@Harry just finished The Three Body problem. What an incredible book! When are you going back on @Blue Collar Bitcoin to talk about it?!

And now I have 2 more books to read you SOB 🤓

coach

coach@bitcoinpark.com

npub1ffpd...4u63

There it is. The war that will justify printing USD to stall the debt spiral.

Never waste a good crisis View quoted note →

Here’s my families spaghetti recipe which was given to my father by the wife of the farmer he worked with 40 years ago.

Instead of tomato juice we use whole tomatoes, peeled and quartered. Instead of freezing we hot pack them into jars. Saves having to thaw them when cooking. In a cool, dark place, the jared sauce will last 1-2 years.

To cook, just partially brown 1lb of hamburger, dump in the jar of sauce, add tomato paste until sauce gets to the thickness you like. We also add bell pepper, onion, mushrooms and jalapeños and let them cook down in the sauce.

Tis the season for canning. 1 crate if tomatoes turned into 17 quarts of homemade spaghetti sauce. Just add meat and tomato paste 🤌🏼

Hit me up if you want the recipe. I feel like this has become a bit of a lost art. I’ll keep posting my preserving projects as I go if people like it. #foodstr

“Citizens, Fifth Third, and M&T have been warned privately by the Fed to shore up capital and liquidity planning”

More bank failures coming. Steady lads

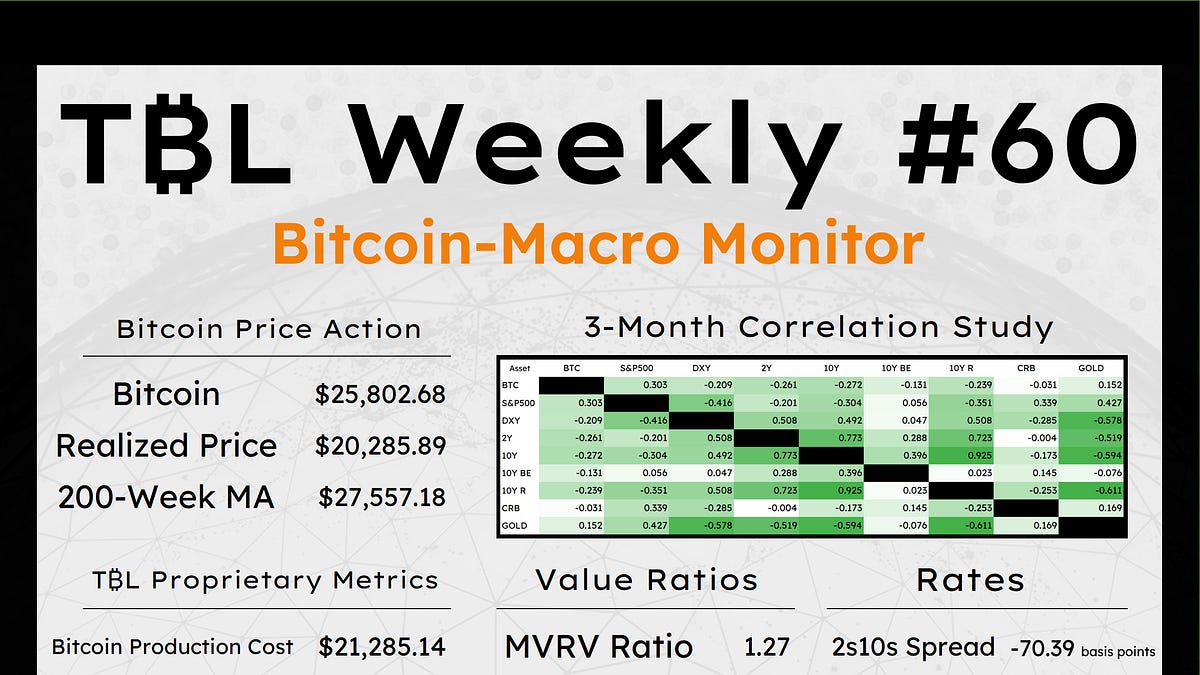

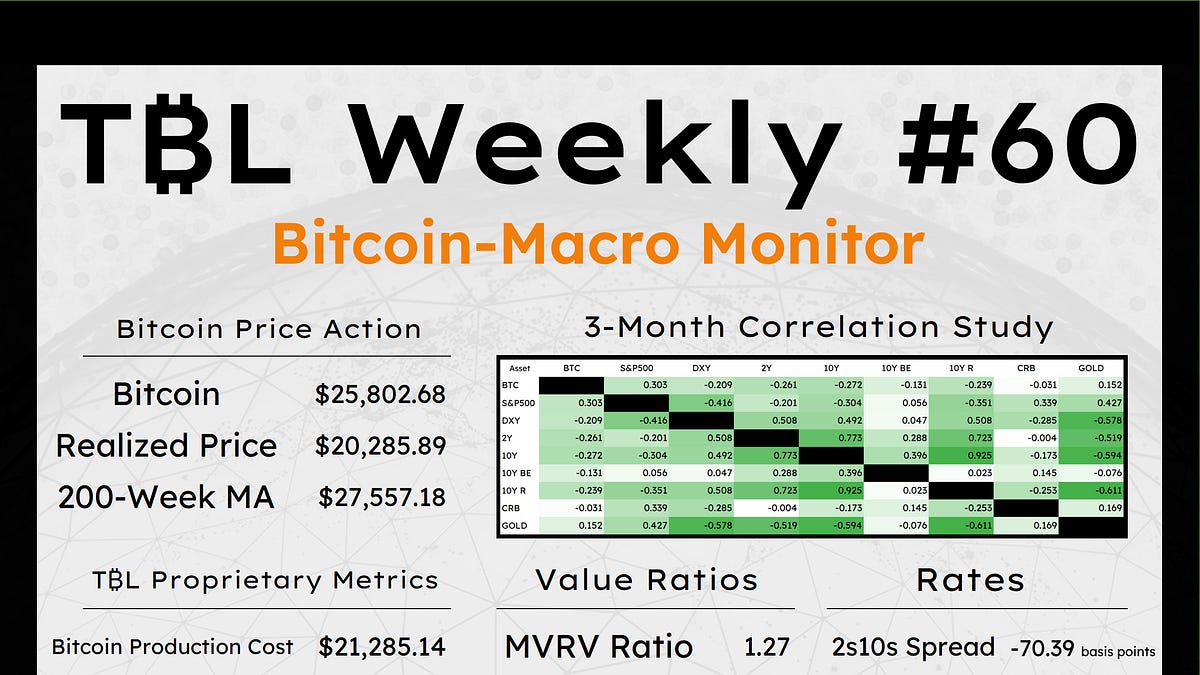

US job data slides & regional banks are warned of danger yet again: TBL Weekly #60

Welcome to TBL Weekly #60—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro.

Everyone joins #Nostr at the level of oppression they deserve.

Welcome @Parker Lewis

Damn I hope this works fingers 🤞🏼 View quoted note →

FUCKING MOOD!

@HODL what are the odds that the next bull run we don’t even make ot back to the ATH?

“About $230 billion of this debt matures throughout the rest of 2023, $790 billion in 2024, and the meat of the refinancing comes in 2025 when $1.07 trillion matures.

Companies that cannot survive a jump from 2% to 8-10% interest rates will die.

Moody’s conservatively expects defaults to peak at 5.1% by April 2024. Its pessimistic scenario is HY defaults jumping as high as 13.7%—exceeding the level reached during the GFC crash.

Given the history of rating agencies severely underestimating the probability of crisis out of either malice or incompetence, we’d lean toward the latter.”

The Corporate, CRE, and AirBNB Debt Timebomb

For borrowers the world over, it's time to sell assets or downsize to operate at higher rates. Anything to avoid default.

The only thing we need for hyperbitcoinization is more @HODL podcasts. Makes you laugh, then think, then blows your mind. Signal