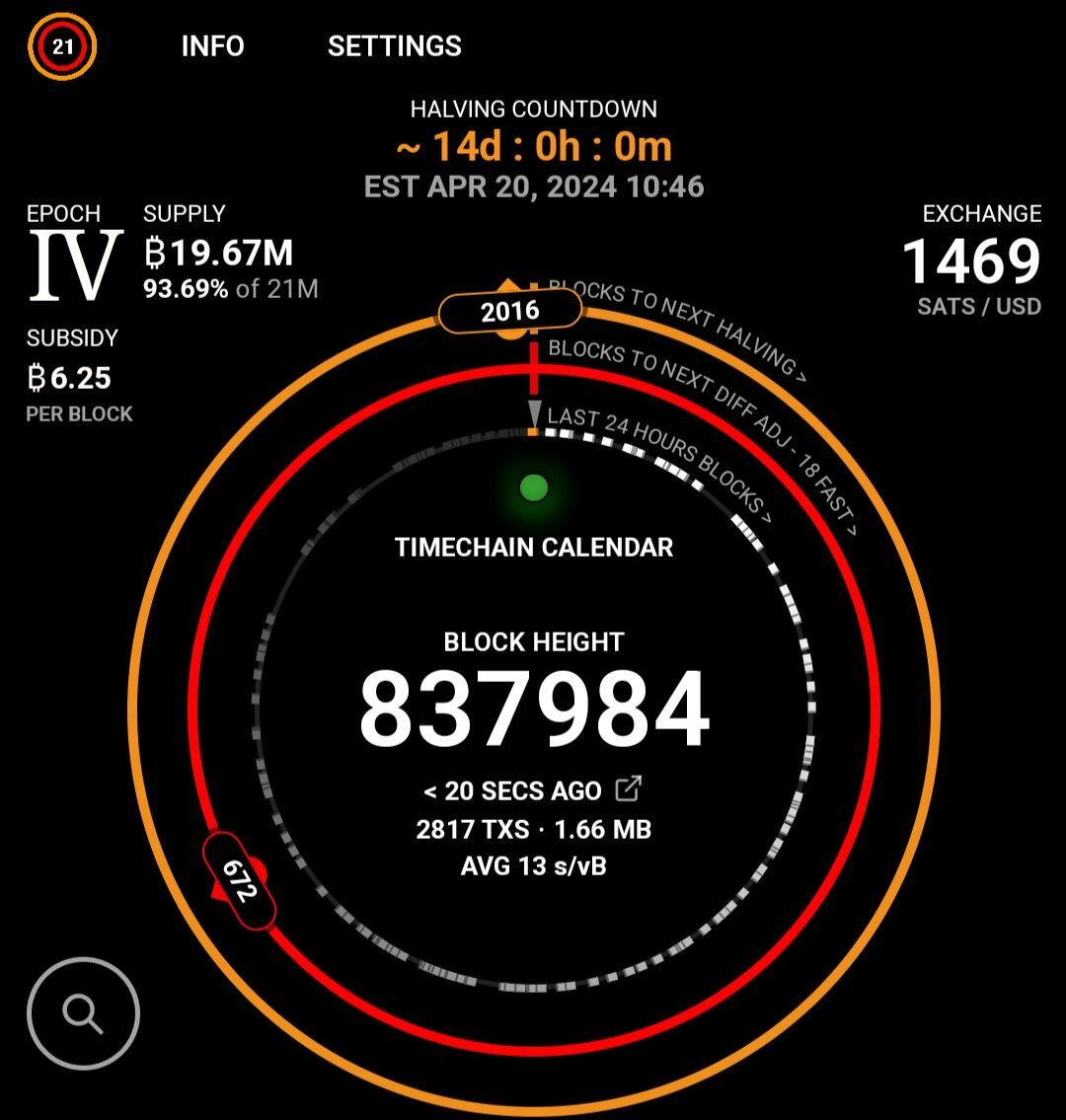

The final difficulty adjustment of this epoch has just occurred. The time of #Bitcoin's #halving draweth nigh!

You can still get your hands on multiple copies of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, though! Whether it’s hardcover, softcover, digital, or audiobook, 𝘵𝘩𝘪𝘴 𝘪𝘴 𝙩𝙝𝙚 𝘣𝘰𝘰𝘬 𝘵𝘰 𝘴𝘩𝘢𝘳𝘦 𝘸𝘪𝘵𝘩 𝘧𝘳𝘪𝘦𝘯𝘥𝘴 𝘢𝘯𝘥 𝘧𝘢𝘮𝘪𝘭𝘺 𝘸𝘩𝘦𝘯 𝘰𝘳𝘢𝘯𝘨𝘦 𝘱𝘪𝘭𝘭𝘪𝘯𝘨 𝘵𝘩𝘦𝘮.

You can still get your hands on multiple copies of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, though! Whether it’s hardcover, softcover, digital, or audiobook, 𝘵𝘩𝘪𝘴 𝘪𝘴 𝙩𝙝𝙚 𝘣𝘰𝘰𝘬 𝘵𝘰 𝘴𝘩𝘢𝘳𝘦 𝘸𝘪𝘵𝘩 𝘧𝘳𝘪𝘦𝘯𝘥𝘴 𝘢𝘯𝘥 𝘧𝘢𝘮𝘪𝘭𝘺 𝘸𝘩𝘦𝘯 𝘰𝘳𝘢𝘯𝘨𝘦 𝘱𝘪𝘭𝘭𝘪𝘯𝘨 𝘵𝘩𝘦𝘮.

We curated the top 21 questions that those new to Bitcoin tend to ask, then reached out to some of the most well-known Bitcoiners, like @Guy Swann, @CARLA⚡️ and @walker, @Samson Mow, and others, and we asked each of them to answer a few of those questions. Additionally, the Spirit of Satoshi language model offers its own answer to each question at the end of every chapter.

We’re in a race against centralized and absolute control of our daily lives on a global scale, and 𝘵𝘩𝘦 𝘴𝘰𝘰𝘯𝘦𝘳 𝘮𝘰𝘳𝘦 𝘱𝘦𝘰𝘱𝘭𝘦 𝘰𝘱𝘵-𝘰𝘶𝘵 𝘸𝘪𝘵𝘩 𝘣𝘪𝘵𝘤𝘰𝘪𝘯, 𝘵𝘩𝘦 𝘣𝘦𝘵𝘵𝘦𝘳 𝘰𝘶𝘳 𝘧𝘶𝘵𝘶𝘳𝘦 𝘸𝘪𝘭𝘭 𝘣𝘦. Preorder yours today through our @Geyser page, and 𝘀𝗮𝘃𝗲 𝟲𝟬% on the total price!

We curated the top 21 questions that those new to Bitcoin tend to ask, then reached out to some of the most well-known Bitcoiners, like @Guy Swann, @CARLA⚡️ and @walker, @Samson Mow, and others, and we asked each of them to answer a few of those questions. Additionally, the Spirit of Satoshi language model offers its own answer to each question at the end of every chapter.

We’re in a race against centralized and absolute control of our daily lives on a global scale, and 𝘵𝘩𝘦 𝘴𝘰𝘰𝘯𝘦𝘳 𝘮𝘰𝘳𝘦 𝘱𝘦𝘰𝘱𝘭𝘦 𝘰𝘱𝘵-𝘰𝘶𝘵 𝘸𝘪𝘵𝘩 𝘣𝘪𝘵𝘤𝘰𝘪𝘯, 𝘵𝘩𝘦 𝘣𝘦𝘵𝘵𝘦𝘳 𝘰𝘶𝘳 𝘧𝘶𝘵𝘶𝘳𝘦 𝘸𝘪𝘭𝘭 𝘣𝘦. Preorder yours today through our @Geyser page, and 𝘀𝗮𝘃𝗲 𝟲𝟬% on the total price!

Well, we 𝘴𝘢𝘺 that today is Satoshi’s birthday only because this is the date he gave for his birth when he created his profile on the P2P Foundation.

Is it 𝘳𝘦𝘢𝘭𝘭𝘺 his birthday? Perhaps not, but the date does carry with it some fascinating significance.

Well, we 𝘴𝘢𝘺 that today is Satoshi’s birthday only because this is the date he gave for his birth when he created his profile on the P2P Foundation.

Is it 𝘳𝘦𝘢𝘭𝘭𝘺 his birthday? Perhaps not, but the date does carry with it some fascinating significance.

If today is actually not his birthday, then Satoshi Nakamoto likely chose this date for a couple reasons. 𝟱 𝗔𝗽𝗿𝗶𝗹 marks the anniversary of when the United States President Franklin D. Roosevelt signed Executive Order 6102, in 1933, which prohibited the hoarding of gold by U.S. citizens.

This action essentially 𝘤𝘰𝘯𝘧𝘪𝘴𝘤𝘢𝘵𝘦𝘥 gold from the general population, and centralized monetary control with the federal government. This event is symbolic of the kind of government overreach and control over money that #Bitcoin seeks to replace by 𝗽𝗿𝗼𝘃𝗶𝗱𝗶𝗻𝗴 𝗮 𝗱𝗲𝗰𝗲𝗻𝘁𝗿𝗮𝗹𝗶𝘇𝗲𝗱 𝗮𝗻𝗱 𝗰𝗲𝗻𝘀𝗼𝗿𝘀𝗵𝗶𝗽-𝗿𝗲𝘀𝗶𝘀𝘁𝗮𝗻𝘁 𝗳𝗼𝗿𝗺 𝗼𝗳 𝗺𝗼𝗻𝗲𝘆.

If today is actually not his birthday, then Satoshi Nakamoto likely chose this date for a couple reasons. 𝟱 𝗔𝗽𝗿𝗶𝗹 marks the anniversary of when the United States President Franklin D. Roosevelt signed Executive Order 6102, in 1933, which prohibited the hoarding of gold by U.S. citizens.

This action essentially 𝘤𝘰𝘯𝘧𝘪𝘴𝘤𝘢𝘵𝘦𝘥 gold from the general population, and centralized monetary control with the federal government. This event is symbolic of the kind of government overreach and control over money that #Bitcoin seeks to replace by 𝗽𝗿𝗼𝘃𝗶𝗱𝗶𝗻𝗴 𝗮 𝗱𝗲𝗰𝗲𝗻𝘁𝗿𝗮𝗹𝗶𝘇𝗲𝗱 𝗮𝗻𝗱 𝗰𝗲𝗻𝘀𝗼𝗿𝘀𝗵𝗶𝗽-𝗿𝗲𝘀𝗶𝘀𝘁𝗮𝗻𝘁 𝗳𝗼𝗿𝗺 𝗼𝗳 𝗺𝗼𝗻𝗲𝘆.

𝗧𝗵𝗲 𝘆𝗲𝗮𝗿 𝟭𝟵𝟳𝟱 𝗺𝗮𝗿𝗸𝘀 𝘁𝗵𝗲 𝘆𝗲𝗮𝗿 𝘄𝗵𝗲𝗻 𝗔𝗺𝗲𝗿𝗶𝗰𝗮𝗻𝘀 𝘄𝗲𝗿𝗲 𝗼𝗻𝗰𝗲 𝗮𝗴𝗮𝗶𝗻 𝗮𝗹𝗹𝗼𝘄𝗲𝗱 𝘁𝗼 𝗼𝘄𝗻 𝗴𝗼𝗹𝗱. The ban on gold ownership was lifted on December 31, 1974, effectively allowing citizens to once again own and trade gold as of January 1, 1975. This moment symbolized a return to a 𝘴𝘦𝘮𝘣𝘭𝘢𝘯𝘤𝘦 of financial freedom and control over one's assets.

Satoshi Nakamoto's choice of this particular date for his pseudonymous birthday, therefore, can be seen as a profound statement on 𝘵𝘩𝘦 𝘪𝘮𝘱𝘰𝘳𝘵𝘢𝘯𝘤𝘦 𝘰𝘧 𝘧𝘪𝘯𝘢𝘯𝘤𝘪𝘢𝘭 𝘴𝘰𝘷𝘦𝘳𝘦𝘪𝘨𝘯𝘵𝘺 and 𝘵𝘩𝘦 𝘳𝘰𝘭𝘦 𝘰𝘧 𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘪𝘯 𝘤𝘩𝘢𝘭𝘭𝘦𝘯𝘨𝘪𝘯𝘨 𝘵𝘩𝘦 𝘦𝘹𝘪𝘴𝘵𝘪𝘯𝘨 𝘮𝘰𝘯𝘦𝘵𝘢𝘳𝘺 𝘳𝘦𝘨𝘪𝘮𝘦.

𝗧𝗵𝗲 𝘆𝗲𝗮𝗿 𝟭𝟵𝟳𝟱 𝗺𝗮𝗿𝗸𝘀 𝘁𝗵𝗲 𝘆𝗲𝗮𝗿 𝘄𝗵𝗲𝗻 𝗔𝗺𝗲𝗿𝗶𝗰𝗮𝗻𝘀 𝘄𝗲𝗿𝗲 𝗼𝗻𝗰𝗲 𝗮𝗴𝗮𝗶𝗻 𝗮𝗹𝗹𝗼𝘄𝗲𝗱 𝘁𝗼 𝗼𝘄𝗻 𝗴𝗼𝗹𝗱. The ban on gold ownership was lifted on December 31, 1974, effectively allowing citizens to once again own and trade gold as of January 1, 1975. This moment symbolized a return to a 𝘴𝘦𝘮𝘣𝘭𝘢𝘯𝘤𝘦 of financial freedom and control over one's assets.

Satoshi Nakamoto's choice of this particular date for his pseudonymous birthday, therefore, can be seen as a profound statement on 𝘵𝘩𝘦 𝘪𝘮𝘱𝘰𝘳𝘵𝘢𝘯𝘤𝘦 𝘰𝘧 𝘧𝘪𝘯𝘢𝘯𝘤𝘪𝘢𝘭 𝘴𝘰𝘷𝘦𝘳𝘦𝘪𝘨𝘯𝘵𝘺 and 𝘵𝘩𝘦 𝘳𝘰𝘭𝘦 𝘰𝘧 𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘪𝘯 𝘤𝘩𝘢𝘭𝘭𝘦𝘯𝘨𝘪𝘯𝘨 𝘵𝘩𝘦 𝘦𝘹𝘪𝘴𝘵𝘪𝘯𝘨 𝘮𝘰𝘯𝘦𝘵𝘢𝘳𝘺 𝘳𝘦𝘨𝘪𝘮𝘦.

If Satoshi was actually born that day, then 𝗵𝗲 𝘄𝗼𝘂𝗹𝗱 𝗯𝗲 𝟰𝟵 𝘆𝗲𝗮𝗿𝘀 𝗼𝗹𝗱 𝘁𝗼𝗱𝗮𝘆. So let us all wish Satoshi a very happy birthday, wherever he is, whoever he is, and regardless of whether or not today is really his birthday.🎂

If Satoshi was actually born that day, then 𝗵𝗲 𝘄𝗼𝘂𝗹𝗱 𝗯𝗲 𝟰𝟵 𝘆𝗲𝗮𝗿𝘀 𝗼𝗹𝗱 𝘁𝗼𝗱𝗮𝘆. So let us all wish Satoshi a very happy birthday, wherever he is, whoever he is, and regardless of whether or not today is really his birthday.🎂 𝗡𝗮𝘁𝗮𝗹𝗶𝗲 𝗕𝗿𝘂𝗻𝗲𝗹𝗹’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

Is there ‘some’ amount of money you are comfortable losing just by holding onto it for the future? Is it ‘good’ if our purchasing power decreases year-by-year as the total supply of dollars increases without a single worker voting for such a policy? Inflation, which is the expansion of the supply of money, is a theft on all holders of that money and it forces them to look for other uses and investments that may carry risk. It encourages investment in other asset classes, such as houses and equities, which causes a distortion in the real value of those goods. And this offers an advantage to wealthier members of society at the expense of the poor. All inflation is theft, and no level of theft is good for society.

𝗡𝗮𝘁𝗮𝗹𝗶𝗲 𝗕𝗿𝘂𝗻𝗲𝗹𝗹’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

Is there ‘some’ amount of money you are comfortable losing just by holding onto it for the future? Is it ‘good’ if our purchasing power decreases year-by-year as the total supply of dollars increases without a single worker voting for such a policy? Inflation, which is the expansion of the supply of money, is a theft on all holders of that money and it forces them to look for other uses and investments that may carry risk. It encourages investment in other asset classes, such as houses and equities, which causes a distortion in the real value of those goods. And this offers an advantage to wealthier members of society at the expense of the poor. All inflation is theft, and no level of theft is good for society.

Natalie Brunell is a podcast host, media commentator and international Bitcoin educator. Her popular show, Coin Stories, is the number 1 rated woman-led show focused on the intersection of Bitcoin and global economics. Natalie is also an award-winning TV journalist and former adjunct professor.

Natalie Brunell is a podcast host, media commentator and international Bitcoin educator. Her popular show, Coin Stories, is the number 1 rated woman-led show focused on the intersection of Bitcoin and global economics. Natalie is also an award-winning TV journalist and former adjunct professor.

Preorder your copy of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟴𝟬%, by contributing to our @Geyser initiative:

Preorder your copy of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟴𝟬%, by contributing to our @Geyser initiative:

The heart of this scarcity is the 𝗱𝗶𝗳𝗳𝗶𝗰𝘂𝗹𝘁𝘆 𝗮𝗱𝗷𝘂𝘀𝘁𝗺𝗲𝗻𝘁 mechanism. As demand burgeons and miners flock, the network's computational puzzle becomes harder. This elegant algorithm ensures that Bitcoin's issuance rate doesn't hasten; it's a temporal constant, 𝘪𝘮𝘱𝘦𝘳𝘷𝘪𝘰𝘶𝘴 𝘵𝘰 𝘩𝘶𝘮𝘢𝘯 𝘸𝘩𝘪𝘮𝘴 𝘰𝘳 𝘦𝘷𝘦𝘯 𝘵𝘦𝘤𝘩𝘯𝘰𝘭𝘰𝘨𝘪𝘤𝘢𝘭 𝘭𝘦𝘢𝘱𝘴.

Traditional assets, even gold, have an S-shaped curve in both adoption and price, where initial demand spikes level off as supply increases. 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝘀𝗵𝗮𝘁𝘁𝗲𝗿𝘀 𝘁𝗵𝗶𝘀 𝗽𝗮𝗿𝗮𝗱𝗶𝗴𝗺. With an immutable supply limit, demand has only one way to manifest — through price. Thus, we foresee a J-shaped curve, ascending indefinitely.

Even after the initial surge of new users tapers off, and the S-curve of adoption flattens, 𝘱𝘦𝘰𝘱𝘭𝘦 𝘸𝘪𝘭𝘭 𝘴𝘵𝘪𝘭𝘭 𝘨𝘦𝘯𝘦𝘳𝘢𝘵𝘦 𝘮𝘰𝘳𝘦 𝘷𝘢𝘭𝘶𝘦 𝘧𝘰𝘳 𝘦𝘢𝘤𝘩 𝘰𝘵𝘩𝘦𝘳, in the form of new businesses and technologies unshackled by fiat constraints. This will continue to push prices denominated in bitcoin down, and make its value go up.

Bitcoin maximalists see this not as speculation, but as 𝗶𝗻𝗲𝘃𝗶𝘁𝗮𝗯𝗹𝗲 𝗿𝗲𝗮𝗹𝗶𝘁𝘆. With every halving, the supply squeeze tightens, amplifying Bitcoin's scarcity. This isn't a bubble; it's recognition of a new monetary epoch. Bitcoin isn't just digital gold; 𝘪𝘵'𝘴 𝘵𝘩𝘦 𝘦𝘱𝘪𝘵𝘰𝘮𝘦 𝘰𝘧 𝘷𝘢𝘭𝘶𝘦 𝘱𝘳𝘦𝘴𝘦𝘳𝘷𝘢𝘵𝘪𝘰𝘯.

Absolute scarcity isn't just a feature; it's Bitcoin's core tenet. As the world grapples with endless money printing, Bitcoin offers an immutable refuge. Its price trajectory isn't just hopeful thinking; 𝘪𝘵'𝘴 𝘵𝘩𝘦 𝘯𝘢𝘵𝘶𝘳𝘢𝘭 𝘢𝘯𝘥 𝘭𝘰𝘨𝘪𝘤𝘢𝘭 𝘰𝘶𝘵𝘤𝘰𝘮𝘦 𝘰𝘧 𝘱𝘦𝘳𝘧𝘦𝘤𝘵 𝘴𝘤𝘢𝘳𝘤𝘪𝘵𝘺. What Michael Saylor said is true: “𝘐𝘵’𝘴 𝘨𝘰𝘪𝘯𝘨 𝘶𝘱 𝘧𝘰𝘳𝘦𝘷𝘦𝘳, 𝘓𝘢𝘶𝘳𝘢.” This is because while its supply is eternally fixed, 𝗵𝘂𝗺𝗮𝗻 𝗶𝗻𝗴𝗲𝗻𝘂𝗶𝘁𝘆 𝗶𝘀𝗻’𝘁.

The heart of this scarcity is the 𝗱𝗶𝗳𝗳𝗶𝗰𝘂𝗹𝘁𝘆 𝗮𝗱𝗷𝘂𝘀𝘁𝗺𝗲𝗻𝘁 mechanism. As demand burgeons and miners flock, the network's computational puzzle becomes harder. This elegant algorithm ensures that Bitcoin's issuance rate doesn't hasten; it's a temporal constant, 𝘪𝘮𝘱𝘦𝘳𝘷𝘪𝘰𝘶𝘴 𝘵𝘰 𝘩𝘶𝘮𝘢𝘯 𝘸𝘩𝘪𝘮𝘴 𝘰𝘳 𝘦𝘷𝘦𝘯 𝘵𝘦𝘤𝘩𝘯𝘰𝘭𝘰𝘨𝘪𝘤𝘢𝘭 𝘭𝘦𝘢𝘱𝘴.

Traditional assets, even gold, have an S-shaped curve in both adoption and price, where initial demand spikes level off as supply increases. 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝘀𝗵𝗮𝘁𝘁𝗲𝗿𝘀 𝘁𝗵𝗶𝘀 𝗽𝗮𝗿𝗮𝗱𝗶𝗴𝗺. With an immutable supply limit, demand has only one way to manifest — through price. Thus, we foresee a J-shaped curve, ascending indefinitely.

Even after the initial surge of new users tapers off, and the S-curve of adoption flattens, 𝘱𝘦𝘰𝘱𝘭𝘦 𝘸𝘪𝘭𝘭 𝘴𝘵𝘪𝘭𝘭 𝘨𝘦𝘯𝘦𝘳𝘢𝘵𝘦 𝘮𝘰𝘳𝘦 𝘷𝘢𝘭𝘶𝘦 𝘧𝘰𝘳 𝘦𝘢𝘤𝘩 𝘰𝘵𝘩𝘦𝘳, in the form of new businesses and technologies unshackled by fiat constraints. This will continue to push prices denominated in bitcoin down, and make its value go up.

Bitcoin maximalists see this not as speculation, but as 𝗶𝗻𝗲𝘃𝗶𝘁𝗮𝗯𝗹𝗲 𝗿𝗲𝗮𝗹𝗶𝘁𝘆. With every halving, the supply squeeze tightens, amplifying Bitcoin's scarcity. This isn't a bubble; it's recognition of a new monetary epoch. Bitcoin isn't just digital gold; 𝘪𝘵'𝘴 𝘵𝘩𝘦 𝘦𝘱𝘪𝘵𝘰𝘮𝘦 𝘰𝘧 𝘷𝘢𝘭𝘶𝘦 𝘱𝘳𝘦𝘴𝘦𝘳𝘷𝘢𝘵𝘪𝘰𝘯.

Absolute scarcity isn't just a feature; it's Bitcoin's core tenet. As the world grapples with endless money printing, Bitcoin offers an immutable refuge. Its price trajectory isn't just hopeful thinking; 𝘪𝘵'𝘴 𝘵𝘩𝘦 𝘯𝘢𝘵𝘶𝘳𝘢𝘭 𝘢𝘯𝘥 𝘭𝘰𝘨𝘪𝘤𝘢𝘭 𝘰𝘶𝘵𝘤𝘰𝘮𝘦 𝘰𝘧 𝘱𝘦𝘳𝘧𝘦𝘤𝘵 𝘴𝘤𝘢𝘳𝘤𝘪𝘵𝘺. What Michael Saylor said is true: “𝘐𝘵’𝘴 𝘨𝘰𝘪𝘯𝘨 𝘶𝘱 𝘧𝘰𝘳𝘦𝘷𝘦𝘳, 𝘓𝘢𝘶𝘳𝘢.” This is because while its supply is eternally fixed, 𝗵𝘂𝗺𝗮𝗻 𝗶𝗻𝗴𝗲𝗻𝘂𝗶𝘁𝘆 𝗶𝘀𝗻’𝘁.

Give this a 𝗟𝗶𝗸𝗲🤙 and a 𝗦𝗵𝗮𝗿𝗲🔄, and 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸🔖 with your other favorite posts.

And tell me in the 𝗖𝗼𝗺𝗺𝗲𝗻𝘁𝘀⬇️ what you think absolute scarcity could mean for humanity.

Give this a 𝗟𝗶𝗸𝗲🤙 and a 𝗦𝗵𝗮𝗿𝗲🔄, and 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸🔖 with your other favorite posts.

And tell me in the 𝗖𝗼𝗺𝗺𝗲𝗻𝘁𝘀⬇️ what you think absolute scarcity could mean for humanity. You are sadly mistaken.

#Bitcoin is not a number on a postit or on anything else; 𝗶𝘁'𝘀 𝗮 𝘀𝗲𝘁 𝗼𝗳 𝗿𝘂𝗹𝗲𝘀 𝘁𝗵𝗮𝘁 𝗲𝘃𝗲𝗿𝘆𝗼𝗻𝗲 𝘂𝘀𝗶𝗻𝗴 𝗯𝗶𝘁𝗰𝗼𝗶𝗻 𝗮𝗴𝗿𝗲𝗲𝘀 𝗼𝗻. These rules involve a type of mathematical function known as 𝘤𝘳𝘺𝘱𝘵𝘰𝘨𝘳𝘢𝘱𝘩𝘺, which is easy to solve in one direction, but impossible to solve in the other direction without a brute force guess-and-check. This brute force requires 𝗿𝗲𝗮𝗹-𝘄𝗼𝗿𝗹𝗱 𝗲𝗻𝗲𝗿𝗴𝘆 𝗲𝘅𝗽𝗲𝗻𝗱𝗶𝘁𝘂𝗿𝗲, in much the same way that mining gold does, which is why Bitcoin's hashing process has been likened to actual mining.

In this way, Bitcoin relies on 3 things to function: 𝘁𝗵𝗲 𝗴𝗮𝗺𝗲 𝘁𝗵𝗲𝗼𝗿𝘆 of its users abiding by its rules, 𝘁𝗵𝗲 𝗺𝗮𝘁𝗵𝗲𝗺𝗮𝘁𝗶𝗰𝗮𝗹 𝗽𝗿𝗶𝗻𝗰𝗶𝗽𝗹𝗲𝘀 of cryptography, and 𝘁𝗵𝗲 𝗹𝗮𝘄𝘀 𝗼𝗳 𝗽𝗵𝘆𝘀𝗶𝗰𝘀 in its use of energy. Bitcoin cannot break or neglect these 3 pillars, and 𝘢𝘴 𝘭𝘰𝘯𝘨 𝘢𝘴 𝘵𝘩𝘦𝘴𝘦 3 𝘦𝘹𝘪𝘴𝘵, 𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘸𝘪𝘭𝘭 𝘤𝘰𝘯𝘵𝘪𝘯𝘶𝘦 𝘵𝘰 𝘧𝘶𝘯𝘤𝘵𝘪𝘰𝘯.

You said that "𝘦𝘷𝘦𝘳𝘺𝘰𝘯𝘦 𝘸𝘩𝘰 𝘣𝘶𝘺𝘴 𝘪𝘯𝘵𝘰 𝘪𝘵 𝘩𝘰𝘱𝘦𝘴 𝘦𝘷𝘦𝘳𝘺𝘰𝘯𝘦 𝘦𝘭𝘴𝘦 𝘸𝘪𝘭𝘭 𝘵𝘰𝘰." This was also the case with gold, when it was first monetizing thousands of years ago, and is an example of the game theory mentioned above. Like Bitcoin, gold is also built on the 3 pillars of game theory, math (on a quantum level), and physics in order to continue to exist. However, 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗵𝗮𝘀 𝗺𝗮𝗻𝘆 𝘂𝘁𝗶𝗹𝗶𝘁𝗮𝗿𝗶𝗮𝗻 𝗮𝗱𝘃𝗮𝗻𝘁𝗮𝗴𝗲𝘀 𝘁𝗵𝗮𝘁 𝗴𝗼𝗹𝗱 𝗱𝗼𝗲𝘀 𝗻𝗼𝘁.

It's often said that gold has "intrinsic value", but in reality, 𝘯𝘰𝘵𝘩𝘪𝘯𝘨 𝘪𝘴 𝘷𝘢𝘭𝘶𝘢𝘣𝘭𝘦 𝘪𝘯𝘵𝘳𝘪𝘯𝘴𝘪𝘤𝘢𝘭𝘭𝘺, 𝘪𝘯 𝘢𝘯𝘥 𝘰𝘧 𝘪𝘵𝘴𝘦𝘭𝘧. Value, by definition, 𝗺𝘂𝘀𝘁 come from a beholder who wants something, and sees a means to achieve their desires in the thing they're beholding. Gold's apparent scarcity, durability, beauty and other attributes led to it being valued by anyone who wanted their money to not be easily debased or destroyed, and wanted it to look nice, too.

Gold's beauty may be one of its only advantages over Bitcoin's invisibility (though that invisibility is often an advantage over gold's confiscatability). Bitcoin's many attributes include being:

- 𝗮𝗯𝘀𝗼𝗹𝘂𝘁𝗲𝗹𝘆 𝘀𝗰𝗮𝗿𝗰𝗲 (unlike gold, which exists in unknown quantities on Earth, practically infinite quantities throughout the universe, and increases in supply when it increases in price)

- 𝗶𝗻𝗱𝗲𝘀𝘁𝗿𝘂𝗰𝘁𝗶𝗯𝗹𝗲 (Bitcoin is made of information, so every additional copy of its code make it more durable)

- 𝗲𝗮𝘀𝗶𝗹𝘆 𝗱𝗶𝘃𝗶𝘀𝗶𝗯𝗹𝗲 (infinitely divisible, if needed, unlike gold, which is very difficult to divide, and can only be divided down to the atomic level)

- 𝗽𝗼𝗿𝘁𝗮𝗯𝗹𝗲 over 𝘢𝘯𝘺 communications medium (unlike gold, which is very difficult to transport)

- 𝗲𝘅𝗮𝗰𝘁𝗹𝘆 𝗲𝗾𝘂𝗮𝗹 𝗶𝗻 𝘃𝗮𝗹𝘂𝗲 𝘁𝗼 𝗼𝘁𝗵𝗲𝗿 𝗲𝗾𝘂𝗮𝗹 𝘂𝗻𝗶𝘁𝘀 (unlike gold, which often has minor impurities)

- easily 𝘃𝗲𝗿𝗶𝗳𝗶𝗮𝗯𝗹𝗲 and 𝘂𝗻𝗰𝗼𝘂𝗻𝘁𝗲𝗿𝗳𝗲𝗶𝘁𝗮𝗯𝗹𝗲 (unlike gold, which has often been faked and is difficult to verify)

- as 𝗲𝗮𝘀𝘆 𝘁𝗼 𝘀𝘁𝗼𝗿𝗲 and 𝗿𝗲𝘀𝗶𝘀𝘁𝗮𝗻𝘁 𝘁𝗼 𝗰𝗼𝗻𝗳𝗶𝘀𝗰𝗮𝘁𝗶𝗼𝗻 as writing down or memorizing 12 words (unlike gold, which is difficult to store and easy to confiscate)

- 𝗶𝗺𝗽𝗿𝗼𝘃𝗮𝗯𝗹𝗲 (as good as Bitcoin's qualities are today, it will always be improvable, unlike gold, which will forever be merely a metal with an atomic number of 79)

𝗔𝗻𝘆𝗼𝗻𝗲 𝘄𝗵𝗼 𝘄𝗮𝗻𝘁𝘀 𝘁𝗵𝗲𝘀𝗲 𝗮𝘁𝘁𝗿𝗶𝗯𝘂𝘁𝗲𝘀 𝗶𝗻 𝘁𝗵𝗲𝗶𝗿 𝗺𝗼𝗻𝗲𝘆 𝘄𝗶𝗹𝗹 𝘀𝗲𝗲 𝘃𝗮𝗹𝘂𝗲 𝗶𝗻 𝗕𝗶𝘁𝗰𝗼𝗶𝗻, and see why it's superior to all other forms of money, including gold. 𝘠𝘰𝘶 may see more value in a substance that has an 𝘶𝘯𝘬𝘯𝘰𝘸𝘯 and 𝘱𝘳𝘢𝘤𝘵𝘪𝘤𝘢𝘭𝘭𝘺 𝘪𝘯𝘧𝘪𝘯𝘪𝘵𝘦 supply, that 𝘦𝘹𝘱𝘢𝘯𝘥𝘴 𝘪𝘯 𝘴𝘶𝘱𝘱𝘭𝘺 when it rises in price, that is 𝘥𝘪𝘧𝘧𝘪𝘤𝘶𝘭𝘵 𝘵𝘰 𝘥𝘪𝘷𝘪𝘥𝘦 𝘢𝘯𝘥 𝘵𝘳𝘢𝘯𝘴𝘱𝘰𝘳𝘵, that is often 𝘯𝘰𝘵 𝘧𝘶𝘯𝘨𝘪𝘣𝘭𝘦, that is 𝘤𝘰𝘶𝘯𝘵𝘦𝘳𝘧𝘦𝘪𝘵𝘢𝘣𝘭𝘦 and 𝘥𝘪𝘧𝘧𝘪𝘤𝘶𝘭𝘵 𝘵𝘰 𝘷𝘦𝘳𝘪𝘧𝘺, and that is difficult to store and 𝘦𝘢𝘴𝘺 𝘵𝘰 𝘤𝘰𝘯𝘧𝘪𝘴𝘤𝘢𝘵𝘦.

If so, then you will value gold more than bitcoin, and that is your right. But 𝗲𝘃𝗲𝗿𝘆𝗼𝗻𝗲 𝗲𝗹𝘀𝗲 𝘄𝗶𝗹𝗹 𝘃𝗮𝗹𝘂𝗲 𝗯𝗶𝘁𝗰𝗼𝗶𝗻 𝗺𝗼𝗿𝗲 𝘁𝗵𝗮𝗻 𝗴𝗼𝗹𝗱, for the tangible advantages it brings to the ways they save and exchange the fruits of their labors. But like the Chinese who, over a century ago, valued silver more than gold, and were left behind by a world that valued gold more than silver, 𝘆𝗼𝘂 𝘄𝗶𝗹𝗹 𝗯𝗲 𝘀𝗶𝗺𝗶𝗹𝗮𝗿𝗹𝘆 𝗹𝗲𝗳𝘁 𝗯𝗲𝗵𝗶𝗻𝗱 𝗯𝘆 𝗮 𝘄𝗼𝗿𝗹𝗱 𝘁𝗵𝗮𝘁 𝗶𝘀 𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗶𝗻𝗴𝗹𝘆 𝘃𝗮𝗹𝘂𝗶𝗻𝗴 𝗯𝗶𝘁𝗰𝗼𝗶𝗻 𝗺𝗼𝗿𝗲 𝘁𝗵𝗮𝗻 𝗴𝗼𝗹𝗱 or anything else that can be used as money.

You are sadly mistaken.

#Bitcoin is not a number on a postit or on anything else; 𝗶𝘁'𝘀 𝗮 𝘀𝗲𝘁 𝗼𝗳 𝗿𝘂𝗹𝗲𝘀 𝘁𝗵𝗮𝘁 𝗲𝘃𝗲𝗿𝘆𝗼𝗻𝗲 𝘂𝘀𝗶𝗻𝗴 𝗯𝗶𝘁𝗰𝗼𝗶𝗻 𝗮𝗴𝗿𝗲𝗲𝘀 𝗼𝗻. These rules involve a type of mathematical function known as 𝘤𝘳𝘺𝘱𝘵𝘰𝘨𝘳𝘢𝘱𝘩𝘺, which is easy to solve in one direction, but impossible to solve in the other direction without a brute force guess-and-check. This brute force requires 𝗿𝗲𝗮𝗹-𝘄𝗼𝗿𝗹𝗱 𝗲𝗻𝗲𝗿𝗴𝘆 𝗲𝘅𝗽𝗲𝗻𝗱𝗶𝘁𝘂𝗿𝗲, in much the same way that mining gold does, which is why Bitcoin's hashing process has been likened to actual mining.

In this way, Bitcoin relies on 3 things to function: 𝘁𝗵𝗲 𝗴𝗮𝗺𝗲 𝘁𝗵𝗲𝗼𝗿𝘆 of its users abiding by its rules, 𝘁𝗵𝗲 𝗺𝗮𝘁𝗵𝗲𝗺𝗮𝘁𝗶𝗰𝗮𝗹 𝗽𝗿𝗶𝗻𝗰𝗶𝗽𝗹𝗲𝘀 of cryptography, and 𝘁𝗵𝗲 𝗹𝗮𝘄𝘀 𝗼𝗳 𝗽𝗵𝘆𝘀𝗶𝗰𝘀 in its use of energy. Bitcoin cannot break or neglect these 3 pillars, and 𝘢𝘴 𝘭𝘰𝘯𝘨 𝘢𝘴 𝘵𝘩𝘦𝘴𝘦 3 𝘦𝘹𝘪𝘴𝘵, 𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘸𝘪𝘭𝘭 𝘤𝘰𝘯𝘵𝘪𝘯𝘶𝘦 𝘵𝘰 𝘧𝘶𝘯𝘤𝘵𝘪𝘰𝘯.

You said that "𝘦𝘷𝘦𝘳𝘺𝘰𝘯𝘦 𝘸𝘩𝘰 𝘣𝘶𝘺𝘴 𝘪𝘯𝘵𝘰 𝘪𝘵 𝘩𝘰𝘱𝘦𝘴 𝘦𝘷𝘦𝘳𝘺𝘰𝘯𝘦 𝘦𝘭𝘴𝘦 𝘸𝘪𝘭𝘭 𝘵𝘰𝘰." This was also the case with gold, when it was first monetizing thousands of years ago, and is an example of the game theory mentioned above. Like Bitcoin, gold is also built on the 3 pillars of game theory, math (on a quantum level), and physics in order to continue to exist. However, 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗵𝗮𝘀 𝗺𝗮𝗻𝘆 𝘂𝘁𝗶𝗹𝗶𝘁𝗮𝗿𝗶𝗮𝗻 𝗮𝗱𝘃𝗮𝗻𝘁𝗮𝗴𝗲𝘀 𝘁𝗵𝗮𝘁 𝗴𝗼𝗹𝗱 𝗱𝗼𝗲𝘀 𝗻𝗼𝘁.

It's often said that gold has "intrinsic value", but in reality, 𝘯𝘰𝘵𝘩𝘪𝘯𝘨 𝘪𝘴 𝘷𝘢𝘭𝘶𝘢𝘣𝘭𝘦 𝘪𝘯𝘵𝘳𝘪𝘯𝘴𝘪𝘤𝘢𝘭𝘭𝘺, 𝘪𝘯 𝘢𝘯𝘥 𝘰𝘧 𝘪𝘵𝘴𝘦𝘭𝘧. Value, by definition, 𝗺𝘂𝘀𝘁 come from a beholder who wants something, and sees a means to achieve their desires in the thing they're beholding. Gold's apparent scarcity, durability, beauty and other attributes led to it being valued by anyone who wanted their money to not be easily debased or destroyed, and wanted it to look nice, too.

Gold's beauty may be one of its only advantages over Bitcoin's invisibility (though that invisibility is often an advantage over gold's confiscatability). Bitcoin's many attributes include being:

- 𝗮𝗯𝘀𝗼𝗹𝘂𝘁𝗲𝗹𝘆 𝘀𝗰𝗮𝗿𝗰𝗲 (unlike gold, which exists in unknown quantities on Earth, practically infinite quantities throughout the universe, and increases in supply when it increases in price)

- 𝗶𝗻𝗱𝗲𝘀𝘁𝗿𝘂𝗰𝘁𝗶𝗯𝗹𝗲 (Bitcoin is made of information, so every additional copy of its code make it more durable)

- 𝗲𝗮𝘀𝗶𝗹𝘆 𝗱𝗶𝘃𝗶𝘀𝗶𝗯𝗹𝗲 (infinitely divisible, if needed, unlike gold, which is very difficult to divide, and can only be divided down to the atomic level)

- 𝗽𝗼𝗿𝘁𝗮𝗯𝗹𝗲 over 𝘢𝘯𝘺 communications medium (unlike gold, which is very difficult to transport)

- 𝗲𝘅𝗮𝗰𝘁𝗹𝘆 𝗲𝗾𝘂𝗮𝗹 𝗶𝗻 𝘃𝗮𝗹𝘂𝗲 𝘁𝗼 𝗼𝘁𝗵𝗲𝗿 𝗲𝗾𝘂𝗮𝗹 𝘂𝗻𝗶𝘁𝘀 (unlike gold, which often has minor impurities)

- easily 𝘃𝗲𝗿𝗶𝗳𝗶𝗮𝗯𝗹𝗲 and 𝘂𝗻𝗰𝗼𝘂𝗻𝘁𝗲𝗿𝗳𝗲𝗶𝘁𝗮𝗯𝗹𝗲 (unlike gold, which has often been faked and is difficult to verify)

- as 𝗲𝗮𝘀𝘆 𝘁𝗼 𝘀𝘁𝗼𝗿𝗲 and 𝗿𝗲𝘀𝗶𝘀𝘁𝗮𝗻𝘁 𝘁𝗼 𝗰𝗼𝗻𝗳𝗶𝘀𝗰𝗮𝘁𝗶𝗼𝗻 as writing down or memorizing 12 words (unlike gold, which is difficult to store and easy to confiscate)

- 𝗶𝗺𝗽𝗿𝗼𝘃𝗮𝗯𝗹𝗲 (as good as Bitcoin's qualities are today, it will always be improvable, unlike gold, which will forever be merely a metal with an atomic number of 79)

𝗔𝗻𝘆𝗼𝗻𝗲 𝘄𝗵𝗼 𝘄𝗮𝗻𝘁𝘀 𝘁𝗵𝗲𝘀𝗲 𝗮𝘁𝘁𝗿𝗶𝗯𝘂𝘁𝗲𝘀 𝗶𝗻 𝘁𝗵𝗲𝗶𝗿 𝗺𝗼𝗻𝗲𝘆 𝘄𝗶𝗹𝗹 𝘀𝗲𝗲 𝘃𝗮𝗹𝘂𝗲 𝗶𝗻 𝗕𝗶𝘁𝗰𝗼𝗶𝗻, and see why it's superior to all other forms of money, including gold. 𝘠𝘰𝘶 may see more value in a substance that has an 𝘶𝘯𝘬𝘯𝘰𝘸𝘯 and 𝘱𝘳𝘢𝘤𝘵𝘪𝘤𝘢𝘭𝘭𝘺 𝘪𝘯𝘧𝘪𝘯𝘪𝘵𝘦 supply, that 𝘦𝘹𝘱𝘢𝘯𝘥𝘴 𝘪𝘯 𝘴𝘶𝘱𝘱𝘭𝘺 when it rises in price, that is 𝘥𝘪𝘧𝘧𝘪𝘤𝘶𝘭𝘵 𝘵𝘰 𝘥𝘪𝘷𝘪𝘥𝘦 𝘢𝘯𝘥 𝘵𝘳𝘢𝘯𝘴𝘱𝘰𝘳𝘵, that is often 𝘯𝘰𝘵 𝘧𝘶𝘯𝘨𝘪𝘣𝘭𝘦, that is 𝘤𝘰𝘶𝘯𝘵𝘦𝘳𝘧𝘦𝘪𝘵𝘢𝘣𝘭𝘦 and 𝘥𝘪𝘧𝘧𝘪𝘤𝘶𝘭𝘵 𝘵𝘰 𝘷𝘦𝘳𝘪𝘧𝘺, and that is difficult to store and 𝘦𝘢𝘴𝘺 𝘵𝘰 𝘤𝘰𝘯𝘧𝘪𝘴𝘤𝘢𝘵𝘦.

If so, then you will value gold more than bitcoin, and that is your right. But 𝗲𝘃𝗲𝗿𝘆𝗼𝗻𝗲 𝗲𝗹𝘀𝗲 𝘄𝗶𝗹𝗹 𝘃𝗮𝗹𝘂𝗲 𝗯𝗶𝘁𝗰𝗼𝗶𝗻 𝗺𝗼𝗿𝗲 𝘁𝗵𝗮𝗻 𝗴𝗼𝗹𝗱, for the tangible advantages it brings to the ways they save and exchange the fruits of their labors. But like the Chinese who, over a century ago, valued silver more than gold, and were left behind by a world that valued gold more than silver, 𝘆𝗼𝘂 𝘄𝗶𝗹𝗹 𝗯𝗲 𝘀𝗶𝗺𝗶𝗹𝗮𝗿𝗹𝘆 𝗹𝗲𝗳𝘁 𝗯𝗲𝗵𝗶𝗻𝗱 𝗯𝘆 𝗮 𝘄𝗼𝗿𝗹𝗱 𝘁𝗵𝗮𝘁 𝗶𝘀 𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗶𝗻𝗴𝗹𝘆 𝘃𝗮𝗹𝘂𝗶𝗻𝗴 𝗯𝗶𝘁𝗰𝗼𝗶𝗻 𝗺𝗼𝗿𝗲 𝘁𝗵𝗮𝗻 𝗴𝗼𝗹𝗱 or anything else that can be used as money.

𝗚𝘂𝘆 𝗦𝘄𝗮𝗻𝗻’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

Money is a good or service from a central party that acts as a ledger to distribute and ensure cooperation between members of society who do not know or trust each other. Along with a number of other characteristics that make it portable, divisible, and uniform across any amount of the good itself, the ability to act as a sound monetary good is an enormous, network-based value. It is much like a language in this way.

A language doesn't have "intrinsic value" in the sense that you can use it to do something other than its intended purpose. A language is valuable because a uniform set of words that can establish and share meaning and understanding has an incredible value by itself. In this same way, many monetary goods in the past have had little or no other purpose other than to serve the role of money. While the digital monies of today, issued and controlled by banks or governments, explicitly have no value or substance in any way at all. Yet these work until they are so badly abused that their value plummets to zero, which is the true price to create more units of a fiat money.

Fiat can be understood as a *virtual* money. It is a digital point system designed to mimic the characteristics of money, but because it is centrally controlled, these characteristics don't actually exist. They are faked by the manager of the monetary system. In this context, bitcoin can be understood as the first true *digital* money: its characteristics are real and verifiable, and it has established itself on the global stage with a substantial and long lasting market. It will either continue to grow or fail based on its ability to maintain its independence, and the core characteristics of monetary goods.

𝗚𝘂𝘆 𝗦𝘄𝗮𝗻𝗻’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

Money is a good or service from a central party that acts as a ledger to distribute and ensure cooperation between members of society who do not know or trust each other. Along with a number of other characteristics that make it portable, divisible, and uniform across any amount of the good itself, the ability to act as a sound monetary good is an enormous, network-based value. It is much like a language in this way.

A language doesn't have "intrinsic value" in the sense that you can use it to do something other than its intended purpose. A language is valuable because a uniform set of words that can establish and share meaning and understanding has an incredible value by itself. In this same way, many monetary goods in the past have had little or no other purpose other than to serve the role of money. While the digital monies of today, issued and controlled by banks or governments, explicitly have no value or substance in any way at all. Yet these work until they are so badly abused that their value plummets to zero, which is the true price to create more units of a fiat money.

Fiat can be understood as a *virtual* money. It is a digital point system designed to mimic the characteristics of money, but because it is centrally controlled, these characteristics don't actually exist. They are faked by the manager of the monetary system. In this context, bitcoin can be understood as the first true *digital* money: its characteristics are real and verifiable, and it has established itself on the global stage with a substantial and long lasting market. It will either continue to grow or fail based on its ability to maintain its independence, and the core characteristics of monetary goods.

Guy Swann is host of the Bitcoin Audible podcast featured in Forbes Magazine’s Top Crypto Podcasts of 2020, and CEO of One Eleven Productions. He also hosts the Shitcoin Insider and AI Unchained podcasts. He found himself engrossed in the economic experiment and technological breakthrough of Bitcoin in 2011, and hasn’t been able to pull himself away since. He has a background in networking and system administration, film and media production, and is an avid student of economics. He’s literally read thousands of hours of works on the many disciplines around Bitcoin and has listened to even more. He’s “read more about Bitcoin than anyone else you know!”

Guy Swann is host of the Bitcoin Audible podcast featured in Forbes Magazine’s Top Crypto Podcasts of 2020, and CEO of One Eleven Productions. He also hosts the Shitcoin Insider and AI Unchained podcasts. He found himself engrossed in the economic experiment and technological breakthrough of Bitcoin in 2011, and hasn’t been able to pull himself away since. He has a background in networking and system administration, film and media production, and is an avid student of economics. He’s literally read thousands of hours of works on the many disciplines around Bitcoin and has listened to even more. He’s “read more about Bitcoin than anyone else you know!”

Preorder your copy of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟴𝟬%, by contributing to our @Geyser initiative:

Preorder your copy of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟴𝟬%, by contributing to our @Geyser initiative:

All the Satoshi and Cypherpunk collectibles are 𝙎𝙊𝙇𝘿 𝙊𝙐𝙏!

All the Satoshi and Cypherpunk collectibles are 𝙎𝙊𝙇𝘿 𝙊𝙐𝙏!

This is your chance to claim 1 of the 4 remaining collectibles:

👉 𝗢𝗻𝗹𝘆 𝟮 𝗼𝘂𝘁 𝗼𝗳 𝘁𝗵𝗲 𝟵 𝗥𝗲𝗺𝗻𝗮𝗻𝘁𝘀 𝗿𝗲𝗺𝗮𝗶𝗻! 👈

👉 𝗢𝗻𝗹𝘆 𝟮 𝗼𝘂𝘁 𝗼𝗳 𝘁𝗵𝗲 𝟮𝟭 𝗠𝗮𝘅𝗶𝗺𝗮𝗹𝗶𝘀𝘁𝘀 𝗿𝗲𝗺𝗮𝗶𝗻! 👈

This is your chance to claim 1 of the 4 remaining collectibles:

👉 𝗢𝗻𝗹𝘆 𝟮 𝗼𝘂𝘁 𝗼𝗳 𝘁𝗵𝗲 𝟵 𝗥𝗲𝗺𝗻𝗮𝗻𝘁𝘀 𝗿𝗲𝗺𝗮𝗶𝗻! 👈

👉 𝗢𝗻𝗹𝘆 𝟮 𝗼𝘂𝘁 𝗼𝗳 𝘁𝗵𝗲 𝟮𝟭 𝗠𝗮𝘅𝗶𝗺𝗮𝗹𝗶𝘀𝘁𝘀 𝗿𝗲𝗺𝗮𝗶𝗻! 👈

𝗢𝗻𝗹𝘆 𝟮𝟰 𝗵𝗼𝘂𝗿𝘀 until the price of the Maximalist print goes to $𝟰𝟵𝟵.

𝘈𝘤𝘵 𝘯𝘰𝘸, as these 4 collectibles are sure to go fast!

And stay tuned for more exciting announcements, 𝗶𝗻𝗰𝗹𝘂𝗱𝗶𝗻𝗴 𝘁𝗵𝗲 𝗼𝗽𝗲𝗻-𝘀𝗼𝘂𝗿𝗰𝗲 𝗿𝗲𝗹𝗲𝗮𝘀𝗲 𝗼𝗳 𝘁𝗵𝗲 𝗦𝗽𝗶𝗿𝗶𝘁 𝗼𝗳 𝗦𝗮𝘁𝗼𝘀𝗵𝗶 𝗺𝗼𝗱𝗲𝗹. 👀

𝗢𝗻𝗹𝘆 𝟮𝟰 𝗵𝗼𝘂𝗿𝘀 until the price of the Maximalist print goes to $𝟰𝟵𝟵.

𝘈𝘤𝘵 𝘯𝘰𝘸, as these 4 collectibles are sure to go fast!

And stay tuned for more exciting announcements, 𝗶𝗻𝗰𝗹𝘂𝗱𝗶𝗻𝗴 𝘁𝗵𝗲 𝗼𝗽𝗲𝗻-𝘀𝗼𝘂𝗿𝗰𝗲 𝗿𝗲𝗹𝗲𝗮𝘀𝗲 𝗼𝗳 𝘁𝗵𝗲 𝗦𝗽𝗶𝗿𝗶𝘁 𝗼𝗳 𝗦𝗮𝘁𝗼𝘀𝗵𝗶 𝗺𝗼𝗱𝗲𝗹. 👀

𝗝𝗼𝗵𝗻 𝗩𝗮𝗹𝗹𝗶𝘀’ 𝗮𝗻𝘀𝘄𝗲𝗿:

Money is the fundamental organizing and coordinating mechanism of a market, and as such, its qualities, which determine the functions which it either permits or prohibits, are highly consequential in both subtle and obvious ways. If there is an inherent unfairness in the money, as is the case with fiat, then that unfairness will propagate, through the money, into every corner and facet of the market which uses it — which is to say, into the people who use it.

In this particular case, fiat is unfair because a certain (small) group of people are permitted to obtain it for free (to ‘print’ it), while others must sacrifice their time and energy to do so. The result is, expectedly, the subjugation of the latter to the former. Such a market comes to increasingly reflect not the ‘will’ of each individual’s choices, but those of a very small few, as they may siphon off purchasing power and deploy it in whatever manner they see fit. The inevitable result is an unnatural concentration of wealth and power in the hands of a select few — those who control or have privileged access to the ‘money printer’ (or digital equivalent).

You may also characterize fiat as a ‘lie’. While perhaps not intuitive or obvious, part of the reason why money is able to perform the stabilizing or harmonizing function which it does, is because it ‘carries’ information about the preferences of all market actors, and the associated time, energy, and sacrifices which were made to either act or not act on them (among other information). If there is an entity arbitrarily manipulating the money supply, all that information becomes corrupted and distorted, and the fidelity with which it coheres to the preferences of market actors, and the market circumstances broadly, is diminished. Decisions are thus made on false or imperfect information, and as such, due to their diminished coherence with ‘reality’, are more likely to be made in error, or to be more wasteful or destructive than necessary. The longer this goes on, the more such a money will erect a ‘false reality’, increasingly detached from what individual preferences and action, in relation to the natural and social worlds, would otherwise have dictated.

Bitcoin, on the other hand, does not permit such arbitrary manipulations, nor any degree of unfairness from one user to the next. Everyone is subject to the same rules. The result is a scenario in which unfairness, and all the damaging consequences of it, is impossible, and where truth, rather than falsehood, is rightly the basis upon which people interact (economically).

Simply put, fiat is immoral, and the qualities that make it so, erect an all-encompassing system of incentives which inevitably influences those who (are forced to) use it. Conversely, bitcoin operates on truth and fairness, and thereby erects (or will erect) an all-encompassing system of virtuous incentives, which likewise will influence behavior in accordance with them.

Simply put, a fiat standard is immoral and destructive, and a bitcoin standard will be virtuous and creative.

𝗝𝗼𝗵𝗻 𝗩𝗮𝗹𝗹𝗶𝘀’ 𝗮𝗻𝘀𝘄𝗲𝗿:

Money is the fundamental organizing and coordinating mechanism of a market, and as such, its qualities, which determine the functions which it either permits or prohibits, are highly consequential in both subtle and obvious ways. If there is an inherent unfairness in the money, as is the case with fiat, then that unfairness will propagate, through the money, into every corner and facet of the market which uses it — which is to say, into the people who use it.

In this particular case, fiat is unfair because a certain (small) group of people are permitted to obtain it for free (to ‘print’ it), while others must sacrifice their time and energy to do so. The result is, expectedly, the subjugation of the latter to the former. Such a market comes to increasingly reflect not the ‘will’ of each individual’s choices, but those of a very small few, as they may siphon off purchasing power and deploy it in whatever manner they see fit. The inevitable result is an unnatural concentration of wealth and power in the hands of a select few — those who control or have privileged access to the ‘money printer’ (or digital equivalent).

You may also characterize fiat as a ‘lie’. While perhaps not intuitive or obvious, part of the reason why money is able to perform the stabilizing or harmonizing function which it does, is because it ‘carries’ information about the preferences of all market actors, and the associated time, energy, and sacrifices which were made to either act or not act on them (among other information). If there is an entity arbitrarily manipulating the money supply, all that information becomes corrupted and distorted, and the fidelity with which it coheres to the preferences of market actors, and the market circumstances broadly, is diminished. Decisions are thus made on false or imperfect information, and as such, due to their diminished coherence with ‘reality’, are more likely to be made in error, or to be more wasteful or destructive than necessary. The longer this goes on, the more such a money will erect a ‘false reality’, increasingly detached from what individual preferences and action, in relation to the natural and social worlds, would otherwise have dictated.

Bitcoin, on the other hand, does not permit such arbitrary manipulations, nor any degree of unfairness from one user to the next. Everyone is subject to the same rules. The result is a scenario in which unfairness, and all the damaging consequences of it, is impossible, and where truth, rather than falsehood, is rightly the basis upon which people interact (economically).

Simply put, fiat is immoral, and the qualities that make it so, erect an all-encompassing system of incentives which inevitably influences those who (are forced to) use it. Conversely, bitcoin operates on truth and fairness, and thereby erects (or will erect) an all-encompassing system of virtuous incentives, which likewise will influence behavior in accordance with them.

Simply put, a fiat standard is immoral and destructive, and a bitcoin standard will be virtuous and creative.

John Vallis is the host of the Bitcoin Rapid-Fire and Portal Orange podcasts. He is a passionate Bitcoin advocate, and an enthusiastic explorer of the profound implications it represents.

John Vallis is the host of the Bitcoin Rapid-Fire and Portal Orange podcasts. He is a passionate Bitcoin advocate, and an enthusiastic explorer of the profound implications it represents.

Preorder your copy of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟴𝟬%, by contributing to our @Geyser initiative:

Preorder your copy of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟴𝟬%, by contributing to our @Geyser initiative:

Financial success transcends mere wealth accumulation. The cornerstone of true wealth is 𝘁𝗵𝗲 𝗹𝗶𝗯𝗲𝗿𝗮𝘁𝗶𝗼𝗻 𝘁𝗼 𝗰𝗵𝗮𝘀𝗲 𝘆𝗼𝘂𝗿 𝗱𝗿𝗲𝗮𝗺𝘀, unshackled by monetary worries. Bitcoin, in its purest form, represents this freedom, offering a path to secure your financial future without reliance on faltering fiat systems.

Financial independence is realized through your ability to master the economics of life. It’s not about the 𝘢𝘮𝘰𝘶𝘯𝘵 of income you earn, but your capability to manage and multiply these resources through hard work and personal responsibility. 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝘀𝘁𝗮𝗻𝗱𝘀 𝗮𝘀 𝘁𝗵𝗲 𝘁𝗵𝗲 𝗯𝗲𝘀𝘁 𝘁𝗼𝗼𝗹 𝘁𝗼 𝗮𝘀𝘀𝗶𝘀𝘁 𝘆𝗼𝘂 𝘄𝗶𝘁𝗵 𝘁𝗵𝗶𝘀, with its Proof of Work algorithm, hard-capped supply, and ability for you to custody it yourself.

Success comes from 𝘢𝘭𝘪𝘨𝘯𝘪𝘯𝘨 𝘺𝘰𝘶𝘳 𝘧𝘪𝘯𝘢𝘯𝘤𝘪𝘢𝘭 𝘥𝘦𝘤𝘪𝘴𝘪𝘰𝘯𝘴 𝘸𝘪𝘵𝘩 𝘱𝘦𝘳𝘴𝘰𝘯𝘢𝘭 𝘷𝘢𝘭𝘶𝘦𝘴 𝘢𝘯𝘥 𝘱𝘳𝘪𝘰𝘳𝘪𝘵𝘪𝘦𝘴. Bitcoin facilitates this by empowering individuals to transact freely, without the oversight of intrusive third parties. It champions the cause of personal sovereignty and privacy in financial matters.

While Bitcoin's rising price in fiat terms makes all other prices fall in relation to your sats, 𝘆𝗼𝘂𝗿 𝘄𝗲𝗮𝗹𝘁𝗵 𝗰𝗮𝗻 𝗯𝗲 𝗲𝗮𝘀𝗶𝗹𝘆 𝗹𝗼𝘀𝘁 𝗶𝗳 𝘆𝗼𝘂 𝗱𝗼𝗻'𝘁 𝗶𝗺𝗯𝘂𝗲 𝘁𝗵𝗲 𝗾𝘂𝗮𝗹𝗶𝘁𝗶𝗲𝘀 𝗼𝗳 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗶𝗻𝘁𝗼 𝘆𝗼𝘂𝗿 𝗼𝘄𝗻 𝗹𝗶𝗳𝗲. Whether you have many full bitcoin or just a few sats, financial success is ultimately a mindset that comes more easily to those who measure their wealth in Bitcoin.

Financial success transcends mere wealth accumulation. The cornerstone of true wealth is 𝘁𝗵𝗲 𝗹𝗶𝗯𝗲𝗿𝗮𝘁𝗶𝗼𝗻 𝘁𝗼 𝗰𝗵𝗮𝘀𝗲 𝘆𝗼𝘂𝗿 𝗱𝗿𝗲𝗮𝗺𝘀, unshackled by monetary worries. Bitcoin, in its purest form, represents this freedom, offering a path to secure your financial future without reliance on faltering fiat systems.

Financial independence is realized through your ability to master the economics of life. It’s not about the 𝘢𝘮𝘰𝘶𝘯𝘵 of income you earn, but your capability to manage and multiply these resources through hard work and personal responsibility. 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝘀𝘁𝗮𝗻𝗱𝘀 𝗮𝘀 𝘁𝗵𝗲 𝘁𝗵𝗲 𝗯𝗲𝘀𝘁 𝘁𝗼𝗼𝗹 𝘁𝗼 𝗮𝘀𝘀𝗶𝘀𝘁 𝘆𝗼𝘂 𝘄𝗶𝘁𝗵 𝘁𝗵𝗶𝘀, with its Proof of Work algorithm, hard-capped supply, and ability for you to custody it yourself.

Success comes from 𝘢𝘭𝘪𝘨𝘯𝘪𝘯𝘨 𝘺𝘰𝘶𝘳 𝘧𝘪𝘯𝘢𝘯𝘤𝘪𝘢𝘭 𝘥𝘦𝘤𝘪𝘴𝘪𝘰𝘯𝘴 𝘸𝘪𝘵𝘩 𝘱𝘦𝘳𝘴𝘰𝘯𝘢𝘭 𝘷𝘢𝘭𝘶𝘦𝘴 𝘢𝘯𝘥 𝘱𝘳𝘪𝘰𝘳𝘪𝘵𝘪𝘦𝘴. Bitcoin facilitates this by empowering individuals to transact freely, without the oversight of intrusive third parties. It champions the cause of personal sovereignty and privacy in financial matters.

While Bitcoin's rising price in fiat terms makes all other prices fall in relation to your sats, 𝘆𝗼𝘂𝗿 𝘄𝗲𝗮𝗹𝘁𝗵 𝗰𝗮𝗻 𝗯𝗲 𝗲𝗮𝘀𝗶𝗹𝘆 𝗹𝗼𝘀𝘁 𝗶𝗳 𝘆𝗼𝘂 𝗱𝗼𝗻'𝘁 𝗶𝗺𝗯𝘂𝗲 𝘁𝗵𝗲 𝗾𝘂𝗮𝗹𝗶𝘁𝗶𝗲𝘀 𝗼𝗳 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗶𝗻𝘁𝗼 𝘆𝗼𝘂𝗿 𝗼𝘄𝗻 𝗹𝗶𝗳𝗲. Whether you have many full bitcoin or just a few sats, financial success is ultimately a mindset that comes more easily to those who measure their wealth in Bitcoin.

𝗟𝗶𝗸𝗲🤙 this, and 𝗦𝗵𝗮𝗿𝗲🔄 it with anyone who wants to be financially successful.

And 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸🔖 it for future reference.

𝗟𝗶𝗸𝗲🤙 this, and 𝗦𝗵𝗮𝗿𝗲🔄 it with anyone who wants to be financially successful.

And 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸🔖 it for future reference.

𝗚𝘂𝘆 𝗦𝘄𝗮𝗻𝗻’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

The properties of sound money are as follows:

𝟭 - It is easy to transport.

𝟮 - It doesn't degrade or rot over time.

𝟯 - Each unit is identical and can be swapped for any other equal unit.

𝟰 - It can be broken down into tiny pieces, or gathered into large amounts and the value of each is still directly proportional to its measured amount.

𝟱 - It is extremely difficult to make more of. This allows it to encourage the creation of actual goods and services that people need to prosper, while trading for money, rather than wasting time and energy making more of the monetary unit.

𝟲 - It is easily verifiable, so that counterfeit versions do not get mistaken for it in the market, or in practice it will lose the property of being extremely difficult to make.

𝟳 - And its characteristics must be the same for all users, which arises from its independence or decentralization. Otherwise it will eventually fail due to the abuses and corruption of any humans who can cheat the money instead of participating in the economy.

These can manifest in varying degrees, but all of them must largely be true for a monetary good to survive at a large scale and across long spans of time. The most successful historical example is gold, which held all of these characteristics when economic activity took place almost entirely in person. But then lost the characteristics of #1, #5, #6, and #7 when more and more economic activity began taking place over telecommunications lines. Thus, the loss of these characteristics led to its ultimate abuse and failure to remain a viable money at scale in our modern society.

𝗚𝘂𝘆 𝗦𝘄𝗮𝗻𝗻’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

The properties of sound money are as follows:

𝟭 - It is easy to transport.

𝟮 - It doesn't degrade or rot over time.

𝟯 - Each unit is identical and can be swapped for any other equal unit.

𝟰 - It can be broken down into tiny pieces, or gathered into large amounts and the value of each is still directly proportional to its measured amount.

𝟱 - It is extremely difficult to make more of. This allows it to encourage the creation of actual goods and services that people need to prosper, while trading for money, rather than wasting time and energy making more of the monetary unit.

𝟲 - It is easily verifiable, so that counterfeit versions do not get mistaken for it in the market, or in practice it will lose the property of being extremely difficult to make.

𝟳 - And its characteristics must be the same for all users, which arises from its independence or decentralization. Otherwise it will eventually fail due to the abuses and corruption of any humans who can cheat the money instead of participating in the economy.

These can manifest in varying degrees, but all of them must largely be true for a monetary good to survive at a large scale and across long spans of time. The most successful historical example is gold, which held all of these characteristics when economic activity took place almost entirely in person. But then lost the characteristics of #1, #5, #6, and #7 when more and more economic activity began taking place over telecommunications lines. Thus, the loss of these characteristics led to its ultimate abuse and failure to remain a viable money at scale in our modern society.

Guy Swann is host of the Bitcoin Audible podcast featured in Forbes Magazine’s Top Crypto Podcasts of 2020, and CEO of One Eleven Productions. He also hosts the Shitcoin Insider and AI Unchained podcasts. He found himself engrossed in the economic experiment and technological breakthrough of Bitcoin in 2011, and hasn’t been able to pull himself away since. He has a background in networking and system administration, film and media production, and is an avid student of economics. He’s literally read thousands of hours of works on the many disciplines around Bitcoin and has listened to even more. He’s “read more about Bitcoin than anyone else you know!”

Guy Swann is host of the Bitcoin Audible podcast featured in Forbes Magazine’s Top Crypto Podcasts of 2020, and CEO of One Eleven Productions. He also hosts the Shitcoin Insider and AI Unchained podcasts. He found himself engrossed in the economic experiment and technological breakthrough of Bitcoin in 2011, and hasn’t been able to pull himself away since. He has a background in networking and system administration, film and media production, and is an avid student of economics. He’s literally read thousands of hours of works on the many disciplines around Bitcoin and has listened to even more. He’s “read more about Bitcoin than anyone else you know!”

Preorder your copy of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟴𝟬%, by contributing to our @Geyser initiative:

Preorder your copy of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟴𝟬%, by contributing to our @Geyser initiative:

There will only ever be 𝟮𝟭 𝗠𝗮𝘅𝗶𝗺𝗮𝗹𝗶𝘀𝘁 𝗰𝗮𝗿𝗱𝘀 made by @Based Trading Cards, and 𝗼𝗻𝗹𝘆 𝟴 𝗿𝗲𝗺𝗮𝗶𝗻 𝘁𝗼 𝗯𝗲 𝗰𝗹𝗮𝗶𝗺𝗲𝗱 on @Geyser.

Make one of them yours.

There will only ever be 𝟮𝟭 𝗠𝗮𝘅𝗶𝗺𝗮𝗹𝗶𝘀𝘁 𝗰𝗮𝗿𝗱𝘀 made by @Based Trading Cards, and 𝗼𝗻𝗹𝘆 𝟴 𝗿𝗲𝗺𝗮𝗶𝗻 𝘁𝗼 𝗯𝗲 𝗰𝗹𝗮𝗶𝗺𝗲𝗱 on @Geyser.

Make one of them yours.

Jack’s backdrop on the video call featured a Blockclock — a clever device from @npub1wu4a...3vw0, made for displaying various details about the current state of Bitcoin’s network — displaying "1952", which was 𝘁𝗵𝗲 𝗻𝘂𝗺𝗯𝗲𝗿 𝗼𝗳 𝘀𝗮𝘁𝘀 𝘁𝗵𝗮𝘁 𝗼𝗻𝗲 𝗰𝗼𝘂𝗹𝗱 𝗽𝘂𝗿𝗰𝗵𝗮𝘀𝗲 𝗳𝗼𝗿 𝗮 𝗱𝗼𝗹𝗹𝗮𝗿 𝗮𝘁 𝘁𝗵𝗲 𝘁𝗶𝗺𝗲, not the time in any geographical time zone.

Like all the best memes, this one’s birth was unintentional. Chris Vickery, a cybersecurity researcher with a keen eye but dull Bitcoin acumen, misinterpreted the Blockclock's display as an 𝘢𝘤𝘵𝘶𝘢𝘭 clock cryptically set to Moscow's timezone.

Jack’s backdrop on the video call featured a Blockclock — a clever device from @npub1wu4a...3vw0, made for displaying various details about the current state of Bitcoin’s network — displaying "1952", which was 𝘁𝗵𝗲 𝗻𝘂𝗺𝗯𝗲𝗿 𝗼𝗳 𝘀𝗮𝘁𝘀 𝘁𝗵𝗮𝘁 𝗼𝗻𝗲 𝗰𝗼𝘂𝗹𝗱 𝗽𝘂𝗿𝗰𝗵𝗮𝘀𝗲 𝗳𝗼𝗿 𝗮 𝗱𝗼𝗹𝗹𝗮𝗿 𝗮𝘁 𝘁𝗵𝗲 𝘁𝗶𝗺𝗲, not the time in any geographical time zone.

Like all the best memes, this one’s birth was unintentional. Chris Vickery, a cybersecurity researcher with a keen eye but dull Bitcoin acumen, misinterpreted the Blockclock's display as an 𝘢𝘤𝘵𝘶𝘢𝘭 clock cryptically set to Moscow's timezone.

Vickery's oversight became fodder for Bitcoin maximalists, who turned his blunder into a rallying cry. Living on “Moscow Time" became a tongue-in-cheek reference to shifting one's economic paradigm to measuring 𝘁𝗵𝗲 𝗱𝗲𝗰𝗹𝗶𝗻𝗶𝗻𝗴 𝗽𝘂𝗿𝗰𝗵𝗮𝘀𝗶𝗻𝗴 𝗽𝗼𝘄𝗲𝗿 𝗼𝗳 𝗱𝗼𝗹𝗹𝗮𝗿𝘀 𝗶𝗻 𝘀𝗮𝘁𝘀, and away from measuring the rising price of bitcoin in dollars.

The "Moscow Time" meme encapsulates Bitcoin's ethos — valuing innovation, mocking stubborn ignorance, and cherishing a global movement that redefines how we see wealth. Moscow Time’s “Number Go Down” rate of sats per dollar 𝘪𝘴 𝘢 𝘵𝘦𝘴𝘵𝘢𝘮𝘦𝘯𝘵 𝘵𝘰 𝘉𝘪𝘵𝘤𝘰𝘪𝘯’𝘴 𝘴𝘶𝘱𝘦𝘳𝘪𝘰𝘳𝘪𝘵𝘺, and adds a little humor to this widely misunderstood revolution.

Vickery's oversight became fodder for Bitcoin maximalists, who turned his blunder into a rallying cry. Living on “Moscow Time" became a tongue-in-cheek reference to shifting one's economic paradigm to measuring 𝘁𝗵𝗲 𝗱𝗲𝗰𝗹𝗶𝗻𝗶𝗻𝗴 𝗽𝘂𝗿𝗰𝗵𝗮𝘀𝗶𝗻𝗴 𝗽𝗼𝘄𝗲𝗿 𝗼𝗳 𝗱𝗼𝗹𝗹𝗮𝗿𝘀 𝗶𝗻 𝘀𝗮𝘁𝘀, and away from measuring the rising price of bitcoin in dollars.

The "Moscow Time" meme encapsulates Bitcoin's ethos — valuing innovation, mocking stubborn ignorance, and cherishing a global movement that redefines how we see wealth. Moscow Time’s “Number Go Down” rate of sats per dollar 𝘪𝘴 𝘢 𝘵𝘦𝘴𝘵𝘢𝘮𝘦𝘯𝘵 𝘵𝘰 𝘉𝘪𝘵𝘤𝘰𝘪𝘯’𝘴 𝘴𝘶𝘱𝘦𝘳𝘪𝘰𝘳𝘪𝘵𝘺, and adds a little humor to this widely misunderstood revolution.

Celebrate the 3rd anniversary of this meme by giving this a 𝗟𝗶𝗸𝗲🤙, 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸𝗶𝗻𝗴🔖 this for later, and 𝗦𝗵𝗮𝗿𝗲🔄 it with others.

And you can keep track of the current “Moscow Time” here:

Celebrate the 3rd anniversary of this meme by giving this a 𝗟𝗶𝗸𝗲🤙, 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸𝗶𝗻𝗴🔖 this for later, and 𝗦𝗵𝗮𝗿𝗲🔄 it with others.

And you can keep track of the current “Moscow Time” here:

𝗣𝗲𝘁𝗲𝗿 𝗦𝘁 𝗢𝗻𝗴𝗲’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

Money is how strangers cooperate; without money we would only engage with friends and family and our economy would remain at a subsistence level. This is eroded when the money itself is no longer a store of value, which happens if new supply is produced at a faster pace than wealth is created, which is typical for easily counterfeited monies like paper. If the counterfeiting comes from the government, it arbitrarily seizes the wealth of society while causing poverty and crisis.

𝗣𝗲𝘁𝗲𝗿 𝗦𝘁 𝗢𝗻𝗴𝗲’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

Money is how strangers cooperate; without money we would only engage with friends and family and our economy would remain at a subsistence level. This is eroded when the money itself is no longer a store of value, which happens if new supply is produced at a faster pace than wealth is created, which is typical for easily counterfeited monies like paper. If the counterfeiting comes from the government, it arbitrarily seizes the wealth of society while causing poverty and crisis.

Peter St Onge, Ph.D. is the Mark A. Kolokotrones Fellow in Economic Freedom at the Heritage Foundation, a Fellow at the Mises Institute, and a former professor at Taiwan’s Feng Chia University. Before academia he worked in corporate strategy in Latin America and Asia and bartended at a dive bar in Osaka. He makes daily videos on economics and freedom.

Peter St Onge, Ph.D. is the Mark A. Kolokotrones Fellow in Economic Freedom at the Heritage Foundation, a Fellow at the Mises Institute, and a former professor at Taiwan’s Feng Chia University. Before academia he worked in corporate strategy in Latin America and Asia and bartended at a dive bar in Osaka. He makes daily videos on economics and freedom.

Preorder your copy of "𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀", and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟴𝟬%, by contributing to our @Geyser initiative:

Preorder your copy of "𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀", and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟴𝟬%, by contributing to our @Geyser initiative:

It’s crucial that you both 𝗵𝗼𝗱𝗹 your bitcoin and 𝘀𝗽𝗲𝗻𝗱 it to help drive adoption and increase its utility as a medium of exchange. While hodling your bitcoin as a store of value is important due to its disinflationary nature and potential for long-term price appreciation, spending it is equally essential, in order to realize its full potential as a decentralized digital currency.

Spending your bitcoin and selling it differ in the sense that selling typically involves converting it back into fiat currency, which adds downward pressure (albeit minor) to Bitcoin’s price. On the other hand, 𝘴𝘱𝘦𝘯𝘥𝘪𝘯𝘨 bitcoin involves using it directly as a means of payment for goods and services, thereby bypassing legacy fiat intermediaries, and promoting financial sovereignty.

By actively spending bitcoin, you can contribute to the growing ecosystem of merchants and businesses that accept it, thus 𝘢𝘥𝘥𝘪𝘯𝘨 𝘵𝘰 𝘪𝘵𝘴 𝘢𝘥𝘰𝘱𝘵𝘪𝘰𝘯 𝘢𝘯𝘥 𝘯𝘦𝘵𝘸𝘰𝘳𝘬 𝘦𝘧𝘧𝘦𝘤𝘵𝘴. This not only strengthens bitcoin's use case as a medium of exchange, but also helps to solidify its position as a viable alternative to fiat.

Furthermore, spending bitcoin helps to circulate the currency within the economy, facilitating economic activity, and promoting a more robust and self-sustaining bitcoin ecosystem. As more individuals use bitcoin for everyday transactions, its utility and acceptance will continue to grow, 𝘂𝗹𝘁𝗶𝗺𝗮𝘁𝗲𝗹𝘆 𝗹𝗲𝗮𝗱𝗶𝗻𝗴 𝘁𝗼 𝗮 𝗺𝗼𝗿𝗲 𝗱𝗲𝗰𝗲𝗻𝘁𝗿𝗮𝗹𝗶𝘇𝗲𝗱 𝗮𝗻𝗱 𝗰𝗲𝗻𝘀𝗼𝗿𝘀𝗵𝗶𝗽-𝗿𝗲𝘀𝗶𝘀𝘁𝗮𝗻𝘁 𝗳𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝘀𝘆𝘀𝘁𝗲𝗺.

In conclusion, it’s essential to strike a balance between hodling bitcoin for its long-term value proposition, and actively spending it to support its use as a currency. By doing both, 𝘆𝗼𝘂 𝗰𝗮𝗻 𝗽𝗹𝗮𝘆 𝗮 𝗰𝗿𝘂𝗰𝗶𝗮𝗹 𝗿𝗼𝗹𝗲 𝗶𝗻 𝗮𝗱𝘃𝗮𝗻𝗰𝗶𝗻𝗴 𝘁𝗵𝗲 𝗮𝗱𝗼𝗽𝘁𝗶𝗼𝗻 𝗮𝗻𝗱 𝗺𝗮𝗶𝗻𝘀𝘁𝗿𝗲𝗮𝗺 𝗮𝗰𝗰𝗲𝗽𝘁𝗮𝗻𝗰𝗲 𝗼𝗳 𝘁𝗵𝗲 𝗯𝗲𝘀𝘁 𝗳𝗼𝗿𝗺 𝗼𝗳 𝗺𝗼𝗻𝗲𝘆 𝘁𝗵𝗲 𝘄𝗼𝗿𝗹𝗱 𝗵𝗮𝘀 𝗲𝘃𝗲𝗿 𝗸𝗻𝗼𝘄𝗻.

It’s crucial that you both 𝗵𝗼𝗱𝗹 your bitcoin and 𝘀𝗽𝗲𝗻𝗱 it to help drive adoption and increase its utility as a medium of exchange. While hodling your bitcoin as a store of value is important due to its disinflationary nature and potential for long-term price appreciation, spending it is equally essential, in order to realize its full potential as a decentralized digital currency.

Spending your bitcoin and selling it differ in the sense that selling typically involves converting it back into fiat currency, which adds downward pressure (albeit minor) to Bitcoin’s price. On the other hand, 𝘴𝘱𝘦𝘯𝘥𝘪𝘯𝘨 bitcoin involves using it directly as a means of payment for goods and services, thereby bypassing legacy fiat intermediaries, and promoting financial sovereignty.

By actively spending bitcoin, you can contribute to the growing ecosystem of merchants and businesses that accept it, thus 𝘢𝘥𝘥𝘪𝘯𝘨 𝘵𝘰 𝘪𝘵𝘴 𝘢𝘥𝘰𝘱𝘵𝘪𝘰𝘯 𝘢𝘯𝘥 𝘯𝘦𝘵𝘸𝘰𝘳𝘬 𝘦𝘧𝘧𝘦𝘤𝘵𝘴. This not only strengthens bitcoin's use case as a medium of exchange, but also helps to solidify its position as a viable alternative to fiat.

Furthermore, spending bitcoin helps to circulate the currency within the economy, facilitating economic activity, and promoting a more robust and self-sustaining bitcoin ecosystem. As more individuals use bitcoin for everyday transactions, its utility and acceptance will continue to grow, 𝘂𝗹𝘁𝗶𝗺𝗮𝘁𝗲𝗹𝘆 𝗹𝗲𝗮𝗱𝗶𝗻𝗴 𝘁𝗼 𝗮 𝗺𝗼𝗿𝗲 𝗱𝗲𝗰𝗲𝗻𝘁𝗿𝗮𝗹𝗶𝘇𝗲𝗱 𝗮𝗻𝗱 𝗰𝗲𝗻𝘀𝗼𝗿𝘀𝗵𝗶𝗽-𝗿𝗲𝘀𝗶𝘀𝘁𝗮𝗻𝘁 𝗳𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝘀𝘆𝘀𝘁𝗲𝗺.

In conclusion, it’s essential to strike a balance between hodling bitcoin for its long-term value proposition, and actively spending it to support its use as a currency. By doing both, 𝘆𝗼𝘂 𝗰𝗮𝗻 𝗽𝗹𝗮𝘆 𝗮 𝗰𝗿𝘂𝗰𝗶𝗮𝗹 𝗿𝗼𝗹𝗲 𝗶𝗻 𝗮𝗱𝘃𝗮𝗻𝗰𝗶𝗻𝗴 𝘁𝗵𝗲 𝗮𝗱𝗼𝗽𝘁𝗶𝗼𝗻 𝗮𝗻𝗱 𝗺𝗮𝗶𝗻𝘀𝘁𝗿𝗲𝗮𝗺 𝗮𝗰𝗰𝗲𝗽𝘁𝗮𝗻𝗰𝗲 𝗼𝗳 𝘁𝗵𝗲 𝗯𝗲𝘀𝘁 𝗳𝗼𝗿𝗺 𝗼𝗳 𝗺𝗼𝗻𝗲𝘆 𝘁𝗵𝗲 𝘄𝗼𝗿𝗹𝗱 𝗵𝗮𝘀 𝗲𝘃𝗲𝗿 𝗸𝗻𝗼𝘄𝗻.

Remember to give this a 𝗟𝗶𝗸𝗲🤙 and a 𝗦𝗵𝗮𝗿𝗲🔄, and add this to your 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸𝘀🔖.

Remember to give this a 𝗟𝗶𝗸𝗲🤙 and a 𝗦𝗵𝗮𝗿𝗲🔄, and add this to your 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸𝘀🔖. 𝗗𝗮𝗻𝗶𝗲𝗹 𝗣𝗿𝗶𝗻𝗰𝗲’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

In Austrian economics, money is viewed as a commodity that has evolved naturally in the market to facilitate exchange. Austrian economists, including figures like Ludwig von Mises and Friedrich Hayek, emphasize the decentralized and spontaneous nature of the emergence of money. In layman's terms, money is an agreed-upon medium of exchange used between two parties to execute a mutually beneficial transaction.

Over time, a commodity with specific desirable characteristics, such as durability, divisibility, portability, and recognizability, comes to be widely accepted in transactions. Without the emergence of a medium of exchange, humans would have been confined to using a barter system and would have not evolved to form complex societies and civilizations. The problem with a barter system is that it doesn't solve the economic phenomenon of ‘The Coincidence of Wants’, whereby one party does not value or desire another party's goods or services. ‘Money’ solves this problem when both parties agree on a medium of exchange to use to transact peacefully and prosperously with each other.

Furthermore, Austrian economists argue against the notion of a central authority (like a government or central bank) having a monopoly on the issuance and control of money. They contend that a competitive and decentralized market for money is more likely to produce a stable and efficient monetary system and a more productive and peaceful society.

𝗗𝗮𝗻𝗶𝗲𝗹 𝗣𝗿𝗶𝗻𝗰𝗲’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

In Austrian economics, money is viewed as a commodity that has evolved naturally in the market to facilitate exchange. Austrian economists, including figures like Ludwig von Mises and Friedrich Hayek, emphasize the decentralized and spontaneous nature of the emergence of money. In layman's terms, money is an agreed-upon medium of exchange used between two parties to execute a mutually beneficial transaction.

Over time, a commodity with specific desirable characteristics, such as durability, divisibility, portability, and recognizability, comes to be widely accepted in transactions. Without the emergence of a medium of exchange, humans would have been confined to using a barter system and would have not evolved to form complex societies and civilizations. The problem with a barter system is that it doesn't solve the economic phenomenon of ‘The Coincidence of Wants’, whereby one party does not value or desire another party's goods or services. ‘Money’ solves this problem when both parties agree on a medium of exchange to use to transact peacefully and prosperously with each other.

Furthermore, Austrian economists argue against the notion of a central authority (like a government or central bank) having a monopoly on the issuance and control of money. They contend that a competitive and decentralized market for money is more likely to produce a stable and efficient monetary system and a more productive and peaceful society.

Daniel Prince is the host of the Once Bitten Podcast, with a mission to help educate as many people about Bitcoin as possible so that they can gain financial freedom, and the InspirEd Podcast, showcasing world thought leaders in the 'alternative' education space. He is also the author of "𝘊𝘩𝘰𝘰𝘴𝘦 𝘓𝘪𝘧𝘦: 𝘛𝘩𝘦 𝘛𝘰𝘰𝘭𝘴, 𝘛𝘳𝘪𝘤𝘬𝘴, 𝘢𝘯𝘥 𝘏𝘢𝘤𝘬𝘴 𝘰𝘧 𝘓𝘰𝘯𝘨-𝘛𝘦𝘳𝘮 𝘍𝘢𝘮𝘪𝘭𝘺 𝘛𝘳𝘢𝘷𝘦𝘭𝘭𝘦𝘳𝘴, 𝘞𝘰𝘳𝘭𝘥𝘴𝘤𝘩𝘰𝘰𝘭𝘦𝘳𝘴, 𝘢𝘯𝘥 𝘋𝘪𝘨𝘪𝘵𝘢𝘭 𝘕𝘰𝘮𝘢𝘥𝘴". He hosted the Homeschool Global Summits 2019 and 2020.

Daniel Prince is the host of the Once Bitten Podcast, with a mission to help educate as many people about Bitcoin as possible so that they can gain financial freedom, and the InspirEd Podcast, showcasing world thought leaders in the 'alternative' education space. He is also the author of "𝘊𝘩𝘰𝘰𝘴𝘦 𝘓𝘪𝘧𝘦: 𝘛𝘩𝘦 𝘛𝘰𝘰𝘭𝘴, 𝘛𝘳𝘪𝘤𝘬𝘴, 𝘢𝘯𝘥 𝘏𝘢𝘤𝘬𝘴 𝘰𝘧 𝘓𝘰𝘯𝘨-𝘛𝘦𝘳𝘮 𝘍𝘢𝘮𝘪𝘭𝘺 𝘛𝘳𝘢𝘷𝘦𝘭𝘭𝘦𝘳𝘴, 𝘞𝘰𝘳𝘭𝘥𝘴𝘤𝘩𝘰𝘰𝘭𝘦𝘳𝘴, 𝘢𝘯𝘥 𝘋𝘪𝘨𝘪𝘵𝘢𝘭 𝘕𝘰𝘮𝘢𝘥𝘴". He hosted the Homeschool Global Summits 2019 and 2020.

Preorder your copy of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟴𝟬%, by contributing to our @Geyser initiative:

Preorder your copy of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟴𝟬%, by contributing to our @Geyser initiative: