We really need to get these psychopaths away from the money printer

I can see no more noble cause then separating money from state

To all the warriors on the front line, god speed

I’m with you

SovereignArab

dweece@nostrplebs.com

npub1tdhr...np6k

I create content, stack stats & Šavāsana

Separate money from state 🔻

#nostr & #bitcoin

بجمّع ساتس وبصنع محتوى #بيتكوين

The thing is, Trump is so polarizing, half the people think he’s a retard, other half think he’s a messiah.

He says both ridiculous and insightful shit in the same sentence. Any moment he can fire off a tweet that contradicts something he said the day before.

So now, he announces a bitcoin strategic reserve… the real thing, not the shitcoin thing he announced last week, and the market has no idea what to do 😂

Your more IMF…

View quoted note →

In Sanskrit, which is the mother language of all spoken word, there’s no word for “fear”. The closest word is “advaita” which translates to lack of knowledge.

High-Time Preference: The hyper-focus on instant gratification and short-termism is the biggest obstacle to building wealth.

Bitcoin dropped 8% today, hitting its lowest level in 3 months… THREE MONTHS! and the market is panicking.

I’ve received several calls: “Shu Bitcoin crashing ah? Should’ve sold at $100k!”

Man, zoom out. Bitcoin is up over 70% in the past year and 1,000% in the past 5 years!

This short-term hysteria is a symptom of living in a fiat society. When money constantly loses value, long-term thinking becomes a luxury few can afford.

Instead of focusing on building long-term wealth, most are chasing the meme coin pipe dream, that 10000x that will solve all their problems.

The best thing you can do for yourself? Cultivate a low-time preference mindset, think in 5-10-year intervals, and act accordingly.

Bitcoin has been the best-performing asset class in the world for 11 of the past 14 years. And now, institutions like BlackRock and sovereign wealth funds like Mubadala are just starting to enter the space.

Short-term price action? Impossible to predict. Long-term thesis? Simple:

Governments are broke. They’ll keep printing money to fund deficits and pay off debt. The global debt-to-GDP ratio is now 328%, with $318 trillion in debt. These numbers are unsustainable, and the debt will never be repaid.

It will be inflated away.

Politicians and CEOs of public companies are judged on short-term results, often just a few years. But your life is longer, on average, 70ish years. In the grand scheme of a 70-year life, 5-10 years is not a long time.

When things get tough, central banks will resort to printing money. They always do. They always will.

Cure yourself of the disease of high-time preference.

Accumulate the scarcest asset in the world and chill.

One of us… one of us… one of us…🎶

The global south when America wakes up to all the nefarious shit #USAID does in the name of “aid”

Cc.

@Marty Bent

Recorded and posted this video back in June 2024.

Gm

“Walk tall, kick ass, learn to speak Arabic, love music, and never forget you come from a long line of truth seekers, lovers, and warriors” Hunter S Thompson

Sometimes I have to interact with the Ethereum eco system, and it feels like this…

I received an airdrop of VVV tokens because I use Venice.ai … I thought nice, let’s sell it and stack some sats… but here’s the rub…

the token is on Base. So I had to set up a Coinbase wallet to access it. Guess how that process went?

It’s shocking how with billions of funding and thousands of developers, the Ethereum user experience is still shit.

I received an airdrop of VVV tokens because I use Venice.ai … I thought nice, let’s sell it and stack some sats… but here’s the rub…

the token is on Base. So I had to set up a Coinbase wallet to access it. Guess how that process went?

It’s shocking how with billions of funding and thousands of developers, the Ethereum user experience is still shit.

I received an airdrop of VVV tokens because I use Venice.ai … I thought nice, let’s sell it and stack some sats… but here’s the rub…

the token is on Base. So I had to set up a Coinbase wallet to access it. Guess how that process went?

It’s shocking how with billions of funding and thousands of developers, the Ethereum user experience is still shit.

I received an airdrop of VVV tokens because I use Venice.ai … I thought nice, let’s sell it and stack some sats… but here’s the rub…

the token is on Base. So I had to set up a Coinbase wallet to access it. Guess how that process went?

It’s shocking how with billions of funding and thousands of developers, the Ethereum user experience is still shit.

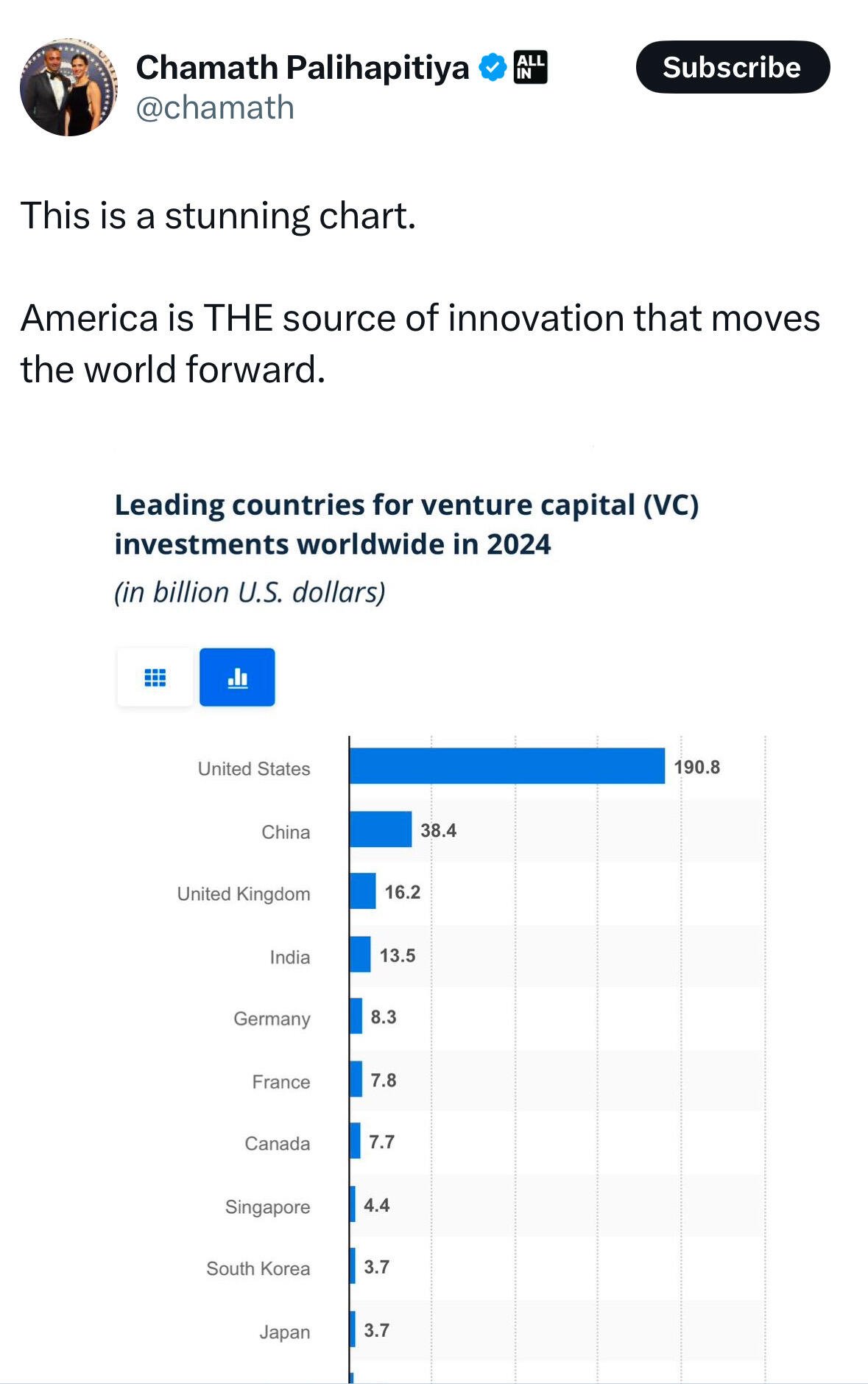

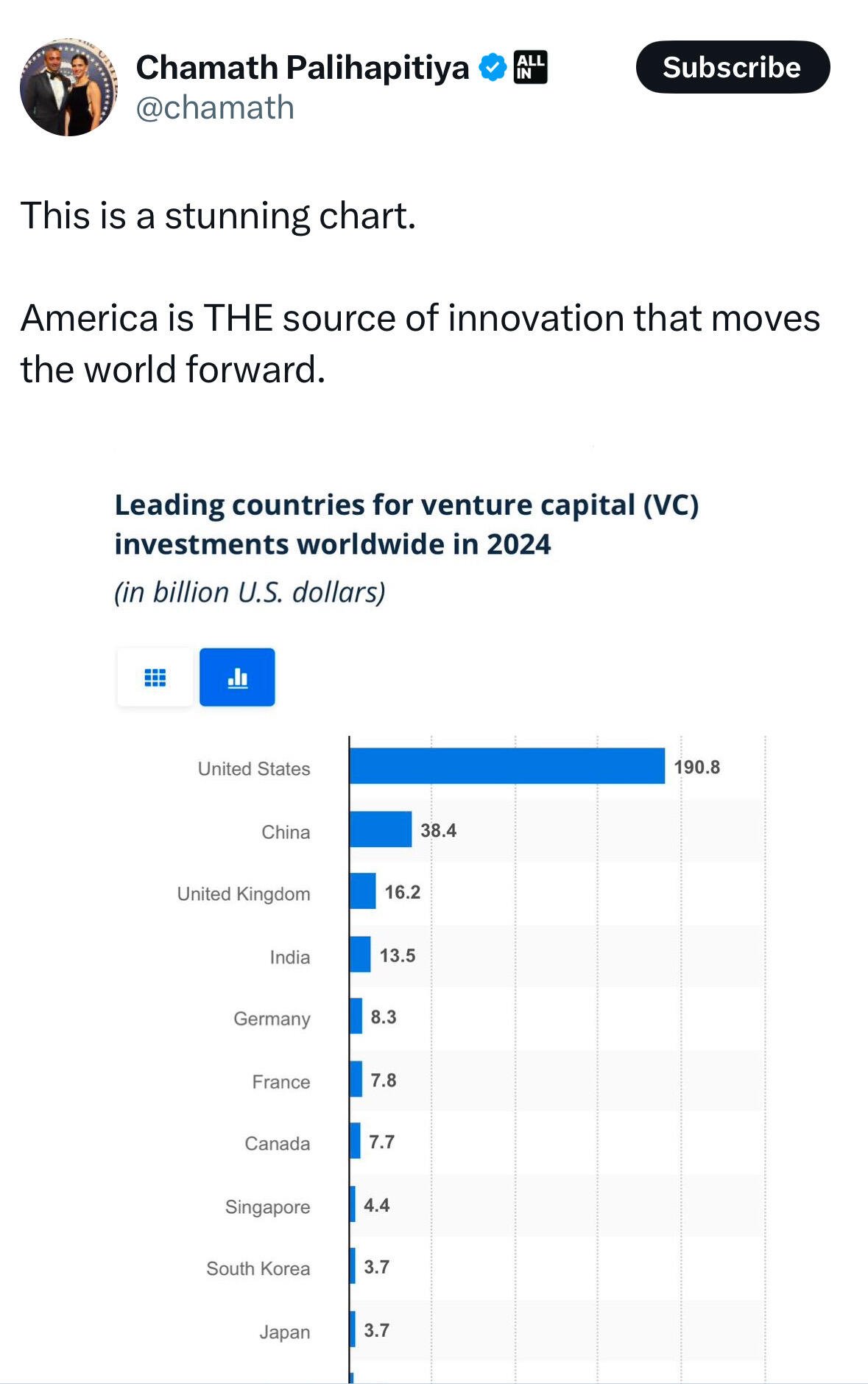

Ummm, u print the world reserve currency bro

Came across this gem while reading @Bushido of Bitcoin 🎯

“Revolution in the primary sense doesn’t mean subversion & revolt, but really even the opposite: return to a point of departure & ordinary motion around a center.”

Julius Evola, Essay: The Inversion of Symbols

Never heard it from this perspective. Amazing when u hear an absolute truth u feel it in your soul.

Like u KNOW it’s right…

Like a veil is lifted off one of life’s many secrets…

One u see it, can’t unsee it…

Bitcoin…

All roads lead to bitcoin.

💡DeepSeek Reveals Why Bitcoin is Not a Risk On Asset

DeepSeek AI shook up the world this week. They released a model that outperforms ChatGPT at a fraction of the cost, shattering the myth that China is "only" an industrial superpower and that no one can compete with U.S. software. The numbers? Staggering:

- Training cost: $100M → $5M

- GPUs needed: 100,000 → 2,000

- API costs: 95% cheaper

Aside from the geopolitical ramifications, the economic impact will be massive, if you're measuring it in the right unit of account…

Technology is deflationary, and contrary to what fiat economists told you, that's a good thing.

AI is ushering in an era of unprecedented productivity. And productivity is faster deflation. (s/o @Jeff Booth )

But here's the problem: in a credit-based fiat system (what we have now), deflation cannot be allowed. The system is insolvent and has to keep expanding. Otherwise, it implodes.

Higher productivity->lower prices->lower GDP, which leads to rising debt-to-GDP ratios (we're already at ~350% globally), forcing central banks to print even more money to keep the system solvent.

And when the money printer goes brrr, no one sucks up liquidity better than #Bitcoin.

This is the beginning of the end of the correlation between Bitcoin and risk-on-tech assets.

Tech can be disrupted at any moment. The days of equity as a store of value are over.

This is Bitcoin's "risk-off" moment. Bitcoin is fixed, immutable, and cannot be disrupted.

We’re barreling into an era of exponential productivity growth, coupled with exponential monetary expansion.

Nothing stops this train. (s/o @Lyn Alden)

Scarcity is where you want your wealth to be preserved. And nothing is more scarce, and less likely to be disrupted, than bitcoin.

What’s your unit of account?

Not all heroes wear capes

“In a closed society where everybody’s guilty, the only crime is getting caught. In a world of thieves, the only final sin is stupidity.” Hunter Thompson

He would have loved bitcoin.

Yes, this is the way. View quoted note →

Seems like a few bitcoiners in ‘Murika forgot the rules…

First rule of Bitcoin: separate money from state.

Second rule of Bitcoin: separate money from state.

Third rule of Bitcoin: SEPERATE MONEY FROM STATE.