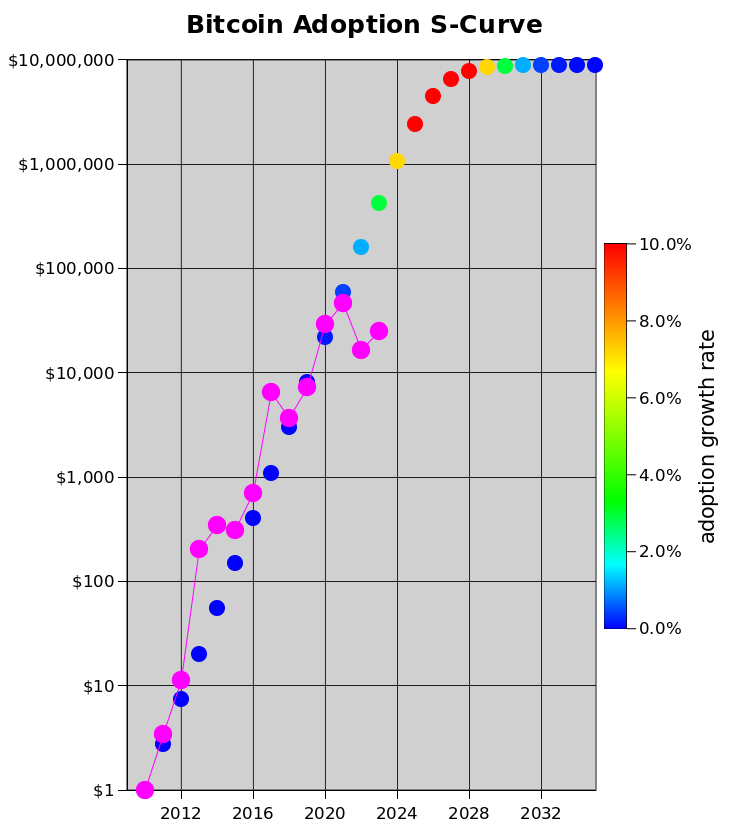

If bitcoin price jumped from $0 to $20k during 1% adoption .. then what will further adoption from 1% to 50% do with bitcoin price?

Bitcoin February closing price $23,145

Although I enjoyed bitcoin adoption last 10+ years (especially the investment returns), I am really looking forward to the vertical part of the S-curve in the next halving period (2024-2028)🚀

X (formerly Twitter)

PlanB (@100trillionUSD) on X

Although I enjoyed #bitcoin adoption last 10+ years (especially the investment returns), I am really looking forward to the vertical part of the S-...

Bitcoin S-curve .. vertical incoming

If bitcoin adoption is now 1-5% then we will enter the vertical of the S-curve next couple of years.

On log scale (left) this just means more exponential growth until 50% adoption. For the linear thinkers (right) everything will change. Bitcoin might be substantially undervalued.

X (formerly Twitter)

PlanB (@100trillionUSD) on X

If bitcoin adoption is now 1-5% then we will enter the vertical of the S-curve next couple of years.

On log scale (left) this just means more expon...

2024 halving will make bitcoin the scarcest asset in the world. Even if we wanted to price that in, we couldn't.

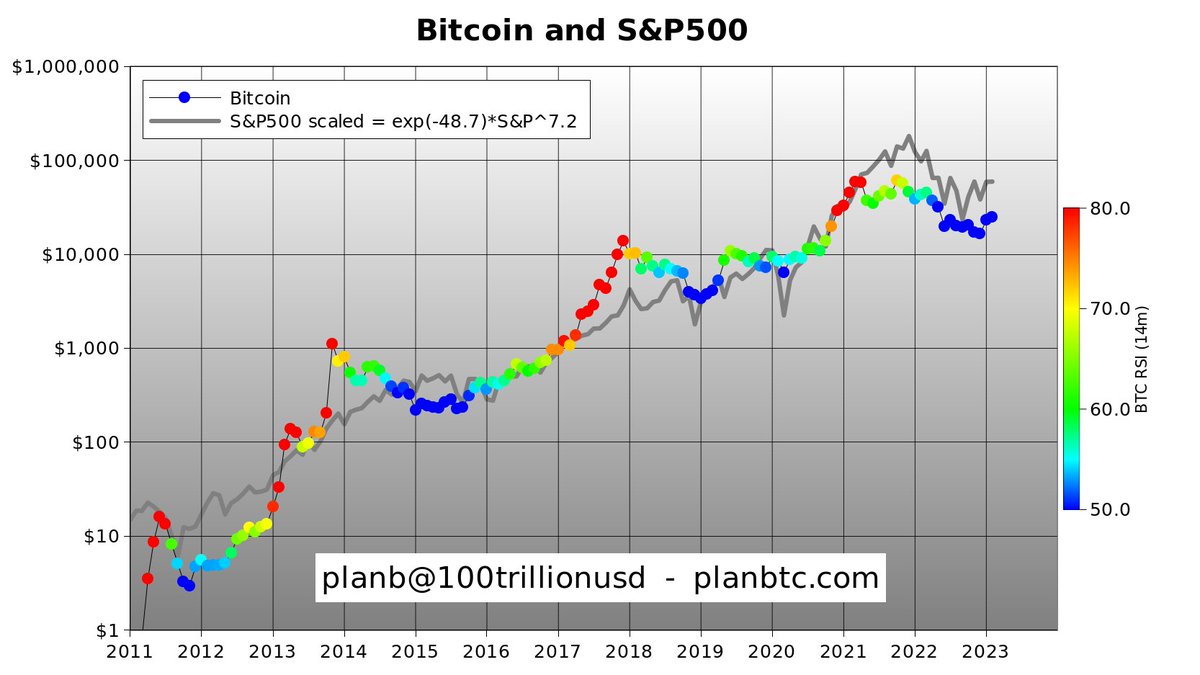

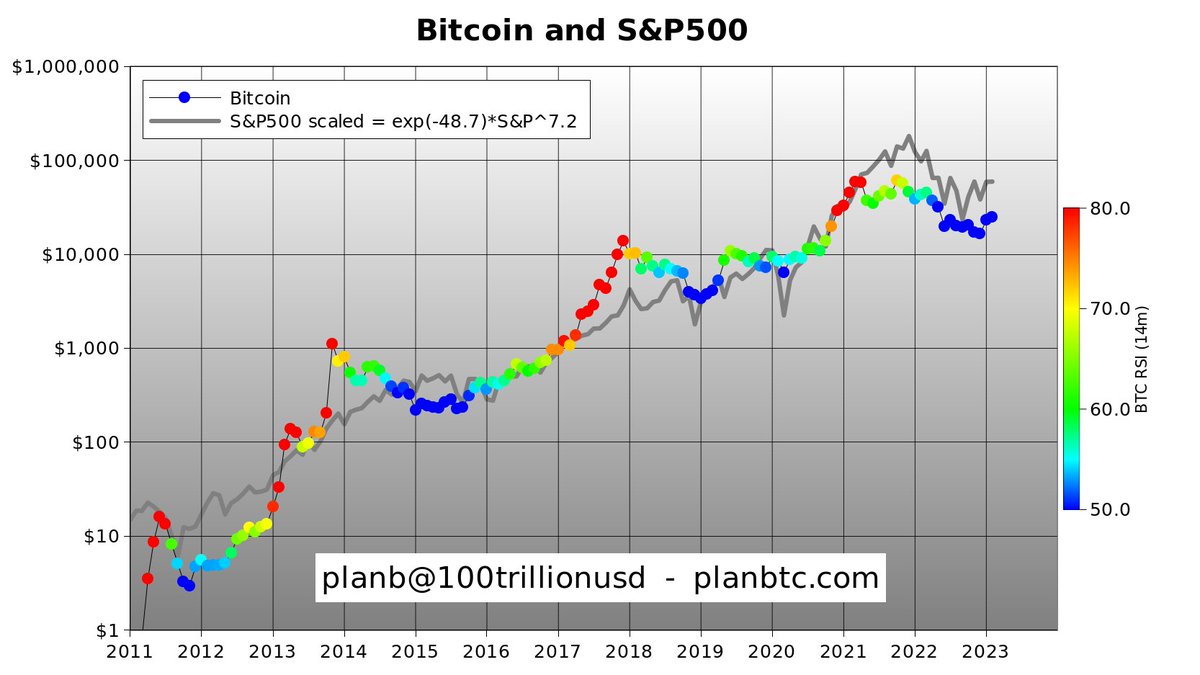

S&P500 is my macro proxy because stock markets price in / anticipate all macro events (inflation, recession, central bank action, war etc)

S&P500 is my macro proxy because stock markets price in / anticipate all macro events (inflation, recession, central bank action, war etc). More on S&P-BTC correlation here:

Stock-to-Flow model discussion:

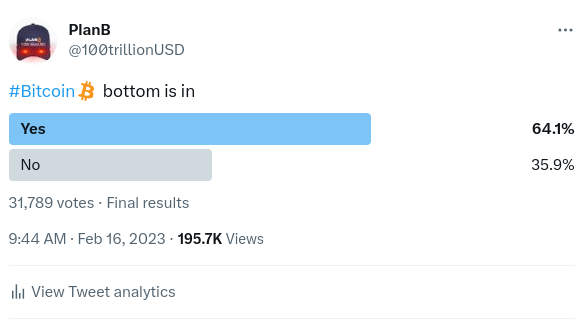

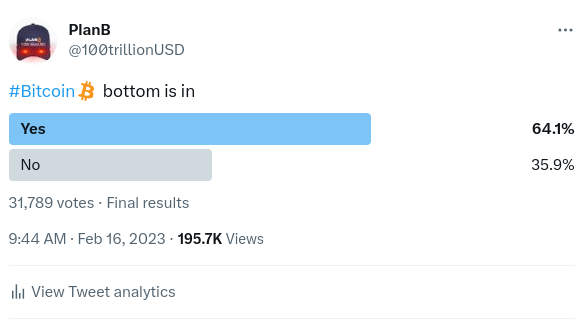

36% bears

Bitcoin Stock-to-Flow model

*NEW PlanB video on YouTube🔥

Last chance to buy below $25k?

Bitcoin = 13 ounces of Gold

Bitcoin halving is not so much about reduced supply and miner reward, but more about increased scarcity in the eyes of investors. 2024 halving will increase scarcity to stock-to-flow ratio 110 .. the world is not ready for a S2F110 asset! Discussion here:

2024 bitcoin halving not priced in, will pump price🚀