All eyes were on silver over the weekend, but with no volume, no liquidity, and all paper trading, gold stayed steady as the anchor. Don’t let silver’s wild swings fool you—it's just the little whining brother in this paper-traded duo!

Sliver going higher welcome to volatility!

₱ⱤØⱠł₣ł₵ JØł₦₮Ⱬ

prolificjointz@nostrplebs.com

npub1jv3t...lakg

Unlucky Kid 369 | Question Everything, Trust Nothing 🫡

I’m here to disrupt the status quo with my independent thoughts, strategic investments in digital assets, and a passion for all things cannabis 🌿. For me, code is law 👨💻. A staunch advocate of #Bitcoin ₿, I believe in the power of decentralized finance to transform our world.

As a crypto trader 📈 and the General of GSBAM 🪖, I navigate the volatile seas of digital currencies with precision and foresight. Fostering a community of like-minded individuals. Living life off experience 😎, I thrive on questioning conventions and forging my own path. I embrace the label {Pronouns} Asshole 🍩 because I refuse to be put in a 📦. I’m a strategist in the shadows 🕶, constantly analyzing, planning, and executing with precision.

✨ Motto: ‘Revolutionize the norm, master the chaos.’ ✨

I am also the owner of the “Wolves of Bitcoin” room 🐺 via Corny Chat

https://cornychat.com/Wolvesofbit

#Bitcoin investors when Saylor buys on monday

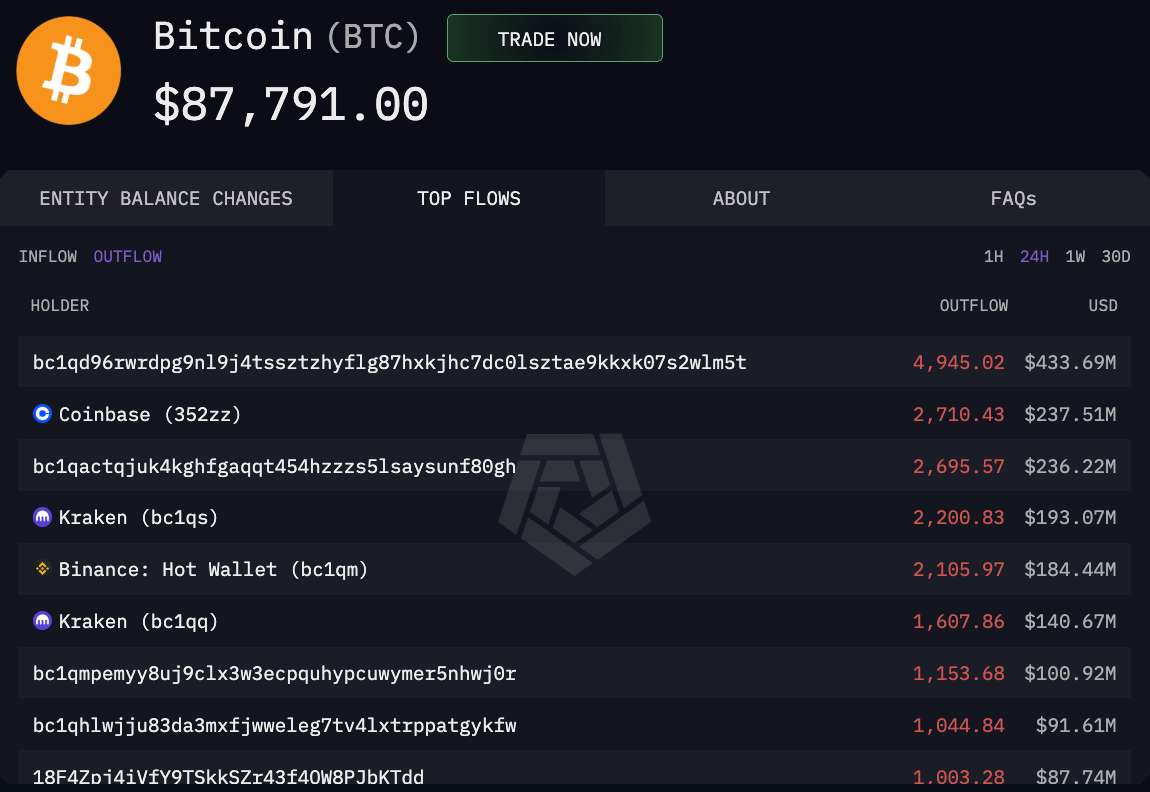

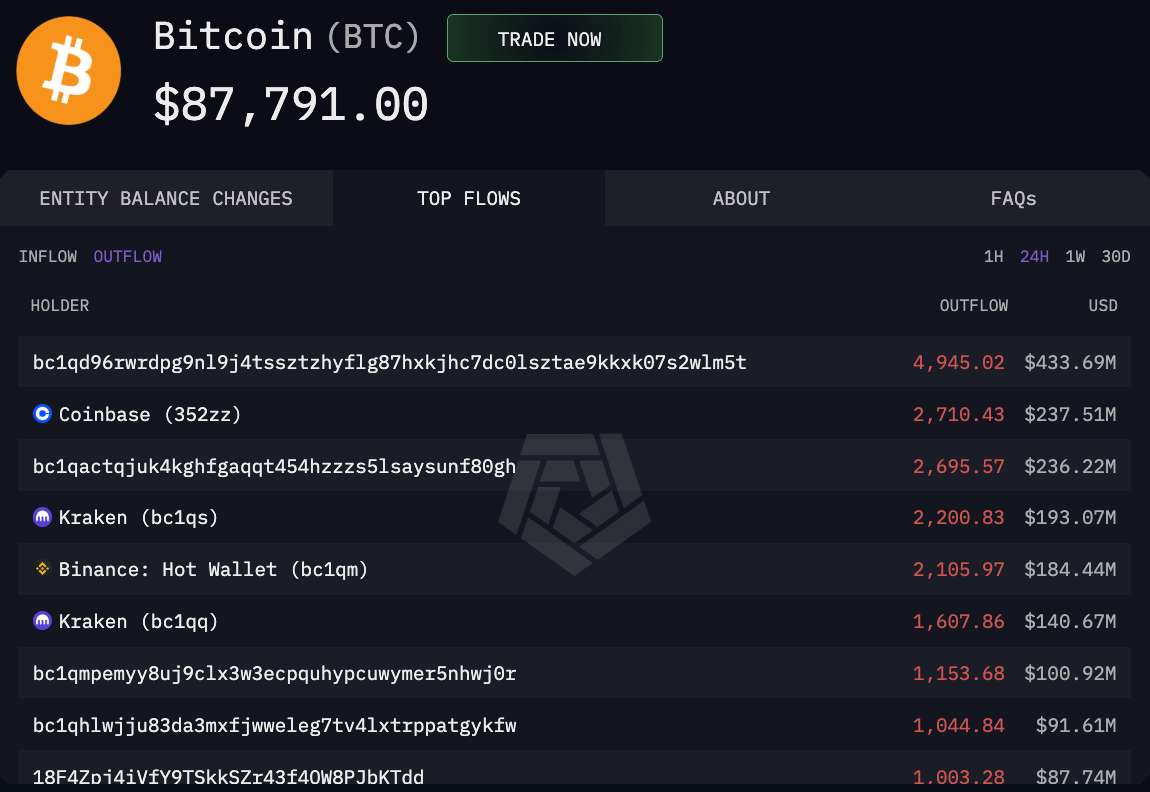

HUGE EXCHANGES AND FUNDS DUMPING MILLIONS OF $BTC DURING LOW LIQUIDITY TIME

THEY LIQUIDATED OVER $2.5B $BTC OVER THE LAST 10 HOURS AND CONTINUE SELLING MORE

WHAT IS GOING ON??

85 and oz in chinas export controls coming 🤣

🚨🚨MARGIN CALL🚨🚨

Is a Large Bullion Bank's Short Silver Position About to Be LIQUIDATED?

⚡️ MASSIVE $429M Call Option Placed on SILJ Moments Before Friday's Close!! ⚡️⚡️

⚡️Did a Bullion Bank Just Buy $429 MILLION in SILJ Silver Miner ETF Calls After Receiving a MARGIN CALL on its Naked Short Silver Position?? ⚡️

🔥Here's what we know:

🔥17 non-US banks were net short 43,084 COMEX silver contracts - (215.42 MILLION oz) prior to silver's parabolic move higher...and reportedly short HUNDREDS OF BILLIONS of oz via the OTC derivatives market.

🔥On Christmas Day, the physical price of silver shot past $80/oz in Shanghai.

That afternoon, SilverTrade warned readers that if COMEX allowed US silver prices to chase Shanghai price setting into the $80's, it would immediately DETONATE the global bullion banks' derivative books.

🔥Once Globex trading resumed Christmas night, silver futures prices gapped higher from $72 to over $74.

The silver squeeze had begun.

🔥At 8:30 Friday morning, the first signs of major stress in the banking system appeared as TBTF banks tapped the Fed's Repo Facility for $17.251 BILLION in emergency liquidity.

🔥As trading progressed Friday, Silver Prices EXPLODED 11% higher on the day, from $71.03 up to $79.70. Silver CLOSED even stronger in Shanghai at $84.97!

🔥Late Friday afternoon, rumors bagan swirling through the market that a large bullion bank was unable to meet a massive MARGIN CALL it had just received over its naked short silver position.

⚡️This means the silver short position would be LIQUIDATED. Unrealized losses immediately MARKED TO MARKET.

🔥At exactly 3:52 pm EST Friday, someone bought $429 MILLION of Silver Miners ETF $SILJ Calls, the majority expiring in only 3 weeks- January 16, 2026.

🔥Only 8 minutes before the close, after silver had ALREADY soared to nearly $80/oz, someone placed a GARGANUTAN $429 MILLION BET on JUNIOR SILVER MINERS placing a huge rally within the next 3 weeks.

⚡️Let's put this number in perspective.

The ENTIRE MARKET CAP of SILJ is $2.67 Billion.

🔥A single entity placed a MASSIVE DIRECTIONAL $429 M BET ON THE SILJ SILVER JUNIOR MINERS ETF with a $2.67 B market cap THAT EXPIRES IN 3 WEEKS.

⚡️8 minutes before the close.

⚡️After a large bullion bank naked short silver reportedly received a margin call it couldn't meet over its silver short position.

🚨Knowing that it couldn't meet its end of day MARGIN CALL in 8 minutes- meaning its legacy silver short position would be⚡️ LIQUIDATED ⚡️the moment silver futures resume trading Sunday night - and KNOWING that liquidating its MASSIVE naked short silver position would cause the MOTHER OF ALL SHORT SQUEEZES, did this bullion bank attempt to save itself by placing a massively leveraged LONG BET on the SILJ Silver Junior Miners ETF?

🔥🔥Because this bank KNOWS that global silver prices are about to be MASSIVELY repriced higher as the bullion banks have lost control of the silver market, and their naked short silver positions are being FORCE LIQUIDATED??

These are the facts. Are we looking at a strange string of coincidences?

Or is a large bullion bank's legacy silver short position about to be LIQUIDATED the moment trading resumes Sunday night?

Make your own conclusion.

What’s happening in silver is a distribution unwind after a failed breakout.

If Bitcoin mirrors this in reverse, it implies a blow-off → liquidity grab → repricing lower, not a slow bleed.

Markets fall faster than they rise because leverage unwinds, bids disappear, and volatility expands.

That means time compresses, moves that took months to build can resolve in weeks or days.

Same structure, opposite direction, faster clock.

Many in the Bitcoin community fall into the trap of hype over fundamentals. Remember: it's all about balancing price and value. Don't just follow the herd. Buy low, sell high. #InvestingWisdom #Bitcoin

Who's ready for new years 🤪

Now this would be a dope Christmas gift 😎

We need that same demand for metals as we do for bitcoin in order for it to give it yall million dollar btc. But obviously investors see it differently

Lets be real since 2018 gold market cap was around 8 trillion today we are sitting at 31.5 trillion

Some literally from then to now add almost 23.5 trillion wasn't bitcoin supposed to do this ?

https://nostr.download/f12e6a44638ff3997c866ddb10c0dc431984b9f103a83a452696268c8f8db25c.jpgq

https://nostr.download/f12e6a44638ff3997c866ddb10c0dc431984b9f103a83a452696268c8f8db25c.jpgq

https://nostr.download/f12e6a44638ff3997c866ddb10c0dc431984b9f103a83a452696268c8f8db25c.jpgq

https://nostr.download/f12e6a44638ff3997c866ddb10c0dc431984b9f103a83a452696268c8f8db25c.jpgqJapan’s bond market has been breaking for decades.

Now rates are rising and the debt bill is coming due.

Japan is a major holder of U.S. assets, so this hits your stocks, your savings, and Bitcoin.

Most won’t notice until it’s too late.

Calling all @Nice and Kind Vic lol

yoo