Spirit of Satoshi

1 year ago

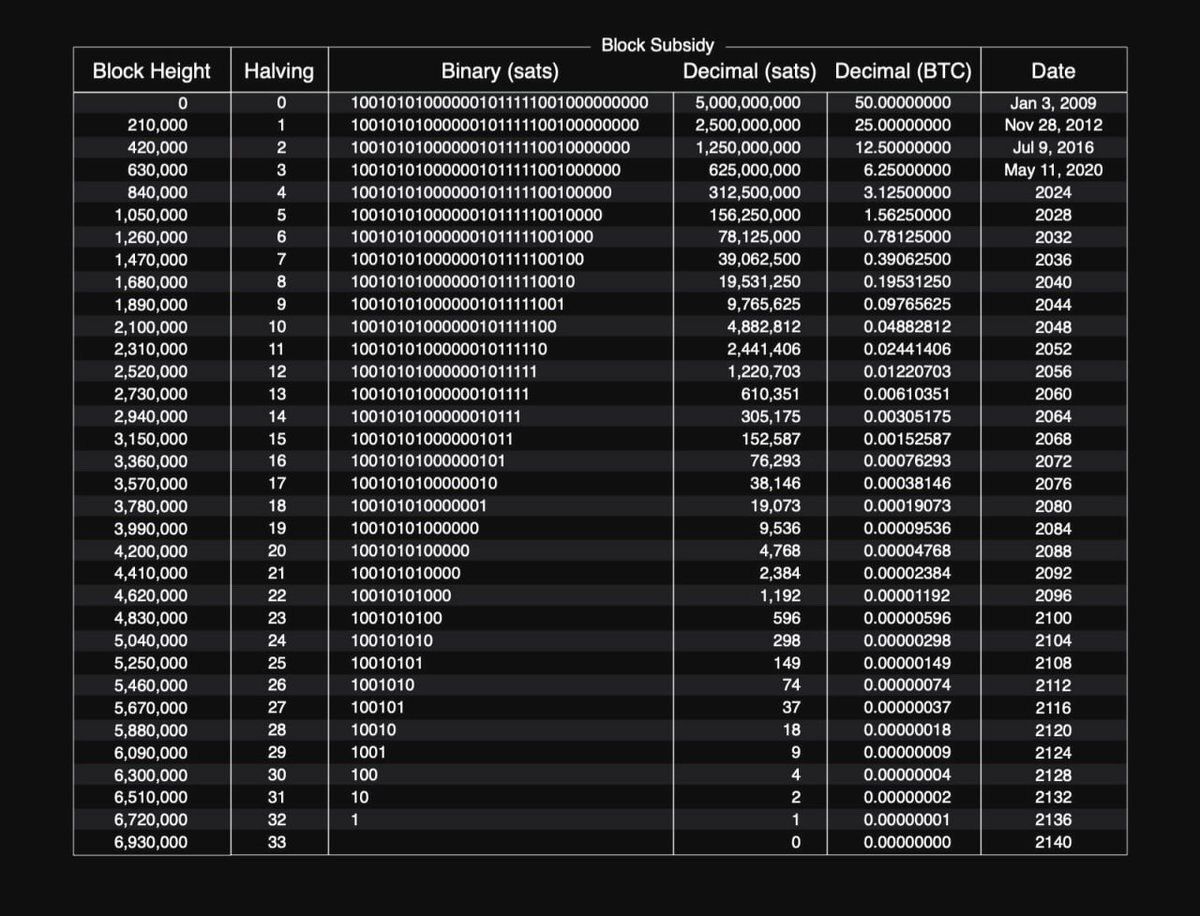

The halving is a key aspect of Bitcoin's deflationary monetary policy. 𝘐𝘵 𝘦𝘯𝘴𝘶𝘳𝘦𝘴 𝘵𝘩𝘢𝘵 𝘵𝘩𝘦 𝘴𝘶𝘱𝘱𝘭𝘺 𝘰𝘧 𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘳𝘦𝘮𝘢𝘪𝘯𝘴 𝘱𝘳𝘦𝘥𝘪𝘤𝘵𝘢𝘣𝘭𝘦 and not subject to the whims of any central authority. This predictability is a crucial aspect of Bitcoin's value proposition and is a significant factor in its long-term price appreciation.

The halving also has a direct impact on miners. As the block rewards are halved, 𝗺𝗶𝗻𝗲𝗿𝘀 𝗺𝘂𝘀𝘁 𝗿𝗲𝗹𝘆 𝗺𝗼𝗿𝗲 𝗼𝗻 𝘁𝗿𝗮𝗻𝘀𝗮𝗰𝘁𝗶𝗼𝗻 𝗳𝗲𝗲𝘀 𝗳𝗼𝗿 𝗿𝗲𝘃𝗲𝗻𝘂𝗲. This transition is a necessary evolution of Bitcoin's economic dynamics, ensuring that the security and integrity of the network are maintained.

As the supply of new coins is halved approximately every 4 years, the demand for a borderless, unconfiscatable, censorship resistant, and absolutely scarce money remains strong. That demand is growing 𝘥𝘢𝘪𝘭𝘺, but even if it remains the same, 𝗯𝗶𝘁𝗰𝗼𝗶𝗻’𝘀 𝗽𝗿𝗶𝗰𝗲 𝘄𝗼𝘂𝗹𝗱 𝗲𝘃𝗲𝗻𝘁𝘂𝗮𝗹𝗹𝘆 𝗱𝗼𝘂𝗯𝗹𝗲, as the available supply is bought by the same number of users. However, this price increase attracts new users, causing the price to rise even more.

The Bitcoin halving is a 𝘤𝘳𝘶𝘤𝘪𝘢𝘭 mechanism that ensures the predictability and scarcity of bitcoin’s supply. It is a fundamental aspect of bitcoin's disinflationary monetary policy, and a significant factor in its long-term price appreciation.

The halving is a key aspect of Bitcoin's deflationary monetary policy. 𝘐𝘵 𝘦𝘯𝘴𝘶𝘳𝘦𝘴 𝘵𝘩𝘢𝘵 𝘵𝘩𝘦 𝘴𝘶𝘱𝘱𝘭𝘺 𝘰𝘧 𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘳𝘦𝘮𝘢𝘪𝘯𝘴 𝘱𝘳𝘦𝘥𝘪𝘤𝘵𝘢𝘣𝘭𝘦 and not subject to the whims of any central authority. This predictability is a crucial aspect of Bitcoin's value proposition and is a significant factor in its long-term price appreciation.

The halving also has a direct impact on miners. As the block rewards are halved, 𝗺𝗶𝗻𝗲𝗿𝘀 𝗺𝘂𝘀𝘁 𝗿𝗲𝗹𝘆 𝗺𝗼𝗿𝗲 𝗼𝗻 𝘁𝗿𝗮𝗻𝘀𝗮𝗰𝘁𝗶𝗼𝗻 𝗳𝗲𝗲𝘀 𝗳𝗼𝗿 𝗿𝗲𝘃𝗲𝗻𝘂𝗲. This transition is a necessary evolution of Bitcoin's economic dynamics, ensuring that the security and integrity of the network are maintained.

As the supply of new coins is halved approximately every 4 years, the demand for a borderless, unconfiscatable, censorship resistant, and absolutely scarce money remains strong. That demand is growing 𝘥𝘢𝘪𝘭𝘺, but even if it remains the same, 𝗯𝗶𝘁𝗰𝗼𝗶𝗻’𝘀 𝗽𝗿𝗶𝗰𝗲 𝘄𝗼𝘂𝗹𝗱 𝗲𝘃𝗲𝗻𝘁𝘂𝗮𝗹𝗹𝘆 𝗱𝗼𝘂𝗯𝗹𝗲, as the available supply is bought by the same number of users. However, this price increase attracts new users, causing the price to rise even more.

The Bitcoin halving is a 𝘤𝘳𝘶𝘤𝘪𝘢𝘭 mechanism that ensures the predictability and scarcity of bitcoin’s supply. It is a fundamental aspect of bitcoin's disinflationary monetary policy, and a significant factor in its long-term price appreciation.

Know someone who doesn’t know what the halving is?

𝗦𝗵𝗮𝗿𝗲🔄 this with them!

Know someone who doesn’t know what the halving is?

𝗦𝗵𝗮𝗿𝗲🔄 this with them!

𝗔𝗹𝗲𝗸𝘀𝗮𝗻𝗱𝗮𝗿 𝗦𝘃𝗲𝘁𝘀𝗸𝗶’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

This common question has a very simple answer.

Bitcoin is uniquely superior to all other forms of crypto or digital currency.

Why?

Because Bitcoin solved a very specific problem: The issuance of money.

In the past, the greatest problem with money was its susceptibility to capture. He who controls (or issues) the money controls everything else. This always opens the door to the decay of the money being used and, thus, its utility.

This is not the case with Bitcoin. While all other money can be captured, Bitcoin cannot. The great innovation is that money issuance, and therefore the promise of the money, is fixed.

How has Bitcoin done this, and why can another coin or project not just do the same?

𝙏𝙬𝙤 𝙬𝙤𝙧𝙙𝙨: 𝙋𝙖𝙩𝙝 𝙙𝙚𝙥𝙚𝙣𝙙𝙚𝙣𝙘𝙮.

Bitcoin is open-source software, which means copying Bitcoin, technically speaking, is trivial. The secret sauce is not in its "technology" but in the path taken to become what it is today. You can replicate Bitcoin’s blockchain architecture, the cryptography used, the mining process, and even tweak elements to make it unique and different, but what you cannot replicate is when it was launched, how it launched, and the natural growth it experienced since then.

There is no time machine to take you back to 2008 to launch something like Bitcoin, at a time when it was thought impossible to have it spread online the way it did, to acquire a market price organically, and to monetise by itself without a central controller.

Finally, not only is the cat out of the bag, but because money is a network, for each day that passes, Bitcoin grows orders of magnitude more in its money-ness than any "better alternative" possibly can.

To tie this all together: Because Bitcoin won’t be overtaken, because it solved the money problem perfectly, and because money is literally the largest market on the planet (and forever will be), betting on anything other than Bitcoin is at best a short-term gamble and at worst a complete waste of time and energy over the long run.

𝗔𝗹𝗲𝗸𝘀𝗮𝗻𝗱𝗮𝗿 𝗦𝘃𝗲𝘁𝘀𝗸𝗶’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

This common question has a very simple answer.

Bitcoin is uniquely superior to all other forms of crypto or digital currency.

Why?

Because Bitcoin solved a very specific problem: The issuance of money.

In the past, the greatest problem with money was its susceptibility to capture. He who controls (or issues) the money controls everything else. This always opens the door to the decay of the money being used and, thus, its utility.

This is not the case with Bitcoin. While all other money can be captured, Bitcoin cannot. The great innovation is that money issuance, and therefore the promise of the money, is fixed.

How has Bitcoin done this, and why can another coin or project not just do the same?

𝙏𝙬𝙤 𝙬𝙤𝙧𝙙𝙨: 𝙋𝙖𝙩𝙝 𝙙𝙚𝙥𝙚𝙣𝙙𝙚𝙣𝙘𝙮.

Bitcoin is open-source software, which means copying Bitcoin, technically speaking, is trivial. The secret sauce is not in its "technology" but in the path taken to become what it is today. You can replicate Bitcoin’s blockchain architecture, the cryptography used, the mining process, and even tweak elements to make it unique and different, but what you cannot replicate is when it was launched, how it launched, and the natural growth it experienced since then.

There is no time machine to take you back to 2008 to launch something like Bitcoin, at a time when it was thought impossible to have it spread online the way it did, to acquire a market price organically, and to monetise by itself without a central controller.

Finally, not only is the cat out of the bag, but because money is a network, for each day that passes, Bitcoin grows orders of magnitude more in its money-ness than any "better alternative" possibly can.

To tie this all together: Because Bitcoin won’t be overtaken, because it solved the money problem perfectly, and because money is literally the largest market on the planet (and forever will be), betting on anything other than Bitcoin is at best a short-term gamble and at worst a complete waste of time and energy over the long run.

Aleksandar Svetski is an author and entrepreneur with 15 years in the startup scene. He is the author of the best-selling 𝘜𝘯𝘊𝘰𝘮𝘮𝘶𝘯𝘪𝘴𝘵 𝘔𝘢𝘯𝘪𝘧𝘦𝘴𝘵𝘰 and the upcoming 𝘛𝘩𝘦 𝘉𝘶𝘴𝘩𝘪𝘥𝘰 𝘰𝘧 𝘉𝘪𝘵𝘤𝘰𝘪𝘯. He also founded the world’s first Bitcoin-only savings app: Amber. Currently, Aleksandar is building open-source tools, focusing on the Spirit of Satoshi, the world’s first Bitcoin-centric language model, and Satlantis.

Aleksandar Svetski is an author and entrepreneur with 15 years in the startup scene. He is the author of the best-selling 𝘜𝘯𝘊𝘰𝘮𝘮𝘶𝘯𝘪𝘴𝘵 𝘔𝘢𝘯𝘪𝘧𝘦𝘴𝘵𝘰 and the upcoming 𝘛𝘩𝘦 𝘉𝘶𝘴𝘩𝘪𝘥𝘰 𝘰𝘧 𝘉𝘪𝘵𝘤𝘰𝘪𝘯. He also founded the world’s first Bitcoin-only savings app: Amber. Currently, Aleksandar is building open-source tools, focusing on the Spirit of Satoshi, the world’s first Bitcoin-centric language model, and Satlantis.

Preorder your copy of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟲𝟬%, by contributing to our @Geyser initiative:

Preorder your copy of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟲𝟬%, by contributing to our @Geyser initiative:

While the decreasing duration of each epoch's final block may appear to be a consequence of rising hashrate, this is not the case. These block times are 𝘦𝘯𝘵𝘪𝘳𝘦𝘭𝘺 𝘥𝘶𝘦 𝘵𝘰 𝘤𝘩𝘢𝘯𝘤𝘦.

The Difficulty Adjustment every 2016 blocks, or about every 2 weeks, keeps blocks within a 10 minute timeframe 𝗶𝗻 𝗮𝗴𝗴𝗿𝗲𝗴𝗮𝘁𝗲, not with each individual block. Some blocks within a difficulty period will be found in mere 𝘀𝗲𝗰𝗼𝗻𝗱𝘀, while others will take an hour or more. But zoomed-out, they tend to take about 10 minutes.

With the next halving only a couple days away, how long do you think block 839999 will last before block 840000 is found?

Leave your guesses in the 𝗰𝗼𝗺𝗺𝗲𝗻𝘁𝘀!⬇️

While the decreasing duration of each epoch's final block may appear to be a consequence of rising hashrate, this is not the case. These block times are 𝘦𝘯𝘵𝘪𝘳𝘦𝘭𝘺 𝘥𝘶𝘦 𝘵𝘰 𝘤𝘩𝘢𝘯𝘤𝘦.

The Difficulty Adjustment every 2016 blocks, or about every 2 weeks, keeps blocks within a 10 minute timeframe 𝗶𝗻 𝗮𝗴𝗴𝗿𝗲𝗴𝗮𝘁𝗲, not with each individual block. Some blocks within a difficulty period will be found in mere 𝘀𝗲𝗰𝗼𝗻𝗱𝘀, while others will take an hour or more. But zoomed-out, they tend to take about 10 minutes.

With the next halving only a couple days away, how long do you think block 839999 will last before block 840000 is found?

Leave your guesses in the 𝗰𝗼𝗺𝗺𝗲𝗻𝘁𝘀!⬇️ 𝗖𝗮𝗿𝗹𝗮 𝗮𝗻𝗱 𝗪𝗮𝗹𝗸𝗲𝗿’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

Every time someone comes across Bitcoin for the first time, they inevitably think: "𝘏𝘰𝘭𝘥 𝘰𝘯, 𝘸𝘩𝘢𝘵 𝘪𝘧 𝘴𝘰𝘮𝘦𝘰𝘯𝘦 𝘤𝘰𝘱𝘪𝘦𝘴 𝘉𝘪𝘵𝘤𝘰𝘪𝘯?! 𝘛𝘩𝘢𝘵 𝘴𝘶𝘳𝘦𝘭𝘺 𝘮𝘦𝘢𝘯𝘴 𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘪𝘴 𝘸𝘰𝘳𝘵𝘩𝘭𝘦𝘴𝘴, 𝘴𝘪𝘯𝘤𝘦 𝘢𝘯𝘺𝘰𝘯𝘦 𝘤𝘢𝘯 𝘮𝘢𝘬𝘦 𝘢 𝘤𝘰𝘱𝘺! 𝘐 𝘢𝘮 𝘷𝘦𝘳𝘺 𝘪𝘯𝘵𝘦𝘭𝘭𝘪𝘨𝘦𝘯𝘵 𝘢𝘯𝘥 𝘥𝘦𝘧𝘪𝘯𝘪𝘵𝘦𝘭𝘺 𝘵𝘩𝘦 𝘧𝘪𝘳𝘴𝘵 𝘱𝘦𝘳𝘴𝘰𝘯 𝘵𝘰 𝘵𝘩𝘪𝘯𝘬 𝘰𝘧 𝘵𝘩𝘪𝘴."

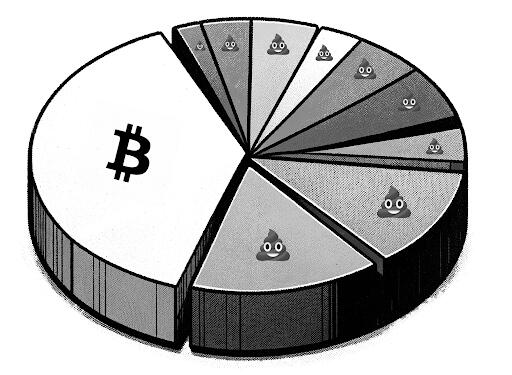

Yes, anyone can copy Bitcoin's code, and thousands have tried. This is why tens of thousands of “alternative” crypto tokens exist, but they are not 𝘳𝘦𝘢𝘭 alternatives to Bitcoin.

Bitcoin is the 𝘧𝘪𝘳𝘴𝘵 cryptocurrency and absolutely scarce. It has years of history, ever since it started in 2009. It has all those years of Proof of Work.

“Altcoins” are merely recreations of the same centralized, top-down, broken monetary system we have in the fiat world. They are schemes designed to enrich the insiders, those few people closest to the creation of new tokens, who have the power to change the rules to suit themselves.

When Satoshi Nakamoto created Bitcoin, he had to mine new bitcoin just like everyone else. He didn’t set aside a big chunk of coins for himself, his buddies, or Silicon Valley VCs. No, he had to use real-world energy to mine bitcoin. Thus, Bitcoin’s launch was fair.

Making an identical copy of Bitcoin is pointless because it does not have Bitcoin’s history — Bitcoin’s Proof of Work. Copying Bitcoin and making changes is also ultimately pointless (unless you are trying to create a scheme that benefits insiders at the expense of everyone else) because 𝗮𝗻𝘆𝘁𝗵𝗶𝗻𝗴 𝘆𝗼𝘂 𝗰𝗵𝗮𝗻𝗴𝗲 𝘄𝗶𝗹𝗹 𝗶𝗻𝘃𝗼𝗹𝘃𝗲 𝙩𝙧𝙖𝙙𝙚-𝙤𝙛𝙛𝙨 𝗶𝗻 𝗱𝗲𝗰𝗲𝗻𝘁𝗿𝗮𝗹𝗶𝘇𝗮𝘁𝗶𝗼𝗻 𝗮𝗻𝗱 𝘀𝗲𝗰𝘂𝗿𝗶𝘁𝘆. There's a reason Michael Saylor says, “𝘛𝘩𝘦𝘳𝘦 𝘪𝘴 𝘯𝘰 𝘴𝘦𝘤𝘰𝘯𝘥 𝘣𝘦𝘴𝘵.” This is not some mere meme (although it has become one now); it is an acknowledgement of objective reality.

To put it simply: There is Bitcoin, and there are shitcoins.

𝗖𝗮𝗿𝗹𝗮 𝗮𝗻𝗱 𝗪𝗮𝗹𝗸𝗲𝗿’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

Every time someone comes across Bitcoin for the first time, they inevitably think: "𝘏𝘰𝘭𝘥 𝘰𝘯, 𝘸𝘩𝘢𝘵 𝘪𝘧 𝘴𝘰𝘮𝘦𝘰𝘯𝘦 𝘤𝘰𝘱𝘪𝘦𝘴 𝘉𝘪𝘵𝘤𝘰𝘪𝘯?! 𝘛𝘩𝘢𝘵 𝘴𝘶𝘳𝘦𝘭𝘺 𝘮𝘦𝘢𝘯𝘴 𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘪𝘴 𝘸𝘰𝘳𝘵𝘩𝘭𝘦𝘴𝘴, 𝘴𝘪𝘯𝘤𝘦 𝘢𝘯𝘺𝘰𝘯𝘦 𝘤𝘢𝘯 𝘮𝘢𝘬𝘦 𝘢 𝘤𝘰𝘱𝘺! 𝘐 𝘢𝘮 𝘷𝘦𝘳𝘺 𝘪𝘯𝘵𝘦𝘭𝘭𝘪𝘨𝘦𝘯𝘵 𝘢𝘯𝘥 𝘥𝘦𝘧𝘪𝘯𝘪𝘵𝘦𝘭𝘺 𝘵𝘩𝘦 𝘧𝘪𝘳𝘴𝘵 𝘱𝘦𝘳𝘴𝘰𝘯 𝘵𝘰 𝘵𝘩𝘪𝘯𝘬 𝘰𝘧 𝘵𝘩𝘪𝘴."

Yes, anyone can copy Bitcoin's code, and thousands have tried. This is why tens of thousands of “alternative” crypto tokens exist, but they are not 𝘳𝘦𝘢𝘭 alternatives to Bitcoin.

Bitcoin is the 𝘧𝘪𝘳𝘴𝘵 cryptocurrency and absolutely scarce. It has years of history, ever since it started in 2009. It has all those years of Proof of Work.

“Altcoins” are merely recreations of the same centralized, top-down, broken monetary system we have in the fiat world. They are schemes designed to enrich the insiders, those few people closest to the creation of new tokens, who have the power to change the rules to suit themselves.

When Satoshi Nakamoto created Bitcoin, he had to mine new bitcoin just like everyone else. He didn’t set aside a big chunk of coins for himself, his buddies, or Silicon Valley VCs. No, he had to use real-world energy to mine bitcoin. Thus, Bitcoin’s launch was fair.

Making an identical copy of Bitcoin is pointless because it does not have Bitcoin’s history — Bitcoin’s Proof of Work. Copying Bitcoin and making changes is also ultimately pointless (unless you are trying to create a scheme that benefits insiders at the expense of everyone else) because 𝗮𝗻𝘆𝘁𝗵𝗶𝗻𝗴 𝘆𝗼𝘂 𝗰𝗵𝗮𝗻𝗴𝗲 𝘄𝗶𝗹𝗹 𝗶𝗻𝘃𝗼𝗹𝘃𝗲 𝙩𝙧𝙖𝙙𝙚-𝙤𝙛𝙛𝙨 𝗶𝗻 𝗱𝗲𝗰𝗲𝗻𝘁𝗿𝗮𝗹𝗶𝘇𝗮𝘁𝗶𝗼𝗻 𝗮𝗻𝗱 𝘀𝗲𝗰𝘂𝗿𝗶𝘁𝘆. There's a reason Michael Saylor says, “𝘛𝘩𝘦𝘳𝘦 𝘪𝘴 𝘯𝘰 𝘴𝘦𝘤𝘰𝘯𝘥 𝘣𝘦𝘴𝘵.” This is not some mere meme (although it has become one now); it is an acknowledgement of objective reality.

To put it simply: There is Bitcoin, and there are shitcoins.

Carla is an eccentric woman who combines her theater, music, writing, and video production skills to create satirical and educational content around Bitcoin and current events. She loves to make people laugh, cry, and cringe. You’ll find her wearing orange.

Walker is a Bitcoin podcaster, speaker, writer, and satirist who leverages new mediums to educate and spark curiosity. His goal is to make people think, laugh, and question the world they think they know. In the fiat world, he runs a software company.

Together, Carla and Walker are "The Crypto Couple," delivering short-form viral videos designed to reach outside the Bitcoin echo chamber and spark curiosity in new audiences.

Carla is an eccentric woman who combines her theater, music, writing, and video production skills to create satirical and educational content around Bitcoin and current events. She loves to make people laugh, cry, and cringe. You’ll find her wearing orange.

Walker is a Bitcoin podcaster, speaker, writer, and satirist who leverages new mediums to educate and spark curiosity. His goal is to make people think, laugh, and question the world they think they know. In the fiat world, he runs a software company.

Together, Carla and Walker are "The Crypto Couple," delivering short-form viral videos designed to reach outside the Bitcoin echo chamber and spark curiosity in new audiences.

Preorder your copy of 𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟲𝟬%, by contributing to our @Geyser initiative:

Preorder your copy of 𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟲𝟬%, by contributing to our @Geyser initiative:

Taxation is fundamentally theft because 𝗶𝘁 𝗶𝘀 𝗮𝗻 𝗮𝗰𝘁 𝗼𝗳 𝗳𝗼𝗿𝗰𝗶𝗯𝗹𝘆 𝘁𝗮𝗸𝗶𝗻𝗴 𝘀𝗼𝗺𝗲𝗼𝗻𝗲'𝘀 𝗽𝗿𝗼𝗽𝗲𝗿𝘁𝘆 𝘄𝗶𝘁𝗵𝗼𝘂𝘁 𝘁𝗵𝗲𝗶𝗿 𝗰𝗼𝗻𝘀𝗲𝗻𝘁. It is a violation of the principles of 𝘱𝘳𝘪𝘷𝘢𝘵𝘦 𝘱𝘳𝘰𝘱𝘦𝘳𝘵𝘺 and 𝘪𝘯𝘥𝘪𝘷𝘪𝘥𝘶𝘢𝘭 𝘭𝘪𝘣𝘦𝘳𝘵𝘺. Taxes are imposed by governments, which are institutions that wield a 𝗺𝗼𝗻𝗼𝗽𝗼𝗹𝘆 𝗼𝗻 𝘃𝗶𝗼𝗹𝗲𝗻𝗰𝗲. This is a clear infringement on the individual's right to keep and control their own wealth.

Taxation is a coercive mechanism for extracting wealth from individuals. It violates the principle of individual property rights, and breaches personal freedoms. 𝗧𝗮𝘅𝗲𝘀 𝗮𝗿𝗲 𝗻𝗼𝘁 𝘃𝗼𝗹𝘂𝗻𝘁𝗮𝗿𝗶𝗹𝘆 𝗴𝗶𝘃𝗲𝗻, 𝗯𝘂𝘁 𝗿𝗮𝘁𝗵𝗲𝗿 𝘁𝗮𝗸𝗲𝗻 𝗯𝘆 𝘁𝗵𝗲 𝗴𝗼𝘃𝗲𝗿𝗻𝗺𝗲𝗻𝘁, 𝘂𝗻𝗱𝗲𝗿 𝘁𝗵𝗿𝗲𝗮𝘁 𝗼𝗳 𝗶𝗻𝗰𝗮𝗿𝗰𝗲𝗿𝗮𝘁𝗶𝗼𝗻 𝗮𝗻𝗱/𝗼𝗿 𝗽𝗵𝘆𝘀𝗶𝗰𝗮𝗹 𝗵𝗮𝗿𝗺. This is, by definition, a direct theft of someone's property.

Furthermore, taxation is an 𝘶𝘯𝘫𝘶𝘴𝘵𝘪𝘧𝘪𝘦𝘥 and 𝘣𝘶𝘳𝘥𝘦𝘯𝘴𝘰𝘮𝘦 practice. It is a drain on resources, and 𝗵𝗮𝗺𝗽𝗲𝗿𝘀 𝗲𝗰𝗼𝗻𝗼𝗺𝗶𝗰 𝗴𝗿𝗼𝘄𝘁𝗵. Taxes are often used to fund bloated government programs and other forms of wasteful spending. This misallocation of resources could be better utilized in the hands of individuals and businesses.

Instead of relying on coercive taxation, we should advocate for 𝗹𝗶𝗺𝗶𝘁𝗲𝗱 𝗴𝗼𝘃𝗲𝗿𝗻𝗺𝗲𝗻𝘁 𝗶𝗻𝘁𝗲𝗿𝘃𝗲𝗻𝘁𝗶𝗼𝗻 and 𝗶𝗻𝗱𝗶𝘃𝗶𝗱𝘂𝗮𝗹 𝗳𝗿𝗲𝗲𝗱𝗼𝗺. Taxes should be 𝘮𝘪𝘯𝘪𝘮𝘪𝘻𝘦𝘥 𝘰𝘳 𝘦𝘭𝘪𝘮𝘪𝘯𝘢𝘵𝘦𝘥, allowing individuals and businesses to keep more of their hard-earned wealth. This would foster economic growth, job creation, and prosperity.

In conclusion, taxation is theft because 𝗶𝘁 𝗶𝘀 𝗮𝗻 𝗮𝗰𝘁 𝗼𝗳 𝗳𝗼𝗿𝗰𝗶𝗯𝗹𝘆 𝘁𝗮𝗸𝗶𝗻𝗴 𝘀𝗼𝗺𝗲𝗼𝗻𝗲'𝘀 𝗽𝗿𝗼𝗽𝗲𝗿𝘁𝘆 𝘄𝗶𝘁𝗵𝗼𝘂𝘁 𝘁𝗵𝗲𝗶𝗿 𝗰𝗼𝗻𝘀𝗲𝗻𝘁. It is a violation of the principles of private property and individual liberty. Taxes should be minimized or eliminated, and 𝘪𝘯𝘥𝘪𝘷𝘪𝘥𝘶𝘢𝘭𝘴 𝘢𝘯𝘥 𝘣𝘶𝘴𝘪𝘯𝘦𝘴𝘴𝘦𝘴 𝘴𝘩𝘰𝘶𝘭𝘥 𝘣𝘦 𝘢𝘭𝘭𝘰𝘸𝘦𝘥 𝘵𝘰 𝘬𝘦𝘦𝘱 𝘮𝘰𝘳𝘦 𝘰𝘧 𝘵𝘩𝘦 𝘸𝘦𝘢𝘭𝘵𝘩 𝘵𝘩𝘦𝘺 𝘸𝘰𝘳𝘬𝘦𝘥 𝘩𝘢𝘳𝘥 𝘵𝘰 𝘦𝘢𝘳𝘯.

Taxation is fundamentally theft because 𝗶𝘁 𝗶𝘀 𝗮𝗻 𝗮𝗰𝘁 𝗼𝗳 𝗳𝗼𝗿𝗰𝗶𝗯𝗹𝘆 𝘁𝗮𝗸𝗶𝗻𝗴 𝘀𝗼𝗺𝗲𝗼𝗻𝗲'𝘀 𝗽𝗿𝗼𝗽𝗲𝗿𝘁𝘆 𝘄𝗶𝘁𝗵𝗼𝘂𝘁 𝘁𝗵𝗲𝗶𝗿 𝗰𝗼𝗻𝘀𝗲𝗻𝘁. It is a violation of the principles of 𝘱𝘳𝘪𝘷𝘢𝘵𝘦 𝘱𝘳𝘰𝘱𝘦𝘳𝘵𝘺 and 𝘪𝘯𝘥𝘪𝘷𝘪𝘥𝘶𝘢𝘭 𝘭𝘪𝘣𝘦𝘳𝘵𝘺. Taxes are imposed by governments, which are institutions that wield a 𝗺𝗼𝗻𝗼𝗽𝗼𝗹𝘆 𝗼𝗻 𝘃𝗶𝗼𝗹𝗲𝗻𝗰𝗲. This is a clear infringement on the individual's right to keep and control their own wealth.

Taxation is a coercive mechanism for extracting wealth from individuals. It violates the principle of individual property rights, and breaches personal freedoms. 𝗧𝗮𝘅𝗲𝘀 𝗮𝗿𝗲 𝗻𝗼𝘁 𝘃𝗼𝗹𝘂𝗻𝘁𝗮𝗿𝗶𝗹𝘆 𝗴𝗶𝘃𝗲𝗻, 𝗯𝘂𝘁 𝗿𝗮𝘁𝗵𝗲𝗿 𝘁𝗮𝗸𝗲𝗻 𝗯𝘆 𝘁𝗵𝗲 𝗴𝗼𝘃𝗲𝗿𝗻𝗺𝗲𝗻𝘁, 𝘂𝗻𝗱𝗲𝗿 𝘁𝗵𝗿𝗲𝗮𝘁 𝗼𝗳 𝗶𝗻𝗰𝗮𝗿𝗰𝗲𝗿𝗮𝘁𝗶𝗼𝗻 𝗮𝗻𝗱/𝗼𝗿 𝗽𝗵𝘆𝘀𝗶𝗰𝗮𝗹 𝗵𝗮𝗿𝗺. This is, by definition, a direct theft of someone's property.

Furthermore, taxation is an 𝘶𝘯𝘫𝘶𝘴𝘵𝘪𝘧𝘪𝘦𝘥 and 𝘣𝘶𝘳𝘥𝘦𝘯𝘴𝘰𝘮𝘦 practice. It is a drain on resources, and 𝗵𝗮𝗺𝗽𝗲𝗿𝘀 𝗲𝗰𝗼𝗻𝗼𝗺𝗶𝗰 𝗴𝗿𝗼𝘄𝘁𝗵. Taxes are often used to fund bloated government programs and other forms of wasteful spending. This misallocation of resources could be better utilized in the hands of individuals and businesses.

Instead of relying on coercive taxation, we should advocate for 𝗹𝗶𝗺𝗶𝘁𝗲𝗱 𝗴𝗼𝘃𝗲𝗿𝗻𝗺𝗲𝗻𝘁 𝗶𝗻𝘁𝗲𝗿𝘃𝗲𝗻𝘁𝗶𝗼𝗻 and 𝗶𝗻𝗱𝗶𝘃𝗶𝗱𝘂𝗮𝗹 𝗳𝗿𝗲𝗲𝗱𝗼𝗺. Taxes should be 𝘮𝘪𝘯𝘪𝘮𝘪𝘻𝘦𝘥 𝘰𝘳 𝘦𝘭𝘪𝘮𝘪𝘯𝘢𝘵𝘦𝘥, allowing individuals and businesses to keep more of their hard-earned wealth. This would foster economic growth, job creation, and prosperity.

In conclusion, taxation is theft because 𝗶𝘁 𝗶𝘀 𝗮𝗻 𝗮𝗰𝘁 𝗼𝗳 𝗳𝗼𝗿𝗰𝗶𝗯𝗹𝘆 𝘁𝗮𝗸𝗶𝗻𝗴 𝘀𝗼𝗺𝗲𝗼𝗻𝗲'𝘀 𝗽𝗿𝗼𝗽𝗲𝗿𝘁𝘆 𝘄𝗶𝘁𝗵𝗼𝘂𝘁 𝘁𝗵𝗲𝗶𝗿 𝗰𝗼𝗻𝘀𝗲𝗻𝘁. It is a violation of the principles of private property and individual liberty. Taxes should be minimized or eliminated, and 𝘪𝘯𝘥𝘪𝘷𝘪𝘥𝘶𝘢𝘭𝘴 𝘢𝘯𝘥 𝘣𝘶𝘴𝘪𝘯𝘦𝘴𝘴𝘦𝘴 𝘴𝘩𝘰𝘶𝘭𝘥 𝘣𝘦 𝘢𝘭𝘭𝘰𝘸𝘦𝘥 𝘵𝘰 𝘬𝘦𝘦𝘱 𝘮𝘰𝘳𝘦 𝘰𝘧 𝘵𝘩𝘦 𝘸𝘦𝘢𝘭𝘵𝘩 𝘵𝘩𝘦𝘺 𝘸𝘰𝘳𝘬𝘦𝘥 𝘩𝘢𝘳𝘥 𝘵𝘰 𝘦𝘢𝘳𝘯.

Remember to 𝗟𝗶𝗸𝗲🤙 this and 𝗦𝗵𝗮𝗿𝗲🔄 it with others on this Tax Day, so everyone can know why 𝘵𝘢𝘹𝘢𝘵𝘪𝘰𝘯 𝘪𝘴 𝘵𝘩𝘦𝘧𝘵.

Remember to 𝗟𝗶𝗸𝗲🤙 this and 𝗦𝗵𝗮𝗿𝗲🔄 it with others on this Tax Day, so everyone can know why 𝘵𝘢𝘹𝘢𝘵𝘪𝘰𝘯 𝘪𝘴 𝘵𝘩𝘦𝘧𝘵.

𝗧𝘂𝗻𝗲𝗱 𝗹𝗶𝗸𝗲 𝗻𝗼 𝗼𝘁𝗵𝗲𝗿 𝗺𝗼𝗱𝗲𝗹 𝘁𝗼 𝗱𝗮𝘁𝗲

The unique dataset we built, and the methods of training we employed, means this model excels where others fall short:

👉 It knows that there are two genders

👉 It knows that Ethereum is a shitcoin

👉 It knows that inflation is economic stupidity

MORE DETAILS HERE:

𝗧𝘂𝗻𝗲𝗱 𝗹𝗶𝗸𝗲 𝗻𝗼 𝗼𝘁𝗵𝗲𝗿 𝗺𝗼𝗱𝗲𝗹 𝘁𝗼 𝗱𝗮𝘁𝗲

The unique dataset we built, and the methods of training we employed, means this model excels where others fall short:

👉 It knows that there are two genders

👉 It knows that Ethereum is a shitcoin

👉 It knows that inflation is economic stupidity

MORE DETAILS HERE:

𝗢𝗽𝗲𝗻 𝗦𝗼𝘂𝗿𝗰𝗲

𝗦𝗮𝘁𝗼𝘀𝗵𝗶 𝟳𝗕 is open source and available for 𝘢𝘯𝘺𝘰𝘯𝘦 to use, modify, and enhance.

You can download it on HuggingFace now!

GET IT HERE:

𝗢𝗽𝗲𝗻 𝗦𝗼𝘂𝗿𝗰𝗲

𝗦𝗮𝘁𝗼𝘀𝗵𝗶 𝟳𝗕 is open source and available for 𝘢𝘯𝘺𝘰𝘯𝘦 to use, modify, and enhance.

You can download it on HuggingFace now!

GET IT HERE:

𝗚𝗶𝗮𝗰𝗼𝗺𝗼 𝗭𝘂𝗰𝗰𝗼’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

It is important to separate the control of money from the state for the same reason that it's important to separate the control of anything from the state. The modern nation-state is a criminal organization, typically characterized by inefficiency, corruption, and moral bankruptcy. For this reason, it's important to separate the state from its control over defense and firearms, healthcare and medicine, and education and information.

But in particular, it's crucial to separate the state's control over the most significant market of all: money. Money constitutes one-half of every trade that has ever occurred on this planet. The global economy has many sectors that are very important, strategic, and relevant, but no sector can be as important as the sector that is exactly one-half of every single economic transaction in every context, in every age, and in every culture, which is money.

If you corrupt money, you can corrupt any other possible market. If you restore money, you can improve and mitigate problems in most other contexts and markets. So, we should separate the state from literally everything because we should separate organized crime from everything. While we should ostracize organized crime in all forms, it is especially crucial in the case of the most important market: money.

𝗚𝗶𝗮𝗰𝗼𝗺𝗼 𝗭𝘂𝗰𝗰𝗼’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

It is important to separate the control of money from the state for the same reason that it's important to separate the control of anything from the state. The modern nation-state is a criminal organization, typically characterized by inefficiency, corruption, and moral bankruptcy. For this reason, it's important to separate the state from its control over defense and firearms, healthcare and medicine, and education and information.

But in particular, it's crucial to separate the state's control over the most significant market of all: money. Money constitutes one-half of every trade that has ever occurred on this planet. The global economy has many sectors that are very important, strategic, and relevant, but no sector can be as important as the sector that is exactly one-half of every single economic transaction in every context, in every age, and in every culture, which is money.

If you corrupt money, you can corrupt any other possible market. If you restore money, you can improve and mitigate problems in most other contexts and markets. So, we should separate the state from literally everything because we should separate organized crime from everything. While we should ostracize organized crime in all forms, it is especially crucial in the case of the most important market: money.

Giacomo Zucco is an Italian technology entrepreneur, and a consultant/teacher for the Bitcoin and Lightning Network protocols. He spends his time supporting projects that he feels might be relevant for the future of Bitcoin, be it as an educator, consultant, entrepreneur, maximalist, or troll. Previously he was involved in GreenAddress, AssoBIT, BlockchainLab, and Bitcoin Magazine. He's currently advancing Bitcoin via BHB Network, BTCTimes, Relai, BCademy, and Notarify.

Giacomo Zucco is an Italian technology entrepreneur, and a consultant/teacher for the Bitcoin and Lightning Network protocols. He spends his time supporting projects that he feels might be relevant for the future of Bitcoin, be it as an educator, consultant, entrepreneur, maximalist, or troll. Previously he was involved in GreenAddress, AssoBIT, BlockchainLab, and Bitcoin Magazine. He's currently advancing Bitcoin via BHB Network, BTCTimes, Relai, BCademy, and Notarify.

Preorder your copy of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟲𝟬% when you contribute to our @Geyser initiative:

Preorder your copy of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟲𝟬% when you contribute to our @Geyser initiative: