Living in the country means stopping and helping out other farmers animals that get their heads stuck in fences.

Rory ₿ Sailor

RealRorySailor@primal.net

npub1t63s...j304

₿itcoin is a hell of a drug!

Vires In Numeris!

The tax man when he sees #bitcoin's yearly ROI

What are the plebs eating tonight? It may look like shit but it tastes Jodidamente increíble!

hey are those reply guys still on nostr ??

If you're a #bitcoin'er, you know who Ross Ulbricht is. Some of you may know his story; if you do or if you don't, you need to hear it in his own words. Trump pardoned him, ₿itcoiners freed him. Some who aren't in the community won't understand why he's free. If you're one of these people, listen to his story, and you will see, you will see what freedom means. ₿itcoin is freedom.

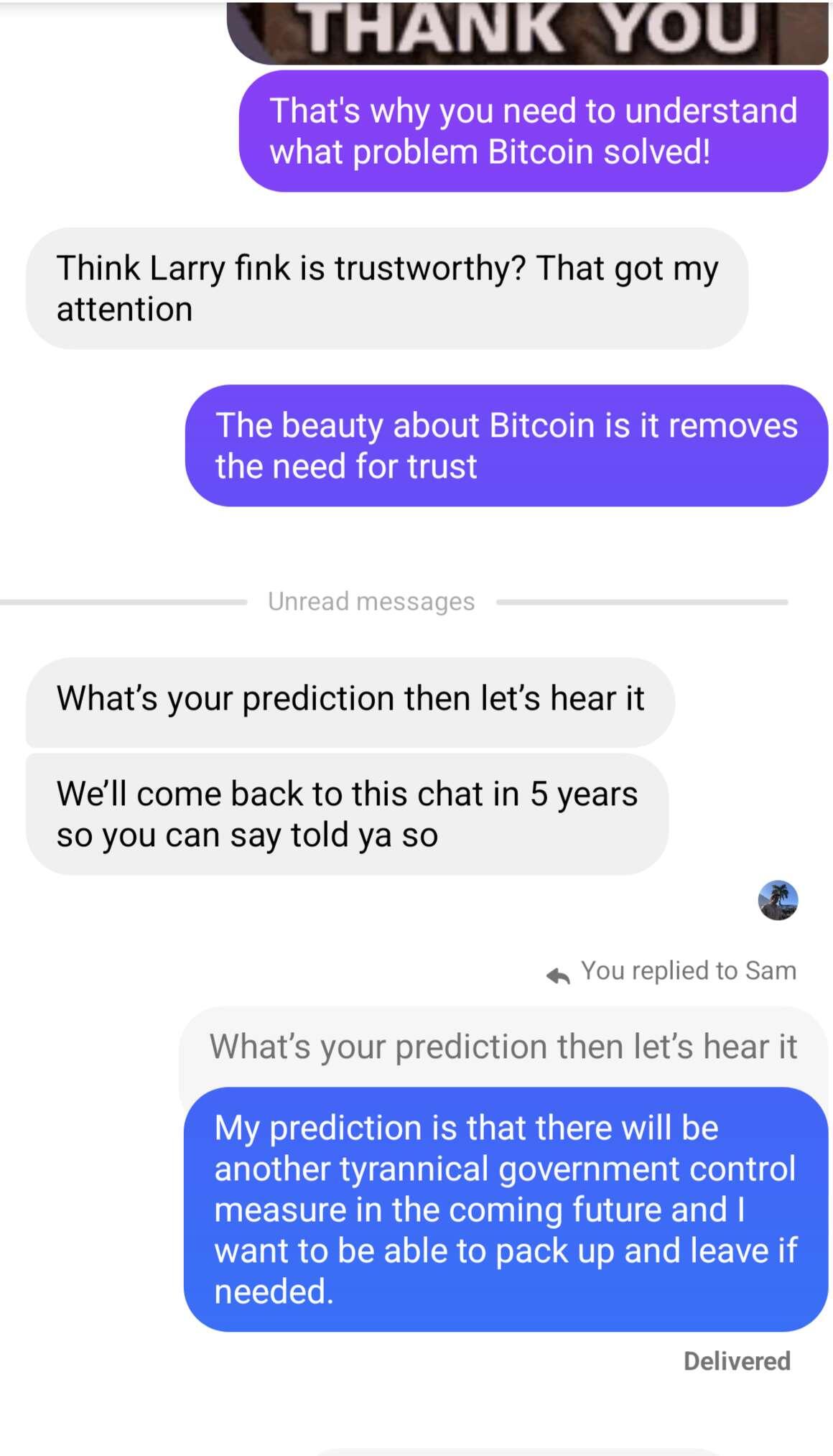

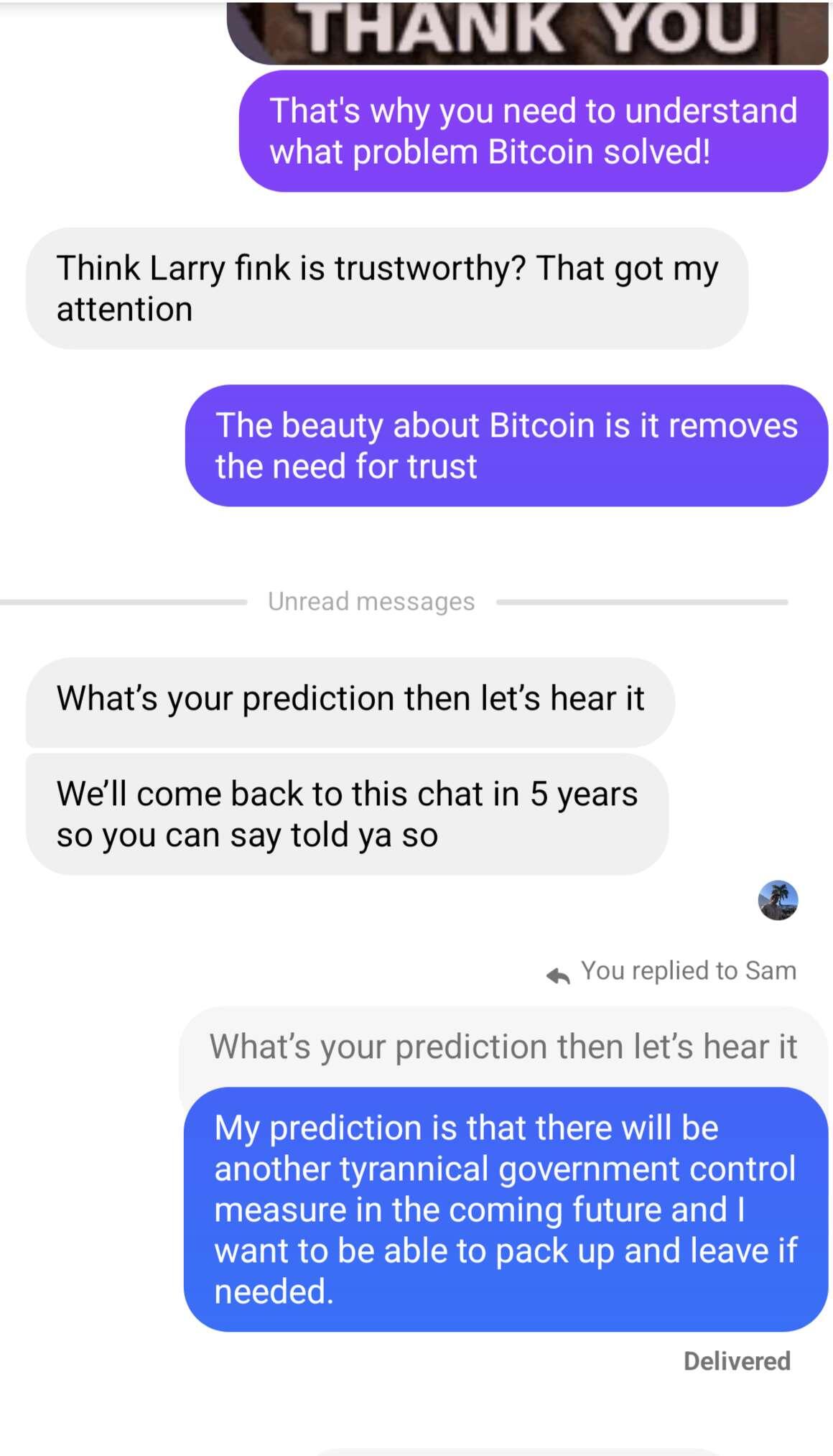

Here's my price prediction for #bitcoin

Happy Australia Day 🇦🇺🦘

𝐔𝐍𝐃𝐄𝐑𝐒𝐓𝐀𝐍𝐃 𝐓𝐇𝐈𝐒👇

Here is a post about the Australian Dollar that was shared with me today by a friend of mine:

Australian M1 money supply has broken it's all time high inflating at alarming rates post pandemic, decaying most of Australian's wealth.

There was only one asset class that beat the rate of inflation over these years.

The Reserve Bank of Australia commenced operations on the 14th of January 1960.

From 1960 to 1975, Australia held approximately $8.269 billion AUD in money reserves (M1) as it broke away from the British pound in 1966.

Australians embarked on a new currency journey with their native Australian Dollar.

From 1975 to 1990, the Australian money supply had increased to $43.51bil, or 419.74%, an average of $2.3 billion, or 7.7% per annum, reflects the consequence of adopting an unbacked currency. This flexibility allows for significant adjustments.

From 1990 to 2016, Australia printed $700 billion dollars, marking a 1,644% increase over 26 years, or an average inflation rate of 7.17% annually.

(To real estate owners: your property may have increased over time, but only at the rate of inflation. Here is the evidence. If property doubles in value every 10 years, so does the money supply).

From 2016 to 2024, the entire M1 supply doubled to $1.67 trillion. It took 40 years to reach $700 billion, but only 5 years to double it and then some, increasing by 2.3 times.

74% of all NEW Australian money was printed since March 2020.

Bitcoin has been the only asset class to not only beat, but perform at multiples of this absurd money value dilutions. From 2016 to 2025, Bitcoin's price is up 14,613%, or an average gain 74.12% every year.

Something to think about 🙂

@less hey mate I just saw your interview with @Robin Seyr can you share the link you were talking about with the Fed website please 🙏

How does one acquire the ₿ emoji from the #bitcoin ?

Hey @jack mallers how do I get in contact with you? Hey @ODELL loving the citadel dispatch hats cheers again.

Who would be happy with these numbers?

21/09/24 touching down in Aus!

Day 21 of 21 days of posting on nostr.

The coffee on day 21 hits different in Spain than it did on day five of posting on nostr from a Coal Mine.

Day twenty of 21 days of posting on nostr.

¡Yo es en Tossa De Mar!

Day nineteen of 21 days of posting on nostr.

¡España es muy elegante!

Can always rely on the Master of GMs to give a reply

@npub1dlkv...488x

Day eighteen of 21 days of posting on nostr.

First day in Barcelona I'm lucky enough to check out the hospital system.

Day seventeen of 21 days of posting on nostr.

₿itcoin is having a noice little bounce.

Day sixteen of 21 days of posting on nostr.

Welcome to Portugal.