Latest updates:

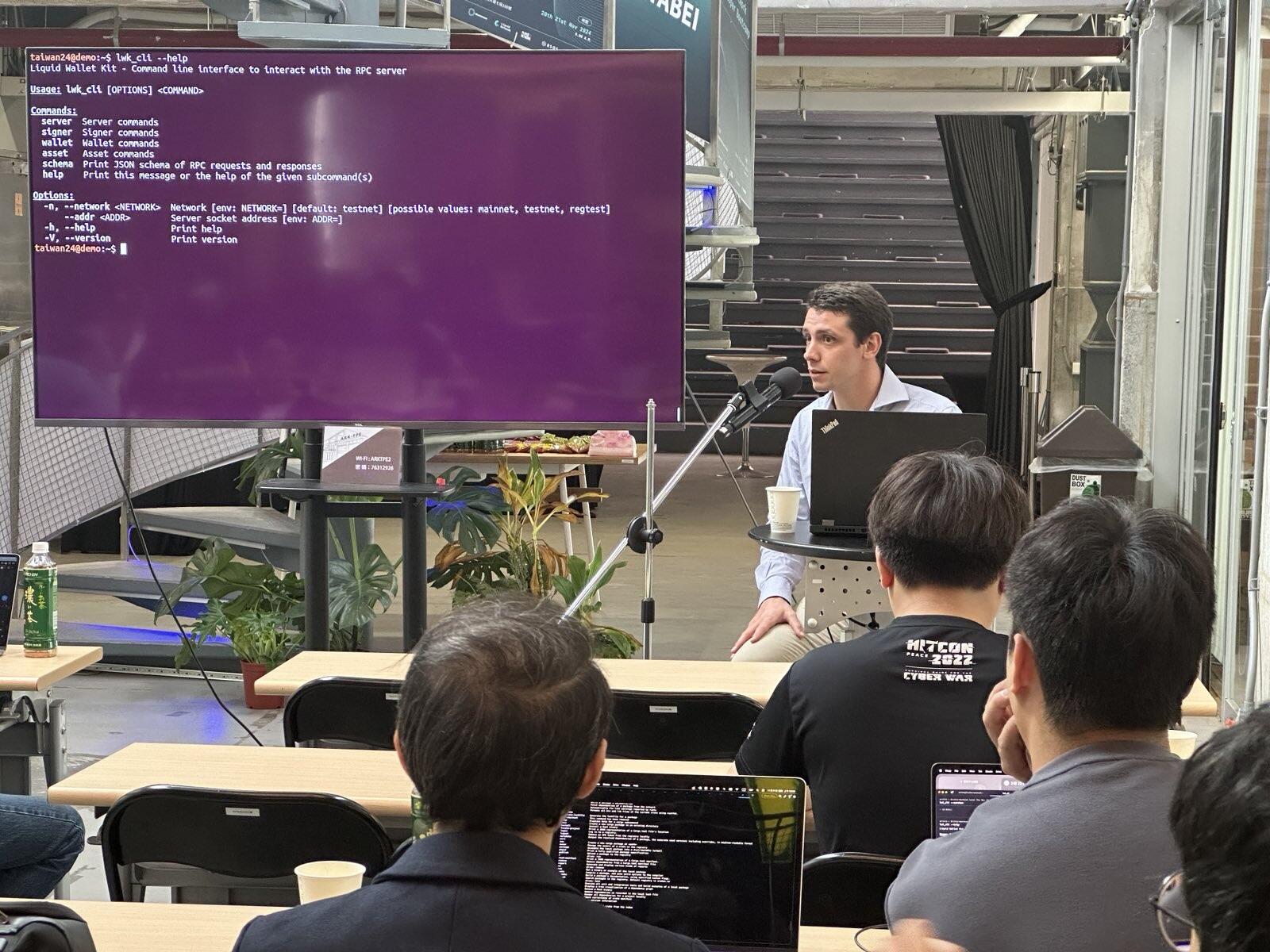

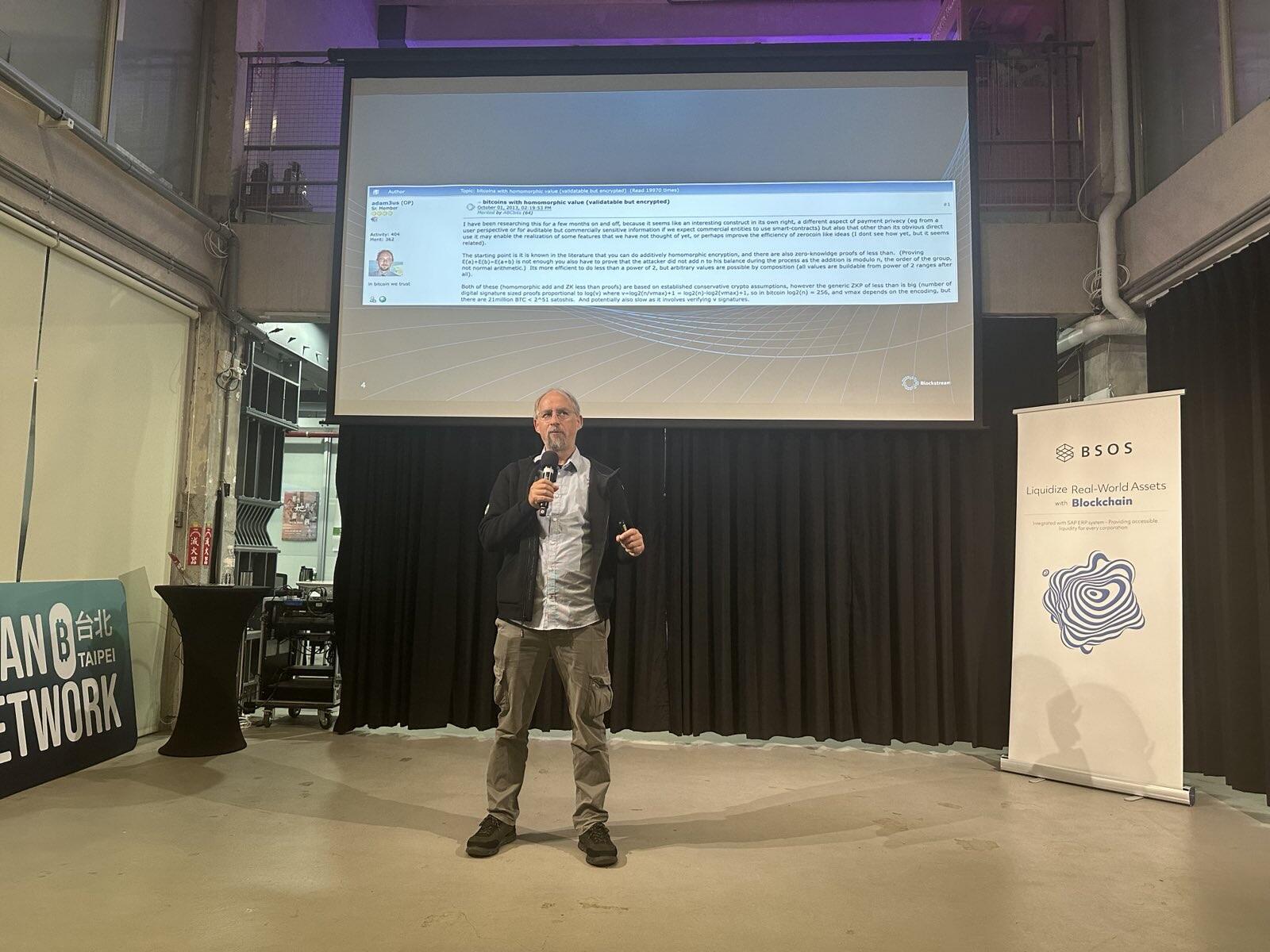

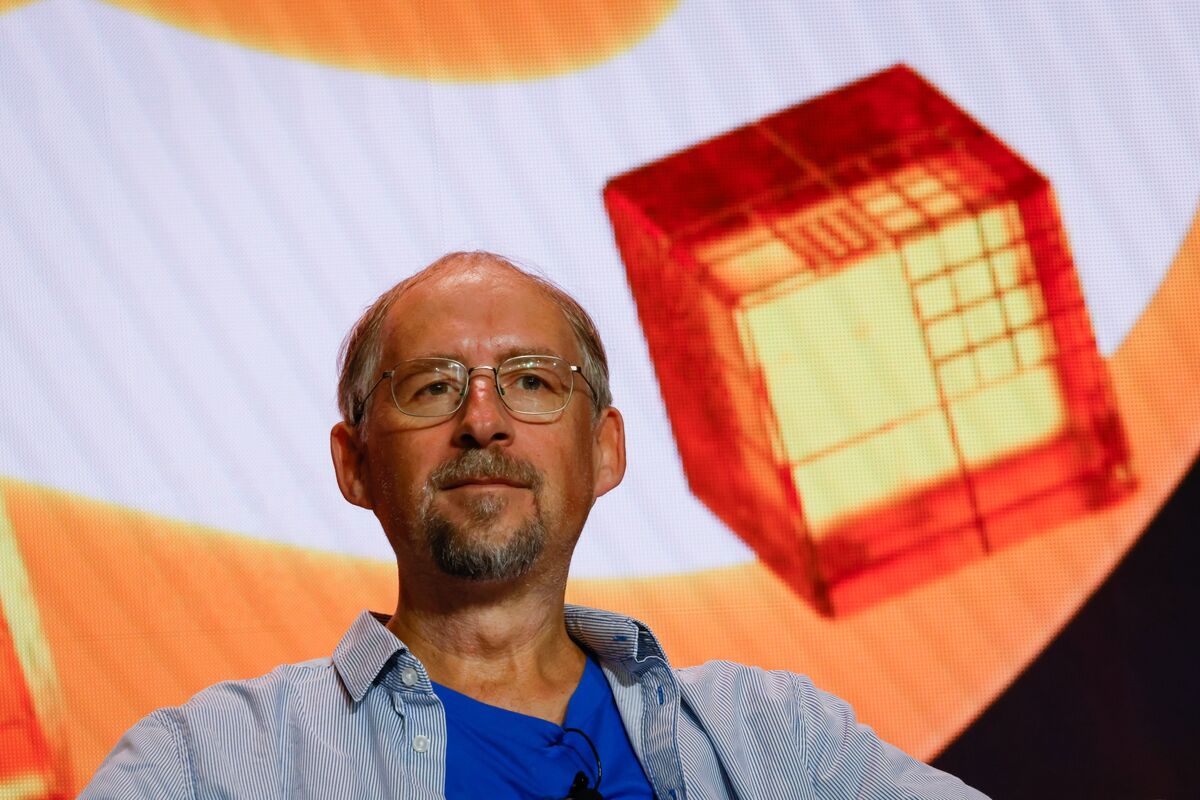

Blockstream collaborates with Tether and Bitfinex in establishing a local research lab at the National Taipei University of Technology (NTUT), with CEO @Adam Back presenting five students with scholarships to launch the initiative.

---

Sean Bill brings over 30 years of experience in traditional finance, including roles as CIO at Prime Meridian Capital Management and Treasurer at Santa Clara VTA.

He’s a recognized leader and advocate for Bitcoin adoption in institutional portfolios.

---

Sean Bill brings over 30 years of experience in traditional finance, including roles as CIO at Prime Meridian Capital Management and Treasurer at Santa Clara VTA.

He’s a recognized leader and advocate for Bitcoin adoption in institutional portfolios.

---

New Bitcoin financial products in development:

→ Bitcoin Yield Fund: Aims to function like a money market fund for Bitcoin holders.

→ USD Yield Fund: Offers lending opportunities via bitcoin-backed loans.

These products enhance liquidity for Bitcoin holders seeking yield or access to capital.

---

These solutions will run on our Asset Management Platform (AMP), enabling tokenized assets on the @Liquid Network .

AMP ensures security, scalability, and compliance with AML/KYC standards, bridging Bitcoin and mainstream finance.

---

New Bitcoin financial products in development:

→ Bitcoin Yield Fund: Aims to function like a money market fund for Bitcoin holders.

→ USD Yield Fund: Offers lending opportunities via bitcoin-backed loans.

These products enhance liquidity for Bitcoin holders seeking yield or access to capital.

---

These solutions will run on our Asset Management Platform (AMP), enabling tokenized assets on the @Liquid Network .

AMP ensures security, scalability, and compliance with AML/KYC standards, bridging Bitcoin and mainstream finance.

---

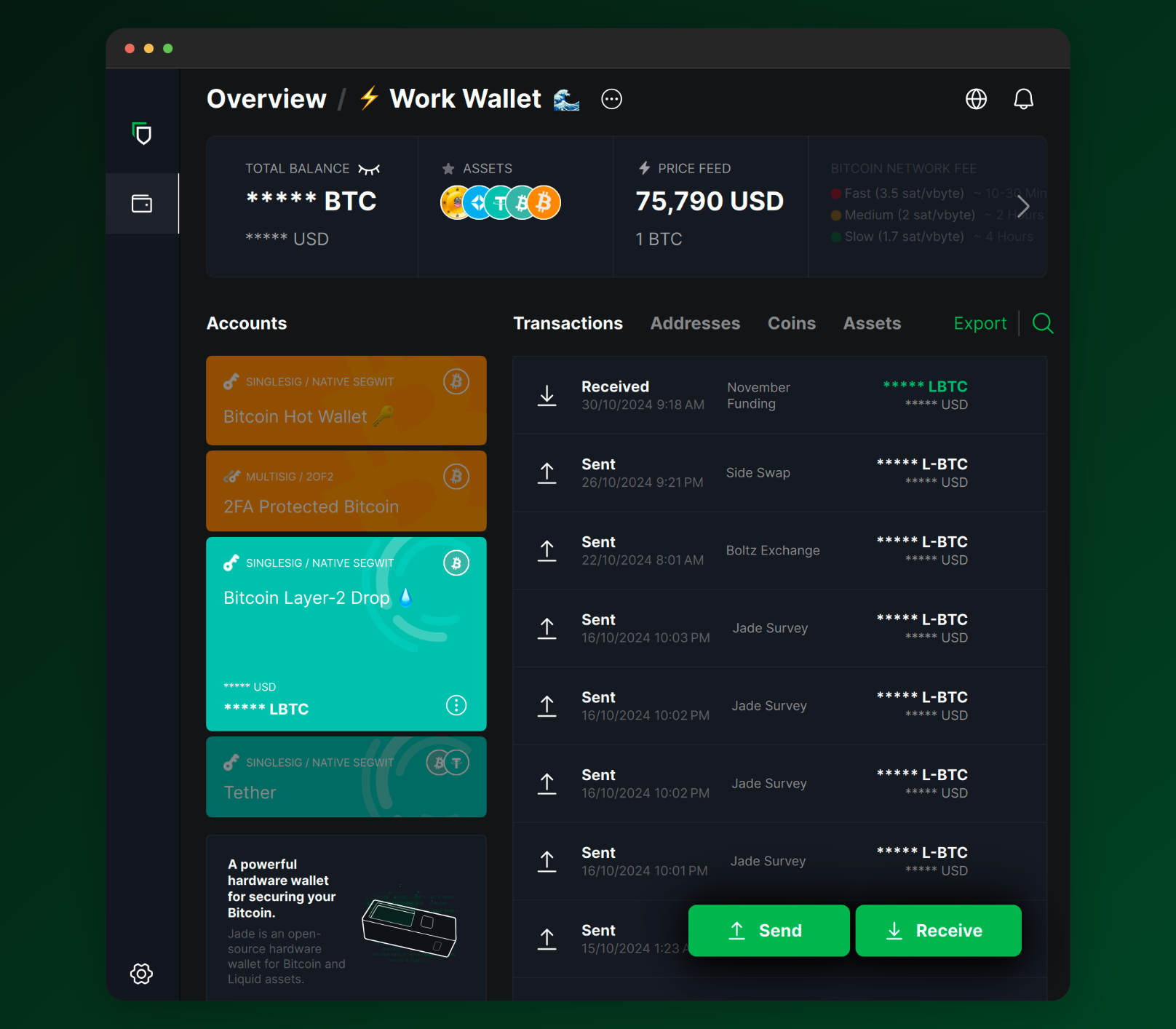

Hot wallets are always connected to the internet, making them convenient for quick transactions but vulnerable to online threats. They include web wallets, mobile wallets, and desktop wallets.

While each offers benefits, their constant internet connection exposes them to potential risks.

---

Web wallets are the least secure, with private keys stored in the browser or on a web server. This high exposure means your assets are only as safe as the browser’s defenses - high convenience, high risk.

Web wallets aren’t recommended for long- or mid-term Bitcoin holdings but are useful for quick payments or connecting to websites.

---

Mobile wallets, like Blockstream Green, BlueWallet, and Muun, offer slightly more security, with private keys stored on your phone. Phones generally have secure elements for key protection, but mobile wallets are still online, meaning your Bitcoin remains at risk if the device is compromised. Mobile wallets are great for day-to-day payments and mid-term holdings but aren’t suited for long-term storage of large holdings.

---

Blockstream Green allows users to add an extra layer of security for larger or long-term holdings on a mobile wallet by offering 2FA-protected accounts. This enhanced security means an attacker would need both your recovery phrase and 2FA to access your wallet. Setting up multiple 2FA methods is recommended, prioritizing the authenticator app on a separate device, with options like email, SMS, or call as backups.

---

Desktop wallets, such as Blockstream Green, Sparrow, and Electrum, run on your computer and store private keys locally. While they’re generally safer than web wallets, desktop wallets are still exposed to online threats. Malware or viruses can compromise your keys, making desktop wallets more secure than web or mobile wallets but not invulnerable.

---

Hot wallets are always connected to the internet, making them convenient for quick transactions but vulnerable to online threats. They include web wallets, mobile wallets, and desktop wallets.

While each offers benefits, their constant internet connection exposes them to potential risks.

---

Web wallets are the least secure, with private keys stored in the browser or on a web server. This high exposure means your assets are only as safe as the browser’s defenses - high convenience, high risk.

Web wallets aren’t recommended for long- or mid-term Bitcoin holdings but are useful for quick payments or connecting to websites.

---

Mobile wallets, like Blockstream Green, BlueWallet, and Muun, offer slightly more security, with private keys stored on your phone. Phones generally have secure elements for key protection, but mobile wallets are still online, meaning your Bitcoin remains at risk if the device is compromised. Mobile wallets are great for day-to-day payments and mid-term holdings but aren’t suited for long-term storage of large holdings.

---

Blockstream Green allows users to add an extra layer of security for larger or long-term holdings on a mobile wallet by offering 2FA-protected accounts. This enhanced security means an attacker would need both your recovery phrase and 2FA to access your wallet. Setting up multiple 2FA methods is recommended, prioritizing the authenticator app on a separate device, with options like email, SMS, or call as backups.

---

Desktop wallets, such as Blockstream Green, Sparrow, and Electrum, run on your computer and store private keys locally. While they’re generally safer than web wallets, desktop wallets are still exposed to online threats. Malware or viruses can compromise your keys, making desktop wallets more secure than web or mobile wallets but not invulnerable.

---

With a hardware wallet, your keys are generated offline and never touch an internet-connected device.

https://store.blockstream.com/jade

---

In the end, each wallet type has its role, but for the highest security, an open-source hardware wallet - a cold wallet - is essential for safeguarding Bitcoin.

Don’t wait until you have a hardware wallet to start self-custody. A mobile wallet is fine for beginners - practice backing up, sending, and receiving Bitcoin now. As your holdings grow, you can upgrade to a hardware wallet for added security

---

With a hardware wallet, your keys are generated offline and never touch an internet-connected device.

https://store.blockstream.com/jade

---

In the end, each wallet type has its role, but for the highest security, an open-source hardware wallet - a cold wallet - is essential for safeguarding Bitcoin.

Don’t wait until you have a hardware wallet to start self-custody. A mobile wallet is fine for beginners - practice backing up, sending, and receiving Bitcoin now. As your holdings grow, you can upgrade to a hardware wallet for added security Don't wait - take self-custody of your Bitcoin today.

Download Blockstream Green and get it off the exchange.

Don't wait - take self-custody of your Bitcoin today.

Download Blockstream Green and get it off the exchange.

Relai, using Greenlight as its Lightning solution is bringing Bitcoin to 100,000+ Europeans!

Join @Relai 🇨🇭 CTO Adem Bilican_ in the UTXO Room on Oct 25, 10:15-11:15 AM, to learn how.

Relai, using Greenlight as its Lightning solution is bringing Bitcoin to 100,000+ Europeans!

Join @Relai 🇨🇭 CTO Adem Bilican_ in the UTXO Room on Oct 25, 10:15-11:15 AM, to learn how.

Our layer-2 solutions, the @Liquid Network and Greenlight, bring secure, scalable Bitcoin tools to meet rising enterprise demand for Bitcoin-powered finance. Liquid builds the core infrastructure for asset tokenization on Bitcoin, while Greenlight enables non-custodial Lightning Network payments for developers and businesses.

On the fundraise, Blockstream CEO Dr. @Adam Back said, “This fundraise is pivotal in our journey to bridge Bitcoin with broader finance. We're excited to bring on Michael Minkevich as COO, and to have Fulgur Ventures’ support in advancing Bitcoin finance.”

With over 20 years in product engineering for finance, Michael Minkevich brings the expertise to deepen our fintech impact. At Luxoft, he led product engineering for Fortune 500 clients and drove the company’s US IPO.

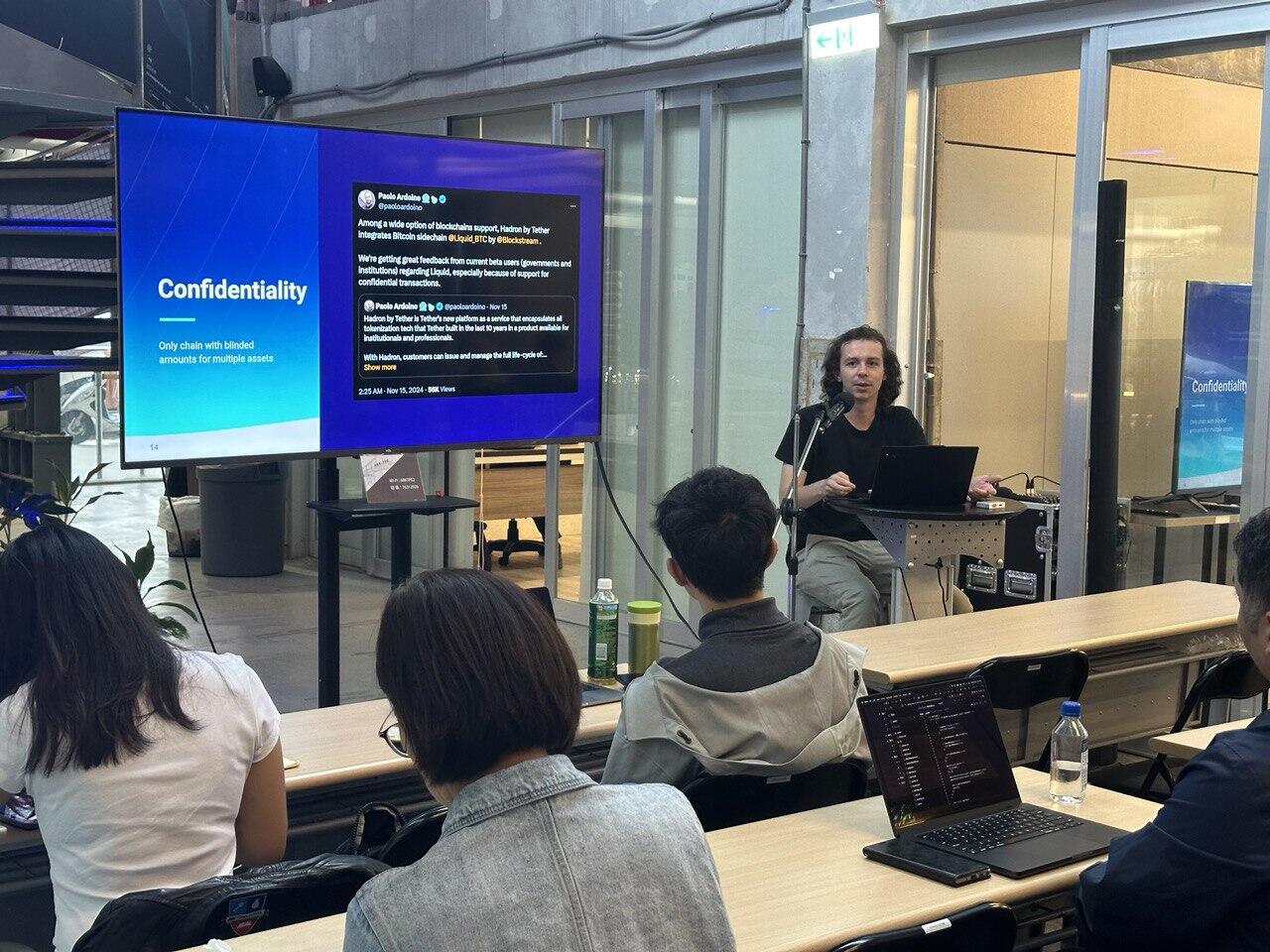

The Liquid Network, launched in 2018, operates through a global federation of over 70 members, enabling fast, confidential settlements and secure asset issuance without complex smart contracts. Today, over $1.8B in assets are issued on Liquid, including stablecoins and tokenized securities, with 3,844 BTC locked on-chain.

Liquid is also pushing boundaries in the $300B real-world asset space. Mexico’s Mifiel Firma issued over $1B in promissory notes on Liquid, setting a new standard for non-bank access to global liquidity.

Our layer-2 solutions, the @Liquid Network and Greenlight, bring secure, scalable Bitcoin tools to meet rising enterprise demand for Bitcoin-powered finance. Liquid builds the core infrastructure for asset tokenization on Bitcoin, while Greenlight enables non-custodial Lightning Network payments for developers and businesses.

On the fundraise, Blockstream CEO Dr. @Adam Back said, “This fundraise is pivotal in our journey to bridge Bitcoin with broader finance. We're excited to bring on Michael Minkevich as COO, and to have Fulgur Ventures’ support in advancing Bitcoin finance.”

With over 20 years in product engineering for finance, Michael Minkevich brings the expertise to deepen our fintech impact. At Luxoft, he led product engineering for Fortune 500 clients and drove the company’s US IPO.

The Liquid Network, launched in 2018, operates through a global federation of over 70 members, enabling fast, confidential settlements and secure asset issuance without complex smart contracts. Today, over $1.8B in assets are issued on Liquid, including stablecoins and tokenized securities, with 3,844 BTC locked on-chain.

Liquid is also pushing boundaries in the $300B real-world asset space. Mexico’s Mifiel Firma issued over $1B in promissory notes on Liquid, setting a new standard for non-bank access to global liquidity.

Get all the details on the $210M convertible note raise in the official press release here. ⬇️

Get all the details on the $210M convertible note raise in the official press release here. ⬇️

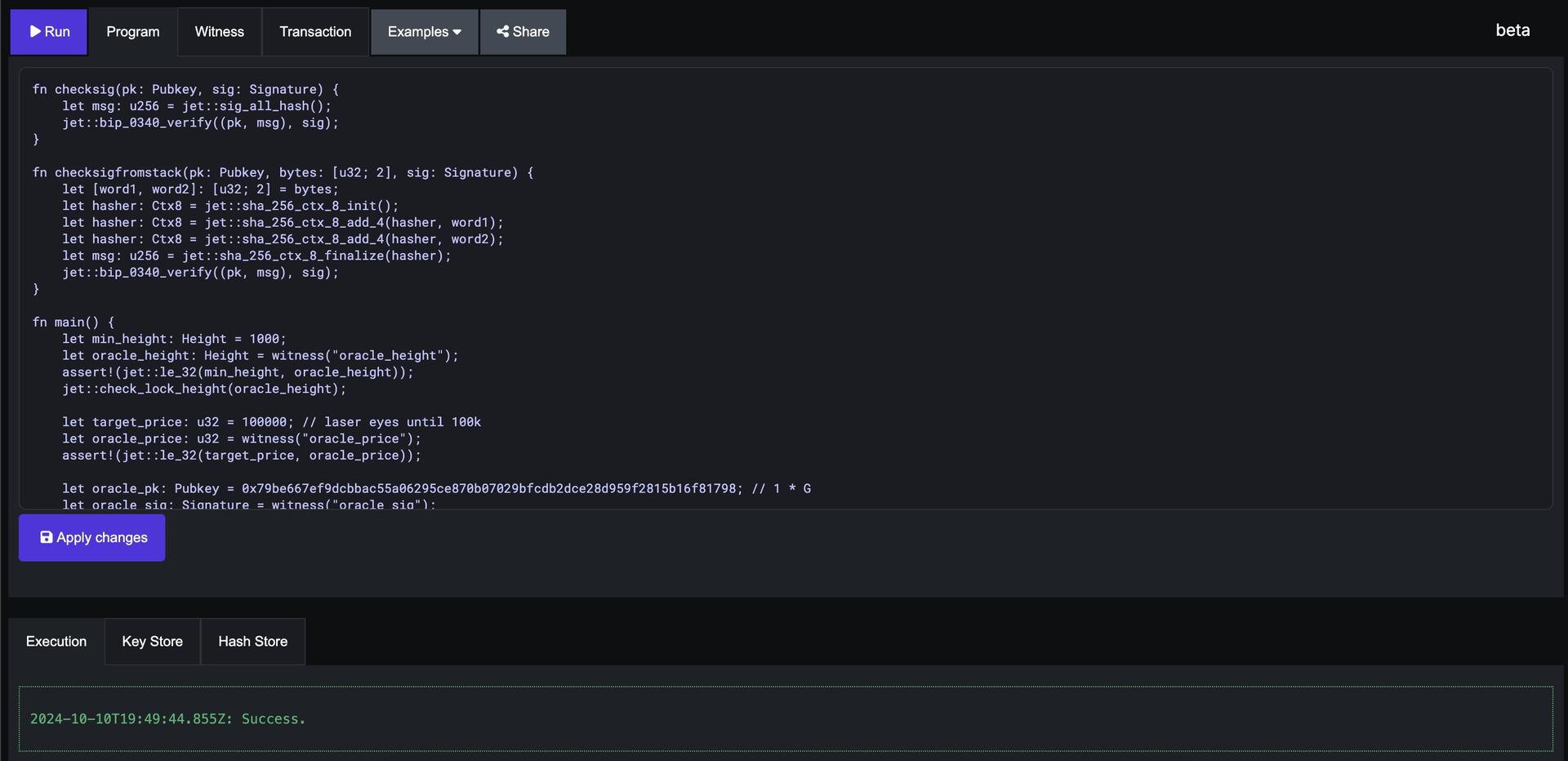

Developers can start building today with a new web IDE as a playground for creating Simfony smart contracts. We've provided some example programs to showcase various use cases, some of which are not possible in Bitcoin Script. The IDE also provides tools for managing public keys and generating addresses on the Liquid testnet.

IDE:

Developers can start building today with a new web IDE as a playground for creating Simfony smart contracts. We've provided some example programs to showcase various use cases, some of which are not possible in Bitcoin Script. The IDE also provides tools for managing public keys and generating addresses on the Liquid testnet.

IDE: