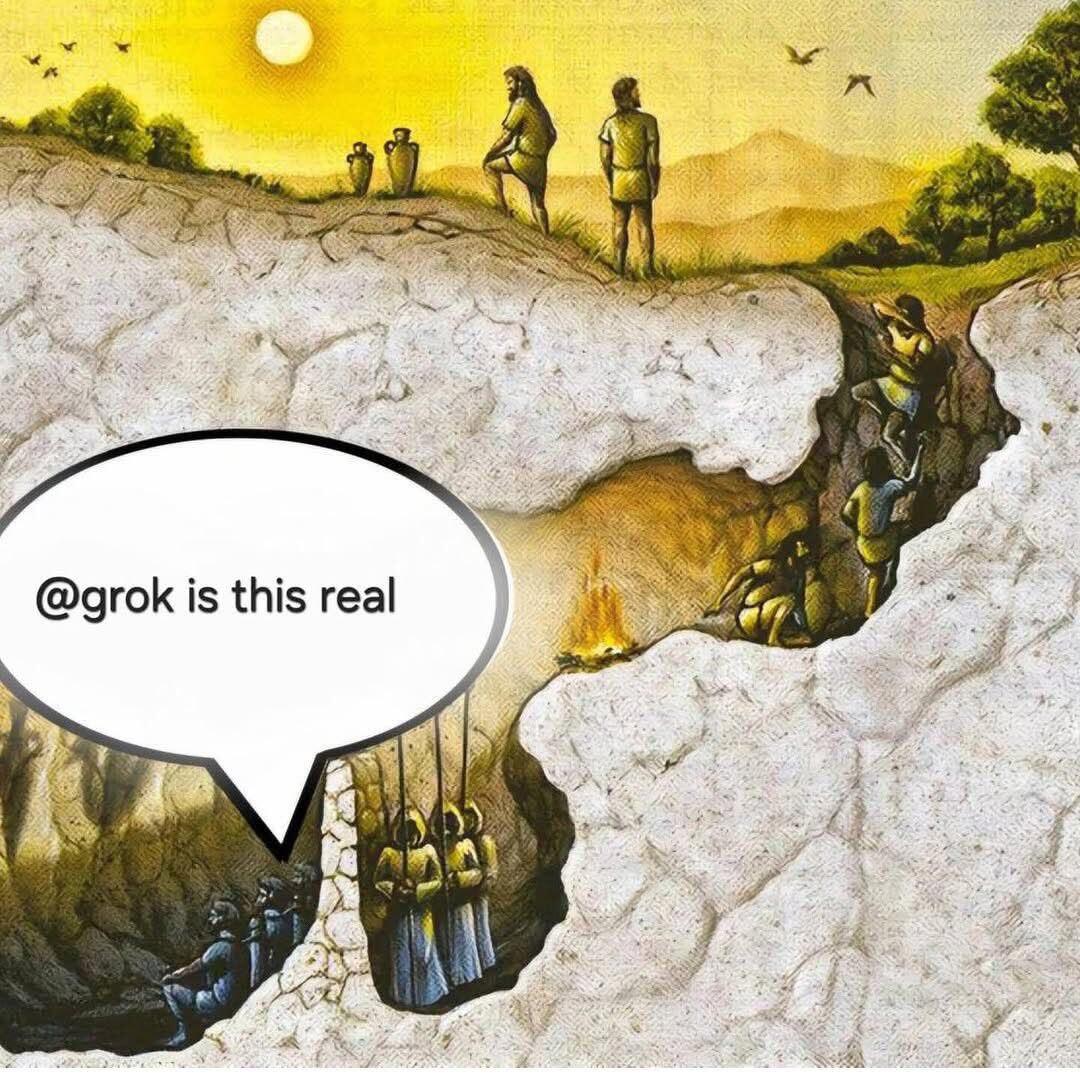

#memes #funny

#memes #funny

Jestopher

Jestopher@Amboss.space

npub18yvp...lpz3

Co-founder of Amboss Technologies, Inc.

"Never before has greed tempted me to live a very simple life."

Mostly #memes & #lightningnetwork thoughts

https://amboss.tech

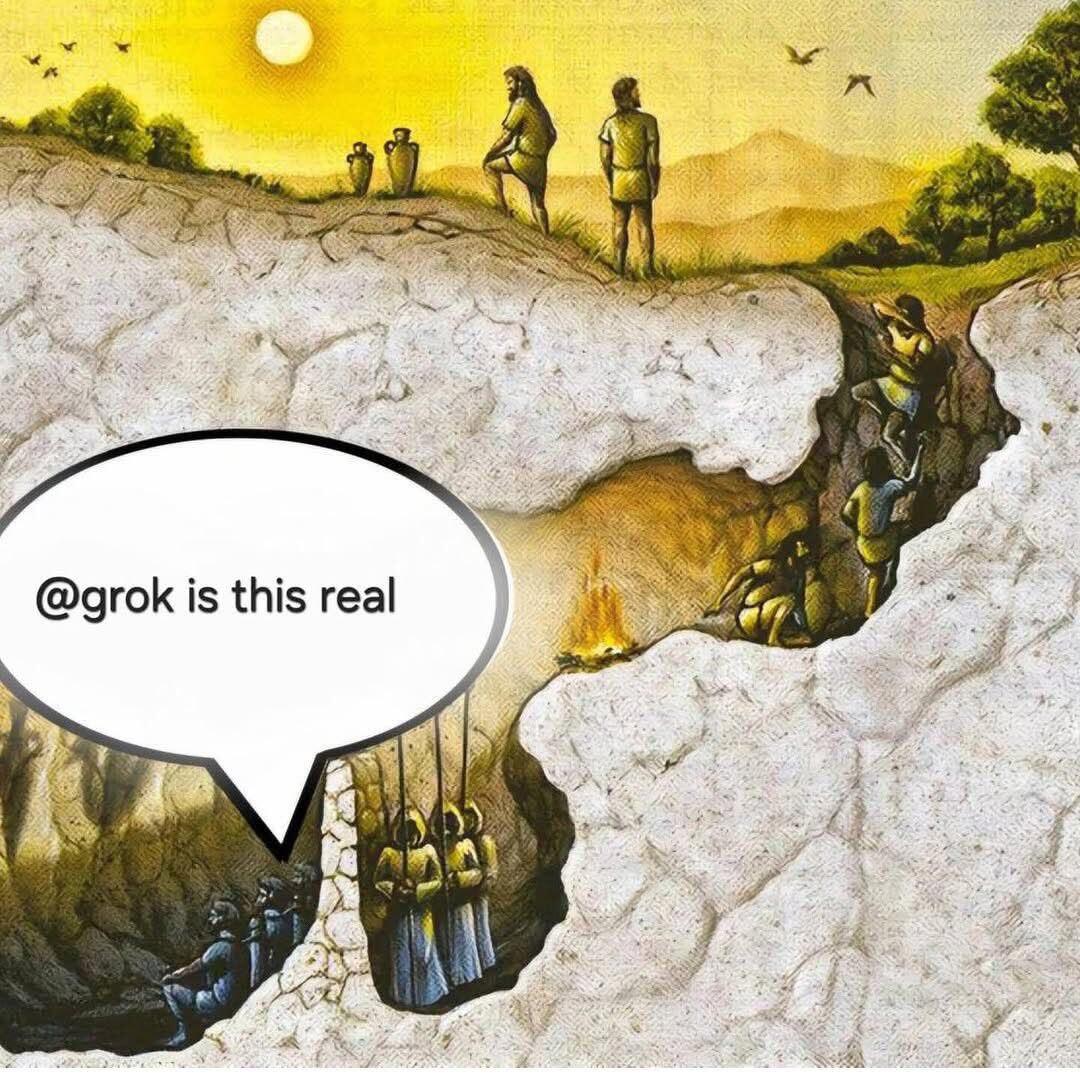

#memes #funny

#memes #funny #memes #funny

#memes #funny #memes #funny

#memes #funnyFeels so close!

#memes #funny

#memes #funny

#memes #funny

#memes #funnyIronically the classic Cali surf song was first recorded as a Greek song, Misirlou in 1927

#tunestr

#memes #funny

#memes #funny #memes #funny

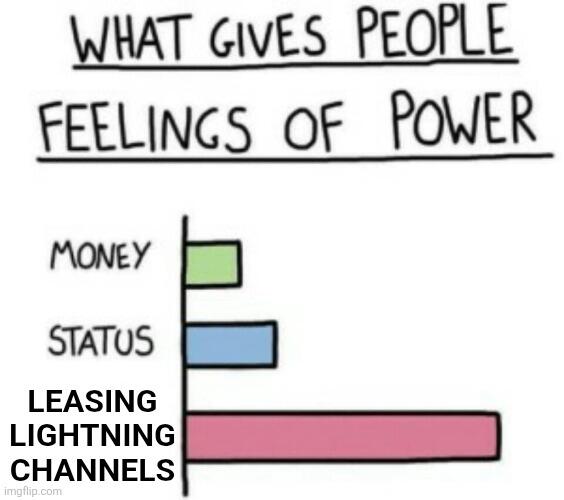

#memes #funny #memes #funny #lightningnetwork

#memes #funny #lightningnetworkBest received line from talking to normies:

"Everyone should own some bitcoin"

#memes #funny

#memes #funnyI broke my coffee machine so now I'm drinking tea.

How's your Monday?

Happy Sunday

#memes #funny

#memes #funny

#memes #funny

#memes #funny #memes #funny

#memes #funny #memes #funny

#memes #funny #memes #funny

#memes #funny #memes #funny

#memes #funnyMy dream is that one day I'll be able to sell my MSTR in my retirement account for real Bitcoin in self-custody

#memes #funny

#memes #funnyIt's kind of a toss up what hits on Twitter but not on Nostr and vice versa.

I just listened to the latest @RABBIT HOLE RECAP with @Marty Bent and @ODELL and was pleased to hear they covered both the Block (C=) routing revenue as well as our new Rails (amboss.tech/rails) service at @Amboss.

@ODELL pointed out (correctly IMO) that the revenue that Block is generating from their node is likely not reproducible by most node operators, deviating from the implications that @npub1uatf...n24e was making. C= has distinct advantages through withdrawal volume and payment data insights.

@Marty Bent made some excellent points too, which might have been overlooked regarding where the "yield" comes from. First, there are two sources of revenue: channel leasing and payment routing. Calling it "transaction fees" loses a lot of nuance when it comes to how decentralized the payment infrastructure is and how it is created (which are the most beautiful parts IMO).

Additionally, Marty generalized the source of yield as the "liquidity locked" which is more accurate than most interpretations, where most expect that the "yield" comes from the Bitcoin deposited (it doesn't, but that's an essential ingredient). The routing revenue comes from the ability to send AND RECEIVE payments. The ability to receive is provided by the network connections and should not be overlooked. The total liquidity locked (or the node Capacity) is actually a more accurate denominator when calculating yields to reflect the sum of the balance held and the Bitcoin connections to it (aka the inbound liquidity).

As for Rails, our new @Amboss yield service, we tried to capture some key motivations for bitcoiners: get more Bitcoin, keep self-custody, and support the Bitcoin network. I think we succeeded. Even if our customers didn't earn anything from Rails, I think we'd still get sign-ups, such is the desire to support Bitcoin ❤️. That's all theoretical though because Rails customers ARE earning bitcoin because they provide a valuable service: the ability to settle payments immediately, inexpensively, and with better privacy.

Providing liquidity within the lightning network is not as straightforward as a simply depositing Bitcoin and earning money (but we made it appear that way with Rails since that's what people expect). Instead, the AI system that we created (not an LLM btw; it uses reinforcement learning and graph neutral networks) is allocating Bitcoin to increase network payment reliability, ensuring decentralized nodes can both receive and send larger payments.

The task that Rails performs will never end because the Lightning Network is dynamic. Lightning is in hyper growth mode as Bitcoin is adopted as a medium of exchange which is a layer of dynamism on top of a dynamic economy.

Consequently, because Bitcoin is scarce, lightning is dynamic, and providing infrastructure is not free, routing revenue will not be a race to the bottom even if adding bitcoin to the lightning network is made easy.

Thanks for reading my thoughts and I'm eager to hear your perspectives!